Online Gambling and Sports Betting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443189 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Online Gambling and Sports Betting Market Size

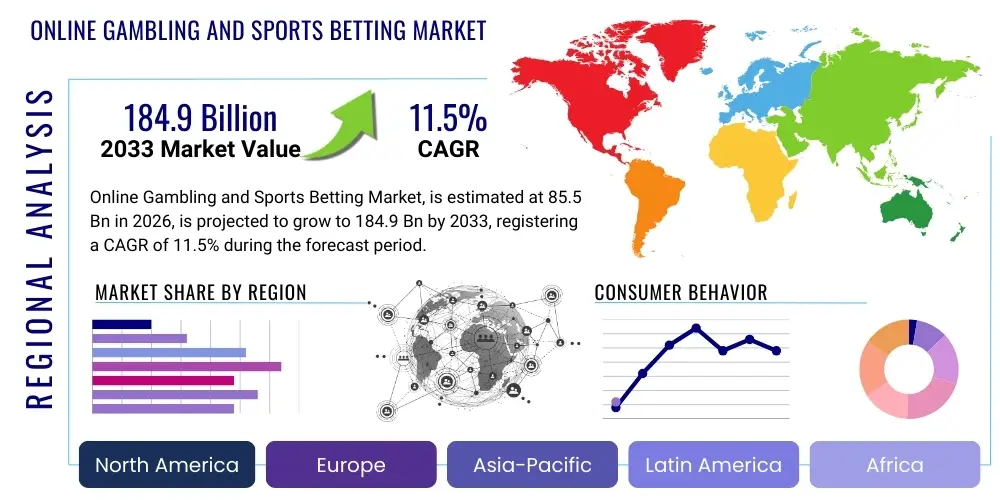

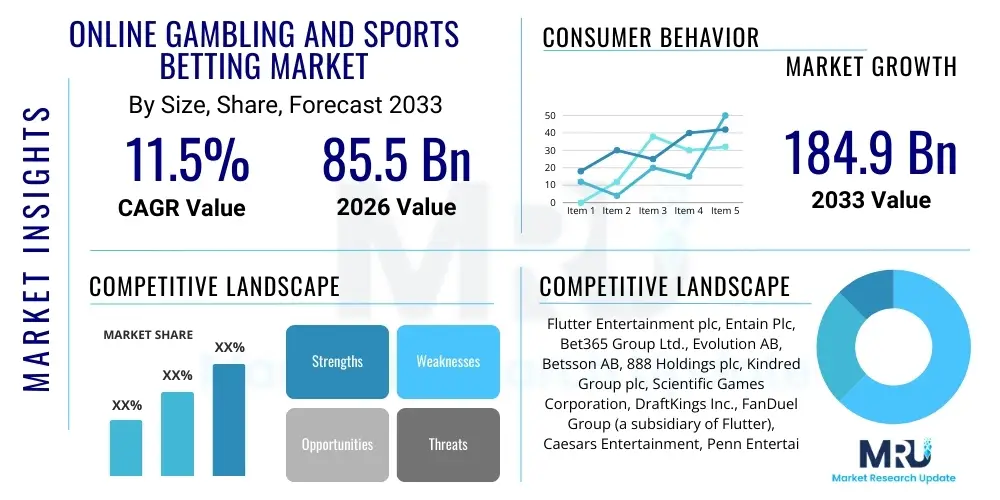

The Online Gambling and Sports Betting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 184.9 Billion by the end of the forecast period in 2033.

Online Gambling and Sports Betting Market introduction

The Online Gambling and Sports Betting Market encompasses all digital platforms and services offering real-money wagering across various verticals, including sports, specialized casino games, poker, and state-regulated lotteries. This highly dynamic sector leverages advanced digital technology to provide instantaneous access to gaming and betting markets globally, primarily via dedicated mobile applications and optimized web interfaces. The primary product offerings range from sophisticated sportsbooks providing thousands of daily betting markets with integrated live streaming capabilities, to immersive live dealer casino experiences that replicate the atmosphere of physical establishments using high-definition video technology. Major applications focus on enhancing consumer engagement with professional sports leagues, delivering accessible and diverse forms of entertainment, and generating substantial tax revenue for jurisdictional governments through formalized regulatory frameworks. The benefits driving accelerated global adoption include unparalleled user accessibility from any location, the innovative introduction of in-play or live betting features, and personalized user journeys facilitated by advanced data analytics and AI. Critical driving factors propelling this growth include the continuous global trend toward regulatory liberalization, particularly the rapid market openings across North America, sustained technological advancements in mobile computing and payment security, and the increasing convergence of online gambling with traditional media and professional sports marketing.

Online Gambling and Sports Betting Market Executive Summary

The Online Gambling and Sports Betting Market is undergoing rapid transformation, characterized by significant consolidation, strategic investment, and intense competitive pressures focused on digital supremacy and market penetration efficiency. Current business trends heavily favor operators capable of achieving vertical integration, controlling both proprietary technological platforms and extensive distribution networks, often achieved through large-scale mergers and acquisitions targeting smaller, technologically adept firms. A key strategic focus is achieving customer acquisition efficiency in newly regulated environments, necessitating massive investment in personalized marketing and robust compliance infrastructure. Regional trends emphatically position North America, particularly the US, as the primary growth accelerator, driven by the ongoing state-by-state transition to legalized mobile sports wagering, contrasting sharply with the mature, stabilization-focused European market where regulatory tightening dictates lower growth rates but ensures reliable revenue streams. The Asia Pacific region offers high long-term potential, contingent upon evolving regulatory clarity across densely populated nations. Segment trends clearly show the mobile platform dominating transactional volume; mobile applications are prioritized for development due to superior user retention and performance capabilities. Sports betting maintains its status as the leading segment by revenue, with live, in-play wagering serving as the critical revenue driver due to its high engagement and profitability, pushing operators towards continuous innovation in real-time data processing and low-latency delivery.

AI Impact Analysis on Online Gambling and Sports Betting Market

Analysis of common user questions reveals significant interest and persistent concerns regarding the transformative influence of Artificial Intelligence (AI) and Machine Learning (ML) across the betting and gaming ecosystem. Users frequently inquire about AI's role in maintaining fair play, particularly in real-time odds setting, and its necessity in developing stringent anti-fraud and responsible gambling mechanisms. Concerns often center on the potential for algorithmic bias in player profiling, the ethical deployment of AI for targeting vulnerable populations, and the transparency of proprietary systems that determine betting limits and promotional offers. There is a high expectation that AI will optimize operational efficiencies, significantly reducing manual risk management overhead and enhancing the speed and accuracy of compliance monitoring. Consumers anticipate improvements in personalized gaming experiences, supported by sophisticated chatbots and recommendation engines, alongside heightened security against cyber threats. Consequently, the industry is increasingly viewed as a high-tech sector where competitive advantage is intrinsically linked to the deployment of advanced AI for superior risk assessment, hyper-personalization, and fulfilling increasingly complex regulatory requirements concerning consumer protection and algorithmic accountability.

- Dynamic Risk Management: AI algorithms automate liability calculation and instantaneously adjust betting lines based on real-time data analysis, optimizing house margin and mitigating significant financial exposure from sophisticated betting syndicates.

- Advanced Anti-Fraud Systems: Machine Learning models analyze billions of transactional and behavioral data points to identify and prevent bonus abuse, identity theft, and money laundering activities with greater speed and accuracy than traditional methods.

- Hyper-Personalized CRM: AI-driven recommendation engines utilize deep learning to suggest tailored betting markets, relevant casino games, and customized promotional bundles, thereby significantly increasing customer engagement and lifetime value (CLV).

- Mandatory Responsible Gambling (RG) Intervention: Predictive AI identifies subtle, early warning signs of problematic gambling behavior, triggering automated, regulatory-compliant interventions such as self-exclusion prompts, deposit limit adjustments, or direct communication with support staff.

- Operational Efficiency via Automation: Robotic Process Automation (RPA) and AI-powered chatbots handle routine customer service inquiries, KYC (Know Your Customer) verification, and basic compliance reporting, drastically cutting operational expenditure.

- Enhanced Geolocation Integrity: AI models integrate and cross-verify multiple data streams (IP, Wi-Fi, cell tower data) to ensure rigorous and continuous real-time verification of a player’s physical location, critical for multi-jurisdictional compliance.

- Virtual Content Generation: AI contributes to the realism and unpredictability of virtual sports and generating innovative variants of casino games, providing a continuous stream of fresh, engaging content without human intervention.

- Optimized Marketing and Advertising: Predictive analytics accurately segment and profile potential users, allowing marketing teams to allocate budgets to channels and demographics with the highest projected return on investment (ROI).

DRO & Impact Forces Of Online Gambling and Sports Betting Market

The structural growth of the Online Gambling and Sports Betting Market is fundamentally propelled by the synergistic interaction of legislative and technological drivers. Legislative factors, specifically the increasing regulatory acceptance and legalization in high-value geographical areas like North America and parts of Latin America, unlock significant untapped market potential and create legitimate, structured channels for revenue generation. Simultaneously, technological advancements serve as a critical catalyst; the pervasive adoption of mobile devices, coupled with the rollout of 5G networks, ensures ubiquitous access to low-latency, real-time betting platforms, fundamentally changing consumer habits and making instantaneous wagering commonplace. The continuous innovation in product features, such as sophisticated live betting interfaces and seamless integration of payment solutions, further solidifies the market's upward trajectory, making digital offerings increasingly attractive compared to traditional land-based venues. These drivers collectively necessitate rapid scaling and substantial technological investment across the industry.

However, the market expansion is subject to significant restraints, primarily stemming from stringent and often inconsistent regulatory frameworks globally. High taxation rates imposed by governments on gross gaming revenue can severely compress operating margins, making certain markets less attractive for investment. Furthermore, intense public scrutiny and regulatory requirements concerning responsible gambling and addiction prevention necessitate substantial financial and technological investment in compliance, marketing limitations, and player protection tools. Persistent operational restraints include continuous cyber security threats, requiring sophisticated data protection and fraud mitigation infrastructure, coupled with the immense capital required for obtaining and maintaining licenses across diverse jurisdictions. These restraints increase the barriers to entry and demand a highly specialized focus on regulatory risk management.

Opportunities for future growth are concentrated in emerging technological applications and untapped geographical regions. The exponential growth of eSports betting presents a compelling opportunity to engage younger, digitally native demographics with specialized wagering products. Furthermore, the integration of nascent technologies like blockchain and decentralized finance (DeFi) offers potential solutions for faster, more transparent, and lower-cost payment processing, particularly appealing in regions with less developed traditional banking infrastructures. Geographically, strategic penetration into Latin American and certain Asian markets, coupled with partnerships targeting localized payment and content needs, offers substantial long-term growth potential. The market faces a set of high impact forces characterized by intense competition and a rapid cycle of innovation, mandating continuous technological superiority and robust, adaptive compliance to thrive in this highly dynamic environment.

Segmentation Analysis

The Online Gambling and Sports Betting market is intricately segmented to delineate distinct consumer cohorts, technological preferences, and operational revenue streams, providing stakeholders with a precise roadmap for strategic investment and product differentiation. Segmentation by type, primarily categorized into Sports Betting, Casino Gaming, and Others (Lottery, Bingo, eSports), highlights that Sports Betting holds a superior market share due to its cultural universality and the explosive popularity of live, in-play wagering, which drives high customer frequency and turnover. The Casino segment, meanwhile, relies on technological innovation, specifically Live Dealer solutions, to maintain steady growth and attract users seeking an authentic, human-managed gaming experience.

Platform segmentation is critical and definitively underscores the supremacy of Mobile platforms, including both dedicated native applications and mobile-optimized web interfaces. The migration from desktop to mobile is near complete in most mature markets, reflecting a pervasive consumer expectation for instant access and seamless, high-performance user experience, making mobile optimization a mandatory core competence for all successful operators. This segment’s dominance is intrinsically linked to the high volume of transactions occurring during live sporting events where mobile access is paramount. Furthermore, segmentation by offering dissects the market into Software Solutions (e.g., platform providers, data integrators) and Service Providers (e.g., operational management, marketing affiliates), revealing the critical role of B2B providers like Kambi and Evolution in enabling market entry for non-specialized operators.

The meticulous division of the market across these axes—type, platform, and offering—enables precise calculation of return on investment for specific technological developments, such as investing in proprietary RNG software versus licensing third-party live dealer feeds. Geographically, segment performance is tied directly to the speed and scope of regulatory approvals, with North America demanding bespoke, state-specific segmentation strategies due to its fragmented legal structure, while Europe relies on broad, pan-regional operational excellence. These segmentation insights guide operators in tailoring content, managing risk portfolios, and allocating marketing resources towards the most profitable segments based on localized consumer behavior and regulatory constraints.

- By Type:

- Sports Betting (Pre-match, In-play/Live Betting)

- Casino (Slots, Table Games, Live Dealer Games, Online Poker)

- Lottery

- Bingo

- Other Games (eSports Betting, Virtual Sports)

- By Platform:

- Desktop/PC

- Mobile (Applications, Mobile Web Browsers)

- By Component/Offering:

- Software Solutions (Gaming Platforms, Payment Systems, Data Analytics)

- Service Providers (Operational Management, Customer Support, Marketing Services)

- By Geography:

- North America (U.S., Canada)

- Europe (UK, Germany, Malta, Sweden, Italy)

- Asia Pacific (Australia, India, Other)

- Latin America (Brazil, Colombia)

- Middle East and Africa (MEA)

Value Chain Analysis For Online Gambling and Sports Betting Market

The value chain for the Online Gambling and Sports Betting Market commences with sophisticated upstream technology and data provision, which lays the foundation for all operational success. Upstream analysis focuses on specialized B2B software vendors that supply the core Gaming Platform Management Systems (GPMS), certified Random Number Generators (RNGs), and specialized Payment Processing Gateways designed for high-volume, secure transactions. Crucially, this stage includes real-time sports data providers (like Sportradar and Genius Sports) who aggregate, analyze, and distribute low-latency data feeds essential for live betting functionality and risk calculation. The quality, speed, and integrity of these upstream inputs directly determine the competitive positioning and regulatory compliance capability of the end-product operator, highlighting the strategic importance of securing reliable data partnerships and investing in proprietary technology development.

The midstream phase is dominated by the operating companies, who integrate the upstream technology to handle core business functions such as license procurement, regulatory compliance across multiple jurisdictions, overall brand management, extensive marketing activities, and sophisticated risk management (often AI-driven). This stage is characterized by high fixed costs associated with licensing fees and the necessity of robust, scalable infrastructure capable of handling millions of concurrent users. Key activities include liability management, defining market odds, ensuring responsible gaming protocols are active, and maintaining stringent data security standards (e.g., PCI compliance for payment data). Operational efficiency at this stage is a primary differentiator, often leveraging cloud technology to manage variable traffic loads efficiently.

Downstream activities center on distribution and the direct interaction with the end consumer. The primary distribution channel is direct-to-consumer (D2C) through branded native mobile applications and websites, requiring significant investment in UI/UX design and mobile optimization. Indirect channels, primarily affiliate marketing networks and media partnerships (especially in North America), play a crucial role in customer acquisition, functioning as highly effective traffic drivers based on commission models. The overall value chain demonstrates a strong trend toward vertical consolidation, where large operators acquire key upstream providers to control the entire technological stack, thereby maximizing margin control, ensuring rapid feature deployment, and securing a distinct advantage over competitors reliant on third-party B2B services. Effective management of this integrated chain, from securing data rights to optimizing the final mobile experience, is essential for high profitability.

Online Gambling and Sports Betting Market Potential Customers

The potential customer landscape for the Online Gambling and Sports Betting Market is extensive, characterized by multiple demographic and psychographic segments defined by their digital fluency, sporting interest, and risk tolerance. The core demographic consists of digitally native sports enthusiasts, primarily males aged 21 to 45, who actively follow professional sports and seek to enhance their viewing experience through live, in-play wagering. These users prioritize mobile access, instant transaction speeds, and a wide array of betting markets. They are highly responsive to promotional offers and loyalty programs, demanding a technologically superior, low-friction user interface that integrates features such as live streaming and cash-out options seamlessly. This segment drives the highest volume and frequency of transactions, making them the most valuable target group for operators.

A secondary, rapidly growing segment includes eSports fans and younger adults (18-30) who are highly engaged with competitive gaming. This group demands highly specialized betting products tailored to specific game formats (e.g., League of Legends, Dota 2) and platform-specific payment methods. Additionally, the casual gambler segment encompasses individuals, often older, who transition from land-based casino environments to the accessibility of online casino games, particularly slots and live dealer table games. This group places a premium on trust, reliability, and ease of use, often preferring simple interfaces and established brand names. The expansion of lotteries and bingo online also successfully targets a broader, more risk-averse audience seeking low-stakes entertainment.

Geographically, potential customers are concentrated in established, regulated markets (Europe, Australia) and rapidly legalizing regions (North America, Latin America). Across all segments, a critical defining characteristic of a high-value potential customer is their willingness to engage through regulated channels and their comfort with digital financial transactions, including traditional cards, e-wallets, and increasingly, cryptocurrencies. Operators utilize sophisticated data analytics to identify and target individuals with high predicted lifetime value (LTV), focusing acquisition efforts on converting casual observers into frequent users through highly personalized marketing funnels and frictionless onboarding processes compliant with strict KYC (Know Your Customer) regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 184.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flutter Entertainment plc, Entain Plc, Bet365 Group Ltd., Evolution AB, Betsson AB, 888 Holdings plc, Kindred Group plc, Scientific Games Corporation, DraftKings Inc., FanDuel Group (a subsidiary of Flutter), Caesars Entertainment, Penn Entertainment, International Game Technology (IGT), Kambi Group plc, Playtech plc, Sportradar Group AG, Genius Sports Ltd., Tipico Group, PointsBet Holdings Ltd., MGM Resorts International (BetMGM), Rush Street Interactive (RSI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Gambling and Sports Betting Market Key Technology Landscape

The operational success of the Online Gambling and Sports Betting market is intrinsically linked to a robust and continuously evolving technological landscape, designed for massive scalability, low latency, and regulatory compliance. Central to this landscape are cloud computing infrastructures, which utilize microservices architectures to ensure platforms can instantaneously scale resources to handle extreme traffic spikes—such as during major televised sporting events—without compromising performance or availability. Critical regulatory technologies include advanced geolocation verification systems, which utilize sophisticated IP filtering, WiFi triangulation, and device data analysis to rigorously confirm the physical location of users in accordance with jurisdictional laws. Furthermore, robust data encryption (AES-256) and tokenization are standard practice to secure all financial and personal data, maintaining the high levels of consumer trust required for sustained market growth.

The core betting operations are driven by Artificial Intelligence and Machine Learning algorithms. AI is indispensable for risk management, automating the complex processes of creating and adjusting thousands of betting markets in real time, managing liability exposure across jurisdictions, and identifying suspicious betting patterns indicative of fraud or market manipulation. Beyond risk, ML models power sophisticated recommendation engines, driving hyper-personalization of the user interface, suggesting relevant betting markets, and tailoring promotional offers to individual player profiles based on established behavioral analytics. This integration of AI elevates customer experience and significantly improves customer retention rates, moving beyond rudimentary segmentation toward truly dynamic user interaction.

Payment technology innovation is also a key competitive area. While traditional card and bank transfer methods persist, the increasing adoption of digital wallets and the integration of blockchain and cryptocurrency payment rails address consumer demand for faster deposit and withdrawal speeds with lower associated fees. Finally, the proliferation of 5G networking capabilities is paramount for the sports betting segment, enabling seamless, high-definition live streaming of sporting events directly within the betting application. This integration of high-quality video alongside betting markets significantly enhances the "in-play" experience, reducing the latency gap between the real world and the digital betting interface, thereby ensuring the technology keeps pace with consumer expectations for instantaneous engagement.

Regional Highlights

The global Online Gambling and Sports Betting Market exhibits pronounced regional variances driven primarily by differing regulatory environments, cultural acceptance of gambling, and economic development levels. These differences dictate market structure, competitive intensity, and the dominant product types consumed in each area. Understanding these regional highlights is essential for market entry and strategic expansion, with specific focus required on regulatory complexity in newly opened markets.

- North America (NA): This region is the primary engine of global market growth, spearheaded by the United States following the 2018 Supreme Court decision overturning PASPA. State-by-state legalization has created a patchwork of regulated markets, driving massive investment in technology, partnerships (e.g., sports leagues and teams), and consumer acquisition. The U.S. market is characterized by a strong focus on online sports betting (OSB) and a highly competitive environment featuring aggressive marketing campaigns. Canada, particularly Ontario, also contributes significantly, adopting a competitive commercial model. Growth is projected to remain explosive as more high-population states transition to legal mobile wagering.

- Europe: Europe remains the largest and most mature market globally, characterized by long-standing regulatory structures in key nations like the UK, Malta, Sweden, and Italy. The market here is defined by high saturation and intense competition, leading operators to innovate heavily in product features and user retention strategies. While growth is slower than in North America, stability and consistent revenue generation are key attributes. Strict responsible gambling mandates, particularly those limiting advertising and bonus offers, define the operational landscape, significantly increasing compliance costs but ensuring high market integrity.

- Asia Pacific (APAC): APAC represents the largest potential market by population, but its growth is highly fragmented and often constrained by strict government regulations, except for territories like Australia, which maintains a highly mature betting environment. Outside regulated markets, a significant grey market persists. The region is characterized by high mobile internet use and strong cultural affinity for specific forms of wagering, including lotteries and eSports betting, which is gaining substantial traction due to the region's dominance in competitive gaming.

- Latin America (LATAM) & Middle East and Africa (MEA): This combined segment offers high-potential emerging markets (LATAM) and niche, highly regulated environments (MEA). LATAM is rapidly formalizing its markets (e.g., Brazil, Colombia), driven by high mobile adoption and a passion for football, attracting major foreign investment despite challenges related to payment infrastructure and currency instability. MEA relies heavily on highly regulated African markets, such as South Africa and Nigeria, focusing on mobile-first, low-bandwidth solutions due to infrastructure constraints. Both regions require extreme localization of technological offerings and payment solutions to capture market share effectively, catering to unique economic and regulatory pressures.

The regulatory framework in the US requires significant operational complexity, demanding state-specific licenses and adherence to often divergent tax structures and responsible gaming protocols. This focus on localized compliance necessitates highly sophisticated geolocation and compliance technology. The strong inherent sports culture directly translates into high participation rates for major league betting, with in-play betting forming the core monetization strategy. Operators are keenly focused on vertical integration and controlling the technology stack, often in partnerships with land-based casinos as mandated by regulation.

The operational landscape within Europe is shifting towards even greater consumer protection, necessitating advanced technological solutions for affordability checks and personalized risk assessment. The segmentation within Europe favors both sophisticated online sports betting platforms and highly engaging live dealer casino gaming. European operators are global pioneers, leveraging their mature technological stacks to drive international expansion into newly regulated territories worldwide, maintaining their historical leadership in software and platform provision.

Growth opportunities primarily rely on localization, requiring operators to tailor interfaces and payment methods to specific regional needs, often bypassing traditional banking for specialized local payment gateways. Regulatory risk remains the highest in this region, demanding careful political and legal maneuvering for sustainable legal entry. Success in APAC is contingent upon the ability to navigate regulatory hurdles while maximizing mobile optimization and localizing content to resonate with diverse user preferences across countries like India and emerging Southeast Asian economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Gambling and Sports Betting Market.- Flutter Entertainment plc

- Entain Plc

- Bet365 Group Ltd.

- Evolution AB

- Betsson AB

- 888 Holdings plc

- Kindred Group plc

- Scientific Games Corporation

- DraftKings Inc.

- FanDuel Group (a subsidiary of Flutter)

- Caesars Entertainment

- Penn Entertainment

- International Game Technology (IGT)

- Kambi Group plc

- Playtech plc

- Sportradar Group AG

- Genius Sports Ltd.

- Tipico Group

- PointsBet Holdings Ltd.

- MGM Resorts International (BetMGM)

- Rush Street Interactive (RSI)

Frequently Asked Questions

What is the primary driving factor for the recent growth in the Online Gambling and Sports Betting Market?

The primary driver is the widespread liberalization of regulatory frameworks globally, particularly the opening of lucrative US state markets post-PASPA, coupled with exponential growth in mobile device penetration and superior 5G connectivity that facilitates seamless, real-time in-play betting experiences.

Which geographic region currently holds the largest market share in online gambling?

Europe currently holds the largest market share due to its regulatory maturity, high market saturation, and large established player base in key countries like the UK, Germany, and Italy, although North America is the fastest-growing region by CAGR.

How is Artificial Intelligence (AI) transforming online betting operations?

AI is transforming operations by enabling dynamic odds setting, minimizing fraud through real-time behavioral monitoring, hyper-personalizing user experiences, and providing crucial predictive analytics for responsible gambling interventions and risk management.

What are the biggest challenges facing online gambling operators?

Major challenges include managing high costs associated with multi-jurisdictional regulatory compliance, addressing intensified public scrutiny regarding responsible gambling and data privacy, and mitigating persistent cyber security threats and bonus abuse tactics.

Which market segment is expected to show the highest growth rate during the forecast period?

The Mobile Platform segment, encompassing dedicated mobile applications and optimized mobile web access, is projected to maintain the highest growth rate, reflecting the consumer shift towards convenient, on-the-go wagering across both sports betting and casino verticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager