Online Beauty and Personal Care Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443331 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Online Beauty and Personal Care Products Market Size

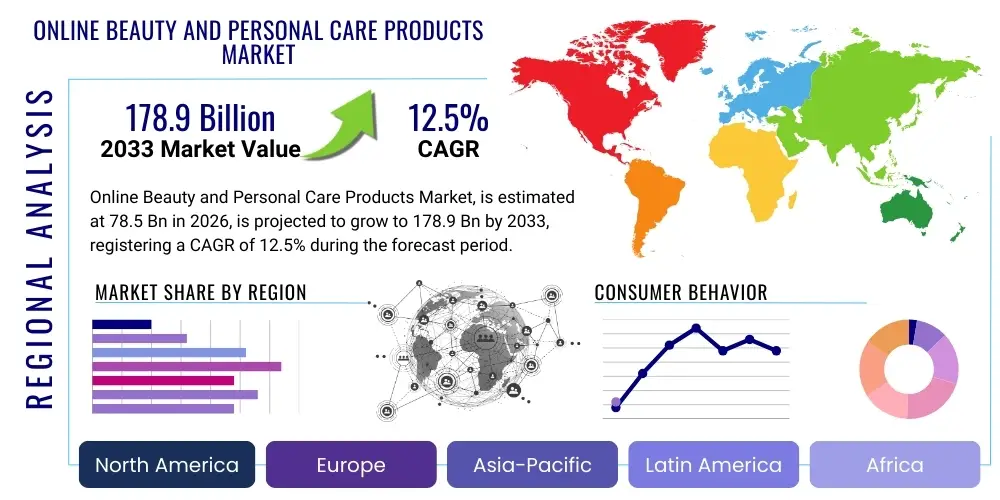

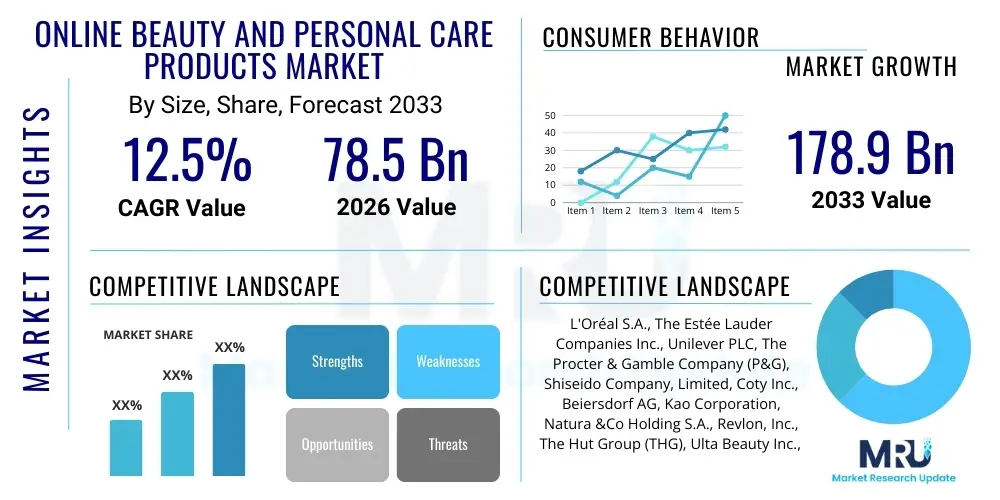

The Online Beauty and Personal Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 78.5 Billion in 2026 and is projected to reach USD 178.9 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing digital penetration globally, coupled with a rising consumer preference for convenient, personalized shopping experiences. The shift towards e-commerce platforms allows brands to bypass traditional retail barriers, offering a wider array of niche, specialized, and direct-to-consumer (DTC) products that cater to evolving consumer demands for ingredient transparency and sustainability.

The transition to online sales channels is accelerated by strong investments in digital infrastructure, particularly in emerging economies across Asia Pacific and Latin America. Market growth is also intrinsically linked to technological advancements in augmented reality (AR) and virtual try-on tools, which significantly mitigate the skepticism associated with purchasing beauty products without prior physical interaction. Furthermore, the proliferation of social media platforms and influencer marketing plays a critical role in driving discovery and conversion, making online channels indispensable for brand visibility and sales velocity in the competitive BPC landscape. The structural advantage of lower overheads for online retailers often translates into competitive pricing, further attracting price-sensitive consumers.

The market valuation reflects a significant pivot from physical retail dominance to a hybrid model where online presence is mandatory for sustainable growth. Factors such as changing demographics, rising disposable incomes in developing nations, and the consistent demand for anti-aging and specialized skincare solutions contribute heavily to this upward trajectory. Despite logistical challenges related to product handling and returns, continuous innovation in supply chain management and fulfillment centers, particularly concerning rapid delivery and secure packaging, ensures that the online channel remains the primary vector for future market expansion through 2033, consistently outpacing traditional retail growth rates.

Online Beauty and Personal Care Products Market introduction

The Online Beauty and Personal Care Products Market encompasses the sale of cosmetic, grooming, and wellness items through digital platforms, including brand websites, dedicated e-commerce marketplaces, social commerce channels, and mobile applications. This segment includes a broad spectrum of products such as skincare, haircare, makeup, fragrances, bath and body products, and men's grooming essentials. The primary mechanism driving this market is the consumer demand for convenience, accessibility to global brands, and the opportunity to research product ingredients and reviews extensively before purchase, characteristics uniquely facilitated by the digital environment. Furthermore, the market is characterized by a high degree of personalization, utilizing data analytics to tailor product recommendations and marketing efforts to individual consumer profiles, thereby enhancing the overall shopping journey.

Major applications of online BPC purchasing include routine replenishment of staple products, discovery of new and niche brands that lack widespread physical distribution, and the purchase of high-value items where detailed product information is critical. The core benefit to consumers is the ability to compare prices, access comprehensive user-generated content (reviews, tutorials), and shop 24/7 without geographic constraints. For businesses, the online channel offers lower operational costs compared to brick-and-mortar stores, direct communication with the consumer, and invaluable access to behavioral data necessary for rapid product iteration and targeted marketing strategies. This direct relationship fostered online allows brands to build stronger loyalty programs and gather immediate feedback, which is crucial in the fast-paced beauty industry.

Key driving factors propelling the growth of this market include the global expansion of high-speed internet connectivity and smartphone penetration, especially in densely populated Asian markets. The COVID-19 pandemic served as a significant accelerator, fundamentally shifting consumer habits towards digital purchasing for even non-essential items. Continuous advancements in digital retail technology, such as AI-powered customer service chatbots, virtual skin diagnostic tools, and sophisticated logistics networks capable of handling sensitive beauty products, further solidify the online channel's competitive advantage. The increasing focus on self-care and wellness, supported by influencers and digital media campaigns, translates directly into higher online sales volumes across all major product categories.

Online Beauty and Personal Care Products Market Executive Summary

The Online Beauty and Personal Care Products Market is exhibiting accelerated growth, defined by rapid digitalization and the strategic adoption of direct-to-consumer (DTC) models by established corporations and emerging startups alike. Business trends highlight a strong focus on sustainability and clean beauty, with consumers utilizing online platforms to meticulously verify ingredient sourcing and ethical claims. Personalization driven by machine learning algorithms is transforming the shopping experience, moving beyond simple recommendations to complex personalized product formulation suggestions, significantly boosting conversion rates and customer satisfaction. The operational shift towards hybrid fulfillment models, integrating digital storefronts with limited physical touchpoints for enhanced convenience, defines the current business landscape, emphasizing efficient last-mile delivery and seamless returns management as critical competitive differentiators in saturated markets.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive internet user bases in China and India, coupled with sophisticated e-commerce ecosystems and high social media engagement related to beauty trends, particularly K-Beauty and J-Beauty. North America and Europe, while mature, are characterized by a strong consumer demand for premium and specialized 'indie' brands accessible solely online, alongside robust adoption of sophisticated virtual try-on technologies. Emerging markets in Latin America and the Middle East and Africa (MEA) are rapidly catching up, benefiting from improved payment gateway infrastructure and a youthful demographic increasingly prioritizing self-grooming, positioning these regions for exponential near-term growth in the online BPC segment.

Segment trends reveal that Skincare continues its dominance, fueled by consumer awareness regarding preventative health and aging, with online channels being preferred for purchasing specialized serums, treatments, and devices. Cosmetics and makeup, while initially lagging due to the need for physical swatching, have been revitalized by advanced augmented reality (AR) technology that allows for accurate virtual color matching and application simulation, driving significant online sales in lip, eye, and foundation categories. Furthermore, men's grooming is emerging as a high-growth segment, with targeted online subscriptions offering discreet and convenient access to specialized shaving, beard care, and skincare products, addressing the specific needs of modern male consumers who favor online privacy and tailored advice.

AI Impact Analysis on Online Beauty and Personal Care Products Market

User queries regarding AI's impact on the Online Beauty and Personal Care Products Market predominantly revolve around three key areas: personalization capabilities (e.g., "How does AI recommend the right foundation shade?"), operational efficiency (e.g., "Will AI replace human customer service in beauty retail?"), and product innovation (e.g., "How is AI used to formulate new skincare ingredients?"). Consumers are highly interested in the accuracy and effectiveness of virtual try-on tools and diagnostic applications, seeking assurance that digital experiences can genuinely replicate or even surpass the fidelity of in-store consultations. There is also significant anticipation regarding AI's role in ingredient transparency and sustainability verification, alongside a foundational concern about data privacy as more personal biometric and skin data is captured and analyzed for personalized services.

The integration of Artificial Intelligence is fundamentally transforming the online beauty retail paradigm from a transactional model to a highly consultative and personalized experience. AI algorithms analyze vast datasets comprising customer purchase history, search behavior, uploaded photos, and external environmental factors to provide hyper-personalized product recommendations and virtual consultations. This capability is crucial for reducing product return rates, which are historically high in the online beauty sector due to color mismatch or incompatibility concerns. Furthermore, AI powers predictive analytics for inventory management, allowing retailers to forecast demand accurately based on fluctuating trends amplified across social media, minimizing waste, and optimizing supply chain flow in a sector characterized by rapid trend cycles.

In terms of internal operations and product development, AI is accelerating research and development (R&D) cycles. Machine learning models are utilized to screen vast libraries of compounds, predicting ingredient efficacy and potential side effects before costly physical trials commence, particularly benefiting the formulation of high-performance skincare and specialized treatments. For customer engagement, Natural Language Processing (NLP) enables sophisticated chatbots to handle complex customer queries, offering detailed ingredient information, application techniques, and managing order logistics, thereby providing scalable 24/7 support that maintains a high level of personalized interaction, which is critical for maintaining brand loyalty in the digital space.

- AI-Driven Personalization: Enabling hyper-personalized product recommendations, customized subscription box curation, and dynamic content tailored to individual skin and hair profiles.

- Virtual Try-On (VTO) and Diagnostics: Utilizing Augmented Reality (AR) and Machine Learning for accurate shade matching, virtual application simulation, and automated skin analysis through consumer device cameras.

- Optimized Supply Chain Management: Employing predictive analytics to forecast demand based on social trends, optimizing inventory levels, and enhancing warehouse robotics for faster fulfillment.

- Accelerated Product R&D: Leveraging AI to screen and formulate novel ingredients, predict stability, and optimize formulations for efficacy and safety, particularly in clean beauty development.

- Enhanced Customer Service: Implementing NLP-powered chatbots and virtual assistants to provide immediate, detailed product consultation and support, improving the overall digital customer journey.

- Fraud Detection and Security: Utilizing advanced algorithms to monitor online transactions, detect fraudulent activities, and ensure the security of consumer payment and personal data on e-commerce platforms.

DRO & Impact Forces Of Online Beauty and Personal Care Products Market

The Online Beauty and Personal Care Products Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form significant Impact Forces. Key drivers include the exponential increase in global internet and smartphone penetration, the rising influence of social media beauty influencers who democratize product knowledge, and the convenience and breadth of product selection offered by e-commerce platforms. These factors create strong upward pressure on market growth, encouraging consumers to shift from traditional in-store purchases to digital channels. However, the market faces restraints such as persistent consumer reluctance regarding color and texture accuracy without physical swatching, the logistical complexities and costs associated with handling fragile and temperature-sensitive products, and the heightened threat of counterfeiting that necessitates continuous technological investments in brand protection and supply chain security.

Opportunities for expansion are abundant, particularly in leveraging emerging technologies like Artificial Intelligence (AI) for hyper-personalization, the deployment of blockchain for ensuring ingredient transparency and ethical sourcing claims, and the strategic expansion into untapped geographical areas in Latin America and Southeast Asia. The rise of sophisticated digital diagnostic tools that provide objective skin assessments offers a major pathway to overcoming the accuracy restraint inherent in online sales, driving customer confidence. Furthermore, the increasing consumer focus on sustainability presents opportunities for brands to utilize the DTC online model to reduce packaging waste through refill programs and efficient direct shipping methods, aligning business practices with strong ethical consumer sentiment, thereby generating positive impact forces.

The ultimate impact forces shaping the market are centered around the consumer experience and digital trust. The integration of high-fidelity Augmented Reality (AR) virtual try-on capabilities is becoming a minimum expectation rather than a competitive edge, transforming the purchasing process from risky to reliable. The need for absolute supply chain integrity to combat counterfeit goods is paramount, requiring substantial investment in verification technologies to maintain consumer trust in product authenticity, especially when purchasing premium and luxury goods online. Ultimately, brands that successfully harmonize convenience, personalization, ingredient transparency, and technological trust will exert the strongest positive impact on market acceleration, while those failing to address digital security and product verification will face decelerating pressure.

Segmentation Analysis

The Online Beauty and Personal Care Products Market is comprehensively segmented based on product type, category, pricing strategy, distribution channel, and geography, reflecting the highly diversified nature of consumer demand and purchasing habits within the digital sphere. Analyzing these segments is critical for market players to tailor their product offerings, digital marketing campaigns, and logistics strategies effectively. The product type segmentation clearly indicates where consumer spending is concentrated, while the category segmentation reveals underlying trends such as the shift towards organic and specialized products. Pricing strategy segmentation differentiates between the mass market and the rapidly expanding luxury sector online, highlighting the consumer willingness to purchase high-end items digitally when trust elements are successfully established.

The segmentation by distribution channel is particularly insightful in the online realm, differentiating between sales generated by dedicated e-commerce marketplaces (e.g., Amazon, Alibaba), direct brand websites (DTC), and specialized online beauty retailers (e.g., Sephora, Ulta Beauty's online presence, Nykaa). This analysis helps understand the varying levels of consumer loyalty and price sensitivity across different platform types. Furthermore, the classification of sales into personalized subscription models versus transactional one-time purchases is crucial for determining the stability and predictability of future revenue streams. The dynamic growth of the market is underpinned by the simultaneous expansion across almost all segments, though skincare remains the financial bedrock, driven by routine repurchase cycles and high average order values (AOV).

Geographic segmentation confirms that market growth is currently polarized, with established e-commerce infrastructure supporting high penetration rates in North America and Europe, while exponential growth potential is unlocked in Asia Pacific due to burgeoning middle-class populations and rapidly improving logistical networks. Understanding these segmented dynamics allows for precise resource allocation, such as focusing on specialized K-Beauty trends within the APAC region or emphasizing ingredient transparency and sustainability features within European markets, ensuring that marketing efforts are contextually relevant and highly conversion-optimized based on localized consumer preferences and digital maturity levels.

- By Product Type:

- Skincare (Face Care, Body Care, Sun Care)

- Haircare (Shampoo, Conditioner, Hair Oil, Styling Products)

- Color Cosmetics (Face, Lip, Eye, Nail)

- Fragrances (Perfumes, Deodorants)

- Personal Hygiene (Soaps, Bath Products, Oral Care)

- By Category:

- Conventional Products

- Natural and Organic Products

- By Pricing Strategy:

- Mass Market Products

- Premium and Luxury Products

- By Gender:

- Women

- Men (Men's Grooming)

- Unisex/Gender-Neutral

- By Distribution Channel:

- E-commerce Marketplaces (Third-Party Retailers)

- Direct-to-Consumer (DTC) Brand Websites

- Omnichannel Retailers (Online Presence of Physical Stores)

- Subscription Box Services

Value Chain Analysis For Online Beauty and Personal Care Products Market

The value chain for the Online Beauty and Personal Care Products Market begins with the Upstream Analysis, which involves raw material sourcing, ingredient research and development, and primary manufacturing. Key players in this stage include specialized chemical suppliers, packaging manufacturers focused on sustainable and appealing digital presentation, and contract manufacturers responsible for formulation and production. The shift towards 'clean beauty' and exotic ingredients necessitates robust traceability systems at this upstream level. Manufacturers must ensure compliance with diverse international regulatory standards, which is particularly challenging given the global nature of online distribution. Operational efficiency at this stage directly impacts the cost of goods sold and the ability to maintain the authenticity and quality promised to the end consumer, making ethical sourcing and material transparency key competitive factors.

The subsequent stages focus on the midstream and downstream activities, encompassing branding, digital marketing, inventory management, and fulfillment. The Distribution Channel analysis is paramount for online sales. Direct channels (DTC) involve brands selling directly through their own e-commerce platforms, offering maximum control over pricing, consumer data, and brand messaging, often utilizing sophisticated Customer Relationship Management (CRM) tools. Indirect channels involve partnering with large e-commerce marketplaces (e.g., Amazon, Tmall) or specialized online beauty retailers (e.g., Sephora), which provide extensive reach and established logistics networks, although at the cost of margin compression and less control over the customer interface. Successful brands often employ an omnichannel strategy, harmonizing these direct and indirect distribution efforts to maximize market penetration.

Downstream analysis centers on the consumer purchasing experience and post-sale activities. This includes digital storefront management, payment processing security, last-mile logistics, and customer service (returns and inquiries). For online BPC, the quality of the virtual experience—such as high-resolution product imagery, compelling video content, user-generated reviews, and effective AR try-on tools—is critical to conversion. Final delivery logistics must be fast and reliable, minimizing damage and ensuring product integrity, particularly for high-value or fragile items. The feedback loop generated downstream, heavily reliant on consumer reviews and social media mentions, feeds back into upstream R&D and digital marketing strategies, creating a highly integrated and iterative value chain optimized for the rapid pace of the digital beauty economy.

Online Beauty and Personal Care Products Market Potential Customers

Potential customers for the Online Beauty and Personal Care Products Market are highly diverse but can primarily be segmented into digitally native Millennials and Gen Z individuals, discerning middle-aged consumers focused on anti-aging and specialized treatments, and the rapidly growing male grooming segment. The common denominator among these buyers is their high proficiency with digital tools, reliance on peer reviews and influencer recommendations, and a strong preference for convenience and product choice diversity. Millennials and Gen Z, in particular, often prioritize ethical sourcing, sustainability, and ingredient transparency, utilizing online channels to conduct rigorous research before committing to a purchase. They are highly responsive to personalized marketing efforts, dynamic content, and community engagement features hosted on e-commerce platforms.

A second major category includes consumers in geographically underserved areas, or those seeking access to international niche brands that are unavailable through local physical retail channels. For these buyers, the online market breaks down traditional geographical barriers, offering an unparalleled global catalog of specialized, organic, or culturally specific beauty products (e.g., Korean or Ayurvedic treatments). This segment often exhibits high brand loyalty once a trusted online source is established. Furthermore, time-constrained professionals and suburban populations who prefer avoiding crowded retail environments represent another key buyer group, valuing the ability to restock routine items quickly and efficiently through subscription models or routine one-time purchases facilitated by streamlined digital interfaces.

Finally, the rapid expansion of the men's grooming market represents a significant untapped customer base. Male consumers often seek discreet, straightforward, and educational purchasing experiences, characteristics well-suited to the online environment. Targeted advertising and subscription services that simplify the replenishment process for shaving, beard care, and specialized men's skincare products appeal strongly to this demographic. These buyers value detailed, technical product information over experiential retail, reinforcing the dominance of the online platform as the preferred channel for men's beauty and personal care purchases globally. Effective market strategies must therefore cater to the distinct informational needs and consumption patterns of these varied end-user groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 78.5 Billion |

| Market Forecast in 2033 | USD 178.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., The Estée Lauder Companies Inc., Unilever PLC, The Procter & Gamble Company (P&G), Shiseido Company, Limited, Coty Inc., Beiersdorf AG, Kao Corporation, Natura &Co Holding S.A., Revlon, Inc., The Hut Group (THG), Ulta Beauty Inc., Sephora (LVMH), Amazon.com, Inc. (as a retailer), Nykaa E-Retail Pvt. Ltd. (FSN E-commerce), Johnson & Johnson, Amorepacific Corporation, Sally Beauty Holdings, Inc., L'Occitane en Provence, Kenvue Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Beauty and Personal Care Products Market Key Technology Landscape

The technological landscape of the Online Beauty and Personal Care Products Market is defined by a rapid adoption of sophisticated digital tools aimed at bridging the gap between physical experience and digital commerce. Central to this transformation is the widespread implementation of Augmented Reality (AR) and Virtual Reality (VR) technologies, specifically utilized for Virtual Try-On (VTO) applications, allowing consumers to digitally sample makeup shades, hairstyles, and accessories using their smartphones or computer cameras. This technology significantly enhances consumer confidence in purchasing color-specific products, thereby reducing return rates and boosting conversion. Furthermore, the foundational e-commerce platforms are continuously upgraded with advanced Search Engine Optimization (SEO) and personalization algorithms powered by Machine Learning (ML), ensuring that product discovery is highly relevant to individual browsing histories and purchase intent.

Another crucial element of the technological ecosystem is the deployment of Artificial Intelligence (AI) for consumer diagnostics and consultation. AI-powered applications analyze images of skin or hair, utilizing sophisticated algorithms to detect conditions, recommend specific treatment regimens, and track progress over time. This mimics the personalized advice historically provided by dermatologists or in-store beauty consultants, offering a scalable, immediate, and data-driven consultation service. Concurrently, the operational side relies heavily on advanced logistics and supply chain management systems, including automated warehousing, IoT tracking devices, and predictive inventory models, all essential for managing the global distribution of frequently replenished, often temperature-sensitive beauty products efficiently.

Finally, the growing importance of digital trust and transparency has driven the adoption of blockchain technology for supply chain traceability, primarily used to verify the authenticity of premium products and track the ethical sourcing of ingredients, particularly within the 'clean beauty' segment. Moreover, the integration of seamless payment technologies, including mobile wallets, buy-now-pay-later (BNPL) schemes, and cryptocurrency options in select regions, improves transaction convenience and expands the potential consumer base. The synergy between these customer-facing technologies (AR/AI) and operational technologies (ML/Logistics) creates a robust digital infrastructure necessary to support the high growth and complexity inherent in the modern online BPC market.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive consumer bases in China and India, coupled with high social media engagement and the global influence of K-Beauty (South Korea) and J-Beauty (Japan). Rapid urbanization, rising disposable incomes, and sophisticated mobile commerce penetration make this region highly dynamic. Chinese platforms like Tmall and JD.com dominate the market, offering specialized cross-border e-commerce solutions that attract global brands. The region’s youth population is particularly engaged in purchasing through live commerce and influencer partnerships, leading to shorter product adoption cycles and extremely high growth rates, especially in the skincare and color cosmetics segments.

- North America: North America represents a mature, high-value market characterized by early adoption of technology and a strong preference for premium, independent, and ethical brands. Growth is fueled by sophisticated omnichannel integration, where consumers seamlessly transition between online research, virtual try-on, and purchase/return at physical points, often utilizing online retailers like Ulta Beauty and Sephora. The market is highly saturated, making competitive differentiation through personalized customer experiences, AI-driven diagnostics, and efficient subscription services critical for maintaining growth velocity.

- Europe: The European market, encompassing Western and Eastern Europe, shows strong demand for certified natural, organic, and sustainable beauty products, often utilizing digital channels to verify complex ingredient lists and ethical sourcing claims. Regulations regarding product testing and packaging are stringent, necessitating technologically advanced compliance and transparency platforms. Key growth drivers include the mature e-commerce infrastructure, high consumer awareness regarding product safety, and the increasing trend of shopping directly from brand websites (DTC) to ensure authenticity and receive tailored loyalty benefits.

- Latin America (LATAM): LATAM is a high-potential emerging market, characterized by fast-growing internet penetration and a young, beauty-conscious consumer base, particularly in Brazil and Mexico. The market faces infrastructural challenges related to logistics and payment processing, but rapid improvements in digital infrastructure and the expansion of mobile banking are unlocking substantial online growth. Consumers often rely heavily on social media platforms for product discovery and favor localized e-commerce solutions that accept diverse payment methods.

- Middle East and Africa (MEA): The MEA market, while varied, shows high spending power for luxury and premium beauty products in the GCC countries (UAE, Saudi Arabia). The shift to online is driven by convenience, discretion, and access to international luxury brands not always physically available. Mobile commerce is rapidly increasing, supported by government initiatives in digitalization. Challenges include logistical complexities in remote areas and the need for localized content and payment options, but the high average transaction value for premium categories makes this a strategically important growth region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Beauty and Personal Care Products Market.- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Unilever PLC

- The Procter & Gamble Company (P&G)

- Shiseido Company, Limited

- Coty Inc.

- Beiersdorf AG

- Kao Corporation

- Natura &Co Holding S.A.

- Revlon, Inc.

- The Hut Group (THG)

- Ulta Beauty Inc.

- Sephora (LVMH)

- Amazon.com, Inc. (as a retailer)

- Nykaa E-Retail Pvt. Ltd. (FSN E-commerce)

- Johnson & Johnson

- Amorepacific Corporation

- Sally Beauty Holdings, Inc.

- L'Occitane en Provence

- Kenvue Inc.

Frequently Asked Questions

Analyze common user questions about the Online Beauty and Personal Care Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Online Beauty and Personal Care Market?

The market is primarily driven by rising global internet and smartphone penetration, the strong influence of social media marketing and beauty influencers, and technological advancements such as AI and AR providing personalized virtual try-on and diagnostic tools, enhancing consumer trust and convenience in digital purchasing.

Which product segment dominates online beauty sales?

Skincare products consistently dominate the online beauty market in terms of revenue, fueled by consumer focus on preventative health, anti-aging solutions, high average order values for specialized treatments, and the routine necessity of product replenishment which is ideally suited for e-commerce and subscription models.

How is AI impacting consumer confidence in online beauty purchases?

AI significantly boosts consumer confidence by enabling highly accurate personalized product recommendations and sophisticated virtual try-on (VTO) features. These tools mitigate the risk of purchasing the wrong shade or formulation, thereby lowering return rates and improving the overall satisfaction with the digital shopping experience.

What are the primary challenges facing online beauty retailers?

Key challenges include managing the high logistical costs associated with shipping fragile or temperature-sensitive goods, overcoming consumer reluctance due to the inability to physically test textures and scents, and combating the pervasive threat of counterfeit products sold via third-party marketplaces.

Which geographic region offers the highest growth opportunity for online BPC?

The Asia Pacific (APAC) region, specifically countries like China and India, presents the highest growth opportunity, driven by burgeoning middle classes, rapid urbanization, extensive mobile commerce adoption, and established local e-commerce giants facilitating both domestic and cross-border beauty trade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager