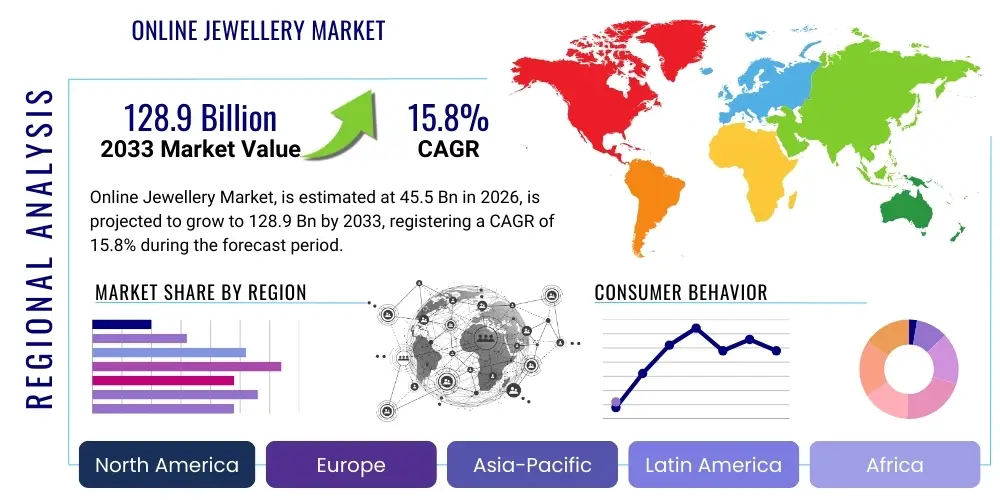

Online Jewellery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441303 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Online Jewellery Market Size

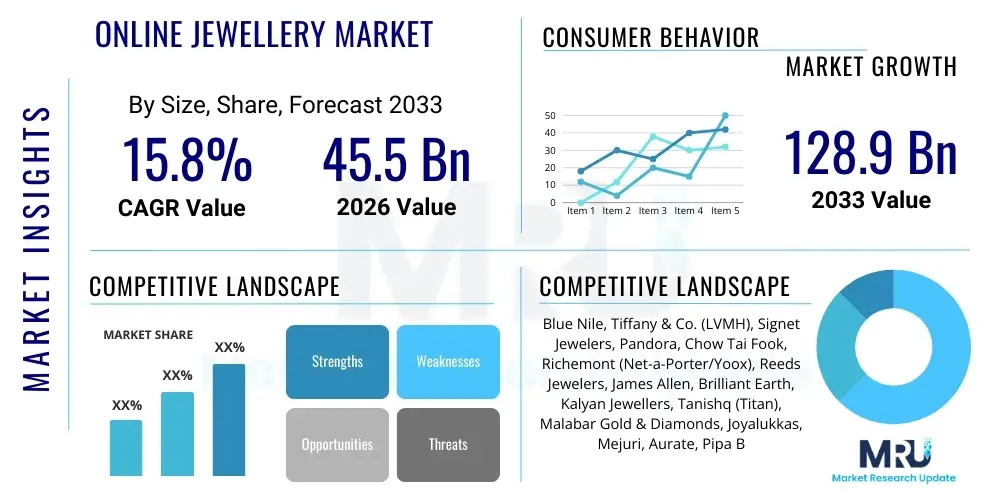

The Online Jewellery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at 45.5 Billion USD in 2026 and is projected to reach 128.9 Billion USD by the end of the forecast period in 2033.

Online Jewellery Market introduction

The Online Jewellery Market encompasses the sale of fine, semi-fine, and fashion jewellery products through digital platforms, including dedicated brand websites, third-party e-commerce marketplaces, and direct-to-consumer (DTC) channels. This market segment is characterized by rapid innovation in customer experience, leveraging advanced technologies like Augmented Reality (AR) for virtual try-ons and sophisticated logistics for secure global delivery. Products range extensively from high-value items such as diamond rings and gold necklaces to affordable costume accessories, catering to diverse consumer demographics globally. The fundamental shift towards online purchasing behavior, driven by convenience, transparency, and a wider selection palette compared to traditional brick-and-mortar stores, forms the cornerstone of this sector's expansion. Furthermore, specialized online retailers are focusing heavily on sustainable and ethically sourced materials, addressing the rising conscious consumerism trends.

Major applications of online jewellery sales span personal adornment, gifting, investment purposes, and significant life events such as engagements and weddings. The key benefits derived from purchasing jewellery online include competitive pricing due to lower overhead costs for retailers, enhanced price comparison tools, detailed product information including 4Cs (cut, color, clarity, carat) certification, and often superior customer service facilitated by chat support and personalized styling consultations. The digital infrastructure provides unparalleled access to niche designers and international brands that might not have a physical presence in specific geographical areas, thereby democratizing access to luxury goods. The transparency in sourcing and manufacturing processes, often mandated by consumer demand and facilitated by blockchain technology, further enhances buyer confidence, making the online channel increasingly viable even for high-ticket purchases.

Driving factors propelling the robust growth of the Online Jewellery Market include escalating global internet penetration and the ubiquitous adoption of smartphones, which enable seamless mobile commerce transactions. The younger, digitally native consumer base (Millennials and Gen Z) exhibits a strong preference for experiential and convenient shopping methods. Additionally, effective digital marketing strategies utilizing influencer collaborations and social media platforms have significantly increased brand visibility and engagement. The sustained normalization of cross-border e-commerce, coupled with continuous advancements in payment security and insured shipping logistics, mitigate past concerns related to purchasing valuable items sight-unseen. Lastly, the strategic integration of technology, particularly 3D visualization and customization tools, provides a compelling, interactive alternative to the in-store experience, fulfilling the modern consumer’s desire for personalization.

Online Jewellery Market Executive Summary

The Online Jewellery Market is undergoing transformative growth fueled by digital modernization and shifting consumer trust in e-commerce platforms for luxury purchases. Key business trends include the strong performance of Direct-to-Consumer (DTC) models, allowing brands to control narrative, pricing, and customer data, leading to higher margins and personalized offerings. There is a pronounced movement toward sustainability and transparency, with consumers prioritizing ethically sourced diamonds and recycled metals, prompting major industry players to overhaul their supply chain reporting. Furthermore, technology integration, specifically AI-driven personalization and AR try-on experiences, is dramatically reducing return rates and enhancing purchase confidence, establishing new standards for online retail excellence. The competitive landscape is intensely focused on digital differentiation, where specialized online-only retailers often outperform traditional legacy brands that have been slower to transition their complex inventory systems to a digital-first approach.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market share, driven by massive consumer populations in countries like China and India, where both fine jewellery (often purchased as investment) and lightweight fashion items are highly valued. North America and Europe, however, lead in technological adoption, particularly in utilizing advanced visualization tools and sophisticated logistics infrastructure, driving higher average transaction values (ATVs). Emerging markets in Latin America and the Middle East are demonstrating significant untapped potential, spurred by increasing disposable incomes and improving digital connectivity. These regions are characterized by a strong cultural affinity for gold and diamond jewellery, making them prime targets for localized e-commerce expansions, often requiring tailored payment solutions and culturally specific design collections. Regulatory environments concerning import duties and precious materials tracking also significantly shape regional market dynamics and entry strategies.

Segmentation trends highlight the increasing importance of the 'Fashion Jewellery' segment, which benefits from lower price points, allowing consumers frequent updates to their accessory wardrobes, aligning with fast fashion cycles. However, the 'Fine Jewellery' segment maintains its dominance in terms of revenue, primarily driven by high-value transactions involving customized engagement rings and certified diamonds. Distribution channels show a bifurcation: established global marketplaces (like Amazon and eBay) capture high volume for fashion jewellery, while dedicated brand websites and specialty online retailers are preferred for high-trust, certified fine jewellery purchases. Demographic analysis shows that women remain the primary buyers, but the men's jewellery segment, encompassing minimalist bands, chains, and cufflinks, is experiencing the highest proportional growth, reflecting a broader acceptance of personal adornment across genders.

AI Impact Analysis on Online Jewellery Market

User queries regarding AI's influence in the Online Jewellery Market primarily center on how artificial intelligence is enhancing customer experience, optimizing inventory management, and ensuring product authenticity. Users frequently ask about the efficacy of AI in personalizing recommendations, specifically whether AI can accurately predict purchasing intent based on style preferences and past interactions, surpassing rudimentary collaborative filtering methods. Another major theme revolves around operational efficiency, questioning how AI algorithms are used for trend forecasting, demand prediction, and dynamic pricing to manage vast, high-value inventory effectively. Concerns also touch upon ethical sourcing and provenance, investigating AI's role in verifying supply chain data and detecting fraudulent or conflict materials, thereby boosting consumer trust in digital certifications. Overall, the expectation is that AI will bridge the experiential gap between online shopping and the traditional tactile experience, making high-value remote purchases safer, more personal, and aesthetically satisfying.

- AI-driven Personalization: Recommending specific styles, materials, and price points based on deep learning analysis of browsing behavior and social media trends, significantly increasing conversion rates.

- Virtual Try-On Experience: Utilizing AI-powered Augmented Reality (AR) to allow customers to visualize jewellery pieces accurately scaled on their bodies or hands via smartphone cameras, reducing cognitive dissonance and returns.

- Inventory and Demand Forecasting: Employing machine learning models to predict seasonal trends, optimize stock levels for precious metals and stones, and manage supply chain logistics efficiently, minimizing holding costs.

- Fraud Detection and Security: Implementing AI algorithms to monitor transaction patterns, authenticate digital certificates (e.g., GIA reports), and detect fraudulent purchase attempts, enhancing trust in high-value transactions.

- Generative Design: Leveraging AI tools to assist designers in rapidly iterating on new jewellery designs based on current market trends and customer feedback, accelerating product development cycles.

DRO & Impact Forces Of Online Jewellery Market

The dynamics of the Online Jewellery Market are shaped by a complex interplay of driving forces, inherent limitations, and emergent opportunities, collectively defining the sector's trajectory. Key drivers include the global expansion of digital retail infrastructure, rising disposable incomes in emerging economies, and the growing consumer demand for personalized and customized products facilitated by digital tools. However, the market faces significant restraints, primarily centered around consumer skepticism regarding the authenticity and quality of high-value items purchased online, necessitating robust third-party verification and insurance mechanisms. Furthermore, the inherent complexities of global logistics for secure, high-value shipments and managing high return rates in the luxury sector pose ongoing challenges to profitability and scalability. The substantial opportunity lies in integrating advanced technologies like blockchain for supply chain transparency, expanding into niche personalization markets (e.g., sustainable and ethical sourcing), and leveraging social commerce platforms to convert engagement into direct sales, especially targeting younger demographics.

The impact forces influencing the Online Jewellery Market can be categorized into technological, economic, competitive, and regulatory pressures. Technologically, the rapid adoption of 3D printing for rapid prototyping and mass customization, coupled with AR/VR visualization tools, is lowering barriers to entry for specialized designers and dramatically improving the remote shopping experience. Economically, inflation and volatile precious metal prices impact procurement costs, requiring sophisticated hedging strategies, while positive macroeconomic conditions generally boost discretionary luxury spending, benefiting the high-end segments. Competitively, the market is fragmenting, witnessing aggressive pricing strategies from pure-play online retailers challenging traditional luxury houses, compelling established brands to invest heavily in their digital presence to retain market share and brand prestige. Regulatory forces, particularly concerning the Kimberley Process for diamonds and international taxation rules (VAT/GST on luxury goods), necessitate stringent compliance and transparent reporting, which often becomes a competitive advantage for ethically focused brands.

The enduring growth of the Online Jewellery Market relies heavily on overcoming trust deficits inherent in purchasing high-value, tactile products remotely. The emphasis on ethical sourcing acts as both a driver (consumer preference) and an operational restraint (increased scrutiny and cost). Success in this evolving ecosystem is determined by a retailer's ability to seamlessly integrate digital trust signals—such as verifiable provenance, guaranteed insured shipping, and hassle-free returns—with cutting-edge, personalized digital experiences. The ongoing digital transformation is fundamentally shifting power dynamics towards informed consumers who demand not only quality and value but also complete transparency regarding the product's entire lifecycle, forcing the industry to adopt standardized digital documentation and traceability protocols across the value chain, ensuring sustained, profitable market expansion throughout the forecast period.

Segmentation Analysis

The Online Jewellery Market is comprehensively segmented based on product type, material, end user, price range, and distribution channel, reflecting the diverse nature of consumer preferences and purchasing power across global regions. This segmentation allows retailers and analysts to pinpoint high-growth niches, tailor marketing strategies, and optimize inventory holdings. Product segmentation distinguishes between Fine Jewellery, which involves high-carat precious metals and certified stones, emphasizing investment value, and Fashion Jewellery, which focuses on aesthetic trends and affordability. Understanding these segments is crucial as they require vastly different operational models, from certification requirements for fine pieces to fast-moving inventory management for fashion accessories. The increasing demand for customizable pieces further intersects these segments, driving technological investment in design tools.

- By Product Type:

- Fine Jewellery (Rings, Necklaces, Earrings, Bracelets)

- Fashion Jewellery (Costume, Semi-Precious)

- By Material:

- Gold

- Diamond

- Silver

- Platinum

- Gemstones (Sapphire, Ruby, Emerald, etc.)

- Others (Base Metals, Pearls)

- By End User:

- Women

- Men (High Growth Segment)

- Unisex

- By Price Range:

- Premium (Luxury/High-End)

- Mid-Range

- Mass/Low-Range

- By Distribution Channel:

- Brand Websites/Direct-to-Consumer (DTC)

- E-commerce Marketplaces (Amazon, Alibaba, etc.)

- Omnichannel Retailers (Online Presence of Physical Stores)

Value Chain Analysis For Online Jewellery Market

The online jewellery value chain is complex and geographically dispersed, starting with upstream activities involving the sourcing of raw materials, predominantly precious metals mining, diamond extraction, and gemstone processing. Upstream analysis focuses heavily on ethical procurement and certification (e.g., conflict-free sourcing), which is increasingly scrutinized by consumers and monitored via technologies like blockchain for transparency. Key participants in this stage include large mining corporations, international gem trading hubs (like Antwerp and Mumbai), and refiners/manufacturers who cut, polish, and prepare the stones and metals for design. Due to the high value and legal constraints, strong supply chain governance is critical here, directly impacting the final retail price and brand reputation.

The midstream involves manufacturing, design, and inventory preparation. Digital capabilities, such as Computer-Aided Design (CAD) and 3D printing, are integrated here to facilitate rapid prototyping and mass customization, a significant advantage for online-focused businesses. Downstream analysis covers warehousing, fulfillment, logistics, and retail distribution, where the online market differs significantly from traditional retail. Distribution channels are bifurcated into direct and indirect methods. Direct channels involve the brand’s own dedicated e-commerce platform (DTC), offering maximum control over branding, pricing, and customer data, leading to higher profit margins. Indirect channels involve utilizing large, established e-commerce marketplaces (Amazon, Tmall) which offer wide reach and high volume, particularly for fashion and mid-range jewellery, but entail sharing customer data and incurring platform fees. Secure and insured shipping is a paramount consideration in the downstream logistics for valuable goods.

Effective value chain management in the online jewellery sector requires seamless integration between physical operations (sourcing, manufacturing) and digital touchpoints (customer experience, marketing). Transparency in the chain is now a core requirement; customers are increasingly willing to pay a premium for certified ethical sourcing. Furthermore, the role of logistics providers specializing in high-value transport, often involving armored vehicles and secure vault storage, is critical. The optimal model often involves a hybrid approach, where brands use flagship physical stores for consultations and trust-building (omnichannel) while driving the majority of transactions and long-tail inventory sales through the highly efficient and scalable online platform, utilizing localized fulfillment centers for rapid regional delivery.

Online Jewellery Market Potential Customers

Potential customers for the Online Jewellery Market are broadly diverse, categorized mainly by purchasing intent, demographic profile, and value perception. The primary consumer groups include Millennials and Gen Z individuals who are highly digitally fluent, prioritize ethical and sustainable sourcing, and frequently purchase fashion jewellery for self-expression or gifting. This group values transparency, social media engagement, and personalized experiences, often opting for DTC brands that align with their ethical values. Another critical segment comprises high-net-worth individuals who purchase fine jewellery for significant life events (engagements, anniversaries) or as investment vehicles. This segment requires high levels of trust, certification guarantees, and specialized, personalized virtual consultations to facilitate high-ticket purchases.

Beyond individual consumers, corporate buyers and specialty niche groups form secondary but high-value customer bases. Corporate customers include large organizations purchasing custom jewellery (e.g., commemorative pins, luxury watches) for employee recognition programs or high-end corporate gifts. Niche groups encompass collectors interested in rare vintage pieces or customized artisanal works, who rely on specialized online auction houses or curated digital boutiques for authenticated items. Geographically, potential customers are concentrated in urban and high-income metropolitan areas globally, exhibiting a strong correlation between internet access, disposable income, and luxury expenditure habits. The expansion into developing economies also targets the burgeoning middle class, particularly in Asia, who are increasingly utilizing mobile commerce for purchasing gold and diamond pieces traditionally bought offline.

Crucially, the modern online jewellery buyer is characterized by intensive pre-purchase research. These buyers utilize multiple digital resources, including comparison shopping engines, independent certification databases (GIA, AGS), and peer reviews, before committing to a purchase. The potential customer base is therefore highly informed, demanding detailed visual representations (360-degree views, high-resolution imagery), detailed specifications, and clear return policies. Effective targeting relies on advanced behavioral segmentation, recognizing the shift from transactional purchasing of goods to experiential purchasing of emotional value and heritage, which online platforms must skillfully communicate through brand storytelling and high-quality digital content, thereby maximizing the conversion potential of sophisticated digital leads.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 45.5 Billion USD |

| Market Forecast in 2033 | 128.9 Billion USD |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blue Nile, Tiffany & Co. (LVMH), Signet Jewelers, Pandora, Chow Tai Fook, Richemont (Net-a-Porter/Yoox), Reeds Jewelers, James Allen, Brilliant Earth, Kalyan Jewellers, Tanishq (Titan), Malabar Gold & Diamonds, Joyalukkas, Mejuri, Aurate, Pipa Bella, CaratLane, Zales, Vashi, The Clear Cut. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Jewellery Market Key Technology Landscape

The technological evolution within the Online Jewellery Market is primarily centered on enhancing consumer trust, improving visualization, and streamlining complex supply chains. Augmented Reality (AR) and Virtual Reality (VR) are foundational technologies, allowing consumers to virtually try on rings, necklaces, and earrings using their smartphones or computer cameras. This capability significantly mitigates the traditional barrier of not being able to physically handle or view the product, thereby boosting conversion rates and reducing returns attributable to size or fit issues. Advanced 3D modeling and high-resolution imaging techniques, often incorporating interactive 360-degree views, provide an unprecedented level of detail regarding cut, clarity, and texture, effectively replicating the examination process that typically occurs in a physical store. These visualization tools are critical differentiators for premium online retailers dealing in certified diamonds and unique designs.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are deeply embedded in backend operations and customer-facing interfaces. AI algorithms are essential for personalized marketing and product recommendation engines, analyzing vast datasets of aesthetic preferences, purchasing history, and style trends to suggest highly relevant pieces, moving beyond simple demographic targeting. On the operational side, ML models are crucial for accurate demand forecasting, especially vital given the long lead times and high cost associated with sourcing precious metals and stones. Blockchain technology represents another pivotal development, primarily used to create immutable digital ledgers for product provenance. This technology allows customers to trace the ethical journey of diamonds and gold from mine to market, addressing the rising consumer demand for sustainability and transparency and building significant trust in the digital transaction environment.

The integration of specialized manufacturing technologies, such as Computer-Aided Design (CAD) software coupled with sophisticated 3D printing (Additive Manufacturing), is revolutionizing customization and small-batch production. These technologies allow online brands to offer complex bespoke designs quickly and cost-effectively, catering to the growing demand for unique, personalized engagement and wedding jewellery. Additionally, advances in secure payment gateways and robust encryption standards, often tailored for high-value transactions, are indispensable for maintaining consumer confidence. The collective adoption of these technologies—visualization, AI personalization, blockchain transparency, and customized manufacturing—is fundamentally transforming the competitive dynamics, establishing a new technological baseline for success in the rapidly digitizing global jewellery sector, enabling scalability without sacrificing the luxury experience.

Regional Highlights

- North America: This region is characterized by high technological adoption and a strong preference for certified fine jewellery, especially engagement rings. The U.S. market, driven by key players like Blue Nile and James Allen, leads in innovative digital strategies, including extensive use of virtual try-on and blockchain-verified products. High average transaction values and a mature e-commerce infrastructure underpin robust growth, particularly in the DTC segment focused on ethically sourced and conflict-free materials.

- Europe: The European market exhibits diverse tastes, ranging from high-end luxury brands originating in France and Italy to strong demand for fast-fashion accessories across the UK and Germany. Growth is boosted by sophisticated logistics networks and cross-border e-commerce liberalization. Sustainability and traceability are particularly important drivers here, with stringent consumer preferences favoring brands that provide detailed environmental and social governance (ESG) reporting on their sourcing.

- Asia Pacific (APAC): APAC remains the largest and fastest-growing region, dominated by populous markets such as China and India. Cultural significance dictates high demand for gold jewellery (often viewed as an investment) and personalized wedding pieces. Mobile commerce is the primary purchasing channel. Key growth factors include rising middle-class income, strong domestic e-commerce giants (Alibaba, Tmall), and significant investment by major regional players (Chow Tai Fook, Tanishq) in digital engagement tools and localized product offerings.

- Latin America: While e-commerce penetration is still maturing compared to other regions, the market shows rapid growth driven by increased internet access and urbanization. Security concerns often prioritize local, trusted platforms, but international brands are gaining traction. The market is primarily sensitive to price fluctuations and localized payment methods are crucial for conversion success.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, holds significant demand for high-carat gold and luxury diamond jewellery due to high disposable incomes and a cultural affinity for ornate designs. Online growth is accelerating, bolstered by high mobile usage, secure digital payment adoption, and government initiatives promoting digital trade, transforming traditional gold souks into sophisticated omnichannel operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Jewellery Market.- Blue Nile

- Tiffany & Co. (LVMH)

- Signet Jewelers

- Pandora

- Chow Tai Fook

- Richemont (Net-a-Porter/Yoox)

- Reeds Jewelers

- James Allen

- Brilliant Earth

- Kalyan Jewellers

- Tanishq (Titan)

- Malabar Gold & Diamonds

- Joyalukkas

- Mejuri

- Aurate

- Pipa Bella

- CaratLane

- Zales

- Vashi

- The Clear Cut

Frequently Asked Questions

Analyze common user questions about the Online Jewellery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Online Jewellery Market between 2026 and 2033?

The Online Jewellery Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 15.8% during the forecast period, reflecting accelerating consumer adoption of digital purchasing for both fine and fashion jewellery.

How is technology, specifically AR, transforming the online jewellery shopping experience?

Augmented Reality (AR) allows potential customers to virtually try on jewellery pieces using their smart devices, providing real-time visualization of how the items look and fit. This technology significantly enhances purchase confidence, bridges the physical gap of e-commerce, and helps reduce high return rates.

Which geographical region holds the largest market share in the Online Jewellery Market?

The Asia Pacific (APAC) region currently dominates the market share due to its vast consumer base, strong cultural preference for gold and diamond investments, and high mobile e-commerce penetration, particularly in China and India.

What are the primary factors restraining growth in the online market for high-value fine jewellery?

The main restraints include consumer trust deficits regarding the authenticity and quality of high-value items purchased sight-unseen, alongside the operational complexities and high costs associated with secure, insured global logistics and managing potential fraud risks.

What role does blockchain technology play in the modern online jewellery supply chain?

Blockchain technology is crucial for providing transparent and immutable traceability of precious materials, verifying the ethical and conflict-free sourcing of diamonds and gold. This enhances brand credibility and meets the growing consumer demand for verifiable supply chain transparency and sustainability reporting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager