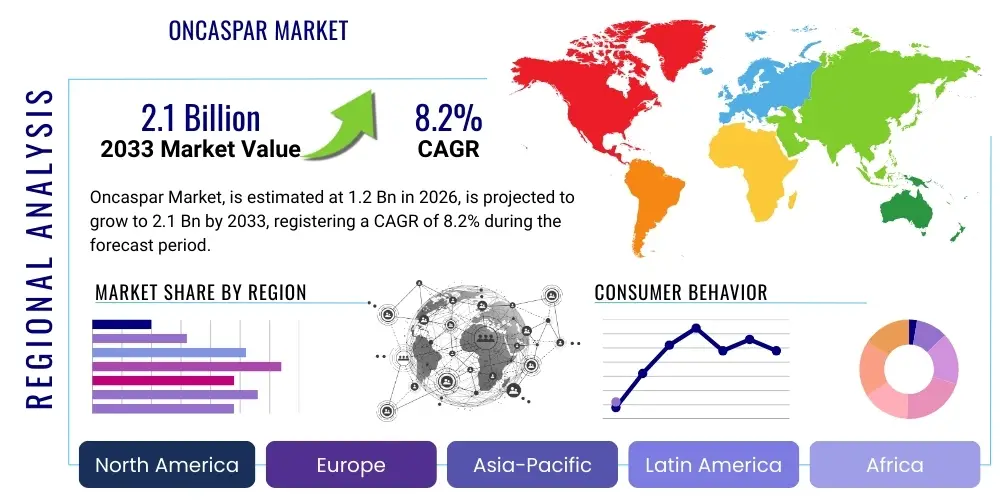

Oncaspar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442996 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Oncaspar Market Size

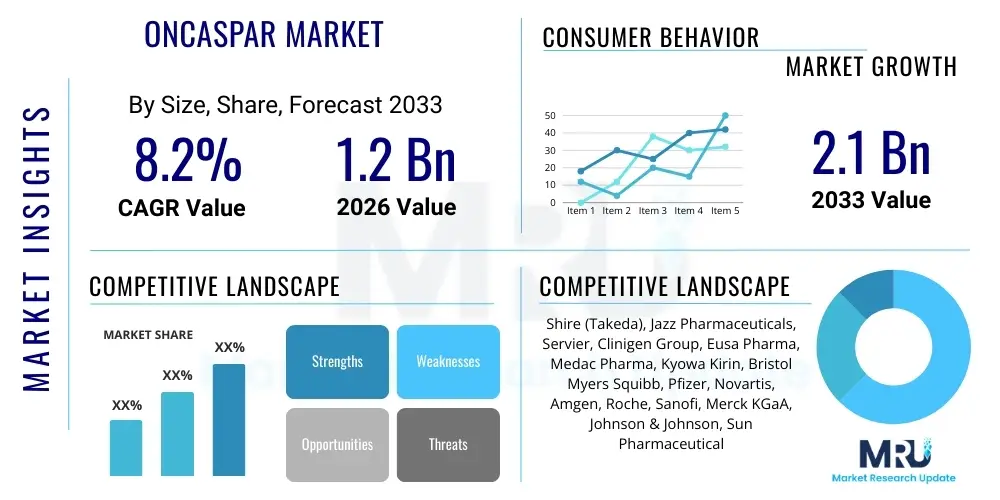

The Oncaspar Market, encompassing the sales and utilization of Pegaspargase (PEG-L-asparaginase) for oncological applications, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by the increasing incidence rates of Acute Lymphoblastic Leukemia (ALL) globally, coupled with the established superior efficacy and improved pharmacokinetic profile of PEGylated enzyme formulations, which allow for reduced dosing frequency and enhanced patient compliance compared to native L-asparaginase preparations. Furthermore, the expansion of standardized chemotherapy protocols, particularly in pediatric oncology settings across developing regions, significantly contributes to the escalating demand for this critical antineoplastic agent.

Oncaspar Market introduction

The Oncaspar market centers around Pegaspargase, a modified, long-acting formulation of the enzyme L-asparaginase, which is integral to multi-agent chemotherapy regimens for hematologic malignancies, predominantly Acute Lymphoblastic Leukemia (ALL) and certain types of Non-Hodgkin Lymphoma (NHL). As an essential component of induction and consolidation therapy, Pegaspargase functions by depleting the circulating levels of L-asparagine, an amino acid critical for the proliferation and survival of malignant lymphoblasts, which are often unable to synthesize asparagine internally. This targeted nutritional deprivation leads to selective apoptosis of cancer cells, positioning Oncaspar as a cornerstone therapeutic agent in pediatric and adult oncology. The product's key advantage lies in its PEGylation technology, which significantly extends its plasma half-life, minimizing the immunogenicity associated with the native enzyme and thereby reducing the frequency of injections required for therapeutic efficacy, ultimately improving the overall quality of life for patients undergoing intensive treatment.

Major applications of Oncaspar extend beyond primary ALL treatment, involving its crucial role in managing central nervous system prophylaxis and as a component in salvage therapy for relapsed or refractory disease. The market's driving factors include persistent high prevalence of ALL, continuous advancements in supportive care that mitigate treatment toxicities, and the inclusion of PEG-asparaginase in revised national and international clinical guidelines as the preferred asparaginase formulation. These guidelines recognize the drug’s superior sustained therapeutic concentrations, which are vital for achieving deep and durable remissions in highly aggressive leukemic disorders. The expanding global pediatric oncology infrastructure, particularly the adoption of Western treatment protocols in high-growth economies such as China and India, further accelerates market penetration and consumption volume.

The benefits associated with Oncaspar utilization, particularly its reduced dosing schedule and decreased antigenicity, have cemented its position as a first-line treatment option. The market is also driven by ongoing clinical research exploring combination therapies where Pegaspargase is utilized synergistically with novel targeted agents, potentially expanding its utility into other solid tumors or challenging hematological indications. However, the market dynamics are simultaneously influenced by emerging biosimilar competition and the need for rigorous cold chain management, which presents logistical challenges, especially in regions with nascent healthcare infrastructure. Nonetheless, the inherent clinical superiority and established safety profile of Pegaspargase continue to ensure strong, sustained market demand within specialized therapeutic areas.

Oncaspar Market Executive Summary

The Oncaspar market is characterized by robust business trends centered on strategic consolidation, supply chain optimization, and heightened focus on regulatory clearances across different geographies for expanded indications. Key industry players are increasingly investing in proprietary protein engineering techniques to develop next-generation PEG-asparaginase formulations that offer improved stability and lower incidence of treatment-related toxicities, specifically addressing pancreatic toxicity and hypertriglyceridemia. Furthermore, the market structure is evolving as major pharmaceutical entities navigate the complexities of biosimilar entry, prompting intensified efforts in lifecycle management, including new drug delivery systems and enhanced patient support programs to maintain market share against potentially lower-cost alternatives. These proactive measures are crucial in an environment where healthcare providers are increasingly pressured to adopt cost-effective treatment protocols without compromising efficacy, thus balancing clinical needs with economic sustainability.

Regionally, the market exhibits clear bifurcation: mature markets like North America and Europe maintain high consumption values driven by high per-patient treatment costs and established clinical pathways, while the Asia Pacific (APAC) region and Latin America are poised for explosive volume growth. This APAC expansion is fueled by rising healthcare expenditure, increased awareness and diagnostic capabilities for pediatric cancers, and government initiatives aimed at universal health coverage and standardized cancer care protocols. Specifically, countries like Japan, South Korea, and Australia lead in adopting advanced protocols, whereas nations like China and India represent significant untapped potential due contingent upon improved drug accessibility and specialized oncology center development. The competitive landscape in these emerging markets often necessitates strategic local partnerships to overcome distribution hurdles and regulatory variances.

Segment trends highlight the dominance of the Acute Lymphoblastic Leukemia (ALL) application segment, given that Oncaspar is a standard-of-care component, required multiple times throughout the multi-year treatment protocol. Within distribution channels, Hospital Pharmacies retain the largest share due to the drug’s intravenous or intramuscular administration requirements and the necessity of specialized monitoring within a controlled clinical setting. The future market trajectory is expected to be influenced by advancements in personalized medicine, where pharmacokinetic monitoring might dictate individualized dosing strategies, ensuring optimal therapeutic drug levels while mitigating adverse events. Additionally, the increasing utilization of genomic screening to identify patients less prone to hypersensitivity reactions could refine prescribing practices, optimizing resource allocation within the overall oncological pharmacopeia.

AI Impact Analysis on Oncaspar Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Oncaspar market primarily revolve around how AI can enhance precision medicine, optimize supply chains, predict patient responses, and identify novel therapeutic targets that could complement or replace current PEG-asparaginase treatments. Users are keenly interested in AI’s capability to analyze vast clinical trial datasets and real-world evidence to predict which ALL patients are most likely to experience severe toxicities (such as pancreatitis or hepatotoxicity) upon receiving Oncaspar, allowing clinicians to preemptively adjust dosages or switch formulations. Furthermore, supply chain and logistics professionals frequently inquire about AI-driven forecasting models to manage the strictly controlled cold chain distribution required for this thermolabile biologic, minimizing wastage and ensuring consistent global availability. The consensus theme is the expectation that AI will transition the administration of Oncaspar from a generalized protocol to a highly personalized treatment course, maximizing efficacy while minimizing patient risk exposure.

- AI-driven Predictive Toxicity Modeling: Utilizing machine learning algorithms to analyze genetic markers and clinical parameters, predicting patient susceptibility to severe adverse events associated with Pegaspargase.

- Optimized Personalized Dosing: AI analysis of patient pharmacokinetic data to recommend precise, individualized dosing schedules, moving beyond weight-based standard protocols to enhance therapeutic drug monitoring and efficacy.

- Enhanced Drug Discovery and Formulation: Employing AI to screen novel conjugation chemistries or enzyme variants that might possess longer half-lives or lower immunogenicity than current PEGylation technology.

- Supply Chain and Cold Chain Management: Use of predictive analytics for real-time inventory tracking, demand forecasting, and optimizing logistics routes for temperature-sensitive biologics, minimizing spoilage.

- Clinical Trial Acceleration: AI facilitating faster identification of eligible patient cohorts for clinical trials studying combination therapies involving Oncaspar or its variants, speeding up regulatory approval processes.

DRO & Impact Forces Of Oncaspar Market

The dynamics of the Oncaspar market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape its growth trajectory and competitive intensity. Primary drivers include the rising global incidence of hematological malignancies, particularly Acute Lymphoblastic Leukemia (ALL), which necessitates the immediate and prolonged utilization of L-asparaginase variants in standardized chemotherapy protocols across pediatric and adult populations. The established clinical superiority of PEG-asparaginase (Oncaspar) over earlier non-PEGylated forms, owing to its extended half-life and reduced need for frequent administration, serves as a fundamental growth catalyst. Furthermore, continuous advancements in supportive care, which enable higher-risk patients to tolerate aggressive chemotherapy regimens, indirectly expands the addressable patient pool eligible for Oncaspar treatment. The global standardization of treatment guidelines, such as those published by cooperative oncology groups, mandates the inclusion of this specific enzyme preparation, reinforcing its market dominance.

However, significant restraints temper the market’s explosive potential. Foremost among these is the extremely high cost of the biologic drug, which poses substantial access barriers, especially in low and middle-income countries and within healthcare systems facing intense budgetary pressures. Another major constraint is the inherent risk of severe treatment-related toxicities, including potentially life-threatening hypersensitivity reactions, hepatotoxicity, and pancreatitis, which require close patient monitoring and sometimes necessitate treatment interruption or discontinuation. Logistical restraints, specifically the absolute requirement for stringent cold chain management throughout the distribution network, add complexity and cost, increasing the risk of product degradation and therapeutic failure if temperature excursions occur. The impending or actual market entry of biosimilar or biobetter asparaginase formulations also acts as a restraint on the pricing power of branded Oncaspar.

Opportunities for market expansion are primarily found in therapeutic area diversification and geographical penetration. Opportunities exist in investigating Oncaspar's utility in combination with novel immunotherapies, such as CAR T-cell therapy or bi-specific T-cell engagers, potentially enhancing treatment depth in relapsed disease settings or in specific genetic subtypes of leukemia. Geographically, significant opportunities exist in emerging markets, where rapid economic development is accompanied by improved access to specialized oncology care and increasing government funding for cancer treatment infrastructure. Moreover, sustained investment in pharmaceutical research aiming to develop enzyme variants with reduced immunogenicity or specific targeted delivery systems represents a core strategic opportunity, allowing manufacturers to maintain competitive advantage even as biosimilars challenge the legacy product portfolio. The refinement of clinical protocols to better manage and mitigate known toxicities also expands the long-term viability of the product.

Segmentation Analysis

The Oncaspar market is systematically segmented based on application, distribution channel, and route of administration to provide detailed insight into consumption patterns and market potential across various clinical and commercial settings. Understanding these segments is critical for manufacturers and stakeholders aiming to optimize supply chain logistics, tailor marketing strategies, and allocate research and development resources effectively. The application segmentation clearly demonstrates the dependence on core hematological indications, while distribution channel analysis highlights the clinical dependency on specialized hospital infrastructure. Geographical segmentation remains paramount, reflecting significant variations in disease prevalence, regulatory approval timelines, and healthcare funding models across different global regions.

- Application:

- Acute Lymphoblastic Leukemia (ALL)

- Non-Hodgkin Lymphoma (NHL)

- Other Hematological Malignancies (e.g., specific T-cell lymphomas)

- Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online/Mail-Order Pharmacies

- Route of Administration:

- Intravenous (IV)

- Intramuscular (IM)

Value Chain Analysis For Oncaspar Market

The Value Chain Analysis for the Oncaspar market is highly specialized and complex, beginning with upstream R&D and manufacturing processes. The initial stages involve the complex biotechnology required for the recombinant production of L-asparaginase enzyme, followed by the proprietary chemical process of PEGylation—covalent conjugation of the enzyme with polyethylene glycol polymers. This upstream activity is highly concentrated among a few specialized biotechnology firms possessing the necessary intellectual property and technical expertise to maintain high purity and stability required for an injectable biologic. Quality control and assurance at this stage are extremely rigorous due to the critical nature of the drug and the high regulatory standards set by bodies such as the FDA and EMA for biologics, ensuring minimal batch-to-batch variation in enzyme activity and immunogenicity profiles.

The midstream phase involves manufacturing, packaging, and logistics. Given that Oncaspar is a temperature-sensitive biologic, the supply chain necessitates continuous cold chain management (typically 2°C to 8°C) from the moment of packaging until administration. Distribution channels are predominantly indirect, relying on specialized third-party logistics (3PL) providers and pharmaceutical distributors who are equipped to handle high-value, temperature-controlled products globally. Direct distribution is rare and usually limited to specific regional contracts or specialized clinical trial distribution. The selection of reliable distribution partners is a crucial strategic decision, as failures in cold chain maintenance can lead to product degradation, loss of efficacy, and significant financial write-offs, directly impacting patient outcomes and commercial viability.

The downstream segment encompasses marketing, sales, and end-user administration. Due to the specialized nature of the drug, marketing efforts are highly targeted towards hematologists, pediatric oncologists, specialized oncology centers, and institutional purchasers. The final consumers/buyers are hospitals and clinics (via their internal pharmacies) that stock and administer the product. Administration is strictly controlled within clinical settings (Hospital Pharmacy focus) due to the necessity of trained medical personnel for IV/IM injection and the requirement to monitor for acute adverse reactions, such as anaphylaxis. Post-market surveillance and pharmacovigilance constitute the final, essential step, ensuring long-term safety data collection and reporting, which influences future prescribing patterns and regulatory renewals. This robust chain ensures that the potent therapeutic agent reaches the patient under optimal conditions.

Oncaspar Market Potential Customers

The primary consumers and end-users of Oncaspar are highly specialized institutional and clinical entities involved in the treatment of hematologic malignancies, rather than individual patients purchasing the product directly. Potential customers overwhelmingly include large academic medical centers, specialized children’s hospitals, dedicated oncology clinics, and community hospitals with established hematology/oncology units. These institutions serve the patient population suffering from Acute Lymphoblastic Leukemia (ALL) and specific types of Non-Hodgkin Lymphoma (NHL), requiring sophisticated multi-agent chemotherapy protocols where Pegaspargase is a non-negotiable component. The purchasing decision within these institutions is typically driven by institutional pharmacy and therapeutics (P&T) committees, influenced heavily by clinical evidence, compliance with standardized treatment protocols (e.g., COG, UKALL), and rigorous cost-effectiveness analyses, often mediated by centralized procurement systems or Group Purchasing Organizations (GPOs).

A significant segment of the potential customer base includes governmental and non-governmental organizations dedicated to public health and cancer access, particularly in developing countries. These organizations often procure bulk quantities of essential oncology medicines like Oncaspar through tenders and subsidized programs to ensure treatment availability for underprivileged pediatric populations. Furthermore, research institutions and biotechnology companies conducting clinical trials focused on novel combination therapies utilizing L-asparaginase variants constitute another important customer segment. These entities require a consistent and qualified supply of the drug for investigational purposes, driving demand outside of standard commercial treatment use. The high technical specification and regulatory burden mean that these customers prioritize product quality, supply reliability, and comprehensive technical support from the manufacturer.

Ultimately, the specific clinical prescribers—pediatric oncologists and adult hematologists—act as key decision influencers. Their clinical preference is determined by established efficacy, perceived safety profile, and ease of incorporation into existing multi-drug regimens. Since Oncaspar offers a distinct advantage through its extended half-life, minimizing hospital visits and maximizing patient adherence to therapy, it maintains a strong preference among prescribers looking to optimize patient care pathways. Consequently, market penetration strategies must focus on providing educational support and clinical data to these specialized medical professionals, demonstrating the superior pharmacokinetic profile and clinical outcomes associated with the branded product over alternatives or generic formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shire (Takeda), Jazz Pharmaceuticals, Servier, Clinigen Group, Eusa Pharma, Medac Pharma, Kyowa Kirin, Bristol Myers Squibb, Pfizer, Novartis, Amgen, Roche, Sanofi, Merck KGaA, Johnson & Johnson, Sun Pharmaceutical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oncaspar Market Key Technology Landscape

The core technology underpinning the Oncaspar market is protein PEGylation, a critical process that involves the covalent attachment of biologically inert polyethylene glycol (PEG) chains to the native L-asparaginase enzyme molecule. This chemical modification significantly alters the enzyme’s pharmacokinetic properties. The large, hydrophilic PEG chains shield the protein from rapid enzymatic degradation and reduce renal clearance, thereby extending the half-life of the drug in the patient’s plasma from hours to several days. This extension is clinically advantageous as it maintains therapeutic levels of asparagine depletion for longer periods, enabling once-per-two-week or monthly dosing schedules compared to the multiple weekly injections required by non-PEGylated counterparts. Furthermore, PEGylation masks the enzyme's surface, reducing its immunogenicity and lowering the incidence of anti-drug antibody formation and associated hypersensitivity reactions, which are major complications of the native enzyme. Continuous innovation in PEGylation focuses on optimizing the size, number, and linkage sites of PEG chains to further improve stability and reduce adverse effects while maintaining maximum enzymatic activity.

Beyond PEGylation, the technological landscape includes advanced recombinant DNA technology used in the upstream production of the L-asparaginase enzyme itself, typically expressed in host organisms like E. coli. Modern manufacturing processes emphasize rigorous purification steps to eliminate endotoxins and host-cell proteins, ensuring a highly pure final product suitable for injection. The industry is also exploring alternative enzyme sources, such as engineered bacterial or yeast strains, which may naturally exhibit lower immunogenicity or possess altered temperature stability profiles. The transition to highly efficient, large-scale bioreactor technologies ensures cost-effective manufacturing capabilities necessary to meet the increasing global demand, although these processes must adhere to stringent Good Manufacturing Practices (GMP) to maintain regulatory compliance across all operating territories. These technological efforts are fundamental to ensuring sustained high-quality supply of this essential medicine.

A third crucial technological domain involves drug delivery systems and cold chain logistics. Given the thermolabile nature of Oncaspar, the market relies heavily on sophisticated cold chain technologies, including validated temperature-controlled packaging, real-time temperature monitoring devices (data loggers), and specialized logistics networks to maintain the required temperature range (2°C to 8°C) consistently. Any deviation from this range risks protein aggregation or loss of enzymatic activity, rendering the product ineffective or potentially harmful. Furthermore, the technology landscape is being influenced by analytical methods, such as highly sensitive high-performance liquid chromatography (HPLC) and specialized enzymatic assays, utilized both in quality control to assess product potency and stability, and in clinical settings for Therapeutic Drug Monitoring (TDM). TDM helps clinicians measure serum asparaginase activity to ensure therapeutic window maintenance, an application that is increasingly integrated with digital health tools for improved patient management and personalized care protocols.

Regional Highlights

North America, particularly the United States, represents the largest and most mature market for Oncaspar, driven by high per-capita healthcare expenditure, established and widely adopted pediatric and adult ALL treatment guidelines (like those from COG), and efficient access to specialized oncology centers. The high average cost of the biologic drug in this region significantly contributes to the overall market valuation. Robust regulatory pathways, combined with significant ongoing clinical trial activity, ensure that novel formulations and combination therapies rapidly enter the market, maintaining North America’s leading position in terms of adoption rates and revenue generation. Demand is stable and predictable, underpinned by strong insurance coverage mechanisms which mitigate the financial burden for individual patients but concentrate the cost burden on payers.

Europe constitutes the second largest market, characterized by varying reimbursement policies and regulatory acceptance across member states, particularly regarding the uptake of biosimilars versus the branded product. Western European nations (Germany, France, UK) maintain sophisticated oncology infrastructure and adhere strictly to regional cooperative group protocols, ensuring high utilization rates. However, pricing pressure from national health services (NHS) and the influence of Health Technology Assessment (HTA) bodies often results in lower net realized prices compared to the US market. Eastern Europe presents emerging potential, but access remains constrained by lower healthcare budgets and less developed specialized pediatric oncology units, resulting in lower penetration rates for premium-priced biologics like Oncaspar.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period. This rapid expansion is primarily fueled by the region's vast population, rising incidence of childhood cancers, and significant improvements in diagnostic capabilities and healthcare infrastructure, particularly in high-growth economies like China, India, and South Korea. Increased governmental investment in oncology care and the gradual adoption of standardized international treatment protocols are opening up large, previously untapped markets. However, challenges related to product accessibility, the establishment of reliable cold chain logistics across diverse geographical terrains, and complex local regulatory approvals necessitate strategic partnerships and localized supply chain solutions for manufacturers seeking to capitalize on this substantial growth opportunity. Furthermore, price sensitivity is high in many APAC nations, necessitating differential pricing strategies.

- North America: Dominant market share due to high treatment costs, established clinical guidelines (COG), and sophisticated oncology network, leading in product uptake and innovation adoption.

- Europe: Strong revenue contributor with utilization driven by unified treatment protocols; faces significant pricing pressure from national health services and rigorous HTA evaluations.

- Asia Pacific (APAC): Fastest growing market fueled by rising incidence, expanding healthcare infrastructure, and government investment; market success contingent upon localized cold chain development and addressing price sensitivity.

- Latin America (LATAM): Moderate growth driven by improving access to care in major economies (Brazil, Mexico); constrained by economic instability and variable reimbursement policies impacting drug affordability.

- Middle East and Africa (MEA): Nascent market with high unmet needs; growth localized to wealthy GCC nations with specialized medical tourism and high-standard facilities; significant barriers to access in broader African regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oncaspar Market.- Shire (Takeda Pharmaceutical Company Limited)

- Jazz Pharmaceuticals plc

- Servier S.A.S.

- Clinigen Group plc

- Eusa Pharma (Acquired by EUSA Pharma)

- Medac Pharma, Inc.

- Kyowa Kirin Co., Ltd.

- Bristol Myers Squibb Company

- Pfizer Inc.

- Novartis AG

- Amgen Inc.

- Roche Holding AG

- Sanofi S.A.

- Merck KGaA

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd.

- Aspen Pharmacare Holdings Limited

- Bayer AG

- Gilead Sciences, Inc.

- Daiichi Sankyo Company, Limited

Frequently Asked Questions

Analyze common user questions about the Oncaspar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Oncaspar in treating leukemia?

Oncaspar (Pegaspargase) functions by depleting L-asparagine, an essential amino acid, from the bloodstream. Malignant lymphoblasts are often auxotrophic (unable to synthesize asparagine internally) and rely on external supply. By removing asparagine, Oncaspar starves the cancer cells, leading to inhibition of protein synthesis and selective apoptosis.

Why is PEGylation critical for the efficacy and patient management of this drug?

PEGylation, the process of attaching polyethylene glycol chains, extends the drug's half-life significantly. This reduces the frequency of administration from multiple times per week to once every two weeks or monthly, improving patient compliance and sustaining therapeutic drug levels for longer periods necessary for effective cancer cell kill.

What are the most common or severe adverse effects associated with Oncaspar treatment?

While generally tolerable under clinical supervision, severe adverse effects can include hypersensitivity reactions, potentially progressing to anaphylaxis, and significant organ toxicities such as pancreatitis, hepatotoxicity, and hypertriglyceridemia. Careful monitoring of liver function, amylase, and lipase is essential during therapy.

How does the emergence of biosimilars impact the branded Oncaspar market?

Biosimilars introduce price competition, primarily in regions with stringent cost containment measures, such as Europe and parts of Asia. This pressure compels branded manufacturers to focus on lifecycle management, demonstrating superior consistency, investing in patient support, and emphasizing the clinical value derived from their established efficacy and safety data.

Which geographical region exhibits the highest growth potential for Oncaspar?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest market growth. This is driven by expanding healthcare budgets, rising incidence rates of ALL, improving diagnostic capabilities, and the adoption of standardized pediatric and adult oncology protocols in populous, developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager