Offline Meal Delivery Kit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441241 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Offline Meal Delivery Kit Market Size

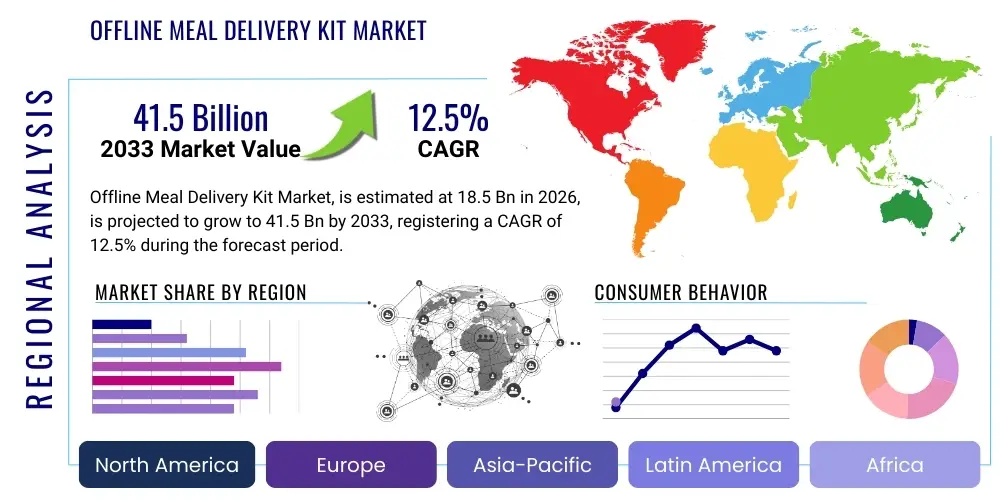

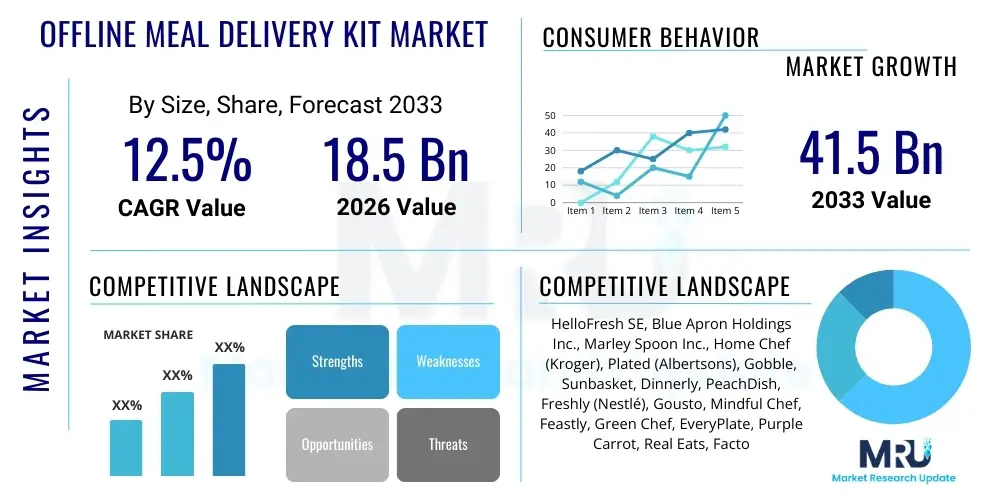

The Offline Meal Delivery Kit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 41.5 Billion by the end of the forecast period in 2033.

Offline Meal Delivery Kit Market introduction

The Offline Meal Delivery Kit Market encompasses pre-portioned ingredient boxes sold directly through physical retail channels, including grocery stores, specialized food markets, convenience stores, and dedicated grab-and-go kiosks, distinguishing itself from traditional online subscription models. These kits cater to consumers seeking convenience, reduced food waste, and the ability to prepare fresh, restaurant-quality meals without the time commitment required for extensive recipe planning or full grocery shopping. The product typically includes fresh produce, proteins, and measured spices, along with detailed instructions, offering a simplified cooking experience.

Major applications of these kits revolve around consumer daily meals, targeting busy professionals, dual-income households, and individuals new to cooking who require structured guidance. Furthermore, the expansion into specialized diets, such as vegetarian, vegan, ketogenic, and gluten-free options, broadens the market reach significantly. The tangible retail presence allows for immediate purchase decisions and eliminates shipping logistics and subscription commitments, which are often barriers for certain consumer segments.

The primary driving factors for the proliferation of offline kits include the sustained trend toward healthier home cooking combined with limited preparation time, increasing urbanization leading to smaller household sizes, and the strategic positioning of these products in high-traffic retail environments. Benefits to consumers include enhanced meal variety, portion control, reduced reliance on processed foods, and the elimination of food waste associated with buying bulk ingredients, thereby offering a perceived value that justifies the premium price point compared to buying ingredients separately.

Offline Meal Delivery Kit Market Executive Summary

The Offline Meal Delivery Kit Market is experiencing robust expansion driven primarily by shifting consumer preference towards instant gratification and flexible purchasing models, moving away from rigid, long-term subscriptions. Business trends highlight strategic partnerships between kit providers and major grocery retailers (Supermarkets and Hypermarkets), leveraging existing cold chain infrastructure and high consumer foot traffic to maximize visibility and accessibility. Retailers are dedicating significant shelf space to chilled meal kits, recognizing them as a high-margin perishable category that drives store visits. Furthermore, consolidation is evident, with larger food conglomerates acquiring specialized kit manufacturers to integrate convenient, prepared options into their conventional product portfolios, ensuring standardized quality and supply chain efficiency across diverse geographical regions.

Regionally, North America and Europe dominate the market, characterized by advanced retail logistics, high disposable incomes, and well-established trends favoring convenience food solutions. Asia Pacific is emerging as the fastest-growing region, particularly due to rapid urbanization in countries like China and India, where nuclear families and busy metropolitan lifestyles fuel demand for time-saving cooking aids. However, success in APAC requires adaptation to local culinary tastes and addressing the fragmented nature of traditional retail distribution channels, leading to greater emphasis on smaller, localized kit formats and culturally appropriate recipes.

Segment trends reveal that the 'Non-Vegetarian' segment maintains the largest market share by meal type, though the 'Plant-Based/Vegan' segment is witnessing the highest CAGR, aligned with global dietary shifts towards sustainable and health-conscious eating. Distribution analysis confirms that Supermarkets remain the primary channel due to their superior infrastructure for perishable goods, while specialized stores and convenience outlets are gaining traction by focusing on niche, premium, or quick-lunch options. The focus for market participants across all segments remains innovation in packaging to enhance shelf-life and clear labeling to address increasing consumer scrutiny regarding ingredient sourcing and nutritional transparency.

AI Impact Analysis on Offline Meal Delivery Kit Market

User inquiries regarding AI's influence on the Offline Meal Delivery Kit Market predominantly focus on how AI can optimize supply chain logistics, predict retail demand fluctuations, and enhance the in-store customer experience. Users are keen to understand if AI can reduce the substantial food waste often associated with perishable retail goods and how predictive analytics might influence inventory management specific to fresh ingredients. Key themes emerging are personalization (using in-store purchase history or loyalty data to suggest relevant kits), dynamic pricing strategies to move inventory efficiently, and the integration of smart shelf monitoring systems that automatically flag expiring products or low stock levels, thus ensuring product freshness and optimal availability on physical shelves.

AI's primary role in this inherently physical market centers on operational efficiency rather than direct customer interaction, unlike the online subscription model. For offline retail kits, minimizing spoilage is paramount, as the cold chain window is often shorter than that of centralized fulfillment centers. Machine learning algorithms analyze historical sales data, localized weather patterns, and promotional activities to generate highly accurate demand forecasts at the individual store level. This granular prediction capability allows manufacturers to adjust production volumes and delivery schedules precisely, dramatically reducing overstocking and subsequent waste, thereby protecting profit margins that are often narrow in the packaged food sector.

Furthermore, AI is instrumental in streamlining the value chain from farm to fridge. Computer vision systems are being deployed in packaging facilities for automated quality control, ensuring ingredient consistency and accuracy in portioning, which is critical for maintaining customer trust in a premium product. In the retail environment, AI-powered tools assist store staff with optimal shelf placement and timely replenishment. This technology ensures that the freshest kits are always visible and available, leading to improved sell-through rates and a better overall shopping experience, which is foundational to impulse purchases characterizing the offline market.

- AI-driven Predictive Analytics: Optimizing production and inventory levels at hyper-local retail points to minimize perishable food waste.

- Dynamic Pricing Models: Adjusting in-store pricing based on shelf life, time of day, and local demand signals to maximize sales velocity.

- Supply Chain Visibility: Utilizing machine learning to track cold chain integrity and identify potential failure points in distribution to retail outlets.

- Automated Quality Control: Implementing computer vision in packaging plants to ensure precise portioning and detect damaged ingredients before shipment.

- Personalized In-Store Recommendations: Leveraging loyalty card data and point-of-sale history to suggest specific meal kits via retailer apps or smart displays near the refrigerated section.

DRO & Impact Forces Of Offline Meal Delivery Kit Market

The Offline Meal Delivery Kit Market is primarily driven by the escalating demand for convenience and the rising consumer recognition of the value proposition in structured home cooking solutions, but it is substantially constrained by challenges related to cold chain logistics and the inherent short shelf life of fresh, pre-portioned ingredients sold in a retail environment. Opportunities exist in diversifying offerings through strategic co-branding with local farms or celebrity chefs and expanding penetration into non-traditional retail spaces like corporate cafeterias and transit hubs, seeking high-density consumer populations. These forces collectively dictate the viability and expansion strategy for market participants, with convenience and freshness serving as the central axes of competition.

Drivers include the increasing number of single-person and two-person households globally, where bulk grocery shopping is inefficient and food waste is a major concern, making pre-portioned kits highly attractive. The post-pandemic shift towards sustained home cooking habits also supports market growth, though consumers often prefer the flexibility of retail purchases over restrictive subscriptions. Restraints are formidable, primarily revolving around the complexity and cost of maintaining a seamless, unbroken cold chain from processing facility to the supermarket shelf, which is crucial for preserving ingredient quality and meeting stringent food safety standards. The necessity for advanced, often expensive, packaging technology to extend shelf life also acts as a financial constraint.

Opportunities are substantial in leveraging technology to enhance the consumer experience, such as developing smart packaging that provides real-time information on ingredient freshness via QR codes or integrating Augmented Reality (AR) instructions for complex recipes, distinguishing premium kits. Impact forces like stringent environmental regulations regarding plastic packaging necessitate continuous innovation towards biodegradable or highly recyclable materials, transforming packaging from a cost center into a competitive advantage. The bargaining power of large retailers (buyers) is high, pressuring kit providers on pricing and shelf allowances, while the threat of substitutes, particularly ready-to-eat (RTE) meals, compels continuous product innovation to maintain the niche appeal of "cooking, but easier."

Segmentation Analysis

The Offline Meal Delivery Kit Market is segmented based on Meal Type, Distribution Channel, and Pricing Tier, allowing businesses to tailor their strategies to specific consumer behaviors and retail environments. Meal Type segmentation is critical, dividing the market based on dietary preferences such as vegetarian, non-vegetarian, and specialized diets (e.g., Keto, Paleo), reflecting the personalized approach modern consumers seek in food preparation. Distribution Channel segmentation distinguishes sales through large Supermarkets and Hypermarkets, which offer scale, from sales via specialty stores and convenience stores, which often offer premium or quick-purchase options. Pricing Tier helps classify products into budget, standard, and premium categories, addressing varying consumer affordability and quality expectations.

- By Meal Type:

- Vegetarian

- Non-Vegetarian (Meat, Poultry, Seafood)

- Specialized Diets (Keto, Gluten-Free, Vegan, Paleo)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores (e.g., Organic Shops)

- Pharmacies/Drug Stores (Limited Offering)

- By Pricing Tier:

- Budget/Economy

- Standard

- Premium/Gourmet

- By End-User:

- Millennials and Gen Z

- Dual-Income Households

- Seniors

Value Chain Analysis For Offline Meal Delivery Kit Market

The value chain for the Offline Meal Delivery Kit Market is complex, involving meticulous coordination across multiple stages, starting with upstream sourcing of highly fresh, often organic, ingredients and concluding with downstream retail distribution and consumer purchase. The primary challenge lies in the perishable nature of the core components, necessitating rapid processing and reliance on specialized logistics providers with sophisticated cold chain management capabilities. Upstream activities involve procurement and quality assurance; suppliers must meet strict freshness and traceability standards, which often requires direct contractual relationships with farms rather than relying solely on open commodity markets.

The midstream phase—kit assembly and packaging—is the most labor-intensive and critical process, involving precise weighing and portioning of ingredients, often utilizing advanced automated systems to minimize contamination and ensure recipe fidelity. Packaging plays a dual role: protection and extended shelf-life, utilizing modified atmosphere packaging (MAP) and recyclable containers. Distribution (downstream) heavily favors indirect channels. Due to the requirement for physical presence and immediate purchase, the manufacturer relies overwhelmingly on Supermarkets and Hypermarkets to serve as the final sales point, leveraging their existing refrigerated display cases and widespread consumer access.

Direct sales are virtually non-existent in the "offline" definition, though manufacturers often engage in indirect promotional activities within the retail environment, such as in-store demonstrations or joint loyalty programs with retailers. The success of the downstream operation hinges on the effectiveness of inventory management systems shared between the manufacturer and the retailer. Efficient stock rotation and minimizing store-level spoilage directly translate to higher profitability for all stakeholders in the value chain, underscoring the collaborative nature required for this perishable retail segment.

Offline Meal Delivery Kit Market Potential Customers

The primary end-users and buyers of Offline Meal Delivery Kits are individuals and small households prioritizing convenience and quality over traditional, time-consuming meal preparation. These customers often exhibit a high propensity for impulse purchasing when browsing the refrigerated aisles of their primary grocery store. The core demographic typically includes Millennials and young professionals residing in urban or suburban areas who possess sufficient disposable income but face severe time constraints due to demanding work schedules or active social lives. They are often characterized as "aspirational cooks" who desire nutritious, varied meals but lack the confidence, skill, or time for full scratch cooking.

A significant secondary segment comprises dual-income families with young children. For this group, meal kits represent a stress-reducing solution, simplifying dinner planning and reducing the friction involved in cooking after a long workday. They value the pre-portioned ingredients as a method of controlling costs and ensuring portion accuracy. This segment heavily relies on the availability of family-friendly recipes that are quick to prepare and appeal to diverse palates within the household.

Furthermore, seniors and empty-nesters form an increasingly important niche. While they may have more time, they often appreciate the reduced hassle of small-scale grocery shopping and the guaranteed freshness offered by a curated kit designed for one or two servings. For this demographic, ease of preparation and simple, clear instructions are paramount. Targeting potential customers requires strategic placement in high-traffic retail locations and utilizing retailer loyalty data to predict demand for specific recipe types based on local demographic profiles and seasonal purchasing habits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 41.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HelloFresh SE, Blue Apron Holdings Inc., Marley Spoon Inc., Home Chef (Kroger), Plated (Albertsons), Gobble, Sunbasket, Dinnerly, PeachDish, Freshly (Nestlé), Gousto, Mindful Chef, Feastly, Green Chef, EveryPlate, Purple Carrot, Real Eats, Factor_ (HelloFresh), Territory Foods, Tovala |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offline Meal Delivery Kit Market Key Technology Landscape

The technology landscape governing the Offline Meal Delivery Kit Market is heavily concentrated on logistics automation, sophisticated cold chain monitoring, and advanced packaging science designed to maximize freshness and extend retail shelf life. Unlike the online market, where IT infrastructure manages subscriptions, the offline market prioritizes physical technologies that safeguard product integrity. Modified Atmosphere Packaging (MAP) techniques are fundamental, adjusting the gas composition inside the kit containers to slow down the natural spoilage process of fresh produce and meats, thereby significantly enhancing the competitive window in retail environments.

Furthermore, intelligent supply chain technologies, specifically IoT (Internet of Things) sensors and blockchain integration, are becoming standard requirements, particularly for premium offerings. IoT sensors monitor temperature and humidity in real-time throughout transit, immediately alerting distributors and retailers to any temperature excursions that might compromise food safety. Blockchain technology offers immutable records of ingredient sourcing, harvest dates, and processing steps, providing the transparency consumers increasingly demand, which is crucial for building trust in products sold via indirect retail channels where the manufacturer has less direct control over the final presentation.

The retail end of the technology spectrum involves integration with retailer Point-of-Sale (POS) systems and inventory management software. Manufacturers often deploy proprietary algorithms that interface with retail data to facilitate just-in-time replenishment models. This integration helps minimize the lag between retail sales and production adjustments, ensuring that the optimal quantity of kits is delivered, preventing both stockouts and excessive waste. Future advancements are focusing on recyclable and compostable barrier films and intelligent labeling systems that change color or display digital messages to indicate peak freshness or impending expiration, further empowering the consumer at the point of purchase.

Regional Highlights

Regional dynamics play a crucial role in shaping the Offline Meal Delivery Kit Market, influenced by local culinary traditions, retail infrastructure maturity, and disposable income levels. North America, specifically the United States, represents the largest and most mature market segment. This dominance is attributed to high consumer receptiveness to convenience foods, well-developed chilled logistics networks, and significant penetration of large grocery chains (Kroger, Albertsons, Walmart) that allocate substantial floor space to meal kit sections. The regulatory environment is standardized, facilitating large-scale operations and national distribution strategies, leading to intense competition and high rates of innovation in quick, family-friendly meals.

Europe stands as the second-largest market, characterized by strong demand in Western European nations (Germany, UK, France). The UK has been particularly fast adopters, driven by smaller average household sizes and a culture of seeking high-quality, pre-prepared options from premium retailers. However, the European market is also highly fragmented by national preference, requiring kit providers to localize recipe selections extensively (e.g., German cuisine kits versus Italian cuisine kits). Logistics standards are exceptionally high due to stringent EU regulations regarding food safety and traceability, which mandates continuous investment in cold chain excellence.

Asia Pacific (APAC) is projected to register the highest growth rate during the forecast period. This rapid acceleration is fueled by massive demographic shifts, particularly the surge in disposable income among the urban middle class in nations like China, South Korea, and Australia. The challenge in APAC lies in adapting packaging to function effectively across varied climates and utilizing highly decentralized distribution networks, often requiring partnerships with local specialty or wet market retailers alongside modern supermarkets. Demand here is often centered on rapid, single-serving meals suitable for lunch or immediate consumption after work, rather than the family dinner focus typical of Western markets.

- North America (USA, Canada): Market leader; high urbanization rates; strong retailer commitment; focus on diversified diets (Keto, Gluten-Free) and family-sized kits.

- Europe (UK, Germany, France): Mature market; strict regulatory standards for food safety; demand for highly localized and gourmet recipes; significant investment in sustainable packaging solutions.

- Asia Pacific (China, Australia, South Korea): Fastest growing region; high penetration in metropolitan areas; strong demand for quick, single-serve options; complex distribution logistics requiring localized partnerships.

- Latin America (Brazil, Mexico): Emerging market; growth restricted by refrigeration infrastructure gaps; opportunity focused on upper-middle-class urban centers; emphasis on competitive pricing.

- Middle East and Africa (MEA): Niche market focused primarily on high-income expatriate communities and luxury retailers in the UAE and Saudi Arabia; growth driven by tourism and specialized dietary needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offline Meal Delivery Kit Market.- HelloFresh SE

- Blue Apron Holdings Inc.

- Marley Spoon Inc.

- Home Chef (Kroger)

- Plated (Albertsons)

- Gobble

- Sunbasket

- Dinnerly

- PeachDish

- Freshly (Nestlé)

- Gousto

- Mindful Chef

- Feastly

- Green Chef

- EveryPlate

- Purple Carrot

- Real Eats

- Factor_ (HelloFresh)

- Territory Foods

- Tovala

- Thrive Market

- Waitrose & Partners

- Tesco plc

- Walmart Inc.

- Carrefour S.A.

Frequently Asked Questions

Analyze common user questions about the Offline Meal Delivery Kit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes the Offline Meal Delivery Kit market from the traditional online subscription model?

The Offline market involves immediate, non-committal purchases made through physical retail stores (grocery stores, convenience stores), eliminating the need for recurring subscriptions, shipping fees, and advanced planning, focusing instead on impulse buying and instant availability.

What is the primary factor limiting growth in the Offline Meal Delivery Kit sector?

The most significant limitation is the inherent short shelf life of fresh ingredients, necessitating complex, expensive, and uninterrupted cold chain logistics and advanced packaging to maintain quality and minimize food waste at the retail level.

How is AI technology specifically benefiting the retail distribution of meal kits?

AI benefits retail distribution primarily through predictive demand forecasting, which minimizes spoilage by calculating precise, store-level inventory needs, and optimizing dynamic pricing based on remaining shelf life and real-time foot traffic data.

Which geographical region is expected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region, driven by rapid urbanization, increasing disposable incomes, and changing metropolitan lifestyle demands for convenient, quick meal solutions, is forecasted to show the highest Compound Annual Growth Rate (CAGR).

What are the key consumer segments targeted by Offline Meal Delivery Kit manufacturers?

Key target segments include time-constrained Millennials and Gen Z, busy dual-income households seeking streamlined dinner solutions, and seniors/empty nesters who prioritize smaller, accurately portioned, and easy-to-prepare meal options.

What role does sustainable packaging play in the future of the Offline Meal Kit market?

Sustainable packaging is a critical competitive necessity. Due to stringent regulations and consumer pressure regarding retail plastic waste, manufacturers are heavily investing in biodegradable and highly recyclable materials to enhance brand image and comply with environmental mandates.

How do Offline Meal Kits address the consumer concern regarding food waste?

Offline kits inherently address food waste by providing perfectly measured, pre-portioned ingredients, ensuring the consumer only purchases and uses exactly what is needed for the recipe, eliminating waste associated with buying bulk groceries.

Are specialty diets, such as Keto or Vegan, well-represented in the offline market?

Yes, the shift towards personalization means specialty diets are heavily represented. While non-vegetarian kits currently hold the largest share, the Vegan and specialized diet segments are growing fastest, offering premium options in specialty food stores and hypermarkets.

What is the impact of large supermarket chains on the pricing structure of offline kits?

Large supermarket chains exert significant buyer power, often dictating wholesale pricing and requiring high margin contributions. This pressure forces manufacturers to focus relentlessly on supply chain efficiency and cost reduction to maintain profitability.

How is the Value Chain different for Offline Kits compared to Online Kits?

The Offline Value Chain emphasizes speed and cold chain integrity in the distribution phase (downstream) to multiple retail locations, relying heavily on third-party retailers for sales. The Online Value Chain focuses more on direct-to-consumer fulfillment and customer relationship management (CRM) via digital platforms.

What are the primary logistical challenges faced by offline kit suppliers?

Primary logistical challenges include managing highly volatile retail demand, ensuring 100% cold chain compliance across numerous independent store locations, and executing precise, frequent, and small-batch deliveries to maintain freshness standards.

Does the convenience store channel offer significant growth opportunities?

Yes, convenience stores offer rapid growth opportunities, particularly in high-density urban areas, by catering to quick lunchtime or immediate dinner purchases. However, this channel often requires smaller, simpler kit formats suitable for microwave or minimal preparation.

What is the role of blockchain technology in the offline meal kit industry?

Blockchain technology is utilized to provide enhanced traceability and transparency, allowing consumers to verify the origin and journey of perishable ingredients from the farm through processing to the retail shelf, boosting consumer trust in premium products.

How does competitive intensity from Ready-to-Eat (RTE) meals affect the market?

RTE meals pose a high threat of substitution, particularly when consumers prioritize zero preparation time. Offline meal kits counter this by emphasizing the superior freshness, perceived health benefits, and minimal, engaging cooking experience they offer.

What is meant by the "Premium/Gourmet" pricing tier in this market?

The Premium/Gourmet tier includes kits featuring high-end ingredients such as Wagyu beef, truffle oil, or exotic seafood, coupled with complex, chef-designed recipes and superior, often eco-friendly, packaging, justifying a significantly higher retail price point.

How do manufacturers ensure consistent ingredient quality in offline retail kits?

Consistency is maintained through strict contractual agreements with specialized suppliers, utilizing automated assembly lines with computer vision for precise portioning, and rigorous internal quality assurance protocols at the packing facility before distribution.

What impact do seasonal variations have on meal kit production and inventory?

Seasonal variations significantly influence both ingredient availability and consumer preference. AI-powered algorithms must adjust production forecasts not only based on predictable holidays but also on unpredictable factors like local weather impacting fresh produce yields and consumer dining habits.

Are co-branding and partnerships key strategies for market penetration?

Yes, strategic co-branding, particularly with well-known local chefs, popular food influencers, or specialized organic farms, is a crucial strategy used to enhance market visibility, differentiate products, and appeal to niche consumer segments seeking authenticity and quality.

What specific challenges does the Latin American market present for expansion?

Expansion in Latin America is constrained by infrastructure deficits, particularly inconsistent cold chain infrastructure outside major metropolitan hubs, and the requirement for deep cultural adaptation of recipes and flavors to meet local tastes.

How does technology enhance the in-store customer experience for offline kits?

Technology enhances the in-store experience through smart refrigerated displays that highlight nutritional information, use QR codes for accessing instructional videos, and integrate with loyalty programs to offer instant personalized discounts or recipe suggestions at the point of decision.

What role do Millennials and Gen Z play in driving demand?

Millennials and Gen Z are key demand drivers due to their high value placed on convenience, ethical sourcing, and varied culinary experiences, coupled with their preference for avoiding the commitment and planning associated with traditional grocery shopping.

How do pricing tiers (Budget, Standard, Premium) affect distribution channel choice?

Budget kits typically rely on mass distribution through Hypermarkets and large grocery chains for volume, while Premium kits are often channeled through specialty food stores or high-end supermarkets where consumers expect superior quality and are willing to pay a higher price.

What is the typical shelf life range targeted for offline meal kits?

Manufacturers typically target a minimum retail shelf life of 5 to 7 days for most fresh meal kits. Achieving this range often requires advanced Modified Atmosphere Packaging (MAP) techniques and impeccable cold chain management to maximize the sales window.

Is food safety inspection more challenging in the offline distribution model?

Food safety inspection is more logistically demanding in the offline model because regulatory compliance must be verified across hundreds of decentralized retail points, requiring rigorous temperature monitoring and adherence to strict hygiene standards at every transfer point.

What metrics are used to measure success in the Offline Meal Delivery Kit Market?

Key success metrics include sell-through rate (percentage of inventory sold before expiration), spoilage rate (or shrink rate), revenue per square foot of shelf space, and new product adoption rates within the retail environment.

How is the market addressing the environmental impact of packaging waste?

The market is addressing waste by transitioning rapidly to mono-material packaging for easier recycling, utilizing plant-based bioplastics, and reducing the total volume of materials used in the packaging design while maintaining necessary barrier properties for freshness.

Do offline kits generally offer more variety than online subscription boxes?

While online boxes often offer a deep weekly rotation, offline kits generally provide broad, stable variety tailored to local tastes and retailer demographics, focusing on reliable, high-demand recipes available immediately without a required pre-order.

What influence do changing consumer dietary trends have on market offerings?

Changing dietary trends (e.g., increased demand for plant-based, low-carb, or allergy-friendly options) force manufacturers to constantly innovate and diversify their product lines to capture niche markets and maintain relevance against general grocery options.

How crucial is recipe instruction clarity for the end-user experience?

Recipe instruction clarity is extremely crucial; as a premium convenience product, any ambiguity or difficulty in preparation undermines the value proposition. Instructions must be concise, visual, and easily executable by cooks of varying skill levels.

What is the role of in-store promotions in driving sales of offline kits?

In-store promotions, including end-cap displays, temporary price reductions (TPR), and bundled offers, are vital for influencing the impulse buying behavior that characterizes the offline market, encouraging trial and driving quick inventory turnover.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager