Offset Printing Plates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441212 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Offset Printing Plates Market Size

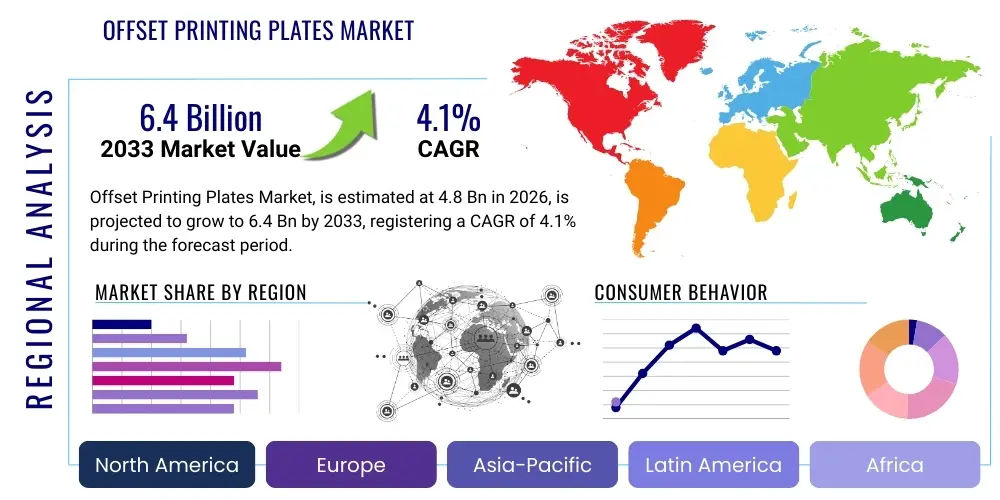

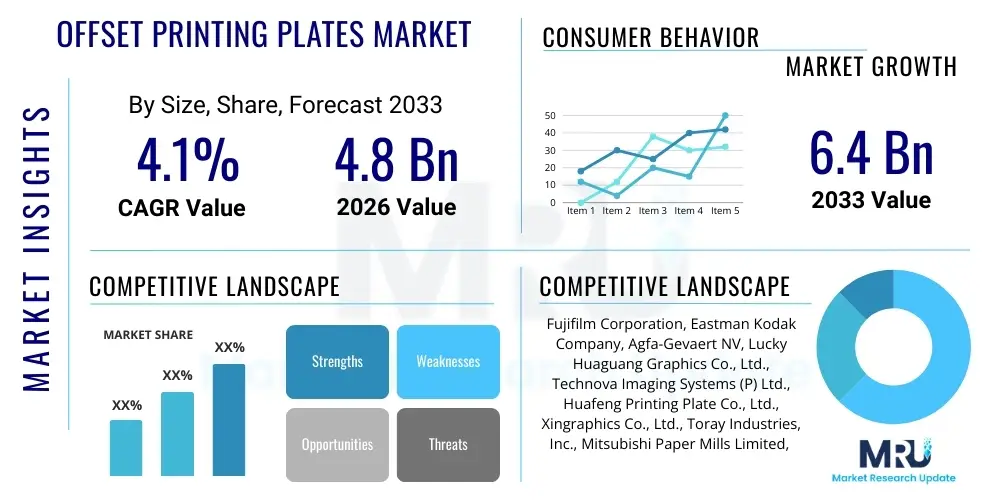

The Offset Printing Plates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.4 Billion by the end of the forecast period in 2033.

Offset Printing Plates Market introduction

The Offset Printing Plates Market encompasses the manufacturing and distribution of specialized plates used in the offset lithography printing process. These plates, typically made of aluminum, are coated with a photosensitive layer which defines the image area (hydrophobic) and non-image area (hydrophilic), enabling the transfer of ink onto a blanket, and subsequently, onto the substrate. Offset printing remains a dominant technology, particularly for high-volume, high-quality print jobs such as commercial brochures, magazines, books, and sophisticated packaging materials, driving sustained demand for consumable plates globally despite the rise of digital alternatives.

The product portfolio within this market includes various types, notably Thermal Computer-to-Plate (CTP), Violet CTP, and the increasingly popular Processless plates. Thermal CTP plates, known for their high resolution and durability, dominate the commercial and packaging segments, while processless plates are gaining traction due to their significant environmental benefits, eliminating the need for chemical processing and reducing overall water and energy consumption in the prepress stage. Major applications span commercial printing houses, newspaper publishing, and specialized packaging industries where consistent color reproduction and low cost per impression are critical operational requirements.

Key benefits driving market adoption include the unmatched quality and sharpness of offset prints, high production speeds achievable on offset presses, and the superior cost-effectiveness for long print runs. Market growth is primarily driven by expanding packaging sectors, especially in emerging economies, and the continuous technological evolution of plates, such such as enhancing run length capabilities and improving plate handling automation. However, the secular decline in traditional publishing volumes poses a restraint, necessitating innovation focused on sustainable and efficient plate technologies.

Offset Printing Plates Market Executive Summary

The Offset Printing Plates Market is characterized by a mature technological landscape undergoing transition towards greater sustainability and automation. Business trends highlight strategic mergers and acquisitions among key global players aiming to consolidate market share and leverage technological synergies, particularly in CTP and processless plate manufacturing. Investment is focused on improving plate sensitivity and environmental profile, addressing strict regulatory requirements in developed markets like Europe and North America. The market demonstrates resilience, underpinned by robust demand from the packaging industry, which relies heavily on offset for high-quality labels and cartons, acting as a crucial counter-balance to declines in traditional publishing and commercial print sectors.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, burgeoning consumer markets, and resultant expansion in packaging and commercial printing capacity, especially in China and India. North America and Europe, while slower growing, maintain high value share, driven by demand for advanced, environmentally friendly solutions like processless plates and high-end thermal plates offering enhanced security features for sensitive documents. Latin America and MEA show moderate growth, contingent upon the standardization and modernization of local printing infrastructure.

Segment trends reveal that the Thermal CTP Plates segment holds the largest market share due to its established reliability and precision in commercial and packaging applications. However, the Processless Plates segment is projected to exhibit the fastest growth rate, reflecting the industry's commitment to reducing environmental footprints and streamlining prepress workflow costs. The packaging printing application segment is expected to outpace others, driven by global e-commerce expansion and increasing complexity in packaging aesthetics, which mandates high-fidelity color reproduction capabilities unique to offset printing.

AI Impact Analysis on Offset Printing Plates Market

User queries regarding AI's impact on the Offset Printing Plates Market frequently center on how sophisticated analytical tools will influence prepress operations, workflow optimization, and demand forecasting. Common concerns include whether AI-driven press management systems will significantly extend plate longevity, potentially reducing replacement cycles, and if AI's ability to optimize short-run production planning might push smaller jobs toward digital printing, impacting offset volumes. Users are keen to understand if AI can enhance the quality control process in plate manufacturing, leading to zero-defect plates, and how advanced algorithms might personalize print jobs, challenging the economic viability of traditional long-run offset operations.

The integration of Artificial Intelligence (AI) and machine learning (ML) is fundamentally altering the optimization phase within prepress and pressroom operations, though the direct impact on the physical plate consumable itself is indirect. AI is primarily used to predict ink consumption, manage color consistency across long runs, and automate plate-setting processes, thereby increasing press efficiency and reducing material waste. This efficiency gain, while positive for printers, can slow down the overall growth rate of plate consumption by maximizing plate lifespan and minimizing job setup errors that often necessitate new plate etching or coating. However, AI also drives the demand for specialized, highly consistent plates that can meet the stringent requirements of automated, high-precision press environments.

Furthermore, AI-powered predictive maintenance and quality assurance systems are being deployed by plate manufacturers to monitor coating thickness, grain structure, and thermal responsiveness during production. This implementation minimizes production variability and enhances the overall reliability of the plate product, which is critical for high-speed automated presses. The long-term implication is a shift in demand towards premium, high-performance plates that are compatible with integrated smart printing systems, rather than commodity products, pushing innovation towards consistent, high-tolerance manufacturing processes that utilize ML feedback loops for continuous improvement.

- AI optimizes job scheduling and press utilization, potentially reducing plate waste due to errors.

- Predictive maintenance driven by ML extends plate run lengths by ensuring optimal press conditions.

- AI-enhanced quality control in manufacturing leads to higher consistency and fewer defective plates.

- Advanced algorithms automate color calibration and ink management, demanding high-precision, stable plate chemistry.

- Increased press automation requires plates with superior handling and imaging characteristics compatible with robotic loading systems.

DRO & Impact Forces Of Offset Printing Plates Market

The Offset Printing Plates Market is driven by the robust expansion of the global packaging industry, which necessitates high-quality, high-volume print runs, favoring the economies of scale offered by offset technology. Technological drivers include the continued advancement of Computer-to-Plate (CTP) systems, making plate preparation faster and more precise, and the increasing adoption of eco-friendly solutions such as processless plates, which eliminate toxic chemicals and streamline operations. However, the market faces significant restraints, chiefly the relentless expansion of digital printing technologies, which is displacing offset, particularly in the short-run, variable data, and transactional printing segments. The structural decline of traditional print media, such as newspapers and magazines in developed regions, also dampens overall plate volume demand.

Opportunities for growth are concentrated in emerging markets, particularly in Asia Pacific and Latin America, where population growth and urbanization are driving consumer goods production, fueling the packaging sector. Furthermore, the push towards enhanced supply chain sustainability provides a major opportunity for manufacturers focusing on developing highly recyclable aluminum plates and non-chemical processing solutions. The increasing complexity of counterfeit prevention and security printing also opens avenues for specialized offset plates with integrated security features, ensuring market relevance in high-security applications like currency and tax stamps.

The core impact forces shaping the competitive landscape include intensified pricing pressure from regional manufacturers, especially those based in China, challenging the dominance of established global players. Environmental regulations, particularly in the EU, act as a powerful external force compelling innovation towards green chemistry and sustainable production methods. Additionally, the bargaining power of major commercial printing houses remains high, as they demand long-lasting, high-resolution plates at competitive prices, forcing manufacturers to continuously improve product performance and cost-efficiency through vertical integration and streamlined supply chains. These forces necessitate a continuous investment in R&D to maintain a competitive edge through efficiency and sustainability.

Segmentation Analysis

The Offset Printing Plates Market is segmented based on plate type, technology, application, and geography, offering granular insights into demand dynamics across different industrial verticals and regional ecosystems. Plate type segmentation differentiates the market based on the chemical and thermal characteristics of the coating layer, directly correlating with the required prepress infrastructure and environmental benefits. Technology segmentation focuses on the method used for imaging the plate, highlighting the transition from traditional photographic processes to modern, automated CTP systems. Application segmentation is crucial, as it clearly delineates the end-use sectors driving volume versus value, with packaging exhibiting strong growth while commercial printing remains the largest volume consumer.

Understanding these segments is vital for strategic market positioning. For instance, manufacturers targeting high-resolution commercial printing typically focus on premium Thermal CTP plates, which offer superior stability and image fidelity. Conversely, companies aiming for environmental leadership and operational simplicity are aggressively investing in Processless CTP plates, appealing to medium-sized printers looking to reduce capital expenditure on processing equipment and comply with stricter environmental mandates. Regional analysis further refines this view, showing disparate adoption rates; for example, North America and Europe prioritize Processless plates due to high labor and disposal costs, whereas high-volume markets in APAC emphasize cost-effective Conventional or high-speed Thermal CTP solutions.

- By Plate Type:

- Thermal CTP Plates

- UV-CTP Plates

- Processless Plates

- Conventional Plates

- By Application:

- Commercial Printing (Magazines, Catalogs, Brochures)

- Packaging Printing (Folding Cartons, Flexible Packaging)

- Publishing Printing (Newspapers, Books)

- Security Printing (Bonds, Stamps)

- By Technology:

- Computer-to-Plate (CTP)

- Plate-on-Press (PoP)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Offset Printing Plates Market

The value chain for the Offset Printing Plates Market begins with the upstream segment, dominated by the sourcing and processing of high-grade aluminum coils, which must meet stringent purity and surface quality standards. Key raw material suppliers include major global aluminum companies and specialized chemical firms providing photosensitive coatings and anodizing solutions. High raw material cost and availability, particularly for aluminum, significantly influence the final pricing and profitability of plate manufacturers, leading many major players to establish robust supply contracts or engage in partial vertical integration to mitigate risk and ensure quality consistency.

The midstream phase involves complex manufacturing processes, including coil preparation (graining, anodizing), coating application (photosensitive layer), and final finishing (cutting, packing). This stage is capital-intensive, requiring specialized machinery and controlled environmental conditions. The market is concentrated at this level, with a few multinational corporations possessing the necessary technological expertise and production scale. Process innovation here focuses on reducing environmental impact, improving coating uniformity, and enhancing plate durability for high-speed presses.

The downstream distribution channel involves a mix of direct sales and indirect channels. Large printing groups often procure plates directly from major manufacturers under long-term contracts, benefiting from technical support and volume discounts. Smaller and medium-sized printers rely heavily on local distributors and resellers who manage inventory, offer financing, and provide regional technical assistance. The effectiveness of the distribution network, including logistics for handling delicate plates, is crucial for market penetration, particularly in fragmented markets like APAC where rapid delivery and localized support are key competitive differentiators.

Offset Printing Plates Market Potential Customers

The primary customers in the Offset Printing Plates Market are entities heavily invested in offset lithography machinery, seeking high-quality, cost-effective consumables for their high-volume print production needs. This includes large commercial printing houses that specialize in producing corporate annual reports, high-end magazines, catalogs, and marketing materials. These customers demand reliability, superior image reproduction capabilities, and high run lengths to maintain efficiency and meet client quality expectations. Their purchasing decisions are often influenced by plate longevity, processing speed, and compatibility with proprietary CTP systems.

Another critical segment comprises the packaging printers, encompassing manufacturers of folding cartons, flexible packaging, and specialized labels. This customer base is rapidly expanding, driven by the global consumption of packaged goods and the shift towards sophisticated, multi-color designs that require the precision of offset printing. Packaging customers prioritize plates that offer chemical resistance, robust durability for demanding substrates, and exceptional color fidelity essential for brand consistency across millions of units.

Furthermore, newspaper and book publishers represent a traditional, though contracting, customer base, primarily utilizing conventional or UV-CTP plates optimized for high-speed, cost-sensitive production runs often involving lower-quality paper stock. Security printing operations (e.g., government agencies or specialized print shops dealing with passports, bank notes, or official documents) constitute a high-value niche segment, requiring specialized plates that can incorporate micro-text and other security features, emphasizing plate security and tamper resistance over sheer volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Growth Rate | 4.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fujifilm Corporation, Eastman Kodak Company, Agfa-Gevaert NV, Lucky Huaguang Graphics Co., Ltd., Technova Imaging Systems (P) Ltd., Huafeng Printing Plate Co., Ltd., Xingraphics Co., Ltd., Toray Industries, Inc., Mitsubishi Paper Mills Limited, Konica Minolta, Inc., Basler Druck & Medien AG, Trelleborg AB, Flint Group, Toyo Ink SC Holdings Co., Ltd., Maxcess International Corporation, Siegwerk Druckfarben AG & Co. KGaA, Hubergroup, DIC Corporation, INX International Ink Co., Sun Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offset Printing Plates Market Key Technology Landscape

The technology landscape of the Offset Printing Plates Market is primarily defined by the evolution of Computer-to-Plate (CTP) systems, which have largely replaced traditional film-based plate making, offering superior registration accuracy, speed, and resolution. Thermal CTP technology, using infrared lasers to expose the plate coating, remains the industry standard, valued for its robust image stability and resistance to ambient light. Continuous R&D efforts in this area focus on improving plate sensitivity to allow for faster imaging speeds and reducing the energy requirements of the thermal heads, making the prepress workflow more energy efficient without compromising print quality or run length capacity.

A significant technological shift gaining momentum is the development and commercialization of processless plates (also known as chemistry-free or wash-out plates). These plates eliminate the need for chemical developers, finishers, and gumming solutions, simplifying the prepress workflow significantly and drastically reducing the environmental footprint by eliminating wastewater and chemical disposal costs. Processless technology utilizes specialized coatings that are either directly oleophilic (ink-accepting) after imaging or are simply washed clean with water on the press, offering a compelling operational advantage, particularly for mid-sized printing operations concerned with regulatory compliance and operational simplicity. While processless plates currently have a lower run length compared to traditional thermal plates, ongoing advancements are rapidly closing this gap, positioning them as a major disruptive force.

Furthermore, innovations are concentrating on enhancing the physical durability and chemical resistance of the plates to meet the demands of advanced printing applications, especially in UV ink printing. Plates designed for UV printing require specialized coatings and baking processes to withstand the aggressive nature of UV inks and cleaning agents. The integration of high-definition (HD) screening technologies also necessitates plates capable of holding finer dots and maintaining exceptional dot gain control across extended runs. This continuous refinement of material science and imaging precision ensures that offset printing can compete effectively with the resolution capabilities of advanced digital printing systems, securing its position for high-quality, high-fidelity applications.

In addition to CTP and processless innovations, Violet CTP technology remains a niche but relevant segment, particularly in newspaper production, where its high speed, lower cost of consumables (compared to thermal systems), and robust performance in high-volume, rapid turnaround environments are advantageous. Violet CTP uses inexpensive visible light diodes and silver-halide or photopolymer plates. While thermal CTP offers higher resolution, Violet CTP delivers the necessary speed and consistency for newspaper operations, maintaining its technological relevance in this specific application segment.

Finally, digitalization is impacting plate management through software and integrated workflow solutions. Manufacturers are providing software platforms that allow printers to manage plate inventory, track usage, predict maintenance needs for CTP units, and integrate prepress processes seamlessly with the press machinery. This transition towards smart manufacturing and integrated workflow management is increasing the demand for certified, high-consistency plates that perform reliably within automated, data-driven production environments, further reinforcing the importance of quality control in plate manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Offset Printing Plates Market, driven by robust industrial growth, rapid urbanization, and escalating consumer demand for packaged goods, particularly in China, India, and Southeast Asian countries. The region benefits from lower manufacturing costs, making it both a massive consumer and a major exporter of printing plates. The expansion of packaging and commercial printing capacity, often involving large, high-speed offset presses, ensures sustained high-volume demand for both conventional and affordable thermal CTP plates.

- North America: This region is characterized by high adoption of advanced, environmentally friendly technologies. While overall print volumes are stable or declining in publishing, the demand for specialized, high-value printing (e.g., premium packaging, security printing) remains strong. North American printers show a significant preference for Processless plates due to high labor costs and strict environmental regulations governing chemical disposal, driving market value towards sustainable, high-efficiency plate solutions.

- Europe: Europe represents a mature but technologically advanced market, strictly governed by environmental and sustainability mandates, such as the EU's directives on chemical usage. This regulatory environment fuels innovation and adoption of Processless CTP and low-chemistry plate solutions. Germany, the UK, and France are key markets, focusing on high-quality commercial and packaging printing. The market growth here is highly reliant on replacement demand and technological upgrades aimed at operational optimization and reduced ecological impact.

- Latin America (LATAM): The LATAM market exhibits moderate but promising growth, primarily driven by Brazil and Mexico, due to increasing domestic consumption and expansion of the local manufacturing and packaging sectors. The market is highly price-sensitive, with a significant demand for cost-effective conventional and thermal CTP plates. Investment in new printing infrastructure is accelerating, slowly phasing out older technologies and opening opportunities for modern CTP systems and compatible plate consumables.

- Middle East and Africa (MEA): This region is still in an earlier phase of market development, characterized by increasing infrastructure investment and rising commercial activities, particularly in the UAE and Saudi Arabia. Market growth is sporadic and tied closely to urbanization and government investment in education and publishing, though packaging is an emerging driver. Plate demand often focuses on basic, reliable, and durable thermal CTP technology, sourced primarily through international distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offset Printing Plates Market.- Fujifilm Corporation

- Eastman Kodak Company

- Agfa-Gevaert NV

- Lucky Huaguang Graphics Co., Ltd.

- Technova Imaging Systems (P) Ltd.

- Huafeng Printing Plate Co., Ltd.

- Xingraphics Co., Ltd.

- Toray Industries, Inc.

- Mitsubishi Paper Mills Limited

- Konica Minolta, Inc.

- Basler Druck & Medien AG

- Trelleborg AB

- Flint Group

- Toyo Ink SC Holdings Co., Ltd.

- Maxcess International Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- Hubergroup

- DIC Corporation

- INX International Ink Co.

- Sun Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Offset Printing Plates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Offset Printing Plates Market?

The predominant driver is the robust and continued expansion of the global packaging industry, particularly for folding cartons and flexible packaging, which demands the high quality, consistency, and cost-effectiveness of offset lithography for long print runs.

How are environmental regulations influencing the technology adoption in this market?

Environmental regulations, particularly in North America and Europe, are accelerating the adoption of Processless CTP plates, which eliminate the need for chemical developers and reduce water usage and toxic waste, offering a sustainable alternative to conventional plates.

Which geographical region holds the largest market share for Offset Printing Plates?

Asia Pacific (APAC) currently holds the largest market share and is projected to exhibit the fastest growth, fueled by rapid industrialization and the substantial expansion of commercial and packaging printing infrastructure across key economies like China and India.

Are traditional Conventional Printing Plates still relevant in the current market?

While Conventional plates have declined significantly due to CTP dominance, they remain relevant in smaller printing shops and specific high-volume, low-cost applications, primarily in emerging markets where the initial capital expenditure for CTP systems is prohibitive.

What role does Artificial Intelligence play in optimizing the use of printing plates?

AI is increasingly used to optimize prepress workflows and press operations through predictive maintenance, enhanced color management, and automated plate setting, maximizing plate run lengths and minimizing material waste, thereby improving overall operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager