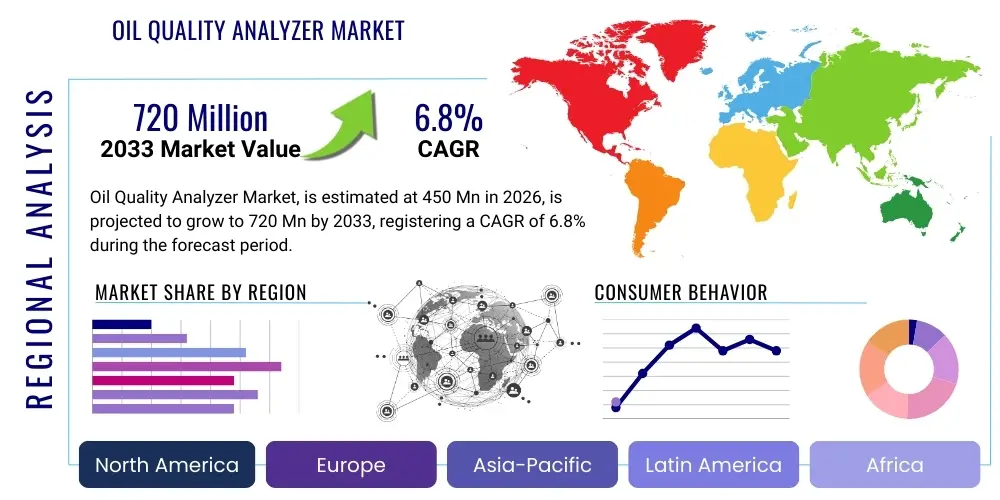

Oil Quality Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442687 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Oil Quality Analyzer Market Size

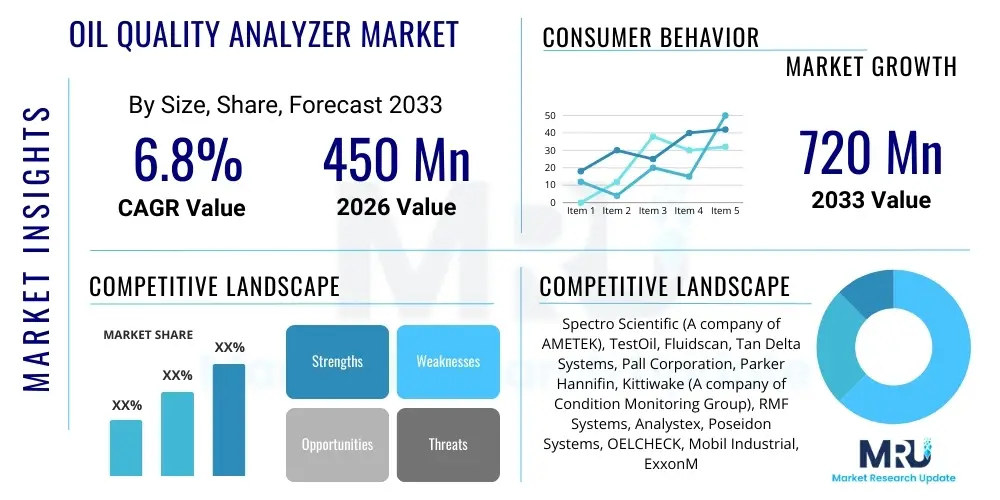

The Oil Quality Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing industrial emphasis on predictive maintenance strategies, stringent regulatory requirements concerning environmental safety, and the continuous need for optimizing machinery lifespan and operational efficiency across sectors such as power generation, manufacturing, and transportation. The proliferation of connected devices and the integration of sophisticated sensor technologies are enabling real-time, in-situ oil analysis, dramatically shifting market dynamics from traditional lab-based testing to portable and continuous monitoring solutions.

Oil Quality Analyzer Market introduction

The Oil Quality Analyzer Market encompasses a range of instruments and systems designed to measure, monitor, and assess the chemical and physical characteristics of lubricating and hydraulic oils, fuels, and coolants. These analyzers provide critical data regarding oil contamination, oxidation, viscosity changes, acid number (AN), base number (BN), and particulate matter, which are direct indicators of equipment health and remaining useful life of the lubricant. Key applications span across heavy industrial machinery, automotive fleets, maritime vessels, and aerospace equipment, where lubrication management is paramount for preventing catastrophic failures and minimizing downtime. The technological foundation includes spectroscopic analysis, dielectric constant measurement, particle counting, and Fourier-Transform Infrared (FTIR) spectroscopy.

The primary benefit derived from adopting oil quality analyzers is the transition from reactive or time-based maintenance scheduling to highly efficient condition-based monitoring. This shift allows operators to maximize the use of lubricants, extending drain intervals responsibly, thereby reducing both operational costs and environmental waste. Modern analyzers are increasingly integrated into centralized asset performance management (APM) systems, offering actionable insights derived from collected data. Furthermore, the analyzers support compliance with original equipment manufacturer (OEM) warranties and evolving safety standards, especially in high-stress environments like mining, offshore drilling, and continuous manufacturing processes.

Several significant factors are driving the market's growth. Firstly, the escalating complexity and cost of industrial machinery necessitate highly precise monitoring to protect capital investments. Secondly, the global push towards sustainability mandates better management of resources, including minimizing lubricant consumption. Finally, advancements in sensor miniaturization and wireless connectivity have led to the development of highly accurate, cost-effective portable analyzers, making sophisticated oil analysis accessible to a wider array of end-users who traditionally relied on outsourced laboratory services. These driving forces collectively ensure sustained demand for advanced oil quality analysis solutions across diverse industrial ecosystems.

Oil Quality Analyzer Market Executive Summary

The global Oil Quality Analyzer Market is characterized by rapid technological assimilation, particularly the integration of Internet of Things (IoT) connectivity and machine learning algorithms, which are refining predictive capabilities. Business trends indicate a strong move toward subscription-based software services accompanying hardware sales, offering continuous data interpretation and advisory services. Leading manufacturers are focusing on creating rugged, highly portable, and user-friendly devices that can provide laboratory-grade accuracy in field conditions, satisfying the immediate needs of maintenance crews. Strategic mergers and acquisitions are shaping the competitive landscape, as larger industrial solution providers seek to integrate specialized oil analysis capabilities into their broader asset management portfolios, driving consolidation and expanding geographical reach.

Regionally, North America and Europe currently dominate the market due to the early adoption of stringent industrial safety regulations, high levels of automation, and substantial investment in digital transformation within critical infrastructure and manufacturing sectors. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, primarily fueled by massive infrastructure development in countries like China, India, and Southeast Asia, coupled with the rapid expansion of their respective manufacturing, energy, and transportation industries. These emerging markets are increasingly prioritizing operational uptime and efficiency, creating substantial demand for cost-effective, real-time analysis tools to manage newly deployed assets effectively.

Segment trends reveal that the Spectroscopic Analysis technology segment maintains a significant market share owing to its ability to detect a wide range of contaminants, including wear metals, additives, and degradation products. Concurrently, the Portable/Handheld analyzer segment is experiencing accelerated adoption due to its convenience and reduced cost compared to fixed laboratory equipment, appealing particularly to mid-sized enterprises and fleet operators. Within the application landscape, the Industrial and Power Generation sectors remain the largest consumers, given the critical role of lubrication in large turbines, compressors, and hydraulic systems. Furthermore, the rising awareness of the long-term cost benefits associated with Condition Monitoring (CM) over preventative maintenance continues to elevate the market penetration of sophisticated oil analysis tools.

AI Impact Analysis on Oil Quality Analyzer Market

User questions regarding the impact of Artificial Intelligence (AI) on the Oil Quality Analyzer Market frequently revolve around two core themes: the accuracy and automation of data interpretation, and the shift from descriptive diagnostics to highly prescriptive maintenance recommendations. Users are keenly interested in how AI can handle the massive influx of continuous monitoring data (from IoT sensors), identify subtle degradation patterns that human analysts might miss, and reduce false positives. Concerns often center on the security of cloud-based data platforms and the initial investment required for integrating sophisticated AI modeling capabilities into existing monitoring infrastructure. Overall, the expectation is that AI will transform oil analysis from a periodic, specialized task into a fully autonomous, integrated component of asset performance management, delivering unparalleled accuracy in predicting component failure.

The integration of AI, particularly machine learning (ML) models, is fundamentally reshaping the value proposition of oil quality analyzers. ML algorithms are used to correlate raw sensor data—such as spectral readings, viscosity indices, and particle counts—with historical equipment performance and failure modes. This correlation allows the system to establish dynamic baselines that adjust based on operating conditions (load, temperature, duty cycle), rather than static thresholds. Consequently, AI-driven analysis provides context-aware diagnostics, enabling maintenance teams to receive highly specific alerts regarding the root cause of the oil degradation, such as bearing wear or coolant leakage, significantly reducing the diagnostic time and improving repair accuracy.

Furthermore, AI facilitates predictive modeling that goes beyond simply flagging impending failures. Advanced systems can recommend the optimal time for oil changes or component replacements, factoring in current operational severity, remaining lubricant life, and projected economic impact of downtime. This prescriptive capability maximizes asset utilization and minimizes unnecessary maintenance interventions, translating directly into substantial operational savings. The development of AI-enabled edge computing solutions is also gaining traction, allowing complex data processing and preliminary diagnostics to occur directly at the sensor level before data is transmitted to the cloud, improving response times and reducing reliance on high-bandwidth connectivity in remote operational environments.

- AI enables highly accurate predictive maintenance schedules, moving beyond static intervals.

- Machine Learning algorithms enhance anomaly detection by establishing dynamic operating baselines.

- Automated data interpretation reduces the need for extensive human expertise in routine analysis.

- AI facilitates the merging of oil analysis data with vibration, temperature, and performance data for holistic asset health assessment.

- Implementation of deep learning models supports the classification of complex wear debris and contaminant types.

- Edge AI processing accelerates diagnostic response times in remote or low-connectivity environments.

- Improved data governance and security are critical focus areas for cloud-based AI oil analysis platforms.

DRO & Impact Forces Of Oil Quality Analyzer Market

The Oil Quality Analyzer Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The primary driving force is the industry's pervasive shift towards proactive maintenance methodologies, necessitated by the high costs associated with unplanned machinery downtime and the increasing longevity expected from capital-intensive assets. Opportunities are predominantly centered around the untapped potential in emerging markets and the continued integration of sophisticated technologies like IoT, 5G, and advanced AI analytics into portable and inline systems, promising higher accuracy and connectivity. However, the market faces restraints, primarily related to the substantial initial capital investment required for implementing comprehensive continuous monitoring systems and the persistent challenge of standardizing oil analysis methodologies across diverse international regulatory frameworks.

The core Impact Forces shaping the market trajectory are competitive rivalry, driven by specialization in sensor technology and software analytics; the threat of substitutes, mainly less accurate and cheaper manual testing methods or extended OEM warranties; and the bargaining power of buyers, especially large fleet operators who demand comprehensive, tailored solutions at competitive pricing. The intense competitive pressure mandates continuous innovation, particularly in enhancing device ruggedness and measurement repeatability, while maintaining a cost-effective price point for wider adoption. Furthermore, the regulatory environment acts as a significant external force, pushing industries toward better environmental and safety compliance, which inherently requires rigorous monitoring of fluid quality.

Ultimately, the market impact is characterized by a strong push toward democratization of analysis. As sensor costs decrease and software complexity is masked by user-friendly interfaces, sophisticated oil analysis is transitioning from a specialized laboratory function to a standard maintenance practice performed by operational staff. The long-term impact is a reduced Total Cost of Ownership (TCO) for industrial assets globally, better resource management through optimized fluid lifecycles, and a demonstrable improvement in industrial safety standards achieved through reliable condition data. Successfully navigating the restraints, particularly ensuring seamless data integration with legacy enterprise resource planning (ERP) systems, will be crucial for companies seeking to capitalize on the prevalent market opportunities.

Segmentation Analysis

The Oil Quality Analyzer Market is comprehensively segmented based on technology type, product type, end-user industry, and region, allowing for detailed strategic planning and market penetration analysis. Segmentation by technology—including Spectroscopic Analysis, Viscosity Sensors, Particle Counters, and others—reveals differential adoption rates corresponding to the precision requirements of various applications. Product segmentation between Portable/Handheld devices and Fixed/Installed (Inline) systems highlights the trade-off between convenience/field use and continuous, high-frequency monitoring. Analyzing these segments provides critical insights into the evolving purchasing preferences of end-users, who increasingly seek integrated solutions that combine high precision with operational flexibility and real-time connectivity, driving higher growth in the combined sensor and software segments.

The primary end-user industries segmented include Industrial Manufacturing, Power Generation, Oil & Gas, Transportation (Automotive & Marine), and Mining. Each segment exhibits unique demand characteristics; for instance, the Oil & Gas sector heavily relies on robust, explosion-proof inline analyzers for monitoring expensive drilling equipment, while the Transportation sector prefers fast, handheld devices for fleet diagnostics. Understanding the nuances within these segments, such as maintenance budget sizes, typical failure modes, and regulatory pressures, is essential for manufacturers targeting specific market niches. The increasing focus on asset uptime across all these verticals ensures a stable and growing demand base for oil quality analysis tools that contribute directly to operational reliability metrics.

Geographical segmentation remains vital, separating mature markets with high regulatory compliance (North America and Europe) from rapidly expanding, high-growth regions (APAC and MEA) where industrialization is accelerating. This delineation helps in tailoring distribution strategies, setting appropriate pricing models, and adapting product specifications to meet local environmental conditions and connectivity infrastructure availability. The overall segmentation analysis underscores the trend toward multi-parameter analysis, where integrated devices providing simultaneous measurements of wear, contamination, and chemistry are displacing single-function testing instruments, offering greater value to the end-user.

- By Technology:

- Spectroscopic Analysis (e.g., FTIR, Atomic Emission Spectroscopy)

- Viscosity Sensors

- Particle Counters (Optical and Magnetic)

- Dielectric Constant Measurement

- Titration and Chemical Analysis Methods (TAN/TBN)

- By Product Type:

- Portable/Handheld Analyzers

- Fixed/Installed (Inline) Systems

- Laboratory/Benchtop Analyzers

- By End-User Industry:

- Industrial Manufacturing (including Hydraulics and Gearboxes)

- Power Generation (Turbines and Generators)

- Oil & Gas (Drilling, Refining, and Pipelines)

- Transportation (Automotive Fleet, Marine, and Rail)

- Mining and Construction

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Oil Quality Analyzer Market

The value chain for the Oil Quality Analyzer Market begins with upstream activities involving the sourcing and refinement of specialized components, notably high-precision sensors (e.g., micro-electro-mechanical systems or MEMS sensors), optical components, and microprocessors essential for data acquisition and processing. This stage is dominated by specialized component manufacturers and technology partners who supply critical elements such as spectroscopic benches and advanced chemical reagents. Strategic alliances with these upstream suppliers are critical for maintaining the high accuracy, miniaturization, and cost-effectiveness of the final product. Significant investment in research and development at this stage focuses on enhancing sensor robustness and expanding the range of measurable parameters, particularly for inline deployment in harsh industrial environments.

The midstream and manufacturing phase involves the assembly, calibration, and integration of hardware components with proprietary software and embedded analytics, performed by the core market players. Operational efficiency in manufacturing, particularly adherence to strict quality control standards for calibration, directly impacts product reliability and market reputation. Downstream activities involve distribution, sales, post-sales support, and crucial data services. Direct sales channels are often employed for large industrial clients requiring custom integration and high-level technical support, particularly for fixed installation systems. Indirect channels, utilizing distributors and value-added resellers (VARs), are highly effective for reaching small to mid-sized enterprises (SMEs) and selling portable devices.

A critical shift in the downstream segment is the increasing reliance on recurring revenue models derived from data services and software subscriptions. Companies are focusing on providing analytical platforms (cloud-based or on-premise) that interpret the sensor data, offer predictive insights, and integrate seamlessly with customer enterprise asset management (EAM) or computerized maintenance management systems (CMMS). This transition means the value chain extends beyond the physical sale of the analyzer to the continuous provision of actionable intelligence. Customer satisfaction and loyalty are now highly dependent not just on the hardware quality, but equally on the efficacy and reliability of the analytical software and the ongoing technical support provided by the supplier.

Oil Quality Analyzer Market Potential Customers

Potential customers for oil quality analyzers are highly diverse, spanning any industrial operation where machinery relies on lubricating or hydraulic fluids and where operational uptime is economically critical. The primary buyers are maintenance managers, reliability engineers, and plant operators responsible for asset performance management across capital-intensive industries. These end-users are driven by the need to minimize unplanned downtime, reduce lubricant costs by extending drain intervals safely, and ensure compliance with both internal safety protocols and external regulatory mandates. The purchasing decision is often influenced by factors such as the analyzer's accuracy, speed of analysis, ease of integration with existing systems, and the ability to operate effectively in challenging environmental conditions, such as high temperatures or corrosive atmospheres.

In the Power Generation sector, major customers include utility companies managing large gas and steam turbines, as well as renewable energy operators maintaining wind turbine gearboxes, where lubricant failure can lead to extremely costly repairs and significant power disruption. Similarly, the Oil & Gas industry—encompassing upstream exploration and midstream pipeline operations—represents a critical customer base, relying on these analyzers to safeguard compressors, pumps, and drilling equipment against catastrophic failure due to contamination from water, fuel, or wear debris. The purchasing cycles in these heavy industries tend to be longer, requiring detailed proof-of-concept testing and validation before large-scale adoption.

Furthermore, the high-volume buyers in the Transportation sector, specifically large commercial trucking fleets and marine shipping companies, represent a rapidly growing customer segment for portable analyzers. These customers utilize the devices for rapid, on-site diagnostics of engine oil, allowing for proactive maintenance before vehicles or vessels leave port or depot, maximizing vehicle availability. The collective focus across all end-user segments is shifting from simply knowing the oil condition to gaining prescriptive guidance on necessary maintenance actions, positioning companies that offer strong software platforms and integrated solutions at a competitive advantage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectro Scientific (A company of AMETEK), TestOil, Fluidscan, Tan Delta Systems, Pall Corporation, Parker Hannifin, Kittiwake (A company of Condition Monitoring Group), RMF Systems, Analystex, Poseidon Systems, OELCHECK, Mobil Industrial, ExxonMobil, Eaton Corporation, Insignia Technology Services, Hy-Pro Filtration, Bureau Veritas, Intertek, SGS, C.C. JENSEN A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Quality Analyzer Market Key Technology Landscape

The technological landscape of the Oil Quality Analyzer Market is rapidly evolving, driven by the need for faster, more accurate, and non-invasive testing methods suitable for both laboratory and field use. Spectroscopic methods, particularly Fourier-Transform Infrared (FTIR) spectroscopy, remain foundational, enabling precise measurement of chemical changes such as oxidation, nitration, sulfation, and the identification of additive depletion or contamination (e.g., water or glycol). Miniaturization efforts are successfully adapting these complex laboratory instruments into rugged, portable formats, significantly enhancing their utility for on-site condition monitoring programs. Furthermore, Atomic Emission Spectroscopy (AES) is critical for identifying and quantifying wear metals and external contaminants, providing essential data for diagnosing mechanical component wear rates within engines and gearboxes.

Parallel to spectroscopy, sensor technology is advancing the Inline/Fixed analysis segment. This includes the development of sophisticated particle counters that utilize laser or magnetic induction principles to provide real-time particle size distribution data, crucial for assessing contamination levels in hydraulic and lubricating systems according to ISO standards. Viscosity sensors, often using acoustic or resonating MEMS technology, offer continuous monitoring of one of the most vital oil properties, directly correlating viscosity changes to temperature, fuel dilution, or excessive degradation. The convergence of these individual sensor technologies into multi-parameter integrated systems is the dominant trend, allowing a single fixed unit to provide a comprehensive oil health assessment continuously.

The most transformative technology development is the integration of IoT connectivity and cloud-based data platforms. Modern analyzers are equipped with wireless communication capabilities (Wi-Fi, Cellular, LoRaWAN) to transmit data instantaneously to centralized platforms. This connectivity supports the use of advanced analytics and AI, moving the market focus from merely collecting data to generating highly prescriptive maintenance recommendations. Cybersecurity and data integrity are becoming non-negotiable aspects of this connected environment, requiring manufacturers to invest heavily in secure data transmission and storage protocols, ensuring that the critical machine health data remains protected and reliable for decision-making.

Regional Highlights

- North America: This region holds a leading market share, attributed to the early and widespread adoption of Condition Monitoring (CM) practices across the energy, manufacturing, and automotive sectors. Strict environmental regulations and high labor costs encourage investment in automated, reliable analytical tools. The presence of major technology providers and a strong push for Industrial IoT (IIoT) integration further solidify the market position of the United States and Canada as mature demand centers demanding sophisticated, high-end, connected analyzer solutions.

- Europe: Characterized by stringent machinery safety standards and an established industrial base, particularly in Germany (manufacturing) and the UK (offshore energy). European demand is driven by lifecycle management and compliance with ISO standards (e.g., ISO 4406 for fluid cleanliness). The market exhibits a high uptake of fixed/inline analysis systems, especially in continuous process industries, supported by strong regulatory frameworks focused on reducing industrial waste and ensuring worker safety.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by rapid industrialization, increasing capital expenditure in infrastructure, and the expansion of manufacturing hubs in China, India, and Southeast Asia. As these economies deploy new, complex industrial assets, the necessity for robust lubrication management tools grows exponentially. The regional market is highly sensitive to price, leading to strong demand for cost-effective portable analyzers, although key players are now introducing advanced inline systems as reliability becomes a core priority.

- Latin America (LATAM): Growth in LATAM is concentrated in resource-intensive sectors like mining, agriculture, and oil production (particularly Brazil and Mexico). The challenging operational environments in these sectors necessitate rugged and reliable on-site analysis tools to prevent machinery failures in remote locations. Market adoption is steadily increasing, driven by the desire to maximize asset availability and minimize reliance on time-consuming external laboratory services.

- Middle East and Africa (MEA): The MEA market growth is intrinsically linked to the immense oil and gas infrastructure, power generation plants, and expansion of the maritime trade routes. High-value assets in extreme climates require continuous and accurate oil monitoring. Investment in advanced, fixed-installation systems is substantial, focused primarily on protecting critical infrastructure and ensuring the continuous operational flow of national energy resources, with increasing opportunities emerging in diversified industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Quality Analyzer Market.- Spectro Scientific (A company of AMETEK)

- TestOil

- Fluidscan

- Tan Delta Systems

- Pall Corporation

- Parker Hannifin

- Kittiwake (A company of Condition Monitoring Group)

- RMF Systems

- Analystex

- Poseidon Systems

- OELCHECK

- Mobil Industrial

- ExxonMobil

- Eaton Corporation

- Insignia Technology Services

- Hy-Pro Filtration

- Bureau Veritas

- Intertek

- SGS

- C.C. JENSEN A/S

Frequently Asked Questions

Analyze common user questions about the Oil Quality Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using an Oil Quality Analyzer in predictive maintenance?

The primary benefit is the ability to transition from scheduled maintenance (time-based) to condition-based monitoring, allowing operators to maximize lubricant lifespan, minimize unnecessary downtime, and prevent catastrophic equipment failure by detecting lubricant degradation and wear debris early and accurately.

How do inline oil quality analyzers differ from portable analyzers?

Inline analyzers are permanently installed within the equipment's fluid circuit, providing continuous, real-time data flow for constant monitoring of critical assets. Portable analyzers are designed for quick, on-site spot checks across multiple machines, offering flexibility but not continuous monitoring capabilities.

Which technologies are essential for diagnosing oil wear and contamination?

Essential technologies include Spectroscopic Analysis (FTIR and AES) for determining chemical degradation and identifying wear metals, and Particle Counters for quantifying solid contamination according to standards like ISO 4406, providing a complete picture of oil health.

How is AI impacting the accuracy of oil analysis results?

AI significantly improves accuracy by utilizing machine learning algorithms to analyze complex, high-volume sensor data, identifying subtle anomalies, establishing dynamic baselines based on operational context, and reducing false positives compared to static alert thresholds.

What are the key industry verticals driving the demand for oil analysis tools?

The key industry verticals include Power Generation (turbines, generators), Oil & Gas (drilling, compression), Heavy Manufacturing (robotics, hydraulics), and Transportation (commercial fleets and maritime), all of which rely heavily on efficient and reliable lubrication management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager