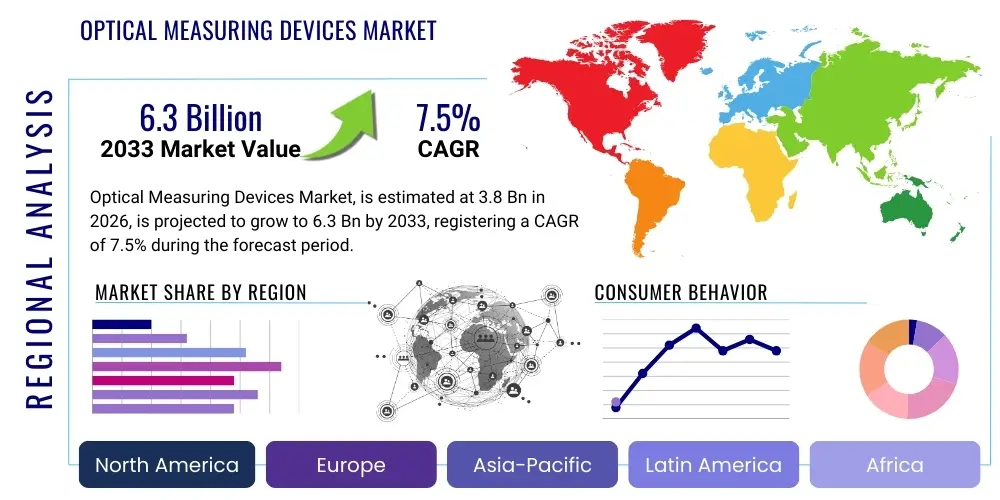

Optical Measuring Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441448 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Optical Measuring Devices Market Size

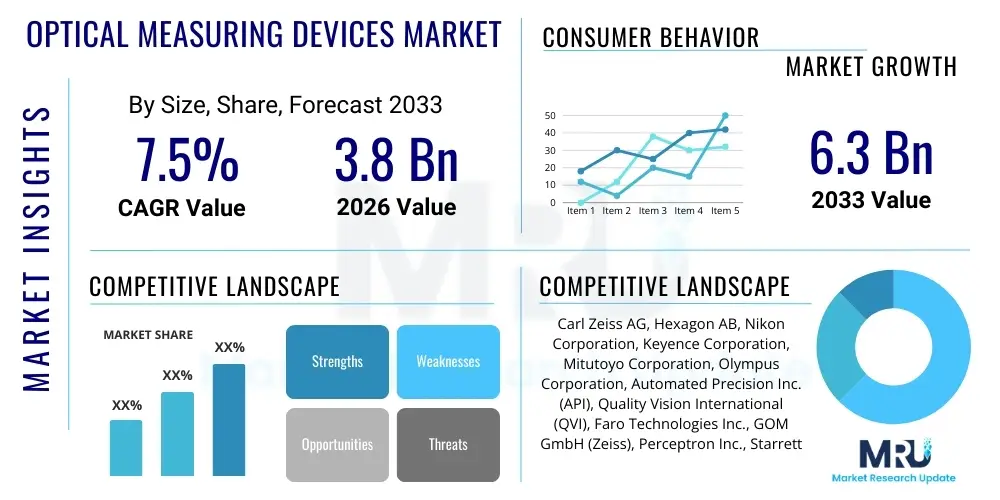

The Optical Measuring Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Optical Measuring Devices Market introduction

Optical measuring devices utilize light-based principles—including reflection, refraction, and diffraction—to perform highly accurate, non-contact measurements of physical dimensions, surface topography, and material properties. These sophisticated instruments are critical for quality control, inspection, and metrology applications across high-precision manufacturing sectors. The core product categories within this market include profile projectors, coordinate measuring machines (CMMs) with optical probes, microscopes (digital and confocal), and advanced spectral analysis tools like spectrometers and interferometers. The non-destructive nature of optical measurement, coupled with its ability to handle intricate geometries and sensitive materials, makes it indispensable in modern industrial environments where zero-defect manufacturing is the standard expectation.

The principal applications of optical measuring devices span vital industrial segments such as automotive, aerospace and defense, electronics, medical devices, and precision machinery manufacturing. In the electronics sector, they are crucial for inspecting the microscopic features of semiconductor wafers and printed circuit boards (PCBs), ensuring component accuracy during the miniaturization trend. For the automotive and aerospace industries, these devices guarantee the dimensional accuracy and surface finish of critical components like turbine blades, engine parts, and structural composites, directly contributing to product safety and performance longevity. The primary benefit derived from the utilization of these systems is the significant enhancement of manufacturing throughput and precision, allowing companies to meet stringent regulatory requirements and reduce scrap rates efficiently.

Key factors driving the expansion of the Optical Measuring Devices Market include the global push towards Industry 4.0 and smart factory automation, which necessitates real-time, high-speed metrology data integrated into production lines. Furthermore, the increasing complexity and decreasing size of manufactured components, particularly in the consumer electronics and medical implant fields, demand measurement precision beyond the capabilities of traditional contact methods. Technological advancements, such as the integration of advanced vision systems, high-resolution cameras, and sophisticated software for rapid data analysis and 3D reconstruction, continue to fuel market growth by expanding the utility and accessibility of these instruments across a wider range of industrial applications. The continuous need for stringent quality assurance across global supply chains reinforces the foundational requirement for highly reliable optical metrology solutions.

Optical Measuring Devices Market Executive Summary

The Optical Measuring Devices Market is experiencing robust growth, primarily propelled by global business trends emphasizing digitization, hyper-precision manufacturing, and stringent quality compliance in highly regulated industries. Key business trends include the shift from traditional laboratory-based inspection to in-line and near-line inspection systems, facilitating immediate feedback loops in automated production environments. Furthermore, vendors are focusing heavily on developing portable, ergonomic, and automated systems that minimize operator variability and maximize measurement speed, catering to the needs of highly dynamic manufacturing settings. The competitive landscape is characterized by strategic mergers, acquisitions, and strong partnerships between optical hardware manufacturers and software developers to offer holistic, integrated metrology solutions that manage the entire data lifecycle from acquisition to analysis and reporting.

Regionally, the Asia Pacific (APAC) market, particularly China, South Korea, and Japan, dominates the landscape due to its status as the global hub for high-volume electronics manufacturing and automotive production. Rapid industrialization, coupled with significant governmental and private investments in semiconductor fabrication plants (fabs), drives the high demand for advanced optical inspection tools crucial for wafer and chip quality assurance. North America and Europe remain key markets characterized by high adoption rates of advanced R&D, specialized aerospace manufacturing, and strict compliance standards in the medical device sector. While APAC leads in volume deployment, North America often leads in the development and adoption of cutting-edge technologies like advanced laser scanning and structured light systems, driven by strong defense and technology budgets.

Segmentation trends highlight the increasing preference for sophisticated non-contact measurement types, with advanced vision measuring systems and 3D scanning solutions experiencing the highest growth rates, surpassing traditional profile projectors. The automotive segment remains a foundational end-user, but the electronics and semiconductor industry is the fastest-growing segment, owing to the relentless Moore's Law progression requiring nanometer-level measurement capabilities. Device complexity and the demand for rapid, multi-sensor data acquisition are driving the integration of various measurement technologies, moving beyond single-point measurement devices towards multi-functional platforms capable of handling both dimensional measurement and surface defect analysis simultaneously, thereby enhancing utility and efficiency across diverse industrial applications.

AI Impact Analysis on Optical Measuring Devices Market

User inquiries regarding AI's impact on Optical Measuring Devices often center on automation, accuracy improvement, and data processing capabilities. Common questions include: How does machine learning enhance defect detection speed? Can AI minimize human error in complex metrology tasks? What role does neural networking play in classifying surface anomalies? The primary themes synthesized from user concerns revolve around the expected integration of machine learning algorithms to interpret complex measurement data faster than human operators, reducing measurement cycle times, and improving the robustness of quality control (QC) decisions. Users anticipate AI will transform optical metrology from a passive data collection process into an active, predictive quality management system, particularly in analyzing high-density 3D scan data and automatically classifying micro-defects that are ambiguous even under high magnification. This integration is expected to drastically lower the skill threshold required for operating advanced optical metrology systems while simultaneously increasing overall system reliability and repeatability.

- AI enables rapid, automated processing of large datasets generated by high-resolution optical scanners and cameras, significantly reducing inspection cycle times.

- Machine learning algorithms improve defect detection by training models on vast libraries of acceptable and defective components, leading to superior accuracy and fewer false positives.

- Predictive maintenance for optical systems is facilitated by AI, which analyzes sensor performance and usage patterns to forecast calibration needs and prevent downtime.

- AI drives advanced feature extraction and segmentation in complex 3D point clouds, enabling automatic recognition and dimensioning of critical geometric features.

- Deep learning supports the classification of subtle surface roughness and textural anomalies, moving beyond simple pass/fail criteria to detailed anomaly characterization.

- Automated decision-making and real-time feedback loops are established, allowing optical systems to adjust production parameters dynamically based on immediate metrology results (Cyber-Physical Systems integration).

DRO & Impact Forces Of Optical Measuring Devices Market

The Optical Measuring Devices Market is fundamentally shaped by the confluence of strong market drivers, inherent technical restraints, compelling growth opportunities, and impactful external forces. The primary driving factors stem from the mandatory quality control requirements across high-stakes industries like aerospace and medical devices, where even minor component flaws can have catastrophic consequences, making precision metrology a non-negotiable step. Restraints typically involve the high initial capital expenditure associated with purchasing and integrating high-resolution optical systems, along with the need for specialized training for operators and maintenance staff. Opportunities are concentrated in emerging technologies, specifically the ongoing development of faster, multi-sensor integration platforms and the growing global demand for inline inspection solutions that provide continuous quality feedback without disrupting the manufacturing process. The overall impact force is generally high, driven by the irreversible trend towards miniaturization and the mandated traceability required under global industrial standards such as ISO 9001 and IATF 16949.

The core drivers are intricately linked to the global adoption of advanced manufacturing paradigms, encapsulated by Industry 4.0. This transformation necessitates not just speed, but also the connectivity of measurement devices, facilitating remote diagnostics and centralized data management across geographically dispersed production sites. Furthermore, the increasing complexity of materials and geometries, especially in additive manufacturing (3D printing), demands highly flexible, non-contact measurement tools capable of analyzing internal structures and complex surface finishes that conventional contact probes cannot effectively reach. This continuous innovation in material science and production methods acts as a perpetual accelerator for the adoption of sophisticated optical solutions, pushing the boundaries of measurement resolution and speed.

Despite the strong demand, market limitations persist, primarily concerning the difficulty of measuring highly transparent, highly reflective, or extremely deep-featured objects, where current optical principles can sometimes struggle with coherence or shadowing effects. Calibration and environmental stability also pose continuous challenges; optical devices are highly sensitive to temperature fluctuations, vibration, and dust, necessitating controlled environments or advanced compensation software, which adds to the operational cost. However, these restraints are continually being addressed through opportunities involving the development of adaptive optics, laser-based structured illumination techniques, and fusion technology that combines the strengths of various sensors (e.g., optical CMMs integrating tactile probing capabilities), mitigating historical measurement constraints and broadening the potential application scope significantly, especially in harsh industrial settings.

Segmentation Analysis

The Optical Measuring Devices Market is categorized based on technology type, end-user application, and geographical region, reflecting the diversity of precision needs across global industries. The segmentation by type is crucial, distinguishing between high-precision scientific instruments like interferometers and spectrometers and more industrial, throughput-focused solutions such as profile projectors and vision measuring machines. Application segmentation reveals the foundational demand originating from traditional manufacturing (automotive, machinery) versus the explosive growth sectors (semiconductors, medical devices), each requiring unique system specifications and resolutions. Analyzing these segments provides strategic insights into investment priorities for manufacturers, highlighting the shift towards non-contact 3D measurement technologies that support automation and complex geometry analysis in modern production environments.

- By Product Type:

- Profile Projectors

- Microscopes (Confocal, Digital, Toolmaker’s)

- Vision Measuring Machines (VMM)

- Interferometers

- Spectrometers

- Optical Comparators

- Advanced 3D Scanners (Laser Triangulation, Structured Light)

- By Application/End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Semiconductors

- Medical Devices and Life Sciences

- Precision Machinery Manufacturing

- Research and Development (R&D)

- Energy and Power

- By Measurement Dimension:

- 2D Measurement

- 3D Measurement

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Optical Measuring Devices Market

The value chain for the Optical Measuring Devices Market begins with upstream suppliers, who provide high-purity raw materials and specialized components critical for system performance. This segment is dominated by specialized manufacturers of high-quality optics (lenses, prisms, mirrors), advanced sensors (high-resolution CCD/CMOS cameras, laser emitters), and precision mechanical stages (granite, air-bearing systems). The quality and reliability of these components directly dictate the accuracy and stability of the final measurement device. Sourcing stable, low-dispersion optical components is a primary concern in the upstream segment, often involving proprietary fabrication techniques and stringent quality inspection processes to ensure metrological accuracy across diverse operating conditions.

The midstream segment involves Original Equipment Manufacturers (OEMs) who integrate these components, along with proprietary software and control systems, to assemble the final optical measuring devices (e.g., VMMs, CMMs, interferometers). This stage adds significant value through system calibration, software development (including AI/ML integration for image processing), and rigorous testing protocols. The core competitive advantage here lies in software capability—specifically the ability to generate complex measurement programs, perform high-speed data acquisition, and provide user-friendly interfaces. The shift towards multi-sensor platforms requires sophisticated integration skills at this stage, enabling seamless switching between optical, laser, and tactile measurement modes within a single device environment.

Downstream activities focus on distribution, sales, installation, and aftermarket services. Distribution channels are typically a mix of direct sales teams for large, custom installations (particularly in aerospace and automotive giants) and indirect networks utilizing specialized technical distributors and integrators who provide local support, calibration, and training. Direct distribution ensures tighter control over complex sales cycles and installation support, while indirect channels provide wider geographical reach and faster response times for standard product lines. Aftermarket services, including routine calibration, maintenance contracts, and software updates, constitute a crucial, high-margin component of the downstream value chain, ensuring the sustained performance and compliance of these high-investment tools throughout their operational lifespan.

Optical Measuring Devices Market Potential Customers

Potential customers for optical measuring devices are concentrated within industries that require exceptional dimensional accuracy, high surface quality inspection, and non-contact analysis of fragile or complex parts. The primary end-users fall into highly regulated and technology-intensive sectors, where measurement traceability and statistical process control are mandatory operational aspects. These high-value buyers include manufacturers in the semiconductor industry, who utilize systems like overlay metrology tools and CD-SEM (Critical Dimension Scanning Electron Microscopes) to ensure pattern fidelity on microchips. For these customers, the devices are integral to yield optimization and are used directly on the production line (in-line metrology).

Another significant customer segment is the medical device and pharmaceutical manufacturing industry. Companies producing joint replacements, surgical tools, catheters, and drug delivery systems require optical systems to verify the micro-dimensions, surface cleanliness, and flawless geometry of components. Since many medical parts are made of polymers or highly polished metals, non-contact measurement is essential to prevent damage or contamination. The defense and aerospace sectors are also major buyers, demanding high-precision CMMs and structured light scanners to verify critical airframe components, engine parts (e.g., blisk inspection), and high-security defense hardware, adhering strictly to standards like AS9100 for quality management.

Furthermore, R&D institutions, national metrology institutes, and large academic laboratories form a robust segment of potential customers, often purchasing the most advanced and specialized optical devices (such as high-end interferometers) for foundational research in materials science, quantum computing, and advanced engineering. For these buyers, the capacity for custom measurement routines, extremely high resolution (sub-micron level), and the ability to handle novel materials are key purchasing criteria. These institutions often drive the demand for the next generation of optical metrology capabilities, influencing future product roadmaps for major equipment manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Hexagon AB, Nikon Corporation, Keyence Corporation, Mitutoyo Corporation, Olympus Corporation, Automated Precision Inc. (API), Quality Vision International (QVI), Faro Technologies Inc., GOM GmbH (Zeiss), Perceptron Inc., Starrett Company, Creaform (AMETEK), KLA Corporation, Zygo Corporation, Renishaw plc, Bruker Corporation, Vision Engineering Ltd., Mahr GmbH, Tokyo Seimitsu Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Measuring Devices Market Key Technology Landscape

The technological landscape of the Optical Measuring Devices Market is rapidly evolving, driven by the demand for higher speed, greater accuracy, and enhanced adaptability to complex geometries. A crucial development is the maturation and commercial adoption of advanced 3D scanning technologies, including Structured Light Scanning and Laser Triangulation. Structured light systems project specific light patterns (like grids or stripes) onto an object, and the deformation of these patterns is captured by two or more cameras to rapidly reconstruct a high-density 3D surface model. This technology excels in capturing organic shapes and achieving high-resolution surface mapping in just seconds, making it ideal for non-contact inspection of prototypes and complex castings.

Another pivotal technological area is the integration of multi-sensor measurement platforms and advanced metrology software. Modern optical measuring devices are increasingly combining multiple non-contact technologies (e.g., high-resolution cameras, laser line probes, chromatic confocal sensors) with traditional contact CMM probes onto a single rigid machine frame. This multi-sensor approach allows users to leverage the unique strengths of each modality for different features of a single component—using vision systems for 2D geometry, lasers for large surface profiles, and chromatic confocal sensors for extreme precision on highly polished or micro-featured surfaces. The software infrastructure managing these diverse data streams and aligning them into a single, unified coordinate system is the core differentiator in this integrated technology space.

Furthermore, high-speed image processing and computational metrology are fundamental to supporting Industry 4.0 requirements. Technologies such as high-frame-rate cameras (up to 1,000 frames per second), combined with high-performance computing units, enable true in-line measurement where components are inspected dynamically as they move along the production line. Telecentric optics, which maintain a constant magnification regardless of the object's distance within the depth of field, are becoming standard for precision 2D vision systems, eliminating perspective error and ensuring high accuracy, particularly in electronics inspection. The ongoing evolution of these integrated vision systems, fueled by AI for automated feature recognition and deviation analysis, solidifies the market's trajectory towards fully autonomous quality control environments.

Regional Highlights

The global Optical Measuring Devices Market exhibits distinct regional dynamics driven by varying levels of industrialization, technological maturity, and quality regulation standards across continents. Asia Pacific (APAC) currently holds the dominant market share and is projected to be the fastest-growing region throughout the forecast period. This dominance is attributed to the presence of extensive manufacturing ecosystems, particularly in the electronics and semiconductor sectors located in China, Taiwan, South Korea, and Japan. Massive investments in consumer electronics, semiconductor fabs, and high-volume automotive production necessitate the continuous purchase and deployment of advanced optical inspection and metrology equipment for ensuring component integrity and production yields. Furthermore, governments in key APAC nations actively support the development of high-tech manufacturing, creating a favorable environment for market expansion.

North America, led by the United States, represents a highly mature market characterized by early adoption of cutting-edge optical technologies, especially in specialized sectors like aerospace, defense, and advanced medical device manufacturing. This region's demand is driven less by volume and more by the need for ultra-high precision and the integration of advanced research and development capabilities. North American companies are often the first to deploy AI-integrated metrology solutions and sophisticated 3D non-contact scanning technologies to meet extremely strict regulatory and quality requirements for complex, high-value components. The strong presence of leading technology providers and the focus on industrial IoT implementation further solidify North America's position as a key innovation hub.

Europe maintains a strong market presence, anchored by Germany and Italy, due to their robust automotive and high-end machinery manufacturing industries. European demand is heavily influenced by stringent quality standards and the widespread adoption of automation within production lines. The focus in Europe is often on comprehensive quality assurance and traceability across the supply chain, necessitating the use of highly certified and reliable optical CMMs and vision systems. While Europe faces slower industrial growth compared to APAC, the consistent demand for high-quality, customized optical solutions for complex engineering tasks ensures steady market stability. The emphasis on advanced manufacturing research and adherence to global standardization bodies ensures continued investment in sophisticated optical metrology tools across the continent.

- Asia Pacific (APAC): Market leader due to semiconductor and electronics manufacturing expansion; highest growth rate projected; driven by China, Japan, and South Korea.

- North America: High penetration of advanced technology; primary drivers include aerospace, defense, and medical device compliance; focus on R&D and AI integration.

- Europe: Stable market growth driven by strict quality control standards in automotive and precision engineering sectors; Germany and Italy are key contributors.

- Latin America (LATAM): Emerging market with increasing industrialization, particularly in automotive assembly and mining; growth concentrated in localized production and quality control requirements.

- Middle East and Africa (MEA): Smallest market share, but experiencing growth driven by infrastructure investment, oil and gas quality inspection, and localized defense spending; slower adoption of high-end optical solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Measuring Devices Market.- Carl Zeiss AG

- Hexagon AB

- Nikon Corporation

- Keyence Corporation

- Mitutoyo Corporation

- Olympus Corporation

- Automated Precision Inc. (API)

- Quality Vision International (QVI)

- Faro Technologies Inc.

- GOM GmbH (Zeiss)

- Perceptron Inc.

- Starrett Company

- Creaform (AMETEK)

- KLA Corporation

- Zygo Corporation

- Renishaw plc

- Bruker Corporation

- Vision Engineering Ltd.

- Mahr GmbH

- Tokyo Seimitsu Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Optical Measuring Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between contact and non-contact optical measurement?

The primary difference is the interaction with the part. Contact measurement (like traditional CMMs) physically touches the component using a probe, while non-contact optical measurement uses light, lasers, or vision systems to acquire data, eliminating the risk of damage or deformation, which is essential for fragile or soft materials.

Which industry drives the highest demand for optical measuring devices globally?

The Electronics and Semiconductor industry is currently the fastest-growing and one of the largest demand drivers, due to the need for ultra-high-resolution inspection of micro-features on wafers, PCBs, and integrated circuits, crucial for maintaining yield rates during miniaturization.

How is Industry 4.0 influencing the design of new optical measuring systems?

Industry 4.0 demands system connectivity, automation, and real-time data integration. This influences design by pushing manufacturers toward developing high-speed, in-line optical systems with integrated AI software capable of automated measurement programming, cloud connectivity, and immediate feedback loops to the manufacturing process control systems.

What are the limitations of using structured light scanning technology?

Limitations of structured light scanning include difficulty measuring highly reflective or transparent surfaces without specialized coatings or preparatory steps, and challenges in maintaining accuracy in environments with significant vibration or uncontrolled ambient lighting.

What are Vision Measuring Machines (VMMs) primarily used for?

VMMs are primarily used for high-accuracy 2D and 3D geometric measurements of complex, small parts, relying on advanced image processing software and high-resolution cameras. They are commonly employed for quality control in stamping, plastics, and precision tool manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager