Nylon 66 Chips Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442856 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Nylon 66 Chips Market Size

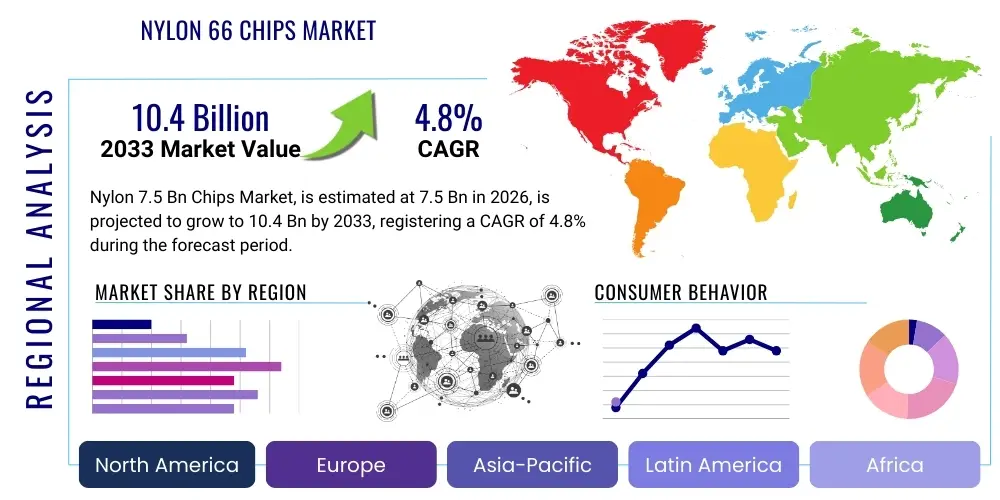

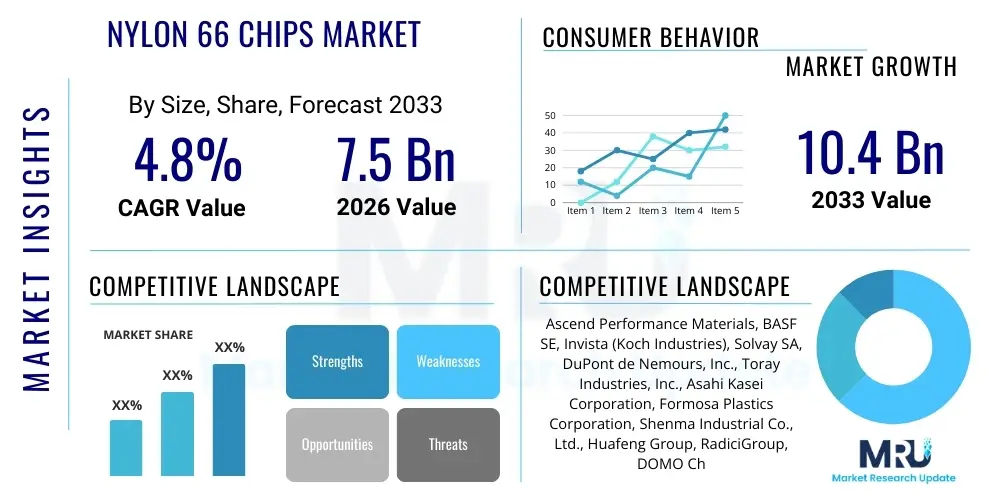

The Nylon 66 Chips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the escalating demand for high-performance engineering plastics across the automotive and electrical and electronics sectors, driven by global trends toward lightweighting and enhanced thermal stability in component design.

Nylon 66 Chips Market introduction

The Nylon 66 (PA66) Chips Market encompasses the production, distribution, and consumption of semi-crystalline polyamides derived from the polycondensation reaction of hexamethylenediamine and adipic acid. These chips serve as a critical feedstock for various downstream manufacturing processes, notably injection molding, extrusion, and spinning. Known for their superior mechanical strength, excellent abrasion resistance, high melting point, and robust chemical inertness, Nylon 66 chips are categorized as high-performance engineering thermoplastics essential for demanding industrial applications where reliability under stress and elevated temperatures is paramount.

Major applications include the production of automotive components such as engine covers, intake manifolds, and radiator end tanks, where the material contributes significantly to vehicle lightweighting and improved fuel efficiency. Furthermore, Nylon 66 is vital in electrical and electronic casings, circuit breaker parts, and connectors, owing to its exceptional dielectric properties and flame retardancy. In the textile industry, it is spun into fibers for high-tenacity yarns used in airbags, tire cord, and specialized industrial fabrics, benefiting from its inherent strength and dimensional stability.

The market expansion is robustly driven by the continuous technological advancements in end-user industries, particularly the shift toward electric vehicles (EVs), which require specialized plastic compounds to manage battery heat and ensure safety. Regulatory mandates promoting vehicle efficiency and the increasing adoption of lightweight materials in consumer goods further stimulate demand. However, the market faces structural challenges related to the volatile pricing and supply stability of key precursors, specifically Adiponitrile (ADN), which remains a major constraint affecting overall production economics and global pricing mechanisms for PA66 chips.

Nylon 66 Chips Market Executive Summary

The Nylon 66 Chips Market is characterized by intense integration of the value chain, highly sensitive to feedstock availability and price volatility, particularly concerning adiponitrile (ADN). Current business trends indicate a strategic focus among major producers on backward integration and the development of bio-based or recycled PA66 alternatives to mitigate supply chain risks and meet stringent sustainability requirements from automotive and consumer goods manufacturers. Technological innovation centers around enhancing melt flow characteristics and improving hydrolysis resistance, crucial for applications in humid or high-temperature environments, thereby securing high-value niche segments.

Regionally, the Asia Pacific (APAC) dominates both production and consumption, spearheaded by manufacturing hubs in China, India, and Southeast Asia, driven by rapid industrialization and escalating automotive production volumes. North America and Europe, while mature markets, emphasize the adoption of premium, specialized grades of Nylon 66 for critical safety components and advanced electronic devices, often incorporating carbon fiber or glass fiber reinforcement. Future growth dynamics suggest a gradual shift in manufacturing capacity expansion towards APAC, although supply chain diversification remains a high-priority risk mitigation strategy globally, influenced by geopolitical trade dynamics.

Segment trends reveal that the engineering plastics grade segment holds the largest market share due to its indispensable role in sophisticated automotive and electrical applications. However, the fiber and filament segment, particularly high-tenacity industrial yarns, is exhibiting substantial growth momentum, spurred by increasing requirements in infrastructure development, safety equipment (airbags), and durable textile applications. Furthermore, the market sees a growing distinction between standard and specialty grades, with customized compounding formulations becoming increasingly important to meet specific performance requirements for new generations of electronic devices and advanced mobility solutions.

AI Impact Analysis on Nylon 66 Chips Market

Common user questions regarding AI's impact on the Nylon 66 Chips market frequently center on optimizing complex manufacturing processes, predicting raw material price volatility, and accelerating R&D for novel material formulations. Users are keen to understand how AI-driven predictive maintenance can reduce operational downtime in polymerization plants and how machine learning algorithms can model the complex reaction kinetics involved in PA66 synthesis to improve yield and quality consistency. Furthermore, there is significant interest in utilizing AI for demand forecasting, especially concerning the highly cyclical and application-specific nature of Nylon 66 consumption in automotive and consumer markets, seeking to stabilize inventory management and supply chain responsiveness. The summarized expectation is that AI will primarily serve as a powerful optimization tool, driving efficiency gains across the entire value chain from precursor purchasing to final product quality assurance, leading to significant cost savings and reduced environmental impact through optimized energy usage.

The adoption of Artificial Intelligence and Machine Learning (ML) technologies is poised to revolutionize the operational efficiency and strategic decision-making processes within the Nylon 66 Chips manufacturing ecosystem. AI algorithms can analyze massive datasets related to reactor temperature, pressure, monomer concentration, and throughput rates, enabling real-time adjustments that optimize polymerization conditions. This level of precision minimizes off-spec material production, enhances consistency, and critically, lowers energy consumption during the highly exothermic chemical reactions involved in PA66 production, addressing both economic and environmental objectives.

Beyond process optimization, AI plays a crucial role in managing the intrinsic volatility of raw material costs, particularly ADN, which is susceptible to global supply disruptions. Predictive modeling, powered by ML, can integrate global economic indicators, oil and gas price fluctuations, and production capacities of key suppliers to forecast future price movements with higher accuracy than traditional statistical methods. This allows manufacturers to implement proactive hedging strategies and optimize procurement timing, stabilizing input costs which are essential for maintaining competitive pricing in downstream markets for PA66 engineering plastics.

Moreover, AI is being leveraged in materials science R&D to accelerate the discovery and formulation of new specialized grades of Nylon 66, such as those with improved flame retardancy, enhanced chemical resistance, or superior mechanical properties required for next-generation applications (e.g., hydrogen fuel cell components or high-voltage electric vehicle parts). Neural networks can quickly evaluate thousands of potential compound modifications (e.g., adding reinforcing fibers or impact modifiers) and predict their resulting physical properties, drastically cutting down the time and cost associated with conventional, iterative laboratory testing, thus accelerating market readiness for innovative PA66 solutions.

- AI-driven Predictive Maintenance: Minimizes plant downtime and optimizes asset lifespan.

- ML-Powered Yield Optimization: Fine-tuning polymerization parameters for maximal output and quality.

- Supply Chain Risk Modeling: Enhancing forecasting accuracy for volatile precursor costs (e.g., ADN).

- Accelerated R&D: Simulating new PA66 compound formulations and property predictions.

- Energy Consumption Reduction: Real-time process adjustments minimizing thermal energy requirements.

DRO & Impact Forces Of Nylon 66 Chips Market

The Nylon 66 Chips Market is propelled primarily by the indispensable requirement for lightweight, high-strength materials in the rapidly evolving automotive industry, especially with the accelerated transition to Electric Vehicles (EVs), where PA66 compounds are crucial for battery modules, structural components, and thermal management systems. The material’s excellent balance of mechanical, thermal, and electrical properties ensures its continued preference over lower-cost alternatives in critical applications. However, the market faces severe restraints stemming from the concentrated and often unpredictable supply chain for adiponitrile (ADN), a primary precursor, which leads to significant cost volatility and supply limitations that impact profitability and investment decisions across the PA66 value chain.

Significant opportunities arise from the increasing global focus on sustainability, driving demand for recycled Nylon 66 (rPA66) and bio-based alternatives. Companies investing in advanced depolymerization and mechanical recycling technologies can tap into this emerging segment, aligning with corporate environmental mandates from major downstream consumers. Furthermore, the burgeoning demand for high-performance specialty chips in niche markets such as medical devices, 5G infrastructure components, and advanced aerospace textiles offers avenues for premium pricing and differentiation, provided manufacturers can maintain rigorous quality and regulatory compliance standards.

Impact forces currently shaping the market include intense regulatory pressure, particularly in Europe, favoring circular economy initiatives and mandates for end-of-life vehicle recycling, which heightens the importance of rPA66 development. The market is also heavily influenced by fluctuating crude oil prices, which affect the cost structure of all petrochemical derivatives, including key PA66 precursors. Competitive dynamics are driven by capacity expansion plans, technological breakthroughs in non-ADN routes for hexamethylenediamine production, and strategic partnerships aimed at securing long-term raw material supply stability. These intersecting drivers and restraints create a complex, high-stakes operational environment demanding resilience and strategic foresight from market participants.

Segmentation Analysis

The Nylon 66 Chips Market is comprehensively segmented based on various technical and commercial factors, including Grade Type, Application, and Manufacturing Process. This segmentation provides clarity regarding the diverse demand profiles and specialized requirements across different end-use sectors. The Grade Type segmentation is crucial, differentiating between standard grades used in commodity fiber production and highly technical, reinforced grades necessary for high-heat, high-stress engineering applications. Application segmentation clearly highlights the dominance of the automotive and electrical sectors, while the manufacturing process segmentation reflects the technological approaches employed by key market participants, influencing product purity and cost competitiveness.

Understanding these segments is vital for strategic market entry and product positioning. For instance, producers focusing on the automotive sector must comply with stringent quality standards and require specialized capacity for compounding high-viscosity, reinforced chips. Conversely, manufacturers targeting the textile industry prioritize cost efficiency and consistency in melt flow properties. The market dynamics within each segment are often distinct, driven by different regulatory environments, competitive landscapes, and technological maturity levels, necessitating tailored marketing and distribution strategies.

- By Grade Type:

- Standard Grade

- Reinforced Grade (Glass Fiber, Carbon Fiber)

- Impact Modified Grade

- Specialty/Custom Compound Grades

- By Application:

- Engineering Plastics (Automotive, E&E, Industrial)

- Textiles and Fibers (Carpet Yarns, Apparel, Industrial Yarns)

- Film and Coating

- Other Applications (Packaging, Consumer Goods)

- By End-Use Industry:

- Automotive Industry

- Electrical and Electronics (E&E)

- Consumer Goods

- Construction

- Industrial Machinery

- By Manufacturing Process:

- Batch Process

- Continuous Process

Value Chain Analysis For Nylon 66 Chips Market

The value chain of the Nylon 66 Chips market is highly concentrated and structurally dependent on the successful production and reliable sourcing of its primary monomers: hexamethylenediamine (HMD) and adipic acid (AA). Upstream analysis reveals that the production of HMD often relies heavily on adiponitrile (ADN), a highly specialized intermediate whose production is dominated by a few global players and is technically demanding and capital-intensive. This concentrated precursor supply chain exposes the entire PA66 market to significant raw material price volatility and supply bottlenecks. Adipic acid, while also critical, has a slightly more diversified raw material base, often derived from cyclohexane. Manufacturers engaging in backward integration to secure ADN supply gain a substantial competitive advantage in mitigating input cost risks and ensuring consistent production capacity.

The midstream stage involves the polycondensation of HMD and AA to form molten Nylon 66 polymer, which is subsequently extruded and cut into chips. Efficiency and process control at this stage are paramount, requiring advanced continuous polymerization technologies to ensure high molecular weight, uniform viscosity, and minimal batch variation, especially for engineering plastics grades. Key activities include precise reaction management, quality assurance testing, and specialized packaging to maintain product integrity before delivery. Companies differentiate themselves here through proprietary catalyst systems and energy-efficient processing methods, critical for lowering the overall carbon footprint of the final product.

Downstream analysis focuses on the transformation of PA66 chips into finished products. The chips are processed via injection molding, extrusion, or spinning by converters who supply end-use manufacturers in the automotive, E&E, and textile industries. The distribution channel is bifurcated: direct sales channels dominate for large-volume purchases by major Tier 1 automotive suppliers and large textile manufacturers, facilitating tailored technical support and just-in-time delivery. Indirect distribution utilizes specialized chemical distributors and compounders, who often modify the PA66 chips with additives (e.g., glass fiber, flame retardants) to create custom compounds for smaller-volume users or specialized applications. The success in the downstream market hinges on collaborative innovation between chip producers and compounders to meet increasingly stringent performance specifications.

Nylon 66 Chips Market Potential Customers

The potential customer base for Nylon 66 chips is diverse yet concentrated primarily within industries requiring materials that offer a superior combination of thermal performance, mechanical resilience, and electrical insulation capabilities. The largest and most demanding customer segment remains the global automotive manufacturing sector, including Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, who utilize PA66 chips for critical under-the-hood components, interior parts, and structural elements essential for vehicle safety and performance optimization, particularly in battery electric vehicles (BEVs).

Another significant customer category includes manufacturers in the Electrical and Electronics (E&E) industry. These buyers require PA66 chips for producing connectors, circuit breaker components, switches, relays, and various housings where high tracking resistance, intrinsic flame retardancy, and dimensional stability under varying temperatures are non-negotiable requirements. The rapid expansion of 5G infrastructure and advanced data center technology is perpetually creating new, high-specification demand for PA66 solutions.

Furthermore, textile and industrial yarn producers represent a traditional but growing customer segment. These customers purchase Nylon 66 chips to spin high-tenacity fibers used in manufacturing airbags, seat belts, tire cord reinforcements, industrial conveyor belts, and durable carpets. The decision criteria for these customers are typically driven by tenacity strength, fatigue resistance, and overall cost-effectiveness, favoring suppliers who can ensure large-volume consistency and provide customized melt viscosity characteristics suited for high-speed spinning operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ascend Performance Materials, BASF SE, Invista (Koch Industries), Solvay SA, DuPont de Nemours, Inc., Toray Industries, Inc., Asahi Kasei Corporation, Formosa Plastics Corporation, Shenma Industrial Co., Ltd., Huafeng Group, RadiciGroup, DOMO Chemicals, Mitsubishi Chemical Corporation, DSM Engineering Materials (now part of Lanxess), CPDC, Ube Industries, Goodway Chemical, Jiangsu Huayang Nylon Co., Ltd., Kingfa SCI. & TECH. CO., LTD., Sinopec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nylon 66 Chips Market Key Technology Landscape

The Nylon 66 Chips market relies on sophisticated chemical engineering processes, with continuous polymerization being the dominant and preferred technology due to its ability to yield high-quality, consistent products efficiently at scale. Modern production plants utilize continuous processes involving a highly controlled polycondensation reaction between hexamethylenediamine salt (AH salt) and adipic acid, often performed in high-pressure reactors. Key technological advancements center on optimizing reaction conditions, such as reactor design improvements (e.g., twin-screw reactors), and implementing proprietary heat exchange systems to manage the highly exothermic reaction profile, which is critical for achieving high molecular weight and superior mechanical properties necessary for engineering plastic applications.

A crucial area of technological focus is sustainable production and feedstock diversification. Given the cost and supply risks associated with petrochemical-derived ADN, significant research is directed towards non-ADN routes for HMD production. This includes bio-based methods, such as utilizing fermentation processes to generate precursors from renewable resources like glucose or lignocellulosic biomass, offering a pathway toward a lower carbon footprint and reduced dependency on fossil fuels. While currently in early commercialization phases, these bio-based technologies represent the next frontier in minimizing raw material cost volatility and aligning with stringent environmental, social, and governance (ESG) criteria demanded by global corporations.

Furthermore, technology related to recycling Nylon 66 is rapidly advancing. Chemical recycling (depolymerization) technologies are being developed to revert post-consumer and post-industrial PA66 waste back into high-purity monomers (HMD and AA) that can be reintroduced into the original polymerization process. This circular economy approach ensures that the resulting PA66 chips maintain virgin-like quality, thereby broadening the material’s sustainable appeal and securing its long-term viability in high-performance applications where material integrity cannot be compromised. The successful scaling of these depolymerization technologies will fundamentally reshape the feedstock supply dynamics in the coming decade.

Regional Highlights

The dynamics of the Nylon 66 Chips Market vary significantly across geographical regions, reflecting differences in industrial development, regulatory environments, and feedstock supply security. The regional analysis underscores the strategic importance of localized production capabilities and efficient logistics networks for ensuring market competitiveness.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Nylon 66 chips, primarily driven by China, India, and ASEAN nations. This dominance stems from robust growth in automotive manufacturing, particularly the accelerated adoption of electric mobility solutions, and the region's status as a global manufacturing base for electronics and consumer goods. Capacity expansions, often backed by domestic chemical giants, are concentrated here, focusing on both fiber grade and high-volume engineering plastics required for regional industrialization.

- North America: This region is characterized by high demand for specialized and premium-grade Nylon 66 chips, predominantly utilized in high-performance automotive safety components (e.g., airbags), aerospace applications, and advanced electrical connectors. The market is mature, emphasizing innovation in recycling and sustainable PA66 solutions, driven by demanding regulatory standards and significant investments in developing robust domestic supply chains for key precursors to reduce reliance on global imports.

- Europe: Europe is a key consumer, particularly in Germany and Italy, linked to their advanced automotive and industrial machinery sectors. The market growth here is highly influenced by the European Green Deal and stringent mandates for circular economy practices, pushing manufacturers towards recycled and bio-based PA66 chips. The regional focus is on high-specification, reinforced grades that meet the rigorous standards for lightweighting in internal combustion engine (ICE) and electric vehicle platforms, alongside significant activity in high-tenacity industrial fibers.

- Latin America (LATAM): LATAM represents an emerging market, driven primarily by automotive production in Brazil and Mexico. The demand is sensitive to regional economic stability and import tariffs. While consumption is growing, the region is heavily reliant on imported Nylon 66 chips or integrated compounds, offering opportunities for strategic partnerships and localized compounding operations to better serve the expanding domestic automotive supply chain.

- Middle East and Africa (MEA): The MEA region exhibits moderate but consistent growth, mainly linked to infrastructure development projects and localized automotive assembly operations. Investment in local petrochemical production capacity, particularly in the Middle East, could potentially alter regional supply dynamics by stabilizing the availability of key hydrocarbon-based precursors, supporting regional economic diversification efforts away from solely crude oil exports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nylon 66 Chips Market.- Ascend Performance Materials

- BASF SE

- Invista (Koch Industries)

- Solvay SA

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Formosa Plastics Corporation

- Shenma Industrial Co., Ltd.

- Huafeng Group

- RadiciGroup

- DOMO Chemicals

- Mitsubishi Chemical Corporation

- DSM Engineering Materials (now part of Lanxess)

- CPDC

- Ube Industries

- Goodway Chemical

- Jiangsu Huayang Nylon Co., Ltd.

- Kingfa SCI. & TECH. CO., LTD.

- Sinopec

Frequently Asked Questions

Analyze common user questions about the Nylon 66 Chips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for Nylon 66 Chips in the current market?

The primary drivers include accelerating production in the global automotive sector, particularly the surge in electric vehicle (EV) manufacturing requiring high-temperature, lightweight materials for battery and powertrain components, and persistent demand from the electrical and electronics industry for reliable insulators and connectors.

How does the volatility of adiponitrile (ADN) impact the Nylon 66 Chips market?

Adiponitrile (ADN) is a critical, often supply-constrained precursor for Nylon 66. Its price volatility directly influences the production cost of PA66 chips, leading to fluctuating end-product prices and impacting the profitability and long-term investment strategies of non-integrated PA66 manufacturers.

Which geographical region dominates the consumption of Nylon 66 Chips?

Asia Pacific (APAC) dominates global consumption, led by massive manufacturing activities in China, driven by the region's rapidly expanding automotive production base, significant infrastructure development, and status as the world’s leading hub for electrical and electronic goods manufacturing.

What is the future potential for sustainable or recycled Nylon 66 (rPA66) chips?

The potential for sustainable and recycled Nylon 66 is extremely high. Market demand, driven by stringent European regulations and corporate sustainability mandates, is fueling significant investments in advanced chemical recycling (depolymerization) technologies to produce high-quality, circular PA66 chips that match virgin material properties.

What are the key technological challenges in Nylon 66 chip manufacturing?

Key technological challenges include optimizing the continuous polymerization process for improved yield and reduced energy consumption, developing cost-effective and scalable non-ADN routes for hexamethylenediamine, and enhancing the material's long-term resistance to hydrolysis (moisture degradation) for critical high-humidity applications.

The Nylon 66 Chips market is positioned for measured yet strategic growth, characterized by intense efforts toward vertical integration and diversification of feedstock sources. The dependency on highly specialized precursor chemicals necessitates continuous technological innovation, especially in recycling and bio-based material development, ensuring the material’s continued relevance as a high-performance polymer in demanding sectors like advanced mobility and industrial manufacturing. Global market leaders are actively pursuing capacity expansions, primarily within the APAC region, while simultaneously focusing R&D efforts on creating specialty grades with enhanced characteristics, such as superior heat aging resistance and dielectric strength, to capture premium market segments. The market dynamics over the forecast period will be heavily influenced by how effectively manufacturers can navigate supply chain security risks while capitalizing on the transition towards electrification and circular economy models.

In terms of competitive strategy, producers are increasingly relying on sophisticated data analytics and AI to fine-tune complex polymerization reactions, minimizing waste and maximizing energy efficiency, thereby gaining marginal competitive advantages in a high-cost environment. The shift toward lighter, more durable, and thermally stable components in EVs dictates that PA66 will remain irreplaceable for specific critical applications, despite competition from other high-performance polyamides and advanced composites. Long-term market success will be determined by firms that successfully integrate sustainability into their core operational model, securing future feedstock supplies through both mechanical and chemical recycling advancements and bio-monomer development. This holistic approach ensures resilience against external economic shocks and alignment with evolving global regulatory frameworks and consumer preferences for eco-friendly materials.

Finally, the proliferation of specialized compounded materials, where PA66 chips serve as the base, underscores the market’s move towards higher value-added products. Compounders are critical intermediaries, customizing PA66 with various fillers, flame retardants, and stabilizers to meet precise specifications for niche uses, ranging from medical device casings to industrial filter elements. This fragmentation of the product offering necessitates close collaboration across the value chain, ensuring that the base Nylon 66 chip feedstock meets exacting quality standards from the outset. As end-use applications become increasingly complex—such as components exposed to high-voltage environments or prolonged chemical exposure—the demand for ultra-pure and highly consistent PA66 chips will only intensify, solidifying its position as a staple engineering polymer for future technological innovation.

*** End of Report Content ***

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager