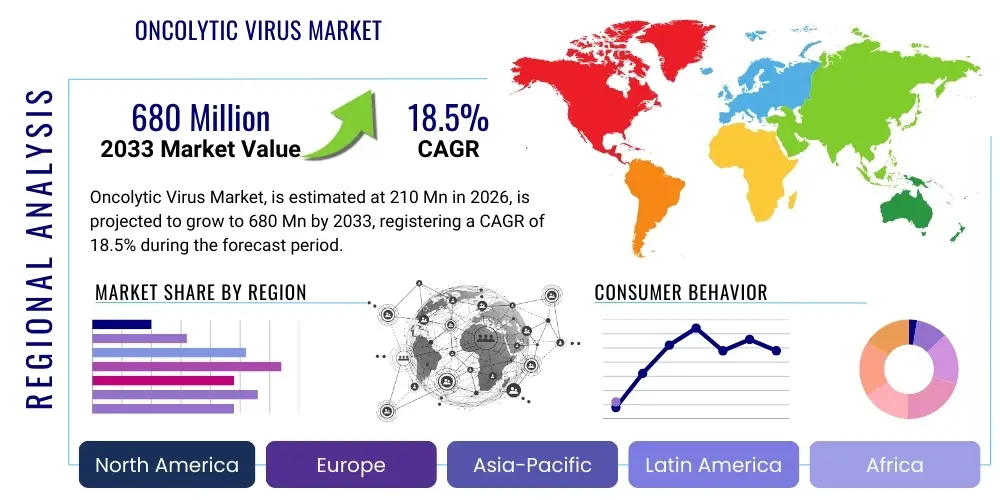

Oncolytic Virus Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441027 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Oncolytic Virus Market Size

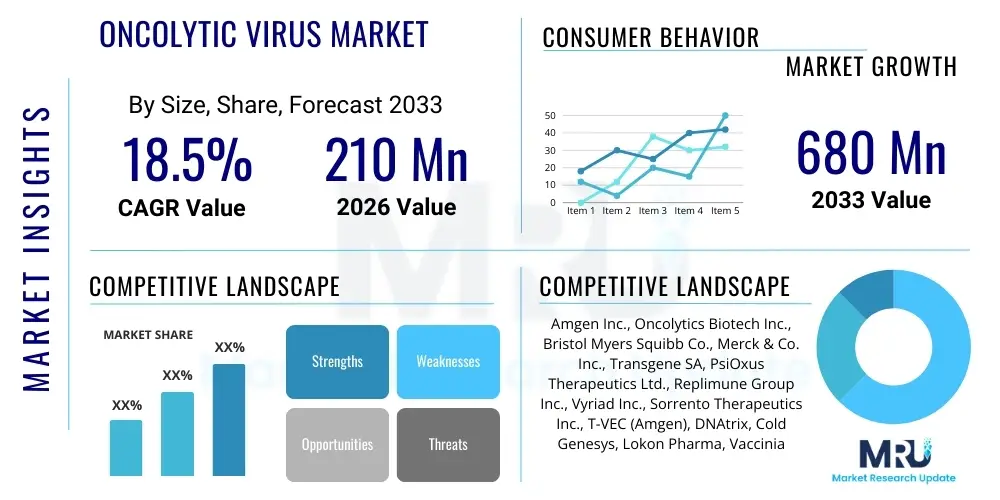

The Oncolytic Virus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $210 Million USD in 2026 and is projected to reach $680 Million USD by the end of the forecast period in 2033.

Oncolytic Virus Market introduction

The Oncolytic Virus Market encompasses the development, manufacturing, and commercialization of genetically modified viruses designed to selectively infect, replicate in, and destroy cancer cells while sparing normal, healthy tissues. These viruses, often derived from common pathogens such as herpes simplex, vaccinia, or adenovirus, represent a highly promising frontier in immuno-oncology. The major applications span solid tumors, including melanoma, breast cancer, lung cancer, and glioblastoma, offering a distinct therapeutic modality often utilized in combination with established treatments like chemotherapy, radiation, or checkpoint inhibitors. The primary benefits include a dual mechanism of action—direct tumor lysis and the initiation of a robust systemic anti-tumor immune response—leading to potentially durable clinical responses and reduced systemic toxicity compared to conventional therapies. The market growth is fundamentally driven by the increasing global prevalence of various cancer types, significant breakthroughs in genetic engineering allowing for enhanced viral specificity and potency, and favorable regulatory pathways for novel biological therapeutics in key markets such as the US and Europe. Furthermore, the high failure rates and limitations of existing advanced therapies, such as certain CAR-T modalities in solid tumors, necessitate exploration into superior, targeted therapeutic platforms like oncolytic viruses.

Oncolytic Virus Market Executive Summary

The Oncolytic Virus (OV) market is characterized by intense research and development activity, transitioning from early-stage pipeline focus to commercialization, heavily influenced by strategic alliances between major pharmaceutical companies and specialized biotech firms. Business trends indicate a strong move toward combination therapy protocols, particularly pairing OVs with PD-1/PD-L1 inhibitors to maximize immune stimulation and clinical efficacy, thereby accelerating regulatory approval timelines and commercial adoption. Regional trends highlight North America as the dominant revenue generator, propelled by advanced clinical infrastructure, high investment in biotechnology, and supportive regulatory bodies like the FDA; however, the Asia Pacific region, particularly China and Japan, is emerging as the fastest-growing market due to escalating cancer incidence and government initiatives focused on localized biotechnology development. Segment trends reveal that the Herpes Simplex Virus (HSV) platform currently dominates due to the successful commercialization of talimogene laherparepvec (T-VEC), but engineered Vaccinia Virus and Adenovirus platforms are rapidly gaining traction, offering optimized payloads and intravenous delivery potential, shifting the segment dynamics towards systemic administration over direct intratumoral injection. Overall market progression is contingent on successful late-stage clinical trials validating efficacy across diverse tumor types and the optimization of manufacturing processes to ensure cost-effective and scalable production of these complex biological agents.

AI Impact Analysis on Oncolytic Virus Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Oncolytic Virus (OV) market frequently center on how AI can accelerate preclinical development, optimize viral engineering for enhanced selectivity and efficacy, and improve clinical trial design. Users are keenly interested in AI’s capability to predict viral tropism, identify optimal patient populations (biomarker discovery), and simulate complex tumor microenvironment interactions that determine OV success or failure. Common concerns involve data privacy in sharing patient and genomic information necessary for robust AI models, as well as the validation and regulatory acceptance of AI-derived insights guiding novel viral construct design. Expectations are high that AI integration will significantly reduce the time and cost associated with generating new OV candidates, moving the field past iterative manual optimization toward precision virotherapy, ultimately enhancing therapeutic outcomes and market accessibility by speeding up the identification of synergistic combination partners.

- AI accelerates target identification for viral payload integration, identifying tumor-specific genetic vulnerabilities.

- Machine learning algorithms optimize viral genome design for improved tumor specificity and reduced off-target toxicity.

- AI models predict viral replication kinetics and spread within heterogeneous tumor tissues, refining dose strategies.

- Advanced analytics enhance patient stratification in clinical trials, identifying ideal responders based on genomic and transcriptomic profiles.

- Automation of large-scale screening of therapeutic combinations (OV plus small molecules or checkpoint inhibitors) for synergistic effects.

- Streamlining of complex manufacturing quality control and process optimization using predictive maintenance and real-time data analysis.

DRO & Impact Forces Of Oncolytic Virus Market

The market is primarily driven by the profound unmet clinical need in advanced solid tumors, coupled with significant scientific advancements enabling precise genetic modification of viruses to enhance their safety and efficacy profile, alongside the demonstrable ability of OVs to convert immunologically "cold" tumors into "hot" tumors receptive to immunotherapy. However, growth is substantially restrained by complex regulatory hurdles associated with live biological agents, challenges in scaling up high-titer, quality-controlled manufacturing, and the inherent difficulties related to systemic delivery and efficient tumor targeting due to neutralizing antibodies developed by the host immune system. Key opportunities lie in the synergistic potential of OVs in combination therapies, especially leveraging the established success of immune checkpoint inhibitors, and the exploration of novel viral platforms capable of systemic delivery and penetration into hard-to-treat malignancies like pancreatic and ovarian cancers. These forces collectively dictate the market trajectory: the strong clinical promise and strategic alliances act as powerful propelling factors, while manufacturing complexities and the need for rigorous safety data necessitate substantial capital investment and elongated development timelines, resulting in an impact force characterized by high potential but regulated, stepwise progression.

The market drivers are heavily influenced by the established limitations of conventional oncology treatments, which often lack the specificity required to minimize damage to healthy tissues, prompting oncologists and patients alike to seek innovative, targeted biological therapies. Furthermore, the demonstrated immunogenic potential of oncolytic viruses—where the destruction of cancer cells releases tumor-associated antigens, activating T-cells against residual and distant metastases (the abscopal effect)—positions OVs as crucial components in next-generation cancer immunotherapy regimens. This shift from purely cytotoxic agents to immunomodulatory agents is a principal growth catalyst. Regulatory agencies, recognizing the transformative potential, are increasingly offering Fast Track, Breakthrough Therapy, and Orphan Drug designations to OV candidates, further incentivizing rapid commercial development and clinical investment, especially for therapies targeting rare or refractory cancers where current treatments are inadequate. The rising prevalence of common cancers globally, particularly in aging populations across developed and emerging economies, fundamentally increases the addressable patient pool for these advanced viral therapeutics, necessitating greater production and broader accessibility.

Conversely, significant restraints hinder wider market penetration. The intricate nature of OV production requires specialized Good Manufacturing Practice (GMP) facilities, demanding substantial upfront capital and highly skilled personnel, making cost of goods (COG) a persistent challenge that limits profitability and potentially restricts market access in cost-sensitive regions. Additionally, overcoming the biological challenge of neutralizing antibodies remains a core limitation; the body’s natural immune response to the virus can rapidly clear the therapeutic agent before sufficient replication and tumor destruction occur, necessitating complex strategies like immunoadsorption or vector modification to mitigate this effect. Finally, the long-term safety profile of genetically altered viruses, while generally favorable in clinical trials, requires extensive post-marketing surveillance, adding regulatory complexity and public perception risks, which pharmaceutical firms must carefully manage. Balancing the high efficacy potential against these manufacturing and immunological hurdles defines the current competitive landscape.

Segmentation Analysis

The Oncolytic Virus Market segmentation provides critical insights into the dynamics of therapeutic platforms, clinical applicability, and administrative modalities. Key segments are delineated by the underlying biological agent (Virus Type), the specific cancer indication targeted (Application), and the context in which the treatment is administered (Therapy Type). The segmentation highlights the dominance of established viral vectors like HSV, successful in commercialization, while demonstrating accelerating innovation in platforms like Vaccinia and Adenovirus, which are better suited for systemic administration. This analytical dissection is vital for stakeholders assessing investment opportunities, identifying high-growth niches, and understanding the evolving competitive landscape shaped by platform technology advancements and shifting clinical guidelines concerning the use of OVs in combination regimens, particularly across major solid tumor indications where unmet needs remain highest.

- By Virus Type:

- Herpes Simplex Virus (HSV)

- Adenovirus

- Vaccinia Virus

- Reovirus

- Others (Measles Virus, Coxsackievirus, etc.)

- By Application:

- Melanoma

- Prostate Cancer

- Head and Neck Cancer

- Lung Cancer

- Breast Cancer

- Glioblastoma

- Other Cancers (Colorectal, Ovarian, Bladder)

- By Therapy Type:

- Monotherapy

- Combination Therapy (OV + Chemotherapy, OV + Radiotherapy, OV + Immunotherapy)

- By Route of Administration:

- Intratumoral Injection

- Intravenous Injection

Value Chain Analysis For Oncolytic Virus Market

The value chain for the Oncolytic Virus market is characterized by several highly specialized, sequential stages, beginning with upstream research and development (R&D) and culminating in complex patient delivery. Upstream activities involve extensive genetic engineering, preclinical safety and efficacy testing, and specialized cell line development crucial for viral production. Due to the high biological complexity, R&D often necessitates strong academic-industry collaboration and specialized contract research organizations (CROs) focusing on viral vector production and analytical testing. Midstream activities focus entirely on clinical trials and GMP manufacturing, which represents a significant bottleneck requiring specialized bioreactors and stringent quality assurance protocols to ensure viral titer consistency and purity. Downstream elements involve distribution channels, which are regulated and often direct, requiring cold chain management due to the bio-lability of the product, followed by administration at specialized oncology centers or hospitals. Direct distribution channels, involving the manufacturer delivering directly to the healthcare provider, are prevalent to maintain stringent quality control and temperature standards, though indirect distribution through specialized, certified pharmaceutical wholesalers also plays a role in wider regional reach, particularly for established products. Successful navigation of this value chain relies on integrated quality systems and robust intellectual property protection.

Upstream analysis highlights the high concentration of expertise required in the early phases. The design of novel oncolytic constructs—optimizing tumor selectivity markers, incorporating immune-stimulating transgenes (payloads), and modifying the viral backbone for safety—is intellectual property intensive. Companies often license proprietary technologies related to promoter elements, attenuation mechanisms, and delivery systems. Key suppliers in this phase include specialized media and reagent manufacturers, as well as firms providing advanced sequencing and bioanalytical services essential for characterizing the final viral product before moving into GMP production. The costs and timelines associated with this R&D phase are substantial, necessitating significant venture capital or strategic pharmaceutical partnerships to mitigate risk. The quality of the viral construct defined upstream directly impacts the manufacturability and clinical success downstream.

Downstream analysis is dominated by the logistics of product handling and patient access. Oncolytic viruses require ultracold storage and highly controlled transportation (cold chain management), demanding specialized courier services and inventory tracking systems that differ markedly from small-molecule pharmaceuticals. Distribution channels, therefore, prioritize reliability and traceability. Direct channels ensure the manufacturer maintains end-to-end control over the product integrity until it reaches the point of care, which is particularly vital for products requiring intratumoral injection procedures performed by trained oncologists. Indirect channels, involving third-party specialized logistics providers (3PLs) and authorized distributors, facilitate broader geographical reach but require rigorous auditing to maintain quality standards. Furthermore, market access and reimbursement strategies, often involving complex negotiations with payers due to the high cost of advanced biological therapies, form a critical downstream component influencing commercial viability and ultimate patient penetration rates.

Oncolytic Virus Market Potential Customers

The primary consumers and end-users of oncolytic virus therapies are specialized healthcare providers and institutions focused on advanced cancer treatment, specifically encompassing oncology hospitals, comprehensive cancer centers, and outpatient infusion clinics. Within these facilities, the key decision-makers and prescribers are highly specialized medical oncologists, surgical oncologists, and interventional radiologists who manage late-stage or refractory solid tumor patients, particularly those with melanoma, lung, or head and neck cancers, where current approved therapies show the strongest clinical profiles. Research institutions and academic centers also constitute a significant customer base, purchasing OVs and related vectors for ongoing preclinical research, mechanism-of-action studies, and participation in investigator-initiated clinical trials designed to explore novel combination regimens. The ultimate beneficiaries are patients suffering from cancers that are resistant to conventional treatments, offering them a promising, often life-extending, alternative when standard care options have been exhausted, positioning the patient population with high unmet needs as the driving demand factor for these complex biological products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $210 Million USD |

| Market Forecast in 2033 | $680 Million USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amgen Inc., Oncolytics Biotech Inc., Bristol Myers Squibb Co., Merck & Co. Inc., Transgene SA, PsiOxus Therapeutics Ltd., Replimune Group Inc., Vyriad Inc., Sorrento Therapeutics Inc., T-VEC (Amgen), DNAtrix, Cold Genesys, Lokon Pharma, Vaccinia, BioVex |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oncolytic Virus Market Key Technology Landscape

The technological landscape of the Oncolytic Virus market is rapidly evolving, driven by innovations in genetic engineering and delivery system optimization, aiming to maximize therapeutic index. Key technologies center on enhancing tumor-specific replication, integrating potent therapeutic transgenes, and improving systemic administration capabilities. Technologies for selective replication typically involve modifying viral promoters to be transcriptionally active only in cancer cells (e.g., telomerase promoters or specific oncogene pathway regulators) or deleting viral genes essential for replication in non-dividing normal cells but dispensable in rapidly dividing cancer cells. Furthermore, advancements in reverse genetics and cloning techniques allow for the precise insertion of immunomodulatory payloads, such as cytokines (e.g., GM-CSF used in T-VEC) or checkpoint inhibitors, directly into the viral genome, effectively converting the virus into an in-situ vaccine and drug delivery system. Recent technological breakthroughs focus heavily on vector modifications, including coating or encapsulation strategies, designed to shield the virus from neutralizing antibodies in the bloodstream, thereby enabling effective intravenous delivery to metastases distant from the primary injection site and expanding the utility of OVs beyond locally injectable tumors.

A critical area of technological focus involves engineering viruses to overcome intrinsic tumor resistance mechanisms. For instance, technologies are being developed to incorporate genes that degrade the dense extracellular matrix of solid tumors, improving viral access and spread (oncolysis). Another significant technological trend is the use of non-human viral platforms, such as those based on animal viruses (e.g., myxoma virus), which often bypass human pre-existing immunity, offering a distinct advantage in repeated dosing and systemic efficacy compared to human-derived vectors like HSV or Adenovirus, which are often susceptible to rapid immune clearance. This technological pivot toward non-human or highly attenuated human vectors is crucial for achieving the desired systemic impact necessary for treating widespread metastatic disease, a major limitation in early OV generations. The continuous refinement of these technologies is not merely incremental; it is essential for widening the therapeutic window and addressing the biological complexity inherent in advanced malignancies.

Advanced manufacturing technology also forms a crucial part of the OV technology landscape. High-yield, scalable production of live biological products requires specialized bioprocess engineering, utilizing large-scale bioreactors and continuous processing methods adapted from monoclonal antibody production but tailored for viral propagation. Key innovations here include serum-free suspension cell culture systems that maximize viral titer while minimizing batch-to-batch variability and sophisticated chromatography techniques for purification that ensure the removal of host cell contaminants and regulatory compliance. Furthermore, analytical technologies like quantitative PCR (qPCR) and advanced mass spectrometry are vital for rapidly and accurately characterizing the final product’s purity, potency, and infectivity—parameters strictly regulated by global health authorities. The convergence of precise genetic modification tools (CRISPR/Cas9) and advanced bioprocessing methods is defining the current state-of-the-art, enabling the translation of highly complex OV candidates from lab bench to commercial scale efficiently.

Regional Highlights

Regional dynamics play a crucial role in shaping the Oncolytic Virus Market, reflecting variations in regulatory environments, healthcare spending, and cancer prevalence. North America, particularly the United States, maintains market leadership due to substantial R&D expenditure, the presence of major biopharma innovators (like Amgen), and an efficient regulatory framework that facilitates rapid clinical translation for novel oncology products. High adoption rates are driven by sophisticated oncology practices and strong insurance coverage for advanced therapies. Europe represents the second-largest market, characterized by stringent yet harmonized regulatory processes (EMA) and strong government investment in clinical research, with countries like the UK, Germany, and France serving as critical hubs for clinical trials and early product adoption. European growth is slightly tempered by price containment pressures relative to the US market, necessitating robust pharmacoeconomic data demonstrating superior clinical value.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate (CAGR) over the forecast period, driven by the escalating burden of cancer, improving healthcare infrastructure, and specific government initiatives in countries like China and Japan aimed at local development and commercialization of advanced therapies. China, in particular, has seen rapid indigenous development and regulatory approvals of viral therapeutics, often mirroring Western innovations. Japan maintains a strong focus on regenerative medicine and advanced therapy, providing favorable regulatory pathways. However, market penetration in APAC can be uneven, heavily dependent on urbanization and insurance penetration, with significant opportunities remaining in large, underserved patient populations across India and Southeast Asia.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer long-term growth potential. LATAM markets are challenged by capital constraints and varying regulatory standards across countries, limiting the speed of adoption for high-cost biologics, though patient demand for novel options is high. In the MEA region, growth is concentrated in economically stable Gulf Cooperation Council (GCC) nations, which possess high-quality healthcare systems capable of implementing complex viral therapies. Investment in these emerging regions is often tied to strategic partnerships aimed at local clinical trials to generate region-specific efficacy data and secure eventual market authorization, indicating that future market expansion will rely heavily on localized pricing and accessibility models tailored to the regional economic realities.

- North America (U.S., Canada): Dominant market share fueled by robust R&D pipelines, high healthcare expenditure, and established infrastructure for complex biological manufacturing and administration.

- Europe (Germany, U.K., France, Italy): Second-largest market, characterized by government-supported clinical research and focus on combination therapy trials, balancing advanced technology adoption with cost-effectiveness considerations.

- Asia Pacific (China, Japan, South Korea): Fastest-growing region due to rising cancer incidence, increasing public and private healthcare spending, and favorable national biotech policies fostering local OV development.

- Latin America & MEA: Emerging markets requiring significant infrastructure investment; growth concentrated in high-income economies, driven by rising demand for advanced therapeutic alternatives in oncology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oncolytic Virus Market.- Amgen Inc.

- Oncolytics Biotech Inc.

- Bristol Myers Squibb Co.

- Merck & Co. Inc.

- Transgene SA

- PsiOxus Therapeutics Ltd.

- Replimune Group Inc.

- Vyriad Inc.

- Sorrento Therapeutics Inc.

- DNAtrix

- Cold Genesys Inc.

- Lokon Pharma AB

- Genelux Corporation

- Viralytics (acquired by Merck)

- BioVex Group (acquired by Amgen)

- Sillajen Inc.

- TILT Biotherapeutics

- Turnstone Biologics Corp.

- Capricor Therapeutics

- Virogin Biotech

Frequently Asked Questions

Analyze common user questions about the Oncolytic Virus market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for oncolytic viruses?

Oncolytic viruses operate through a dual mechanism: direct oncolysis (selectively infecting and lysing cancer cells, releasing progeny viruses) and immunogenic cell death, which stimulates a localized and systemic anti-tumor immune response against distant metastases (the abscopal effect).

Which viral platforms dominate the current Oncolytic Virus market?

The Herpes Simplex Virus (HSV) platform currently leads the market, primarily due to the commercial success of T-VEC (Talimogene laherparepvec) for melanoma. However, Adenovirus and Vaccinia Virus platforms are gaining momentum due to enhanced genetic modification capabilities and potential for intravenous administration.

What are the main challenges hindering the widespread adoption of OVs?

Key challenges include complex and costly GMP manufacturing processes, the potential for host immune system neutralization (generating antibodies against the virus), and difficulties in achieving effective systemic delivery to deep-seated solid tumors without loss of therapeutic efficacy.

How is the Oncolytic Virus market progressing toward systemic administration?

Current research heavily focuses on technological solutions such as engineering non-immunogenic viral platforms (e.g., non-human vectors) or using protective shielding/encapsulation strategies to evade neutralizing antibodies, thereby enabling successful intravenous delivery necessary for treating metastatic disease.

What role do combination therapies play in the future of the OV market?

Combination therapy is crucial. OVs are increasingly combined with immune checkpoint inhibitors (PD-1/PD-L1) to convert immunologically 'cold' tumors into 'hot' tumors, synergistically enhancing the efficacy of both agents and driving higher response rates in refractory patient populations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Oncolytic Virus Therapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oncolytic Virus Therapy Market Size Report By Type (HSV-based Oncolytic Viruses, Adenoviruses-based Oncolytic Viruses, Vesicular Stomatitis Virus-based Oncolytic Viruses, Newcastle Disease Virus-based Oncolytic Viruses), By Application (Melanoma, Prostate Cancer, Breast Cancer, Ovarian Cancer , Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Oncolytic Virus Therapy Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Newcastle Disease Virus-Based Oncolytic Viruses, Vesicular Stomatitis Virus-Based Oncolytic Viruses, Vaccinia Virus-Based Oncolytic Viruses, Adenoviruses-Based Oncolytic Viruses, HSV-Based Oncolytic Viruses), By Application (Ovarian Cancer, Breast Cancer, Prostate Cancer, Melanoma, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Oncolytic Virus Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (HSV-based Oncolytic Viruses, Adenoviruses-based Oncolytic Viruses, Vaccinia Virus-based Oncolytic Viruses, Vesicular Stomatitis Virus-based Oncolytic Viruses, Newcastle Disease Virus-based Oncolytic Viruses), By Application (Pharmaceutical, Health Care, Commerical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager