Online Course Booking System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441423 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Online Course Booking System Market Size

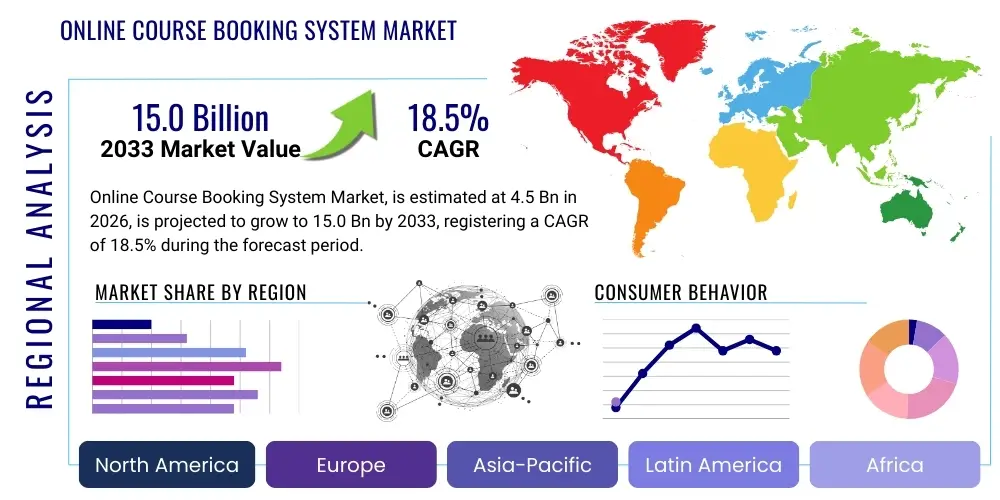

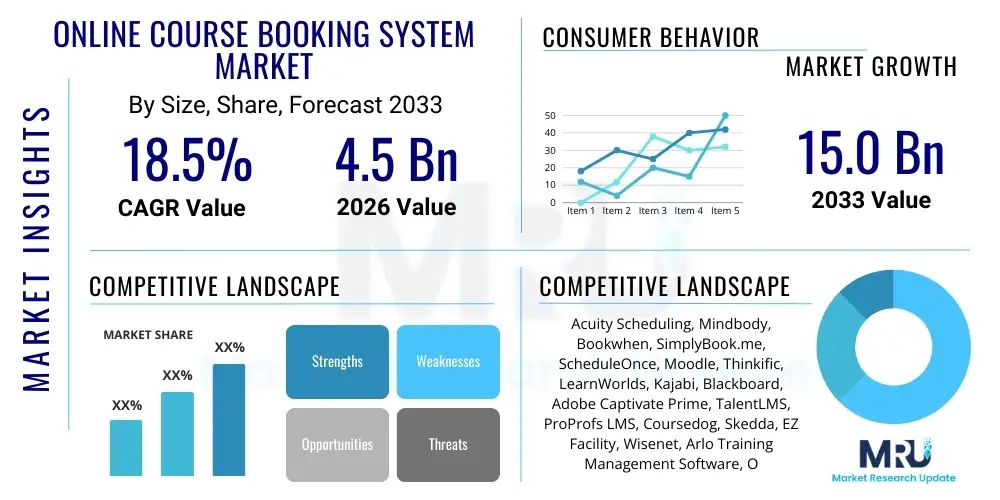

The Online Course Booking System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 15.0 Billion by the end of the forecast period in 2033.

Online Course Booking System Market introduction

The Online Course Booking System Market encompasses software solutions designed to automate the administrative tasks associated with managing, scheduling, registering, and processing payments for educational and training courses. These systems provide a centralized platform for institutions, corporate trainers, and independent educators to manage their full course catalog online, offering features like calendar integration, student portals, waitlist management, and automated communications. The foundational purpose of these systems is to enhance efficiency, reduce manual errors, and provide a seamless, 24/7 booking experience for end-users, thereby maximizing enrollment rates and improving resource utilization for course providers across various educational modalities, including hybrid, synchronous, and asynchronous learning environments. The proliferation of digital learning initiatives, accelerated significantly by global shifts towards remote engagement, serves as the primary impetus driving market expansion.

Product descriptions within this market vary widely, ranging from specialized scheduling tools for small, skill-based workshops to comprehensive Learning Management System (LMS) integrated booking platforms utilized by large universities and multinational corporations. Key features often include robust payment gateway integration (supporting credit cards, digital wallets, and institutional billing), customizable registration forms tailored to compliance requirements (such as GDPR or specific professional certifications), and comprehensive reporting dashboards for tracking enrollment metrics, financial performance, and resource allocation. Furthermore, these modern systems often feature Application Programming Interface (API) integrations with third-party tools like Customer Relationship Management (CRM) systems and marketing automation platforms, positioning them as critical components of the broader educational technology (EdTech) infrastructure used by institutions globally.

Major applications of online course booking systems span across traditional academic sectors, professional development, and specialized vocational training. Educational institutions leverage them for continuing education programs and extracurricular enrollment; corporate entities use them for mandatory compliance training and upskilling initiatives; and independent trainers rely on them to manage high volumes of personal coaching sessions or small group classes. The principal benefits derived from adopting these systems include significant time savings in administrative tasks, improved revenue collection accuracy, enhanced customer satisfaction due to ease of use, and detailed data analytics capabilities that inform strategic course development and marketing efforts. These driving factors, coupled with the global push for accessible and flexible learning options, underscore the continued high growth trajectory projected for the market through the forecast period.

Online Course Booking System Market Executive Summary

The Online Course Booking System market is experiencing rapid acceleration driven by pervasive digital transformation in the education sector and the increasing demand for flexible, modular learning pathways. Key business trends indicate a strong movement toward platform consolidation, where dedicated booking systems are integrating deeper functionalities, often blurring the lines between scheduling tools and full-scale LMS solutions, offering providers a unified operational backend. Furthermore, there is a notable competitive shift emphasizing mobile responsiveness and superior user experience (UX), recognizing that seamless access via smartphones is paramount for attracting and retaining modern students and corporate trainees. Investment flows are heavily directed towards scalable cloud-based solutions, favoring Software-as-a-Service (SaaS) models which lower initial capital expenditure and facilitate quick deployment across diverse organizational sizes, from micro-businesses to large academic consortia seeking agile administrative technology upgrades.

Regionally, North America and Europe maintain leading positions due to established educational technology infrastructures and high penetration rates of cloud services, characterized by stringent data security requirements and sophisticated platform utilization in universities and corporate training centers. However, the Asia Pacific (APAC) region is poised for the most explosive growth, fueled by massive government investments in digital education initiatives, a rapidly expanding middle class seeking professional certification, and the swift adoption of mobile-first learning technologies, particularly in populous countries like India and China. Latin America and MEA are also demonstrating significant adoption, focusing primarily on solutions that facilitate cross-border access to international courses and address localized payment processing complexities, indicating a global acceptance of online booking as a necessity rather than a luxury for modern educational service delivery.

Segment trends highlight the dominance of cloud-based deployment due to scalability, lower maintenance, and rapid updates, making it the preferred choice for both startups and established institutions adapting to volatile market demands. Regarding end-users, corporate trainers and educational institutions remain the largest revenue contributors, yet the independent tutor and small course provider segment is showing the fastest adoption rate, primarily driven by affordable SaaS options that empower solopreneurs to manage their business operations professionally. Technology segmentation also underscores the increasing relevance of Artificial Intelligence (AI) and Machine Learning (ML) features, particularly for dynamic pricing models, personalized course recommendations, and optimizing scheduling algorithms to reduce resource conflicts, driving demand for intelligent, predictive booking solutions capable of maximizing utilization rates.

AI Impact Analysis on Online Course Booking System Market

Common user questions regarding AI's impact on the Online Course Booking System Market often center on its ability to truly personalize the student journey, optimize institutional resource utilization, and automate complex decision-making processes beyond basic scheduling. Users frequently ask: "How can AI dynamically adjust course availability based on predicted demand?" and "Will AI integration enhance the accuracy of prerequisite checking and skill-gap identification?" There is a strong expectation that AI should move booking systems from static reservation tools to proactive advisory platforms. Key themes emerging from these inquiries include the demand for intelligent scheduling that predicts cancellations and suggests optimal rebooking times, the use of ML to analyze historical enrollment data for precise demand forecasting, and the implementation of Natural Language Processing (NLP) within virtual assistants to handle routine booking queries, thereby significantly reducing the administrative load on human staff and ensuring 24/7 service availability for a global user base.

The implementation of predictive analytics, powered by Artificial Intelligence, is revolutionizing how course providers manage capacity and market their offerings. By analyzing vast datasets related to user behavior, historical enrollment trends, regional economic indicators, and seasonal fluctuations, AI models can forecast demand for specific courses with high accuracy. This capability allows institutions to dynamically adjust class sizes, launch new sessions proactively, or allocate instructor resources more efficiently, minimizing the risk of underutilized capacity or excessive waiting lists. Furthermore, AI algorithms are crucial for optimizing pricing strategies, introducing dynamic pricing based on time until the course start, current demand elasticity, and competitor pricing, ensuring revenue management is maximized while maintaining competitive enrollment levels in volatile educational markets.

Beyond optimization, AI profoundly influences the user experience through enhanced personalization and automated support functions. Machine Learning models analyze individual student profiles—including past course history, performance data, stated career goals, and browsing behavior—to offer hyper-personalized course recommendations directly within the booking interface. This shift from generic listings to curated suggestions significantly improves conversion rates and student satisfaction. Moreover, AI-driven chatbots and virtual assistants are seamlessly integrated to handle the bulk of customer support related to booking, cancellation policies, payment issues, and prerequisite clarifications, providing instantaneous responses, freeing up administrative staff for complex tasks, and ensuring a high level of service quality irrespective of time zone.

- AI optimizes dynamic pricing models based on real-time demand and inventory.

- Predictive analytics forecasts enrollment capacity needs, reducing resource wastage.

- Machine learning enhances personalized course recommendations for individual students.

- NLP-powered chatbots automate 24/7 customer support for booking queries.

- AI assists in intelligent scheduling, minimizing conflicts and optimizing instructor utilization.

- Automated compliance checking ensures students meet prerequisites before booking confirmation.

DRO & Impact Forces Of Online Course Booking System Market

The market is significantly influenced by a powerful combination of Driving factors, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological trajectory. Major drivers include the global mandate for digital transformation across educational sectors, the increasing adoption of asynchronous and blended learning models requiring robust scheduling tools, and the pressure on institutions and corporations to deliver flexible, easily accessible training programs. These drivers amplify the need for sophisticated, centralized booking systems that can handle complex scheduling logistics across multiple locations, time zones, and instructor availability constraints, pushing course providers toward immediate technological modernization to remain competitive in a highly fragmented global learning market.

However, the market faces significant Restraints, primarily stemming from integration complexities and data security concerns. Many established educational institutions operate with legacy management systems (LMS or SIS) that lack seamless API compatibility, making the integration of a new, high-performance booking engine costly and time-consuming. Furthermore, given the sensitive nature of student data (personal information, academic performance, financial transactions), strict global regulatory frameworks like GDPR and FERPA impose high compliance costs and necessitate advanced security protocols, which can deter smaller providers from adopting high-end, centralized booking solutions. The initial capital expenditure and the need for specialized technical expertise for large-scale customization also present barriers to entry for some potential users.

Despite these challenges, substantial Opportunities exist, particularly in the expansion into niche segments such as specialized vocational training, short-course bootcamps, and professional regulatory certification bodies that require mandatory, recurrent bookings. The ongoing shift toward micro-credentialing and continuous professional development (CPD) mandates high-frequency, low-duration course enrollment, perfect use cases for streamlined online booking systems. Impact forces, which are the external pressures dictating market evolution, include technological disruption (AI/ML integration), changing consumer preferences (demand for mobile-first, instant booking), and economic dynamics (focus on cost efficiency through automation). These forces emphasize that future market success depends heavily on scalability, superior security features, and the ability to offer highly customized, white-labeled solutions to maintain brand integrity for diverse institutional clients.

Segmentation Analysis

The Online Course Booking System Market is segmented across several critical dimensions, including deployment model, end-user type, course type, and system component, providing a multifaceted view of market dynamics and catering to the varied needs of global course providers. Understanding these segments is crucial for technology vendors seeking to tailor their product offerings, sales strategies, and marketing efforts towards high-growth areas. The segmentation reflects the maturity of the EdTech landscape, moving beyond simple scheduling to specialized solutions that address the unique administrative, logistical, and compliance challenges inherent in different educational contexts, from K-12 administration to advanced corporate compliance training ecosystems.

The Deployment Model segmentation, notably between Cloud (SaaS) and On-Premise solutions, highlights the industry's directional shift. Cloud solutions dominate due to their accessibility, flexibility, and reduced operational burden, aligning perfectly with the dynamic scaling requirements of modern online education delivery. Meanwhile, the End-User segmentation reveals that while educational institutions represent a large, stable revenue base, the fastest-growing adoption is observed in the Independent Trainers and Corporate segment, where streamlined administrative tools are essential for scaling a business rapidly without substantial overhead. This granular breakdown enables stakeholders to accurately assess market penetration rates and identify underserved populations.

- Deployment Model:

- Cloud-based (SaaS)

- On-Premise

- End-User:

- Educational Institutions (Universities, K-12, Vocational Schools)

- Corporate Trainers and Enterprises

- Independent Tutors and Small Course Providers

- Government and Public Sector

- Course Type:

- Academic Courses (Degree, Diploma)

- Professional Certification and Training

- Skill-Based and Vocational Workshops

- Component:

- Software/Platform (Core Booking Engine)

- Services (Implementation, Training, Consulting, Support)

Value Chain Analysis For Online Course Booking System Market

The value chain for the Online Course Booking System market begins with the Upstream Analysis, focusing on core technology development, data center infrastructure, and foundational software elements. This initial stage involves platform architects, specialized software developers, and cloud service providers (like AWS, Azure, or Google Cloud) who supply the computing power and infrastructure necessary for scalable, secure, and reliable SaaS delivery. Key activities at this stage include intellectual property generation, algorithm development (especially for scheduling optimization and AI integration), and ensuring compliance with global data localization and security standards. Efficiency in this upstream segment directly impacts the scalability and technical sophistication of the final product offered to end-users.

Midstream activities revolve around the platform providers themselves—the vendors who develop, customize, and maintain the booking systems. This stage involves continuous product development, integration with third-party tools (LMS, CRM, payment gateways), and rigorous quality assurance testing. The distribution channel analysis is critical here: most sales utilize Direct channels via internal sales teams focusing on large institutional contracts, offering customized enterprise solutions and dedicated implementation services. Simultaneously, Indirect channels, such as authorized resellers, EdTech consultancies, and digital marketplaces, play a significant role in penetrating the SMB and independent tutor segments, providing broader geographical reach and localized support, particularly in emerging markets where direct sales presence may be limited.

The Downstream Analysis focuses on the end-user implementation and ongoing service provision. This includes system implementation (often handled by the vendor's professional services team), administrator training, and integration with the client's existing Student Information Systems (SIS). Customer support and platform maintenance services are crucial, as system downtime or scheduling errors can severely disrupt course delivery and revenue generation. The end of the value chain is focused on maximizing customer lifetime value (CLV) through subscription retention, continuous feature updates based on user feedback, and leveraging usage data to refine product offerings, thereby solidifying the platform's role as an indispensable operational tool within the educational ecosystem.

Online Course Booking System Market Potential Customers

Potential customers, or End-Users/Buyers, for online course booking systems are broadly categorized by their scale, operational complexity, and specific educational focus. Educational Institutions form a cornerstone customer base, encompassing universities, community colleges, vocational training centers, and increasingly, large K-12 districts managing extensive extracurricular and remedial programs. These clients require robust, high-volume systems capable of managing thousands of concurrent enrollments, handling complex prerequisites, and integrating seamlessly with campus-wide financial and academic record systems (SIS). Their procurement process often involves lengthy security and compliance reviews, prioritizing platforms that demonstrate verifiable data integrity and scalability across diverse departments.

The Corporate Training and Enterprise segment represents another high-value customer group. These clients, ranging from Fortune 500 companies to specialized consulting firms, utilize booking systems primarily for internal employee development, compliance training (e.g., certifications required by OSHA or industry regulators), and onboarding programs. Their need is often focused on tracking attendance, measuring training effectiveness, and generating audit-ready reports, necessitating strong integration with Human Resources Information Systems (HRIS) and performance management platforms. The requirement here is less about public enrollment and more about sophisticated internal access control, automated tracking, and ensuring mandated training is booked and completed within specific regulatory windows.

The rapidly expanding Independent Tutors and Small Course Providers segment (including individual coaches, workshop organizers, and specialized online bootcamps) constitutes the fastest-growing segment in terms of customer volume. These users are typically attracted to low-cost, high-flexibility SaaS models that are easy to set up without technical expertise. Their focus is on maximizing their time by automating scheduling, reducing no-shows through automated reminders, and integrating simple payment solutions. While their individual contract value is smaller, their sheer number and rapid market entry drive significant overall demand, making platforms that offer tiered, scalable subscription models highly competitive in this dynamic and entrepreneurial sector of the global education market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 15.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acuity Scheduling, Mindbody, Bookwhen, SimplyBook.me, ScheduleOnce, Moodle, Thinkific, LearnWorlds, Kajabi, Blackboard, Adobe Captivate Prime, TalentLMS, ProProfs LMS, Coursedog, Skedda, EZ Facility, Wisenet, Arlo Training Management Software, Omnipress, Learning Cart |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Course Booking System Market Key Technology Landscape

The technological landscape of the Online Course Booking System market is defined by the integration of core scheduling mechanisms with advanced cloud computing infrastructure, leveraging Software-as-a-Service (SaaS) architecture for maximized accessibility and scalability. Modern systems rely heavily on robust API frameworks to facilitate seamless, bi-directional data exchange with essential enterprise systems such as Student Information Systems (SIS), Customer Relationship Management (CRM) tools, and various global payment gateways. This reliance on open APIs ensures that the booking engine does not operate as a silo but rather as an integral layer within the institution's overall technological stack, enabling real-time data synchronization necessary for accurate enrollment tracking, financial reconciliation, and automated student communications throughout the entire lifecycle, from initial interest to post-course feedback mechanisms.

A critical technology driving differentiation is the adoption of advanced database management techniques optimized for real-time concurrency and transaction processing. Since course enrollments often spike immediately following registration windows opening, the underlying database structure must efficiently handle thousands of simultaneous bookings without latency or data corruption, which is paramount for high-stakes professional certifications and competitive academic courses. Furthermore, the integration of security technologies, including multi-factor authentication (MFA), end-to-end data encryption (both in transit and at rest), and compliance with international standards such as ISO 27001, forms a non-negotiable part of the technology offering, particularly when contracting with large governmental or highly regulated institutional clients who prioritize data governance above all other functional capabilities.

Looking forward, the technology landscape is increasingly incorporating predictive and prescriptive technologies. Machine Learning (ML) algorithms are being utilized not just for forecasting demand but also for optimizing server load distribution during peak times, ensuring platform stability. Moreover, the development of sophisticated mobile applications, which offer identical functionality to the desktop web interface, is crucial, driven by the mobile-first behavior of both course providers and end-users. Future success hinges on vendors' ability to offer a highly configurable front-end interface (allowing clients to maintain brand consistency) powered by a complex, secure, and intelligent back-end engine that minimizes human intervention through high levels of automation and AI-driven decision support systems regarding resource allocation.

Regional Highlights

- North America: Market dominance driven by early adoption of cloud technology, high expenditure on EdTech infrastructure, and the presence of numerous global platform providers.

- Europe: Strong growth propelled by stringent compliance requirements (GDPR) driving demand for secure, high-integrity systems, and widespread adoption in professional development and vocational training sectors.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive government investment in digital education, rapid growth in online tutoring markets, and expanding internet penetration in emerging economies.

- Latin America (LATAM): Emerging market characterized by increasing demand for accessible, multi-lingual platforms that address localized payment challenges and support rapid expansion of private education providers.

- Middle East & Africa (MEA): Growth concentrated in GCC nations due to substantial government initiatives promoting digital skills and higher education modernization, requiring specialized solutions for large-scale institutional management.

North America currently holds the largest share of the Online Course Booking System Market, primarily due to the maturity of its educational technology ecosystem and the significant presence of major SaaS providers and cloud computing hubs. Universities and large corporate training entities in the US and Canada have been pioneers in adopting comprehensive administrative software to manage complex academic calendars, student recruitment logistics, and mandatory compliance training schedules. The market penetration is exceptionally high, leading to a focus on advanced feature integration, such as sophisticated analytics dashboards, AI-driven resource optimization tools, and seamless interoperability with high-end Learning Management Systems (LMS). Competitive dynamics here often revolve around platform robustness, advanced security certifications, and the ability to demonstrate quantifiable Return on Investment (ROI) through administrative time savings and enhanced enrollment rates across diverse educational modalities, including executive education and non-credit programs.

Europe represents a highly lucrative but complex market, characterized by regulatory diversity and a strong emphasis on data privacy and consumer protection, primarily dictated by the General Data Protection Regulation (GDPR). This regulatory environment necessitates that booking system vendors prioritize localized hosting, robust consent mechanisms, and transparent data processing practices, making regional expertise a significant competitive advantage. Demand is particularly strong in the professional certification and vocational training sectors, where continuous upskilling is mandated by EU directives and national professional bodies. Countries such as the UK, Germany, and France show high adoption, focusing on systems that support multiple languages, currencies, and complex taxation requirements, driving demand for highly configurable and compliant booking solutions that minimize legal risk for educational providers operating across borders.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally driven by demographic factors, including a massive youth population requiring vocational training, rapidly growing internet and mobile connectivity, and substantial governmental push towards digital learning initiatives in countries like India, China, and Southeast Asian nations. The APAC market segment is characterized by a strong preference for mobile-first solutions and systems capable of handling high transaction volumes at low latency, often catering to large-scale, high-frequency online tutoring and test preparation markets. Localization in terms of language support and integration with region-specific payment methods (e.g., Alipay, WeChat Pay) is crucial for market success, where competitive pricing and ease of deployment often outweigh the need for highly complex, customized enterprise functionalities.

Latin America (LATAM) and the Middle East and Africa (MEA) are categorized as emerging markets, showing accelerated, albeit targeted, growth. In LATAM, adoption is being driven by the expansion of private education institutions seeking efficiency and the need for standardized systems to manage courses across different regional campuses and languages (Spanish and Portuguese). The key market challenge and opportunity in this region lie in facilitating diverse, often complex, local currency payment processing and managing varying levels of digital infrastructure quality. MEA, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in educational modernization as part of national economic diversification strategies (e.g., Saudi Vision 2030, UAE National Agenda). This investment creates high demand for enterprise-level booking systems suitable for large state-funded universities and specialized professional development centers, where the emphasis is on integration with national identity management systems and world-class security protocols to protect sensitive citizen data and maintain government compliance.

Collectively, the global regional landscape underscores a universal trend toward digital automation in education administration. North America and Europe lead in maturity and technological sophistication, emphasizing AI and deep integration, while APAC and emerging markets lead in volume growth, focusing on accessibility, localization, and high-frequency transaction capabilities. Vendors must maintain a globally scalable core platform while offering targeted, region-specific configurations regarding compliance, currency, and local language support to capture growth across all these diverse operational landscapes, recognizing the distinct purchasing behaviors and regulatory pressures prevalent in each geographic cluster.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Course Booking System Market.- Acuity Scheduling (Squarespace)

- Mindbody

- Bookwhen

- SimplyBook.me

- ScheduleOnce (Setmore)

- Moodle

- Thinkific

- LearnWorlds

- Kajabi

- Blackboard

- Adobe Captivate Prime

- TalentLMS

- ProProfs LMS

- Coursedog

- Skedda

- EZ Facility

- Wisenet

- Arlo Training Management Software

- Omnipress

- Learning Cart

Frequently Asked Questions

Analyze common user questions about the Online Course Booking System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating to a cloud-based course booking system?

The primary benefit of migrating to a cloud-based (SaaS) course booking system is enhanced operational scalability, enabling organizations to handle rapid fluctuations in enrollment volume without requiring significant internal IT infrastructure investment. Cloud platforms also ensure automatic updates, disaster recovery, and global accessibility.

How does AI impact resource allocation within course booking platforms?

AI significantly impacts resource allocation by utilizing machine learning algorithms to forecast student demand, predict peak enrollment periods, and optimize the scheduling of instructors, classrooms, and specialized equipment, minimizing conflicts and maximizing the utilization rate of expensive institutional assets.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region exhibits the highest growth potential, driven by vast governmental investments in digital education infrastructure, a burgeoning online learning consumer base, and the rapid adoption of mobile-centric educational technology solutions across developing economies.

What are the main integration challenges associated with implementing new booking software?

The main integration challenges involve achieving seamless data synchronization between the new booking system and pre-existing institutional legacy systems, such as Student Information Systems (SIS), financial management software, and Human Resources Information Systems (HRIS), often requiring complex API development and data mapping.

Are online course booking systems primarily targeted towards academic institutions or corporate training?

While traditionally strong in academic settings, modern online course booking systems are increasingly crucial for both segments. Corporate training shows high growth due to mandates for continuous professional development and compliance training, driving demand for systems with strong tracking and reporting capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager