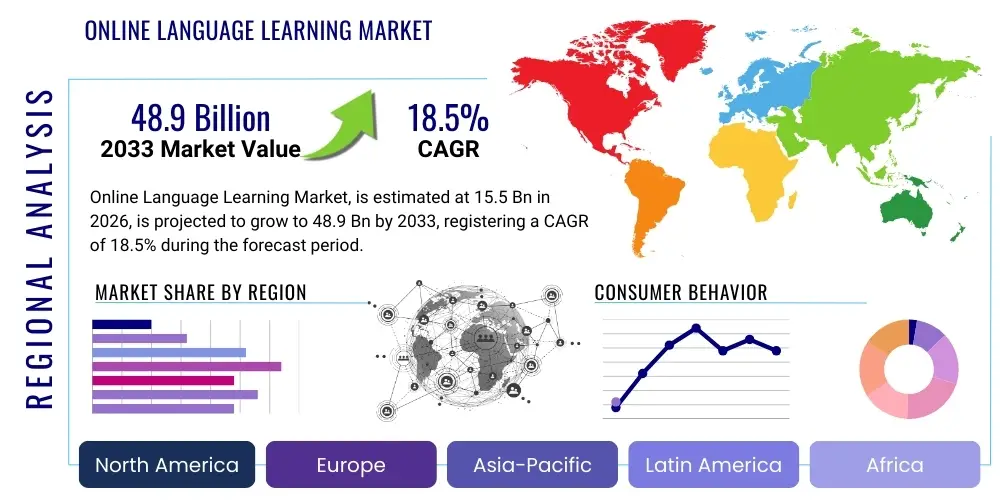

Online Language Learning Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441259 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Online Language Learning Market Size

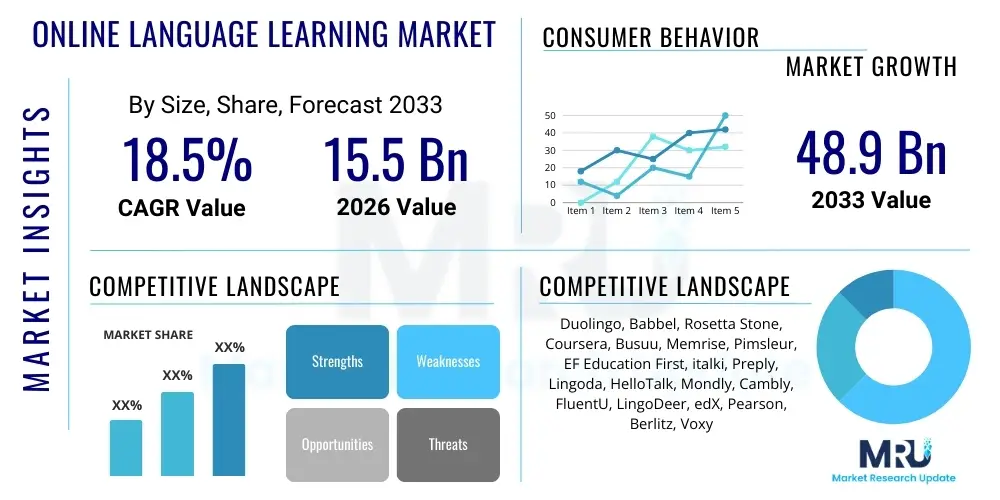

The Online Language Learning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $48.9 Billion by the end of the forecast period in 2033.

This robust expansion is primarily driven by the escalating demand for flexible, accessible, and personalized education solutions globally. The shift towards remote work and the increasing globalization of business operations necessitate multilingual proficiency, making online platforms the preferred choice for professional and personal development. Furthermore, technological advancements, including improved internet infrastructure and the proliferation of mobile devices, have lowered the barriers to entry for learners across all demographics, substantially boosting market penetration and accelerating the rate of adoption across emerging economies.

The market valuation reflects significant investment in platform innovation, particularly the integration of advanced pedagogical tools such as gamification, adaptive testing, and live tutoring sessions. While the initial growth phase focused on basic vocabulary and grammar instruction, the current market trajectory indicates a move towards comprehensive fluency development, supported by sophisticated speech recognition and real-time interaction capabilities. The competitive landscape is intensely focused on acquiring and retaining users through differentiated content offerings and superior user experience (UX) design, securing the market's strong financial outlook through 2033.

Online Language Learning Market introduction

The Online Language Learning Market encompasses digital platforms, software, and services designed to facilitate second or foreign language acquisition outside traditional classroom settings. These solutions leverage internet technologies, mobile applications, and sophisticated algorithms to deliver personalized learning pathways to a global audience. The primary offerings range from asynchronous, self-paced courses and mobile vocabulary applications (such as microlearning platforms) to synchronous, instructor-led virtual classrooms and AI-powered conversational tools. Major applications span educational enrichment, professional career advancement, migration preparedness, and leisure learning, serving both individual consumers (B2C) and corporate/institutional clients (B2B).

The fundamental benefits driving the market include unparalleled flexibility in scheduling, significant cost-effectiveness compared to traditional schooling, and the ability to tailor content to individual proficiency levels and learning styles. The driving factors are multifaceted, rooted in increasing cross-border trade, the cultural impact of global media, the imperative for global communication skills in a digitized economy, and governmental initiatives promoting multilingualism. Moreover, the inherent scalability of digital platforms allows providers to reach vast, geographically dispersed populations efficiently, making language learning accessible irrespective of location, time zone, or economic background, which substantially enhances market reach and utilization.

The core product description revolves around Software-as-a-Service (SaaS) models featuring diverse instructional methodologies, including content immersion, spaced repetition systems (SRS), adaptive testing modules, and interactive practice environments. Key applications involve corporate training programs aimed at upskilling global teams, K-12 and higher education supplementary tools, and test preparation services for standardized language exams (e.g., TOEFL, IELTS). The market's structural evolution is characterized by continuous integration of immersive technologies, such as Virtual Reality (VR) and Augmented Reality (AR), aimed at creating highly contextualized and engaging practice environments that simulate real-world linguistic interactions, thereby enhancing learner outcomes and market desirability.

Online Language Learning Market Executive Summary

The Online Language Learning Market is experiencing robust acceleration, fueled by pervasive digital transformation across educational sectors and a structural shift in global workforce requirements favoring polyglots. Business trends indicate a strong move toward platform consolidation, strategic partnerships between EdTech firms and traditional educational institutions, and a premium placed on proprietary content libraries focusing on high-demand languages like Mandarin, Spanish, and specific technical terminologies essential for niche professional fields. Key strategic imperatives for market leaders include developing comprehensive B2B enterprise solutions that offer bulk licensing and customized curricula, and maintaining technological superiority through continuous AI integration for highly granular user progress tracking and personalized curriculum adjustments.

Regionally, North America and Europe remain dominant in terms of market value due to high disposable income and established digital infrastructure, yet the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR, driven by massive population bases, rising smartphone penetration, and intense competitive pressure in educational achievement. Countries like India and China are demonstrating exponential demand for English language proficiency tools, fueling market growth in both institutional and individual learner segments. Latin America and MEA are emerging markets, characterized by rapid urbanization and increasing international business engagement, resulting in a burgeoning appetite for Spanish and Arabic language solutions.

Segment trends reveal that the institutional segment (B2B/B2G) is rapidly gaining ground, particularly within the corporate sector which prioritizes language training as a critical component of global talent management and operational efficiency. Furthermore, the Component segmentation highlights that the Solutions segment (core software platforms) currently holds the largest market share, but the Services segment (live tutoring, custom curriculum development, and professional support) is expanding rapidly, reflecting the growing demand for hybrid learning models that blend self-study flexibility with personalized human interaction. Deployment via cloud-based models is universally preferred due to its inherent accessibility, scalability, and cost-efficiency, facilitating mass adoption across disparate geographical areas and technological ecosystems.

AI Impact Analysis on Online Language Learning Market

User inquiries regarding AI's role in online language learning frequently center on core themes of personalization, conversational fluency, and instructional quality assurance. Common questions explore how AI-driven tutors can replicate human conversation fidelity, whether automated grading systems accurately assess complex linguistic nuances, and the extent to which AI will democratize high-quality instruction versus creating a dependency on technology that limits authentic interaction. Users expect AI to deliver hyper-personalized learning paths, real-time error correction, and immersive conversational practice that transcends basic chatbot capabilities. Concerns often relate to data privacy, the potential loss of cultural context in algorithmically generated lessons, and the fear that AI might eventually displace human language instructors entirely, necessitating clear communication from providers about the complementary role of technology and human expertise.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the efficacy and scalability of online language platforms, moving beyond simple dictionary lookups and flashcards to sophisticated, adaptive learning environments. AI now powers advanced speech recognition systems, enabling instantaneous feedback on pronunciation and intonation with remarkable accuracy, simulating a native speaker's ear. ML algorithms analyze vast datasets of user performance to dynamically adjust the difficulty, pace, and content relevance of lessons, ensuring that instructional time is maximized by focusing precisely on areas where the learner requires improvement, thereby substantially reducing the time needed to achieve measurable proficiency goals.

Furthermore, Natural Language Processing (NLP) is critical in generating highly realistic conversational AI, which serves as a tireless practice partner for learners. These AI agents can handle complex, open-ended dialogues, understand context, and respond appropriately, offering an unparalleled level of conversational immersion that was previously only achievable through expensive one-on-one human tutoring. This technological shift addresses the perennial challenge in language learning—the lack of safe, non-judgmental environments for active speaking practice—and is set to significantly widen the competitive gap between platforms that successfully integrate cutting-edge AI and those relying on static content delivery models.

- AI-Powered Adaptive Learning Paths: Algorithms dynamically adjust content difficulty and topic sequencing based on real-time performance data.

- Enhanced Speech Recognition and Pronunciation Feedback: Utilizing deep learning to provide highly accurate, instantaneous phonetic error correction.

- NLP-Driven Conversational Tutors: Enabling realistic, context-aware dialogue practice, simulating human interaction complexity.

- Automated Content Curation and Translation: Rapid generation and localization of new learning materials across multiple languages.

- Real-time Performance Analytics: Providing granular insights into learner weaknesses, fluency rates, and optimal learning interventions.

- Gamification Optimization: Using ML to tailor rewards, challenges, and motivational triggers for sustained engagement.

DRO & Impact Forces Of Online Language Learning Market

The market dynamics of Online Language Learning are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming potent Impact Forces that dictate strategic direction and growth rates. Key drivers include the overwhelming global demand for multilingual communication skills, accelerated by corporate globalization, increased internet penetration in developing regions, and the demonstrable convenience and cost-effectiveness of digital delivery models over traditional methods. These drivers exert a significant upward force, pushing vendors toward broader market access and greater scalability in their infrastructure. The demand spike following global events requiring remote education solutions has solidified online learning as a permanent fixture in the educational ecosystem.

Conversely, the market faces significant restraints that temper aggressive growth projections. These primarily involve challenges related to technological access, such as unreliable internet connectivity in rural or low-income areas, and the crucial requirement for quality control, where the sheer volume of content necessitates rigorous vetting to maintain pedagogical standards and prevent misinformation. Furthermore, cultural resistance to digital learning models, particularly among older populations or highly traditional educational systems, acts as a structural impediment. These restraints compel companies to invest heavily in low-bandwidth solutions, robust regulatory compliance, and extensive training programs aimed at building digital literacy among their target demographics.

Opportunities abound in harnessing niche markets, specifically through offering highly specialized language training (e.g., medical terminology, legal Spanish, aviation English) for professional certification and career advancement, moving beyond general fluency training. Moreover, the integration of immersive technologies like VR/AR offers an untapped opportunity to create highly engaging, contextual learning experiences that address the fluency gap often associated with purely digital instruction. The primary impact forces are digital transformation, which serves as the overarching driver, the democratization of education through technology, and the intense competitive pressure forcing continuous technological innovation and content diversification among market participants to capture and maintain learner loyalty.

- Drivers: Globalization of commerce and labor; High cost-efficiency and flexibility of digital platforms; Increased penetration of mobile devices and high-speed internet; Emphasis on continuous professional development requiring language skills.

- Restraints: Need for rigorous content quality assurance and standardization; Digital divide related to connectivity and device affordability; High initial investment required for developing sophisticated AI and proprietary content; Issues related to certification acceptance by traditional institutions.

- Opportunities: Expansion into corporate training and B2B enterprise solutions; Development of highly immersive VR/AR language environments; Focus on specialized, niche languages and technical vocabulary training; Leveraging government contracts for public sector language education.

- Impact Forces: Intense technological innovation cycles; Consumer demand for personalization; Regulatory environment concerning data privacy and educational standards; Competitive pricing models and subscription fatigue mitigation.

Segmentation Analysis

The Online Language Learning Market is structurally segmented based on Component, Deployment Type, End-User, and Language Type, providing a comprehensive framework for strategic assessment and targeted marketing efforts. Component segmentation divides the market into core software solutions (platforms, apps, content libraries) and supplementary services (live tutoring, consulting, customized curriculum development), reflecting the shift toward hybrid offerings. Deployment type focuses on Cloud versus On-premise installations, with Cloud commanding significant dominance due to accessibility and scalability. The End-User analysis distinguishes between individual consumers (B2C), which represent the largest volume, and institutional users (B2B/B2G), which generate higher average revenue per user (ARPU) through long-term contracts.

Analyzing these segments reveals critical insights into market preferences and investment areas. The proliferation of mobile devices has dramatically boosted the B2C segment, driven by microlearning apps that prioritize convenience and gamification. Simultaneously, the institutional segment is demanding highly tailored learning management system (LMS) integration capabilities, robust reporting features, and accreditation support. Language type segmentation shows consistently high demand for global business languages—English, Spanish, Mandarin, and French—while demand for regional or critically endangered languages provides niche market opportunities for specialist providers and governmental educational partners.

Strategic success within this diverse market environment hinges on providers effectively balancing broad consumer appeal with deep institutional customization. For instance, platforms must offer affordable subscription models for individual learners while simultaneously developing enterprise-grade security and integration frameworks for corporate clients. The ongoing transition towards services, particularly high-quality live instruction integrated seamlessly within digital platforms, indicates that superior pedagogical outcomes, rather than just technological novelty, will be the decisive factor in market leadership going forward. This intricate segmentation allows stakeholders to accurately gauge market maturity and direct capital expenditure toward high-growth, underserved areas.

- By Component:

- Solutions (Software, Content, Platforms)

- Services (Tutoring, Consulting, Customization, Technical Support)

- By Deployment Type:

- Cloud-based

- On-premise

- By End-User:

- Individual Learners (B2C)

- Institutional Learners (K-12, Higher Education, Corporate, Government)

- By Language Type:

- English

- Spanish

- French

- Mandarin

- German

- Others (Japanese, Korean, Arabic, etc.)

Value Chain Analysis For Online Language Learning Market

The Value Chain for the Online Language Learning Market begins with upstream activities focused on content generation and platform development. This involves curriculum designers, linguistic experts, and educational technologists collaborating to create proprietary, pedagogically sound learning modules, often leveraging intellectual property in instructional design methods like spaced repetition or total immersion techniques. The technological foundation—platform architecture, AI integration, hosting solutions, and mobile app development—forms the critical initial component, requiring significant investment in R&D to ensure platform stability, scalability, and an engaging user interface. Upstream efficiency is measured by the speed and quality of content localization and the integration of novel technologies like machine learning for adaptive testing.

Midstream activities center on platform delivery, marketing, and sales. Distribution channels are predominantly direct, relying heavily on proprietary websites, dedicated mobile application stores (iOS and Android), and sophisticated digital marketing strategies employing SEO/AEO and targeted social media campaigns to acquire individual learners (B2C). For institutional sales (B2B), distribution involves specialized sales teams, strategic alliances with consulting firms, and integration partnerships with existing Learning Management Systems (LMS) used by corporations and universities. The shift toward a subscription-based revenue model necessitates continuous optimization of the customer acquisition cost (CAC) and lifetime value (LTV) metrics.

Downstream activities involve customer relationship management (CRM), technical support, and the provision of high-value services such as live tutoring and certification support. Direct channels ensure maximum control over the user experience and data collection, which feeds back into content refinement and personalized product development. Indirect channels, while less common, may include authorized resellers or educational affiliates in specific geographical regions that handle localization or local regulatory compliance. The long-term success of the value chain relies on establishing strong brand loyalty through superior user support and continuously updated, high-quality educational content that delivers verifiable learning outcomes, thereby ensuring high retention rates and minimizing customer churn.

Online Language Learning Market Potential Customers

Potential customers for the Online Language Learning Market are broadly categorized into four main end-user segments, each driven by distinct needs and procurement preferences. The largest volume segment comprises individual learners (B2C), who are typically seeking self-improvement, cultural immersion, or basic conversational skills for travel. This demographic spans students, young professionals focused on career mobility, and retirees pursuing leisure learning. Their purchasing decisions are highly sensitive to pricing, user experience (UX), and gamification elements, often preferring mobile-first applications that support microlearning sessions.

The institutional segment includes K-12 and Higher Education institutions utilizing platforms for blended learning models, supplementary instruction, or fulfilling language requirements. These educational buyers prioritize content accreditation, alignment with standardized curricula, integration capabilities with existing campus technology, and robust administrative reporting tools. Procurement often involves institutional-level licensing and is motivated by improving academic outcomes and efficiency of instruction within limited budgets, requiring providers to demonstrate pedagogical validity and efficacy data.

The Corporate segment represents high-value B2B buyers seeking to upskill their global workforce, enhance cross-cultural communication, and prepare employees for international assignments. These customers require highly customized, job-specific curricula (e.g., business Mandarin, technical French), secure data handling, and seamless integration with corporate Learning & Development (L&D) platforms. The focus here is on tangible ROI, measured by improved team performance, reduced communication errors, and faster talent deployment capabilities across different geographies. Finally, Government and Non-profit Organizations seek bulk language training for diplomatic staff, defense personnel, or public service workers, often demanding strict adherence to specialized linguistic requirements and high security standards for platform deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $48.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Duolingo, Babbel, Rosetta Stone, Coursera, Busuu, Memrise, Pimsleur, EF Education First, italki, Preply, Lingoda, HelloTalk, Mondly, Cambly, FluentU, LingoDeer, edX, Pearson, Berlitz, Voxy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Language Learning Market Key Technology Landscape

The technological landscape of the Online Language Learning market is defined by rapid innovation centered on enhancing immersion, personalization, and interaction quality. The foundational technology relies heavily on robust cloud computing infrastructure, necessary to handle massive simultaneous user traffic and the storage of extensive multimedia content libraries. Crucial proprietary technologies include sophisticated Natural Language Processing (NLP) engines, which analyze text and speech input to understand meaning and context, and Machine Learning (ML) algorithms, which power adaptive testing systems and optimize the pacing of lessons to minimize learning plateaus. Furthermore, the reliance on high-fidelity audio and video streaming technologies is essential for delivering synchronous live tutoring sessions with minimal latency, ensuring a high-quality user experience critical for fluency development.

Modern platforms are increasingly integrating advanced pedagogical tools such as Spaced Repetition Systems (SRS), which use ML to schedule review material precisely when a user is likely to forget it, maximizing memory retention. Furthermore, the integration of conversational AI chatbots has moved from simple scripted responses to highly sophisticated virtual tutors capable of dynamic, context-aware dialogue, offering unlimited practice opportunities. This technological shift is underpinned by continuous investment in big data analytics, allowing platforms to track billions of data points on user interactions, error patterns, and engagement metrics, which are then used to refine content algorithms and improve overall instructional efficacy.

Looking forward, the technology landscape is poised for further disruption through the widespread adoption of immersive technologies. Virtual Reality (VR) and Augmented Reality (AR) are beginning to create highly contextualized, simulated environments—such as a virtual coffee shop or a foreign customs office—where learners can practice language skills in realistic, low-stakes scenarios. This move towards embodied cognition and spatial learning represents the next frontier in achieving true fluency and retention. Mobile optimization remains paramount, with platforms developing sophisticated offline capabilities and seamless cross-device synchronization to ensure uninterrupted access and flexibility for the global mobile-first user base.

Regional Highlights

Regional analysis reveals stark differences in market maturity, growth drivers, and preferred learning models across the globe. North America maintains market leadership in terms of technology adoption and revenue contribution, characterized by high consumer willingness to pay for premium, specialized language services and a strong corporate emphasis on language training for diversity and inclusion initiatives. The region benefits from a highly competitive vendor landscape, significant venture capital investment in EdTech, and early adoption of AI-driven personalized learning solutions. Demand is primarily centered on Spanish, French, and Mandarin, serving diverse immigrant populations and global business needs.

Europe represents a highly mature but fragmented market, driven by the necessity for multilingualism within the European Union (EU) and high labor mobility. Educational mandates and strong governmental support for cultural exchange fuel sustained growth. The market sees strong uptake of hybrid models combining digital platforms with local language school networks. Demand is diversified, focusing on major European languages (German, Italian, Spanish, French) alongside English proficiency for international career paths. Regulatory factors, particularly GDPR compliance, significantly influence platform deployment strategies and data handling protocols within this region.

The Asia Pacific (APAC) region is the fastest-growing market globally, propelled by immense population size, rapid urbanization, and an intense cultural focus on competitive educational attainment, especially in China, India, and South Korea. The primary driver is the overwhelming demand for English language proficiency, crucial for economic access and higher education opportunities abroad. The market is highly price-sensitive and dominated by mobile application usage, necessitating high investment in localization and affordable, scalable microlearning content. Furthermore, the rise of intra-regional commerce is increasing demand for Japanese, Korean, and regional dialects.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting substantial growth potential. In LATAM, demand for English and Portuguese, driven by business ties with North America and Europe, is strong. MEA growth is concentrated in urban centers, fueled by increasing smartphone penetration and a need for professional communication skills, particularly English and French, often influenced by historical ties and energy sector demands. Challenges in these regions include infrastructure variability and lower average purchasing power, requiring providers to focus on value-driven, accessible product offerings and robust offline access capabilities.

- North America: Market leader in revenue; focus on high-fidelity AI tools and specialized B2B corporate training; high willingness to pay for premium services.

- Europe: Mature market driven by EU multilingual mandates and labor mobility; high adoption of hybrid learning and strong regulatory oversight (GDPR).

- Asia Pacific (APAC): Highest growth region driven by massive demand for English proficiency and mobile-first learning; high competition and price sensitivity.

- Latin America (LATAM): Emerging market focused on English and Portuguese acquisition for economic mobility; growth constrained by internet infrastructure challenges.

- Middle East & Africa (MEA): Growing rapidly in urban centers; demand centered on English, French, and specialized industry vocabulary; potential for large-scale government contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Language Learning Market.- Duolingo

- Babbel

- Rosetta Stone (A division of IXL Learning)

- Coursera

- Busuu (A part of Chegg)

- Memrise

- Pimsleur (A division of Simon & Schuster)

- EF Education First

- italki

- Preply

- Lingoda

- HelloTalk

- Mondly (A part of Pearson)

- Cambly

- FluentU

- LingoDeer

- edX (A part of 2U)

- Pearson PLC

- Berlitz Corporation

- Voxy

Frequently Asked Questions

Analyze common user questions about the Online Language Learning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Online Language Learning Market?

The Online Language Learning Market is projected to grow at a strong Compound Annual Growth Rate (CAGR) of 18.5% through the forecast period spanning 2026 to 2033, driven by digitalization and globalization.

How is AI transforming the personalization of language learning platforms?

AI, through Machine Learning and NLP, facilitates hyper-personalization by dynamically adjusting lesson difficulty, providing real-time pronunciation feedback, and generating customized conversational practice scenarios based on individual learner performance data.

Which segment holds the largest market share in the Online Language Learning industry?

The Individual Learner (B2C) end-user segment currently holds the largest volume share, primarily utilizing mobile applications and self-paced subscriptions for general language acquisition, though the corporate B2B segment is growing rapidly in terms of revenue value.

What are the primary drivers of market growth in the Asia Pacific (APAC) region?

Growth in APAC is fundamentally driven by the enormous demand for English proficiency for career advancement, high mobile penetration rates, rapid urbanization, and a strong cultural emphasis on achieving competitive educational outcomes.

What are the key technological advancements expected in the market?

Key expected advancements include the wider integration of Virtual Reality (VR) and Augmented Reality (AR) for immersive practice environments, highly sophisticated context-aware conversational AI tutors, and further optimization of mobile-first, low-bandwidth learning solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Online Language Learning Market Size Report By Type (English, Chinese (Mandarin), Others), By Application (Individual Learner, Institutional Learners), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Online Language Learning Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Courses, Solutions (Software & Apps), Support), By Application (Individual Learners, Corporate Learners, Educational Institutions, Government Learners), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Corporate Online Language Learning Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-premise, Cloud Platforms), By Application (SME, Large Enterprises), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager