Oral Care or Oral Hygiene Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442335 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Oral Care or Oral Hygiene Market Size

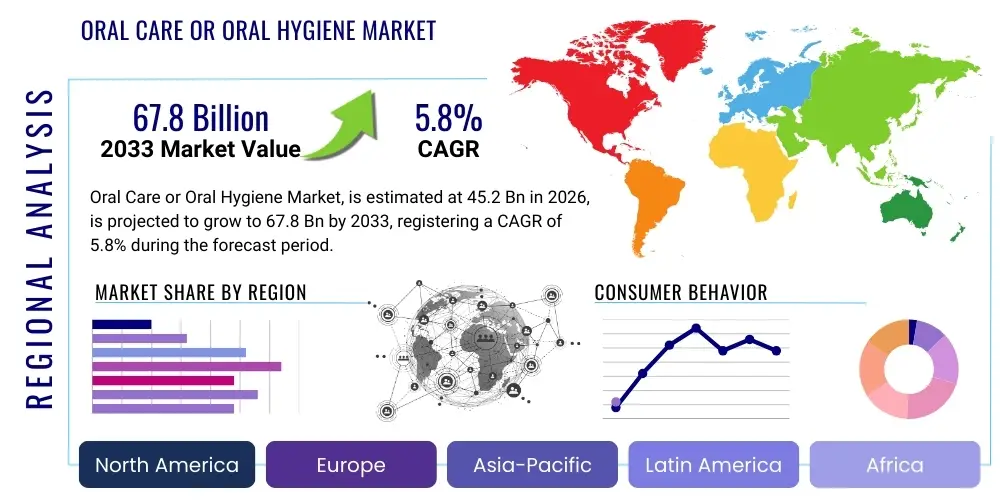

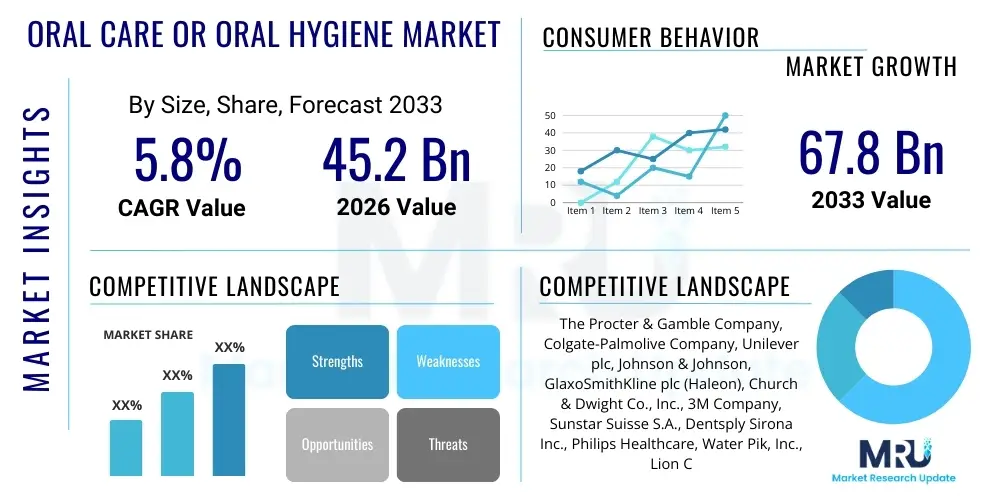

The Oral Care or Oral Hygiene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 67.8 Billion by the end of the forecast period in 2033.

Oral Care or Oral Hygiene Market introduction

The Oral Care or Oral Hygiene Market encompasses products and services dedicated to maintaining dental and periodontal health, including preventative measures, cosmetic treatments, and therapeutic solutions. Key product descriptions span a wide array of consumer goods, from essential items like toothbrushes (manual and electric), toothpaste, mouthwashes, and dental floss, to specialized products such as denture care systems, oral pain relievers, and professional dental tools used in clinical settings. The increasing global awareness regarding the linkage between poor oral health and systemic diseases, such as cardiovascular issues and diabetes, acts as a primary catalyst for market expansion, driving consumers toward higher-efficacy and technologically advanced products.

Major applications of oral care products include plaque removal, cavity prevention, gum disease management (gingivitis and periodontitis), and aesthetic improvements like teeth whitening and breath freshening. The benefits derived from consistent oral hygiene are manifold, contributing significantly to overall quality of life, including improved digestion, enhanced self-esteem due to better aesthetics, and reduction in the incidence of serious chronic illnesses. Furthermore, the market is characterized by a high degree of innovation, particularly in sustainable packaging, personalized formulations, and incorporation of natural or herbal ingredients, catering to evolving consumer preferences.

Driving factors propelling this market include rising disposable incomes in emerging economies, increased penetration of organized retail channels and e-commerce platforms, and favorable governmental initiatives and public health campaigns promoting preventative dental care. The geriatric population, which often requires specialized oral hygiene solutions due to issues like dry mouth and denture needs, represents a consistently expanding demographic driver. Additionally, the shift from conventional chemical-based products towards natural, cruelty-free, and organic oral care formulations is influencing product development strategies across leading industry participants.

Oral Care or Oral Hygiene Market Executive Summary

The global Oral Care or Oral Hygiene Market exhibits robust growth driven by elevated consumer health consciousness and rapid technological advancements in product delivery and formulation. Business trends indicate a strong move toward premiumization, where consumers are willing to invest in electric toothbrushes, therapeutic mouthwashes, and professional-grade whitening kits. Strategic mergers, acquisitions, and partnerships aimed at strengthening distribution networks and incorporating niche sustainable brands are defining the competitive landscape. Furthermore, digital engagement through personalized recommendations and telehealth consultations for oral health advice is rapidly becoming a standard offering, impacting direct-to-consumer (D2C) channels significantly.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, largely due to immense population size, rapid urbanization, improving economic conditions, and low historical penetration rates, which are now accelerating. North America and Europe maintain dominance in terms of revenue contribution, characterized by high adoption rates of advanced electric and smart oral care devices, and sophisticated demand for cosmetic dentistry products. Regulatory standardization, particularly concerning ingredients and claims verification, is becoming a key factor influencing market entry and expansion strategies across developed regions, leading companies to prioritize clinical validation.

Segmentation trends reveal significant consumer preference shifts. By product type, the toothpaste category remains the foundational segment, though specialized toothpaste (sensitive, whitening, fluoride-free) is capturing substantial market share. The tools and accessories segment, particularly electric toothbrushes integrated with smart sensor technology and app connectivity, is expected to register the highest CAGR. In terms of end-use, the professional segment, involving dental clinics and hospitals, is experiencing growth fueled by increased demand for preventative in-office treatments and complex restorative procedures. The integration of artificial intelligence into diagnostics and treatment planning also promises to reshape the professional oral care sector.

AI Impact Analysis on Oral Care or Oral Hygiene Market

Analysis of common user questions regarding the impact of AI on the Oral Care or Oral Hygiene Market reveals key themes centered on diagnostic accuracy, personalized treatment plans, and the automation of clinical processes. Users frequently inquire about the reliability of AI-powered diagnostic tools for detecting early-stage caries and periodontal disease, the ethical implications of data usage in patient records, and the potential for AI to create customized oral hygiene product recommendations based on individual genetic or microbiome data. There is also significant interest in how AI can streamline operational efficiencies in dental practices and reduce the overall cost of advanced oral care. The overarching expectation is that AI will democratize access to expert-level diagnostics and fundamentally alter how preventative care is administered.

The application of Artificial Intelligence extends from consumer-facing smart devices to clinical backend systems. For consumers, AI integration in electric toothbrushes tracks brushing patterns, pressure application, and coverage areas, offering real-time feedback and customized coaching via mobile applications, thereby enhancing the efficacy of daily hygiene routines. In the professional segment, AI algorithms are being trained on millions of radiographs and 3D scans to enhance the precision of diagnoses, assisting practitioners in identifying subtle pathologies often missed by the human eye, leading to earlier intervention and better patient outcomes. This predictive capability reduces diagnostic ambiguity and improves consistency across different practitioners.

This technological shift is not only improving care quality but is also impacting product development cycles. AI-driven consumer data analytics allow manufacturers to rapidly identify underserved needs, leading to the creation of highly specialized products, such as toothpaste formulations optimized for specific microbiome profiles or custom-fitted retainers designed using machine learning algorithms. Furthermore, the use of chatbots and virtual assistants for preliminary patient screening, scheduling, and post-treatment follow-up is optimizing clinic workflow and enhancing patient experience, positioning AI as a critical transformative force across both the clinical and retail sectors of the oral care ecosystem.

- AI-driven personalized oral hygiene recommendations based on real-time sensor data.

- Enhanced diagnostic accuracy in radiology through machine learning for early disease detection.

- Automation of clinical workflow, scheduling, and patient record management systems.

- Development of smart electric toothbrushes offering real-time feedback and coaching.

- Predictive modeling for caries risk assessment and periodontitis progression.

- Optimized inventory and supply chain management for dental clinics using predictive AI.

DRO & Impact Forces Of Oral Care or Oral Hygiene Market

The Oral Care or Oral Hygiene Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces shaping its trajectory. Key drivers include heightened awareness campaigns globally emphasizing the importance of preventative dentistry, the rising prevalence of dental ailments such as cavities and periodontal disease tied to shifting dietary habits, and substantial advancements in material science leading to more effective and comfortable oral care products. Restraints primarily involve the high cost associated with advanced electric toothbrushes and premium whitening treatments, leading to affordability barriers in low-income regions, alongside the lack of universal access to professional dental care in many rural areas. Opportunities are vast, focusing on the untapped potential of emerging markets, the rapid expansion of the natural and organic product segment, and the integration of telehealth and remote monitoring capabilities.

The primary impact forces propelling market revenue are rooted in demographic shifts, particularly the aging population, which necessitates specialized oral health solutions (e.g., dry mouth remedies, denture adhesives), and the youth population's growing focus on cosmetic dentistry and orthodontic alignment. Socioeconomic factors, such as increased urbanization and higher disposable income levels, translate directly into greater spending on non-essential, high-margin products like electric devices and premium specialized pastes. Conversely, stringent regulatory oversight regarding ingredient safety, especially in regions like the European Union, acts as a constraining force, mandating complex approval processes and potentially slowing down the introduction of novel chemical formulations.

Innovation cycles play a crucial role in maintaining market momentum, driven by competitive pressures among leading players to introduce differentiated products. For instance, the transition from traditional chemicals to bio-active compounds and sustainable ingredients represents a major opportunity. Furthermore, the digital transformation, spurred by the integration of IoT (Internet of Things) into oral care tools and the rise of e-commerce as a primary sales channel, amplifies market reach and consumer engagement. Successfully navigating these impact forces requires companies to invest heavily in R&D, tailor product offerings to regional cultural preferences, and establish robust, compliant supply chains.

Segmentation Analysis

The Oral Care or Oral Hygiene Market is extensively segmented based on Product Type, Distribution Channel, and End-User, reflecting the diverse range of consumer needs and access points globally. This segmentation is crucial for stakeholders to tailor marketing strategies and product development investments. Product categorization distinguishes between essential daily consumables and durable advanced equipment, while distribution analysis highlights the dominant roles of retail pharmacies and online platforms. End-user classification separates mass consumer purchases from specialized clinical applications, revealing varying price elasticities and demand patterns across segments.

- Product Type:

- Toothpaste (Gel, Paste, Powder, Polishes)

- Toothbrushes (Manual, Electric, Battery-Powered)

- Mouthwashes/Rinses (Cosmetic, Therapeutic)

- Dental Floss and Floss Picks

- Denture Care Products (Cleaners, Adhesives)

- Oral Pain Relievers and Specialized Products

- Distribution Channel:

- Supermarkets and Hypermarkets

- Retail Pharmacies and Drug Stores

- Online Retail Channels (E-commerce)

- Dental Clinics and Hospitals (Professional Channels)

- End-User:

- Residential/Household Consumers

- Professional/Clinical (Dental Offices, Hospitals)

- Function:

- Whitening

- Sensitivity

- Caries Protection

- Fresh Breath

- Gum Care

Value Chain Analysis For Oral Care or Oral Hygiene Market

The value chain for the Oral Care or Oral Hygiene Market starts with the sourcing of specialized raw materials (upstream analysis), primarily involving pharmaceutical-grade chemicals, abrasive agents (like silica), humectants, flavors, packaging plastics, and specific functional ingredients (e.g., fluoride, xylitol, herbal extracts). The upstream segment is dominated by a few large chemical and ingredient suppliers who must adhere to stringent quality and safety standards. Innovation at this stage focuses on developing sustainable, bio-based, and highly effective functional ingredients, such as advanced fluoride alternatives or novel biofilm disruptors, which provide competitive advantages to the manufacturers.

The central manufacturing stage involves sophisticated formulation, packaging, and quality control processes. Large manufacturers often manage multiple product lines across different geographies, requiring optimized production facilities. Once products are manufactured, the downstream analysis focuses on market access, which is highly fragmented yet critical. Products move through complex distribution channels, including direct sales to large retailer chains, sales to professional dental distributors for clinic supplies, and increasingly, direct-to-consumer fulfillment facilitated by e-commerce and specialized online oral care subscription services. Effective logistics and inventory management are paramount to ensure product freshness and compliance.

Distribution channels in this market are bifurcated into direct and indirect routes. Direct distribution often involves large contracts with hypermarkets or major retail pharmacy chains, where products are managed internally. Indirect channels rely heavily on wholesalers, regional distributors, and specialized dental supply houses that service independent dental practices. The rise of e-commerce has blurred these lines, allowing manufacturers to bypass traditional retail middlemen and establish direct relationships with end consumers, offering greater control over pricing and brand messaging. The efficiency of this value chain determines both the final consumer price and the speed of market penetration for new innovations.

Oral Care or Oral Hygiene Market Potential Customers

Potential customers, or end-users/buyers, of the Oral Care or Oral Hygiene Market are broadly categorized into mass market consumers (residential) and professional entities (clinical). The residential segment represents the largest volume market, encompassing individuals across all age demographics—from infants requiring specialized brushes and pastes, to adults seeking preventative care and cosmetic enhancements, and geriatric populations needing specific solutions for age-related oral issues. This segment is characterized by habitual purchasing patterns, high brand loyalty, but also responsiveness to promotional activities and perceived value-added features like smart technology or natural ingredients.

The professional segment, comprising dental surgeons, hygienists, specialized clinics, and hospitals, constitutes a critical high-value market. These buyers demand clinical-grade products, including professional scaling tools, high-concentration fluoride varnishes, advanced impression materials, and therapeutic mouth rinses. Their purchasing decisions are driven by product efficacy, clinical validation, regulatory approval, and long-term supplier relationships, often involving bulk purchases. As preventative dental insurance coverage expands globally, the demand for professional-grade preventative products used in-office treatments continues to rise steadily.

Furthermore, niche customer groups are emerging, such as orthodontic patients who require specialized cleaning tools for braces and aligners, and individuals focused on wellness and sustainability who specifically seek out organic, zero-waste, and vegan oral care alternatives. Targeting these distinct buyer groups requires highly differentiated product lines and targeted distribution strategies. Understanding the pain points of each customer segment, whether it's the professional need for superior instrument longevity or the consumer desire for gentle yet effective whitening, is essential for successful market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 67.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Procter & Gamble Company, Colgate-Palmolive Company, Unilever plc, Johnson & Johnson, GlaxoSmithKline plc (Haleon), Church & Dwight Co., Inc., 3M Company, Sunstar Suisse S.A., Dentsply Sirona Inc., Philips Healthcare, Water Pik, Inc., Lion Corporation, Henkel AG & Co. KGaA, Dr. Fresh, LLC, Ivoclar Vivadent AG, Ultradent Products Inc., GC Corporation, Jordan AS, Curaprox AG, Sensodyne (Haleon) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Care or Oral Hygiene Market Key Technology Landscape

The technology landscape of the Oral Care or Oral Hygiene Market is undergoing rapid transformation, moving beyond basic mechanical cleaning to sophisticated digital health integration and bio-active formulations. A primary technological driver is the adoption of the Internet of Things (IoT) in electric toothbrushes, enabling features such as pressure sensors, 3D mapping of the mouth, and Bluetooth connectivity for data transfer to mobile applications. These smart devices provide unprecedented granularity regarding user behavior, allowing for highly personalized feedback and optimization of brushing techniques. Furthermore, advancements in battery technology and miniaturization are making these sophisticated devices more practical and appealing to a broader consumer base.

Another crucial technological development lies in formulation chemistry, particularly the shift toward advanced materials for enamel repair and plaque prevention. This includes the utilization of hydroxyapatite (a natural component of tooth enamel) as an alternative to fluoride, catering to consumer preferences for bio-mimetic and safer ingredients. Furthermore, sustained-release technology in mouthwash and toothpaste ensures prolonged efficacy of active ingredients like chlorhexidine or essential oils, enhancing protection between brushing sessions. Biotechnology is also influencing the professional segment through the development of specialized probiotics designed to balance the oral microbiome and inhibit pathogenic bacteria growth, moving oral care towards preventative biological interventions.

In the professional sphere, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into diagnostic imaging systems (e.g., intraoral scanners and panoramic X-rays) is paramount for early detection and precision treatment planning. Digital dentistry technologies, including CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) for dental restorations and 3D printing for customized aligners and retainers, have revolutionized the speed and accuracy of restorative and orthodontic procedures. These technologies not only improve patient outcomes but also enhance the overall efficiency and profitability of dental clinics, establishing digital transformation as a non-negotiable component of modern oral health delivery.

Regional Highlights

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

North America represents a mature and highly lucrative market segment, characterized by high consumer awareness, strong purchasing power, and rapid adoption of premium and technologically advanced oral care solutions. The United States is the primary revenue contributor, driven by a culture of preventative healthcare spending and high expenditure on cosmetic dentistry services, particularly teeth whitening and aligner technology. The market here is witnessing significant growth in electric and smart toothbrush sales, reflecting consumer willingness to invest in devices that offer real-time data tracking and personalized feedback. Regulatory standards, especially those enforced by the FDA, ensure product safety and effectiveness, fostering consumer confidence in both over-the-counter and professional-grade products. Competition is fierce, compelling major players to continuously innovate in the sustainable packaging and natural ingredient sectors to maintain market share.

Europe holds a substantial share of the global oral care market, marked by stringent quality control and a strong consumer preference for eco-friendly and natural products, particularly in Western European countries like Germany and the UK. Product innovation frequently centers on minimizing environmental impact, leading to the rapid growth of plastic-free toothpaste, bamboo toothbrushes, and recyclable packaging. The market is segmented, with high penetration of professional dental services driving demand for clinical-grade products, while retail channels see intense competition in the manual toothbrush and basic toothpaste categories. Economic stability and robust public health systems supporting preventative dental check-ups further contribute to stable demand across the region.

Asia Pacific (APAC) is positioned as the fastest-growing regional market, offering immense growth opportunities fueled by rapid urbanization, substantial increases in disposable income, and expanding access to modern retail infrastructure. Countries such as China and India are major engines of growth, driven by large, underserved populations who are transitioning from traditional, basic oral care practices to adopting standardized products like branded toothpaste and mouthwash. Government initiatives focused on reducing dental disease burden and private sector investments in establishing dental clinics are boosting the professional segment. While price sensitivity remains a factor, there is an accelerating trend toward premiumization, especially in metropolitan areas, where demand for advanced electric devices and specialized whitening products is rapidly catching up with Western markets.

Latin America exhibits consistent growth, primarily driven by improving economic conditions and increased spending on personal hygiene products. Brazil dominates this region due to its large population base and high consumer interest in cosmetic products, including teeth whitening and orthodontic care. The distribution network relies heavily on drugstores and local pharmacies, though e-commerce penetration is rising rapidly, particularly in urban centers. Challenges include localized regulatory complexities and varying levels of access to professional dental services, which necessitates a focus on affordable and accessible mass-market products to achieve widespread penetration.

Middle East and Africa (MEA) represent an emerging market characterized by significant regional disparities. The Gulf Cooperation Council (GCC) nations show high per capita spending on oral care due to affluent populations and advanced healthcare infrastructure, driving demand for premium imported brands and specialized professional treatments. Conversely, many African countries focus primarily on basic, affordable toothpaste and manual brushes, with significant growth potential tied to improved healthcare literacy and economic development. Key growth factors include increasing foreign investment in retail and rising public health awareness regarding dental hygiene, prompting local and international companies to adapt their product portfolios to meet diverse economic and cultural needs across the sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Care or Oral Hygiene Market.- The Procter & Gamble Company

- Colgate-Palmolive Company

- Unilever plc

- Johnson & Johnson

- GlaxoSmithKline plc (Haleon)

- Church & Dwight Co., Inc.

- 3M Company

- Sunstar Suisse S.A.

- Dentsply Sirona Inc.

- Philips Healthcare

- Water Pik, Inc.

- Lion Corporation

- Henkel AG & Co. KGaA

- Dr. Fresh, LLC

- Ivoclar Vivadent AG

- Ultradent Products Inc.

- GC Corporation

- Jordan AS

- Curaprox AG

- Sensodyne (Haleon)

Frequently Asked Questions

Analyze common user questions about the Oral Care or Oral Hygiene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growing demand for electric toothbrushes globally?

The primary driver is the scientifically proven superior plaque removal efficacy of electric toothbrushes compared to manual versions, coupled with integrated smart technology (IoT and AI) offering personalized coaching, pressure sensors to prevent gum damage, and real-time tracking of brushing habits, elevating consumer engagement and perceived health benefits.

How significant is the shift towards natural and sustainable oral care products?

The shift is highly significant and accelerating, driven by consumer concerns regarding synthetic ingredients like parabens, microplastics, and certain sulfates. Consumers increasingly seek products containing natural extracts (e.g., charcoal, bamboo, herbal oils), minimal chemical additives, and prioritizing sustainable packaging options such as recyclable tubes and zero-waste designs.

Which geographic region presents the highest growth potential for oral care manufacturers?

The Asia Pacific (APAC) region presents the highest growth potential, largely attributable to increasing disposable incomes, rapid urbanization, expanding distribution networks, and a significant population shift towards adopting higher-quality, branded oral hygiene standards, particularly in emerging economies like China and India.

What role does Artificial Intelligence play in modern professional dentistry?

AI significantly enhances modern professional dentistry by improving diagnostic accuracy in analyzing radiographs (detecting subtle caries or bone loss), optimizing treatment planning for orthodontics and restorative procedures, and streamlining practice management through automated scheduling and patient data analysis, leading to more efficient and personalized patient care.

What are the primary restraints impacting the mass adoption of premium oral care devices?

The main restraint is the high initial capital investment required for premium devices, such as high-end sonic toothbrushes or advanced water flossers, which creates affordability barriers, particularly in developing markets or for low-income demographics. Additionally, consumer skepticism regarding the necessity of features beyond basic cleaning sometimes impedes mass adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager