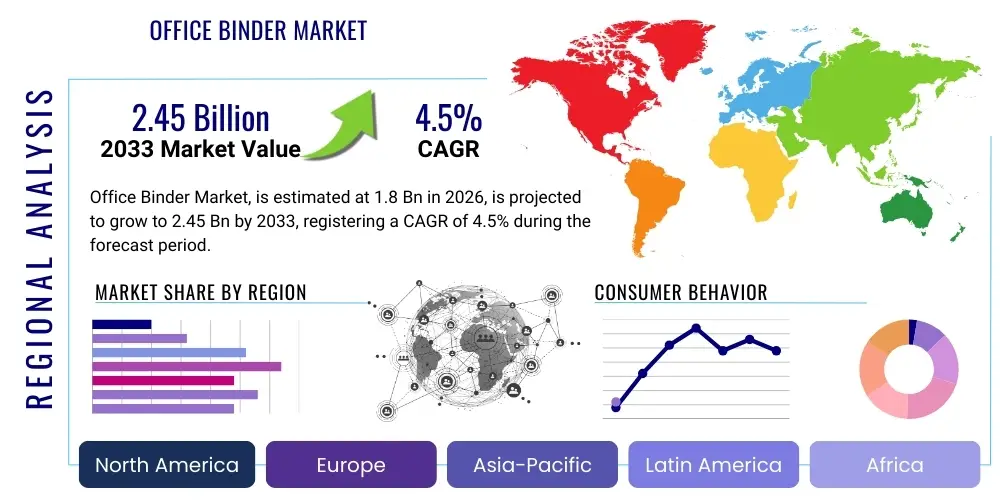

Office Binder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443224 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Office Binder Market Size

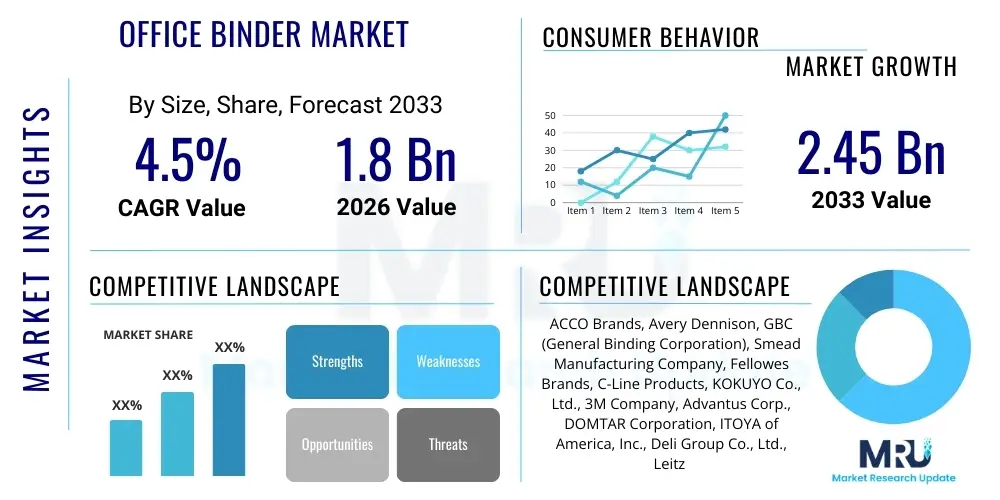

The Office Binder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by sustained demand across regulated industries, educational institutions, and the expanding small and medium-sized enterprise (SME) sector, despite pervasive digitalization efforts globally.

Office Binder Market introduction

The Office Binder Market encompasses the manufacturing and distribution of organizational tools primarily used for securing and archiving physical documents. These essential office products, including ring binders, lever arch files, and report covers, serve crucial functions in document management, presentation, and long-term storage across diverse environments. While core functionality remains consistent, the market is continually evolving through material innovation, focusing heavily on durability, ergonomic design, and sustainability to meet modern corporate social responsibility objectives. Binders are fundamentally utilized for sequential documentation, compliance filing, and maintaining accessible physical records where digital reliance is either insufficient or restricted by regulatory mandates.

Major applications of office binders span critical areas such as legal documentation, financial auditing, internal training manuals, operational Standard Operating Procedures (SOPs), and educational curricula materials. In corporate settings, binders are indispensable for board meeting materials, quarterly reports requiring physical signatures, and complex project documentation that necessitates rapid, non-digital access. Furthermore, the specialized requirements of government and healthcare sectors for mandatory physical backups, patient records, and classified documents ensure a consistent baseline demand for high-quality, secure binding solutions. The perceived reliability and ease of accessibility offered by physical files continue to solidify the market position of these products.

Key benefits of utilizing office binders include enhanced document organization, protection against physical wear and tear, and simplified information retrieval. The driving factors sustaining market growth involve stringent regulatory requirements across sectors like finance and healthcare that mandate physical record-keeping for defined periods, the expansion of commercial real estate leading to higher corporate office density, and the preference for tangible study materials within the global education system. Additionally, the increasing complexity of international trade and supply chain operations generates substantial paperwork requiring formalized physical organization for auditing and logistical verification purposes, further fueling market momentum and demand for differentiated binding products.

Office Binder Market Executive Summary

The Office Binder Market is characterized by resilient demand driven by legal and corporate compliance, counteracting the structural shift toward digitalization. Current business trends indicate a strong movement towards premium and specialized binders, particularly those offering enhanced security features, ergonomic locking mechanisms, and robust materials capable of withstanding heavy usage in demanding professional environments. Manufacturers are strategically focusing on optimizing supply chain efficiency and implementing just-in-time inventory systems to cater to fluctuating wholesale and direct-to-consumer demands, especially through burgeoning e-commerce platforms. Consolidation among major office supply retailers also influences procurement strategies, favoring large-scale contracts with manufacturers capable of providing diverse product lines and sustainable material options.

Geographically, regional trends highlight North America and Europe as mature markets defined by replacement demand and a strong emphasis on sustainable and eco-friendly products, often mandated by regional regulations or corporate policies. Conversely, the Asia Pacific (APAC) region is experiencing significant market expansion, propelled by rapidly growing commercial infrastructure, increasing literacy rates, and burgeoning educational enrollment. This region presents substantial opportunities for manufacturers focusing on cost-effective, high-volume production models, particularly targeting small businesses and emerging educational institutions. The adoption rate of advanced binding materials and automated manufacturing processes is accelerating in APAC to meet this escalating domestic demand efficiently.

Segmentation trends reveal vinyl and polypropylene binders dominating the volume segment due to their cost-effectiveness and durability, although sustainable materials like recycled paperboard and bio-plastics are experiencing the highest growth rates, driven by consumer preference and regulatory pressures. The end-user segment is increasingly bifurcated: the corporate sector demands high-capacity, durable lever arch files for archival purposes, while the home office and small business segments prefer medium-capacity, aesthetically pleasing, and easy-to-store ring binders. The shift toward online distribution channels continues to reshape competitive dynamics, emphasizing direct-to-consumer branding, rapid fulfillment capabilities, and transparent pricing structures optimized for bulk purchasing and enterprise contracts.

AI Impact Analysis on Office Binder Market

User queries regarding AI's impact on the Office Binder Market often center on whether AI-driven documentation automation will render physical binders obsolete, the role of AI in optimizing supply chain logistics for manufacturers, and the potential for AI to personalize office supply procurement. Users frequently express concern about the future viability of the physical organization sector given advancements in automated digital archiving and search technologies. The consensus among these questions points to a necessary transformation in how physical documentation is viewed, transitioning from primary storage to legally mandated backup or high-security, sensitive document handling, areas where AI's influence is more indirect but profound.

The primary influence of Artificial Intelligence on the Office Binder market is not direct product displacement but rather the optimization of supporting commercial processes and a subtle reduction in non-essential physical record-keeping. AI algorithms are increasingly employed by major office supply retailers and distributors to forecast demand more accurately, managing inventory levels precisely, which minimizes waste and optimizes storage costs. Furthermore, AI-driven customer service tools and personalized marketing platforms are used to identify enterprise purchasing patterns, allowing binder manufacturers to tailor large-volume contract offerings and identify niche demands for specialized or customized products, enhancing market responsiveness.

While AI technologies significantly enhance digital document management, thereby reducing the volume of general paperwork, they simultaneously reinforce the importance of the physical binder for specific, highly regulated compliance requirements. Financial institutions, legal firms, and government bodies often maintain dual systems, where AI handles preliminary digital organization, but the final, legally admissible, and signed documents must be printed and secured in physical binders as mandatory archival proof. Therefore, AI drives efficiency upstream (manufacturing/logistics) and defines the critical role of physical binders downstream (compliance/security), leading to a higher demand for premium, tamper-evident, and durable binding solutions rather than general-purpose, low-cost options.

- AI optimizes supply chain forecasting, minimizing inventory costs for manufacturers.

- Generative AI tools assist in automating routine digital documentation, potentially reducing general office printing volume.

- AI-driven e-commerce platforms enhance personalized bulk purchasing recommendations for corporate clients.

- Intelligent digital archiving reinforces the strategic, compliance-focused necessity of physical backups secured in binders.

- Advanced analytics inform product design, optimizing binder features (e.g., durability, capacity) based on actual corporate usage data.

DRO & Impact Forces Of Office Binder Market

The market is predominantly influenced by three primary forces: Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory requirement for physical documentation in auditing, legal, and compliance frameworks globally, such as financial regulatory bodies and healthcare privacy acts, which counteract the prevalent trend of digitalization. The continuous growth of the education sector, particularly in emerging economies, mandates physical textbooks and supplementary materials organized using binders. Restraints primarily involve the accelerating adoption of cloud storage and digital workflow solutions, which reduce the daily creation of physical paper records, coupled with fierce price competition in the low-end segment due to the standardized nature of basic binder products. Opportunities lie significantly in product innovation related to sustainability, the development of specialized high-security binders, and expansion into customizable, branded corporate documentation solutions.

The core Impact Forces shaping the competitive landscape include increasing pressure from environmental, social, and governance (ESG) standards, which compel manufacturers to invest heavily in recycled, recyclable, and bio-based materials, impacting production costs and consumer pricing. Technological standardization dictates that while the physical design remains simple, the precision and material science used in components like the metal rings and locking mechanisms must be high-quality to ensure longevity and functionality, serving as a key differentiator. Furthermore, the shift in distribution channels, migrating from traditional office supply stores to large B2B e-commerce platforms, demands enhanced logistical capabilities and optimized packaging strategies to minimize damage during shipping, fundamentally altering manufacturer-retailer relationships.

Specific market dynamics show that the growth in hybrid work models acts as both a driver and a restraint. While dispersed teams require standardized physical documentation for occasional in-office meetings or archival purposes (driver), the overall reduction in physical office hours lowers the daily operational demand for consumables like paper and standard binders (restraint). Manufacturers must therefore pivot their marketing to target the home office segment with smaller, more versatile products, while simultaneously offering high-volume, enterprise-grade archival solutions to large corporations focused on permanent, compliant storage, navigating this complex dual market demand successfully.

Segmentation Analysis

The Office Binder Market is highly fragmented and segmented across material, capacity, ring type, end-user, and distribution channels, reflecting the diverse requirements of institutional, corporate, and private consumers. Segmentation based on material, ranging from economic paperboard and vinyl to durable polypropylene and premium faux leather, directly impacts the product's longevity and price point. Capacity segmentation—small (up to 1 inch), medium (1 to 3 inches), and large (over 3 inches)—addresses the specific filing volume needs of different applications, with large-capacity binders being crucial for archival and regulatory filing. Analyzing these segments is essential for manufacturers to tailor production and inventory strategies to specific market pockets where demand remains robust.

Ring type segmentation (O-Ring, D-Ring, and Slant-Ring) reflects variations in ergonomic preference and functionality. D-Ring binders are often preferred in professional settings for their higher capacity and better alignment of stacked papers, while O-Ring binders remain common for low-volume, general use. Furthermore, the end-user segmentation clearly distinguishes the requirements of the Education sector, which prioritizes durability and cost-efficiency, from the Corporate sector, which demands aesthetic quality, security features, and compliance-grade construction. The continuous refinement of products within these segments allows market participants to maintain competitive edge despite the maturity of the underlying product category.

The distribution channel segment is rapidly changing, with B2B e-commerce and direct procurement emerging as dominant pathways, challenging traditional brick-and-mortar office supply retailers. This shift requires significant investment in digital storefronts and robust logistics infrastructure capable of handling large, complex enterprise orders efficiently. Successfully navigating this segmented landscape demands a multi-channel strategy that balances visibility in online marketplaces with customized services for large institutional contracts, ensuring market penetration across all key consumer groups and operational requirements.

- Material Type:

- Vinyl (PVC)

- Polypropylene (PP)

- Paperboard/Chipboard

- Recycled/Eco-friendly Materials

- Faux Leather/Premium Composites

- Ring Mechanism Type:

- O-Ring

- D-Ring (Round and Square)

- Slant-Ring

- Lever Arch Mechanism

- Capacity (Ring Size):

- Small (0.5 to 1.5 inches)

- Medium (2 to 3 inches)

- Large (Over 3 inches)

- End-User:

- Corporate/Enterprise

- Educational Institutions

- Government and Public Sector

- Home Office/SME

- Distribution Channel:

- Online Retail (E-commerce)

- Offline Retail (Supermarkets, Office Supply Stores)

- Direct Sales (B2B Contracts)

Value Chain Analysis For Office Binder Market

The Office Binder market value chain commences with the upstream analysis, primarily involving the procurement of raw materials such as PVC, polypropylene plastics, recycled paperboard, and precision steel or aluminum for the ring mechanisms. This phase is critical because material quality directly influences the binder's final durability, cost structure, and compliance with sustainability mandates. Suppliers of raw materials are often large petrochemical or paper pulp companies, and their pricing volatility significantly impacts manufacturer margins. Effective management of this upstream segment requires strategic sourcing partnerships and contingency planning against supply chain disruptions, especially for specialized components like high-tolerance metal ring assemblies, which demand specific manufacturing expertise.

The midstream involves the core manufacturing process, encompassing material preparation (e.g., cutting and printing), thermal sealing for vinyl products, injection molding for plastic components, and automated assembly of the ring hardware into the cover structure. Efficiency in this stage is achieved through automation and adherence to stringent quality control, especially concerning the functionality and longevity of the ring mechanism—the most critical part of the product. Manufacturers capable of vertical integration, particularly in producing the ring metal hardware, often achieve higher cost efficiencies and greater control over product quality and innovation, offering a competitive advantage over pure assemblers.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is bifurcated into direct sales (large enterprise and government contracts) and indirect sales through retail channels (both physical office supply stores and major e-commerce platforms). The increasing dominance of e-commerce has necessitated complex logistical solutions, including optimized packaging for single-unit sales and bulk palletized shipping. Direct and indirect sales channels require tailored marketing strategies: direct channels focus on enterprise customization, volume discounts, and service level agreements, while indirect channels emphasize brand visibility, shelf appeal (physical retail), and search engine ranking (online retail). Effective management of the downstream logistics and channel relationships is paramount for maximizing market reach and ensuring competitive pricing for both individual consumers and large organizational buyers.

Office Binder Market Potential Customers

The primary potential customers for the Office Binder Market are large corporations and Small and Medium Enterprises (SMEs) operating in highly regulated industries, forming the backbone of enterprise demand. These entities rely on binders for critical, legally required functions such as archiving financial audit trails (Sarbanes-Oxley Act compliance), maintaining Human Resources documentation, securing proprietary intellectual property, and managing complex project portfolios that necessitate physical organization. Procurement decisions in this segment are typically centralized, driven by criteria such as durability, fire-resistance rating (for archival purposes), security features (e.g., locking mechanisms), and the manufacturer's demonstrated commitment to sustainable sourcing practices, reflecting corporate purchasing policy.

Another significant customer segment is the global Education sector, encompassing K-12 schools, higher education institutions, and professional training centers. Educational customers require high volumes of cost-effective, durable binders for student organizational use, faculty course materials, administrative records, and curriculum development. This segment is characterized by peak demand periods coinciding with the start of academic terms and a strong preference for polypropylene or durable vinyl products that can withstand frequent handling and transport. Opportunities within this sector often involve large, institutional tender processes where price competitiveness and bulk delivery capabilities are the decisive factors for securing multi-year contracts.

Furthermore, Government and Public Sector agencies represent a vital segment, particularly due to their mandated adherence to strict long-term physical record retention policies for classified documents, public records, and policy manuals. These customers often demand specialized, heavy-duty binders with unique specifications for size, color coding, and locking mechanisms to ensure the integrity and security of sensitive information. The increasing proliferation of home offices and hybrid workers post-pandemic also constitutes a growing, highly diverse customer base. This segment requires aesthetically pleasing, space-saving binders, often purchased individually through online retail channels, prioritizing ease of use and personalized design over industrial capacity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACCO Brands, Avery Dennison, GBC (General Binding Corporation), Smead Manufacturing Company, Fellowes Brands, C-Line Products, KOKUYO Co., Ltd., 3M Company, Advantus Corp., DOMTAR Corporation, ITOYA of America, Inc., Deli Group Co., Ltd., Leitz GmbH & Co. KG, MeadWestvaco Corporation, Quality Park Products, Esselte (part of ACCO Brands), Swingline, TOPS Products, Tervakoski Oy, Renz GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Office Binder Market Key Technology Landscape

The technological landscape of the Office Binder market is primarily centered on advancements in material science and high-speed manufacturing automation rather than digital integration, given the inherently physical nature of the product. A key area of innovation involves the development and deployment of sustainable materials, including bio-plastics derived from renewable resources (e.g., corn starch or sugarcane) and increased utilization of high post-consumer recycled (PCR) content in both the plastic covers and paperboard cores. Manufacturers are leveraging chemical engineering to ensure that these eco-friendly alternatives meet or exceed the durability and structural integrity standards of traditional vinyl or virgin plastic, addressing growing corporate demands for demonstrable environmental compliance in their procurement processes.

Precision engineering and manufacturing automation are critical technologies used to ensure the reliability and longevity of the mechanical components, specifically the ring mechanisms. Advanced stamping, molding, and assembly techniques are employed to produce metal rings with higher tensile strength and smoother opening and closing functionality, minimizing the common failure points associated with low-quality binders. This focus on precision allows for the production of specialized features such as one-touch opening, tamper-evident seals, and gap-free ring closure, which are particularly important for premium archival or security-sensitive products. Robotics and automated production lines minimize human error and drastically increase throughput, enabling manufacturers to compete effectively on price in high-volume markets.

Furthermore, printing and customization technologies represent a crucial technological investment. High-resolution digital printing and advanced screen-printing techniques allow manufacturers to offer complex corporate branding, detailed graphic elements, and personalized labeling directly onto the binder surface. This customization capability extends beyond simple logos to include specialized regulatory warnings, unique color-coding schemes, and sequential serial numbering for tracking sensitive internal documents. Integration with enterprise resource planning (ERP) systems allows for streamlined production of these customized orders, ensuring rapid turnaround times and accuracy, positioning the binder as an integral, branded component of a company's organizational infrastructure and corporate identity management efforts.

Regional Highlights

Regional dynamics play a crucial role in the Office Binder market, reflecting variations in business practices, regulatory environments, and economic growth rates. North America and Europe represent mature, high-value markets where demand is stable and driven heavily by replacement cycles and regulatory mandates in finance and healthcare. The emphasis in these regions is heavily skewed towards premiumization, sustainable sourcing (FSC certification, recycled content), and specialized features like anti-microbial coatings, aligning with high consumer awareness regarding corporate responsibility and environmental impact. The strong presence of global corporate headquarters in these regions ensures continuous demand for high-quality, standardized documentation tools for compliance and presentation purposes.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid urbanization, massive infrastructure development, and substantial expansion of both the commercial and educational sectors, particularly in emerging economies like India, China, and Southeast Asian nations. Market strategy in APAC focuses on achieving economies of scale, competitive pricing, and catering to the vast, expanding SME market. While cost remains a primary factor, increasing foreign investment and the establishment of international corporate branches are simultaneously raising the demand for internationally compliant, higher-quality binders for legal and financial documentation, creating a dual-tier market structure.

Latin America and the Middle East & Africa (MEA) offer substantial untapped potential, characterized by fluctuating demand influenced by local economic stability and regulatory reforms. In these regions, the adoption of physical documentation is often tied to government bureaucracy and traditional business practices. Investment in localized manufacturing and robust distribution networks that navigate complex logistics are essential for success. The demand generally leans toward durable, functional, and moderately priced products, with specific opportunities existing in countries undertaking significant governmental or educational reforms that necessitate large-scale procurement of organizational tools.

- North America: Focus on premium quality, high-security features, and strict compliance with sustainability standards, driven by major corporate and government archival needs.

- Europe: High growth in eco-friendly binders (bio-plastics, recycled paperboard) driven by EU environmental directives and robust B2B demand for standardized filing systems.

- Asia Pacific (APAC): Largest volume growth market; driven by educational enrollment, expanding commercial infrastructure, and rising adoption of formalized documentation practices across SMEs.

- Latin America: Characterized by economic sensitivity; demand focuses on functional durability and moderate pricing, with potential tied to regulatory modernization.

- Middle East and Africa (MEA): Growth linked to investment in education and corporate formalization; emphasis on bulk procurement for large governmental and institutional projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Office Binder Market.- ACCO Brands

- Avery Dennison

- GBC (General Binding Corporation)

- Smead Manufacturing Company

- Fellowes Brands

- C-Line Products

- KOKUYO Co., Ltd.

- 3M Company

- Advantus Corp.

- DOMTAR Corporation

- ITOYA of America, Inc.

- Deli Group Co., Ltd.

- Leitz GmbH & Co. KG

- MeadWestvaco Corporation

- Quality Park Products

- Esselte (part of ACCO Brands)

- Swingline

- TOPS Products

- Tervakoski Oy

- Renz GmbH

Frequently Asked Questions

Analyze common user questions about the Office Binder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving sustained demand for physical office binders despite digitalization?

The primary driving factor is mandatory regulatory compliance and legal archival requirements across finance, healthcare, and government sectors, which necessitate the physical storage of signed, original documents for auditing and long-term legal admissibility, ensuring a non-negotiable baseline demand for secure binding solutions.

How is sustainability influencing the material composition of modern office binders?

Sustainability is shifting manufacturing practices towards using high post-consumer recycled (PCR) plastics, certified recycled paperboard, and bio-based polymers (bio-plastics). These innovations ensure binders meet corporate social responsibility goals and comply with increasingly stringent environmental procurement policies globally.

Which regional market is forecast to exhibit the highest growth rate for office binders?

The Asia Pacific (APAC) region is projected to have the highest growth rate, driven by significant expansion in commercial infrastructure, rapid educational sector growth, and increasing formalization of business practices across emerging economies, fueling high-volume demand for organizational tools.

What is the most significant restraint challenging the growth of the Office Binder Market?

The most significant restraint is the accelerating adoption of digital workflow management, cloud storage solutions, and electronic signature technologies, which systematically reduce the volume of general, daily transactional paperwork that previously required physical binding.

Are specialty binders, such as D-ring or Lever Arch, more popular than standard O-ring binders?

In professional and corporate environments, D-ring and Lever Arch binders are significantly more popular due to their superior capacity, better document alignment, and enhanced durability for long-term archival and heavy-duty use, contrasting with O-ring binders often favored for lower-volume, general consumer use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager