Octabin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441214 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Octabin Market Size

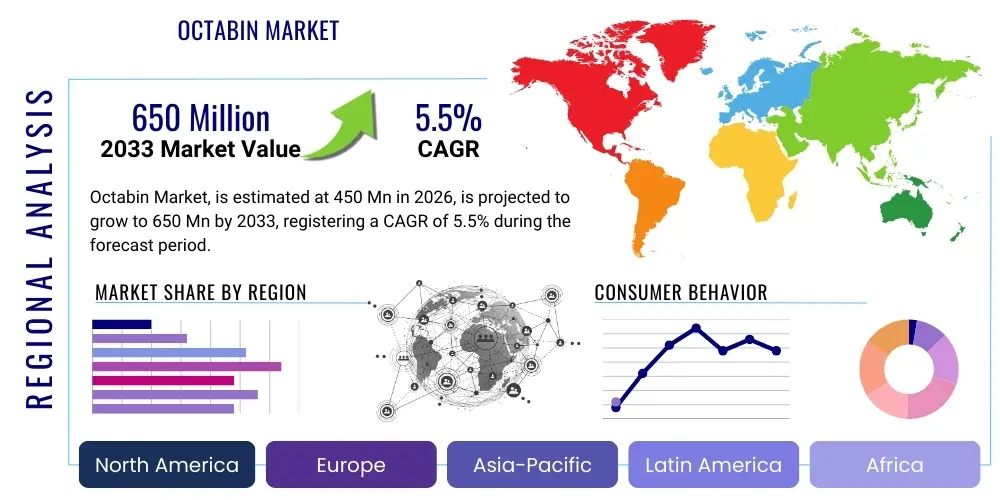

The Octabin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 650 million by the end of the forecast period in 2033.

Octabin Market introduction

The Octabin Market encompasses specialized bulk packaging solutions primarily constructed from heavy-duty corrugated cardboard, designed for the efficient storage and transportation of dry, granular, or free-flowing materials. These containers are octagonal in shape, maximizing stacking strength and load-bearing capacity, making them a cost-effective alternative to traditional wooden crates or specialized Intermediate Bulk Containers (IBCs). The primary applications span diverse industries including chemicals, plastics, food processing (ingredients and powders), agriculture (seeds and fertilizers), and pharmaceuticals, where safe, contamination-free bulk handling is paramount. Their intrinsic design facilitates easier loading, discharging, and superior cube utilization within standard shipping containers and warehouses.

A key characteristic driving the adoption of Octabins is their environmental profile; being predominantly paper-based, they offer high recyclability and reduced logistics costs due to their light tare weight. This aligns powerfully with global corporate sustainability goals and increasing regulatory pressures against single-use plastic packaging. Major benefits include excellent product protection, the ability to ship large volumes efficiently (often ranging from 500 kg to over 1,500 kg), and simplified assembly and flat-pack storage when empty, optimizing warehouse space. These benefits, coupled with the rising global demand for efficient supply chain logistics in bulk commodities, position Octabins as a critical component of modern industrial packaging strategy.

Driving factors for sustained market growth include the robust expansion of the global polymer industry, which heavily relies on Octabins for shipping plastic resins and granules; the acceleration of international trade requiring standardized, resilient bulk packaging; and continuous innovation in corrugated board technology, leading to Octabins with enhanced moisture resistance and stacking strength. The shift towards sustainable packaging practices, particularly in developed economies like North America and Europe, further solidifies the market trajectory, compelling end-users to adopt paper-based solutions over rigid plastic or metal alternatives where product compatibility allows.

Octabin Market Executive Summary

The Octabin market is undergoing structural shifts driven by global supply chain optimization and heightened environmental consciousness, resulting in sustained growth projections throughout the forecast period. Business trends indicate a marked preference among bulk commodity shippers for lightweight, sustainable, and customizable packaging solutions. Key strategic movements include increased investment by manufacturers in automated production lines capable of producing high-strength, water-resistant Octabins, often incorporating barrier coatings tailored for sensitive materials like food powders or reactive chemicals. Furthermore, consolidation among major packaging providers is leading to integrated offerings that combine the Octabin container with specialized liners and discharge mechanisms, enhancing overall operational efficiency for end-users and solidifying market leadership positions.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, largely fueled by explosive manufacturing output in China, India, and Southeast Asia, particularly within the plastics and automotive components sectors that require substantial volumes of raw materials transported in bulk. North America and Europe, while exhibiting slower volume growth, lead in technology adoption and sustainability compliance, driving demand for premium, multi-wall Octabins made from certified sustainable forest materials. Emerging markets in Latin America and the Middle East and Africa (MEA) represent significant future opportunities, characterized by infrastructure modernization and increasing industrialization, necessitating reliable and standardized bulk packaging for new chemical and agricultural processing plants.

Segment trends reveal that the corrugated cardboard material segment dominates due to its cost-effectiveness and recyclability, though there is rising niche demand for hybrid Octabins incorporating plastic or wooden pallets for superior handling longevity and moisture resistance. In terms of application, the Polymers/Plastics segment remains the largest consumer, reflecting the massive scale of resin production and global distribution. However, the Food & Beverage segment is demonstrating the highest CAGR, propelled by stringent sanitary requirements and the global increase in trade of bulk food ingredients such as sugar, cocoa, and various industrial starches, demanding specialized food-grade liners within the Octabin structure.

AI Impact Analysis on Octabin Market

Analysis of common user questions regarding AI's influence on the Octabin market reveals a focus on supply chain predictive capabilities, optimization of packaging design for performance, and factory automation efficiency. Users are primarily concerned with how AI can minimize waste by forecasting precise demand for custom Octabin sizes, thus reducing inventory holding costs and improving fulfillment rates. Key expectations center around leveraging machine learning algorithms to analyze external factors—such as commodity price fluctuations, port congestion data, and weather patterns—to provide real-time adjustments to Octabin production schedules and distribution logistics. This strategic implementation aims not only to improve operational resilience but also to enable advanced quality control, where imaging AI systems monitor the integrity and consistency of the corrugated board during manufacturing.

- AI-driven Predictive Maintenance: Utilizing sensor data on production machinery to forecast equipment failure, minimizing unplanned downtime in Octabin manufacturing lines.

- Demand Forecasting Optimization: Machine learning algorithms analyze historical sales, seasonal trends, and macro-economic indicators to optimize inventory levels and material procurement for corrugated feedstock.

- Logistics Route Planning: AI integration with Transport Management Systems (TMS) to optimize bulk shipment routes of filled Octabins, reducing fuel consumption and delivery lead times.

- Automated Quality Inspection: Deployment of computer vision systems to detect minute defects in corrugated board structure, sealing points, or stacking performance before deployment.

- Smart Packaging Integration: Use of AI to process data from smart sensors embedded in Octabins (monitoring temperature, humidity, shock) to ensure product quality throughout the transit cycle.

DRO & Impact Forces Of Octabin Market

The dynamics of the Octabin market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Major drivers include the relentless expansion of global trade, particularly in the bulk movement of dry commodities such as polymers, chemicals, and agricultural products, which require robust and standardized unit loads. Furthermore, the imperative for sustainable packaging is a significant catalyst; Octabins, being recyclable and biodegradable, are increasingly preferred over less environmentally friendly options. Operational efficiency is also a key driver, as the octagonal design offers superior stacking ability and maximized container utilization, directly reducing overall logistics costs for shippers. The flexibility in customization regarding size, strength, and barrier properties allows Octabins to serve highly specialized market needs effectively.

Conversely, the market faces specific restraints that temper growth rates. The high dependence on fluctuating raw material prices, primarily virgin and recycled paper pulp, creates cost volatility that manufacturers must absorb or pass on, impacting competitiveness against plastic IBCs. A critical technical restraint is the suitability limitation; Octabins are generally unsuitable for liquids or materials requiring extreme pressure containment, restricting their application scope. Moreover, intense competition from established alternatives like specialized flexible intermediate bulk containers (FIBCs/bulk bags) and reusable plastic IBCs, which offer greater durability and resistance to moisture, represents a continuous challenge, forcing Octabin manufacturers to constantly innovate and differentiate their products.

Opportunities for market expansion are substantial, particularly through technological enhancements and geographic diversification. There is significant potential in developing highly advanced barrier coatings (e.g., moisture vapor transmission rate barriers) that allow Octabins to penetrate segments traditionally dominated by rigid containers, such as high-purity chemicals or pharmaceutical ingredients. Geographic expansion into developing industrial hubs in Africa and Southeast Asia, where bulk infrastructure is rapidly evolving, offers untapped demand. Furthermore, the focus on closed-loop recycling programs and establishing partnerships with waste management companies to guarantee high end-of-life recovery rates presents a strategic opportunity to reinforce the Octabin's sustainable value proposition against competing materials, solidifying their role in circular economy initiatives.

Segmentation Analysis

The Octabin market is critically segmented based on material type, capacity, and end-use application, providing a granular view of demand drivers and market dynamics across various industrial verticals. The segmentation reflects the diverse requirements for bulk packaging solutions, ranging from simple, low-cost options for commodity plastics to highly specialized, multi-layered configurations necessary for sensitive food-grade or chemical applications. Understanding these segments is crucial for manufacturers targeting specific industry needs, allowing for optimized production strategies and customized product development, particularly concerning strength requirements (single-wall, double-wall, or triple-wall constructions) and moisture protection features.

Material composition, primarily the choice between corrugated cardboard and hybrid structures (incorporating wood or plastic bases), dictates the container's structural integrity, cost, and environmental profile. Capacity segmentation reflects operational needs, separating standard pallet loads (500–1000 kg) common in general manufacturing from ultra-high capacity loads (above 1000 kg) often required in large-scale agricultural or chemical processing. The application segment, detailing end-user industries such as Plastics, Chemicals, and Food & Beverage, provides the most valuable insight into demand stability and regulatory compliance requirements, as each sector mandates distinct specifications for sanitation, labeling, and handling protocols.

- By Material:

- Corrugated Cardboard (Single-Wall, Double-Wall, Triple-Wall)

- Wood (Base/Pallet only)

- Plastic (Base/Pallet only or Hybrid Liners)

- By Capacity:

- Up to 500 kg

- 500 kg to 1000 kg

- Above 1000 kg

- By Application:

- Chemicals and Fertilizers

- Plastics and Polymers (Resins, Granules)

- Food and Beverage (Ingredients, Powders)

- Pharmaceuticals

- Agriculture (Seeds, Nuts, Feed)

- Others (Automotive Components, General Manufacturing)

Value Chain Analysis For Octabin Market

The value chain for the Octabin market commences with upstream activities, centering on the sourcing and processing of raw materials. This primarily involves the pulp and paper industry, which supplies heavy-duty Kraft linerboard and corrugated medium—the foundational components of the Octabin structure. Upstream efficiency and stability are heavily reliant on sustainable forestry practices, the availability of high-quality recycled fiber, and the technological capability of paper mills to produce boards with specified burst and compression strengths. Suppliers of specialized materials, such as adhesive manufacturers, wax/polymer coating providers for moisture resistance, and manufacturers of form-fitting plastic liners, also play a crucial role in determining the final product's performance characteristics and cost structure. Volatility in global pulp pricing is a significant upstream risk factor impacting the entire chain.

The midstream stage involves the highly specialized manufacturing and conversion of the raw corrugated sheets into the final octagonal structure. This involves sophisticated machinery for die-cutting, scoring, printing, and gluing the multi-layered walls. Manufacturers focus heavily on precision engineering to ensure the structural integrity required for stacking and transportation robustness. Distribution channels, linking manufacturers to the diverse end-user industries, are vital. This often involves a mix of direct sales channels for major polymer producers and chemical companies that require high volumes and customized specifications, and indirect channels leveraging packaging distributors and third-party logistics (3PL) providers to reach smaller or geographically dispersed consumers, particularly those in the food and agricultural sectors.

Downstream activities focus on the utilization and ultimate disposal or recycling of the Octabins. End-users (e.g., plastics processors or food manufacturers) integrate the Octabins into their production lines for storage, inter-facility transfer, or export shipping. The efficiency of the Octabin's discharge mechanism and compatibility with automated material handling systems are critical downstream considerations. Post-use, the value chain emphasizes recycling; due to their high paper content, Octabins are highly recyclable, provided they are separated from liners and pallet components. The effectiveness of the circular economy loop—collecting, baling, and returning the used corrugated material to paper mills—is crucial for maintaining the environmental credentials and long-term viability of the Octabin solution.

Octabin Market Potential Customers

Potential customers for Octabins are concentrated within industrial sectors that require efficient, large-volume packaging for dry, non-hazardous, or semi-bulk goods, prioritizing ease of handling, cost savings on logistics, and compliance with sustainability mandates. The primary buyers are large-scale manufacturers and distributors involved in the global trade of granular and powder commodities. The plastics and polymer industry represents the cornerstone of demand, as manufacturers of polyethylene, polypropylene, and specialized resins rely heavily on Octabins for shipping their products globally from production sites to conversion facilities. These customers prioritize Octabins for their strength-to-weight ratio and ability to prevent contamination during transit, securing the purity of expensive plastic feedstocks.

The chemical industry, including producers of non-hazardous specialty chemicals, pigments, and detergents, forms another major customer base. These buyers seek customized Octabins with specialized barrier liners to protect sensitive products from moisture or oxygen exposure, requiring strict quality control documentation. Furthermore, the Food & Beverage sector, particularly suppliers of bulk ingredients such as industrial sugar, starch derivatives, powdered milk, and grains, is a rapidly expanding customer segment. These buyers mandate food-grade certified materials, adherence to sanitary standards, and traceability, often favoring Octabins due to their clean, single-use nature which minimizes cross-contamination risks inherent in reusable containers.

Agricultural and pharmaceutical industries also constitute crucial potential customer segments. Agricultural end-users, including large seed producers and fertilizer manufacturers, utilize Octabins for their logistical efficiency in moving high volumes of materials internationally. Pharmaceutical bulk ingredient suppliers, while requiring lower volumes, demand the highest standards of structural integrity and documentation for regulatory compliance, often requiring highly specialized, dust-free containers. Ultimately, any entity involved in the cost-effective, international movement of non-liquid bulk powders or granules that seeks an optimized, recyclable alternative to wooden crates or standard drums is a potential buyer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 650 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mondi Group, DS Smith Plc, Smurfit Kappa Group, International Paper Company, WestRock Company, Huhtamaki Oyj, Nefab Group, Rigid Containers Ltd (VPK Packaging Group), S.A.I.C.A. (Sociedad Anónima Industrias Celulosa Aragonesa), GWP Group, Customized Packaging, Inc., Bulk Handling Systems, Inc., Tri-Wall Limited, Orbis Corporation, Packaging Corporation of America (PCA), Atlas Packaging Ltd., Thimm Group, Box Board Products, Inc., Conitex Sonoco, Georgia-Pacific LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Octabin Market Key Technology Landscape

The technological landscape of the Octabin market is characterized by advancements in material science, focusing on enhancing structural performance and barrier properties, alongside sophisticated manufacturing automation. A critical area of development involves multi-wall corrugated board technology, utilizing innovative flute combinations and heavy-duty liners (such as triple-wall or quad-wall constructions) to significantly increase the compression strength and stacking resilience of the Octabins. This allows for higher load capacities and greater stacking density in warehouses and shipping containers, directly contributing to logistics efficiency. Furthermore, the use of advanced paper coatings, including paraffin wax alternatives and water-based polymer dispersions, is essential for improving moisture resistance without compromising the material’s recyclability, addressing the vulnerability of traditional cardboard in humid environments or for sensitive chemical applications.

Manufacturing process technology is equally crucial, driven by the need for high-speed, precision conversion. Modern Octabin production relies on fully automated converting equipment capable of complex die-cutting and multi-point gluing to ensure dimensional consistency and structural integrity across large batches. Robotics and sensors are increasingly integrated into these lines for precise material handling, quality control checks (e.g., dimensional scanning), and minimizing labor costs. The adoption of laser-guided cutting and scoring systems ensures highly accurate folds and seams, which are paramount for containers designed to support metric tons of product. These technological upgrades allow manufacturers to handle complex, custom orders with greater agility and lower production tolerances.

A key focus area involves the integration of Octabins with complementary handling technologies. This includes the engineering of proprietary liner insertion and automated discharge systems compatible with standard industrial processing equipment. Innovation in pallet coupling—designing Octabins that lock securely onto standard wooden or plastic pallets—improves stability during dynamic transportation. Emerging technologies also include traceable printing methods (e.g., RFID or QR code implementation) and specialized tamper-evident features, which leverage digital integration to enhance supply chain visibility, authenticity verification, and ensure the integrity of the bulk contents throughout the transit life cycle, especially critical in the high-value pharmaceutical and specialized chemical segments.

Regional Highlights

The global Octabin market exhibits distinct dynamics across key geographical regions, influenced by industrial activity levels, logistics infrastructure maturity, and regional regulatory frameworks concerning packaging sustainability and material handling standards. North America, encompassing the United States and Canada, represents a mature market characterized by high standards for quality and an accelerating shift towards sustainable packaging. The region is driven significantly by the substantial plastics and automotive industries, which require high-performance Octabins for domestic and international bulk material movement. Demand here focuses on technologically advanced products, including triple-wall structures and specialized liners, emphasizing compliance with complex food safety and material handling regulations. The robust e-commerce and logistics sectors further catalyze demand for reliable bulk shipping containers, promoting investment in large-scale domestic production capabilities.

Europe stands as a leading region in adopting high-recycled content Octabins, strongly influenced by the ambitious circular economy policies set by the European Union. Regulatory drivers, such as the Packaging and Packaging Waste Directive, encourage businesses to prioritize recyclable and renewable packaging formats, giving Octabins a significant market advantage over certain plastic or non-recyclable composite materials. Key markets in Western Europe (Germany, France, UK) show robust demand from the chemical, food processing, and pharmaceutical industries. Furthermore, the integration of smart logistics and digitized supply chains drives demand for Octabins compatible with automated warehousing systems. Manufacturers in this region are heavily focused on optimizing corrugated board weight while maintaining structural performance, a crucial balance driven by cost pressures and environmental targets.

Asia Pacific (APAC) is unequivocally the fastest-growing region in the Octabin market, propelled by rapid industrialization, massive export volumes, and escalating domestic consumption across major economies like China, India, Japan, and Southeast Asian nations. The region’s dominance in global manufacturing, particularly in polymer production and electronic component fabrication, generates vast demand for bulk packaging solutions. While cost sensitivity remains high, the increasing complexity of international logistics and growing awareness of product safety are gradually shifting focus toward higher-quality, multi-layered Octabins. Significant investment in logistics infrastructure modernization across developing APAC countries further enhances the utility and demand for standardized bulk containers that streamline port and customs operations. India and Southeast Asia are particularly promising growth centers due to booming manufacturing bases and substantial agricultural output requiring bulk export packaging.

Latin America represents an emerging market with substantial, yet currently fragmented, growth potential. Demand is driven primarily by agricultural exports (e.g., coffee, sugar, seeds) and the expanding regional chemical and mining sectors. Brazil and Mexico are the primary markets, characterized by significant investment in industrial capacity and an increasing need for standardized packaging to facilitate international trade with North American and European partners. Challenges include less sophisticated logistics infrastructure in certain areas and higher reliance on imported Octabins or raw corrugated materials, which can impact local pricing. However, as trade agreements mature and local manufacturing bases strengthen, the requirement for efficient, customizable bulk solutions like Octabins is expected to accelerate significantly.

The Middle East and Africa (MEA) region, although the smallest market segment, is experiencing strong localized growth, heavily correlated with ongoing diversification efforts away from solely oil and gas dependence into manufacturing, chemicals, and specialized agriculture. Countries in the Gulf Cooperation Council (GCC) are investing heavily in petrochemical complexes, necessitating large volumes of high-quality Octabins for polymer export. Similarly, the African continent, benefiting from global investments in food processing and industrial development, presents long-term market opportunities. The market here is sensitive to durability and temperature resistance due to harsh climatic conditions and extended transit times, driving demand for premium, highly protective liners and base constructions integrated with the Octabin structure.

- Asia Pacific (APAC): Dominates volume consumption due to polymer manufacturing and export infrastructure; highest growth rate expected.

- North America: Focuses on high-performance, specialized Octabins for plastics, automotive, and regulated food ingredients; driven by logistics efficiency.

- Europe: Leads in sustainable material adoption and circular economy compliance; strong demand from chemical and pharmaceutical industries.

- Latin America: Emerging market driven by agricultural exports and chemical processing; relies on Brazilian and Mexican industrial bases.

- Middle East and Africa (MEA): Growth tied to petrochemical expansion and industrial diversification, requiring highly resilient packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Octabin Market.- Mondi Group

- DS Smith Plc

- Smurfit Kappa Group

- International Paper Company

- WestRock Company

- Huhtamaki Oyj

- Nefab Group

- Rigid Containers Ltd (VPK Packaging Group)

- S.A.I.C.A. (Sociedad Anónima Industrias Celulosa Aragonesa)

- GWP Group

- Customized Packaging, Inc.

- Bulk Handling Systems, Inc.

- Tri-Wall Limited

- Orbis Corporation

- Packaging Corporation of America (PCA)

- Atlas Packaging Ltd.

- Thimm Group

- Box Board Products, Inc.

- Conitex Sonoco

- Georgia-Pacific LLC

Frequently Asked Questions

Analyze common user questions about the Octabin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in Octabins and why is it preferred?

The primary material is heavy-duty corrugated cardboard, typically in double or triple-wall configurations. It is preferred for its superior compression strength, low tare weight, cost-effectiveness, and high recyclability, aligning with global sustainability mandates for bulk packaging.

How do Octabins compare to traditional Intermediate Bulk Containers (IBCs)?

Octabins are cost-effective, disposable (recyclable), and lightweight, maximizing cube utilization for dry goods. Rigid IBCs (plastic/metal) are reusable, more durable, and suitable for liquids or highly sensitive hazardous materials, but incur cleaning and return logistics costs.

Which end-use industry represents the largest market share for Octabin consumption?

The Plastics and Polymers industry holds the largest market share, using Octabins extensively for the bulk shipment of plastic resins, granules, and pellets globally from manufacturing plants to processors due to the need for contaminant-free, high-capacity containers.

What are the key technological advancements driving Octabin market growth?

Key advancements include high-performance multi-wall structures, development of recyclable moisture-barrier coatings, and advanced manufacturing automation for precise, high-volume production, ensuring containers meet specific stacking and climatic requirements.

Which geographical region exhibits the fastest growth rate in the Octabin Market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid industrial expansion, particularly in polymer production and export activities across countries like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager