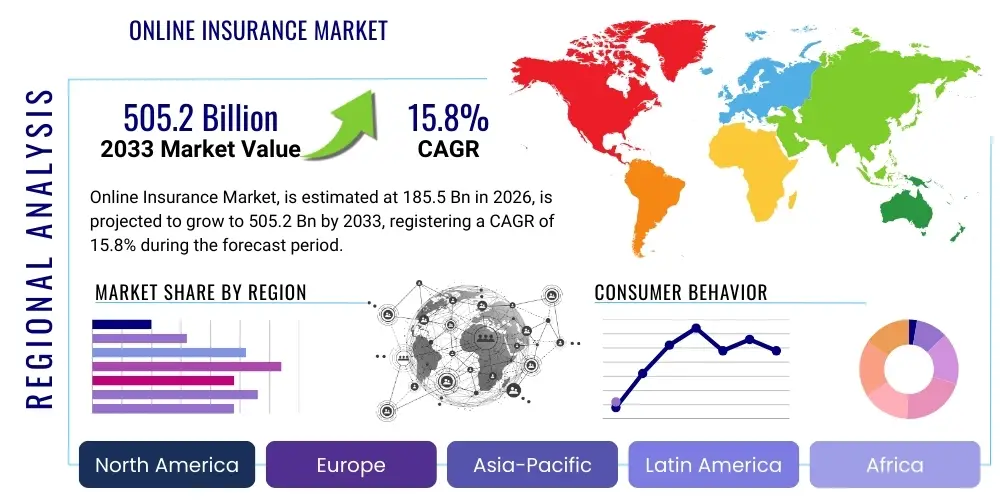

Online Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442362 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Online Insurance Market Size

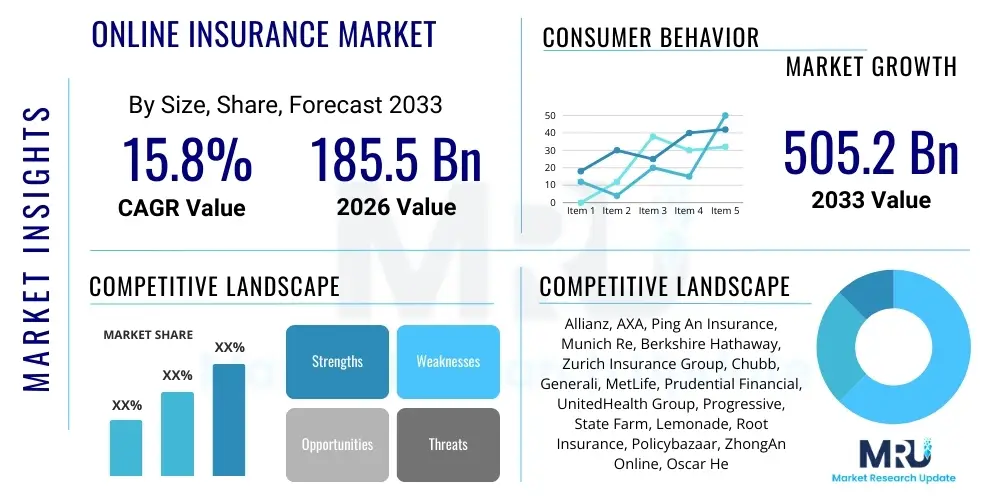

The Online Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $505.2 Billion by the end of the forecast period in 2033. This robust expansion is fueled by accelerated digital adoption across emerging economies, coupled with increased consumer preference for convenience, transparency, and personalized insurance products accessible via digital platforms. Regulatory shifts supporting digital identity verification and electronic policy issuance further cement this growth trajectory, establishing online channels as the primary engagement point for a new generation of policyholders globally.

Online Insurance Market introduction

The Online Insurance Market encompasses the distribution, management, and servicing of insurance products—including life, property & casualty (P&C), health, and specialized lines—through digital platforms such as websites, mobile applications, and aggregator portals. This digital transformation allows consumers to research, compare, purchase, and manage policies without the need for traditional intermediary interaction, thereby streamlining the customer journey and significantly reducing operational costs for insurers. The primary product description centers around digitized policy platforms offering instant quoting capabilities, tailored risk assessments utilizing advanced analytics, and seamless claims processing interfaces. This efficiency gain, driven by reduced dependency on physical infrastructure and manual underwriting processes, has fundamentally shifted the industry paradigm towards direct-to-consumer models and sophisticated Insurtech solutions.

Major applications of online insurance span across retail and corporate sectors. Retail applications focus heavily on personal lines such as motor vehicle insurance, home insurance, simplified life insurance products, and travel insurance, where standardization allows for quick digital underwriting. Corporate applications, while still requiring some human oversight for complex risks, increasingly utilize online platforms for purchasing small-to-medium enterprise (SME) package policies, employee benefits management, and cyber insurance. The fundamental benefit delivered by the online channel is unparalleled speed and access; policies can be bound within minutes, and consumers gain real-time access to pricing adjustments based on dynamic risk data. Furthermore, the enhanced data collection capabilities inherent in digital transactions allow insurers to create highly sophisticated pricing models and preventative services, moving beyond mere risk mitigation to proactive risk management and engagement.

Driving factors for this market are multi-faceted, including the pervasive global penetration of smartphones and high-speed internet, which has democratized access to financial services. The COVID-19 pandemic acted as a major catalyst, accelerating the mandatory shift away from face-to-face interactions for financial transactions, thereby normalizing digital policy purchasing among demographics previously hesitant to adopt online channels. Furthermore, competitive pressure from agile Insurtech startups, often backed by significant venture capital, forces established carriers to invest heavily in modernizing legacy IT systems and enhancing user experience (UX). These technological investments are crucial not only for consumer acquisition but also for meeting increasingly stringent regulatory requirements regarding data privacy and security, ensuring that the digital ecosystem remains robust and trustworthy for handling sensitive personal and financial information across diverse global jurisdictions.

Online Insurance Market Executive Summary

The Online Insurance Market is characterized by vigorous competition and rapid technological innovation, evidenced by sustained double-digit growth projected through 2033. Key business trends include the consolidation of digital distribution channels, where large established carriers are acquiring or partnering with leading Insurtech firms to rapidly integrate advanced capabilities like AI-driven underwriting and blockchain-enabled claims verification. There is a discernible shift towards usage-based insurance (UBI) and parametric insurance models, driven by the ability of online platforms to capture real-time data from connected devices (IoT), offering policyholders hyper-personalized premiums and instant payouts, thus increasing consumer stickiness and improving loss ratios for carriers.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the vast, underserved populations in countries like China and India experiencing simultaneous leaps in mobile connectivity and middle-class expansion, leapfrogging traditional agent-based systems entirely. North America and Europe, conversely, focus on optimization and refinement, leveraging their high digital maturity to deepen penetration into complex product lines, such as commercial property and specialty risk, using sophisticated online broker platforms. Regulatory frameworks globally are attempting to keep pace with these innovations, introducing sandbox environments and consumer protection laws tailored for digital transactions, ensuring market stability while fostering necessary technological evolution.

Segment-wise, the Property & Casualty (P&C) segment, particularly motor insurance, currently dominates the online sales volume due to its relative simplicity and mandatory nature, making it ideal for digital comparison and purchase. However, the Life and Health insurance segments are exhibiting the fastest CAGR, driven by simplified issue products utilizing algorithmic underwriting and the critical need for health coverage highlighted by recent global events. The focus across all segments is on creating a unified omnichannel experience, where digital interaction complements, rather than completely replaces, human advisory for complex needs, ensuring that the technology delivers both efficiency and the necessary trust required in long-term financial products.

AI Impact Analysis on Online Insurance Market

User queries regarding AI in the Online Insurance Market overwhelmingly center on themes of job displacement for human agents, the accuracy and fairness of algorithmic underwriting, and concerns about data privacy and security vulnerabilities introduced by sophisticated machine learning models. Consumers frequently ask how AI can genuinely lower premiums and speed up claims, while regulators and industry professionals inquire about the ethical deployment of AI systems, particularly concerning bias in risk selection and pricing for minority groups. The core expectation is that AI should deliver immediate, measurable improvements in efficiency, transparency, and personalization, moving insurance away from being a necessary burden to a proactive, value-adding service. The summary theme is one of cautious optimism: stakeholders recognize AI as an indispensable tool for future competitiveness, but demand rigorous oversight to ensure fair, transparent, and secure implementation that ultimately benefits the end policyholder.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming every stage of the insurance value chain, from initial lead generation and policy issuance to fraudulent activity detection and claims settlement. AI algorithms analyze vast datasets, including telematics information, social media activity, and historical claims records, to generate highly accurate risk profiles in real-time. This capability drastically reduces the time required for underwriting complex policies, enabling instant decisions for simplified products and providing highly granular pricing adjustments that reward low-risk behavior, moving underwriting from retrospective analysis to predictive science. Consequently, Insurtech firms prioritizing AI integration are achieving significantly lower loss adjustment expenses (LAE) and enhanced competitive pricing structures.

Furthermore, AI-powered chatbots and virtual assistants are revolutionizing customer relationship management (CRM) within the online insurance space. These tools handle routine inquiries, process initial claims notifications (First Notice of Loss - FNOL), and guide customers through policy modifications 24/7, vastly improving service responsiveness and policyholder satisfaction scores. The deployment of predictive models is also critical in combating fraud; AI can identify anomalies and suspicious patterns in claims submissions that would be invisible to human adjusters, leading to substantial cost savings and maintaining the integrity of the collective risk pool. Ethical deployment remains a paramount concern, driving significant investment into explainable AI (XAI) models to ensure regulatory compliance and maintain consumer trust in automated decision-making processes.

- Automated Underwriting and Personalized Pricing: AI analyzes complex data points (e.g., driving behavior, health records) for real-time risk assessment, allowing for dynamic pricing and instant policy issuance.

- Enhanced Fraud Detection: Machine learning models identify suspicious claims patterns and anomalies with higher accuracy than traditional methods, leading to significant savings on leakage.

- Optimized Customer Service: Chatbots and virtual assistants provide instantaneous, 24/7 support for policy inquiries, modifications, and initial claims filing (FNOL).

- Predictive Modeling for Risk Mitigation: AI analyzes macro and micro environmental data to predict future claims events (e.g., catastrophic weather events), enabling proactive policyholder communication and mitigation strategies.

- Streamlined Claims Processing: Computer vision and natural language processing (NLP) expedite claims handling by analyzing images (e.g., auto damage) and extracting key information from unstructured documents.

DRO & Impact Forces Of Online Insurance Market

The Online Insurance Market is shaped by a powerful confluence of accelerating digital adoption, persistent regulatory hurdles, and transformative technological capabilities. Key drivers include the overwhelming consumer demand for personalized and transparent digital experiences, mimicking the convenience found in other e-commerce sectors, which forces insurers to prioritize digital channel investment. Restraints largely revolve around entrenched consumer skepticism regarding the security of personal data, the complexity of migrating legacy IT systems, and the ongoing challenge of achieving regulatory uniformity across different jurisdictions for digital insurance products. Opportunities are substantial, centered on penetrating emerging markets through mobile-first strategies and the ability to leverage IoT and telematics to offer preventative services rather than merely compensatory coverage. The impact forces are driving an irreversible transition toward a fully digitized and data-centric insurance ecosystem, where technological agility dictates competitive success and market share gains.

Drivers: A primary driver is the significantly lower operating cost structure offered by online channels compared to traditional brick-and-mortar operations, allowing carriers to offer more competitive premiums while maintaining healthy margins. Furthermore, the massive increase in global digital literacy and smartphone penetration has created a fertile ground for online engagement, particularly among Millennials and Generation Z, who inherently expect digital interaction for all financial services. The proliferation of comparative shopping platforms and aggregators also acts as a powerful driver, increasing price transparency and compelling carriers to ensure their offerings are digitally accessible and highly competitive. Strategic partnerships between established carriers and specialized Insurtech platforms accelerate the pace of digital innovation, enabling faster time-to-market for complex, algorithmically underwritten products like parametric coverage for weather events or flight delays, which appeal specifically to the digitally native consumer base seeking immediate and clear policy terms.

Restraints and Opportunities: Significant restraints include the inherent trust deficit associated with purchasing complex financial products online, particularly for long-term savings and life insurance, which often require complex financial planning and human advisory. Regulatory fragmentation remains a substantial barrier, forcing insurers to develop bespoke digital compliance systems for each country, inhibiting scalability. However, these restraints are counterbalanced by robust opportunities. The ability to utilize granular behavioral data (e.g., fitness tracking, driving habits) offers a pathway to fundamentally redefine risk assessment, leading to ultra-customized policy creation that was previously impossible. Moreover, opportunities exist in harnessing blockchain technology to create tamper-proof records for smart contracts, automating claims payments (especially for micro-insurance products), and reducing counterparty risk in reinsurance, enhancing the overall efficiency and trustworthiness of the digital transaction infrastructure. This technological edge allows online insurers to target previously uninsurable or high-risk populations through dynamic, short-term coverage solutions.

- Drivers:

- Accelerated Digital Consumer Preference: High demand for convenience, transparency, and 24/7 access to services via mobile devices.

- Lower Operational Costs: Elimination of intermediary commissions and reduced overheads associated with physical branch networks.

- Advancements in Insurtech: Rapid development of AI, ML, and big data analytics enabling superior risk modeling and personalization.

- Mandatory Insurance Digitalization: Regulatory pushes and macroeconomic events (e.g., pandemics) accelerating the transition of essential policies online.

- Restraints:

- Data Privacy and Cybersecurity Concerns: High-profile data breaches eroding customer trust in storing sensitive financial and health information online.

- Legacy System Integration Challenges: Difficulty in migrating entrenched, traditional IT infrastructures to modern, agile digital platforms.

- Regulatory Heterogeneity: Lack of standardized digital insurance regulations across diverse international markets hindering cross-border expansion.

- Need for Human Advisory in Complex Products: Consumer hesitation to purchase high-value, complex life or specialized commercial policies without personal consultation.

- Opportunities:

- Expansion into Underserved Markets: Leveraging mobile infrastructure to offer micro-insurance and accessible policies in developing economies.

- Implementation of Telematics and IoT: Utilizing connected devices for Usage-Based Insurance (UBI) models, fostering preventative service offerings.

- Adoption of Blockchain for Smart Contracts: Automating claim payouts and improving transactional transparency and security.

- Parametric Insurance Development: Creating simple, trigger-based policies for rapid disbursement following defined external events (e.g., weather).

- Impact Forces:

- Technological Disruption: Insurtech firms setting new benchmarks for customer experience and efficiency, forcing incumbents to rapidly adopt digital practices.

- Shift in Risk Perception: Data-driven insights moving the industry from reactive compensation to proactive risk prediction and mitigation.

- Consolidation and Partnerships: Strategic mergers and acquisitions blurring the lines between tech providers and traditional carriers.

- Evolving Regulatory Compliance: Increased scrutiny on AI ethics, data governance, and consumer protection in digital sales channels.

Segmentation Analysis

The Online Insurance Market is meticulously segmented across various dimensions, including Type of Insurance (Life, P&C, Health), Distribution Channel (Direct Sales, Aggregators/Brokers), Technology Platform (Web-based, Mobile Apps), and End-User (Individual, Commercial). Analyzing these segments provides crucial insights into market dynamics, highlighting where digital penetration is deepest and where significant growth potential remains untapped. The ongoing segmentation shift is characterized by a move towards personalized product customization enabled by advanced analytics, allowing insurers to create micro-segments based on highly specific risk behaviors and demographic profiles. This granular approach moves away from generalized mass-market policies toward hyper-targeted digital offerings, maximizing marketing efficiency and minimizing adverse selection risk.

The dominance of Property & Casualty (P&C) in the current market volume is attributed to the inherent simplicity of products like auto and home insurance, which are easily standardized and priced algorithmically, facilitating instant comparisons and purchases through online channels. Conversely, while smaller in current volume, the Life and Health segments are poised for explosive growth, driven by simplified medical underwriting using digital health records and wellness data, alongside the integration of lifestyle policies. Within distribution, the aggregator model continues to gain traction globally, providing consumers with a single point of comparison, although carriers are increasingly investing in direct-to-consumer digital channels to control the entire customer relationship and avoid commission payments.

Further analysis of the technology platform segment reveals a strong pivot toward mobile-first strategies, especially in high-growth regions where consumers access the internet primarily through smartphones. Mobile applications are evolving beyond mere purchasing tools to become integrated risk management platforms, offering features such as driving behavior monitoring, health tracking, and instant claims submission capabilities, thereby enhancing policyholder engagement beyond the annual renewal cycle. Understanding the nuanced growth rates and competitive landscapes within each segment is paramount for market players seeking to optimize their digital investments and secure a defensible position in this rapidly evolving and highly competitive digital insurance ecosystem. The interplay between technology and product complexity will define the future leading segments.

- By Type of Insurance:

- Life Insurance (Term Life, Whole Life, Annuities)

- Property and Casualty (P&C) Insurance (Motor, Homeowner’s, Commercial Property)

- Health Insurance (Individual Health, Group Health, Critical Illness)

- Travel Insurance

- Specialty Insurance (Cyber, Pet, Parametric)

- By Distribution Channel:

- Direct Sales (Carrier Websites, Mobile Apps)

- Aggregators/Price Comparison Websites

- Online Brokers and Agents

- Bancassurance (Digital Partnerships with Banks)

- By Technology Platform:

- Web-based Platforms

- Mobile Applications

- API Integration (Embedded Insurance)

- By End-User:

- Individual Policyholders (Retail)

- Commercial Clients (SMEs, Large Enterprises)

Value Chain Analysis For Online Insurance Market

The value chain for the Online Insurance Market is highly digitized and significantly shorter than traditional models, eliminating several physical touchpoints and intermediary layers. The upstream activities focus heavily on data sourcing and predictive analytics; raw data from IoT devices, third-party data providers, and internal databases is aggregated and processed using sophisticated algorithms (often AI/ML) to develop accurate risk models and product blueprints. This analytical capability is the foundation of the digital value proposition, driving product innovation and pricing efficiency. Unlike traditional insurance where upstream involved physical printing and massive paper handling, the digital upstream emphasizes cloud infrastructure management, data security protocols, and rigorous model validation to ensure compliance and accuracy in automated underwriting.

The core midstream process involves policy issuance, customer acquisition, and engagement, predominantly handled through direct and indirect online distribution channels. Direct channels involve proprietary carrier websites and mobile apps, providing full control over the customer experience and data captured. Indirect channels include aggregators and online brokers, which specialize in comparative shopping and lead generation. The seamless integration of these channels requires robust APIs and microservices architectures to ensure real-time quoting and instant policy binding. Effective midstream management relies on exceptional UI/UX design and powerful customer relationship management (CRM) systems capable of handling large volumes of simultaneous digital interactions while maintaining stringent compliance standards.

Downstream operations in the online insurance value chain are centered on policy servicing and claims management, where automation delivers the greatest speed advantage. Digital platforms allow policyholders to manage their accounts, update personal details, and initiate claims submission 24/7. Claims processing is increasingly automated, utilizing technologies like computer vision for damage assessment (in auto claims) and smart contracts (in parametric insurance) for instant, automated payouts, minimizing human intervention and dramatically improving cycle times. Direct distribution is crucial here, as it minimizes dependency on external adjusters for routine claims, creating a more responsive and transparent claims experience that reinforces consumer trust in the digital service model. The ongoing efficiency improvements across the entire chain are directly tied to the level of technological adoption at each stage.

Online Insurance Market Potential Customers

Potential customers for the Online Insurance Market are highly diverse, spanning demographics from digitally native young adults seeking their first affordable auto or renters insurance policy, to established commercial entities looking for specialized cyber insurance solutions managed through digital portals. The primary common characteristic among retail end-users/buyers is a high level of digital comfort and an expectation of instant, transparent service. These consumers value the ability to compare multiple quotes effortlessly and finalize purchases outside of traditional banking hours. Geographically, potential customers are concentrated in high-density urban areas with excellent mobile penetration and in emerging markets where the absence of entrenched legacy systems allows consumers to jump directly to digital insurance models without prior exposure to agency networks.

A significant growth segment comprises small and medium-sized enterprises (SMEs) and self-employed individuals (gig economy workers) who require flexible, modular insurance products that can be quickly scaled up or down based on their operational needs. Traditional commercial insurance is often complex and inaccessible for SMEs, whereas online platforms offer simplified, package policies (e.g., general liability, professional indemnity) with clear digital documentation and streamlined renewal processes. This customer base prioritizes efficiency and cost-effectiveness, making the low overhead associated with online distribution highly attractive for managing essential business risks.

Furthermore, the health-conscious and data-sharing segments represent high-value potential customers, particularly for Life and Health insurance providers. These individuals are willing to share personal data from wearable devices and wellness apps in exchange for personalized risk assessments, preventative health services, and lower premiums through Usage-Based Insurance (UBI) models. Insurers are specifically targeting these proactive consumers who are engaged in managing their own health and financial wellness. The long-term success in targeting these sophisticated customers relies heavily on the insurer’s ability to guarantee robust data security and demonstrate tangible value-added services beyond mere policy issuance, transforming the carrier relationship into a continuous partnership focused on risk reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $505.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz, AXA, Ping An Insurance, Munich Re, Berkshire Hathaway, Zurich Insurance Group, Chubb, Generali, MetLife, Prudential Financial, UnitedHealth Group, Progressive, State Farm, Lemonade, Root Insurance, Policybazaar, ZhongAn Online, Oscar Health, GEICO, Allstate. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Insurance Market Key Technology Landscape

The technological infrastructure underpinning the Online Insurance Market is a complex and rapidly evolving ecosystem characterized by the convergence of foundational cloud computing services and cutting-edge artificial intelligence applications. Cloud native architectures, utilizing platforms such as AWS, Google Cloud, and Azure, provide the scalable, flexible, and cost-effective environment necessary to handle the massive data storage and real-time processing demands of digital insurance transactions, including instantaneous quoting, sophisticated risk aggregation, and high-volume claims handling. This migration to the cloud allows Insurtechs and established carriers alike to deploy new products rapidly, iterate on existing services, and integrate external data sources seamlessly, moving away from the rigid, monolithic structures of legacy enterprise systems that often impede digital transformation efforts.

Central to competitive differentiation is the deployment of Advanced Analytics, Machine Learning (ML), and Natural Language Processing (NLP). ML models are crucial for developing dynamic, granular pricing strategies (Usage-Based Insurance) and significantly improving fraud detection capabilities by identifying subtle behavioral and transactional anomalies in real-time claims streams. NLP capabilities are increasingly used in customer service applications, powering advanced chatbots and analyzing unstructured data—such as customer feedback, policy documents, and open-ended claims descriptions—to extract meaningful insights and automate routine communication, thereby freeing up human capital for complex advisory tasks requiring emotional intelligence and nuanced judgment. The effectiveness of these analytical tools determines the precision of risk modeling and the overall efficiency of the digital claims cycle.

Furthermore, the adoption of Distributed Ledger Technology (DLT), commonly known as Blockchain, is gaining momentum, particularly in niche applications like reinsurance and parametric insurance. Blockchain provides an immutable and transparent ledger for policy contracts (smart contracts), which automatically execute payouts when predefined external conditions (e.g., flight cancellation, specified wind speed) are met, dramatically reducing administrative overhead and eliminating disputes. Simultaneously, the proliferation of Internet of Things (IoT) devices, including smart homes and vehicle telematics units, is vital, as these devices generate the continuous streams of behavioral and environmental data that fuel the predictive models used in modern online insurance. The ongoing challenge for the industry remains the secure and compliant integration of these diverse technologies, ensuring data governance meets international privacy standards like GDPR and CCPA, while maximizing the utility of the data for both the insurer and the policyholder.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive growth in mobile internet penetration and rising middle-class disposable incomes, particularly in China and India. Governments are actively promoting digital finance inclusion, creating fertile ground for mobile-first insurance models (e.g., micro-insurance, health covers). Market development here is characterized by 'leapfrogging,' bypassing traditional distribution channels entirely. Insurers often partner with super-apps and large e-commerce ecosystems (e.g., Ping An’s extensive digital health network) to embed insurance products seamlessly into daily transactions, capturing a massive and rapidly urbanizing population base.

- North America: This region is defined by high digital maturity and intense competition, dominated by sophisticated Insurtech startups (e.g., Lemonade, Root) alongside major incumbents (e.g., Progressive, GEICO) that have successfully transitioned significant portions of their business online. The focus is on technological refinement, including advanced AI integration for hyper-personalization, telematics-driven UBI, and the expansion of digital offerings into complex specialty lines, such as cyber insurance for corporate clients, leveraging high consumer trust in online financial security measures.

- Europe: Europe exhibits a diversified market structure, balancing stringent regulatory frameworks (GDPR, IDD) with consumer demand for digital transparency. The UK and Nordic countries lead in digital adoption, heavily utilizing aggregators and comparison sites for P&C insurance. The challenge lies in harmonizing digital distribution across member states, though pan-European Insurtech players are leveraging open banking initiatives and APIs to streamline policy access and pricing, particularly focusing on robust security features to comply with consumer privacy laws and ethical data usage requirements.

- Latin America (LATAM): This region shows significant potential, driven by high mobile usage and low penetration of traditional insurance products. Brazil and Mexico are key markets seeing substantial investment in localized mobile applications and partnerships with fintech firms to offer accessible, simple insurance solutions. The digital transition here is critical for increasing insurance penetration among historically underserved populations, focusing on user interfaces designed to accommodate variability in internet quality and digital literacy levels.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the UAE, Saudi Arabia, and South Africa, fueled by large government-led digital transformation initiatives and the proliferation of mobile payment systems. The market is developing rapidly, with a particular emphasis on Sharia-compliant Takaful models being digitized. The African segment benefits from low conventional banking penetration, allowing mobile network operators to often act as initial distribution channels for micro-insurance products, utilizing SMS and simple mobile money transfers for premium collection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Insurance Market.- Allianz

- AXA

- Ping An Insurance

- Munich Re

- Berkshire Hathaway

- Zurich Insurance Group

- Chubb

- Generali

- MetLife

- Prudential Financial

- UnitedHealth Group

- Progressive

- State Farm

- Lemonade

- Root Insurance

- Policybazaar

- ZhongAn Online

- Oscar Health

- GEICO

- Allstate

Frequently Asked Questions

Analyze common user questions about the Online Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Online Insurance Market?

The Online Insurance Market is projected to experience robust expansion, with a Compound Annual Growth Rate (CAGR) forecasted at 15.8% between 2026 and 2033. This growth is primarily fueled by rising digital adoption, advances in Insurtech, and consumer preference for direct digital policy purchases.

How is Artificial Intelligence (AI) transforming the online insurance value chain?

AI is fundamentally transforming the online insurance sector by enabling real-time, automated underwriting, highly personalized pricing based on predictive risk modeling, and accelerated claims processing through sophisticated machine learning algorithms and computer vision for damage assessment, significantly reducing operational costs and improving customer experience.

Which segment of the Online Insurance Market is growing the fastest?

While Property & Casualty (P&C) currently holds the largest market share, the Life and Health insurance segments are exhibiting the fastest growth rates. This acceleration is driven by the simplification of medical underwriting processes using digital data and the increased availability of personalized health and wellness-integrated policies.

What are the primary challenges restraining the growth of digital insurance adoption?

Key challenges include persistent consumer concerns regarding data privacy and the cybersecurity of sensitive information, the complexity and cost associated with migrating traditional carriers’ legacy IT systems to agile digital platforms, and the regulatory fragmentation across diverse geographic markets.

Why is the Asia Pacific (APAC) region leading the expansion in the Online Insurance Market?

APAC leads market expansion due to high rates of smartphone penetration, rapid urbanization, and a growing middle class that is increasingly digitally literate. These factors, combined with the lack of deeply entrenched traditional agency systems, allow populations to "leapfrog" directly to mobile-first, digital insurance purchasing models, particularly in emerging economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager