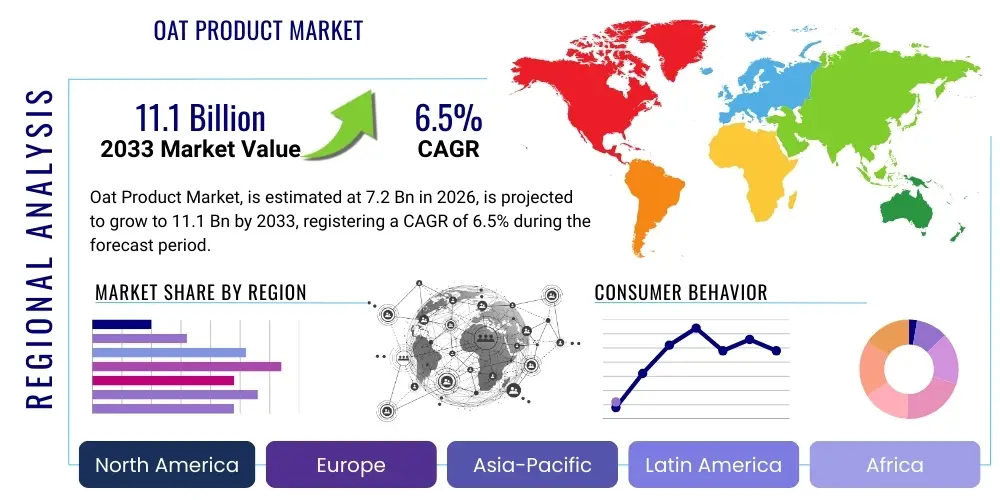

Oat Product Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440917 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Oat Product Market Size

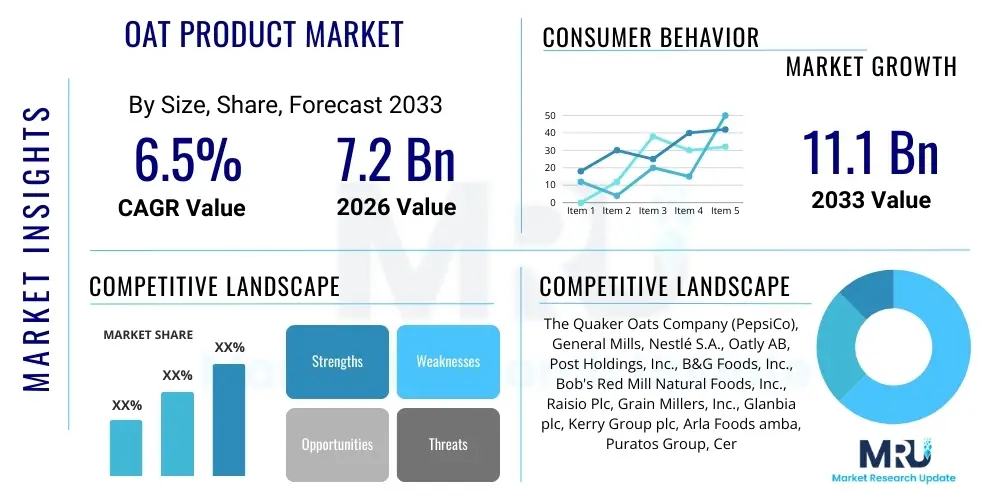

The Oat Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 7.2 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033.

Oat Product Market introduction

The Oat Product Market encompasses a diverse range of food and beverage items derived from oats, including traditional rolled oats, instant oats, oat flour, oat milk, oat-based snacks, and specialized ingredients like beta-glucan concentrates. Driven primarily by escalating consumer awareness regarding health and wellness, particularly the recognized benefits of oats in cardiovascular health and digestive well-being, the market has witnessed robust expansion. Oats are inherently gluten-free, though often processed in facilities that handle gluten, leading to a strong demand for certified gluten-free oat variants. The versatility of oats allows their integration into numerous dietary regimes, appealing to vegans, vegetarians, and consumers seeking high-fiber, sustainable food sources.

Major applications for oat products span across breakfast cereals, bakery and confectionery, functional food formulations, dairy alternatives (oat milk being the most prominent), and sports nutrition. The transition away from traditional cow's milk and the increasing prevalence of lactose intolerance globally have significantly boosted the oat milk segment, positioning it as a dynamic engine of market growth. Furthermore, the functional ingredients derived from oats, such as oat fiber and oat oil, are increasingly utilized in cosmetics and pharmaceutical sectors due to their moisturizing and stabilizing properties. This diversification of applications solidifies the oat product value proposition beyond conventional breakfast foods.

Key benefits driving market adoption include the high soluble fiber content (beta-glucan), which assists in lowering cholesterol levels and regulating blood sugar. Oats also offer essential nutrients, including manganese, phosphorus, magnesium, copper, iron, and B vitamins, contributing to energy production and overall metabolic health. Driving factors for this sustained growth involve aggressive product innovation, especially in ready-to-eat and on-the-go formats, extensive marketing efforts emphasizing natural and clean label attributes, and strong governmental support for sustainable grain farming practices globally. The perceived sustainability advantage of oat farming compared to other crops also resonates strongly with environmentally conscious consumers.

Oat Product Market Executive Summary

The global Oat Product Market is characterized by vigorous business trends focusing on premiumization, functional enhancement, and environmental sustainability. Consumer demand is rapidly shifting towards plant-based dairy alternatives, placing oat milk at the forefront of innovation and investment. Strategic mergers and acquisitions are common, as major food conglomerates seek to incorporate successful niche oat-based brands to diversify their portfolios and capture the rapidly expanding health-conscious consumer base. Furthermore, advancements in processing technology are enabling the production of highly refined oat ingredients, such as specialized oat proteins and low-sugar oat beverages, catering to specific dietary requirements like keto and low-glycemic diets. The increasing adoption of circular economy principles within the supply chain, optimizing the use of oat husks and by-products, represents a crucial operational trend impacting profitability and public perception.

Regionally, North America and Europe currently dominate the market, largely due to established health food culture, high disposable incomes, and early adoption of plant-based diets. Europe, particularly the Nordic countries, serves as a hub for oat cultivation and processing innovation, driven by favorable climate conditions and deep-rooted traditions in oat consumption. Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period, fueled by rapid urbanization, Westernization of diets, and a burgeoning middle class increasingly prioritizing preventive healthcare through functional foods. Key markets like China and India are seeing significant entry of global and domestic players introducing oat beverages and instant breakfast options tailored to local flavor preferences, addressing the need for convenient, nutritious meals in fast-paced urban settings. Regulatory harmonization concerning food labeling and health claims across various regions also plays a vital role in facilitating international trade and market expansion.

Segment trends reveal that the Food & Beverage category, particularly the ready-to-drink oat milk and oat-based snack bars, maintains the largest market share. However, the specialized functional ingredient segment, encompassing oat bran and beta-glucan extracts used in pharmaceuticals and dietary supplements, is growing at an exceptionally high rate, reflecting the clinical validation of oat benefits. By distribution channel, supermarkets and hypermarkets remain the primary sales point, although the e-commerce segment is experiencing accelerating growth, driven by convenience and the ability for niche brands to reach a wide geographical consumer base directly. The shift towards organic and non-GMO certified oat products underscores a major segmentation trend, commanding premium pricing and signaling consumer willingness to pay more for transparency and perceived purity.

AI Impact Analysis on Oat Product Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Oat Product Market frequently center on themes of supply chain optimization, predictive consumer trend analysis, and precision farming techniques for maximizing oat yield and quality. Key concerns often revolve around the ethical deployment of AI in grain sourcing, ensuring equitable benefits for smaller farmers, and the effectiveness of using machine learning models to detect contaminants or improve product safety and traceability. Consumers and industry stakeholders are highly interested in how AI can personalize nutritional advice based on individual health data and recommend specific oat-based products, moving beyond general demographic targeting towards hyper-customized product development. Expectations are high for AI to revolutionize new product development cycles by simulating ingredient interactions and predicting shelf-life stability, thereby reducing time-to-market for innovative oat formulations.

Furthermore, significant user interest focuses on AI’s role in optimizing the efficiency of oat processing plants. This includes utilizing computer vision for quality control, optimizing energy consumption in milling and drying processes, and employing predictive maintenance algorithms to minimize costly downtime. The application of AI in sustainability reporting is also a recurring topic, where complex data sets regarding water usage, carbon footprint, and soil health are analyzed to provide accurate, transparent environmental impact assessments for oat products, fulfilling stringent corporate social responsibility (CSR) objectives. This integration of advanced analytics helps manufacturers align their practices with increasingly environmentally conscious consumer demands, providing verified claims of sustainability.

The industry anticipates that AI-driven insights into genetic mapping and breeding programs will accelerate the development of oat varieties resilient to climate change, possess higher beta-glucan content, or exhibit natural resistance to pests, ensuring long-term raw material security. The ability of deep learning models to process vast amounts of unstructured data from social media and sales figures allows companies to dynamically adjust production volumes and marketing strategies in real-time. This predictive capability significantly mitigates risks associated with inventory management and ensures that marketing campaigns are precisely targeted, leading to higher conversion rates and improved resource allocation throughout the entire value chain.

- AI optimizes agricultural input management, improving oat yield and reducing resource waste through precision farming sensors.

- Machine learning algorithms predict complex consumer behavior patterns, driving demand forecasting and personalized product recommendations, notably for novel oat beverages.

- Advanced analytics enhance supply chain transparency and traceability, verifying the origin and sustainability claims of certified organic and non-GMO oat sources.

- Computer vision systems are implemented in processing facilities for automated, high-speed quality control, detecting foreign materials or inconsistent oat flake sizes.

- AI-powered simulation tools accelerate new oat product formulation, predicting stability, texture, and flavor profiles before physical prototyping.

- Generative AI supports marketing content creation, producing targeted campaigns emphasizing the specific health benefits of oat products.

DRO & Impact Forces Of Oat Product Market

The dynamics of the Oat Product Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively exert significant impact forces on market trajectory. Key drivers include the global pivot towards plant-based nutrition and the scientifically validated health benefits of oats, particularly the beta-glucan fiber content recognized for cholesterol reduction and blood sugar management. This is strongly supported by an expanding range of innovative products, such as fortified oat milks and savory oat snacks, broadening consumer appeal beyond traditional breakfast consumption. Simultaneously, the market faces restraints, primarily volatility in raw material prices due to climate-dependent harvest yields and increasing competitive pressure from alternative plant-based ingredients like almond, soy, and rice, particularly in the beverage sector. The energy-intensive nature of drying and processing oats also presents a cost challenge, especially amidst fluctuating global energy prices and stringent sustainability mandates.

Opportunities for exponential growth are concentrated in the untapped potential of emerging economies, especially in APAC and Latin America, where demand for fortified, shelf-stable, and affordable nutritional solutions is surging due to rising incomes and changing lifestyles. Furthermore, technological advances in extraction and purification offer opportunities to introduce high-purity oat protein isolates and specialized functional ingredients for use in the clinical nutrition and sports performance markets, commanding premium pricing. The development of value-added products utilizing oat by-products (e.g., oat hulls for biomass energy or animal feed) presents a crucial opportunity for achieving cost efficiencies and strengthening the circular economy model within the industry. Addressing clean-label demands through minimal processing and natural fortification methods also provides a significant competitive edge.

The impact forces driving the market are overwhelmingly positive, dominated by demographic shifts favoring healthier, fiber-rich diets and strong lobbying efforts by sustainability advocates promoting responsible agriculture. However, regulatory harmonization remains a subtle but powerful restrictive force; inconsistencies in health claims validation across different geographic jurisdictions can hinder global expansion and complicate labeling requirements. The innovation impact force is extremely high, with rapid product cycles necessitating continuous investment in research and development to maintain market relevance and differentiate offerings from mass-produced conventional products. Successful market navigation requires companies to strategically leverage the health credentials of oats while aggressively mitigating supply chain risks and adapting to dynamic consumer preferences, particularly concerning texture and sweetness profiles in new product launches.

Segmentation Analysis

The Oat Product Market is comprehensively segmented based on Type, Application, Distribution Channel, and Form, allowing for granular analysis of market penetration and growth potential across various consumer bases and industrial uses. Segmentation by Type includes whole oats, rolled oats, instant oats, oat bran, and specialty ingredients like oat fiber and beta-glucan concentrates. Segmentation by Application reveals the dominance of the Food and Beverage sector, covering breakfast cereals, baked goods, dairy alternatives, and infant food, while the Non-Food segments include cosmetics, pharmaceuticals, and animal feed. Analyzing these segments provides strategic insights into investment areas, such as the rapid expansion expected in the alternative dairy and functional food segments, which are outpacing traditional whole grain consumption rates.

Further analysis of the distribution channel segmentation highlights the importance of traditional retail formats such as supermarkets and convenience stores, which account for the majority of volume sales due to the widespread nature of breakfast foods. However, the robust growth of the online retail segment, driven by digital native consumers and the increased availability of niche and premium organic brands, is fundamentally altering the distribution landscape. Form segmentation differentiates between solid formats (flakes, flour, bran) and liquid formats (oat milk, creams), reflecting distinct consumer usage patterns and manufacturing requirements. Solid forms maintain volume leadership, but liquid forms are driving revenue growth, especially in developed markets where convenience and non-dairy options are highly prioritized.

The sophisticated nature of consumer demands necessitates continuous refinement of segmentation strategies, focusing particularly on health claims (e.g., gluten-free, low sugar, high protein) and organic certifications. This detail allows manufacturers to effectively tailor product characteristics and pricing strategies to capture specific high-value demographics. For instance, the high-protein segment is increasingly relevant for sports nutrition, while the low-sugar segment targets health-conscious older adults. The geographical spread of these segments also mandates regional tailoring, where local culinary traditions influence the preferred oat product form, such as using oat flour in regional baking or consuming instant oats for quick preparation in busy urban centers.

- Type

- Whole Oat Groats

- Rolled Oats (Old-fashioned)

- Instant/Quick Oats

- Oat Bran

- Oat Flour

- Specialty Oat Ingredients (Beta-Glucan, Oat Oil, Oat Protein)

- Application

- Food and Beverages

- Breakfast Cereals

- Bakery and Confectionery (Bread, Biscuits, Muffins)

- Dairy Alternatives (Oat Milk, Yogurt, Ice Cream)

- Snacks and Energy Bars

- Infant Formula and Baby Food

- Non-Food Applications

- Animal Feed

- Cosmetics and Personal Care

- Pharmaceuticals and Dietary Supplements

- Food and Beverages

- Distribution Channel

- Supermarkets and Hypermarkets (Mass Retail)

- Convenience Stores

- Specialty Stores (Health Food Stores)

- Online Retail/E-commerce

- Food Service (Hotels, Restaurants, Cafes)

- Form

- Solid (Flakes, Groats, Flour, Bran)

- Liquid (Oat Milk, Oat Cream, Beverages)

Value Chain Analysis For Oat Product Market

The Value Chain for the Oat Product Market begins with upstream analysis, focusing heavily on primary production—the cultivation and harvesting of oats. This phase is critical as the quality of the raw material directly impacts the final product grade, especially for premium segments like certified organic or gluten-free oats. Upstream activities involve seed breeding, large-scale farming, sustainable agricultural practices, and initial cleaning and drying processes carried out typically close to the harvesting region. Key players in this segment are large agricultural cooperatives and specialized grain traders who manage procurement and ensure adherence to quality standards and safety regulations, including minimal pesticide residues and appropriate moisture content for long-term storage, mitigating spoilage risks.

The core processing stage involves turning raw oats into usable forms such as rolled oats, oat flour, and specialty ingredients. This midstream phase requires advanced milling, steaming, flaking, and thermal treatment to enhance digestibility and extend shelf life. For liquid products like oat milk, this stage includes specialized separation and homogenization techniques, often incorporating enzymatic hydrolysis to achieve desired sweetness and texture profiles without added sugar. Direct and indirect distribution channels then move these finished products. Direct distribution involves sales through dedicated brand websites or company-owned outlets, offering higher control over branding and pricing. Indirect distribution relies on an extensive network of third-party logistics providers, wholesalers, and retailers (supermarkets, hypermarkets, e-commerce platforms) to achieve broad market saturation, particularly for high-volume, staple products.

Downstream analysis centers on reaching the end consumer, spanning retail shelf presence, marketing, and post-sales consumer interaction. Brand visibility, innovative packaging emphasizing health benefits, and strategic promotions are crucial in this competitive environment. The end-user segment is diverse, ranging from household consumers purchasing breakfast staples to commercial buyers in the food service and functional ingredients industries. The efficiency of the distribution channel—whether direct-to-consumer (DTC) e-commerce or traditional mass retail—significantly impacts consumer accessibility and price elasticity. The shift towards e-commerce necessitates robust logistics and cold chain capabilities, particularly for perishable liquid oat products, representing a major focus area for optimizing the downstream supply chain.

Oat Product Market Potential Customers

Potential customers for the Oat Product Market are highly diversified, extending far beyond the traditional breakfast consumer. The primary end-user/buyer segment includes health-conscious consumers aged 25-55, characterized by high engagement in wellness and preventive healthcare, often seeking products high in fiber and low in saturated fat. This demographic actively seeks functional benefits such as improved cardiovascular health and digestive regularity. Another major segment consists of individuals adopting specific dietary patterns, including vegans, lactose-intolerant individuals, and those managing specific conditions like Celiac disease, driving high demand for certified gluten-free oat products and plant-based dairy alternatives like oat milk. The appeal of oats as a sustainable protein and energy source also makes them highly attractive to the environmentally conscious consumer segment.

The commercial and industrial buyer base forms a crucial second layer of potential customers. This includes large food and beverage manufacturers that utilize oat flour and specialty ingredients in the formulation of baked goods, snacks, and ready-to-eat meals. The burgeoning food service industry, encompassing cafes, restaurants, and catering services, represents a rapidly growing buyer segment, driven by the need to offer popular plant-based milk alternatives for beverages like coffee and tea. Furthermore, pharmaceutical and nutraceutical companies purchase highly refined oat extracts, such as beta-glucan concentrates, for use in dietary supplements and clinical nutrition products designed to address specific metabolic health needs, validating the ingredient's clinical efficacy and driving high-value sales.

A final, specialized customer group includes pediatric nutrition companies and specialized sports nutrition brands. Oat products are increasingly used in infant formulas due to their mild nature and good digestibility. For sports nutrition, oat protein and complex carbohydrates are valued for sustained energy release and recovery, appealing to athletes and active lifestyle individuals. These professional buyers demand consistency, high purity standards, and detailed nutritional specifications, often engaging in long-term supply agreements directly with processors or specialized ingredient suppliers. The growing trend of home baking and gourmet cooking also positions high-quality, specialty oat flours and grains as attractive purchases for affluent hobbyists and artisanal food producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Quaker Oats Company (PepsiCo), General Mills, Nestlé S.A., Oatly AB, Post Holdings, Inc., B&G Foods, Inc., Bob's Red Mill Natural Foods, Inc., Raisio Plc, Grain Millers, Inc., Glanbia plc, Kerry Group plc, Arla Foods amba, Puratos Group, Cereal Partners Worldwide (CPW), Vlippo Foods, Nature's Path Foods, Inc., Blue Diamond Growers, SunOpta Inc., Elmhurst Milked, Koa Life. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oat Product Market Key Technology Landscape

The technological landscape within the Oat Product Market is rapidly evolving, driven primarily by the need to enhance nutritional value, improve process efficiency, and meet stringent consumer demands for better texture and stability, particularly in oat-based beverages. A pivotal technology is enzymatic hydrolysis, widely used in oat milk production. This process breaks down complex oat starches into simpler sugars, naturally sweetening the product and improving its mouthfeel, allowing manufacturers to create "barista-style" oat milk that foams and blends effectively, a crucial requirement for the rapidly expanding café segment. This enzymatic treatment also increases shelf stability and enhances the digestibility of the final product, directly addressing core consumer preferences for quality and function. Further research is focused on optimizing enzyme selection to maximize beta-glucan retention while achieving desired viscosity and sweetness levels.

Another crucial area involves advanced milling and separation techniques, such as air classification and specialized micronization processes. These technologies are essential for producing high-purity oat ingredients, including fine oat flour for specialty bakery applications and concentrated oat protein isolates. Air classification efficiently separates oat components based on particle size and density, enabling the targeted extraction of beneficial components like beta-glucan and protein, minimizing waste and maximizing ingredient functionality. The development of advanced thermal processing methods, including Ultra-High Temperature (UHT) treatment and sophisticated sterilization protocols, is vital for ensuring the microbial safety and extended shelf life required for globally distributed liquid oat products, providing a competitive advantage in global distribution logistics and reducing the need for chemical preservatives.

Furthermore, technology focused on enhancing agricultural output and sustainability is gaining traction. Precision agriculture, supported by Internet of Things (IoT) sensors and satellite imagery, allows farmers to optimize water and nutrient application, resulting in higher quality oat crops with improved yield predictability, reducing the vulnerability of the supply chain to local environmental variances. In manufacturing, the implementation of sophisticated traceability systems utilizing blockchain technology is providing end-to-end transparency regarding the origin and processing history of oats. This transparency not only assures regulatory compliance but also builds consumer trust, particularly important for certified organic and gluten-free claims. Novel packaging technologies, including aseptic and biodegradable materials, are also critical investments aligning the industry with global sustainability objectives and reducing environmental impact associated with high-volume sales of oat beverages.

The convergence of biotechnology with traditional food science is paving the way for genetically improved oat varieties. Research focuses on increasing the natural content of desirable components like avenanthramides (antioxidants) and specific fatty acids, or developing oats with enhanced resistance to diseases without relying on extensive chemical treatments. High-pressure processing (HPP) is an emerging, non-thermal preservation technology being explored for oat-based products. HPP extends shelf life and maintains the fresh taste and nutritional integrity better than traditional heat treatment, offering a pathway for cleaner label products with superior sensory attributes. Continuous investment in these process technologies and agricultural innovation remains paramount for maintaining the cost-effectiveness and competitive differentiation of oat products against cheaper, less functional grain alternatives in the global marketplace.

Processing efficiency is also being significantly boosted by automation and digitalization. Modern oat mills are increasingly integrated with SCADA (Supervisory Control and Data Acquisition) systems and robotic sorting equipment, minimizing human error and ensuring highly consistent product quality across massive production volumes. Advanced moisture meters and online spectroscopy tools are used for real-time compositional analysis, allowing for immediate process adjustments and optimizing energy consumption during the critical drying stages. The focus on energy recovery and waste utilization—converting oat hulls into bio-fuel or compost—is driven by innovative green technologies that improve the operational sustainability profile, appealing to institutional buyers and large retailers committed to ethical sourcing and low-carbon supply chains. This continuous innovation across the entire value chain, from seed to shelf, is fundamental to the long-term profitable expansion of the oat product sector.

Regional Highlights

- North America: This region holds a significant market share, driven by strong consumer awareness regarding heart health and the widespread adoption of plant-based diets, particularly in the United States and Canada. The region is a hotbed for oat milk innovation, characterized by aggressive marketing, extensive venture capital investment in emerging oat brands, and robust retail infrastructure supporting easy access to diverse oat products. The demand for certified gluten-free oats is particularly high here, necessitated by a large, health-literate population.

- Europe: Europe is the global leader in oat processing technology and consumption per capita, spearheaded by the Nordic countries (Sweden, Finland), which have a long history of oat farming and consumption. The European market is highly regulated concerning health claims and organic certification, favoring localized, sustainable supply chains. Demand is heavily concentrated in the dairy alternative segment, driven by governmental encouragement of lower-environmental impact food choices.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid urbanization, increasing disposable income, and the shift toward convenient, Westernized breakfast options. While traditional rice consumption remains dominant, countries like China, Japan, and Australia are seeing explosive growth in demand for oat milk and ready-to-eat oatmeal, often tailored to local flavor profiles (e.g., savory oat porridge or flavored oat drinks).

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in wealthier urban centers of Brazil and Mexico. The driver here is improving awareness of nutritional benefits and a growing demand for premium, imported health food products. Distribution challenges and fluctuating economic conditions present restraints, but the potential for growth in functional oat ingredients used in local food manufacturing is substantial.

- Middle East and Africa (MEA): This region represents the smallest but most nascent market, primarily dependent on imports of processed oat products. Growth is observed in the Gulf Cooperation Council (GCC) countries, fueled by high per capita wealth and a strong preference for high-quality, fortified packaged foods. The market is slowly developing local processing capabilities, focusing initially on animal feed and basic rolled oats for expatriate and high-income domestic consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oat Product Market.- The Quaker Oats Company (PepsiCo)

- General Mills

- Nestlé S.A.

- Oatly AB

- Post Holdings, Inc.

- B&G Foods, Inc.

- Bob's Red Mill Natural Foods, Inc.

- Raisio Plc

- Grain Millers, Inc.

- Glanbia plc

- Kerry Group plc

- Arla Foods amba

- Puratos Group

- Cereal Partners Worldwide (CPW)

- Vlippo Foods

- Nature's Path Foods, Inc.

- Blue Diamond Growers

- SunOpta Inc.

- Elmhurst Milked

- Koa Life

- Danone S.A.

- Califia Farms

- WhiteWave Foods Company (now part of Danone)

- Alpro (Danone)

- Tate & Lyle PLC

- Ingredion Incorporated

- Cargill, Incorporated

- ADM (Archer Daniels Midland Company)

- Bunge Limited

- Wilmar International Limited

- Richardson International Limited

- Marubeni Corporation

- AgriPure Holding PLC

- Müller Group

- Südzucker AG

- Dr. Schär AG

- Kellogg Company

- The Hain Celestial Group, Inc.

Frequently Asked Questions

Analyze common user questions about the Oat Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Oat Product Market?

The primary driver is the accelerating consumer shift towards plant-based diets and the scientifically validated health benefits of oats, particularly the beta-glucan fiber content known for cholesterol reduction and digestive health improvement, coupled with a robust expansion in convenient dairy alternatives like oat milk.

How is the Oat Product Market segmented by form?

The market is segmented into Solid forms (including whole oat groats, flakes, oat flour, and oat bran) and Liquid forms (primarily oat milk, oat creams, and ready-to-drink beverages). Liquid forms, especially oat milk, are exhibiting the fastest revenue growth rates globally.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, increased disposable incomes, and the growing preference for nutritious, convenient breakfast and snack options among the burgeoning middle class in countries like China and India.

What technological advancement significantly impacts oat milk quality?

Enzymatic hydrolysis is a key technology used in oat milk production. It naturally sweetens the beverage by breaking down starches and significantly improves texture and foaming capabilities, making it ideal for high-demand applications like "barista-style" coffee preparation.

What are the main restraints hindering market growth?

Major restraints include the price volatility of raw oats, which is heavily reliant on weather conditions and agricultural yields, and intense competitive pressure from other established and emerging plant-based milk alternatives such as almond, soy, and coconut milk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager