Nuclear Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441195 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Nuclear Valves Market Size

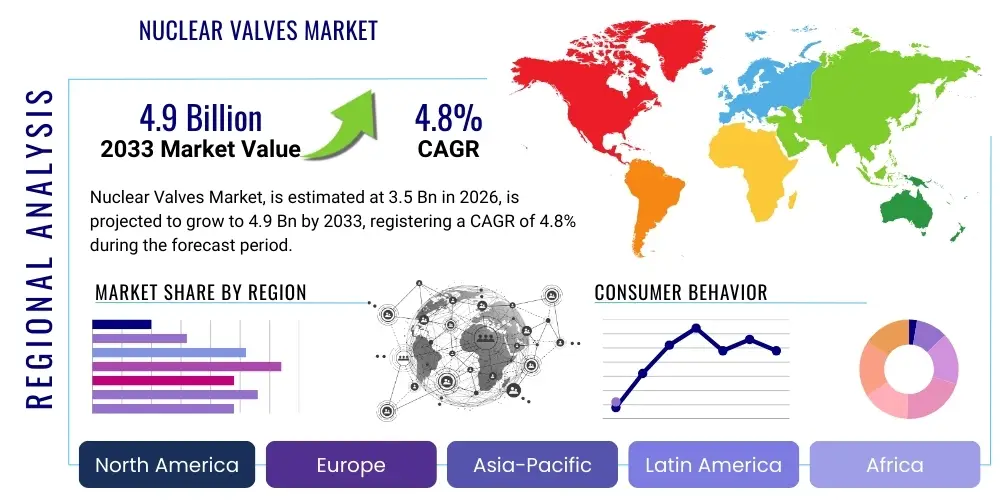

The Nuclear Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Nuclear Valves Market introduction

The Nuclear Valves Market encompasses the design, manufacturing, supply, and maintenance of specialized flow control components utilized within nuclear power generation facilities. These valves are critical safety-related and non-safety-related components designed to withstand extreme operating conditions, including high pressure, high temperature, radiation exposure, and seismic events. Their primary function is to manage the flow of various fluids (water, steam, heavy water, and reactive chemicals) across the reactor coolant system, auxiliary systems, steam generators, and containment structures, ensuring safe and efficient operation and preventing radiological releases. Due to the stringent regulatory requirements mandated by global bodies such as the International Atomic Energy Agency (IAEA) and national regulators, nuclear valves require rigorous certification (e.g., ASME N-stamp) and adhere to extremely high quality assurance standards, making the barrier to entry for manufacturers significant.

Major applications of nuclear valves span the entire nuclear fuel cycle, from the primary loop regulating coolant flow in Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs) to secondary systems involved in steam production and turbine operation. The products are fundamentally essential for reactor core isolation, pressure relief during transients, controlling water level, and ensuring emergency shutdown capabilities. The benefits derived from high-quality nuclear valves include enhanced plant safety, improved operational efficiency, reduced risk of unplanned downtime, and prolonged lifespan of aging nuclear infrastructure. Furthermore, advancements in materials science and actuation technology are leading to valves with better leak integrity and lower maintenance requirements, directly contributing to the economic viability of nuclear power.

The market is predominantly driven by the global resurgence in nuclear energy as a crucial component of low-carbon electricity generation strategies, alongside significant investment in the maintenance, modernization, and life extension of the existing operational reactor fleet. The increasing construction of Small Modular Reactors (SMRs) and advanced Generation III+ and IV reactors presents new avenues for specialized valve designs. However, the market remains highly dependent on political stability, regulatory timelines for new reactor approvals, and the sustained commitment of governments to nuclear power programs, balancing the need for safety with the imperative for clean energy.

Nuclear Valves Market Executive Summary

The Nuclear Valves Market exhibits robust growth, primarily fueled by global commitments to decarbonization driving the construction of new nuclear capacity, particularly in Asia Pacific, and substantial expenditure on maintaining and upgrading legacy assets in North America and Europe. Business trends indicate a strong focus on localization of manufacturing, driven by geopolitical concerns and national security imperatives surrounding critical infrastructure components. Key manufacturers are investing heavily in advanced manufacturing techniques, such as additive manufacturing for complex parts, and enhanced diagnostic systems to predict valve failure, shifting the focus from reactive maintenance to proactive asset management. Supply chain resilience, given the specialized nature of materials and lengthy qualification processes, remains a core strategic priority for major original equipment manufacturers (OEMs).

Regionally, the Asia Pacific segment, led by China and India, is projected to command the highest growth rate due to aggressive national nuclear buildout programs focused on large-scale conventional reactors and foundational investments in SMR technology. North America and Europe, while having limited new large-scale projects, generate stable demand through mandatory scheduled maintenance, component replacement cycles (refurbishment of control valves, isolation valves, and safety relief valves), and the extension of operational licenses for reactors past their initial design life. Regulatory standardization across international markets is slowly progressing, offering opportunities for streamlined certification and reduced time-to-market, though national preferences still dominate procurement decisions.

Segment trends demonstrate increasing demand for Actuated Valves, driven by the need for faster response times and integration into modern digital control systems (DCS). Safety and Relief Valves constitute a stable segment due to their direct regulatory mandate for reactor protection. In terms of reactor types, while Pressurized Water Reactors (PWRs) currently account for the largest installed base and maintenance market, the future growth trajectory is increasingly linked to investments in SMR technology, which requires smaller, modular, highly standardized, and often hermetically sealed valve designs suitable for simplified system architecture. Furthermore, the market sees consolidation among specialist valve manufacturers aiming to offer comprehensive, integrated solutions spanning the entire nuclear component portfolio.

AI Impact Analysis on Nuclear Valves Market

User queries regarding AI’s influence on the Nuclear Valves Market primarily center on three themes: predictive maintenance efficacy, the potential for AI-driven design optimization, and the role of autonomous monitoring in safety-critical systems. Users frequently ask if AI can significantly reduce costly unplanned outages caused by valve failures, given the extreme consequences in a nuclear context. There is also keen interest in how machine learning algorithms can analyze vast datasets from operating reactors to predict material degradation, leakage rates, and necessary calibration schedules for control valves. Finally, stakeholders seek clarity on regulatory acceptance of AI/ML models guiding operational decisions for components designated as safety-critical.

The key themes emerging from this analysis confirm that expectations are high for AI to transition nuclear plant operations from time-based or condition-based maintenance to true predictive maintenance. Concerns revolve around the 'black box' nature of complex AI models, which contradicts the nuclear industry's core requirement for transparency and rigorous validation of every safety decision. Expectations are focused on deploying AI in non-safety-critical secondary loops initially, proving the reliability of the predictive models before integration into primary containment systems, thus enhancing operational efficiency and extending component lifecycles safely.

AI's primary influence will be in transforming asset management and quality assurance (QA). By applying deep learning to acoustic monitoring, vibration analysis, and thermal imaging data collected from in-situ valves, operators can detect incipient faults long before they become critical. Furthermore, AI tools can streamline the complex regulatory documentation process by automating compliance checks against thousands of standards and specifications, significantly reducing the administrative burden associated with manufacturing highly regulated nuclear components.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, acoustics, temperature) to forecast potential failure points in critical valves, thereby minimizing unexpected shutdowns and extending service intervals.

- Optimized Manufacturing Quality Assurance: Machine learning models analyzing non-destructive testing (NDT) data (ultrasonics, radiography) to identify microscopic material defects during the manufacturing phase with greater accuracy than human inspection.

- Digital Twin Simulation: AI enhancing digital twins of nuclear plants to simulate stress, wear, and thermal fatigue on valve components under various transient conditions, optimizing material selection and design tolerance.

- Automated Compliance and Documentation: Natural Language Processing (NLP) tools automating the generation and verification of regulatory compliance documentation required for certification (e.g., ASME N-stamp renewal).

- Enhanced Cyber Security for Actuators: AI algorithms deployed to detect and mitigate malicious intrusions targeting digitally controlled valve actuators and control system networks.

DRO & Impact Forces Of Nuclear Valves Market

The Nuclear Valves Market is significantly influenced by a unique set of drivers, restraints, and opportunities, underpinned by pervasive impact forces stemming from regulatory mandates and public perception. The primary drivers include the global push for carbon neutrality, which necessitates the expansion and long-term operation of the nuclear fleet, alongside massive investment in the maintenance and refurbishment of aging reactors. These components, often exposed to harsh radiation and thermal cycles, must be replaced periodically, guaranteeing a resilient aftermarket demand irrespective of new build progress. Restraints largely stem from the extraordinarily high capital costs and lengthy lead times associated with nuclear component qualification and procurement, compounded by complex, multi-layered regulatory approval processes that delay project execution. Opportunities are vast in the emerging Small Modular Reactor (SMR) segment, which demands high-integrity, compact, and standardized valves suitable for factory fabrication and modular installation, alongside technological advancements in advanced materials that offer superior radiation resistance and thermal performance.

Impact forces in this sector are profound and dualistic. Regulatory forces are paramount; non-compliance carries existential risks for manufacturers. Strict adherence to codes like ASME Boiler and Pressure Vessel Code (Section III, Class 1, 2, or 3) and global safety standards dictate design, manufacturing, and QA practices, increasing production complexity but ensuring high safety thresholds. Economic impact forces are defined by governmental subsidies and financing mechanisms for nuclear projects, which dramatically influence the volume and timing of large valve orders. Furthermore, geopolitical shifts, such as trade restrictions on high-tech components or national energy security strategies, directly affect sourcing decisions and market accessibility.

The continuous need for modernization within the existing fleet acts as a powerful stabilizing force for the aftermarket segment. As plants extend their operating lives from 40 to 60 or even 80 years, component obsolescence becomes a critical issue, requiring manufacturers to either reverse-engineer parts or design modern equivalents that meet legacy plant interfaces while utilizing superior current technology. This dynamic creates a steady, high-margin revenue stream for qualified suppliers capable of handling complex legacy interfaces and strict documentation requirements, insulating the market somewhat from the volatility associated with new construction projects.

Segmentation Analysis

The Nuclear Valves Market segmentation provides a granular view of demand across various product types, operational mechanisms, reactor designs, and end-use applications, reflecting the highly technical and specialized nature of the industry. The segmentation by Valve Type (e.g., Globe, Gate, Ball, Check) is crucial as each type fulfills a specific function—isolation, regulation, or non-return—within the plant's flow systems. The distinction between Manual and Actuated mechanisms highlights the technological shift towards automation, where actuated valves (using pneumatic, hydraulic, or electric means) are preferred for remote operation and integration into advanced control systems, especially those deemed safety-critical and requiring swift response times during emergencies. The market structure is intrinsically tied to the installed reactor base globally, making segmentation by Reactor Type (PWR, BWR, CANDU) essential for targeting specific maintenance and refurbishment contracts, as valve specifications vary significantly between these designs.

Geographically, market trends are dominated by investment priorities: North America and Europe focus heavily on refurbishment and life extension, driving demand for replacement valves and specialized maintenance services, while Asia Pacific dominates the new installation segment. Further differentiation is seen in the Application segment, where New Reactor Construction projects involve high-volume, multi-year supply contracts for large primary components, contrasted sharply with the lucrative, recurring demand for smaller, more specialized replacement parts required for Maintenance and Repair operations. The increasing global focus on decommissioning activities also generates demand for robust, often remotely operated, isolation valves required to manage radioactive waste streams and safely drain systems during plant closure.

The complexity of nuclear systems requires that manufacturers offer a broad portfolio, navigating the stringent standards required for primary loop components (often custom-engineered and manufactured from highly corrosion-resistant materials like stainless steel or specialized alloys) versus less critical, though still highly scrutinized, secondary components. Understanding these segmented demands allows stakeholders to optimize manufacturing capacities, align R&D efforts with future reactor technology (like molten salt reactors or SMRs), and tailor market strategies to address the distinct purchasing cycles associated with new builds versus mandatory outages, ultimately facilitating targeted market penetration and compliance efficiency.

- By Valve Type:

- Gate Valves (Isolation, High Pressure)

- Globe Valves (Flow Regulation, Throttling)

- Check Valves (Backflow Prevention)

- Ball Valves (On/Off Isolation)

- Butterfly Valves (Large Diameter, Low Pressure)

- Safety/Relief Valves (Pressure Protection)

- By Mechanism:

- Manual Valves (Handwheel, Lever Operated)

- Actuated Valves (Electric, Pneumatic, Hydraulic)

- By Reactor Type:

- Pressurized Water Reactors (PWR)

- Boiling Water Reactors (BWR)

- CANDU Reactors (Heavy Water Reactors)

- VVER Reactors (Russian Design)

- Advanced Reactors (SMRs, Fast Breeder Reactors)

- By Application:

- New Reactor Construction (Large-scale procurement)

- Maintenance, Repair, and Overhaul (MRO)

- Decommissioning Activities

Value Chain Analysis For Nuclear Valves Market

The value chain for nuclear valves is characterized by extreme specialization, high dependency on certified raw material suppliers, and stringent quality control at every stage. The chain begins with the procurement of specialized, traceable raw materials—primarily high-grade stainless steel, specific alloys (like Inconel or Hastelloy), and specialized seal materials—that must meet nuclear-grade standards and undergo rigorous testing for resistance to corrosion and radiation embrittlement. Upstream analysis involves a small cohort of specialized metallurgical companies that supply these certified materials. Manufacturers then focus on complex machining, forging, and welding processes, often using specialized facilities that maintain cleanliness and security protocols mandated by nuclear regulatory bodies. The long lead times for obtaining and qualifying raw materials frequently dictates the overall production schedule, making robust supply agreements crucial.

The midstream involves the core manufacturing process, which includes assembly, non-destructive examination (NDE), hydrostatic testing, functional performance testing, and final certification (ASME N-stamp application). This stage is capital-intensive and requires highly skilled, certified labor. Distribution channels are typically direct or utilize highly specialized agents. Direct sales are common for large, safety-critical valves used in new construction, where the OEM works directly with the Nuclear Steam Supply System (NSSS) vendor or the reactor operator. Indirect distribution, leveraging authorized service partners or distributors, is more prevalent in the aftermarket segment for replacement parts, maintenance kits, and standard commercial-grade components used in secondary loops.

Downstream analysis focuses on the end-users (nuclear power plant operators), maintenance service providers, and decommissioning entities. Service provision is a highly lucrative segment, as nuclear valves require specialized repair, diagnostics, and re-qualification services during routine outages (refueling outages typically occur every 18-24 months). The indirect distribution of service and maintenance requires suppliers to partner with local, certified engineering firms capable of operating within secured, radiation-controlled areas. The high cost of failure and the critical safety function of these components mean that decisions are rarely based purely on price, but rather on demonstrable quality, reliability, regulatory compliance, and a proven track record, reinforcing the vertical integration of expertise within the key market players.

Nuclear Valves Market Potential Customers

Potential customers in the Nuclear Valves Market are predominantly institutions and organizations directly involved in the construction, operation, maintenance, and eventual retirement of nuclear facilities. The primary end-users are the utility companies (e.g., EDF, Exelon, China National Nuclear Corporation) that own and operate the nuclear power plants. These operators are responsible for capital expenditure on new builds, scheduled component replacement, and emergency maintenance procurement. They drive demand directly by specifying requirements for both safety-critical and balance-of-plant components and managing the procurement processes during long-duration outages.

A secondary, yet highly influential, customer group includes Nuclear Steam Supply System (NSSS) vendors and Engineering, Procurement, and Construction (EPC) firms (e.g., Westinghouse, Rosatom, Framatome). For new reactor projects, NSSS vendors often select and procure the majority of the primary loop components, acting as the key decision-makers for large, custom valve packages. EPCs manage the balance-of-plant requirements and coordinate the installation and commissioning phases, representing significant indirect procurement opportunities for specialized valve suppliers.

Furthermore, government agencies, research institutions operating research reactors, and specialized decommissioning contractors represent niche but important customer segments. Decommissioning contractors, in particular, require specialized, highly durable isolation and sampling valves designed to handle contaminated fluids during the complex process of plant disassembly and waste management. The key characteristic across all customer segments is the requirement for comprehensive documentation, lifetime traceability, and a long-term supplier relationship due to the critical nature and multi-decade lifespan of the end application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Curtiss-Wright Corporation, Velan Inc. (Flowserve Corporation), Emerson Electric Co., Weir Group PLC, IMI plc, KSB SE & Co. KGaA, Copes-Vulcan, Metso Outotec Corporation, Rotork plc, Nikkiso Co., Ltd., BHEL, TEADIT, Parker Hannifin Corp., Samson AG, Fives Group, Pentair plc, Crane Co., Powell Valves, SchuF Valve Group, CIRCOR International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nuclear Valves Market Key Technology Landscape

The technology landscape within the Nuclear Valves Market is defined by continuous incremental improvements aimed at enhancing safety, operational reliability, and reducing maintenance requirements, rather than radical shifts, due to the industry's conservative nature. A primary technological focus is on developing advanced sealing technologies, including bellow seals and specialized graphite or metallic packing systems, which significantly improve fugitive emissions control and ensure zero leakage, especially in high-radiation, high-temperature environments. Furthermore, advanced actuation technologies, specifically electric motor-operated valves (MOVs) and sophisticated digital positioners, are replacing older pneumatic systems, offering higher precision, faster response, and seamless integration with modern Distributed Control Systems (DCS). Material science remains paramount, with ongoing research into high-performance alloys and specialized coatings that resist flow-accelerated corrosion (FAC) and radiation-induced material degradation, ensuring component longevity.

Non-Destructive Examination (NDE) and condition monitoring systems represent another critical technological area. Manufacturers are increasingly integrating smart sensors (pressure, temperature, acoustic emission sensors) directly onto or within the valve body and actuator assembly. This embedded monitoring allows for real-time diagnostics of valve stroke timing, seat leakage, and packing friction, enabling predictive maintenance strategies driven by data analytics and increasingly, Artificial Intelligence (AI) algorithms. This shift moves away from manual inspections toward continuous, automated surveillance, which is essential for maximizing operational efficiency and minimizing human exposure to radiation during maintenance checks.

The emergence of Small Modular Reactors (SMRs) is driving innovation toward smaller, simpler, highly standardized valve designs suitable for modular fabrication and assembly line production. These SMR-specific valves often require specialized features, such as hermetically sealed designs to eliminate leakage paths entirely, or integrated control units optimized for autonomous, remote operation. Additive Manufacturing (3D printing) is also gaining traction for producing complex internal components and specialized repair parts, though its use for primary pressure boundary components is still under stringent regulatory review and qualification, posing both an opportunity for faster prototyping and a challenge regarding material qualification.

Regional Highlights

The Nuclear Valves Market demonstrates pronounced regional variation based on the maturity of nuclear programs, regulatory frameworks, and national energy policies. Asia Pacific (APAC) stands out as the highest-growth region, driven by extensive new reactor construction programs, particularly in China and India, which are rapidly expanding their nuclear fleets to meet massive electricity demand and decarbonization targets. These countries represent the largest demand pool for large, custom-engineered primary loop valves and associated balance-of-plant components. South Korea and Japan, while focused more on maintaining and restarting existing reactors, also contribute significantly to the MRO segment through mandatory safety upgrades and component replacement cycles mandated after seismic events and regulatory reassessments.

North America (primarily the US and Canada) constitutes a stable and mature market heavily focused on the aftermarket and life extension projects. The high average age of the US reactor fleet (often exceeding 40 years) necessitates continuous investment in replacing control valves, safety valves, and isolation components to secure license renewals. Furthermore, North America is a pioneer in SMR development, creating initial high-value, high-specification demand for specialized, next-generation valves that meet innovative design criteria. The market here is characterized by high compliance costs and rigorous certification, favoring established domestic or long-standing international suppliers.

Europe’s market is segmented, with Western Europe (France, UK) focusing on strategic life extension programs and limited new builds (e.g., Hinkley Point C), generating steady, high-value demand for complex safety-critical parts. Eastern Europe, influenced by Russian-designed VVER technology (Rosatom), maintains demand for specific component types and often relies on specialized supplier chains. The regulatory environment in Europe is governed by both national agencies and broader European directives (like PED), necessitating complex compliance strategies for manufacturers operating across multiple member states. Overall, the market remains highly strategic, underpinned by energy security concerns and the pivotal role nuclear power plays in meeting the continent's climate goals.

- Asia Pacific (APAC): Highest growth driver globally due to large-scale nuclear capacity expansion in China and India; strong demand for both conventional and new reactor valve technologies.

- North America: Dominant market for MRO and life extension services; initial commercialization ground for SMR-specific valve designs; stringent regulatory environment favoring certified, high-reliability components.

- Europe: Stable aftermarket demand driven by reactor life extension in France and modernization projects in the UK and Eastern Europe; high focus on safety upgrades and compliance with both national and EU directives.

- Middle East & Africa (MEA): Emerging market driven by new build projects in countries like the UAE (Barakah Plant) and potential future programs in Saudi Arabia and Egypt; procurement heavily influenced by international EPC and NSSS vendors.

- Latin America: Small but steady market focused on maintaining existing facilities (e.g., Brazil, Argentina) and intermittent small-scale expansion or refurbishment projects; highly dependent on state financing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nuclear Valves Market.- Curtiss-Wright Corporation

- Velan Inc. (Flowserve Corporation)

- Emerson Electric Co.

- Weir Group PLC

- IMI plc

- KSB SE & Co. KGaA

- Copes-Vulcan (A division of SPX Flow)

- Metso Outotec Corporation

- Rotork plc

- Nikkiso Co., Ltd.

- BHEL (Bharat Heavy Electricals Limited)

- TEADIT

- Parker Hannifin Corp.

- Samson AG

- Fives Group

- Pentair plc

- Crane Co.

- Powell Valves

- SchuF Valve Group

- CIRCOR International

Frequently Asked Questions

Analyze common user questions about the Nuclear Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards govern the manufacturing of nuclear safety-related valves?

Nuclear safety valves are primarily governed by the ASME Boiler and Pressure Vessel Code, specifically Section III, which mandates design, material selection, fabrication, and testing for components receiving the N-stamp certification, ensuring adherence to rigorous quality and safety standards worldwide.

How is the growth of Small Modular Reactors (SMRs) impacting nuclear valve demand?

SMRs are shifting demand towards smaller, highly standardized, modular, and often hermetically sealed valves suitable for factory assembly and reduced system complexity. This trend requires less custom engineering but higher volumes of standardized, compact, high-integrity components.

What is the primary driver for nuclear valve replacement in aging reactors?

The primary driver is scheduled component replacement as part of mandatory life extension programs (MRO), where valves must be replaced due to material degradation from corrosion, erosion, thermal fatigue, and radiation exposure to secure continued operational licenses.

Which geographical region leads the demand for new nuclear valve installations?

The Asia Pacific region, specifically driven by extensive new reactor construction programs in China and India, currently leads the global demand for large-scale, new installation nuclear valve procurement.

Are manually operated nuclear valves being replaced by actuated valves?

Yes, there is a clear trend towards replacing manual systems with actuated valves (electric or pneumatic) to improve safety response times, facilitate remote operation, and enable seamless integration with modern digital control and predictive maintenance systems in both new and existing plants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager