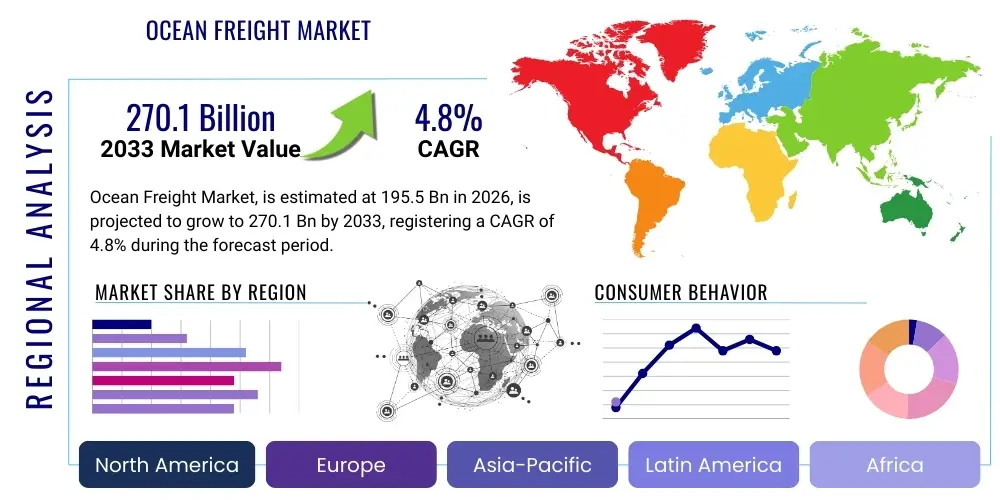

Ocean Freight Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441280 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ocean Freight Market Size

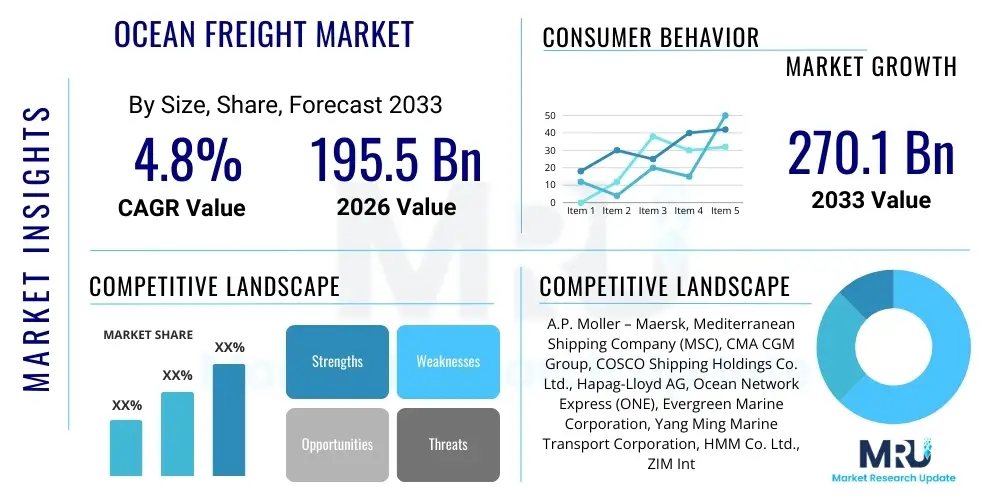

The Ocean Freight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 270.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the sustained expansion of global merchandize trade, driven by industrial shifts, rising middle-class consumption across developing economies, and the continuous specialization of global supply chains. The valuation reflects the freight revenues generated across key vessel segments, including container shipping, dry bulk, and liquid bulk, accounting for both long-haul intercontinental routes and vital regional feeders. Market size fluctuations are notably influenced by macroeconomic conditions, geopolitical events affecting major maritime chokepoints, and the cyclical nature of shipbuilding capacity additions, which dictates the overall supply-demand balance globally. Furthermore, the increasing complexity of cargo handling requirements, especially for specialized goods and refrigerated containers (reefers), adds significant value to the overall market valuation, contributing substantially to the projected size increase over the forecast period.

Ocean Freight Market introduction

The Ocean Freight Market serves as the backbone of international commerce, responsible for transporting approximately 90% of global trade volume by utilizing a massive fleet of vessels optimized for efficiency and scale. This sector provides essential services ranging from the standardized movement of manufactured goods in containers to the bulk transport of raw materials like iron ore, crude oil, and grain. The primary product description involves the provision of secure, timely, and cost-effective sea transportation solutions between global ports, often integrated with complex inland logistics networks (intermodal transport). Major applications span nearly every industrial sector, including retail, automotive manufacturing, energy production, construction, and agriculture, relying heavily on reliable ocean services to maintain global production schedules and consumer supply. The enduring relevance of ocean freight is rooted in its unparalleled capacity to achieve massive economies of scale, making it the most economical method for large-volume, long-distance movements, despite recent concerns regarding volatility and vulnerability to geopolitical disruption.

The benefits associated with robust ocean freight services are multifaceted, encompassing low per-unit transportation costs, reduced environmental impact per ton-mile compared to other freight modes, and the ability to access vast global markets efficiently. Driving factors sustaining and accelerating market growth include the persistent trend toward globalized production, where manufacturing and assembly processes are distributed across multiple continents, demanding frequent and large-scale material exchanges. Secondly, the proliferation of e-commerce, which requires vast inventories to be repositioned globally to meet rapid fulfillment demands, has significantly boosted demand for reliable container shipping services, especially through high-frequency arterial trade routes like the Trans-Pacific and Asia-Europe corridors. Technological advancements, particularly in digitalization and automation within ports and onboard vessels, are further enhancing efficiency, reducing administrative bottlenecks, and improving the overall resiliency of maritime logistics networks in response to escalating demand pressures and operational complexities.

Beyond commercial factors, the market is profoundly shaped by regulatory drivers, specifically the International Maritime Organization’s (IMO) ambitious targets for decarbonization. This mandatory shift is compelling carriers to invest billions in new, greener vessel designs utilizing fuels such as LNG, methanol, or ammonia, fundamentally restructuring the capital expenditure profile of the industry and creating a premium segment for sustainable logistics solutions. Furthermore, increasing geopolitical uncertainty necessitates robust risk management, pushing carriers towards greater operational flexibility, including fleet diversification and strategic partnerships to mitigate risks associated with trade route disruptions and sanctions. The combination of sustained global economic activity, technological maturation, and mandatory environmental compliance forms the core set of dynamics driving the market's structure and performance leading up to 2033, focusing stakeholders on efficiency, scale, and environmental stewardship as key competitive differentiators within the saturated global trade environment.

Ocean Freight Market Executive Summary

The global ocean freight market is currently characterized by heightened volatility, driven by cyclical fluctuations in supply and demand coupled with structural shifts towards environmental sustainability and deep technological integration. Business trends show a continued pattern of carrier consolidation, exemplified by strategic alliances and mergers focused on optimizing global network design and controlling capacity to stabilize freight rates against external shocks. Major carriers are strategically moving beyond port-to-port services, investing heavily in cold chain logistics, warehousing, and comprehensive door-to-door solutions, effectively transforming into integrated end-to-end logistics powerhouses. This vertical integration strategy aims to capture greater value across the supply chain, enhancing customer stickiness and optimizing the intermodal transition. Furthermore, the adoption of long-term service contracts (SCs) by Beneficial Cargo Owners (BCOs) is becoming a dominant mechanism for mitigating short-term spot market rate volatility, providing carriers with stable revenue streams necessary for financing large-scale green fleet renewal programs.

Regional trends underscore the dominance of the Asia Pacific (APAC) as the world's manufacturing and export powerhouse, generating the majority of global outbound container volumes, particularly across the critical East-West trade lanes. North America and Europe remain the principal consumption markets, focusing on advanced port automation and intermodal connectivity to manage massive import surges efficiently. Emerging markets in Latin America and Africa are showcasing accelerating growth, particularly driven by expanding infrastructure investments and resource extraction, increasing demand for both bulk and project cargo shipping. However, operational risks stemming from geopolitical tensions, such as those impacting transit through the Suez Canal or Strait of Hormuz, continue to necessitate strategic regional adjustments, including fleet repositioning and the implementation of prolonged routing options, significantly increasing regional fuel costs and transit times across sensitive geographical areas.

Segment trends reveal that the containerized freight sector remains the largest and most complex segment, reflecting the intricate needs of global retail and manufacturing supply chains. This segment is witnessing rapid digitalization, including the widespread deployment of smart containers and blockchain-enabled documentation. Meanwhile, the liquid bulk segment, particularly the transport of Liquefied Natural Gas (LNG) and future fuels like ammonia, is experiencing accelerated growth tied directly to the global energy transition away from coal and oil, driving demand for highly specialized and expensive gas carriers. Across all segments, the unifying trend is the pursuit of operational resilience; carriers are utilizing advanced data analytics and real-time visibility tools to proactively manage disruptions, thereby optimizing scheduling, improving vessel turnaround times, and ultimately delivering greater certainty to customers in an inherently unpredictable global shipping environment.

AI Impact Analysis on Ocean Freight Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Ocean Freight Market frequently revolve around quantifying efficiency gains, understanding pricing predictability, and evaluating the long-term strategic implications for workforce and infrastructure. Key themes explored by users include: "Can AI fully automate the booking and documentation process?" "How effective is machine learning in forecasting container rate bubbles?" and "What is the expected ROI for implementing AI-driven port logistics software?" This focus highlights a market eager to transition from traditional, experience-based decision-making to data-driven, preemptive operational management, simultaneously seeking assurances regarding the scalability and security of AI applications, especially in areas touching regulatory compliance and sensitive trade data handling. The consensus expectation is that AI will move the industry beyond incremental optimization into a paradigm of structural efficiency, addressing historical challenges related to information asymmetry and capacity utilization through complex pattern recognition.

The strategic deployment of AI technologies is fundamentally reshaping the operational core of ocean freight, primarily through advanced predictive analytics for demand and capacity management. Machine learning models, capable of processing billions of data points—including historical booking curves, seasonal demand shifts, port dwell times, and prevailing macroeconomic indicators—can generate highly refined forecasts. This precision allows carriers to dynamically adjust vessel deployment and pricing strategies, ensuring optimal vessel utilization while minimizing the costly occurrence of empty repositioning trips. Furthermore, AI algorithms are crucial for optimizing complex logistical challenges such as stowage planning, calculating the ideal arrangement of thousands of containers on a vessel to ensure stability, maximize capacity, and simplify discharge sequences at subsequent ports, reducing operational time dramatically and increasing overall voyage efficiency.

Beyond operational planning, AI is increasingly instrumental in enhancing safety and compliance, two non-negotiable aspects of maritime trade. Computer vision and deep learning techniques are being integrated into autonomous navigation systems, enabling real-time detection of obstacles, potential collision risks, and environmental hazards with greater speed and accuracy than human observation alone. In the realm of finance and risk, AI models are rapidly evaluating counterparty credit risk, assessing insurance premiums based on dynamic route risk profiles, and automating the verification of trade documents against global regulatory databases. This automation drastically cuts down the time required for customs clearance and reduces exposure to potential trade sanctions or non-compliance penalties, positioning AI not merely as an efficiency booster but as a critical mechanism for ensuring regulatory fidelity and maintaining supply chain fluidity in an era of increasing global trade scrutiny.

- AI-Driven Forecasting: Implementation of advanced algorithms to predict freight rate trends, fuel price volatility, and seasonal demand peaks across specific trade lanes.

- Autonomous Vessel Optimization: Utilization of AI for real-time adjustments to speed, trim, and ballast, maximizing fuel efficiency and minimizing emissions during the voyage.

- Cognitive Port Systems: AI managing container stacking logic, crane assignment, and truck scheduling to reduce truck turnaround times and eliminate human error in yard management.

- Risk and Compliance Automation: ML tools rapidly analyzing cargo declarations and Bills of Lading (B/L) to flag potential customs violations or hazardous material discrepancies before sailing.

- Predictive Maintenance: AI analyzing sensor data from vessel machinery (engines, pumps) to forecast potential failures, scheduling maintenance proactively and preventing expensive breakdowns at sea.

DRO & Impact Forces Of Ocean Freight Market

The Ocean Freight Market dynamic is governed by powerful and often conflicting forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). Global economic recovery and sustained growth in international trade volumes stand as the fundamental driver, continuously increasing the overall demand for shipping capacity, particularly for containerized manufactured goods moving from Asia to Western consumption hubs. Simultaneously, the accelerating rate of digitalization across the entire logistics spectrum—including IoT tracking, blockchain documentation, and AI-driven optimization—serves as a powerful internal driver, improving operational resilience, reducing latency, and creating new value propositions for shippers seeking enhanced supply chain visibility and predictability. Furthermore, strong government support for trade liberalization and infrastructure investment in major developing ports, especially in South and Southeast Asia, directly fuels market expansion by improving port throughput capacity and reducing system bottlenecks.

However, the market is severely restrained by several high-impact factors. Principal among these are persistent geopolitical uncertainties and conflict, which necessitate significant diversions from established, efficient routes (e.g., bypassing the Suez or Panama canals due to instability or drought), drastically increasing transit times, bunker fuel consumption, and insurance costs. Financial restraint is also imposed by the high capital expenditure required for fleet decarbonization, as carriers must transition to significantly more expensive green fuels and acquire new, dual-fuel vessels to meet regulatory targets, potentially leading to long-term rate inflation. Operational bottlenecks related to labor shortages, intermittent port strikes, and outdated terminal infrastructure in specific emerging markets also limit the ability of the global system to handle peak season surges efficiently, creating capacity crunches and exacerbating rate volatility.

Opportunities for growth are heavily concentrated around the green transition and technological differentiation. The global push for Net Zero emissions creates a lucrative market for carriers pioneering sustainable shipping solutions, offering premium rates for low-carbon transport services that major multinational corporations are increasingly willing to pay to meet their ESG commitments. Secondly, the opportunity for vertical integration is compelling; by offering comprehensive end-to-end logistics solutions—encompassing port handling, warehousing, and inland transport—carriers can capture a larger share of the overall logistics spend and establish more defensible market positions. Furthermore, the development and commercialization of new trade routes, such as the Arctic Sea routes (North Sea Route), presents a long-term opportunity, contingent on overcoming complex environmental and political hurdles, promising shorter transit times between Asia and Europe during viable operating windows, fundamentally altering the global network design and strategic planning horizon for key carriers.

Segmentation Analysis

Market segmentation in ocean freight provides a critical framework for understanding the diverse operational requirements and economic characteristics of global shipping. The segmentation highlights variations in asset utilization, cargo handling complexity, and exposure to different commodity cycles. The primary division rests on cargo type, differentiating between goods that require specialized containers or bulk handling facilities versus standardized, high-volume containerized traffic. Secondary segmentation based on trade lanes offers insight into competitive intensity and rate dynamics specific to geographical corridors, where capacity deployment and utilization vary significantly based on regional import/export balances and seasonal trade patterns. This structured approach allows stakeholders to perform granular analysis of specific sub-markets, enabling tailored commercial strategies and optimized asset allocation to maximize revenue generation and operational efficiency in a highly dynamic global environment.

- By Cargo Type:

- Containerized Freight (Manufactured consumer goods, electronics, textiles, refrigerated perishable goods)

- Dry Bulk (Iron Ore, Coal, Grain, Fertilizer, Cement, Bauxite) – Highly cyclical and driven by global construction and commodity extraction.

- Liquid Bulk (Crude Oil, Refined Petroleum Products, Liquefied Natural Gas (LNG), Chemicals) – Driven by energy demand and industrial processing requirements.

- General Cargo and Project Cargo (Oversized machinery, wind turbine components, specialized vehicles) – Requires specialized heavy-lift vessels and complex engineering support.

- By Service Type:

- Full Container Load (FCL) – Predominantly used by large BCOs and contract shippers.

- Less than Container Load (LCL) – Critical for SMEs, consolidated and managed by NVOCCs and freight forwarders.

- Break Bulk (Non-containerized general cargo) – Used for items that do not fit standard container dimensions.

- By Trade Lane:

- Trans-Pacific (Asia to North America) – Highest volume and most competitive route globally.

- Asia-Europe (Far East to Europe) – Highly sensitive to chokepoint risks and subject to stringent environmental regulations.

- Trans-Atlantic (North America to Europe) – Stable but lower-volume route compared to East-West lanes.

- Intra-Asia and Regional Feeder Routes – Essential for connecting local production hubs to major international terminals.

- By End-User Industry:

- Retail and E-commerce Fulfillment (Fast Moving Consumer Goods, high inventory turnover)

- Manufacturing (Automotive supply chain, heavy machinery components)

- Oil and Gas (Tanker movements, specialized rig components)

- Mining and Metals (Dry bulk movements)

- Chemicals and Petrochemicals (Specialized liquid bulk tankers and ISO tank containers)

Value Chain Analysis For Ocean Freight Market

The upstream segment of the Ocean Freight value chain is dominated by highly technical and capital-intensive industries responsible for providing the core physical assets and operational inputs. This includes the major global shipyards (primarily in South Korea, China, and Japan) that design and build vessels, engine manufacturers providing highly sophisticated propulsion systems (increasingly dual-fuel capable), and large financial institutions specializing in maritime financing and leasing. Bunker fuel suppliers, now encompassing conventional heavy fuel oil alongside burgeoning markets for cleaner alternatives like LNG and methanol, represent a major variable cost input and risk factor for carriers. Strategic partnerships with upstream technology providers focusing on maritime satellite communications, voyage planning software, and hull coatings that enhance hydrodynamics are crucial for gaining operational cost advantages and regulatory compliance in a highly competitive asset-driven environment.

The midstream constitutes the core service delivery components, centered around the carriers (major shipping lines), port authorities, and stevedoring companies. Carriers manage the complex process of fleet scheduling, capacity allocation, route planning, and the provision of containers. Port terminals, often managed by independent operators or carrier subsidiaries, are responsible for handling the vessel interface, including berthing, loading, and discharging operations, utilizing specialized crane equipment and yard management systems. Efficiency in this segment is paramount; bottlenecks due to congestion or labor disputes directly translate to supply chain delays and increased global shipping costs. Freight forwarders and NVOCCs act as essential facilitators in the midstream, bridging the gap between BCOs with small or fragmented shipments and the large capacity blocks controlled by ocean carriers, handling complex customs brokerage, insurance, and consolidation/deconsolidation processes.

The downstream value realization is where the physical goods transition from sea transport to final consumption or further manufacturing. This segment involves an extensive network of road, rail, and air logistics providers, connecting ports to inland distribution centers and warehousing facilities. Distribution channels are rapidly polarizing between two primary models: the direct channel, where integrated logistics providers (often carrier-owned entities) offer seamless door-to-door services, providing BCOs with a single point of accountability and enhanced control over the entire supply chain flow; and the indirect channel, dominated by traditional 3PLs and local trucking firms that specialize in flexible, tailored last-mile solutions. The trend is clearly towards maximizing end-to-end visibility and utilizing digitized documentation to minimize handover friction and administrative costs in the downstream flow, thereby securing premium pricing for integrated, resilient logistics chains.

Ocean Freight Market Potential Customers

Potential customers for ocean freight services primarily fall into two broad categories: direct purchasers of capacity (Beneficial Cargo Owners, or BCOs) and intermediary buyers (NVOCCs and 3PLs) who aggregate and manage logistics for numerous smaller shippers. Large BCOs, such as multinational automotive manufacturers, high-volume electronic companies, and global retail giants, are core customers seeking long-term, high-volume contracts to secure capacity and mitigate price volatility. These customers typically require specialized handling, adherence to strict delivery schedules, and high visibility throughout the transit process. Their purchasing decisions are driven by total supply chain cost optimization, inventory management goals, and increasingly, the environmental performance (carbon footprint) of the carrier, leading them to favor carriers with robust sustainability credentials and advanced data integration capabilities.

Intermediate buyers, including NVOCCs, global freight forwarders (like Kuehne+Nagel or DSV), and specialized customs brokers, constitute the vast majority of transactional volume. They purchase large blocks of capacity from major carriers and resell it to thousands of small and medium enterprises (SMEs) that cannot commit to large contract volumes. These intermediaries provide critical services such as cargo consolidation (LCL), customs expertise, cargo insurance, and inland transportation management. Their success relies on their ability to aggregate diverse demand streams, secure competitive rates, and offer flexible, reliable service packages to shippers who prioritize simplicity and end-to-end logistics solutions over direct carrier relationships, making them essential conduits for global trade access for smaller market participants.

Additionally, specialized end-users represent high-value niches within the market. This includes major energy companies requiring tanker capacity for crude oil and LNG, large mining conglomerates needing dry bulk carriers for iron ore and coal, and engineering procurement construction (EPC) firms requiring project cargo specialists to move massive infrastructure components. These buyers demand carriers with specialized fleets, superior safety records, and technical expertise in handling hazardous or uniquely dimensioned cargo. The contractual relationships in these segments are often long-term charters or highly specific one-off voyages, characterized by rigorous technical specifications and robust risk-sharing agreements, placing a premium on carrier reliability and specialized asset quality over sheer volume capacity in the general container trade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 270.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk, Mediterranean Shipping Company (MSC), CMA CGM Group, COSCO Shipping Holdings Co. Ltd., Hapag-Lloyd AG, Ocean Network Express (ONE), Evergreen Marine Corporation, Yang Ming Marine Transport Corporation, HMM Co. Ltd., ZIM Integrated Shipping Services Ltd., Hyundai Glovis, Wallenius Wilhelmsen, Genco Shipping & Trading Limited, Teekay Corporation, Nippon Yusen Kaisha (NYK), Orient Overseas Container Line (OOCL), Star Bulk Carriers Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ocean Freight Market Key Technology Landscape

The Ocean Freight Market's technological landscape is rapidly migrating toward integration, autonomy, and advanced data utilization to enhance operational efficiency and meet critical sustainability objectives. Central to this evolution is the pervasive deployment of the Internet of Things (IoT), where smart sensors are embedded across containers, reefer units, and vessel machinery. These sensors generate massive amounts of real-time telemetry data concerning cargo conditions (temperature, shock, intrusion), vessel performance (engine health, fuel consumption, hydrodynamic efficiency), and precise geographical location. This data stream is crucial for providing shippers with high-fidelity supply chain visibility and enabling carriers to perform predictive maintenance, minimizing unscheduled vessel downtime and optimizing energy consumption based on prevailing sea conditions, thereby ensuring greater reliability and lower operating costs across global operations.

Automation and Artificial Intelligence (AI) represent the next frontier in minimizing human error and maximizing throughput in high-volume environments. In ports, autonomous guided vehicles (AGVs) and remotely operated cranes are standardizing cargo handling, dramatically increasing terminal throughput capacity and improving safety standards. On the commercial side, AI and Machine Learning (ML) are utilized for highly complex tasks such as dynamic capacity forecasting, optimizing the negotiation and setting of spot market rates, and designing optimal network loops to balance trade flow imbalances. Furthermore, the development of sophisticated weather routing systems powered by AI processes high-resolution meteorological data to advise captains on the safest and most fuel-efficient routes, automatically adjusting voyage plans in response to evolving environmental conditions, demonstrating tangible reductions in both transit time and fuel usage per voyage.

Beyond operational optimization, significant technological investment is directed toward achieving decarbonization and enhancing data security. Carriers are heavily adopting alternative fuel technologies, necessitating the implementation of complex monitoring and handling systems for fuels like LNG, methanol, and in the future, ammonia, which require specialized storage and bunkering infrastructure. Simultaneously, the adoption of Blockchain technology is addressing systemic fragmentation and security issues inherent in traditional paper-based trade documentation. Blockchain offers a tamper-proof ledger for documents such as the Bill of Lading (B/L) and Customs Declarations, accelerating the flow of administrative processes, reducing the vulnerability to fraud, and significantly speeding up cargo clearance at busy global ports, positioning digital trust infrastructure as a core element of competitive differentiation and regulatory compliance in the modern ocean freight sector.

Regional Highlights

The Asia Pacific (APAC) region continues to dominate the global ocean freight narrative, not only as the primary global manufacturing and export nexus but also as a rapidly growing consumption market fostering significant intra-regional trade. Countries like China, Vietnam, India, and South Korea leverage vast production capabilities, requiring immense inbound raw material logistics and generating massive outbound container traffic destined for Europe and North America. This sustained production strength results in the APAC region controlling a significant share of global port throughput and possessing the world's largest shipowning and shipbuilding capacity. The key regional dynamic is the increasing complexity of Intra-Asia trade lanes, driven by regional supply chain diversification and rising middle-class consumer demand within the region itself, requiring complex feeder services and advanced regional port connectivity to manage the high frequency and volume of shipments efficiently across the diverse archipelago geography.

North America and Europe, while primarily acting as import-driven destination markets, significantly influence the global market structure through their stringent demand for service reliability and commitment to environmental standards. North American dynamics are heavily influenced by the constant challenge of managing large-scale import surges through constrained port infrastructure, prompting multi-billion-dollar investments in automation, dredging projects, and developing robust intermodal rail connections to efficiently distribute cargo inland. Europe is distinguished by its pioneering regulatory environment, particularly the inclusion of shipping in the EU Emissions Trading System (ETS), which mandates carriers operating within European waters to account for and offset their carbon emissions. This regulatory pressure makes Europe a critical early adopter market for green shipping technologies and alternative fuels, creating a segmented demand for premium, sustainable freight services that directly impacts the design and deployment of the global fleet.

High-potential emerging markets, specifically Latin America and the Middle East & Africa (MEA), are characterized by growth anchored in commodity exports and strategic infrastructure development. Latin America's ocean freight relies heavily on the export of agricultural products, minerals, and resources, dictating demand for dry bulk and reefer capacity, often connected via the Panama Canal to Asian and European markets. MEA is vital due to its strategic control over global oil and gas routes and major transshipment hubs (e.g., Jebel Ali, Tanger Med), positioning it as a critical logistics nexus for connecting global trade flows. Continued investment in modern port facilities, coupled with economic diversification strategies away from pure hydrocarbon reliance, ensures that MEA will experience above-average growth, driven by both energy transition flows (LNG) and increased East-West transshipment volumes, solidifying its role as a pivotal hub for global maritime connectivity and regional distribution across the African continent.

- Asia Pacific (APAC): Dominates global export volumes; large shipbuilding capacity; focus on developing smart ports and managing high-volume Intra-Asia trade.

- North America: High import volume necessitates rapid adoption of port automation and intermodal rail optimization to mitigate chronic congestion issues.

- Europe: Regulatory leader in decarbonization (EU ETS); strong demand for green logistics services and sophisticated regional distribution networks; high focus on North Sea and Mediterranean feeder routes.

- Middle East & Africa (MEA): Controls critical global chokepoints; growth centered around energy exports (tankers, LNG carriers) and expanding regional transshipment hubs like the Gulf and Red Sea ports.

- Latin America: Growth tied to agricultural commodity and mineral exports; infrastructure deficits remain a challenge; increasing strategic importance due to growing trade links with China and India.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ocean Freight Market.- A.P. Moller – Maersk

- Mediterranean Shipping Company (MSC)

- CMA CGM Group

- COSCO Shipping Holdings Co. Ltd.

- Hapag-Lloyd AG

- Ocean Network Express (ONE)

- Evergreen Marine Corporation

- Yang Ming Marine Transport Corporation

- HMM Co. Ltd.

- ZIM Integrated Shipping Services Ltd.

- Hyundai Glovis

- Wallenius Wilhelmsen

- Genco Shipping & Trading Limited

- Teekay Corporation

- Nippon Yusen Kaisha (NYK)

- Orient Overseas Container Line (OOCL)

- Star Bulk Carriers Corp.

- Kawasaki Kisen Kaisha (K Line)

- Crowley Maritime Corporation

- X-Press Feeders

Frequently Asked Questions

Analyze common user questions about the Ocean Freight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards sustainable fuels in ocean freight?

The primary driver is stringent regulatory mandates from the International Maritime Organization (IMO) aiming to significantly reduce greenhouse gas (GHG) emissions by 2050, alongside pressure from major BCOs committed to decarbonizing their supply chains. This necessitates investment in alternative fuels like LNG, methanol, and ammonia to meet future compliance and customer demands, securing competitive access to environmentally conscious logistics contracts and avoiding future carbon taxes like the EU ETS.

How does port congestion affect global shipping rates?

Port congestion forces vessels to queue, reducing available global fleet capacity. This artificial scarcity tightens the market supply, leading to increased demand for available slots and consequently pushing up short-term freight rates and surcharges for carriers aiming to recover operational losses from delays. Congestion also increases fuel consumption due to idling and disrupts vessel schedules globally.

What is the role of digital platforms in ocean freight booking?

Digital platforms provide instant rate quotations, real-time cargo tracking, and simplified electronic documentation (e-BLs). They enhance transparency, reduce transactional complexity, and allow small and medium-sized enterprises (SMEs) easier access to global shipping services, bypassing traditional intermediary roles and integrating directly with inland logistics systems for true door-to-door visibility.

Which trade lane currently exhibits the highest volatility?

The Asia-Europe trade lane often exhibits high volatility due to massive seasonal volume fluctuations, geopolitical disruptions affecting crucial chokepoints (like the Red Sea/Suez Canal), and high competition, which results in dynamic and unpredictable pricing patterns compared to more stable routes like Trans-Atlantic. Operational risks from conflict and regulatory changes also heighten rate uncertainty.

What is the difference between FCL and LCL shipping?

FCL (Full Container Load) means a single shipper uses the entire container capacity, offering better speed and security, generally preferred for large volume movements. LCL (Less than Container Load) means multiple shippers share space within one container, which is more cost-effective for smaller volumes but involves additional handling and potential delays during consolidation and deconsolidation processes managed by NVOCCs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ocean Freight Forwarding Market Size Report By Type (LCL, FCL), By Application (Agricultural, Automotive, Beverage, Electronic, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Artificial Intelligence (AI) in the Freight Transportation Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hardware, Software), By Application (Road Freight Transportation, Rail Freight Transportation, Air Freight Transportation, Ocean Freight Transportation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ocean Freight and Air Freight Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ocean Freight, Air Freight), By Application (Agricultural, Automotive, Seafood, Electronic, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager