Oligosaccharide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442772 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Oligosaccharide Market Size

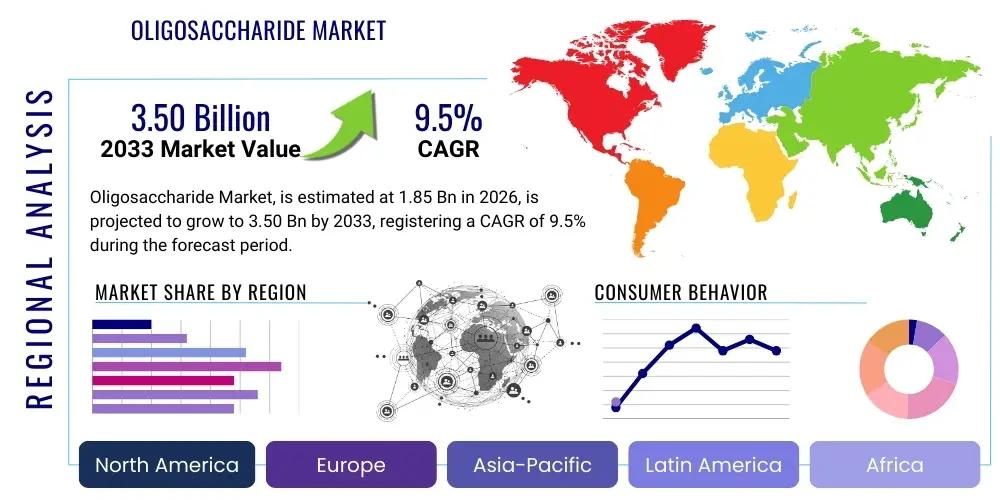

The Oligosaccharide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $3.50 Billion USD by the end of the forecast period in 2033.

Oligosaccharide Market introduction

The Oligosaccharide Market encompasses the production, distribution, and utilization of short-chain carbohydrates derived primarily from plant or microbial sources, valued extensively for their prebiotic properties. Oligosaccharides, such as Fructo-oligosaccharides (FOS) and Galacto-oligosaccharides (GOS), function as non-digestible components that selectively stimulate the growth and activity of beneficial bacteria in the colon, predominantly Bifidobacteria and Lactobacilli. This fundamental characteristic positions oligosaccharides as essential functional ingredients in the burgeoning global health and wellness sector, driving demand across diverse commercial applications.

Major applications of oligosaccharides span the Food & Beverages industry, especially in dairy products, functional drinks, and baked goods, where they serve as effective sugar replacers, texture improvers, and fiber fortifiers. Crucially, they are indispensable components of infant formula, mimicking the functional benefits of human milk oligosaccharides (HMOs) to support the development of a healthy gut microbiome in newborns. The inherent benefits, including improved digestive health, enhanced mineral absorption, and potential immune system modulation, underpin their rising adoption.

Key driving factors propelling market expansion include the increasing consumer awareness regarding the linkage between gut health and overall systemic wellness, the escalating prevalence of lifestyle diseases necessitating dietary modifications, and the continued innovation in enzymatic and fermentation technologies which allow for cost-effective and high-purity production of specialized oligosaccharide types. Regulatory support for the inclusion of prebiotics in functional foods and dietary supplements further solidifies the long-term growth trajectory of this specialized carbohydrate market.

Oligosaccharide Market Executive Summary

The Oligosaccharide Market is poised for substantial growth, driven by sustained global emphasis on preventive healthcare and functional nutrition. Business trends indicate a significant shift towards the personalization of nutrition, with manufacturers focusing on developing highly specific oligosaccharide blends optimized for targeted health outcomes, such as immune support or cognitive function. Strategic partnerships between raw material suppliers, biotechnology firms, and finished product manufacturers are accelerating product development cycles, particularly in emerging areas like specialized medical foods and tailored dietary supplements. Furthermore, the push for natural and clean-label ingredients favors oligosaccharides derived from chicory root or other natural plant sources, influencing sourcing and processing methods across the supply chain.

Regionally, Asia Pacific (APAC) represents the fastest-growing market due to rapid urbanization, increasing disposable incomes, and the strong cultural acceptance of functional foods, notably in Japan, South Korea, and China. North America and Europe, however, retain significant market share driven by established regulatory frameworks, high consumption rates of fortified foods, and a mature dietary supplement market focused on digestive health. Regional trends also show robust investment in R&D across Western markets to produce next-generation human milk oligosaccharides (HMOs) via precision fermentation, aiming to capture the lucrative high-end infant nutrition segment.

Segment trends highlight the dominance of FOS and GOS due to their widespread use and proven efficacy, though the IMO segment is gaining traction for its utility in sports nutrition and texture modification. The Infant Formula application segment remains the most critical revenue generator, mandating stringent quality standards and technological leadership. Looking ahead, segmentation by source is seeing increased interest in microbial/synthetic routes, promising higher purity and scalability compared to traditional plant extraction, thus influencing competitive dynamics and long-term investment strategies within the oligosaccharide manufacturing landscape.

AI Impact Analysis on Oligosaccharide Market

Common user questions regarding AI's impact on the Oligosaccharide market center on optimizing strain development for enhanced prebiotic synthesis, predicting consumer preferences for functional food formulations, and streamlining large-scale fermentation processes. Users frequently inquire about AI's role in accelerating the discovery of novel oligosaccharide structures with unique bioactivities, especially in mimicking complex Human Milk Oligosaccharides (HMOs). Key themes revolve around AI's capability to manage vast metabolic and genomic data sets to improve yield and purity, address complex formulation challenges (e.g., solubility, stability in various matrices), and utilize machine learning for predictive quality control in high-volume production environments. Concerns often include the substantial initial investment required for AI infrastructure and the need for highly specialized data scientists trained in bioinformatics and food technology to effectively deploy these sophisticated tools.

- AI-driven optimization of microbial strains for efficient biosynthesis of complex oligosaccharides, reducing production costs.

- Machine learning algorithms applied to clinical trial data for predicting the efficacy of specific oligosaccharide types on diverse human microbiomes.

- Predictive modeling used to analyze consumer trends and preference patterns, guiding R&D towards in-demand functional food formulations.

- Automation and robotic process optimization in fermentation and purification stages, enhancing yield and consistency.

- Utilizing neural networks for rapid quality control and contamination detection during high-volume oligosaccharide manufacturing.

DRO & Impact Forces Of Oligosaccharide Market

The Oligosaccharide Market is primarily driven by the escalating demand for functional ingredients that support digestive wellness, coupled with the increasing integration of prebiotics into routine dietary supplements and fortified foods across developed and developing economies. Restraints include the high production costs associated with specialized oligosaccharides, particularly GOS and HMOs produced via enzymatic synthesis or precision fermentation, alongside stringent regulatory approval processes varying significantly across global jurisdictions which can hinder market entry. Opportunities are substantial in leveraging advanced biotechnology for the production of novel, highly specific oligosaccharide molecules that offer targeted health benefits beyond general gut health, such as in mood regulation (gut-brain axis) and personalized medical nutrition. The interaction of these forces—high demand, technological complexity, and regulatory oversight—establishes a dynamic environment where innovation in process efficiency becomes the critical competitive differentiator.

Segmentation Analysis

The Oligosaccharide market segmentation provides a detailed framework for understanding market dynamics based on type, source, application, and form. This granular analysis is crucial for stakeholders to identify high-growth pockets and tailor product strategies. The Type segmentation reveals market preference for widely studied and cost-effective prebiotics like FOS and GOS, while the Application segment underscores the critical role of oligosaccharides in highly regulated sectors such as Infant Formula. Continuous innovation in production technologies, particularly enzymatic conversion, heavily influences the Source segmentation, shifting the reliance from traditional plant extraction towards highly controlled synthetic and microbial processes, which promise greater purity and scalability for future market expansion.

- Type: Fructo-oligosaccharides (FOS), Galacto-oligosaccharides (GOS), Isomalto-oligosaccharides (IMO), Mannan-oligosaccharides (MOS), Human Milk Oligosaccharides (HMOs), Others.

- Source: Plant-based (Chicory, Sugar Beet, Cereals, Others), Synthetic/Enzymatic, Microbial.

- Application: Food & Beverages (Dairy Products, Baked Goods & Cereals, Confectionery, Beverages, Others), Dietary Supplements, Infant Formula, Animal Feed, Pharmaceuticals.

- Form: Powder, Liquid.

Value Chain Analysis For Oligosaccharide Market

The oligosaccharide value chain begins with upstream analysis, focusing on the procurement and processing of raw materials. For traditional FOS and inulin, this involves agricultural sourcing of chicory root, sugar cane, or sugar beet, requiring efficient extraction and purification methods. For specialized GOS and emerging HMOs, the upstream segment involves highly technical enzyme production and complex fermentation processes utilizing specialized microbial strains, demanding significant R&D investment and bioreactor capacity. The quality and purity of these initial inputs directly dictate the functionality and commercial viability of the final oligosaccharide product, making raw material stability and consistent sourcing critical risk factors.

The midstream stage centers on the manufacturing process, which includes enzymatic conversion, hydrolysis, purification, concentration, and final drying (for powder form). Efficiency in this stage, particularly minimizing byproducts and optimizing yield, is paramount for maintaining competitive pricing. Key manufacturers invest heavily in separation technologies, such as chromatography and membrane filtration, to achieve the high purity levels required for premium applications like infant nutrition. Rigorous quality control and adherence to global food safety standards are non-negotiable elements in this manufacturing phase.

Downstream analysis involves distribution channels and end-user engagement. Distribution is multifaceted, involving both direct sales to large industrial buyers (e.g., major infant formula and dairy manufacturers) and indirect sales through specialized distributors and ingredient suppliers who service smaller food and supplement producers. Direct channels ensure customized solutions and technical support, while indirect channels provide broad market reach. End-users, including food formulators, functional beverage companies, and pharmaceutical firms, utilize oligosaccharides to enhance product nutritional profiles and marketing claims, solidifying the market's dependence on effective B2B technical marketing and regulatory guidance support from the ingredient suppliers.

Oligosaccharide Market Potential Customers

The primary consumers of bulk oligosaccharides are large-scale industrial end-users operating in sectors where functional ingredients are integrated into consumer goods designed for health benefits. Infant formula manufacturers represent the most critical customer segment, given the mandatory inclusion of prebiotics (GOS and increasingly HMOs) to replicate the benefits of human milk. These customers demand the highest purity, consistency, and traceability, often necessitating long-term supply agreements with rigorous specifications, thereby favoring established ingredient suppliers with robust quality systems.

Another major customer group is the functional food and beverage industry, particularly companies specializing in dairy alternatives, fortified yogurts, nutritional bars, and fiber-enriched drinks. These buyers value oligosaccharides not only for their prebiotic effects but also for their utility as low-calorie sweeteners and texturizing agents. Their purchasing decisions are often driven by ingredient cost, ease of incorporation into existing product lines, and consumer-perceived naturality, leading to high demand for high-volume FOS and inulin varieties.

Furthermore, the dietary supplement and pharmaceutical sectors constitute significant, albeit more niche, customer bases. Supplement manufacturers integrate oligosaccharides into capsules, powders, and gummies aimed at targeted digestive, immune, or weight management goals. Pharmaceutical companies explore oligosaccharide derivatives for drug delivery systems or as active pharmaceutical ingredients (APIs) focused on gut-mediated therapies. These customers require highly specialized product grades and extensive technical documentation, highlighting the opportunity for suppliers offering custom synthesis and regulatory expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $3.50 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingredion Incorporated, FrieslandCampina, DuPont (Danisco), Sensus, BENEO GmbH, Cosucra, Cargill, Tate & Lyle, Quantum Hi-Tech, Clasado Bio, Futaste Co., Ltd., Baolingbao, Beghin Meiji, New Francisco Biotech, Shandong Jianyuan Foods Co., Kerry Group, AIDP Inc., Wacker Chemie AG, BASF SE, Jennewein Biotechnologie GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oligosaccharide Market Key Technology Landscape

The technological landscape of the oligosaccharide market is defined by continuous advancements aimed at improving yield, purity, and enabling the synthesis of highly complex structures. Enzymatic synthesis remains a cornerstone technology, utilizing specific glycosyltransferases or hydrolases to convert simple sugars (like lactose or sucrose) into complex oligosaccharides (GOS or FOS). Recent innovations in enzyme immobilization and reaction engineering have dramatically increased efficiency and reduced processing time, making large-scale, cost-effective production more feasible. The refinement of continuous flow reactors further optimizes these enzymatic processes, ensuring consistent product quality while reducing the environmental footprint of manufacturing.

Precision fermentation technology is rapidly emerging as the key differentiator, particularly for the production of Human Milk Oligosaccharides (HMOs). This biotechnology leverages genetically modified microorganisms (typically yeasts or bacteria) as 'cellular factories' to synthesize specific HMO structures identically to those found in human milk. While technically demanding and capital-intensive, precision fermentation offers unparalleled structural specificity and scalability, positioning it as the future standard for high-value infant nutrition ingredients. Investments in optimizing microbial hosts and upstream bioprocessing are central to reducing the current high cost of goods for these advanced prebiotics.

Furthermore, separation and purification technologies are crucial for achieving final product quality, especially for pharmaceutical and infant formula applications. Advanced chromatographic techniques, including simulated moving bed (SMB) chromatography, are widely employed to separate target oligosaccharides from unreacted raw materials and byproducts with high precision. Membrane filtration technologies, such as nanofiltration and reverse osmosis, are also utilized for concentrating solutions and removing unwanted impurities, contributing significantly to the stability and functional efficacy of the final powder or liquid products offered to industrial customers.

Regional Highlights

The global demand for oligosaccharides is heterogeneously distributed, reflecting varied dietary habits, economic growth, and regulatory environments across major geographical regions. North America and Europe currently dominate the market in terms of value, primarily driven by high consumer adoption of dietary supplements, established functional food markets, and rigorous regulatory standards that endorse the health benefits of prebiotics. In these regions, the focus is shifting toward premium, research-backed products, including advanced GOS blends and early adoption of commercially available HMOs, especially targeting the sophisticated senior nutrition and digestive health segments.

Asia Pacific (APAC) stands out as the engine for future market volume growth. Countries such as China, India, and Southeast Asian nations are experiencing rapid economic expansion, leading to increased consumer spending on infant nutrition and preventative health products. The robust local demand for fortified dairy products and traditional fermentation processes further fuels the market. Moreover, the aging populations in countries like Japan and South Korea contribute significantly to the demand for gut health solutions, establishing APAC as the most dynamic region for both consumption and localized production capacity expansion.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with high untapped potential. While market penetration remains lower than in established regions, increasing health consciousness, particularly among the middle class, and government initiatives promoting food fortification are creating new avenues for oligosaccharide suppliers. Infrastructure development in food processing and manufacturing within key countries in these regions will be critical for unlocking significant market value over the forecast period, positioning these regions as crucial areas for strategic entry and investment in localized supply chains.

- North America: High penetration in dietary supplements and sports nutrition; rapid uptake of HMOs; strong R&D focus on personalized gut health solutions.

- Europe: Mature functional food market; stringent quality control and regulatory approval; major production hub for FOS and Inulin from chicory.

- Asia Pacific (APAC): Highest volume growth driven by China and India; significant application in infant formula; growing local manufacturing capabilities and consumer awareness.

- Latin America (LATAM): Increasing industrialization of food processing; growing awareness of prebiotics benefits; focus on cost-effective FOS solutions.

- Middle East & Africa (MEA): Nascent market with potential driven by nutritional security initiatives and rising incomes in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oligosaccharide Market.- Ingredion Incorporated

- FrieslandCampina

- DuPont (Danisco)

- Sensus

- BENEO GmbH

- Cosucra

- Cargill

- Tate & Lyle

- Quantum Hi-Tech

- Clasado Bio

- Futaste Co., Ltd.

- Baolingbao

- Beghin Meiji

- New Francisco Biotech

- Shandong Jianyuan Foods Co.

- Kerry Group

- AIDP Inc.

- Wacker Chemie AG

- BASF SE

- Jennewein Biotechnologie GmbH

Frequently Asked Questions

Analyze common user questions about the Oligosaccharide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Fructo-oligosaccharides (FOS) and Galacto-oligosaccharides (GOS) in market application?

FOS are derived typically from chicory or sugar, offering high fiber content and general prebiotic activity, widely used in baked goods and cereals. GOS are derived from lactose, closely mimicking the structure of natural human milk oligosaccharides, making them essential and premium ingredients primarily utilized in infant formula and specialized pediatric nutrition.

How is the production of Human Milk Oligosaccharides (HMOs) impacting the broader oligosaccharide market?

The synthetic production of HMOs, primarily through precision fermentation, introduces high-value, highly functional ingredients that set a new benchmark for prebiotic efficacy, particularly in infant formula. This trend stimulates intense R&D investment and pushes traditional GOS and FOS producers to innovate their product offerings to maintain competitiveness.

Which geographical region exhibits the highest growth potential for oligosaccharide consumption?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to register the highest Compound Annual Growth Rate (CAGR) due to expanding middle-class populations, increasing health expenditure, and substantial growth in local infant nutrition and functional food industries.

What are the major technological challenges facing large-scale oligosaccharide manufacturing?

Key challenges include reducing the high cost of goods associated with complex enzymatic synthesis and fermentation processes, achieving high purity levels required for premium applications (especially separating target molecules from residual sugars), and managing scalability while maintaining stringent quality control for novel oligosaccharide structures.

Beyond gut health, what emerging applications are driving market innovation for oligosaccharides?

Emerging applications include the use of specific oligosaccharides in the gut-brain axis modulation for mental wellness supplements, their integration into clinical nutritional products for immune support in hospital settings, and their use in animal feed to enhance livestock health and reduce the reliance on antibiotics.

Detailed Segmentation Analysis: By Type

The segmentation of the oligosaccharide market by type is crucial as the functional benefits, cost structures, and target applications vary significantly between different classes of molecules. Fructo-oligosaccharides (FOS) and Galacto-oligosaccharides (GOS) currently dominate the market share owing to their proven efficacy, cost-effectiveness, and established regulatory status across major regions. FOS, derived primarily from chicory inulin, remains the foundational fiber ingredient in the functional food sector, valued for its dual benefits as a prebiotic and a low-calorie bulking agent. GOS, synthesized from lactose, commands a premium due to its critical role as a core component in pediatric nutrition, directly supporting the development of a healthy infant gut flora.

Isomalto-oligosaccharides (IMO) and Mannan-oligosaccharides (MOS) represent growing segments. IMO is gaining traction particularly in the sports nutrition and clean-label snack categories, appreciated for its favorable textural properties and moderate sweetness, alongside its dietary fiber status. MOS, derived from yeast cell walls, is heavily utilized in the animal feed industry to bind pathogenic bacteria, improving animal gut health and performance, thus reflecting the market's expansion beyond human consumption. The diversification of consumer needs, from high-fiber bulking agents to highly specific infant nutrition components, necessitates continuous product portfolio expansion by major players.

The segment experiencing the most transformative growth and investment, however, is Human Milk Oligosaccharides (HMOs). Although currently representing a smaller volume share due to high production costs via precision fermentation, HMOs are the gold standard for infant formula formulation. Their unique structures offer benefits extending beyond simple prebiotics, influencing immune development and potentially cognitive function. As production technologies mature and costs decline, HMOs are expected to rapidly penetrate broader functional food and supplement markets, signaling a significant shift in the competitive landscape towards complex, synthesized oligosaccharides rather than solely plant-extracted varieties.

- Fructo-oligosaccharides (FOS): Highest volume, cost-effective; used broadly in fortified foods, dairy, and supplements.

- Galacto-oligosaccharides (GOS): Premium ingredient derived from lactose; essential component of infant formula; strong focus on purity.

- Isomalto-oligosaccharides (IMO): Moderate sweetness and good stability; popular in nutrition bars, sports supplements, and low-sugar alternatives.

- Mannan-oligosaccharides (MOS): Key application in animal feed, particularly poultry and swine; supports gut immunity and pathogen exclusion.

- Human Milk Oligosaccharides (HMOs): Rapidly growing, highest-value segment; produced via precision fermentation; crucial for advanced infant nutrition.

- Others: Includes Xylo-oligosaccharides (XOS), Pectic Oligosaccharides (POS), and novel variants, characterized by niche applications and ongoing research into specific bioactivities.

Detailed Segmentation Analysis: By Source

The sourcing methodology for oligosaccharides fundamentally impacts the cost profile, scalability, and structural integrity of the final product, creating distinct market segments. Traditionally, plant-based extraction, predominantly from chicory root (for inulin and FOS) and sugar beet, has dominated the market, providing large volumes of cost-competitive ingredients. The plant-based segment benefits from established agricultural supply chains and consumer perception of naturalness, aligning with clean-label trends. However, this source is inherently susceptible to seasonality, geographical limitations, and variability in raw material composition, presenting challenges in guaranteeing absolute consistency and purity required for sensitive applications.

The Synthetic/Enzymatic source category, primarily responsible for GOS production from lactose, represents a high-volume, industrialized process. This method allows for greater control over the molecular yield and reduces dependence on agricultural cycles. Advances in enzyme technology, including using engineered enzymes and optimizing biocatalytic reactions, are continuously driving down production costs and improving the efficiency of converting simple sugars into desired oligosaccharide profiles. This segment is highly reliant on the dairy industry for lactose supply but offers significant advantages in product standardization and regulatory compliance due to the controlled manufacturing environment.

The Microbial source segment, encompassing production via fermentation (used for MOS and virtually all commercial HMOs), is the most technologically advanced and fastest-evolving. Microbial biosynthesis offers the ability to create complex, highly specific oligosaccharide structures that are difficult or impossible to obtain via simple enzymatic conversion or plant extraction. While currently the most expensive method, this segment is characterized by enormous R&D investment aimed at strain optimization, bioreactor scale-up, and continuous process refinement to achieve cost parity with traditional sources. The microbial route is critical for accessing the high-end infant formula and pharmaceutical markets requiring molecular identity and structural specificity.

- Plant-based (Chicory, Sugar Beet, Cereals): High volume, cost-efficient FOS and Inulin; strong consumer acceptance; vulnerability to agricultural variability.

- Synthetic/Enzymatic: Dominant method for GOS production; controlled, scalable process; dependent on reliable lactose or sucrose feedstock supply; focus on yield optimization.

- Microbial: Specialized production of HMOs and MOS; highest structural specificity; capital-intensive R&D; projected to drive innovation in high-value prebiotics.

Detailed Segmentation Analysis: By Application

The application landscape defines the consumption pattern and value proposition of oligosaccharides across various industries. The Infant Formula segment holds the highest value share due to the non-negotiable requirement for prebiotics (GOS and HMOs) to support healthy development in formula-fed infants. This application necessitates ingredients of pharmaceutical-grade quality, demanding rigorous safety testing, purity standards, and global regulatory approval (e.g., FDA, EFSA clearance). The market for oligosaccharides in this segment is driven by global birth rates, increasing preference for premium formula, and regulatory mandates on nutritional fortification.

The Food & Beverages segment is the largest in terms of sheer volume consumption, where oligosaccharides are utilized broadly across dairy products (yogurts, fermented milk), baked goods, cereals, and functional beverages. In this sector, FOS and inulin often serve as low-calorie sweeteners, sugar substitutes, and sources of dietary fiber, addressing the public health challenge of excessive sugar intake. Manufacturers leverage the prebiotic claim to market products focusing on digestive wellness and immune support, driving demand based on consumer trends for preventative health and "better-for-you" food choices. Competitive pressures in this segment favor suppliers who can offer bulk quantities at competitive prices with consistent functionality.

Dietary Supplements and Pharmaceuticals constitute rapidly expanding segments. Supplement manufacturers utilize encapsulated or powdered oligosaccharides for targeted digestive aid, often blending them with probiotics (synbiotics). The pharmaceutical segment involves exploring oligosaccharides as excipients, drug stabilizers, or even active compounds in therapies aimed at inflammatory bowel diseases (IBD) or modulating the gut-brain axis. These applications require specialized, high-purity grades and are characterized by longer product development cycles and high investment in clinical research to substantiate specific health claims, opening lucrative opportunities for specialized oligosaccharide producers.

- Infant Formula: Highest value, critical application; utilizes GOS and HMOs; driven by stringent quality standards and nutritional mandates.

- Food & Beverages: Largest volume consumption; includes Dairy Products, Baked Goods & Cereals, Confectionery, and functional Beverages; utilized as fiber, sugar replacer, and prebiotic.

- Dietary Supplements: High growth segment; consumption via capsules, powders, and gummies; focus on targeted digestive and immune health benefits.

- Animal Feed: Uses MOS primarily to enhance gut health and prevent colonization by pathogens in livestock and aquaculture, improving efficiency and reducing veterinary costs.

- Pharmaceuticals: Niche but high-potential segment; exploration as excipients, targeted drug delivery agents, and APIs for gut-mediated disorders.

Detailed Segmentation Analysis: By Form

The market segmentation by form dictates the ease of handling, storage, and final application of the ingredients in industrial settings. The Powder form dominates the market share, offering significant advantages in terms of shelf stability, reduced transportation costs, and versatile application across dry mix products, nutritional supplements, and powdered infant formula. Powdered oligosaccharides are typically produced through spray drying or freeze-drying processes, requiring careful control to maintain molecular integrity and ensure optimal flow properties. Manufacturers must focus on achieving consistent particle size distribution and low water activity to prevent caking and extend shelf life, catering to the needs of manufacturers operating across diverse geographical locations and supply chains.

The Liquid form segment is crucial for specific applications where solubility and ease of incorporation into liquid matrices are paramount, such as in functional beverages, liquid dietary supplements, and specific dairy applications (e.g., concentrated yogurts or milk drinks). Liquid oligosaccharides typically contain a higher concentration of the active compound dissolved in water or another suitable medium, offering ease of dosing and dispersion without the need for additional mixing steps required for powders. While liquid forms inherently involve higher transportation weights and reduced shelf stability compared to powders, their utility in continuous liquid processing lines ensures sustained demand from specialized food and beverage processors.

The decision between powder and liquid forms is often driven by the end product's formulation requirements, manufacturing infrastructure, and stability needs. High-purity HMOs, for example, are frequently utilized in powder form for infant formula to ensure maximum stability over a long shelf life. Conversely, bulk FOS incorporated into high-volume functional drinks may utilize liquid concentrate to streamline manufacturing. Suppliers capable of offering highly customizable solutions in both forms, supported by robust technical service and stability data, are better positioned to capture diverse customer segments across the food and pharmaceutical industries.

- Powder: Dominant form; superior shelf stability, reduced logistics costs, and ideal for dry blending applications (supplements, infant formula).

- Liquid: Preferred for functional beverages and liquid dietary applications; offers easy dispersion and handling in continuous liquid processing lines; requires specific storage conditions.

Competitive Landscape Analysis

The Oligosaccharide market is characterized by intense competition among a few large, multinational ingredient specialists and several specialized regional players focused on specific technologies (like HMO synthesis) or raw materials (like chicory extraction). Key market players, such as Ingredion, FrieslandCampina, and DuPont, leverage their extensive global distribution networks, diversified product portfolios (including starches, fibers, and sweeteners), and substantial financial resources to dominate the bulk FOS and GOS segments. Competition is primarily focused on achieving economies of scale, optimizing supply chain efficiency, and offering competitive pricing, especially in high-volume applications like general functional foods and beverages.

Technological differentiation is increasingly becoming the critical determinant of competitive success, particularly in the high-value HMO space. Companies that have mastered precision fermentation and biocatalysis, such as Jennewein Biotechnologie and specific divisions of major chemical and food companies, hold a distinct competitive advantage. These firms compete not on volume, but on the intellectual property surrounding specific oligosaccharide structures, purity levels, and documented clinical efficacy. Strategic alliances and licensing agreements are common in this sub-segment, allowing larger companies to access cutting-edge technologies without internal R&D duplication.

The competitive strategy also involves rigorous adherence to regulatory compliance and investment in clinical substantiation. As consumer skepticism grows, ingredient suppliers must provide robust scientific evidence supporting their prebiotic claims, particularly in highly sensitive markets like infant and medical nutrition. Furthermore, sustainability and ethical sourcing are emerging competitive factors. Companies that can demonstrate transparent and environmentally responsible sourcing (e.g., sustainable chicory farming or efficient bioreactor operation) are better positioned to capture the loyalty of corporate customers committed to global sustainability goals, influencing long-term supply agreements and brand perception.

Market Dynamics: Drivers and Restraints Detailed Assessment

Market Drivers

One of the foremost drivers fueling the oligosaccharide market is the overwhelming shift in consumer focus toward preventive healthcare, specifically recognizing the pivotal role of the gut microbiome in overall health, immunity, and mental well-being. This heightened awareness, amplified by extensive scientific research and media coverage, translates directly into increased consumer demand for products explicitly formulated to support digestive health. Consequently, food manufacturers and dietary supplement companies are aggressively incorporating prebiotics like oligosaccharides into their portfolios to meet this evolving consumer expectation for functional benefits, leading to significant volume growth across various product categories.

The rapid expansion and innovation within the Infant Formula sector constitute a second major driver. As the understanding of Human Milk Oligosaccharides (HMOs) advances, regulatory bodies and pediatric nutrition guidelines increasingly encourage or mandate the inclusion of complex prebiotics to replicate the functional benefits of breast milk. This drives continuous technological innovation and substantial capital expenditure in advanced synthesis methods (precision fermentation) to scale up production of high-purity GOS and novel HMOs. The high-value nature of the infant nutrition segment provides strong revenue incentives for market players, pushing the technological envelope for the entire oligosaccharide industry.

Furthermore, the global imperative to reduce sugar intake and combat rising rates of obesity and diabetes offers a powerful complementary driver. Oligosaccharides, particularly FOS and Inulin, function effectively as low-calorie bulk sweeteners and sugar replacers, providing desirable texture and sweetness without the negative metabolic consequences of sucrose. This dual functionality—offering both prebiotic health benefits and addressing clean-label, low-sugar formulation needs—makes oligosaccharides an extremely attractive ingredient for mainstream food and beverage companies looking to reformulate legacy products and launch health-conscious alternatives, thereby broadening the market adoption significantly.

Market Restraints

A primary restraint inhibiting market growth, particularly for advanced oligosaccharide types, is the complexity and high cost associated with manufacturing. Production methods for high-purity GOS and, critically, HMOs, rely on sophisticated enzymatic conversions and proprietary precision fermentation technologies. These processes require substantial initial capital investment in specialized bioreactor facilities and advanced purification equipment (like chromatography), resulting in a high cost of goods that limits widespread use in mass-market, low-margin food products. The difficulty in achieving economies of scale quickly for novel HMOs keeps their price prohibitively high, restricting their current use largely to premium infant formula.

Another significant barrier is the fragmented and often opaque global regulatory environment. While prebiotics are generally recognized as safe (GRAS) in established markets like the US and EU, the specific health claims and dosage requirements for different oligosaccharide types (FOS, GOS, HMOs) can vary dramatically by country. Navigating these disparate regulatory frameworks requires extensive, expensive, and time-consuming clinical trials to substantiate claims for each jurisdiction. This regulatory complexity raises the barrier to market entry, especially for small and medium-sized enterprises seeking global expansion, and adds substantial lead time to new product launches, thereby slowing the overall pace of market penetration.

Finally, consumer acceptance and gastrointestinal tolerance issues present a localized restraint. Although oligosaccharides are recognized as beneficial, excessive consumption, particularly of standard FOS or Inulin, can lead to digestive discomfort, including bloating and gas, especially in individuals with sensitivity issues (e.g., those following a low-FODMAP diet). This potential for adverse effects necessitates clear labeling and dosage recommendations, and it mandates that ingredient suppliers must constantly work on developing new oligosaccharide structures with improved digestive tolerance profiles. If consumers experience negative side effects, it can lead to negative perceptions and a withdrawal from the category, impacting overall market growth momentum.

Future Outlook and Emerging Trends

The future outlook for the oligosaccharide market is profoundly optimistic, underpinned by ongoing advancements in biotechnology and a global demographic shift towards preventative nutrition. One major trend driving the industry is the relentless pursuit of personalized nutrition solutions. Future product development will focus on creating customized oligosaccharide blends tailored to an individual’s specific gut microbiome profile or genetic predisposition. AI and machine learning tools will analyze stool sample data and dietary intake to recommend precise prebiotic regimens, moving the market away from generic FOS/GOS formulations towards highly specific, efficacious interventions delivered through dietary supplements or specialized medical foods.

A second crucial trend involves the technological shift towards sustainable and high-purity microbial synthesis. As the regulatory and consumer environment increasingly scrutinizes food ingredient sourcing, precision fermentation for HMOs and other complex prebiotics will become the dominant technological platform. This technology not only offers structural purity but also provides a more controlled and scalable production method compared to seasonal agricultural extraction. This transition will attract significant venture capital investment into biomanufacturing firms, leading to sharp reductions in production costs for complex molecules, enabling their eventual use in mainstream consumer products beyond premium infant formula.

Finally, the expanded functional utility of oligosaccharides beyond simple digestive health is emerging as a powerful market catalyst. Researchers are actively exploring the role of prebiotics in systemic health benefits, including reducing inflammation, enhancing mineral absorption (particularly calcium), managing weight and satiety, and positively influencing neurological function via the gut-brain axis. This expanding body of clinical evidence will open entirely new, high-value application segments in therapeutic nutrition, sports performance, and cognitive health supplements, broadening the competitive arena and solidifying oligosaccharides' position as indispensable functional ingredients for the 21st-century diet.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Isomaltooligosaccharide (IMO) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Isomalto-oligosaccharide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Galacto-Oligosaccharide Market Size Report By Type (Prebiotic, Sweetener), By Application (Food and Beverage, Dietary Supplements), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Mannan Oligosaccharide (Mos) Market Size Report By Type (.), By Application (Food, Animal Feed), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Fructooligosaccharide (FOS) Market Size Report By Type (Liquid FOS, Solid FOS), By Application (Food Industry, Baby Nutrition Products, Health Products, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager