Optometry Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441530 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Optometry Software Market Size

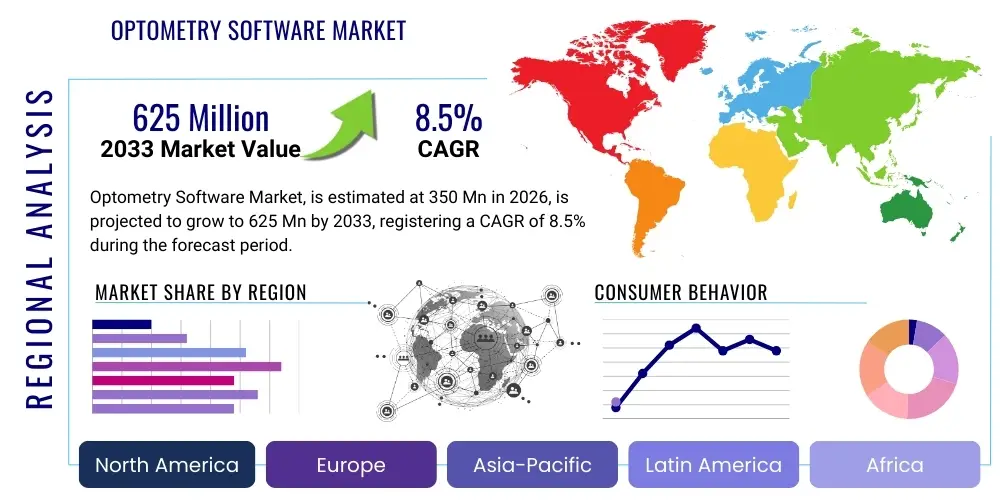

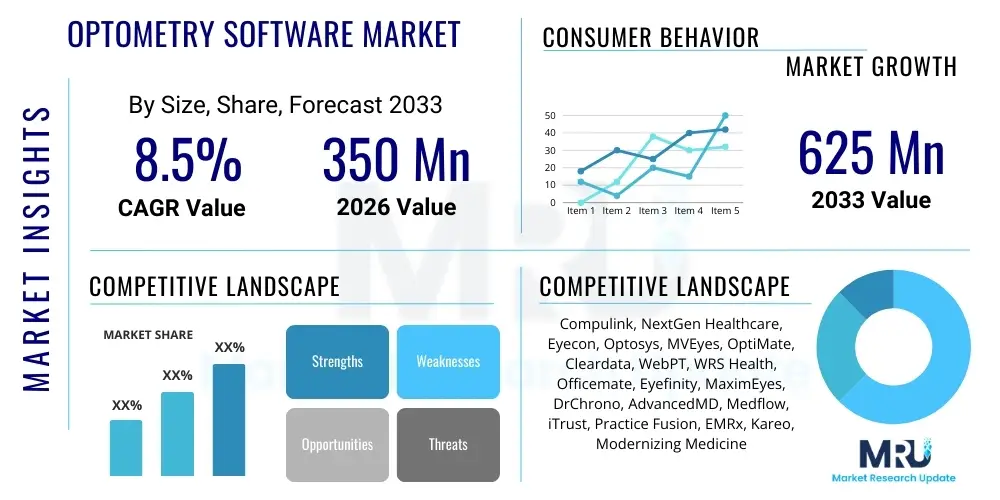

The Optometry Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 625 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating adoption of Electronic Health Records (EHR) systems within eye care practices globally, driven by stringent regulatory mandates for digital patient data management and efficiency improvements in practice workflow.

Optometry Software Market introduction

The Optometry Software Market encompasses specialized digital solutions designed to streamline and automate the operations of eye care practices, including optometrists, ophthalmologists, and retail optical stores. These systems integrate vital functions such as patient scheduling, billing, claims processing, inventory management, and clinical documentation (EHR/EMR). The product description revolves around comprehensive practice management systems (PMS) tailored specifically for the unique workflow of eye examinations, prescription generation, and optical dispensing.

Major applications of optometry software include clinical data recording, which replaces traditional paper charts with digital records, enhancing accessibility and reducing error rates. Furthermore, these platforms are crucial for insurance eligibility verification and robust revenue cycle management (RCM), ensuring timely reimbursement and improved financial health for practices. The inherent benefits include increased operational efficiency, enhanced data security compliant with regulations like HIPAA, and improved patient engagement through automated communication tools and patient portals.

Driving factors for market acceleration include the global shift towards digital healthcare transformation, rising incidences of chronic eye diseases requiring continuous monitoring, and government incentives promoting the use of certified EHR systems. The demand for integrated systems that can interface seamlessly with diagnostic equipment, such as refractors, visual field analyzers, and fundus cameras, further solidifies the market trajectory, making interoperability a critical feature for contemporary optometry software solutions.

Optometry Software Market Executive Summary

The Optometry Software Market is undergoing significant transformation, characterized by rapid adoption of cloud-based solutions which offer scalability, reduced initial investment costs, and easier maintenance compared to traditional on-premise systems. Key business trends indicate a strong move toward vendor consolidation and the integration of advanced features such as telehealth modules and sophisticated data analytics capabilities, enabling practices to optimize resource allocation and patient outreach strategies. The increasing need for robust cybersecurity measures, particularly in safeguarding sensitive protected health information (PHI), is also shaping product development, driving investments in secure, compliant platforms.

From a regional perspective, North America maintains the dominant market share, primarily due to well-established regulatory frameworks mandating EHR adoption and a high concentration of technologically advanced healthcare facilities willing to invest in premium solutions. However, the Asia Pacific (APAC) region is demonstrating the highest growth potential, fueled by increasing healthcare spending, expanding access to eye care services, and government initiatives aimed at modernizing healthcare infrastructure. European markets exhibit steady growth, influenced heavily by GDPR requirements, necessitating data sovereignty and enhanced privacy features in software solutions.

Segmentation trends highlight the increasing preference for integrated practice management and EHR suites over standalone modules. The small-to-mid-sized practice segment, which constitutes a large portion of the market, is a crucial target demographic, increasingly adopting subscription-based, cloud-deployed models. Functionally, the revenue cycle management (RCM) and electronic prescribing modules are experiencing high growth, reflecting the pressure on practices to maximize revenue capture and adhere strictly to pharmacological regulations. This digital integration is essential for providing continuous and efficient patient care pathways.

AI Impact Analysis on Optometry Software Market

Analysis of common user questions reveals significant interest in how Artificial Intelligence (AI) will enhance diagnostic accuracy, automate complex administrative tasks, and personalize patient care within optometry practices. Users frequently inquire about AI's ability to interpret complex imaging data (such as OCT scans and fundus photography) for early detection of conditions like diabetic retinopathy and glaucoma, thereby reducing diagnostic workload and improving predictive outcomes. Concerns often revolve around the validation and reliability of AI algorithms, data privacy issues associated with large-scale clinical data processing, and the necessity for clear regulatory guidelines governing AI use in clinical decision support. Users expect AI integration to transition optometry from reactive treatment models to proactive, personalized preventative care.

The core expectation from AI integration is not replacement but augmentation of the optometrist’s role. AI-powered tools integrated into optometry software are anticipated to revolutionize workflow efficiency, particularly in areas like automated preliminary refraction analysis, intelligent scheduling optimization based on patient history and urgency, and streamlining insurance claim submissions by automatically identifying coding errors. Furthermore, Generative AI is beginning to be explored for generating personalized patient education materials and automating follow-up communications, enhancing patient compliance and engagement outside the clinic setting, thereby strengthening the quality of care delivered.

The shift towards cloud-native software facilitates the deployment of AI modules, as these platforms provide the necessary computational power and standardized data structures required for machine learning models. Future developments are heavily focused on developing sophisticated predictive analytics tools embedded within EHR systems, capable of flagging high-risk patients for urgent intervention. This necessitates strong partnerships between software vendors, diagnostic device manufacturers, and AI research institutions to ensure the seamless, ethical, and clinically valuable deployment of these transformative technologies across the eye care sector.

- Automated image analysis for diabetic retinopathy and glaucoma detection.

- Predictive modeling for patient risk assessment and disease progression forecasting.

- Enhanced clinical decision support systems integrated directly into EHR workflows.

- Intelligent automation of administrative tasks, including appointment optimization and billing reconciliation.

- Personalization of treatment plans and patient communication via Generative AI tools.

- Improved data security through AI-driven anomaly detection and fraud prevention systems.

- Integration of machine learning for optimizing spectacle and contact lens inventory management.

DRO & Impact Forces Of Optometry Software Market

The dynamics of the Optometry Software Market are shaped by powerful drivers, systemic restraints, and significant opportunities that collectively determine its growth trajectory and competitive landscape. The primary driver is the accelerating trend of digital transformation in healthcare, mandated by global regulatory bodies pushing for the adoption of Electronic Health Records (EHR) to ensure data interoperability and enhance patient safety. Opportunities often emerge from technological convergence, particularly the rise of telehealth capabilities and the integration of IoT devices, which allow optometrists to extend their services beyond the physical clinic, accessing remote populations and managing chronic conditions proactively. These forces create a substantial positive momentum, ensuring sustained investment in advanced software solutions.

Key restraints, however, temper this growth. The high initial capital expenditure associated with implementing comprehensive practice management systems, especially for smaller, independent practices, poses a significant barrier to entry. Furthermore, resistance to change among long-term practitioners who are accustomed to paper-based systems or older legacy software requires extensive training and change management initiatives. A critical ongoing restraint is the pervasive concern regarding data security and privacy compliance (HIPAA in the US, GDPR in Europe), requiring continuous, costly software updates and rigorous adherence to evolving standards, which can strain the resources of smaller software providers.

The impact forces are substantial, pushing the industry toward standardization and higher technological sophistication. The need for comprehensive interoperability between diverse clinical systems, including diagnostic equipment and external laboratory services, acts as a powerful force compelling vendors to develop open API architectures. Competitive pressure forces continuous innovation, focusing on user experience (UX) to ensure high adoption rates among clinical staff. Ultimately, the cumulative effect of these drivers and opportunities outweighs the restraints, establishing a market environment highly conducive to the adoption of advanced, feature-rich optometry software solutions that support improved clinical outcomes and streamlined business operations.

Segmentation Analysis

The Optometry Software Market is broadly segmented based on deployment model, application type, and end-user. Understanding these segmentations is critical for both market participants and investors to accurately gauge demand pockets and tailor product offerings. The shift toward cloud-based deployment remains the most influential segmentation trend, reflecting the need for flexible, accessible, and lower-maintenance solutions. Application segmentation highlights the growing demand for comprehensive integrated systems that combine clinical documentation with administrative tools, moving away from fragmented, single-function software applications.

Deployment models categorize solutions into on-premise, requiring internal IT infrastructure, and cloud-based (SaaS), hosted by the vendor. Cloud solutions are experiencing significantly higher growth due to their scalability, automatic updates, and reduced upfront cost burden. Application segmentation centers around Practice Management Systems (PMS) which handle administrative tasks like scheduling and billing, and Electronic Health Records (EHR) which focus on clinical documentation, patient history, and e-prescribing. The synergy between these two components is increasingly mandatory for new market entrants.

End-user segmentation is vital, differentiating the needs of large group practices and hospitals from those of small, solo optometry clinics. While hospitals require robust, high-volume systems that integrate with larger hospital information systems (HIS), small clinics prioritize ease of use and affordability, often opting for dedicated, simplified cloud platforms. This detailed segmentation analysis aids in strategic marketing and resource allocation, ensuring that products meet the specific operational and compliance requirements of each distinct segment within the eye care ecosystem.

- By Deployment Type:

- Cloud-Based

- On-Premise

- By Application:

- Electronic Health Records (EHR)

- Practice Management Systems (PMS)

- Revenue Cycle Management (RCM)

- Inventory Management

- Patient Engagement and Communication

- By End-User:

- Independent Optometry Practices

- Group Practices and Clinics

- Ophthalmic Hospitals and Academic Centers

- Retail Optical Chains

Value Chain Analysis For Optometry Software Market

The value chain for the Optometry Software Market initiates with upstream activities involving core software development, clinical consulting, and technological infrastructure provisioning, particularly in cloud computing services. Software developers invest heavily in R&D to ensure compliance with healthcare standards (e.g., HL7, FHIR for interoperability) and integrate emerging technologies like AI and machine learning for predictive clinical support. Key upstream suppliers include database providers, cloud service giants (AWS, Azure), and specialized medical coding and billing experts who provide the foundational knowledge for RCM functionality.

Midstream activities primarily involve integration, customization, and distribution. Value Added Resellers (VARs) and specialized IT integrators play a crucial role in adapting generic software platforms to the unique workflow of individual practices or large hospital systems. Distribution channels are varied: direct sales teams are often used for large enterprise clients, while smaller, cloud-based vendors frequently utilize online subscription models and indirect sales through professional industry associations and partnerships with equipment manufacturers. The effectiveness of sales and technical support during implementation is a major determinant of success in this midstream phase.

Downstream analysis focuses on the end-user adoption and ongoing support, which is critical for long-term customer retention. Optometry practices and hospitals utilize the software for daily clinical and administrative operations. The direct channel ensures personalized implementation and training, fostering strong client relationships necessary for high-stakes healthcare software. The indirect channel, often facilitated through partnerships, allows for wider geographical reach. Success at the downstream level is measured by user satisfaction, regulatory audit success, and measurable improvements in practice efficiency and revenue capture, driven by continuous vendor updates and robust technical support services.

Optometry Software Market Potential Customers

The primary customers for Optometry Software are any professional entities involved in primary eye care and vision correction services, encompassing a diverse range of clinical and retail settings. These end-users typically require comprehensive solutions that manage both the clinical side (EHR, diagnostic interfacing) and the commercial side (inventory, sales, RCM). The most immediate and high-volume buyers are independent optometry practices, which constantly seek integrated, cost-effective solutions to compete with larger corporate chains and manage complex insurance billing efficiently.

Another major segment includes large group practices and specialized ophthalmic clinics which require multi-location, scalable systems with advanced security and robust networking capabilities. These organizations prioritize interoperability with hospital information systems (HIS) and require sophisticated data aggregation tools for research and quality reporting. Furthermore, academic medical centers and teaching hospitals represent a premium customer base, demanding highly customized software that supports complex research protocols and resident training alongside clinical operations, often necessitating open API access for custom integrations.

The fastest-growing segment of potential customers includes retail optical chains and franchised eye care centers. For these customers, inventory management, point-of-sale (POS) integration, and seamless patient relationship management (PRM) are equally as important as clinical documentation. The software must efficiently track spectacle frames, contact lenses, and lab orders across numerous locations while maintaining centralized patient records and consistent branding. These customers often drive demand for SaaS models due to the need for rapid deployment and standardized implementation across a large number of geographically dispersed sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 625 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Compulink, NextGen Healthcare, Eyecon, Optosys, MVEyes, OptiMate, Cleardata, WebPT, WRS Health, Officemate, Eyefinity, MaximEyes, DrChrono, AdvancedMD, Medflow, iTrust, Practice Fusion, EMRx, Kareo, Modernizing Medicine |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optometry Software Market Key Technology Landscape

The technological landscape of the Optometry Software Market is defined by a strong migration toward secure, cloud-native architectures that facilitate real-time data access and support advanced interoperability standards. The shift to Software as a Service (SaaS) models leverages robust third-party cloud infrastructure, reducing the burden of IT maintenance for clinical practices and ensuring high availability and disaster recovery capabilities. Essential technology components include highly secure encryption protocols, multi-factor authentication, and compliance monitoring features necessary to meet evolving healthcare privacy standards globally.

Interoperability remains a cornerstone technology, driven by the need for seamless data exchange between the software and various diagnostic instruments (e.g., optical coherence tomography, fundus cameras). This is achieved through the widespread adoption of standardized health information protocols such as Health Level Seven International (HL7) and Fast Healthcare Interoperability Resources (FHIR). FHIR, in particular, is critical for enabling modular integration and allowing practices to connect specialized applications, enhancing the flexibility of the overall system architecture and supporting patient data portability across different healthcare settings.

Furthermore, the integration of telehealth platforms and mobile applications is rapidly becoming standard practice. These technologies enable remote patient consultations, virtual monitoring of chronic eye conditions, and enhanced patient engagement through secure messaging and automated reminders accessible via smartphones. Future technological advancements are centered on harnessing AI and machine learning capabilities for clinical decision support, particularly in automating preliminary diagnosis of retinal pathologies and optimizing operational efficiencies through advanced predictive analytics embedded within the core practice management modules.

Regional Highlights

Regional dynamics play a crucial role in shaping the Optometry Software Market, influenced by variations in healthcare infrastructure, regulatory environments, and technological maturity. North America, comprising the United States and Canada, currently dominates the global market, primarily driven by stringent government mandates favoring the adoption of certified EHR systems, significant investment in healthcare IT, and the presence of major industry players. The mature regulatory environment (HIPAA compliance) necessitates high-quality, feature-rich software, commanding premium pricing and higher technology adoption rates, especially in large group practices and integrated delivery networks.

Europe represents the second-largest market, characterized by fragmentation across various national healthcare systems, yet unified by the strict data protection requirements of the General Data Protection Regulation (GDPR). Adoption in countries like Germany, the UK, and France is steadily increasing, motivated by national digitalization strategies and a strong focus on enhancing primary care efficiency. The demand here is skewed toward cloud-based solutions that offer robust data residency and compliance features, ensuring that software vendors meet localized standards for patient data storage and processing.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the forecast period. This growth is attributable to expanding medical tourism, massive government initiatives to digitize public health records (e.g., in China and India), and a rapidly growing middle class seeking professional eye care services. While APAC currently lags slightly in technology saturation compared to the West, increasing awareness regarding chronic eye diseases and competitive market pricing strategies from local and international vendors are catalyzing widespread adoption, particularly in urban, technologically savvy markets like Japan and Australia. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth primarily concentrated in urban economic hubs and private healthcare sectors, driven by improving economic conditions and investments in digital infrastructure.

- North America: Market leader due to regulatory push (EHR mandates) and high digital integration in healthcare.

- Europe: Stable growth driven by efficiency needs and adherence to strict GDPR data privacy regulations.

- Asia Pacific (APAC): Fastest-growing market fueled by government digitalization efforts and improving healthcare access.

- Latin America: Emerging market focusing on essential PMS and RCM functionality in private clinics.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to high per capita healthcare spending and modernizing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optometry Software Market.- Compulink

- NextGen Healthcare

- Eyecon

- Optosys

- MVEyes

- OptiMate

- Cleardata

- WebPT

- WRS Health

- Officemate

- Eyefinity

- MaximEyes

- DrChrono

- AdvancedMD

- Medflow

- iTrust

- Practice Fusion

- EMRx

- Kareo

- Modernizing Medicine

- Total Access EHR

- Crystal Practice Management

Frequently Asked Questions

Analyze common user questions about the Optometry Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of switching to cloud-based optometry software?

The primary benefit of cloud-based optometry software is enhanced accessibility and reduced capital expenditure. Cloud systems allow practitioners to access patient records securely from any location, facilitate automatic updates, and eliminate the need for costly in-house server maintenance and IT infrastructure management, making them ideal for scaling practices.

How does optometry software ensure HIPAA and GDPR compliance for patient data?

Optometry software ensures compliance by implementing robust data encryption, secure login protocols (like two-factor authentication), detailed audit trails for tracking data access, and physical security measures in certified data centers. Vendors must adhere strictly to regional regulations concerning patient data storage, transmission, and privacy breach reporting.

What is the role of Artificial Intelligence (AI) in modern optometry practice management systems (PMS)?

AI in PMS is used primarily to enhance operational efficiency and clinical accuracy. This includes automating complex billing and coding processes (RCM), optimizing appointment scheduling, and integrating machine learning algorithms for preliminary analysis of diagnostic images (e.g., OCT scans) to flag potential pathological conditions early on.

Is interoperability standard across all major optometry EHR systems?

While the market is moving toward greater interoperability, it is not universally standard. Leading optometry EHR systems utilize standard protocols like FHIR and HL7 to interface with diagnostic equipment and external health information exchanges (HIEs). Prospective buyers should specifically verify the vendor’s ability to integrate with their existing hardware and regional HIE network requirements.

Which segment holds the largest share in the Optometry Software Market by application?

The Practice Management Systems (PMS) segment, often integrated with Electronic Health Records (EHR), holds the largest market share. This dominance is driven by the immediate need for efficient revenue cycle management (RCM), billing, scheduling, and inventory control, which directly impact the financial sustainability and operational workflow of an eye care practice.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager