Oil Tanker Management System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443272 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Oil Tanker Management System Market Size

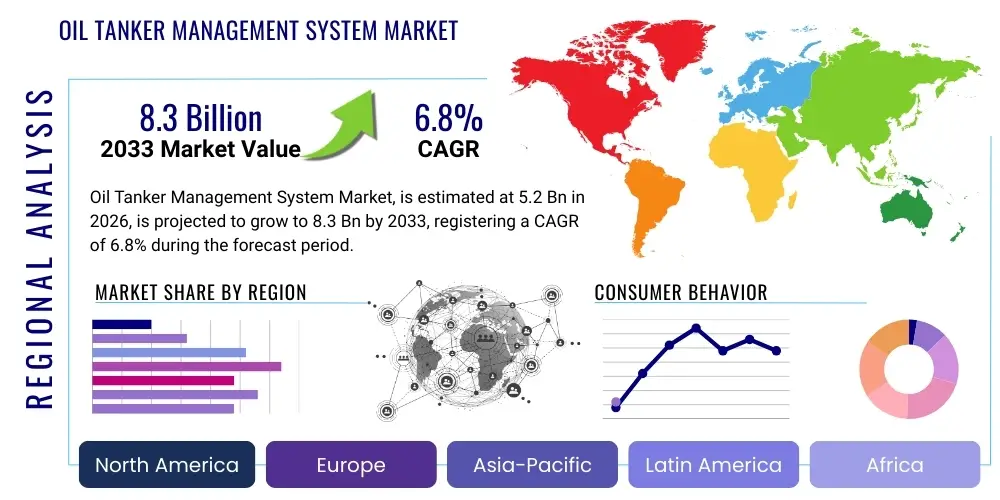

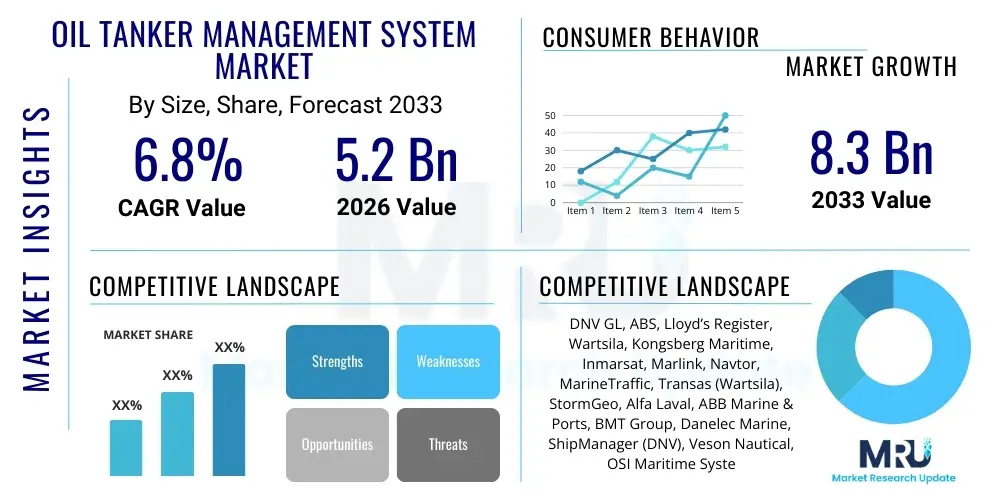

The Oil Tanker Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.3 Billion by the end of the forecast period in 2033.

Oil Tanker Management System Market introduction

The Oil Tanker Management System (OTMS) Market encompasses the specialized software, hardware, and services designed to optimize the operation, safety, security, and maintenance of crude oil and refined petroleum product tankers. These sophisticated systems integrate various functions, including voyage management, cargo handling monitoring, hull stress analysis, regulatory compliance documentation (such as vetting and port state control readiness), and predictive maintenance scheduling. The core objective of an OTMS is to enhance operational efficiency by minimizing fuel consumption through optimal routing and maximizing safety standards to prevent catastrophic incidents like oil spills, thereby ensuring adherence to stringent international maritime regulations imposed by bodies like the International Maritime Organization (IMO). The systems are increasingly utilizing data analytics and IoT sensors to provide real-time situational awareness to fleet managers and vessel crews, transforming traditional manual management into a highly digitized process.

Major applications of OTMS extend across large fleet operators, independent tanker owners, oil & gas majors with dedicated shipping divisions, and third-party logistics providers specializing in bulk liquid transport. Key benefits derived from the adoption of these systems include substantial reductions in operational expenditure (OPEX) due to optimized speed and trim, improved compliance scores leading to lower insurance premiums, and enhanced crew performance supported by decision-making tools. The integration of environmental monitoring modules, particularly those tracking greenhouse gas (GHG) emissions and energy efficiency metrics (EEXI/CII compliance), is driving significant investment in next-generation OTMS solutions, positioning them as essential tools for achieving industry decarbonization targets.

The market is predominantly driven by the escalating global demand for crude oil and petroleum products, necessitating a robust and efficient global supply chain for maritime transportation. Furthermore, the relentless pressure from regulatory bodies to implement stricter safety and environmental protocols, coupled with the increasing digitalization of the shipping industry (Maritime 4.0), compels tanker operators to upgrade legacy systems. Technological advancements in sensor technology, satellite communication, and cloud computing infrastructure are making comprehensive OTMS solutions more accessible and powerful, facilitating complex data integration necessary for predictive risk assessment and autonomous operations planning.

Oil Tanker Management System Market Executive Summary

The Oil Tanker Management System market is exhibiting robust growth, propelled by mandatory international safety standards and the industry's strategic shift toward digitalization and sustainability. Business trends highlight a strong movement towards integrated fleet management platforms that offer holistic operational views rather than siloed solutions. Key technology providers are focusing on subscription-based software-as-a-service (SaaS) models for easier scalability and deployment, particularly attractive to mid-sized fleet owners looking to manage capital expenditure effectively. Mergers and acquisitions are common as larger technology firms seek to incorporate specialized vessel performance monitoring and compliance software capabilities, solidifying market dominance and offering integrated end-to-end maritime solutions. The competitive landscape is characterized by innovation in predictive analytics and cyber resilience features, given the critical nature of oil transport infrastructure.

Regional trends indicate that the Asia Pacific (APAC) region, driven by massive oil consumption in emerging economies such as China, India, and South Korea, remains the largest and fastest-growing market for new OTMS installations, correlated directly with rapid fleet expansion. Europe and North America, while possessing mature fleets, are leading in the adoption of advanced, highly compliant, and environmentally focused OTMS solutions due to strict regional mandates (e.g., EU MRV regulations). Specific segment trends show that the market for Tanker Vetting and Inspection Management software is seeing accelerated demand, spurred by high charter rates contingent upon exemplary safety records. Furthermore, the increasing complexity of dual-fuel and LNG-powered tankers is driving growth within the specialized Cargo Monitoring and Stability Systems segment, requiring sophisticated software for managing volatile cargo conditions and bunkering operations safely.

AI Impact Analysis on Oil Tanker Management System Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in OTMS center primarily on optimizing operational costs, ensuring proactive regulatory compliance, and enhancing maritime safety protocols. Common questions revolve around the efficacy of AI in predicting equipment failure (e.g., pump or engine breakdown), the accuracy of ML algorithms in dynamic weather routing to minimize fuel burn (bunker optimization), and how AI systems can streamline the voluminous regulatory documentation required for port entry and inspections. Concerns frequently address data privacy, the reliability of autonomous decision-making in high-risk scenarios, and the necessity for specialized training to ensure crew competency in managing AI-driven systems. The overarching expectation is that AI will transition OTMS from reactive record-keeping to proactive, intelligence-driven operational management, fundamentally altering voyage execution and risk mitigation strategies across global oil tanker fleets.

- AI-driven Predictive Maintenance: Reduces unplanned downtime and operational risk by analyzing sensor data to forecast equipment failure.

- Optimized Voyage Routing: Utilizes ML algorithms to calculate the most fuel-efficient and safe routes considering real-time weather, currents, and navigational hazards, significantly reducing bunker costs.

- Enhanced Regulatory Compliance: Automates the monitoring and documentation of complex environmental regulations (CII, EEXI), minimizing the risk of non-compliance penalties.

- Autonomous Cargo Management: Uses smart sensors and ML for real-time monitoring of tank levels, pressure, and temperature, ensuring optimal stability and preventing critical incidents during loading/unloading.

- Cybersecurity Threat Detection: Implements AI to identify and neutralize sophisticated cyber threats targeting critical vessel IT/OT networks, protecting sensitive navigational and cargo data.

DRO & Impact Forces Of Oil Tanker Management System Market

The momentum of the Oil Tanker Management System Market is significantly driven by mandatory global safety and environmental regulations, particularly those enforced by the IMO, which necessitate continuous technological upgrades to vessel operations. However, this growth faces considerable restraint due to the high initial capital investment required for installing complex integrated systems and the persistent threat of cyberattacks targeting maritime communication and navigation infrastructure. Substantial opportunities exist in the development of specialized systems for managing next-generation, environmentally friendly fuels (e.g., ammonia, methanol) and integrating Internet of Things (IoT) technologies for comprehensive, remote fleet oversight. These factors collectively exert a strong directional force on the market, pushing technology vendors toward developing more secure, efficient, and compliance-focused solutions.

Primary drivers include the imperative for improved operational efficiency, driven by fluctuating fuel prices, which encourages the adoption of performance monitoring systems capable of optimizing speed and trim. The increasing complexity of the global oil trade, coupled with tighter vetting procedures imposed by major oil companies, further compels tanker owners to invest in advanced OTMS to maintain competitive charter rates. Furthermore, the aging global tanker fleet requires modern management systems to extend operational life safely and economically. The societal pressure and legal liability associated with oil spills make robust safety and emergency response planning systems essential, thereby sustaining demand for high-end OTMS software and services.

Conversely, market restraints include the fragmented nature of the existing maritime technology landscape, often requiring difficult integration between legacy systems and modern digital platforms. Skilled personnel shortages, particularly marine engineers and navigators trained in utilizing complex data analytics tools, hinder full system adoption. The high switching costs associated with moving from one vendor’s proprietary platform to another also act as a constraint. Nevertheless, the market opportunity is vast in areas such as predictive analytics for hull stress monitoring, which extends asset lifespan, and the burgeoning market for specialized systems that aid in the transition to decarbonized shipping, offering lucrative long-term contracts for technology providers who can meet these sustainability requirements.

Segmentation Analysis

The Oil Tanker Management System market is systematically segmented based on various operational and technological dimensions, providing clarity on where investment and technological uptake are most concentrated. Key segmentation pillars include the specific component type (software, hardware, services), the deployment model (on-premise vs. cloud-based), the type of tanker managed (crude tanker, product tanker, chemical tanker), and the core application area (safety and security, performance monitoring, cargo management). This structured analysis helps stakeholders understand niche market requirements, ranging from the need for robust, on-board hardware required for harsh environments to sophisticated cloud-based software necessary for real-time global fleet visibility and regulatory data aggregation.

The software segment, especially SaaS solutions, dominates the market due to its flexibility and lower initial setup costs, facilitating faster integration of advanced features like AI-driven routing and predictive maintenance modules. Deployment trends show a rapid shift towards hybrid and cloud models, driven by the need for remote access to real-time vessel data and simplified software updates. Crucially, the application segment focused on Performance Monitoring and Fuel Efficiency is experiencing exponential growth, directly correlating with operators’ aggressive targets for reducing carbon emissions and operational costs. Furthermore, the specific segment for Very Large Crude Carriers (VLCCs) and Suezmax tankers drives demand for high-capacity, integrated stability and stress monitoring systems due to the sheer volume and value of the cargo transported.

- By Component:

- Software (e.g., Fleet Management Suites, Compliance Modules)

- Hardware (e.g., Sensors, Communication Systems, Bridge Equipment)

- Services (e.g., System Integration, Maintenance, Training, Consultation)

- By Deployment Type:

- On-Premise

- Cloud-Based

- Hybrid

- By Tanker Type:

- Crude Oil Tankers (VLCC, ULCC)

- Product Tankers (Aframax, Panamax)

- Chemical and Specialized Tankers

- By Application:

- Voyage Planning and Navigation

- Cargo Handling and Stability Management

- Vessel Performance Monitoring and Fuel Efficiency

- Safety, Security, and Compliance (ISM, ISPS, Vetting)

Value Chain Analysis For Oil Tanker Management System Market

The value chain for the Oil Tanker Management System market begins with the upstream suppliers of core technology, including manufacturers of highly specialized sensors (pressure, level, flow), advanced satellite communication equipment (VSAT, Inmarsat), and high-performance computing hardware suitable for marine environments. These upstream providers supply the foundational technological building blocks necessary for system functionality, emphasizing ruggedness, reliability, and data acquisition accuracy. Innovation at this stage is focused on developing low-power, high-bandwidth communication solutions and increasingly sophisticated IoT sensors capable of integration with diverse legacy systems.

The midstream comprises the core OTMS providers, which are the software developers and system integrators. These entities procure hardware and raw technology components, designing, integrating, and packaging them into comprehensive management platforms. System integrators play a critical role, customizing standardized software packages to meet the specific requirements of individual fleets or tanker types (e.g., ensuring compliance for chemical vs. crude carriers). This stage adds significant value through proprietary algorithms for route optimization, predictive modeling, and robust user interface development, translating complex maritime data into actionable intelligence for crew and shore teams.

Downstream distribution channels involve direct sales teams engaging with major fleet operators and indirect channels, primarily through specialized maritime technology distributors and authorized service partners who provide local support, installation, and ongoing maintenance. Direct channels are typically utilized for large, bespoke fleet contracts, while indirect channels provide market reach for standardized software modules and maintenance services. The ultimate beneficiaries—the end-users, which are the tanker owners and operators—derive value through reduced operational risk and improved profitability, validating the entire value chain through sustained investment in necessary system upgrades and services.

Oil Tanker Management System Market Potential Customers

The primary purchasers and end-users of Oil Tanker Management Systems are entities that own, operate, or charter large fleets of oil, product, or chemical tankers. This includes major international oil and gas corporations such as Shell, BP, and ExxonMobil, which maintain dedicated shipping divisions or utilize sophisticated chartering desks that mandate high standards of operational management and safety. Independent tanker owners and operators, including large players like Euronav, Teekay Tankers, and DHT Holdings, represent a substantial customer base, as their profitability is directly tied to maximizing vessel utilization and maintaining impeccable safety records necessary for lucrative charter agreements.

Furthermore, specialized segments of the maritime industry constitute significant potential customers. This includes state-owned shipping enterprises, particularly those in Asia and the Middle East, that are expanding their crude transport capacities and require robust systems for compliance and fleet standardization. Ship management companies that handle the technical and operational management of third-party vessels also procure and implement OTMS solutions on behalf of vessel owners, often standardizing systems across multiple managed fleets to gain efficiency in training and maintenance. The stringent requirements for environmental compliance ensure that even smaller independent operators are compelled to invest in modern OTMS to meet global sustainability reporting mandates (e.g., IMO’s CII framework).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DNV GL, ABS, Lloyd’s Register, Wartsila, Kongsberg Maritime, Inmarsat, Marlink, Navtor, MarineTraffic, Transas (Wartsila), StormGeo, Alfa Laval, ABB Marine & Ports, BMT Group, Danelec Marine, ShipManager (DNV), Veson Nautical, OSI Maritime Systems, Star Bulk Carriers Corp. (Technology Division), Mitsui O.S.K. Lines (MOL Tech). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Tanker Management System Market Key Technology Landscape

The technological core of modern Oil Tanker Management Systems is characterized by high levels of integration and connectivity, moving far beyond simple electronic charting and logging. Central to this landscape are robust Integrated Bridge Systems (IBS) that consolidate navigation, communication, and dynamic positioning data into a single operational interface. These systems are heavily reliant on high-speed satellite communication technologies, such as VSAT (Very Small Aperture Terminal), which provide the necessary bandwidth for transferring massive datasets—including real-time engine performance metrics and high-resolution weather data—between the vessel and the shore management team. This seamless data exchange is critical for enabling cloud-based fleet management and predictive analytics tools.

Another crucial technological pillar is the proliferation of the Industrial Internet of Things (IIoT) sensors deployed across the vessel. These sensors continuously monitor parameters such as hull stress, vibration levels in critical machinery, fuel consumption rates (flow meters), and cargo tank integrity (pressure and temperature). The data collected forms the foundation for predictive maintenance models, allowing operators to move away from fixed time-based maintenance schedules. Furthermore, advanced software platforms incorporating GIS (Geographic Information Systems) and proprietary hydrodynamics models are standard for voyage optimization, calculating optimal trim and speed to minimize resistance and, consequently, bunker consumption, a significant operating cost for tanker operators.

Finally, the growing threat landscape demands advanced cybersecurity measures integrated directly into the OTMS architecture. Technology vendors are increasingly incorporating features like network segmentation, intrusion detection systems, and dedicated secure endpoints to protect both operational technology (OT) systems—which control propulsion and cargo—and traditional IT systems. The focus is on developing platforms compliant with recognized cybersecurity standards (e.g., IMO 2021 Resolution MSC.428(98)), ensuring resilience against evolving threats that could compromise vessel control or breach sensitive commercial data.

Regional Highlights

- North America: This region represents a highly mature market characterized by stringent environmental regulations, particularly regarding oil spill prevention and response (e.g., US Coast Guard regulations). OTMS adoption here is driven by the necessity for advanced risk mitigation software, robust vetting systems, and sophisticated compliance reporting tools. North American operators are early adopters of AI-driven optimization solutions focused on maximizing operational efficiency within complex port and canal systems. The presence of major energy companies and sophisticated technology vendors further supports sustained investment in high-end, cyber-secure management platforms.

- Europe: Europe is a global leader in setting environmental standards for maritime transport (e.g., EU MRV, Fit for 55 package). Consequently, the market growth is heavily concentrated in OTMS solutions that provide detailed monitoring and reporting capabilities related to carbon intensity (CII) and energy efficiency (EEXI). European operators prioritize integrated systems that facilitate the transition to alternative fuels and require advanced performance monitoring tools to validate environmental claims. The region's emphasis on safety and quality also drives strong demand for robust crew management and training modules integrated within the OTMS framework.

- Asia Pacific (APAC): APAC dominates the market in terms of volume and growth potential, fueled by massive maritime trade expansion, rapid fleet replacement cycles, and the status of countries like China, South Korea, and Japan as major global shipbuilding hubs. Demand in APAC is broad, encompassing basic fleet tracking systems for new entrants and highly sophisticated, localized management solutions for large state-owned enterprises. The region’s focus is dual-pronged: cost efficiency through fuel optimization and scale management to handle the logistical complexity of the world's largest tanker fleets. Regulatory harmonization across various Asian jurisdictions presents a specific growth opportunity for OTMS providers offering flexible compliance solutions.

- Middle East and Africa (MEA): Growth in MEA is inextricably linked to crude oil production and export capabilities. The market is primarily driven by national oil companies investing in proprietary tanker fleets and associated management systems to control their entire logistics chain. The focus is on security and reliable data transfer across vast distances. Investments tend toward robust, resilient hardware and communication infrastructure necessary for reliable operation in challenging geopolitical environments. The need for precise cargo custody transfer measurement also boosts the demand for highly accurate cargo management systems.

- Latin America: The market here is smaller but growing, influenced primarily by major oil exporters like Brazil and Mexico. Demand is concentrated among state oil companies and international operators transporting crude from regional offshore fields. The emphasis is often on utilizing cloud-based OTMS solutions to manage geographically dispersed operations efficiently, focusing on regulatory compliance related to specific regional port regulations and maritime safety standards. Cost-effectiveness is a key consideration, favoring modular, scalable software solutions over large, monolithic systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Tanker Management System Market.- Kongsberg Maritime

- Wartsila

- ABB Marine & Ports

- DNV GL

- ABS (American Bureau of Shipping)

- Lloyd’s Register

- Navtor

- StormGeo

- Marlink

- Inmarsat

- BMT Group

- Veson Nautical

- Danaos Corporation

- Helm Operations (A Wartsila Company)

- MarineTraffic

- Transas (Integrated by Wartsila)

- Dualog AS

- Dorian LPG (Technology Division)

- Goltens Worldwide

- Alfa Laval

Frequently Asked Questions

Analyze common user questions about the Oil Tanker Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of an Oil Tanker Management System (OTMS)?

The primary functions of an OTMS include voyage planning and navigation optimization, real-time monitoring of cargo stability and safety parameters, comprehensive fuel efficiency reporting, and automated regulatory compliance documentation for international maritime standards like IMO and flag state requirements.

How does the implementation of an OTMS reduce operational costs for tanker operators?

OTMS significantly reduces operational costs by employing predictive maintenance to minimize unplanned downtime, utilizing AI for dynamic weather routing to optimize vessel speed and trim, and providing precise fuel consumption analytics (bunker savings), leading to lower overall OPEX.

What role does digitalization play in the future growth of the OTMS market?

Digitalization is the core driver, enabling advanced capabilities such as IoT sensor integration, cloud-based fleet centralization, remote monitoring, and the use of machine learning for proactive risk management, transforming the industry toward Maritime 4.0 standards and autonomous operations.

Which regulatory compliance issues are most addressed by modern OTMS solutions?

Modern OTMS solutions prioritize addressing complex environmental regulations such as the IMO’s Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), alongside critical safety mandates like the International Safety Management (ISM) code and vetting requirements imposed by major oil companies.

What is the current adoption trend concerning cloud-based versus on-premise OTMS deployment?

There is a strong and accelerating trend toward cloud-based or hybrid OTMS deployment models. Cloud solutions offer superior scalability, lower initial capital expenditure, automatic software updates, and essential real-time data access required for centralized shore-side fleet management and advanced analytics.

The Oil Tanker Management System Market analysis confirms that regulatory imperatives and the pursuit of energy efficiency are the dominant forces shaping technology adoption. The transition toward data-driven decision-making, powered by integrated sensor networks and advanced analytics, is irreversible. Key stakeholders must prioritize investments in cybersecurity infrastructure and AI-enabled performance optimization tools to maintain competitiveness and compliance in an increasingly scrutinized global shipping environment. Regional differences in regulatory pressure mean that vendors must offer flexible, modular systems capable of meeting both stringent Western environmental laws and the high-volume, cost-efficiency demands of the rapidly expanding APAC fleet. The forecasted market growth is highly dependent on continuous innovation in software integration, especially platforms that successfully merge operational technology (OT) with traditional IT infrastructure to create truly seamless and safe operational ecosystems. The long-term trajectory indicates a move towards fully autonomous management features, further driven by enhanced satellite communication bandwidth and sophisticated machine learning algorithms capable of predictive risk assessment across complex marine environments, ensuring that safety and sustainability remain the paramount concerns for all market participants. This strategic technological shift requires significant investment in crew training to manage sophisticated systems effectively, positioning human capital development as a critical success factor alongside technological deployment. The integration of specialized modules for managing new low-carbon fuels (e.g., ammonia, methanol, hydrogen) will create new, highly lucrative segments within the OTMS software market in the latter half of the forecast period, addressing the industry's commitment to achieving net-zero emissions targets by 2050, as outlined by the IMO.

In terms of component breakdown, the services segment, including installation, integration, and consultancy for complex system deployments, is expected to grow marginally faster than the core software segment, reflecting the difficulty fleet operators face in integrating proprietary systems from diverse vendors. This highlights the ongoing necessity for expert third-party integrators who can bridge the gap between legacy systems and next-generation platforms. Furthermore, the specialized market for tanker vetting software, which automates the process of demonstrating compliance and safety records to charterers, is projected to see significant double-digit growth. This is due to the increasing reluctance of major oil companies to charter vessels without impeccable, digitally verifiable safety histories, turning OTMS data into a crucial competitive asset for tanker owners. The adoption curve for sophisticated OTMS solutions is expected to steepen among mid-sized and smaller tanker operators in the coming years, primarily because cloud-based solutions have lowered the barrier to entry, offering them access to the same high-level operational intelligence previously exclusive to large, financially powerful fleet owners. This democratization of high-performance management tools will further intensify competitive dynamics across all tanker size segments, from Aframax to ULCCs, globally.

Geopolitical stability and trade route security are secondary, yet significant, factors influencing the deployment strategy of OTMS. In regions prone to security risks, OTMS platforms featuring advanced security surveillance integration and rapid distress communication protocols are highly valued. The focus on supply chain resilience, exacerbated by recent global events, means that accurate, real-time tracking and transparency provided by advanced management systems are no longer optional but mandatory for maintaining charter contracts and securing favorable insurance terms. Technology vendors are therefore investing heavily in resilient data recovery mechanisms and secure, encrypted communication links that operate reliably even in bandwidth-constrained environments. This focus ensures data integrity, which is paramount when dealing with high-value, high-risk cargo such as crude oil. This comprehensive approach to technology, regulation, and operational excellence defines the modern Oil Tanker Management System Market.

The escalating pressure on maritime companies to improve Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) ratings is compelling nearly all operators to deploy sophisticated performance monitoring modules within their OTMS. These modules move beyond simple fuel consumption tracking, integrating meteorological data, hull fouling analytics, and propulsion system diagnostics to provide actionable insights for continuous operational improvement. The market for sensor technology specific to measuring shaft power, hull roughness, and engine exhaust emissions is seeing robust growth, as regulatory compliance depends directly on the accuracy and fidelity of this real-time data input into the OTMS. Furthermore, the market is seeing increased collaboration between classification societies and software providers, aiming to pre-certify OTMS solutions for regulatory reporting, thereby simplifying the compliance burden for end-users. This trend towards validated, compliance-ready platforms ensures that technology adoption is mandated by external market forces rather than just internal efficiency goals, providing a stable foundation for continuous market expansion throughout the forecast period. The integration of digital twin technology, allowing shore teams to simulate the vessel's operational environment and test different operational scenarios before implementation, represents the cutting edge of this market, promising unprecedented levels of safety and efficiency.

The specialized requirements of chemical and liquefied natural gas (LNG) carriers, which are often grouped under the broader tanker segment, necessitate highly customized management system features. For instance, chemical tankers require systems capable of managing complex tank cleaning procedures, inert gas control, and meticulous documentation of cargo compatibility and residues, a level of complexity standard crude oil OTMS may not support. Similarly, LNG carriers demand specialized boil-off gas management modules and cryogenic temperature monitoring, making the "Chemical and Specialized Tankers" segment a high-value niche for vendors offering tailored solutions. This differentiation drives revenue within the software segment, where customization services and specialized module licensing contribute significantly to overall market value. The persistent global focus on reducing methane slip, particularly from LNG carriers, further fuels demand for precise, verifiable emissions monitoring integrated directly into the ship's OTMS, ensuring transparency and accountability for environmental performance.

The competition among hardware suppliers within the OTMS value chain is intense, focused on miniaturization, increased processing power, and enhanced reliability in harsh marine environments. The trend is toward ruggedized, modular hardware components that can seamlessly interface with both new and old systems, supporting flexible upgrade pathways for operators managing mixed fleets. Furthermore, the reliance on high-speed data transmission necessitates continuous innovation in satellite communication solutions, particularly Low Earth Orbit (LEO) satellite constellations, which promise lower latency and higher bandwidth than traditional GEO satellites. This technological leap enables truly real-time data synchronization between ship and shore, unlocking the full potential of cloud-based AI analytics for applications such as instantaneous route correction and remote diagnostic maintenance, thus creating significant value for OTMS end-users.

The human element remains central to the successful deployment of OTMS. Even the most automated systems require skilled human oversight and interpretation. Consequently, the services segment sees strong demand for advanced crew training, particularly simulator-based training that replicates the functionality of specific OTMS platforms. This service ensures that crew members are competent in utilizing the system's predictive capabilities, handling complex data outputs, and responding effectively to system alerts or failures. Market vendors who offer comprehensive training and ongoing support services, alongside their core software and hardware, gain a significant competitive advantage by addressing the critical challenge of skills gap within the global maritime labor force, ensuring maximized return on investment for the complex technology deployed onboard the tankers.

In summary, the Oil Tanker Management System Market is undergoing a rapid technological renaissance, driven by regulatory compliance and the economic necessity of operational optimization. The market structure favors integrated, AI-driven, and cyber-resilient platforms, with growth concentrated in cloud deployment models and applications focused on environmental performance monitoring. Key regional drivers are regulatory stringency in North America and Europe, and fleet expansion/cost optimization in the Asia Pacific region. The overall market trajectory is one of modernization and convergence, where IT and OT systems blend to deliver safer, greener, and more profitable maritime transport operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager