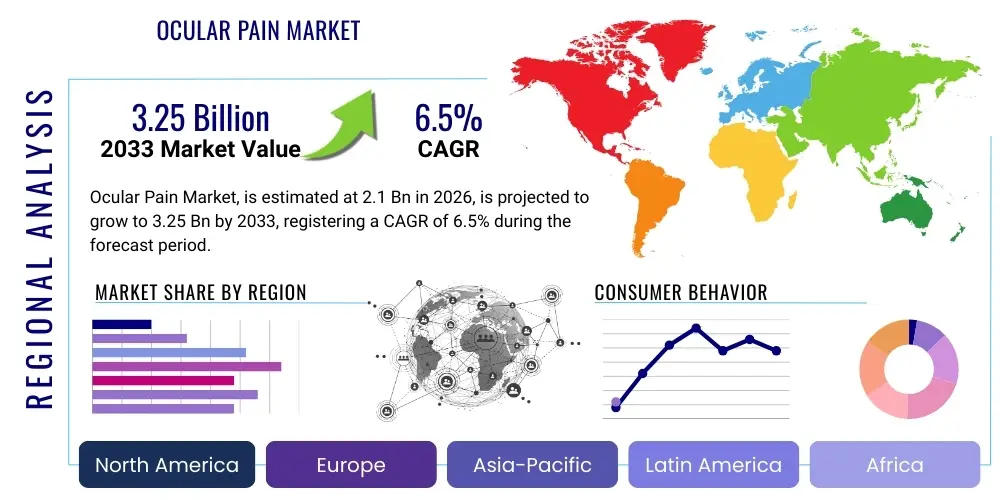

Ocular Pain Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441319 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ocular Pain Market Size

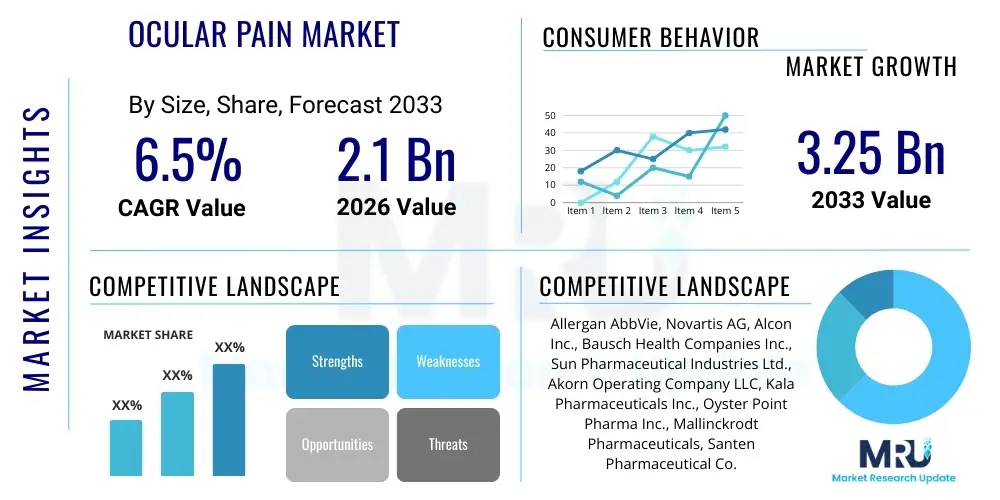

The Ocular Pain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Ocular Pain Market introduction

The Ocular Pain Market encompasses diagnostic tools, pharmaceutical treatments, and surgical interventions aimed at managing discomfort arising from various conditions affecting the surface or internal structures of the eye. Ocular pain, ranging from mild irritation to severe, debilitating neuropathic pain, is a common symptom associated with dry eye syndrome, corneal abrasions, post-surgical inflammation, ocular infections, glaucoma, and persistent corneal nerve damage. The complexity of ocular pain management stems from the diverse etiology and the highly sensitive nature of the ocular surface, necessitating specialized therapeutic approaches that often combine lubrication, anti-inflammatory agents, and specific analgesic modalities.

Key products driving market traction include prescription non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroid drops, lubricating eye drops (artificial tears), and novel compounds targeting specific pain pathways, such as transient receptor potential (TRP) channels. Major applications span post-operative recovery, chronic disease management (e.g., severe dry eye associated pain), and acute trauma treatment. The inherent benefit of effective pain management is the significant improvement in patient quality of life, prevention of secondary complications like photophobia and chronic headache, and faster recovery times, particularly after intricate ophthalmic procedures like cataract surgery or refractive error correction.

Driving factors propelling this market growth include the rising global prevalence of chronic ocular surface diseases, particularly among aging populations, increasing rates of diabetic retinopathy which can lead to associated neuropathic pain, and the growing number of elective and essential ophthalmic surgeries worldwide. Furthermore, sustained investments in research and development leading to the approval of targeted therapies, such as calcineurin inhibitor formulations and nerve growth factor (NGF) agonists, are creating new avenues for treating persistent and challenging forms of ocular discomfort, contributing substantially to market expansion over the forecast period.

Ocular Pain Market Executive Summary

The global Ocular Pain Market is poised for substantial growth, driven by an expanding base of patients suffering from chronic dry eye, post-operative inflammation, and ocular neuropathies. Current business trends indicate a strong focus on developing long-acting, preservative-free formulations, particularly in the anti-inflammatory and immunomodulatory categories, reflecting a shift towards better tolerability and compliance for chronic users. The competitive landscape is characterized by intense R&D activities centered on biologic therapies and advanced delivery systems, such as sustained-release implants and nano-micellar technologies, designed to improve drug bioavailability in the anterior segment of the eye. Strategic collaborations between pharmaceutical giants and specialized biotech firms are prevalent, aiming to rapidly commercialize pipeline drugs targeting refractory ocular pain conditions.

Regional trends demonstrate North America maintaining market dominance, attributed to high healthcare expenditure, sophisticated diagnostic infrastructure, and rapid uptake of novel, high-value therapies, particularly in the management of post-herpetic and post-refractive surgery neuropathic pain. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market due to the enormous volume of ophthalmic procedures performed, increasing awareness regarding ocular surface disorders, and improving access to branded therapeutics in densely populated countries like China and India. European growth is steady, bolstered by rigorous clinical guidelines favoring immunomodulatory treatments for chronic pain associated with inflammatory conditions.

Segmentation trends highlight the pharmaceutical segment's continued leadership, specifically driven by the robust performance of NSAIDs and steroids in acute settings, alongside the accelerated adoption of cyclosporine and lifitegrast for chronic inflammatory pain management. In terms of disease cause, dry eye syndrome remains the largest contributor to market revenue, necessitating continuous innovation in tear film stabilization and anti-inflammatory strategies. The diagnostic segment is experiencing moderate growth, spurred by the integration of advanced osmolarity testing and imaging techniques crucial for objectively characterizing the severity and underlying causes of patient reported discomfort, thereby facilitating more precise treatment protocols and enhancing segment penetration across various clinical settings.

AI Impact Analysis on Ocular Pain Market

User queries regarding AI's influence in the Ocular Pain Market primarily revolve around its capability to enhance diagnostic precision, personalize treatment regimens, and accelerate drug discovery for novel analgesics. Users frequently ask if AI can differentiate between nociceptive (acute injury) and neuropathic (nerve damage) pain types, which is clinically challenging but crucial for effective treatment. Concerns also focus on the potential for AI-driven algorithms to streamline clinical trials for new ocular pain therapies, and whether predictive modeling can identify patients at highest risk of developing chronic pain post-surgery. The overarching expectation is that AI will move pain assessment beyond subjective reporting (e.g., visual analog scales) towards objective, biomarker-driven evaluation, leading to more responsive and effective interventions.

The deployment of Artificial Intelligence in ophthalmology is revolutionizing the approach to pain management, particularly through sophisticated image analysis and data processing. AI algorithms are being trained on vast datasets of corneal images (captured via confocal microscopy or optical coherence tomography) to accurately quantify corneal nerve density and morphology, offering an objective measure of underlying neuropathic pain severity—a condition often resistant to conventional analgesics. This objective measurement capacity is critical for diagnosing conditions like corneal neuralgia and monitoring therapeutic efficacy, transforming the qualitative nature of pain assessment into a quantitative science. Such advancements reduce diagnostic delays and prevent unnecessary or ineffective prescriptions.

Furthermore, AI is significantly impacting the drug development pipeline for ocular pain. Machine learning models are utilized to predict the efficacy and toxicity profiles of potential therapeutic compounds targeting pain mediators like Substance P or CGRP, substantially accelerating the preclinical phase. In clinical settings, AI-powered tools are optimizing trial design by selecting highly specific patient cohorts based on clinical biomarkers and genetic predisposition, improving statistical power, and lowering the overall cost and time required to bring novel ophthalmic analgesics to market, promising quicker access to next-generation pain relief solutions for patients.

- AI enhances diagnostic accuracy by objectively quantifying corneal nerve structure via image recognition (Confocal Microscopy).

- Predictive modeling identifies patients at risk of chronic post-operative ocular pain, allowing for prophylactic intervention strategies.

- Machine learning accelerates drug discovery by screening and optimizing compounds targeting novel pain pathways (e.g., neurotrophic factors).

- AI algorithms personalize pain treatment by correlating individual patient biomarkers and response data to specific drug formulations (e.g., topical NSAIDs vs. corticosteroids).

- Telemedicine integration utilizes AI chatbots and triage systems for initial pain assessment, severity scoring, and appropriate referral.

DRO & Impact Forces Of Ocular Pain Market

The Ocular Pain Market is primarily driven by the escalating prevalence of ophthalmic conditions requiring acute and chronic pain management, while facing challenges related to medication compliance and the cost of innovative therapies. Opportunities lie predominantly in developing disease-modifying agents that target the root cause of neuropathic pain, moving beyond symptomatic relief. These market dynamics are shaped by potent impact forces, including stringent regulatory approval processes for new ophthalmic drugs, the influence of insurance coverage on accessibility, and the rapid pace of technological advancements in drug delivery systems ensuring sustained drug concentration at the site of action, minimizing systemic side effects.

Major drivers include the global demographic shift towards an older population segment, which is inherently susceptible to age-related conditions like cataracts, glaucoma, and chronic dry eye syndrome, all significant contributors to ocular discomfort. Increased consumer awareness regarding early diagnosis and sophisticated treatment options for conditions like post-refractive surgery pain and ocular allergies also fuels demand. Conversely, key restraints encompass the high rates of off-label use of existing pharmaceutical compounds, potential side effects associated with prolonged use of topical corticosteroids (e.g., intraocular pressure elevation), and the difficulty in objectively measuring and validating patient-reported pain, which complicates clinical trial endpoints and regulatory approvals for purely analgesic agents.

Opportunities are substantial in the domain of sustained-release technologies, such as punctal plugs or subconjunctival injections capable of delivering anti-inflammatory agents over weeks or months, vastly improving patient adherence compared to daily drops. Furthermore, the development of non-opioid, non-NSAID therapies that specifically modulate peripheral corneal nerves is an untapped area offering significant commercial potential, especially for patients with persistent corneal neuralgia refractory to conventional management. The collective impact forces ensure that success in this market is intrinsically linked to demonstrating superior safety profiles and high efficacy in challenging patient populations, particularly those suffering from debilitating chronic ocular pain.

Segmentation Analysis

The Ocular Pain Market is meticulously segmented based on product type, underlying disease cause, and distribution channel, reflecting the diverse approaches required for diagnosis and treatment. This segmentation aids stakeholders in identifying high-growth niches, ranging from over-the-counter (OTC) lubricants catering to mild discomfort to highly specialized prescription anti-inflammatory and immunomodulatory drugs used for severe, chronic conditions. Analyzing these segments reveals shifting consumer preferences towards preservative-free and advanced biologic therapies, signaling a maturation of the market away from generic, first-generation treatments.

Segmentation by product type is crucial, dividing the market into pharmaceuticals (further categorized into NSAIDs, Corticosteroids, Anesthetics, and Immunomodulators like Cyclosporine and Lifitegrast) and medical devices (such as punctal plugs and diagnostic tools). The pharmaceutical segment dominates due to the necessity of drug intervention across all severities of ocular pain, while the device segment, though smaller, exhibits robust growth fueled by innovative sustained-release delivery systems enhancing drug adherence and clinical efficacy. Furthermore, understanding the primary causes—which include dry eye syndrome, post-operative inflammation, infections (keratitis), and trauma—is essential for pharmaceutical companies to tailor their marketing and R&D efforts toward the highest incidence conditions.

The distribution channel analysis further delineates market access, distinguishing between hospital pharmacies, retail pharmacies, and online channels. Hospital pharmacies remain critical for post-operative acute pain management and specialized in-patient treatments, while retail and online channels are rapidly gaining traction for chronic condition management, particularly for OTC artificial tears and prescribed long-term immunomodulatory drops. The increasing convenience and accessibility offered by e-commerce platforms, coupled with the rising availability of prescription fulfillment services, are democratizing access to ocular pain treatments, albeit requiring stringent quality control measures for temperature-sensitive ophthalmic solutions.

- Product Type:

- Pharmaceuticals

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Corticosteroids

- Local Anesthetics

- Immunomodulators (Cyclosporine, Lifitegrast)

- Neurotrophic Factors

- Medical Devices (Punctal Plugs, Diagnostic Instruments)

- Pharmaceuticals

- Cause:

- Dry Eye Syndrome (DES)

- Post-Operative Inflammation (Cataract, Refractive Surgery)

- Infection (Keratitis, Conjunctivitis)

- Trauma/Abrasion

- Ocular Neuropathy (Corneal Neuralgia)

- Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies/E-commerce

Value Chain Analysis For Ocular Pain Market

The Ocular Pain Market value chain begins with intensive upstream activities, primarily involving pharmaceutical discovery and development. This stage is capital-intensive, focusing on identifying and synthesizing active pharmaceutical ingredients (APIs), conducting rigorous preclinical testing, and managing complex intellectual property rights surrounding novel drug targets, such as specialized receptor antagonists or recombinant proteins. Key upstream participants include specialized biotech firms, large pharmaceutical R&D divisions, and contract research organizations (CROs) that execute specialized ophthalmic toxicology and efficacy studies. Raw material sourcing, particularly for complex biologic molecules and excipients for preservative-free formulations, must meet stringent regulatory standards, establishing the foundation for quality and efficacy.

The midstream phase involves manufacturing, quality assurance, and logistics. Manufacturing specialized ophthalmic solutions, especially sterile, temperature-sensitive, and preservative-free formulations, requires state-of-the-art facilities compliant with Good Manufacturing Practices (GMP). Packaging and labeling must adhere to global pharmacological standards, emphasizing clarity and child-proofing. The distribution channel, which bridges manufacturing to the end-users, is bifurcated into direct and indirect routes. Direct sales often involve large hospitals or specialized clinics procuring high-cost surgical treatments, while indirect sales rely heavily on wholesalers, distributors, and large pharmacy chains to manage the high volume of prescription and OTC drops.

Downstream activities center on marketing, prescribing, and end-user consumption. Ophthalmic pharmaceutical marketing requires targeted education directed towards ophthalmologists, optometrists, and primary care physicians about drug safety and clinical efficacy data. Direct distribution primarily occurs through hospital procurement for surgical inventory. Indirect distribution is dominated by retail pharmacies, which fulfill prescriptions and dispense OTC products like artificial tears. Potential customers, or end-users, range from individuals seeking mild relief (OTC) to patients with severe, chronic conditions requiring long-term specialized prescription management, making patient education and adherence programs a critical final step in maximizing the therapeutic value of the product.

Ocular Pain Market Potential Customers

The primary end-users and buyers of products within the Ocular Pain Market are segmented into clinical institutions, professional healthcare providers, and individual patients, each having distinct purchasing motivations and needs. Clinical institutions, including specialized eye hospitals and large ambulatory surgical centers, are significant purchasers of high-volume products such as post-operative NSAIDs, local anesthetics for in-office procedures, and diagnostic equipment. Their buying decisions are driven by clinical protocols, cost-effectiveness within bundled payments, and the need for immediate, high-quality stock to ensure seamless surgical workflow and rapid patient recovery management.

Professional healthcare providers, such as independent ophthalmologists and optometrists, represent another crucial customer segment. These practitioners directly influence prescribing patterns for chronic conditions like dry eye and corneal neuralgia. They procure specialized diagnostic supplies and often stock or recommend high-margin prescription immunomodulators (like cyclosporine) for patients requiring long-term management of inflammatory pain. Their purchasing choices are highly influenced by pharmaceutical representatives' data, peer-reviewed clinical evidence, and formulary coverage, prioritizing efficacy and minimal side-effects to ensure patient compliance and favorable treatment outcomes.

Individual patients constitute the largest volume of consumers, primarily purchasing over-the-counter lubricating drops, basic pain relievers, and prescription medication refills through retail or online pharmacies. Patients managing chronic conditions like severe dry eye pain are long-term, high-value customers for specialized, premium-priced immunomodulatory agents. Their purchasing behavior is strongly influenced by brand reputation, perceived relief effectiveness, insurance copayments, and convenience of access, driving the demand for user-friendly, preservative-free, and readily available formulations across various retail and e-commerce platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allergan AbbVie, Novartis AG, Alcon Inc., Bausch Health Companies Inc., Sun Pharmaceutical Industries Ltd., Akorn Operating Company LLC, Kala Pharmaceuticals Inc., Oyster Point Pharma Inc., Mallinckrodt Pharmaceuticals, Santen Pharmaceutical Co. Ltd., Aerie Pharmaceuticals Inc., Ocular Therapeutix Inc., Sentiss Pharma Pvt. Ltd., Johnson & Johnson Services Inc., Teva Pharmaceutical Industries Ltd., Tarsus Pharmaceuticals Inc., Glaukos Corporation, Eyevance Pharmaceuticals LLC, Regeneron Pharmaceuticals Inc., Dompe Farmaceutici S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ocular Pain Market Key Technology Landscape

The technological landscape for the Ocular Pain Market is dominated by advancements in specialized drug formulation and delivery systems aimed at enhancing corneal penetration and prolonging therapeutic efficacy while minimizing preservative-related toxicity. A significant technological focus is on nanoparticle and micellar formulations (e.g., Dextenza, Lotemax SM) that improve the bioavailability of hydrophobic drugs, such as corticosteroids and certain NSAIDs, allowing for lower dosing frequencies and reduced systemic absorption. Furthermore, the push towards preservative-free ophthalmic solutions, achieved through specialized unit-dose vials or proprietary bottle technologies (e.g., OSD systems), is a critical response to the market demand for products that mitigate ocular surface irritation, particularly vital for chronic pain sufferers.

Another transformative technology involves sustained-release drug delivery devices. These include drug-eluting punctal plugs, subconjunctival inserts, and bio-erodible inserts (like the dexamethasone insert approved for pain and inflammation management) that release medication over several days to months. This approach addresses the pervasive issue of patient non-compliance with multi-dose daily eye drop regimens, ensuring consistent drug concentration at the pain site. These technologies offer a significant advantage in managing predictable post-operative pain or chronic inflammatory conditions, drastically reducing the variability in therapeutic outcomes associated with patient self-administration.

Beyond drug delivery, diagnostic technologies utilizing Artificial Intelligence (as discussed previously) and advanced imaging techniques contribute significantly to the landscape. High-resolution in vivo confocal microscopy (IVCM) allows for non-invasive visualization and quantification of corneal nerve damage, providing an objective measure of small fiber neuropathy often associated with severe ocular pain. The integration of advanced ocular surface analyzers, which measure tear film stability, osmolarity, and meibomian gland function, further enables clinicians to precisely categorize the pain source, moving treatment decisions away from empirical guessing toward targeted, technology-supported interventions, driving market innovation in both therapeutic and diagnostic segments simultaneously.

Regional Highlights

North America currently holds the largest share of the Ocular Pain Market, primarily due to the established presence of leading pharmaceutical companies, robust governmental and private funding for specialized ophthalmic research, and high patient awareness leading to early diagnosis and adoption of premium branded therapies. The region benefits from sophisticated healthcare infrastructure and favorable reimbursement policies for advanced treatments, including biologic agents and complex sustained-release drug delivery systems. The high prevalence of refractive surgeries and chronic conditions like diabetic retinopathy contributes substantially to the volume of ocular pain cases treated annually, solidifying its market leadership in terms of revenue generation and technological innovation uptake.

Europe represents a mature market with steady growth, characterized by strong clinical guidelines that favor evidence-based treatments for inflammation and chronic surface pain. Countries such as Germany, the UK, and France show high adoption rates of immunomodulatory drugs (Cyclosporine, Lifitegrast) for managing dry eye-related pain and post-surgical inflammation. While European markets often exhibit greater price sensitivity compared to the US, the increasing standardization of clinical practice across the European Union drives consistent demand for high-quality, approved pharmaceutical products, fostering innovation in preservative-free formulations to meet rigorous regulatory requirements for chronic use.

The Asia Pacific (APAC) region is projected to register the highest CAGR during the forecast period. This accelerated growth is fueled by massive, untapped patient populations, rapidly improving healthcare access, and a surge in ophthalmic surgical volumes, particularly cataract and glaucoma procedures in economically expanding nations like China, India, and South Korea. Increased disposable incomes and rising health consciousness are translating into greater willingness to spend on prescription pain management options. While the market faces challenges related to the penetration of branded specialty drugs versus lower-cost generics, concerted efforts by global companies to expand distribution networks and localized clinical trial data generation are crucial factors propelling the dynamic growth trajectory of this region.

- North America: Dominant market share; driven by high healthcare expenditure, rapid adoption of novel specialty drugs, and high prevalence of ocular surgeries. Focus on neuropathic pain treatment innovations.

- Europe: Steady growth, mature market; high adoption of immunomodulatory agents for chronic inflammatory pain. Strong emphasis on preservative-free formulations.

- Asia Pacific (APAC): Fastest-growing region; boosted by increasing surgical volumes (especially cataract), expanding middle-class populations, and improving access to branded therapeutics.

- Latin America (LATAM): Moderate growth, driven by increasing insurance coverage and localized manufacturing partnerships. Market is highly sensitive to pricing.

- Middle East and Africa (MEA): Emerging market; growth tied to improving specialty healthcare infrastructure and rising prevalence of environmental irritant-related ocular surface disorders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ocular Pain Market.- Allergan (Now AbbVie)

- Novartis AG

- Alcon Inc.

- Bausch Health Companies Inc.

- Sun Pharmaceutical Industries Ltd.

- Kala Pharmaceuticals Inc.

- Oyster Point Pharma Inc.

- Mallinckrodt Pharmaceuticals

- Santen Pharmaceutical Co. Ltd.

- Aerie Pharmaceuticals Inc.

- Ocular Therapeutix Inc.

- Sentiss Pharma Pvt. Ltd.

- Johnson & Johnson Services Inc.

- Teva Pharmaceutical Industries Ltd.

- Tarsus Pharmaceuticals Inc.

- Glaukos Corporation

- Eyevance Pharmaceuticals LLC

- Regeneron Pharmaceuticals Inc.

- Dompe Farmaceutici S.p.A.

- Akorn Operating Company LLC

Frequently Asked Questions

Analyze common user questions about the Ocular Pain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Ocular Pain Market?

The primary factor driving market growth is the globally rising prevalence of chronic ocular surface diseases, particularly dry eye syndrome and age-related conditions like cataracts requiring surgical intervention, both of which necessitate effective acute and chronic pain management solutions. Additionally, the development and regulatory approval of high-value, novel immunomodulatory and neurotrophic therapies for persistent corneal pain are expanding the treatable patient pool, contributing substantially to revenue growth.

How is sustained drug delivery technology impacting treatment protocols for ocular pain?

Sustained drug delivery systems, such as drug-eluting punctal plugs and subconjunctival inserts, are revolutionizing treatment by ensuring continuous and localized release of anti-inflammatory or analgesic agents over weeks or months. This dramatically improves patient compliance, reduces the variability associated with self-administered drops, and minimizes peak-and-trough drug concentrations, thereby achieving more consistent therapeutic outcomes, especially critical in chronic or post-operative pain management.

Which product segment accounts for the largest share of the Ocular Pain Market revenue?

The Pharmaceutical segment, specifically encompassing Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, and advanced Immunomodulators (like Cyclosporine and Lifitegrast), accounts for the largest market share. This dominance is due to their essential role in managing both acute post-operative inflammation and chronic inflammatory pain associated with severe dry eye disease, offering high efficacy across a wide spectrum of painful ocular conditions.

What are the key challenges restraining market expansion, especially concerning chronic ocular pain?

Key challenges include the difficulty in objectively diagnosing and measuring chronic neuropathic ocular pain, which often leads to delays and empirical treatment trials. Furthermore, the high cost and lack of universal reimbursement for novel specialty drugs, coupled with patient adherence issues related to complex, multi-dose regimens and the side effects associated with long-term topical corticosteroid use, pose significant restraints on widespread market adoption.

How is AI being utilized to improve diagnosis in the context of ocular nerve pain?

Artificial Intelligence (AI) is utilized in conjunction with advanced imaging technologies, such as in vivo confocal microscopy (IVCM), to objectively analyze and quantify corneal nerve fiber density and morphology. AI algorithms process these complex images to detect signs of small fiber neuropathy, offering clinicians a quantifiable, objective biomarker to accurately diagnose persistent corneal neuralgia, moving beyond subjective patient pain reporting and enabling highly targeted treatment decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager