Optical Transport Network (OTN) Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441624 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Optical Transport Network (OTN) Equipment Market Size

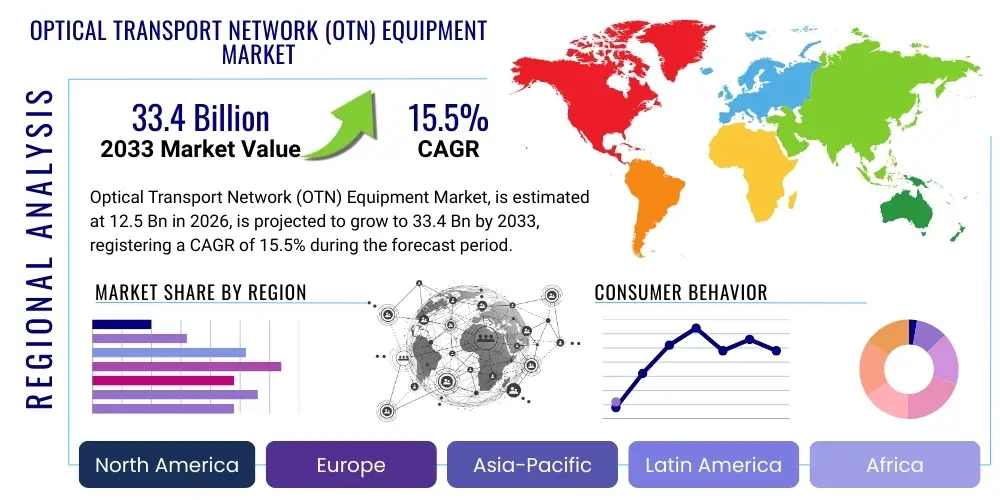

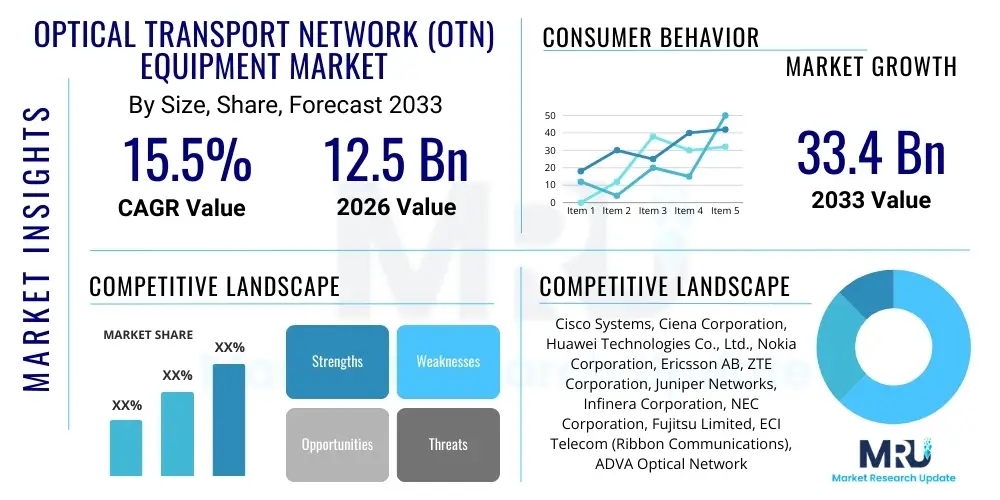

The Optical Transport Network (OTN) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $33.4 Billion by the end of the forecast period in 2033.

Optical Transport Network (OTN) Equipment Market introduction

The Optical Transport Network (OTN) Equipment Market is fundamentally driven by the exponential demand for high-bandwidth data transmission across metropolitan and long-haul networks. OTN, standardized under ITU-T G.709, provides a robust, standardized framework for the efficient multiplexing, switching, and transport of various client signals (such as Ethernet, IP, and SAN) over a single optical infrastructure, typically utilizing Dense Wavelength Division Multiplexing (DWDM). This technology enables superior quality of service (QoS) management, enhanced operational transparency, and simplified network operations compared to older synchronous digital hierarchy (SDH) or synchronous optical networking (SONET) architectures. The equipment essential for this infrastructure includes OTN switches, optical cross-connects (OXCs), and multi-service provisioning platforms (MSPPs) capable of 100G, 200G, and increasingly 400G and 800G wavelengths.

Major applications of OTN equipment span diverse sectors, including telecom carrier networks, enterprise data centers, and government institutions requiring massive data exchange capabilities. The primary benefits derived from adopting OTN include reduced latency, enhanced spectral efficiency allowing more data to be transported per fiber, and improved fault isolation and performance monitoring capabilities inherent in the OTN framing structure. This transparency ensures that client data formats are preserved, which is crucial for high-speed protocols like Fibre Channel and native Ethernet services, enabling network operators to offer tiered services with guaranteed service level agreements (SLAs). The proliferation of bandwidth-intensive applications such as 4K/8K streaming, cloud computing, and massive scale virtualization necessitate this underlying high-capacity transport layer.

Driving factors propelling market expansion include the global deployment of 5G infrastructure, which requires high-capacity, low-latency backhaul and fronthaul networks; the increasing need for Data Center Interconnect (DCI) solutions to link hyperscale cloud facilities; and the ongoing transition from legacy 10G and 40G systems to standardized 100G and 400G networks. Furthermore, the rising adoption of coherent optics and pluggable coherent modules (like ZR/ZR+) is reducing the cost and complexity of deploying high-speed OTN links, democratizing access to massive transport capacity. This integration allows network providers to scale their transport layer flexibly and cost-effectively, meeting the relentless growth in digital traffic volume.

Optical Transport Network (OTN) Equipment Market Executive Summary

The OTN equipment market is characterized by robust technological innovation, primarily centered on increasing spectral efficiency and integrating packet-optical capabilities. Business trends highlight a strong shift toward modular, software-defined networking (SDN)-enabled OTN platforms that allow dynamic resource allocation and automation, moving away from static, dedicated hardware. Major telecom carriers and cloud providers are prioritizing investments in programmable infrastructure to manage complex, multi-layered networks efficiently. Furthermore, consolidation among component suppliers and strategic partnerships between system vendors and coherent module manufacturers are shaping the competitive landscape, focused on delivering cost-per-bit reductions for mass-scale deployments. The market trajectory is defined by the critical necessity of supporting next-generation services like edge computing and ultra-reliable low-latency communication (URLLC).

Regional trends indicate that the Asia Pacific (APAC) region remains the largest market and the fastest-growing due to extensive 5G rollout initiatives, particularly in China, Japan, and South Korea, coupled with massive submarine cable deployments interconnecting the region. North America and Europe, while mature, exhibit strong demand driven by hyperscale cloud expansion and the continuous upgrade of metro and long-haul core networks to 400G and above, focusing heavily on integrating automation tools. The Middle East and Africa (MEA) and Latin America are emerging markets, showing significant investment spurred by digital transformation agendas and increased fiber penetration, although infrastructure heterogeneity remains a challenge.

Segmentation trends reveal strong growth in the High-Capacity OTN Switching segment, driven by the need for flexible grooming of high-speed client signals (400GbE and 1TbE interfaces) onto optical transport layers. By Technology, the Packet-Optical Transport Systems (P-OTS) segment is expanding rapidly as operators seek integrated platforms that combine Layer 2/3 processing with Layer 0/1 transport functionality, optimizing CapEx and OpEx. The service provider application segment, including long-haul, metro core, and access networks, dominates revenue share, although the Data Center Interconnect (DCI) segment, facilitated by pluggable coherent optics, shows the highest growth trajectory, reflecting the massive interdependence between cloud services and transport infrastructure.

AI Impact Analysis on Optical Transport Network (OTN) Equipment Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the OTN market frequently revolve around topics such as the potential for predictive network maintenance, the role of AI in optimizing wavelength routing and traffic grooming, and the application of machine learning (ML) to enhance network resilience and security in optical layers. Users are particularly interested in how AI can automate complex provisioning tasks, reduce power consumption in dense optical networks, and improve fault detection capabilities before service degradation occurs. The overarching theme is the expectation that AI will transition network management from reactive trouble-shooting to proactive, intent-based networking, thereby significantly lowering operational expenditures (OpEx) for carriers managing vast, dynamic OTN infrastructures.

AI is set to revolutionize OTN deployment and operation by enabling true closed-loop automation. By processing enormous volumes of real-time telemetry data—including optical power levels, bit error rates (BER), and component temperatures—AI/ML algorithms can identify complex, non-obvious patterns indicative of impending component failure or service impairment. This capability facilitates predictive maintenance, extending equipment lifespan and minimizing unplanned downtime. Furthermore, AI optimizes resource utilization within the network by dynamically adjusting modulation formats and transmission parameters (such as launching power and dispersion compensation) based on current link conditions and traffic load, maximizing the data throughput achievable over existing fiber infrastructure.

The implementation of AI-driven control planes allows for highly sophisticated traffic engineering. Instead of relying on static routing tables, AI can calculate the optimal path for a service across a mesh OTN network, considering multiple constraints simultaneously, including latency, cost, energy consumption, and available spectral capacity. This level of optimization is beyond human capability in large-scale networks. Consequently, OTN equipment vendors are embedding AI-ready telemetry agents and high-performance processors into their platforms to facilitate real-time data collection and execution of AI-derived instructions, ensuring that the transport network remains agile and responsive to the highly variable demands of 5G and cloud applications.

- AI-driven Predictive Maintenance: Minimizing unplanned outages by forecasting component degradation using real-time optical performance data.

- Automated Traffic Grooming: Optimizing the allocation and placement of client signals onto specific wavelengths and sub-wavelengths dynamically.

- Enhanced Spectral Efficiency: Using ML to select optimal coherent modulation formats (e.g., QPSK, 16QAM) based on link distance and fiber quality.

- Network Resilience and Security: Applying AI for rapid anomaly detection and automated remediation against physical layer or control plane attacks.

- Intent-Based Networking (IBN): Translating high-level business objectives into low-level OTN configurations automatically.

DRO & Impact Forces Of Optical Transport Network (OTN) Equipment Market

The dynamics of the OTN equipment market are fundamentally shaped by the surging global data traffic volume (Driver) coupled with high initial investment and system complexity (Restraint). The compelling opportunity lies in integrating OTN with software-defined networking (SDN) and Network Function Virtualization (NFV) to create highly agile, programmable transport layers. These forces interact to accelerate innovation in coherent optics and automated management systems, driving rapid replacement cycles and prioritizing vendors that can deliver scalable, energy-efficient, and easy-to-manage solutions across diverse geographical topologies. The impact forces are currently skewed towards high growth due to non-negotiable capacity requirements stemming from 5G expansion and hyperscale cloud services.

Drivers: The dominant driver is the relentless increase in bandwidth demand, fueled by consumer adoption of cloud services, video streaming, and the explosive growth of IoT devices, requiring continuous upgrades of core and metro networks. The global rollout of 5G necessitates massive investment in high-capacity, low-latency transport for backhaul and fronthaul, utilizing OTN’s robust encapsulation and traffic separation capabilities. Furthermore, the expansion of global data center interconnect (DCI) networks, linking massive cloud infrastructure across cities and continents, mandates the use of scalable, high-speed coherent OTN systems (400G and 800G per wavelength) to reduce cost per bit and optimize fiber utility.

Restraints: Significant restraints include the substantial initial capital expenditure (CapEx) required for deploying high-speed OTN equipment, particularly in developing regions. Furthermore, the complexity of integrating diverse OTN vendor equipment and managing multi-layer networks (IP/MPLS over OTN/WDM) poses operational challenges that require highly specialized technical expertise. The rapid technological obsolescence, where 400G is quickly being superseded by 800G, forces carriers into aggressive upgrade cycles, putting pressure on return on investment (ROI). Standardization challenges in certain aspects of OTN management and control planes also slightly hinder unified global deployment.

Opportunities: Key opportunities are centered around the ongoing development of coherent pluggable optics (CFP2-DCO, QSFP-DD ZR/ZR+) which lower power consumption and integration costs, enabling OTN deployment deeper into metro access and aggregation networks. The migration towards Packet-Optical Transport Systems (P-OTS) offers an opportunity for vendors to provide converged platforms that streamline IP and optical layers, simplifying network architecture. Finally, the integration of automation, AI, and SDN controllers provides a vast market opportunity for delivering service assurance and dynamic capacity provisioning solutions, transforming OTN infrastructure into a flexible service delivery mechanism.

- Drivers: Massive bandwidth consumption acceleration (5G, DCI), technological breakthroughs in coherent optics (400G, 800G), and network migration towards all-optical switching.

- Restraints: High CapEx requirements, operational complexity of multi-domain optical networks, and the steep learning curve for network technicians.

- Opportunities: Adoption of SDN/NFV for network programmability, proliferation of cost-effective pluggable coherent modules, and growing demand for integrated packet-optical solutions (P-OTS).

- Impact Forces: High impact and strong positive acceleration due to critical infrastructure status of OTN for digital economies.

Segmentation Analysis

The Optical Transport Network (OTN) Equipment Market segmentation provides a granular view of market dynamics based on technology, capacity, application, and end-user, revealing where investment is most concentrated. Technological segmentation highlights the shift from purely WDM/OTN systems to converged Packet-Optical Transport Systems (P-OTS), reflecting the desire of service providers to manage both TDM/OTN and packet traffic (Ethernet/IP) efficiently on a single platform. Capacity segmentation illustrates the rapid obsolescence of 10G and 40G systems as the industry overwhelmingly standardizes on 100G and higher wavelength rates.

Analyzing the market by application delineates the core drivers of demand, where Long-Haul networks remain critical for connecting distant geographies, but Metro networks show the highest density of new deployments due to urbanization and the need to connect local data centers and 5G aggregation points. End-user segmentation confirms that Communication Service Providers (CSPs) constitute the majority of spending, although large Content and Cloud Providers (CSPs) are increasingly investing in their own hyperscale OTN equipment, particularly for DCI, bypassing traditional carriers in certain segments.

The complexity within the market requires vendors to offer highly adaptable solutions. For instance, in the 400G and above capacity segments, flexibility in modulation schemes (e.g., 16QAM for shorter distances, QPSK for ultra-long haul) is a critical differentiator. Moreover, the integration of Layer 2 switching capabilities within OTN hardware is crucial for meeting the dynamic bandwidth requirements characteristic of enterprise and 5G applications, ensuring efficient grooming of traffic before transmission over the optical layer, maximizing fiber utilization.

- By Technology:

- Wavelength Division Multiplexing (WDM) Systems

- Optical Transport Network (OTN) Switchers

- Packet-Optical Transport Systems (P-OTS)

- Optical Cross-Connects (OXCs)

- By Application:

- Metro Networks (Access, Aggregation, Core)

- Long-Haul Networks

- Submarine Networks

- Data Center Interconnect (DCI)

- By Capacity:

- Less than 100 Gbps

- 100 Gbps to 400 Gbps (Dominant segment)

- 400 Gbps and Above (Fastest growing segment, 800G/1.2T)

- By End User:

- Communication Service Providers (CSPs)

- Cloud and Content Providers (C&CPs)

- Enterprises (Financial, Government, Education)

Value Chain Analysis For Optical Transport Network (OTN) Equipment Market

The value chain for OTN equipment begins with upstream suppliers, primarily semiconductor manufacturers who provide critical optical components such as high-speed Digital Signal Processors (DSPs) for coherent detection, tunable lasers, photodetectors, and complex silicon photonics chips. These foundational components dictate the maximum speed (e.g., 400G, 800G) and energy efficiency of the final transport system. Key vendors in this upstream layer invest heavily in R&D to push the boundaries of spectral efficiency and reduce form factors (leading to pluggable optics), significantly influencing the cost structure and performance capabilities of the downstream equipment integrators.

The mid-stream encompasses the major OTN equipment manufacturers, who design, assemble, and integrate these components into modular chassis, line cards, and specialized switching matrices. This stage involves complex software development for control planes (SDN integration), network management systems (NMS), and operational software to manage the optical layer. The distribution channel is predominantly direct, especially for large Tier 1 carriers and hyperscalers, involving lengthy procurement processes and direct engagement with the equipment vendor’s sales and engineering teams. Indirect distribution, involving system integrators and specialized value-added resellers (VARs), is more common for enterprise or regional service provider deployments that require localized integration support.

Downstream analysis focuses on the end-users—Communication Service Providers (CSPs), Content Providers (C&CPs), and large enterprises—who deploy, operate, and maintain the OTN infrastructure. CSPs utilize OTN equipment to offer high-speed leased lines, fiber backbones, and 5G transport services. C&CPs, conversely, use OTN systems primarily for robust Data Center Interconnect (DCI) and building their expansive private backbone networks. The downstream phase is characterized by intense focus on optimizing operational expenditure (OpEx) through automation tools, minimizing power consumption, and ensuring compliance with stringent service level agreements (SLAs).

Optical Transport Network (OTN) Equipment Market Potential Customers

The primary customers for high-speed Optical Transport Network equipment are organizations managing large-scale, mission-critical networks where bandwidth, latency, and reliability are paramount. Communication Service Providers (CSPs), including global Tier 1 telcos, national carriers, and regional ISPs, are the largest segment, requiring OTN infrastructure for their core, metro, and submarine networks to handle unified voice, video, and data traffic. The massive investment cycle associated with global 5G rollout ensures CSPs remains the foundational customer base for the foreseeable future, driving demand for multi-terabit switching and flexible WDM systems.

Content and Cloud Providers (C&CPs), notably hyperscalers like Google, Amazon, and Microsoft, represent the fastest-growing customer segment. Their need for near-infinite capacity between data centers necessitates specialized, disaggregated OTN solutions, often featuring pluggable coherent optics used in white-box systems for DCI applications. These customers prioritize equipment scalability, energy efficiency, and openness to SDN control over traditional monolithic architectures. Enterprise customers, particularly those in the financial services sector, high-frequency trading, and large government agencies, also require dedicated, secure OTN circuits for disaster recovery and massive data backups.

Finally, specialized network operators, such as utility companies managing smart grids and organizations operating major research and education networks (RENs), constitute niche but high-value customer groups. These entities often require high-performance, guaranteed bandwidth for scientific computation and critical operational control systems. The shift towards edge computing will further expand the customer base to include providers building regional aggregation sites that need compact, high-density OTN gear capable of efficient traffic grooming at the network edge.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $33.4 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Ciena Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, ZTE Corporation, Juniper Networks, Infinera Corporation, NEC Corporation, Fujitsu Limited, ECI Telecom (Ribbon Communications), ADVA Optical Networking (ADTRAN), Coriant, FiberHome Technologies Group, Accedian Networks, Tejas Networks, Xilinx (AMD), Lumentum, Coherent Corp., Marvell Technology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Transport Network (OTN) Equipment Market Key Technology Landscape

The technology landscape of the OTN equipment market is rapidly evolving, driven primarily by advances in coherent optical transmission technology. Coherent detection, utilizing sophisticated Digital Signal Processors (DSPs), allows for higher data rates (400G, 800G, and future 1.2T per wavelength) and significantly increases transmission reach by compensating for chromatic and polarization mode dispersion. The shift from bulky line cards to smaller, hot-pluggable coherent modules (such as QSFP-DD, OSFP) compliant with industry standards like OpenZR+ and 400ZR is a major disruptive trend, enabling cloud providers to integrate high-capacity optics directly into routers and switches, blurring the lines between IP and optical layers.

Packet-Optical Transport Systems (P-OTS) represent another crucial technological shift. These platforms consolidate the functionality of traditional WDM/OTN gear with integrated Layer 2 (Ethernet) switching and Layer 3 (IP/MPLS) routing capabilities. P-OTS allows service providers to handle both time-division multiplexed (TDM) traffic and packet-based traffic efficiently on a single hardware chassis, offering substantial CapEx and OpEx savings. The convergence is critical for 5G network densification, where numerous packet-based services need to be aggregated and groomed before being transparently transported over the high-speed optical backbone.

Furthermore, the move towards disaggregated and Software-Defined Networking (SDN) architectures is redefining how OTN networks are deployed and managed. SDN controllers centralize network intelligence, allowing for automated service provisioning, dynamic capacity scaling, and multi-layer optimization (e.g., coordinating IP routing decisions with optical layer switching). This shift necessitates open interfaces (like YANG/NETCONF) and robust orchestration tools that can manage diverse vendor environments, transforming static optical infrastructure into a flexible, programmable utility essential for delivering dynamic cloud-based services and ensuring optimal performance in increasingly complex optical mesh networks.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in OTN equipment deployment, largely driven by aggressive 5G infrastructure build-outs, particularly in China, India, and Southeast Asia. The region is home to massive internet user populations, necessitating continuous investment in high-capacity metro and long-haul links. Government initiatives supporting digital transformation and significant expenditure on submarine cable systems connecting various island nations and continents further solidify APAC’s dominant market position and high CAGR. Key focus areas include 400G upgrades in metro core networks and extensive deployment of OTN equipment for mobile backhaul.

- North America: This region is characterized by substantial demand from hyperscale cloud providers (C&CPs) driving the Data Center Interconnect (DCI) segment. North American carriers prioritize the rapid adoption of new technologies, such as 400ZR and 800G coherent optics, often leading global trends in network disaggregation and SDN implementation. Investment is heavily focused on upgrading metro-core links to manage the exponential growth of cloud traffic and improving residential broadband capacity in response to increased remote work and streaming demands.

- Europe: The European OTN market shows steady growth, propelled by regional efforts to harmonize digital infrastructure and implement fiber-to-the-home (FTTH) initiatives. The market is highly competitive, with a strong focus on cost efficiency and energy consumption reduction, leading to high adoption rates of P-OTS and sophisticated network automation tools. Regulatory pressures regarding data privacy and cross-border connectivity drive steady investment in resilient, high-capacity long-haul networks linking major financial and technical hubs.

- Latin America: This emerging market is witnessing significant growth spurred by increased fiber penetration and the need to modernize legacy infrastructure. Investment in OTN equipment is targeted at improving inter-city connectivity and linking the region to global submarine cable systems. While CapEx constraints remain a factor, the increasing maturity of local ISPs and the expanding presence of global C&CPs are fueling demand for cost-effective 100G and 200G solutions in core networks.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, concentrated in the Gulf Cooperation Council (GCC) countries which are investing heavily in smart city projects and digital diversification. These nations are adopting advanced OTN solutions, including 400G technology, rapidly. In contrast, Africa’s market is primarily driven by expansion in mobile data and the need for new terrestrial fiber backbones, creating demand for robust, easily deployable OTN equipment suitable for challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Transport Network (OTN) Equipment Market.- Cisco Systems

- Ciena Corporation

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Ericsson AB

- ZTE Corporation

- Juniper Networks

- Infinera Corporation

- NEC Corporation

- Fujitsu Limited

- ADTRAN (ADVA Optical Networking)

- Ribbon Communications (ECI Telecom)

- FiberHome Technologies Group

- Tejas Networks

- Lumentum Holdings Inc.

- Coherent Corp. (formerly II-VI Incorporated)

- Marvell Technology Inc.

- Xilinx (AMD)

- Accedian Networks

- EKINOPS

Frequently Asked Questions

Analyze common user questions about the Optical Transport Network (OTN) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of OTN over traditional WDM systems?

The primary technical advantage of OTN (G.709) is its standardized digital wrapper which provides enhanced management capabilities, including transparent transmission of various client signals (Ethernet, IP), robust forward error correction (FEC) for extended reach, and detailed performance monitoring (PM) and fault isolation capabilities at the optical layer.

How is 5G rollout specifically driving the demand for OTN equipment?

5G requires extremely high capacity and low latency in the transport network, particularly for mobile backhaul and fronthaul. OTN equipment facilitates the efficient, scalable aggregation and transparent transmission of massive amounts of packetized 5G traffic from radio access sites back to the core network, ensuring guaranteed quality of service.

Which segment, Metro or Long-Haul, exhibits the fastest growth in the OTN market?

While Long-Haul networks demand the highest aggregate capacity, the Metro network segment, encompassing aggregation and core urban links, currently exhibits the fastest growth rate. This acceleration is driven by the proliferation of edge computing, 5G densification, and the increasing need for localized Data Center Interconnect (DCI) capacity within metropolitan areas.

What role do coherent pluggable optics play in the future of OTN?

Coherent pluggable optics (such as 400ZR and OpenZR+) are crucial as they drastically reduce the size, power consumption, and cost of high-speed transmission (400G and above). They enable the disaggregation of the optical layer and integration directly into standard routing platforms, driving simplification and cost efficiency, particularly in DCI and short-to-medium haul OTN deployments.

How does Software-Defined Networking (SDN) impact OTN network management?

SDN fundamentally transforms OTN management by centralizing control intelligence. It allows carriers to automate service provisioning, optimize multi-layer traffic flows dynamically (IP and optical layers), and achieve rapid service deployment, moving network operations toward an agile, intent-based model rather than manual, element-by-element configuration.

Detailed Market Dynamics and Competitive Landscape Analysis

The intensity of competition in the OTN equipment market is categorized as high, driven by technological parity among Tier 1 vendors and the increasing adoption of open standards which reduce barriers to entry for specialized component manufacturers. Major system vendors (Ciena, Huawei, Nokia, Cisco) compete aggressively on the basis of spectral efficiency (maximizing bits per Hz), network automation capabilities (SDN integration), and system density. Price wars, particularly in the mass-volume 100G and 200G segments, are common, placing constant downward pressure on gross margins. However, differentiation is maintained through proprietary ASIC development, leading to superior performance in FEC algorithms and DSP capabilities required for 400G and 800G ultra-long-haul transmission.

A notable trend influencing competitive dynamics is the shift toward network disaggregation, where hyperscale cloud providers purchase optical components and white-box systems separately, leveraging standards like OIF 400ZR. This move bypasses traditional, fully integrated OTN vendor platforms, forcing established players to adapt by offering open line systems and integrated pluggable optics portfolios. Furthermore, the convergence of the IP and optical layers, formalized by Packet-Optical Transport Systems (P-OTS), requires vendors to possess expertise in both routing/switching and high-speed optics, fueling strategic mergers and acquisitions aimed at acquiring necessary intellectual property and platform integration capabilities.

Supply chain resilience remains a critical factor following recent global disruptions. Vendors that secured robust supply chains for critical components, particularly high-performance DSPs and silicon photonics, have maintained market advantage. The competitive landscape is also increasingly influenced by sustainability metrics; carriers are prioritizing OTN equipment that offers the lowest power consumption per bit, driving innovation towards highly integrated components and energy-efficient system architectures that comply with environmental, social, and governance (ESG) standards, especially in regions with high energy costs like Europe.

Impact of Coherent Optics and Pluggable Modules on OTN Market

The evolution of coherent optics represents the single most significant technical driver shaping the OTN equipment market. Early OTN deployments used Intensity Modulation/Direct Detection (IM/DD), which severely limited speed and reach. Modern coherent technology utilizes advanced modulation techniques (QPSK, 16QAM, etc.) and sophisticated digital signal processing (DSP) to maximize the amount of data transmitted over a single wavelength. The progression from 100G to 400G and currently emerging 800G coherent solutions has provided the necessary capacity scale required by hyperscale networking and 5G density, fundamentally redefining the potential lifespan and utilization of existing fiber infrastructure globally.

The commercialization and standardization of pluggable coherent modules, such as 400ZR and OpenZR+, have catalyzed a major market disruption. These modules allow high-speed optics to be placed directly into standard router and switch cages, eliminating the need for separate dedicated OTN transponder shelves in many Data Center Interconnect (DCI) and metro applications. This integration simplifies network architectures, significantly reduces the physical footprint, and lowers overall CapEx and OpEx by converging the traditionally separate IP and optical procurement cycles. Network architects can now deploy OTN capacity much closer to the edge of the network, enhancing service flexibility.

While coherent pluggable modules offer tremendous benefits in cost and density, the market is currently seeing a divergence: traditional, high-performance embedded coherent solutions (using proprietary DSPs) continue to dominate the ultra-long-haul and submarine segments where maximum reach and extreme spectral efficiency are paramount. Conversely, standardized pluggables are rapidly becoming the solution of choice for high-volume metro and regional DCI applications. The technological race is now focused on achieving higher performance (e.g., 800G) within the standardized pluggable form factor while maintaining low power consumption, thereby further pushing OTN capabilities into edge and access networks.

Growth in Data Center Interconnect (DCI) and Hyperscale Networking

The rapid expansion of cloud computing and the subsequent proliferation of massive data centers globally have positioned Data Center Interconnect (DCI) as one of the most critical applications for OTN equipment. Hyperscale C&CPs require resilient, massive-capacity links (terabits per second) between their co-located facilities and major regional hubs. OTN, with its ability to efficiently aggregate, groom, and transport diverse client traffic (especially 100GbE, 400GbE) over high-speed coherent wavelengths, is the foundational technology enabling this critical infrastructure layer. The need for redundancy and near-zero latency in financial and transactional environments further cements OTN’s role in DCI.

Hyperscale network operators are distinct buyers, often favoring customized, open-line systems and relying heavily on standardized, multi-vendor interoperable components rather than proprietary chassis systems. This demand has accelerated the market shift toward disaggregated OTN solutions, where C&CPs manage the optical transmission layer independently of the routing layer. The key requirement for these customers is not just raw bandwidth but operational simplicity and energy efficiency, pushing manufacturers to innovate in thermal management and system density. This customer segment is defining future product roadmaps, focusing heavily on power-optimized 400G and 800G platforms.

The synergy between OTN technology and DCI is intensifying as cloud architecture expands geographically. As cloud services move closer to end-users (edge computing), OTN equipment must become smaller and more resilient in varied environments, moving from dedicated, air-conditioned central office settings to ruggedized roadside cabinets. This trend mandates specialized OTN equipment designed for higher temperature tolerances, smaller form factors, and simplified remote provisioning, opening new sub-segments focused on modular, low-power metro access OTN solutions capable of handling massive localized traffic bursts efficiently.

Future Outlook and Technological Roadmap

The future outlook for the OTN equipment market is characterized by a continued and accelerated pursuit of spectral efficiency and automated operation. The immediate technological roadmap centers on the maturation and mass deployment of 800G and the initial trials of 1.2 Terabit per second (1.2T) transmission systems. Achieving these higher speeds will rely on next-generation silicon photonics, advanced probabilistic constellation shaping (PCS), and even more powerful DSPs that can handle highly complex modulation formats over longer distances. This constant capacity expansion is non-negotiable for meeting global data projections.

The long-term roadmap heavily involves the practical integration of AI/ML into the optical control plane. Future OTN systems will not just be faster; they will be smarter, capable of self-diagnosing faults, predicting capacity saturation, and autonomously adjusting network topology. This movement toward fully automated, zero-touch provisioning will dramatically reduce the OpEx associated with complex transport networks, making services faster to deploy and more reliable. This shift requires significant investment in standardized telemetry gathering and open interfaces to facilitate third-party AI algorithm integration.

Furthermore, the industry is closely watching the commercialization of all-optical switching technologies, such as micro-electro-mechanical systems (MEMS) or emerging Liquid Crystal on Silicon (LCoS) based switching fabrics, which could potentially replace current electrical switching matrices (O-E-O conversion) in certain core nodes. While full photonic switching remains technically challenging for mass deployment, hybrid OTN systems that selectively leverage optical switching for bulk traffic bypass while retaining electrical switching for detailed grooming will define the next generation of high-density core networks, ensuring the OTN framework remains central to telecommunications infrastructure development for the next decade.

Regulatory and Standardization Environment

The stability and interoperability of the OTN market are critically dependent on international standards established primarily by the International Telecommunication Union (ITU-T), specifically the G.709 series. These standards ensure that equipment from different vendors can seamlessly interoperate, which is vital for global carrier networks and submarine cable systems. Recent standardization efforts focus on defining specifications for high-speed client interfaces (e.g., beyond 400G) and developing standardized frameworks for OTN control plane interactions, particularly within an SDN environment (e.g., G.7712 and related frameworks).

Beyond the ITU-T, organizations like the Optical Internetworking Forum (OIF) play a crucial role, especially in rapid technological adoption, such as defining implementation agreements for coherent optics like 400ZR and 800ZR. The OIF’s work ensures that pluggable optics are standardized across the industry, facilitating multi-vendor sourcing and promoting competition, which benefits the end-users by lowering costs. Compliance with these specifications is non-negotiable for any vendor targeting hyperscale C&CPs or Tier 1 service providers, driving uniformity in the hardware layer while allowing software differentiation.

Regulatory bodies in various regions, such as the FCC in North America and ETSI in Europe, influence the market indirectly by setting guidelines for spectrum use, data security, and critical infrastructure resilience. For instance, regulations governing 5G deployment often mandate specific quality of service (QoS) metrics, which directly translate into stringent requirements for the underlying OTN backhaul network's latency and jitter performance. Furthermore, geopolitical considerations and national security concerns increasingly influence vendor selection in key regions, particularly impacting major global suppliers of high-capacity networking equipment, leading to market fragmentation and regional preferences.

OTN in Emerging Applications: Edge Computing and IoT

The paradigm shift towards edge computing, where processing power and data storage are moved closer to the source of data generation (e.g., factory floors, smart cities, remote aggregation points), is creating new demands for OTN equipment. Edge data centers require high-capacity, low-latency connectivity back to regional and core data centers. OTN’s robust nature and deterministic traffic handling are perfectly suited for these edge-to-core connections, ensuring that time-sensitive applications, crucial for industrial IoT (IIoT) and autonomous systems, maintain strict performance requirements.

In the context of the Internet of Things (IoT), the sheer volume and diversity of data generated necessitates efficient aggregation and grooming mechanisms before transport. OTN equipment, particularly P-OTS platforms, plays a crucial role in the metro aggregation layer, consolidating thousands of lower-speed packet streams originating from IoT gateways onto high-speed 100G/400G wavelengths destined for cloud analysis. This ensures the optical transport layer can scale without requiring continuous overhauls of the physical fiber plant, maximizing the return on investment for carriers managing large numbers of IoT connections.

The demand profile for OTN at the network edge differs significantly from core networks. Edge deployment requires smaller, ruggedized, and highly energy-efficient equipment with comprehensive remote management capabilities, often integrated into challenging physical locations. This trend is driving innovation in modular OTN devices that support flexible capacity scaling and can handle mixed traffic types (Ethernet, CPRI/eCPRI for 5G, and dedicated enterprise services) seamlessly. Vendors focusing on compact, high-density edge OTN solutions tailored for 5G fronthaul and enterprise remote office interconnectivity are capitalizing on this rapidly expanding application segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager