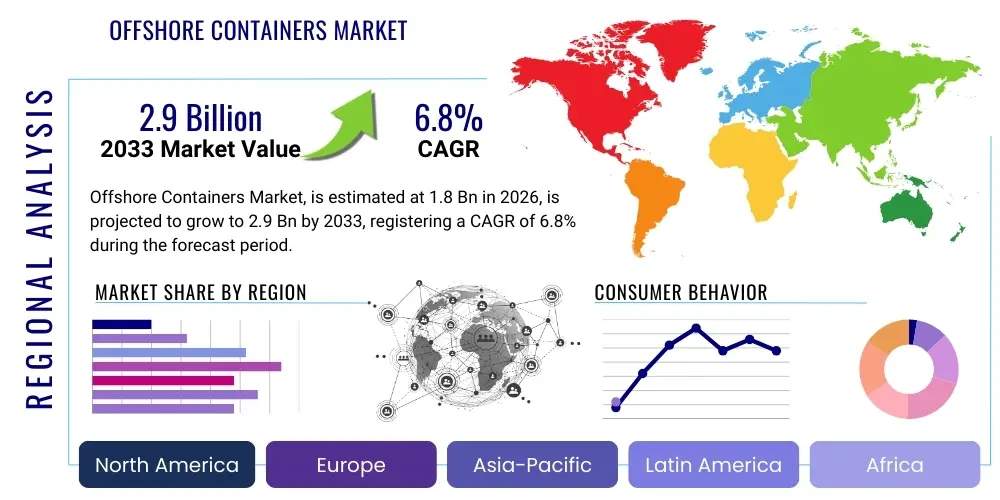

Offshore Containers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441990 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Offshore Containers Market Size

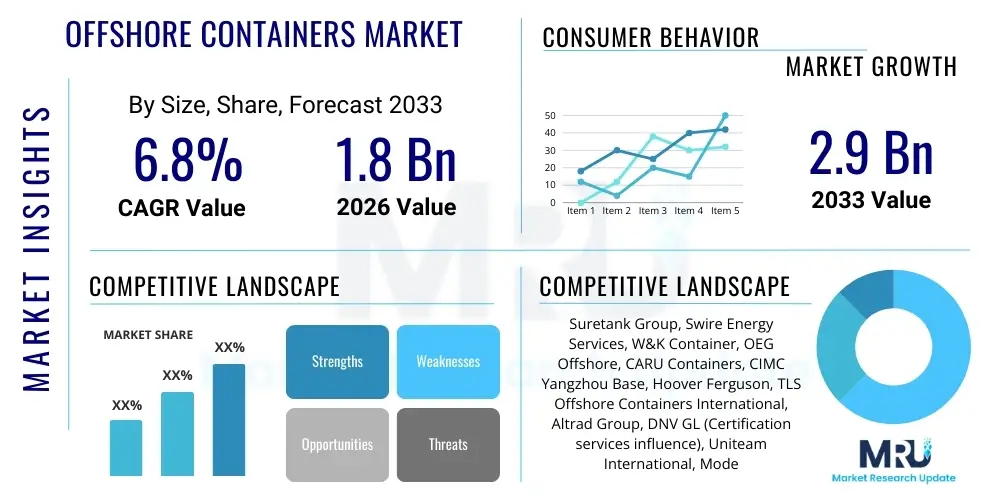

The Offshore Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Offshore Containers Market introduction

The Offshore Containers Market encompasses specialized intermodal cargo units designed and certified for transportation, storage, and handling of goods and equipment in harsh marine environments, specifically utilized within the oil and gas, marine, and increasingly, the offshore wind sectors. These containers adhere to stringent safety standards, primarily DNV 2.7-1 or EN 12079, ensuring they can withstand dynamic lifting operations, stacking loads, and extreme weather conditions encountered during offshore logistics. Key product types include standard dry freight containers, specialized units like reefers, baskets, workshops, waste skips, and gas cylinder racks, essential for maintaining operational continuity across fixed platforms, Floating Production Storage and Offloading (FPSO) units, and drilling rigs.

Major applications of offshore containers span crucial operational areas such as drilling support, subsea construction, maintenance and modification (M&M) activities, and the secure transport of hazardous materials and specialized tools required for deepwater exploration and production (E&P). The primary benefit derived from these specialized containers is enhanced safety, regulatory compliance, and optimization of supply chain logistics in high-risk zones, reducing operational downtime and improving overall personnel safety during lifting operations. Furthermore, the robust construction and certified lifting frames ensure asset integrity even under extreme environmental stress, which is paramount for costly offshore projects.

Driving factors for market expansion include the sustained global demand for energy, prompting new offshore E&P investments, particularly in ultra-deepwater fields, coupled with the rapid acceleration of the offshore renewable energy sector, notably floating offshore wind projects. The cyclical nature of oil prices influences capital expenditure, yet the necessity for maintenance and refurbishment of existing infrastructure provides a foundational demand. Regulatory mandates enforcing stricter safety compliance (like SOLAS and MARPOL requirements) further compel operators to utilize certified DNV-standard containers, solidifying market growth trajectory.

Offshore Containers Market Executive Summary

The Offshore Containers Market is experiencing significant dynamic shifts driven by the transition in global energy infrastructure, balancing traditional oil and gas needs with emerging demands from the renewable energy sector. Business trends indicate a strong move toward digitalization of asset tracking and monitoring, utilizing Internet of Things (IoT) sensors embedded in containers to optimize logistics and enhance maintenance planning, thereby reducing operational expenditure for leasing companies and end-users alike. Furthermore, consolidation among key manufacturers and leasing firms is observed as companies seek to expand their global fleet capacity and standardize offerings to meet increasing demand for complex, customized container solutions, especially those required for specialized subsea equipment.

Regionally, the market growth is heavily concentrated in areas with intensive offshore activity. Asia Pacific (APAC) stands out due to increasing E&P activity in countries like Malaysia, Indonesia, and Australia, alongside substantial governmental investments in offshore wind farms, particularly in Vietnam, Taiwan, and China, creating dual demand streams. North America, driven by the Gulf of Mexico, remains a crucial market for deepwater oil and gas containers, while Europe is pivotal due to stringent regulatory frameworks and dominance in offshore wind technology deployment. The Middle East continues to drive significant demand tied to massive national oil company projects focused on expanding production capacity and maintaining aging infrastructure.

Segment trends highlight the growing preference for specialized containers, such as customized waste skips and offshore baskets, over general-purpose units, reflecting the complexity of modern offshore operations, including decommissioning and subsea construction. The leasing segment is expected to outpace the sales segment due to the cyclical nature of offshore projects, allowing operators greater flexibility and lower capital outlay. Within the material segment, high-grade steel remains dominant due to cost-effectiveness and durability, although composite materials are being explored for weight reduction benefits in specific niche applications, aiming to improve payload efficiency and reduce transportation costs.

AI Impact Analysis on Offshore Containers Market

Common user questions regarding AI’s impact on the Offshore Containers Market center primarily on how AI can enhance supply chain predictability, optimize fleet utilization, and automate inspection and certification processes to reduce operational risks. Users are keenly interested in predictive maintenance schedules driven by machine learning algorithms analyzing sensor data (vibration, shock, temperature) gathered during transit and deployment. There is a strong expectation that AI will streamline the highly complex logistics involved in coordinating container movements across multiple offshore assets and onshore bases, minimizing expensive delays and maximizing the efficiency of limited vessel space. Concerns also revolve around the cost of integrating AI technologies, cybersecurity vulnerabilities associated with connected assets, and the reliability of automated certification verification.

- AI-driven Predictive Maintenance: Utilizing ML algorithms on sensor data to forecast container failure or structural degradation, minimizing unplanned downtime and enhancing safety compliance.

- Optimized Logistics and Fleet Management: Employing AI to dynamically route containers, manage inventory, and optimize vessel loading sequences based on real-time weather and operational schedules, reducing fuel consumption and turnaround times.

- Automated Damage Assessment: Implementing computer vision and AI for faster, more accurate remote inspections and digital certification verification, accelerating regulatory compliance (DNV 2.7-1 checks).

- Enhanced Demand Forecasting: Using time-series analysis powered by AI to predict seasonal or project-specific container requirements, allowing leasing companies to strategically position assets globally.

- Improved Safety Monitoring: AI systems processing CCTV and IoT data to monitor container handling procedures, flagging non-compliant or risky lifting operations in real-time.

DRO & Impact Forces Of Offshore Containers Market

The market is primarily driven by the robust capital expenditure in the global offshore energy sector, encompassing both deepwater oil and gas projects and the accelerating deployment of offshore wind farms, which necessitate certified, heavy-duty logistics solutions. Restraints include the inherent volatility of crude oil prices, which directly impacts the sanctioning of large-scale E&P projects, leading to cyclical demand fluctuations and surplus container capacity during downturns. Significant opportunities arise from the increasing focus on decommissioning activities for aging offshore infrastructure, which requires specialized containers for waste handling and material disposal, alongside the expansion into new frontiers like the Arctic, requiring containers with enhanced cold-weather resilience and insulation properties. These dynamics create powerful impact forces centered around regulatory pressures for safety (driving demand for high-specification containers) and technological adoption for logistics efficiency (shaping competitive advantage among providers).

One major driver is the global energy security imperative, pushing nations to maximize indigenous hydrocarbon production alongside renewable energy integration. Deepwater projects, particularly in regions like the Gulf of Mexico, Brazil, and West Africa, demand specialized, often customized containers for complex subsea equipment, maintaining a high average transaction value in these areas. However, stringent governmental regulations and complex international shipping laws related to hazardous materials transportation pose a significant restraint, forcing manufacturers to invest heavily in specialized R&D and certification processes, which can elevate production costs and limit entry for smaller players. The shift towards sustainable energy also presents a dual-edged challenge: while it fuels demand for containers in offshore wind, it concurrently introduces uncertainty regarding the long-term viability of deepwater oil and gas focused assets, necessitating fleet diversification.

Impact forces are heavily weighted toward safety compliance, where the mandate for containers to adhere strictly to DNV 2.7-1 standards is non-negotiable, acting as a critical barrier to entry and a constant pressure point for maintenance and recertification. Technological advancements, particularly in remote monitoring and anti-corrosion coatings, represent a significant competitive force, enabling leading vendors to offer enhanced service reliability. Furthermore, the rising cost of raw materials, primarily steel, combined with increasing operational costs associated with complex global supply chains, exerts upward pressure on leasing and purchase prices, influencing end-user procurement strategies towards long-term leasing agreements to manage capital expenditure effectively.

Segmentation Analysis

The Offshore Containers Market is comprehensively segmented based on product type, application, business model, and material type, reflecting the diverse operational needs of the offshore industry. Understanding these segments is crucial for stakeholders to tailor their product offerings and strategic investments, ensuring compliance with sector-specific demands, whether related to deepwater drilling, subsea construction, or maintenance operations. Specialized containers, which include baskets and skips, are generally experiencing faster growth than general-purpose containers due to the increasing complexity and regulatory requirements of offshore tasks, particularly in waste management and handling oversized components.

- By Product Type:

- Standard Dry Freight Containers

- Refrigerated Containers (Reefers)

- Cargo Baskets

- Waste Skips

- Gas Racks

- Specialized Workshop Containers

- By Application:

- Oil & Gas Exploration & Production (E&P)

- Offshore Wind Energy

- Marine & Subsea Construction

- Decommissioning

- By Business Model:

- Sales

- Leasing

- By Material Type:

- Steel

- Aluminum

- Composite Materials

Value Chain Analysis For Offshore Containers Market

The value chain for the Offshore Containers Market begins with the upstream procurement of high-grade, certified steel and other raw materials, typically sourced from specialized metal fabricators capable of meeting stringent marine specifications. This phase is characterized by intense price sensitivity based on global commodity markets and rigorous quality assurance to meet DNV standards. Fabrication and manufacturing constitute the core value addition, involving specialized welding, coating (anti-corrosion treatment), and fitting operations, resulting in the certified offshore container. Key players in this stage often hold crucial intellectual property regarding structural design and lifting gear attachment methodologies.

The downstream activities involve distribution and logistics, heavily relying on specialized leasing companies and distributors who acquire the manufactured containers and manage their global deployment and fleet maintenance. Direct distribution (sales) occurs predominantly for large, specialized projects or for national oil companies building proprietary fleets, while the indirect channel (leasing) dominates the market due to the project-based, cyclical nature of demand. Leasing companies provide critical value through asset tracking, maintenance, recertification services, and offering flexible short-term and long-term rental agreements, enabling end-users to manage capital expenditure effectively.

End-users, including major oil companies (IOCs and NOCs), offshore drilling contractors, and offshore wind farm developers, represent the final consumer. The efficiency of the distribution channel—whether direct from manufacturer or through third-party logistics providers managing leasing—is paramount for ensuring just-in-time delivery to remote port facilities and maximizing asset utilization offshore. The increasing complexity of regulatory oversight across different jurisdictions necessitates that both manufacturers and leasing firms integrate regulatory compliance and recertification scheduling deeply into their distribution and service offerings, adding considerable specialized value post-sale.

Offshore Containers Market Potential Customers

Potential customers for offshore containers are diverse yet heavily concentrated within the global energy extraction and marine infrastructure sectors, requiring certified equipment to transport vital supplies and specialized tools to remote platforms and vessels. Primary buyers include International Oil Companies (IOCs) such as Shell, ExxonMobil, and TotalEnergies, and National Oil Companies (NOCs) like Saudi Aramco and Petrobras, who require large fleets for their ongoing drilling and production activities. These companies often utilize leasing models to maintain flexibility and minimize capital outlay, especially for short-duration campaigns or exploratory drilling.

Secondary but rapidly growing customer segments include offshore drilling contractors, such as Transocean and Noble Corporation, who mandate specific container types to support rig operations, including maintenance workshops, gas storage racks, and mud skips. Furthermore, the surge in global offshore wind projects has positioned wind farm developers and their subsea construction partners (e.g., Siemens Gamesa, Ørsted) as increasingly significant potential customers. These entities require containers for transporting turbine components, specialized subsea installation equipment, and crew amenities to remote wind farm sites during construction and operational phases.

Finally, specialized service providers focusing on subsea construction, well intervention, and platform decommissioning form a crucial customer base, driving demand for specialized heavy-duty baskets and waste management skips designed to handle hazardous or oversized loads. Given the high safety and compliance standards, customers prioritize reliability, DNV 2.7-1 certification, and the global availability of the container provider’s fleet, often preferring established vendors capable of offering integrated logistics solutions across multiple geographies and project sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suretank Group, Swire Energy Services, W&K Container, OEG Offshore, CARU Containers, CIMC Yangzhou Base, Hoover Ferguson, TLS Offshore Containers International, Altrad Group, DNV GL (Certification services influence), Uniteam International, Modex, Hempel (Coatings influence), A.P. Moller – Maersk (Logistics influence), Box-Tainer, Container Solutions International (CSI), K.S. Engg, Miko Marine, Dolphin Offshore, Global Containers & Logistics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Containers Market Key Technology Landscape

The Offshore Containers Market is increasingly integrating advanced technologies focused on safety, asset longevity, and logistical efficiency, moving beyond simple structural compliance. Key technological developments center around the utilization of specialized corrosion-resistant coatings, such as high-performance epoxy and polyurethane systems, crucial for extending the container lifespan in saline, harsh marine environments, thereby reducing maintenance costs and ensuring structural integrity over longer operational periods. Furthermore, advancements in welding techniques and material science are enabling the fabrication of lighter yet equally robust containers using high-strength steel alloys, improving payload capacity and reducing the cost associated with vessel transportation and lifting operations.

A major area of innovation is the incorporation of digital technologies for "smart" fleet management, leveraging the Internet of Things (IoT). This involves embedding telemetry sensors (GPS trackers, shock detectors, temperature probes) within containers to provide real-time location and condition monitoring. This technology facilitates proactive maintenance scheduling, prevents damage during handling, and provides auditable data trails for regulatory compliance, addressing a core need for transparency in complex offshore logistics. The integration of these sensors is becoming essential for large leasing firms managing thousands of assets spread across global operational zones, offering clients valuable data for supply chain optimization.

Moreover, the adoption of advanced digital twin technology and augmented reality (AR) is beginning to revolutionize the inspection and certification process for offshore containers, which traditionally relies on time-consuming physical inspections. Digital twins allow for virtual modeling and simulation of structural stress, while AR tools can guide inspectors through standardized checklists, improving the accuracy and speed of DNV 2.7-1 compliance checks. This technological shift is paramount for maintaining high operational standards, especially as regulations concerning asset integrity and safety in deepwater and arctic environments continue to tighten, demanding verifiable and immediate compliance records.

Regional Highlights

- North America: This region, dominated by the Gulf of Mexico (GOM) deepwater activity, remains a critical market for high-specification offshore containers, especially those supporting complex drilling and well intervention projects. Although the market experiences volatility linked to oil price fluctuations, the structural demand for specialized equipment, coupled with stringent safety standards enforced by BSEE, ensures sustained replacement and fleet expansion requirements. Canada's East Coast and emerging Arctic activities also contribute, demanding containers certified for extreme low-temperature operations.

- Europe: Europe is characterized by stringent environmental and safety regulations and is the global epicenter for the offshore wind energy market, particularly in the North Sea. The demand here is dual: steady requirements for oil and gas decommissioning and maintenance in mature fields, coupled with explosive growth in specialized containers (e.g., bespoke baskets for cable spooling and waste skips) necessary for constructing and maintaining large-scale offshore wind farms, including floating offshore wind projects. Norway and the UK drive regulatory compliance and technological adoption.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising energy demand and increasing exploration activities in regions like the South China Sea, offshore Malaysia, and Australia. Significant investments in offshore infrastructure development, alongside the rapid scaling of the renewable energy sector (notably China, Taiwan, and India’s offshore wind ambitions), necessitate large volumes of certified containers. Local manufacturing capabilities are also expanding rapidly, though international certification remains a key requirement for major projects.

- Middle East and Africa (MEA): This region is characterized by massive, long-term offshore development projects led by National Oil Companies (NOCs) aiming to expand production capacity, particularly in Saudi Arabia and the UAE. Demand is driven by the need for maintenance and expansion of mega-platforms and artificial islands, relying heavily on reliable leasing services for standard and specialized cargo units. Africa, particularly West Africa (Nigeria, Angola), contributes demand linked to deepwater E&P, where logistics constraints emphasize the need for robust, reliable container supply chains.

- Latin America: Brazil and Guyana are the central growth hubs in Latin America, driven by extensive pre-salt and deepwater oil discoveries requiring substantial logistics support for FPSOs and drilling units. Petrobras’s expansive capital expenditure plans ensure consistent, large-scale demand for offshore containers, often procured through international leasing firms operating local bases. Guyana's emerging basin further adds to the regional focus on high-specification, deepwater-capable container fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Containers Market.- Suretank Group

- Swire Energy Services

- W&K Container

- OEG Offshore

- CARU Containers

- CIMC Yangzhou Base

- Hoover Ferguson

- TLS Offshore Containers International

- Altrad Group

- Uniteam International

- Modex

- Eide Marine Services

- Container Solutions International (CSI)

- Miko Marine

- Dolphin Offshore

- Global Containers & Logistics

- A.P. Moller – Maersk (Specialized Logistics Arm)

- Box-Tainer

- Sure Products

- Palfinger Marine (Lifting/Handling Equipment Influence)

Frequently Asked Questions

Analyze common user questions about the Offshore Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is DNV 2.7-1 certification and why is it mandatory for offshore containers?

DNV 2.7-1 is a globally recognized standard established by DNV (Det Norske Veritas) that specifies the rigorous design, manufacture, testing, and certification requirements for offshore freight and portable units. It is mandatory because it ensures the containers are structurally sound to withstand the extreme dynamic loads, harsh weather, and complex lifting operations inherent in marine environments, thereby guaranteeing safety for personnel and asset integrity.

How do offshore container leasing rates compare to outright purchase, and which model dominates the market?

Leasing typically dominates the market (especially for short-term or cyclical projects) as it offers financial flexibility and lower initial capital expenditure compared to outright purchase. Leasing rates fluctuate based on crude oil prices, project duration, container type (specialized units cost more), and regional demand, allowing operators to manage fleet requirements without long-term maintenance burdens.

What role does the offshore wind sector play in driving current demand for offshore containers?

The offshore wind sector is a rapidly growing demand driver, particularly for specialized containers (baskets and open-top units) needed to transport large, heavy components, subsea infrastructure, and tools to construction sites. This sector emphasizes customization and robust handling capabilities for installation vessels, compensating for slower growth in some traditional oil and gas segments.

What are the primary technological advancements enhancing offshore container management?

Key technological advancements involve integrating Internet of Things (IoT) sensors for real-time asset tracking, condition monitoring (shock, temperature), and predictive maintenance. Additionally, improved anti-corrosion coating technologies and the digitalization of inspection and recertification processes are critical for extending operational lifespan and ensuring swift regulatory compliance.

Which geographical region exhibits the strongest growth potential for offshore container adoption?

Asia Pacific (APAC) shows the strongest growth potential, driven by parallel expansion in offshore oil and gas exploration in Southeast Asia and substantial, government-backed investments in large-scale offshore wind farm development across countries like China, Taiwan, and Vietnam, creating sustained, dual-sector demand.

The extensive analysis indicates that while traditional oil and gas demands for drilling support containers remain foundational, the future expansion of the Offshore Containers Market is inextricably linked to the rapid global development of the offshore renewable energy sector. Manufacturers and leasing companies must strategically align their product portfolios to address the differing specifications required by wind farm developers versus deepwater E&P operators, focusing on specialized, certified units and advanced logistical technology to maintain market relevance.

Furthermore, the competitive landscape is shifting toward integrated service offerings where compliance, fleet optimization using digital tools, and global availability are paramount value propositions. Companies that can efficiently manage the entire lifecycle of the container—from DNV 2.7-1 certification and maintenance to deployment tracking and timely recertification—will secure dominant positions. Regulatory scrutiny remains the chief non-market constraint, necessitating constant investment in quality assurance and specialized testing protocols to mitigate operational risk for end-users operating in challenging deep-sea environments.

The trend towards deeper water and harsher environments globally, including arctic regions and ultra-deepwater basins, necessitates continuous innovation in materials science to reduce weight while maintaining structural integrity. The market is increasingly demanding lighter, yet highly durable, containers to maximize payload efficiency on support vessels, which are often operating at high daily rates. This technological push, coupled with the mandatory decommissioning of older platforms in mature regions like the North Sea and Gulf of Mexico, provides sustained specialized demand, particularly for large, certified waste skips and customized cargo units designed for handling complex subsea recoveries and hazardous material transportation.

The economic impact of macroeconomic factors, such as global inflation and interest rates, also plays a crucial role in the market dynamics. Higher financing costs can influence the capital expenditure decisions of energy companies, often pushing them away from outright container purchases and toward leasing agreements, thereby strengthening the revenue streams of major leasing providers. This sensitivity highlights the need for market participants to offer flexible financial and contractual terms to mitigate risks associated with the cyclical and highly capital-intensive nature of offshore energy projects. Supply chain resilience, particularly regarding the sourcing of high-grade steel and specialized components, remains a strategic imperative, given geopolitical uncertainties affecting global trade flows.

In summary, successful navigation of the Offshore Containers Market demands a dual focus on rigorous safety compliance and digital innovation. The convergence of oil and gas maintenance requirements with the burgeoning offshore wind development creates a robust, albeit complex, opportunity landscape. Stakeholders prioritizing certified fleet quality, advanced IoT integration, and global logistical support are best positioned to capture long-term value and meet the evolving demands of the global energy transition.

The growing complexity of subsea tie-backs and intervention campaigns requires containers capable of handling highly sensitive and specialized subsea control modules and tools. This customization trend means that standard ISO containers, while foundational, are being supplemented by bespoke baskets, racks, and customized workshops. Manufacturers are responding by adopting modular design approaches, allowing for easier adaptation and quicker turnaround times for specialized container fabrication, critical for fast-paced offshore projects. The demand for refrigerated containers (reefers) is also experiencing moderate growth, driven by the need to store critical drilling fluids and specific electronic components at controlled temperatures offshore, especially in tropical operating environments.

Furthermore, sustainability concerns are beginning to influence material selection, although slowly due to certification requirements. While steel remains dominant, research into durable, recyclable composite materials that maintain DNV 2.7-1 compliance while offering significant weight reduction is underway. Adopting such materials would substantially reduce the carbon footprint associated with both manufacturing and transportation, aligning the industry with broader ESG (Environmental, Social, and Governance) goals increasingly prioritized by major energy firms and investors. This gradual shift toward sustainable practices represents a long-term opportunity for niche market players focusing on innovative material science.

Regulatory consistency across global operational hubs is another key factor shaping the market. While DNV 2.7-1 provides a unified benchmark, regional variations in environmental protection laws and port authority requirements necessitate flexible container design and handling protocols. Leasing companies, in particular, must navigate this regulatory patchwork, often requiring multi-certified fleets to serve clients operating across multiple continents. This regulatory complexity acts as a barrier to smaller competitors and favors large, globally integrated market leaders who possess the infrastructure and expertise to maintain comprehensive compliance records across diverse operating jurisdictions, further consolidating the market's structure and favoring established, highly capitalized firms with robust global support networks.

The impact of technological advancements extends significantly into the manufacturing process itself. Automation in welding and painting, coupled with advanced non-destructive testing (NDT) techniques, ensures higher structural integrity and consistency in the production phase, reducing manufacturing defects that could compromise safety offshore. Quality control systems that integrate digital inspection data directly into the container's digital passport streamline the initial certification process and subsequent re-certification checks, offering immediate traceability and verifiable compliance records, which are highly valued by rigorous end-users like tier-one drilling contractors and major oil companies committed to zero-incident safety targets across their global fleets and logistical operations.

The specialized demands arising from deepwater gas field development, particularly the need for specialized equipment protection against high pressures and corrosive fluids, necessitate containers built to exceptionally high specifications, often exceeding minimum regulatory requirements. This focus on durability and specialized protective features translates into higher average selling prices for these niche units. Simultaneously, the maintenance segment of the market—driven by the continuous need to inspect, repair, and recertify the existing global fleet—provides a stable, recession-resistant revenue stream for manufacturers and certified repair workshops, buffering the cyclical volatility inherent in new construction and drilling campaigns. This stable maintenance demand underscores the essential, non-discretionary nature of certified offshore container assets within the broader marine energy ecosystem.

In conclusion, the Offshore Containers Market is characterized by high barriers to entry, driven primarily by mandatory DNV certification and the necessity for global fleet management infrastructure. Success hinges on a company's ability to maintain an impeccably certified fleet, leverage digital logistics technology to maximize asset utilization, and strategically position itself to serve both the growing offshore wind sector and the sustained, complex needs of deepwater oil and gas operations. The market is not merely selling steel boxes, but providing certified, safety-critical logistics solutions essential for the viability and safe operation of the entire offshore energy supply chain.

The forecast growth trajectory is heavily reliant on sustained investment in energy infrastructure globally, encompassing both traditional sources and the accelerated deployment of large-scale renewable projects that necessitate specialized, certified transport solutions. Political stability in key production regions and the predictable execution of major offshore projects are critical external factors that will dictate the realized market value by 2033. Furthermore, the ability of leasing companies to adapt their financing models to accommodate varying project durations and risk profiles, particularly in emerging markets, will be instrumental in unlocking latent demand and facilitating broader market penetration across new geographical frontiers in offshore exploration.

The market also faces pressure from the evolving design of offshore platforms and drilling units, which are increasingly emphasizing modularity and integrated logistics handling systems. This requires container manufacturers to coordinate closely with rig and platform designers to ensure seamless compatibility between lifting gear, deck layout, and container dimensions. The trend toward digitalization in platform operations, utilizing centralized control systems and advanced data analytics, further demands that the physical assets, including containers, are equipped to interface with these digital ecosystems, reinforcing the need for smart container technology and robust data exchange capabilities for optimized operational workflow.

The competitive environment is increasingly characterized by differentiation through service rather than just product specification. Leading firms are offering comprehensive packages that include not only the container asset but also maintenance contracts, specialized rigging gear, and dedicated logistics planning support, positioning themselves as integrated supply chain partners rather than mere equipment providers. This shift in value proposition is particularly appealing to major energy contractors seeking to consolidate vendor relationships and simplify the complex logistical oversight required for multi-site offshore operations, further strengthening the market position of established, global service providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager