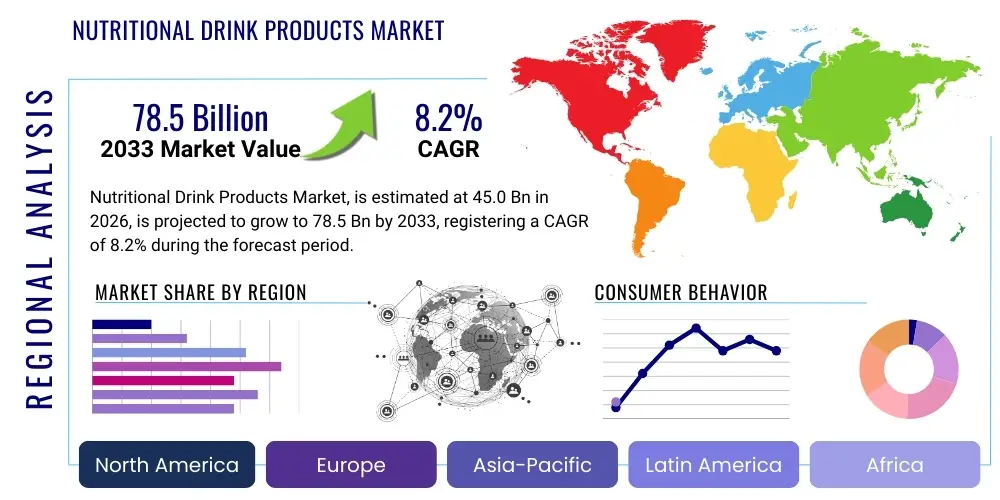

Nutritional Drink Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440918 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Nutritional Drink Products Market Size

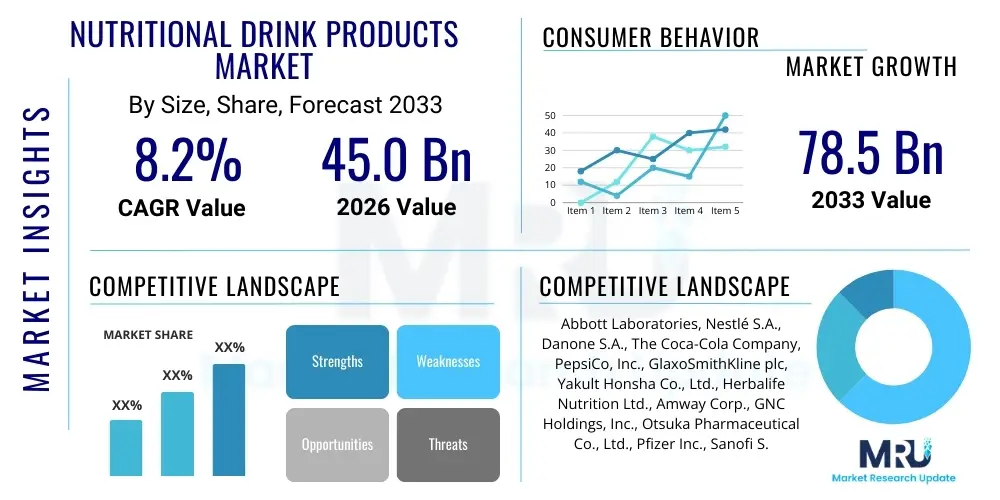

The Nutritional Drink Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% CAGR between 2026 and 2033. The market is estimated at USD 45.0 Billion in 2026 and is projected to reach USD 78.5 Billion by the end of the forecast period in 2033.

Nutritional Drink Products Market introduction

The Nutritional Drink Products Market encompasses a broad category of beverages specifically formulated to deliver targeted health benefits, often beyond basic hydration or simple refreshment. These products include a diverse range, such as fortified juices, protein shakes, meal replacement beverages, functional teas, electrolyte solutions, and specialized clinical nutrition formulas. The core value proposition of these drinks lies in their ability to offer convenient, measurable doses of essential nutrients, vitamins, minerals, proteins, and specialized compounds like probiotics or adaptogens, catering to specific dietary needs, lifestyle goals, or health conditions. The increasing global focus on proactive health management and preventative nutrition is the primary catalyst driving market expansion. As consumers seek easy and portable solutions to meet their daily nutritional requirements, nutritional drinks are transitioning from niche health food items to mainstream consumer packaged goods (CPG), heavily influencing global food and beverage innovation trends.

Product descriptions vary widely across sub-segments. For instance, sports nutritional drinks focus on optimizing performance and recovery through balanced electrolytes and protein content, while clinical nutritional drinks are meticulously designed to support patients recovering from illness or surgery, often requiring specific caloric density and macronutrient profiles. Meal replacement drinks offer balanced energy and satiety for weight management or busy lifestyles. The major applications for these products span across sports nutrition, clinical care, weight management programs, and general daily wellness, supporting everything from muscle synthesis in athletes to immune function in the general population. The market’s dynamism is fueled by rapid technological advancements in formulation science, allowing manufacturers to mask unpleasant flavors associated with high protein or vitamin concentrations and integrate exotic, scientifically validated ingredients.

The significant benefits derived from nutritional drink consumption include enhanced dietary compliance, improved energy levels, targeted nutrient delivery, and unmatched convenience, which is highly valued by modern, time-constrained consumers. Driving factors include the global rise in chronic diseases, an aging population with specific nutritional needs, expanding disposable incomes in emerging economies, and pervasive digital health communication which increases consumer awareness regarding specific nutrient deficiencies and health goals. Furthermore, the robust growth of e-commerce platforms has drastically improved the accessibility of specialized nutritional formulas, moving them beyond traditional pharmacy channels and into mainstream online purchasing, thereby accelerating market penetration and overall growth trajectory in diverse global regions. The convenience of these ready-to-drink formats directly addresses the lifestyle constraints of modern consumers, positioning them as essential components of daily dietary routines, especially for those pursuing active or high-demand professional lives.

Nutritional Drink Products Market Executive Summary

The global Nutritional Drink Products Market is characterized by intense innovation, driven by shifting consumer paradigms favoring functional ingredients, plant-based alternatives, and personalized nutrition. Key business trends include the consolidation of smaller, innovative brands by major CPG conglomerates seeking to acquire specialized formulation expertise and diversify their health portfolio. Furthermore, sustainability is emerging as a critical competitive factor; companies are investing heavily in eco-friendly packaging, transparent sourcing, and ethical production practices, responding directly to heightened consumer demand for responsible manufacturing. Digital engagement, utilizing AI-driven platforms for personalized recommendations and direct-to-consumer (D2C) marketing, is reshaping the supply chain and consumer interaction landscape, allowing for faster product development cycles targeted at microniche segments. This strategic focus on merging health, technology, and environmental responsibility dictates future market leadership.

Regionally, North America and Europe currently dominate the market, primarily due to high levels of health awareness, robust purchasing power, and well-established regulatory frameworks supporting the introduction of novel functional ingredients. These regions possess mature distribution networks and high per capita expenditure on preventive health products. However, the Asia Pacific (APAC) region is poised for the most explosive growth, propelled by massive demographic shifts—a burgeoning middle class, urbanization, and increasing rates of lifestyle-related diseases (such as diabetes and obesity)—which create enormous demand for preventative health solutions and convenient nutritional support. Governments in APAC are also increasingly promoting public health initiatives, further stimulating the adoption of fortified beverages. Latin America and the Middle East and Africa (MEA) present significant untapped opportunities, focusing initially on affordability and clinical nutrition applications, with gradual expansion into performance-based segments as local economies strengthen.

Segmentation trends indicate a clear preference shift toward specialized dietary categories. The fastest-growing segments include plant-based protein drinks (fueled by vegan and flexitarian trends), functional beverages enhanced with nootropics or adaptogens (targeting stress and cognitive health), and products aimed at the senior care demographic (focusing on bone health and muscle maintenance). Traditional categories, such as standard meal replacements, continue to grow steadily but are increasingly being reformulated to meet clean label criteria, reducing sugar and artificial additives. Distribution is leaning heavily toward online retail, which offers convenience and the ability to stock a wider variety of specialized, niche products that traditional brick-and-mortar stores may not accommodate, ensuring comprehensive market coverage. This fragmentation of demand necessitates highly flexible manufacturing and marketing approaches, moving away from mass-market products toward highly specific functional solutions tailored to individual consumer needs.

AI Impact Analysis on Nutritional Drink Products Market

User queries regarding AI's impact on the Nutritional Drink Products Market primarily revolve around personalization at scale, optimizing supply chain efficiency, and enhancing product safety and quality assurance. Consumers and industry stakeholders frequently ask how AI can tailor nutritional recommendations based on individual biometric data, genetics, and lifestyle inputs, moving beyond generic products to truly personalized functional formulas. There is significant interest in how machine learning can predict flavor preferences and ingredient synergy to accelerate research and development (R&D), minimizing trial-and-error costs. Furthermore, supply chain optimization using AI to forecast demand variability, especially for perishable ingredients, and ensure cold chain integrity remains a major concern area, emphasizing the industry's need for predictive logistics solutions to maintain product efficacy.

The integration of Artificial Intelligence is revolutionizing product formulation by enabling highly complex data analysis, far beyond human capacity, correlating ingredient efficacy with specific health outcomes based on vast datasets of clinical trials and real-world consumer feedback. AI algorithms can identify subtle, non-obvious relationships between nutrient combinations, optimizing bioavailability and sensory attributes simultaneously. This capability allows manufacturers to develop highly targeted, condition-specific nutritional drinks much faster, leading to a proliferation of sophisticated, micro-targeted products addressing niche concerns like specialized microbiome support or detailed energy modulation tailored to specific times of the day or activity levels. This shift fundamentally transforms the competitive landscape by raising the barrier to entry for companies not leveraging data science in R&D, favoring those with robust data capture and processing capabilities. AI-driven predictive modeling can simulate consumer responses to new formulations, drastically shortening the time from concept to market launch.

Beyond product creation, AI is also fundamentally altering market interaction. Machine learning models power advanced predictive analytics used to fine-tune marketing campaigns, determining optimal pricing strategies, and identifying emerging consumer segments before they become mainstream. On the manufacturing side, AI-driven quality control systems monitor production lines in real-time, detecting deviations in composition or purity much earlier than traditional sampling methods, thereby significantly enhancing product safety and reducing waste. This level of automated precision is critical for high-value nutritional drinks, where consistency and trust are paramount. The overarching expectation is that AI will eventually enable fully customized, single-serving nutritional drinks formulated on demand, integrating diagnostics directly into the consumer experience, thus creating ultra-personalized products that maximize health return on investment for the individual consumer.

- AI enables personalized nutrition formulation based on individual biometric and genetic data.

- Machine learning optimizes flavor profiles and ingredient efficacy, accelerating R&D cycles.

- Predictive logistics driven by AI enhances cold chain management and reduces spoilage of sensitive ingredients.

- AI-powered demand forecasting improves inventory management and minimizes stockouts in fluctuating markets.

- Automated quality assurance systems ensure real-time purity monitoring and batch consistency during manufacturing.

- Chatbots and conversational AI deliver personalized consumer support and track post-purchase outcomes.

- Advanced data mining identifies emerging ingredient trends and consumer health goals globally.

DRO & Impact Forces Of Nutritional Drink Products Market

The market's trajectory is primarily driven by escalating consumer interest in preventative healthcare and the profound convenience offered by ready-to-drink (RTD) formats. Restraints largely center around stringent regulatory scrutiny, particularly concerning health claims and ingredient safety, coupled with high initial costs associated with premium, specialized functional ingredients. Opportunities are vast in the areas of personalized nutrition, the integration of digital health trackers, and expansion into untapped emerging economies, especially targeting the growing elderly and pediatric populations. These four factors—Drivers, Restraints, Opportunities, and the resulting Impact Forces—collectively shape the competitive environment, pushing companies towards sustainable innovation while navigating complex public trust and compliance issues, ultimately determining the long-term viability and profitability across various sub-segments.

Drivers: A primary driver is the demonstrable link between diet and chronic disease management, prompting consumers to proactively invest in functional foods and beverages. The increasing penetration of lifestyle disorders like diabetes, obesity, and hypertension globally necessitates dietary adjustments, making nutritional drinks valuable tools for calorie control, specialized sugar substitutes, and targeted nutrient delivery. Furthermore, the pervasive trend of 'on-the-go' consumption perfectly aligns with the RTD format's convenience, appealing especially to busy professionals and active individuals. Continuous ingredient innovation, such as the successful integration of novel botanicals, high-absorption proteins, and shelf-stable probiotics, keeps the product category fresh and appealing, continually addressing new consumer pain points and creating persistent market pull. The sports nutrition segment continues its expansion beyond elite athletes into mainstream fitness enthusiasts, broadening the consumer base significantly by making performance nutrition accessible and socially acceptable for everyday use, thereby greatly expanding the total addressable market.

Restraints: The most significant restraint is the complex and often fragmented regulatory environment across different regions. Making specific health claims requires extensive clinical substantiation, which can be costly and time-consuming, hindering speed-to-market. Furthermore, consumer skepticism regarding the efficacy of certain functional ingredients, often fueled by historical instances of unsubstantiated claims, poses a challenge to building long-term brand trust. Pricing sensitivity is another major barrier; specialized nutritional drinks often carry a premium price tag compared to conventional beverages, potentially limiting adoption among lower- and middle-income demographics. Additionally, the challenge of maintaining long shelf stability for sensitive bioactive ingredients (like certain vitamins or probiotics) without compromising nutritional integrity or taste requires significant investment in advanced processing technologies, increasing production complexity and demanding higher capital expenditure from manufacturers.

Opportunities: Major opportunities exist in tapping into the burgeoning demand for specialized dietary requirements, such as vegan, ketogenic, or paleo-compliant formulas, as consumers increasingly self-identify with specific diets. The integration of digital health technology, where drinks can be recommended based on real-time activity data or health metrics captured via wearables, offers a pathway toward hyper-personalization, establishing brand loyalty through tailored efficacy. Geographically, emerging markets in Asia and Latin America represent substantial long-term growth potential as their healthcare infrastructures mature and preventative spending increases. Finally, the focus on sustainable and transparent sourcing, including certified organic and non-GMO ingredients, allows companies to capture the high-value, ethically conscious consumer segment, creating premium revenue streams and competitive differentiation. Exploration into postbiotic technology and customized hydration solutions further presents lucrative, technologically demanding market expansion possibilities.

Segmentation Analysis

The Nutritional Drink Products Market is analyzed across various critical dimensions including Product Type, Consumer Group, Distribution Channel, and Application, providing a granular view of market dynamics and growth pockets. The segmentation highlights the market's shift from generalized health support to highly specialized and targeted solutions, driven by demographic changes and increased consumer sophistication regarding personal health goals. Analyzing these segments is essential for identifying high-growth niches, optimizing product portfolios, and tailoring marketing strategies to specific buyer personas, such as the fitness enthusiast versus the clinical patient, each with distinct needs and purchasing behaviors. This detailed breakdown facilitates strategic resource allocation and targeted innovation efforts across the entire industry value chain.

- By Product Type:

- Sports Drinks (Isotonic, Hypotonic, Hypertonic)

- Energy Drinks (High Caffeine, Natural Caffeine, Herbal Extracts)

- Meal Replacement Drinks (Weight Management, Clinical Care)

- Functional Beverages (Fortified Water, Vitamin Drinks, Immunity Boosters)

- Protein Drinks (Whey-based, Casein-based, Plant-based – Soy, Pea, Rice, Hemp)

- Others (Electrolyte Solutions, Hydration Drinks, Specialty Juices, Collagen Drinks)

- By Consumer Group:

- Adults (General Wellness, Performance, Stress Management, Aging)

- Children (Pediatric Nutrition, Growth Formulas, Immune Support)

- Senior Citizens (Bone Health, Muscle Mass Retention, Disease Management, Cognitive Support)

- Athletes (Professional, Amateur, Endurance, Strength Training)

- By Distribution Channel:

- Supermarkets/Hypermarkets (Mass Market Access, High Volume)

- Convenience Stores (Immediate Consumption, High Visibility)

- Pharmacies/Drug Stores (Clinical and Specialized Formulas, Trust Factor)

- Online Retail (D2C, Subscription Models, Specialized E-commerce, Broad Portfolio)

- Direct Sales (Multi-Level Marketing, Health Practitioners, Personalized Consultation)

- By Application:

- Weight Management (Calorie Control, Satiety Enhancement, Metabolic Support)

- Immunity Support (Vitamins C, D, Zinc, Probiotics, Adaptogens)

- Digestive Health (Prebiotics, Probiotics, Fiber, Enzyme Support)

- General Well-being (Daily Nutrient Fortification, Hydration)

- Sports Nutrition (Recovery, Hydration, Energy Boost, Muscle Synthesis)

- Clinical Nutrition (Disease-Specific Management, Post-Surgery Recovery, Tube Feeding Formulas)

Value Chain Analysis For Nutritional Drink Products Market

The value chain for the Nutritional Drink Products Market is complex, involving intricate relationships from specialized raw material sourcing to final consumer delivery. Upstream analysis focuses heavily on the procurement of high-quality, often exotic or scientifically processed ingredients such as specialized protein isolates, novel botanical extracts, synthesized vitamins, and shelf-stable probiotics. Ensuring the integrity and traceability of these ingredients is paramount, requiring robust supplier validation and long-term contracts, especially for patented or proprietary components. Processing and manufacturing involve advanced techniques like ultra-high-temperature (UHT) treatment or aseptic packaging to ensure microbial safety and extend shelf life without compromising nutrient stability, representing a major cost center and point of technological differentiation in the midstream. Ingredient costs, particularly for premium, certified organic, or sustainable inputs, constitute a significant portion of the overall production expenditure, demanding efficiency in procurement and formulation.

The downstream analysis primarily concerns efficient and compliant distribution. The distribution channel is multifaceted, utilizing both direct and indirect routes. Indirect distribution, leveraging major wholesalers, retailers (supermarkets, hypermarkets), and drug stores, allows for broad market access and high volume sales, benefiting from established retail foot traffic. Direct distribution, increasingly vital, involves D2C e-commerce platforms and direct engagement with clinical institutions or specialized health practitioners. This direct model allows for greater control over brand message, personalized consumer interaction, and immediate feedback loops, crucial for optimizing product formulations and minimizing inventory holding costs. The success of the downstream operation is highly dependent on effective cold chain management, particularly for products requiring refrigeration to preserve the efficacy of live cultures or fresh ingredients, which adds layers of complexity and cost to logistics.

Distribution complexity is heightened by the need for cold chain logistics for many highly sensitive probiotic or fresh juice-based nutritional drinks, increasing operational costs compared to shelf-stable conventional beverages. The marketing and sales segment in the downstream focuses on detailed education about product efficacy, often relying on scientific validation and endorsements from health professionals to build consumer trust. Success in this market segment hinges not just on producing a high-quality product, but also on effectively communicating its targeted health benefits, often leveraging digital platforms for transparent ingredient narratives and outcome-based testimonials. The overall chain is marked by high capital intensity in both R&D (upstream) and advanced packaging/logistics (downstream), emphasizing the strategic importance of supply chain resilience and vertical integration capabilities to maintain consistent quality and margin control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 Billion |

| Market Forecast in 2033 | USD 78.5 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Nestlé S.A., Danone S.A., The Coca-Cola Company, PepsiCo, Inc., GlaxoSmithKline plc, Yakult Honsha Co., Ltd., Herbalife Nutrition Ltd., Amway Corp., GNC Holdings, Inc., Otsuka Pharmaceutical Co., Ltd., Pfizer Inc., Sanofi S.A., DuPont de Nemours, Inc., ADM, Keurig Dr Pepper, Inc., Campbell Soup Company, Kellogg Company, Premier Protein (BellRing Brands), Muscle Milk (PepsiCo) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nutritional Drink Products Market Potential Customers

Potential customers for the Nutritional Drink Products Market are highly diversified, extending far beyond the traditional athletic consumer base to include specific demographic groups seeking functional and convenient solutions for health management. Key end-users include health-conscious millennials and Gen Z consumers prioritizing mental wellness and immunity support, leading to high demand for nootropic-enhanced and vitamin-rich functional beverages. The clinical segment comprises hospitals, nursing homes, and rehabilitation centers, requiring specialized formulas for tube feeding, post-operative recovery, and management of chronic diseases like renal failure or cancer-related cachexia, where specific macro- and micronutrient ratios are medically critical. This segment prioritizes validated efficacy and compliance with medical standards, creating a highly demanding but stable customer base.

A rapidly expanding customer base is the aging population (65+), particularly in developed economies. This demographic requires products addressing sarcopenia (muscle loss), bone density issues, and cognitive decline, driving demand for high-protein, Vitamin D-fortified, and omega-3 rich drinks. Additionally, parents seeking nutritious, low-sugar alternatives for their children constitute a major buyer segment, demanding transparency regarding ingredients and assurance of safety and palatability. Furthermore, individuals adopting specialized diets (e.g., vegan, gluten-free, low-carb) are consistent buyers, actively seeking nutritional drinks that fill potential nutrient gaps inherent in restrictive eating patterns, driving innovation in plant-based and novel ingredient applications. The growing professional athlete segment also remains a high-value customer group, requiring scientifically advanced products for hydration, rapid recovery, and performance enhancement under competitive conditions.

The buyer profiles are characterized by high levels of information seeking, often relying on expert recommendations (doctors, dietitians) or detailed online research before purchase. Their purchasing decisions are heavily influenced by perceived efficacy, brand trust, and increasingly, alignment with environmental, social, and governance (ESG) factors. The shift toward subscription models demonstrates the high loyalty and routine consumption patterns of this customer base once a product meets their specific health requirements and taste preferences, indicating strong potential for sustained revenue streams through direct-to-consumer relationships. Manufacturers must therefore focus their engagement strategies on scientific communication, clear labeling, and utilizing health professionals as key opinion leaders to effectively reach and retain these diverse and informed consumer groups.

Nutritional Drink Products Market Key Technology Landscape

The technological landscape in the Nutritional Drink Products Market is defined by advancements aimed at enhancing bioavailability, improving flavor profiles of highly functional ingredients, and extending the shelf life of sensitive nutritional components. Aseptic processing and ultra-high-temperature (UHT) sterilization techniques are critical technologies, allowing for the creation of shelf-stable liquid products without the need for refrigeration, while preserving most nutritional value. Microencapsulation technology is increasingly prevalent; it is used to protect sensitive ingredients like probiotics, omega-3 fatty acids, and certain vitamins from degradation due to heat, light, or gastric acidity, ensuring targeted release and maximum absorption within the body, which significantly boosts product efficacy and supports complex health claims. These advancements minimize waste and allow broader market distribution.

Beyond processing, formulation technology plays a pivotal role. This includes advanced flavor masking techniques essential for high-protein or bitter botanical extracts, making these highly functional drinks palatable and appealing to a mass audience. Furthermore, sustainable packaging technology is emerging as a critical competitive edge. Manufacturers are rapidly adopting bio-degradable, plant-based, and highly recyclable packaging materials (such as fully recyclable aluminum cans or paper-based bottles) to reduce their environmental footprint and meet consumer demand for eco-friendly products. Traceability technologies, utilizing blockchain, are also being implemented to provide consumers with transparent information regarding the sourcing and quality validation of premium ingredients, reinforcing trust, especially for organic and ethically sourced components, thereby enhancing brand equity.

The convergence of biotechnology and food science is leading to novel ingredient production. Precision fermentation is being used to create sustainable, non-animal-derived proteins and specialized fats with optimized nutritional profiles, offering scalable and ethically sourced alternatives to traditional ingredients like whey or soy. Digital integration forms the third pillar of the technology landscape; this involves leveraging sophisticated sensors in production for real-time quality monitoring and utilizing consumer-facing apps for tracking product consumption effects, thereby feeding valuable efficacy data back into the R&D cycle. These technological investments are crucial for sustaining high growth and meeting the demand for complex, clean-label, and functionally superior products, ensuring manufacturers can operate efficiently at scale while meeting stringent quality and environmental standards globally.

Regional Highlights

- North America (USA, Canada): Dominates the market value due to extremely high consumer awareness regarding health and wellness, established fitness culture, and high disposable income. The US market is characterized by rapid adoption of performance and lifestyle-oriented nutritional drinks, driven by strong D2C channels and innovation in plant-based protein and cognitive health beverages. High regulatory stability supports complex product launches, reinforcing market maturity.

- Europe (Germany, UK, France): A mature market defined by strict regulatory standards and strong demand for natural, organic, and 'clean label' products. The growth is substantial in the senior nutrition segment and functional drinks fortified with vitamins and minerals to address recognized deficiencies, often through pharmacy and health food store channels. Sustainability certifications and ethical sourcing play a critical role in consumer purchasing behavior.

- Asia Pacific (APAC) (China, India, Japan, Australia): Expected to exhibit the highest CAGR. Growth is fueled by rapid urbanization, rising middle-class populations, increased spending on preventative health, and the rapid adoption of Western dietary trends. China and India are massive growth engines, focusing initially on pediatric and clinical nutrition, quickly expanding into sports and immunity drinks. Localized flavor adaptation is key to regional market penetration.

- Latin America (Brazil, Mexico): Characterized by increasing demand for basic nutritional supplements and meal replacement drinks addressing high rates of obesity and associated metabolic disorders. Affordability and accessibility through local retail chains are key factors driving market success. The sports nutrition segment is rapidly growing, supported by regional fitness movements and increasing awareness of performance optimization.

- Middle East and Africa (MEA): A nascent but growing market, primarily concentrated in the affluent Gulf Cooperation Council (GCC) countries. Demand is driven by clinical nutrition needs in advanced private healthcare facilities and a growing expatriate population adopting Western fitness trends. Challenges include complex logistics and lower general awareness in some regions, necessitating targeted educational campaigns for wider adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nutritional Drink Products Market.- Abbott Laboratories

- Nestlé S.A.

- Danone S.A.

- The Coca-Cola Company

- PepsiCo, Inc.

- GlaxoSmithKline plc

- Yakult Honsha Co., Ltd.

- Herbalife Nutrition Ltd.

- Amway Corp.

- GNC Holdings, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- DuPont de Nemours, Inc.

- ADM

- Keurig Dr Pepper, Inc.

- Campbell Soup Company

- Kellogg Company

- Premier Protein (BellRing Brands)

- Muscle Milk (PepsiCo)

Frequently Asked Questions

Analyze common user questions about the Nutritional Drink Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Nutritional Drink Products Market?

The primary factor driving market growth is the global acceleration of health consciousness, coupled with increasing consumer preference for convenient, ready-to-drink (RTD) solutions that offer targeted functional benefits, such as immunity support, specific nutrient fortification, and enhanced energy delivery, aligning with preventative health strategies, especially among aging and urban populations seeking efficient dietary management.

How is the shift toward plant-based diets impacting nutritional drink formulations?

The growing adoption of vegan and flexitarian lifestyles is profoundly impacting formulations, leading to a surge in products using plant-based proteins (pea, rice, almond, soy) and utilizing non-dairy bases. Manufacturers are focused on overcoming texture and flavor challenges while ensuring complete amino acid profiles comparable to traditional dairy-based options, often through ingredient blending and advanced processing techniques.

Which distribution channel is experiencing the fastest growth for specialized nutritional drinks?

Online retail (e-commerce and direct-to-consumer models) is the fastest-growing distribution channel. This channel allows specialized brands to bypass traditional retail limitations, stock a wider variety of niche and personalized products, and leverage subscription services to ensure consistent consumer access and brand loyalty, while also providing rich data for personalized marketing efforts.

What regulatory challenges do companies face when marketing nutritional drinks?

Companies face significant regulatory hurdles related to substantiating specific health claims (e.g., "supports cognitive function" or "boosts immunity"). Regulations require rigorous scientific evidence and careful labeling to avoid misleading consumers, necessitating substantial investment in clinical trials and compliance infrastructure across diverse global markets, creating market entry barriers for smaller players lacking clinical backing.

How does technological advancement in processing influence product efficacy and shelf life?

Advanced processing technologies like microencapsulation and aseptic filling are crucial. Microencapsulation protects highly sensitive ingredients (like probiotics and certain vitamins) from degradation during processing and storage, ensuring their bioavailability upon consumption, while aseptic filling extends product shelf life without relying heavily on artificial preservatives or refrigeration, thus preserving efficacy and enabling broader global distribution.

The nutritional drink market's resilience during economic fluctuations is noteworthy, often positioned as a non-discretionary health investment rather than a luxury purchase, particularly within the clinical and specialized segments. Market dynamics are heavily influenced by scientific breakthroughs in microbiome research, which continuously opens avenues for functional ingredients targeting gut health, establishing prebiotics and postbiotics as new frontiers alongside traditional probiotics. Investment in research and development remains concentrated on reducing the sugar content without compromising taste, often utilizing high-intensity natural sweeteners or advanced flavor systems that mimic sugar profiles, thereby meeting the massive consumer demand for "better-for-you" options. Geographical expansion strategies necessitate detailed understanding of local dietary laws and cultural flavor preferences; for example, Asian markets often favor traditional herbal ingredients integrated into modern drink formats, requiring localized innovation and supply chain adaptation. The competitive intensity forces companies into aggressive portfolio diversification and strategic alliances, particularly between established food giants and biotech startups specializing in novel ingredients. Sustainability commitments are now non-negotiable aspects of brand identity, extending beyond just packaging to include water usage efficiency and ingredient waste minimization throughout the entire production lifecycle. Data analytics capability is rapidly becoming a core competency, guiding everything from flavor launches to pricing optimization in dynamic retail environments. The integration of personalized subscription boxes for nutritional drinks, driven by self-reported health goals or wearable data, represents the pinnacle of consumer-centric marketing in this sector. Clinical trials validating functional benefits are now frequently highlighted in marketing materials, demonstrating a move towards evidence-based consumer communication to build credibility and justify premium pricing structures. The interplay between regulatory bodies and industry innovators is constant, particularly concerning novel food status for emerging ingredients derived from cellular agriculture or synthetic biology, which promises future radical shifts in sourcing and formulation. The senior nutrition segment is rapidly evolving, moving away from purely remedial formulas towards preventative products designed for active aging, featuring ingredients like collagen and specific amino acids crucial for mobility. Brand authenticity and transparency regarding sourcing and processing methods are key drivers for millennial purchasing decisions, demanding end-to-end supply chain visibility and ethical sourcing certification. The penetration of nutritional drinks into mainstream cafe culture and quick-service restaurants, beyond traditional retail aisles, is another key growth vector, offering convenience and immediate consumption opportunities in new settings. Furthermore, cross-border e-commerce activities are accelerating, allowing niche European or North American brands to directly reach Asian consumers who seek unique or specialized formulas not yet available locally, bypassing traditional import complexities and distribution layers. This fluid market environment necessitates continuous vigilance regarding ingredient safety, consumer trends, and technological adoption to maintain competitive advantage and secure long-term market share in this expansive and specialized beverage category. The shift towards nootropics, ingredients aimed at enhancing cognitive function, is particularly relevant as consumers increasingly link physical health with mental performance, driving innovation in areas like adaptogens and specialized amino acids, cementing the market’s focus on holistic wellness solutions. The ongoing convergence of food, pharma, and technology is fundamentally redefining what constitutes a nutritional drink product, pushing boundaries into bio-engineered functional matrices designed for maximum physiological impact and optimized absorption efficiency in the human body.

The impact of macro-economic variables, such as inflation affecting commodity prices for inputs like sugar, protein powder, and specialized vitamins, consistently influences the final retail price, challenging affordability in price-sensitive markets. Companies are utilizing hedging strategies and backward integration to stabilize costs, ensuring profitability while minimizing consumer price shocks. The demand for clean label attributes—meaning minimal ingredients, easily recognizable names, and absence of artificial colors, flavors, or preservatives—is a non-negotiable quality standard in developed markets, necessitating technological mastery in natural preservation techniques. Flavor innovation, moving beyond standard fruit or chocolate profiles to include complex, savory, or highly sophisticated culinary notes, is a vital competitive tool to capture the discerning palates of modern consumers seeking differentiated experiences. Moreover, the role of certified dietitians and nutritionists as influencers and recommendation engines is growing, creating a professional marketing channel that leverages scientific credibility to drive adoption in both clinical and mainstream settings. The global supply chain challenges experienced recently have underscored the importance of localized sourcing and diversified manufacturing footprints to ensure resilience against geopolitical risks and logistical bottlenecks, especially for high-volume, globally distributed brands. Regulatory convergence, while slow, remains an optimistic long-term trend, potentially simplifying market entry and harmonization of health claim standards across major economic blocks, reducing compliance burdens for international players. Investment in advanced clinical research that substantiates the long-term benefits of sustained consumption is crucial for transitioning nutritional drinks from occasional supplements to essential daily dietary components, securing future revenue stability and justifying ongoing premium pricing strategies across various consumer segments globally, fostering an environment of continuous trust building and scientific validation within the consumer packaged goods sector.

The strategic deployment of micro-segmentation strategies, informed by granular demographic and psychographic data, allows market participants to launch highly specific products addressing narrow, yet profitable, consumer needs, such as drinks tailored for night shift workers or those specifically formulated to aid recovery from high-intensity interval training (HIIT). This level of focus ensures that marketing spend is maximized by reaching the most receptive audience directly. Furthermore, the incorporation of adaptogenic mushrooms and complex natural compounds into functional beverages is a rapidly expanding area, driven by ancient wellness traditions meeting modern scientific validation, appealing strongly to consumers seeking natural stress relief and enhanced mental clarity without relying on caffeine or synthetic stimulants. The need for transparency around genetically modified organisms (GMOs) and other agricultural practices means that non-GMO verification and certified organic status continue to command a significant price premium, particularly in North America and Europe, influencing sourcing decisions heavily. The clinical nutrition market, while less volatile, is witnessing intense competition among major pharmaceutical and nutrition companies to develop proprietary formulas for chronic disease management, often requiring partnerships with healthcare providers and specialized compounding pharmacies for customized patient solutions. The overall market is evolving into a technology-driven, health-focused ecosystem where product efficacy, convenience, and ethical production practices are equally important determinants of commercial success and sustained consumer loyalty.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager