Oral Dissolving Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443456 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Oral Dissolving Film Market Size

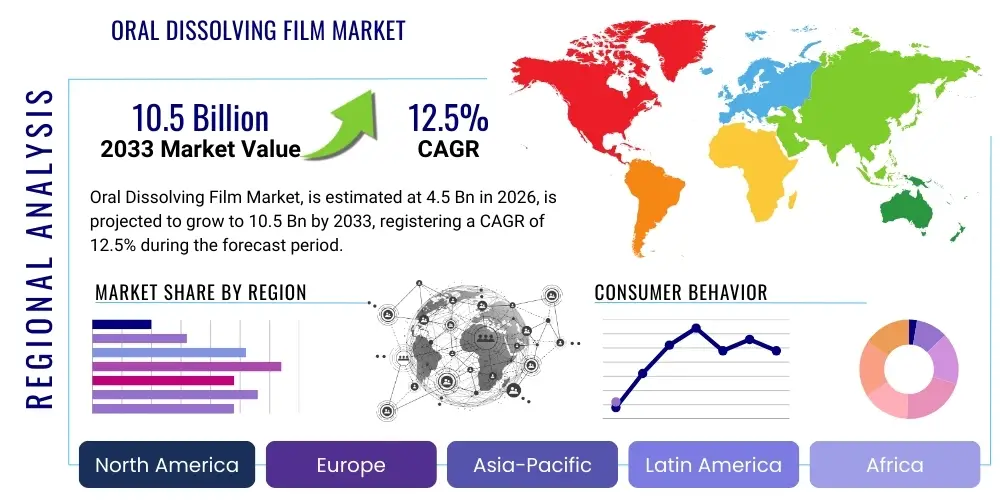

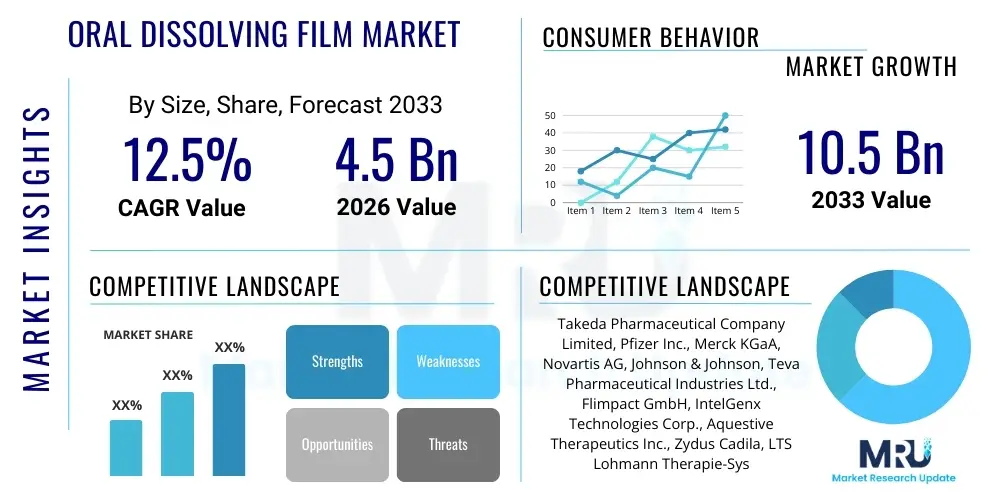

The Oral Dissolving Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

Oral Dissolving Film Market introduction

The Oral Dissolving Film (ODF) Market encompasses the development, production, and distribution of ultra-thin polymeric films designed to rapidly dissolve or disintegrate upon contact with saliva in the mouth, releasing active pharmaceutical ingredients (APIs) or nutritional supplements. This drug delivery system offers a significant advantage over traditional dosage forms, particularly for patients experiencing dysphagia (difficulty swallowing), pediatric and geriatric populations, and those requiring quick onset of action. The inherent convenience and portability of ODFs make them highly desirable in a fast-paced consumer environment, leading to their increasing adoption across diverse therapeutic areas, including pain management, central nervous system (CNS) disorders, and vitamins/dietary supplements.

ODFs are characterized by their small size, lightweight nature, and flexible composition, often utilizing hydrophilic polymers like pullulan, cellulose derivatives, or gelatin. Major applications span prescription medications and over-the-counter (OTC) products. In the pharmaceutical sector, ODFs are utilized for anti-emetics, anti-migraine agents, and controlled substances where rapid systemic absorption is beneficial. The formulation technology aims to enhance bioavailability, mask unpleasant tastes, and improve patient compliance, addressing some of the critical limitations associated with conventional tablets and capsules. Furthermore, the discrete administration provided by ODFs minimizes the risk of choking and facilitates consumption without the need for water, enhancing their utility in emergency or on-the-go scenarios.

The market growth is fundamentally driven by the rising global prevalence of chronic diseases requiring long-term medication, coupled with the escalating demand for patient-centric drug delivery solutions. Technological advancements in film manufacturing, such as solvent casting and hot-melt extrusion, are continually improving the drug loading capacity and stability of ODF products. Moreover, the expiration of patents for several blockbuster drugs is encouraging pharmaceutical companies to explore novel delivery methods, positioning ODFs as an attractive option for life cycle management and market differentiation. Regulatory support for innovative drug delivery systems also plays a crucial role in accelerating market expansion across mature and emerging economies.

Oral Dissolving Film Market Executive Summary

The global Oral Dissolving Film market is witnessing robust expansion driven primarily by shifting demographics, including a growing aging population susceptible to swallowing difficulties, and increased investment in R&D for specialized drug formulations. Key business trends indicate a strong focus on strategic collaborations between specialized technology providers and large pharmaceutical companies seeking to diversify their product portfolios and capture niche therapeutic markets. Intellectual property surrounding film formulation and manufacturing processes remains a critical competitive differentiator, compelling major players to continuously innovate. Furthermore, the market is characterized by intense activity in the nutraceutical and dietary supplement sectors, utilizing ODFs for vitamins and wellness products due to their enhanced absorption profile and consumer appeal, positioning this sector as a major revenue contributor alongside traditional prescription drugs.

Regionally, North America maintains market leadership, attributed to high healthcare expenditure, sophisticated regulatory infrastructure facilitating product approval, and the early adoption of advanced drug delivery technologies. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare access, increasing disposable incomes, and large patient populations in countries like China and India. European nations are emphasizing regulatory harmonization and standardization of ODF formulations, focusing on pediatric applications and abuse deterrence properties for controlled substances. These geographical dynamics underscore a global transition toward more convenient and effective dosage forms, making regional market penetration strategies highly valuable for market participants.

Segment trends reveal that the prescription drugs application segment, particularly for CNS and pain management therapies, holds the largest market share, driven by the need for quick and reliable therapeutic effects. Concurrently, the consumer products segment, encompassing OTC drugs and nutritional supplements, is exhibiting the fastest growth due to strong consumer acceptance and extensive retail distribution networks. In terms of technology, the solvent casting method currently dominates the manufacturing landscape due to its versatility and established track record, though hot-melt extrusion technology is gaining traction for specific formulations requiring high drug loading and improved stability. The evolution of polymer science continues to enable new ODF product categories with superior physical and release characteristics.

AI Impact Analysis on Oral Dissolving Film Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Oral Dissolving Film market frequently revolve around how AI can accelerate formulation discovery, optimize manufacturing processes, and improve personalized medicine through dose tailoring. Key themes include the use of machine learning (ML) for predicting API stability within various polymeric matrices, simulating drug release profiles before extensive laboratory work, and optimizing complex solvent casting or hot-melt extrusion parameters for maximum yield and quality control. Users express concerns about the initial investment required for AI infrastructure and the need for specialized data science expertise within pharmaceutical formulation teams. Expectations are high regarding AI’s potential to dramatically shorten the time-to-market for novel ODF products and enhance product consistency across batches, fundamentally transforming the R&D pipeline for oral film technologies.

- AI-driven optimization of polymer selection and plasticizer ratios to achieve desired dissolution rates and mechanical strength.

- Machine learning algorithms predict API-polymer compatibility, reducing pre-formulation screening time and costs.

- Predictive maintenance analytics applied to continuous manufacturing systems (e.g., hot-melt extrusion lines) to minimize downtime and ensure process robustness.

- AI-enhanced quality control systems utilizing computer vision for real-time defect detection during film cutting and packaging.

- Development of personalized ODF dosing regimens based on patient biometric data and therapeutic needs, managed via smart dispensing systems.

- Accelerated computational modeling of drug permeation through mucosal membranes, improving efficacy predictions for fast-dissolving formulations.

DRO & Impact Forces Of Oral Dissolving Film Market

The Oral Dissolving Film market expansion is powered by strong Drivers, tempered by existing Restraints, yet presenting significant Opportunities, which together shape the Impact Forces defining the industry's future trajectory. A primary driver is the undeniable advantage of ODFs in improving medication compliance, particularly among non-cooperative patient demographics such as children and the elderly, where traditional oral solids pose challenges. This patient-centric benefit, coupled with the growing demand for convenience and portability, provides continuous momentum. However, high manufacturing complexity, particularly achieving uniform film thickness and ensuring API stability across varying storage conditions, acts as a significant restraint, requiring specialized and costly production equipment and highly controlled environments. Additionally, stringent regulatory hurdles associated with novel drug delivery systems can slow down product commercialization.

Opportunities abound in leveraging ODF technology for high-value biological drugs and vaccines, moving beyond small molecules. Furthermore, the vast and rapidly growing global market for nutraceuticals and dietary supplements, seeking enhanced bioavailability through mucosal absorption, presents an immediate commercial expansion avenue. Strategic initiatives focusing on taste-masking technologies, to overcome the often-bitter taste of highly concentrated APIs in thin films, will unlock broader therapeutic applications. The collective impact forces suggest a market poised for accelerated adoption, driven by healthcare system emphasis on compliance and quality of life improvements, mitigating the existing manufacturing bottlenecks through continuous process innovation and robust investment in high-throughput production lines. The synergy between patient needs and technological feasibility fundamentally anchors the market's positive outlook.

The imperative for rapid onset of action, especially in acute care scenarios like migraine attacks or emergency pain relief, further fuels the market’s growth, classifying rapid systemic absorption as a major impact force. Conversely, a technical restraint involves the inherent limitation on the maximum drug dose that can be incorporated into a physically acceptable film size, limiting ODF utility for certain high-dose medications. Navigating the intellectual property landscape—where many foundational film technologies are patented—and securing adequate patent protection for new formulations are crucial determinants of competitive success. The resultant impact is a market that favors firms capable of continuous technological refinement and robust clinical validation, ensuring safety and efficacy in challenging patient groups.

Segmentation Analysis

The Oral Dissolving Film (ODF) Market is comprehensively segmented based on its structural characteristics, therapeutic use, distribution channels, and the underlying technology utilized for manufacturing. Analyzing these segments provides a granular view of market dynamics, revealing high-growth niches and established revenue streams. Segmentation by product type differentiates between prescription drugs and OTC products, highlighting the regulatory and commercial pathways relevant to each category. Application segmentation provides insights into the therapeutic areas driving adoption, such as Central Nervous System (CNS) disorders, pain management, and cardiovascular diseases, where the rapid onset of action offered by ODFs is highly valued. Furthermore, the technology segmentation identifies the dominant and emerging manufacturing methods, such as solvent casting and hot-melt extrusion, which dictate the physical properties and scalability of the final product. Understanding these segment interactions is vital for strategic market positioning and resource allocation.

The market also differentiates based on distribution channels, recognizing the importance of hospital pharmacies, retail pharmacies, and online channels in reaching the target consumer base. The rise of e-commerce platforms has significantly facilitated the distribution of OTC ODF products and nutritional supplements, often bypassing traditional physical pharmacy channels. End-user segmentation typically divides the market between pediatric, geriatric, and adult populations, reflecting the formulation efforts tailored to address specific needs, such as taste-masking for children and ease of administration for the elderly. The geriatric population, in particular, represents a lucrative and expanding end-user segment due to the high incidence of dysphagia associated with aging and chronic medication use. Each segment interacts closely with the others; for instance, a solvent-casted film (technology) used for an anti-migraine drug (application) sold through retail pharmacies (distribution) targets the adult population (end-user), defining a specific market vertical.

Detailed analysis of the segments underscores the market’s maturity in leveraging ODFs for established APIs and the emergent opportunities in novel therapeutic areas. The growing focus on biological agents and complex molecules necessitates advancements in film stability and preservation technologies, impacting the technological segment. Simultaneously, competitive pricing pressures in the high-volume OTC segment demand efficiency in manufacturing, favoring scalable technologies. These segmentation analyses serve as a foundational tool for market participants to identify unmet needs, assess competitive intensity, and formulate effective commercial strategies, ensuring that product development aligns accurately with demonstrated market demand and technological capability.

- Product Type: Prescription Drugs, Over-the-Counter (OTC) Products

- Application: Central Nervous System (CNS) Disorders, Pain Management, Cardiovascular Diseases, Nausea/Vomiting, Dietary Supplements/Vitamins, Others

- Technology: Solvent Casting, Hot-Melt Extrusion, Solid Dispersion

- Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

- End-User: Pediatric, Geriatric, Adult

Value Chain Analysis For Oral Dissolving Film Market

The value chain of the Oral Dissolving Film market begins with upstream activities focused on the procurement and processing of specialized raw materials, primarily pharmaceutical-grade polymers, plasticizers, and Active Pharmaceutical Ingredients (APIs). Upstream suppliers are crucial, as the quality and characteristics (e.g., molecular weight, dissolution rate) of the polymers—such as pullulan, HPMC, and PVA—directly impact the film's mechanical strength, stability, and drug release profile. Collaboration with specialty chemical companies is essential to secure consistent, high-quality material supply and ensure compliance with strict pharmaceutical standards. Innovation at this stage involves developing novel biodegradable or bioadhesive polymers that offer enhanced stability or specific targeting capabilities. Efficient sourcing and quality control of these sensitive ingredients are prerequisite steps for successful product development and mass production.

Mid-stream activities encompass the core manufacturing and formulation processes, including R&D, scale-up, and commercial production using technologies like solvent casting or hot-melt extrusion. This stage involves complex engineering to maintain uniform film thickness, ensure homogenous API distribution, and execute precise cutting and slitting processes. Manufacturers, ranging from specialized contract development and manufacturing organizations (CDMOs) to integrated pharmaceutical companies, invest heavily in highly automated, clean-room environments to meet GMP (Good Manufacturing Practice) standards. The complexity here often translates to high capital expenditure, creating barriers to entry. Successful mid-stream operation relies heavily on intellectual property protection concerning the film formulation (e.g., taste-masking techniques) and process optimization for cost-effective mass production while maintaining stringent quality assurance.

Downstream analysis focuses on distribution and sales channels, which are segmented into direct and indirect routes. Direct distribution involves sales to hospitals and large integrated healthcare systems, often secured through long-term supply agreements. Indirect distribution utilizes pharmaceutical wholesalers, retail pharmacy chains (e.g., CVS, Walgreens), and increasingly, online pharmacies for broader market reach, especially for OTC and nutraceutical products. The selection of the distribution channel is highly dependent on the regulatory classification of the ODF product (prescription vs. non-prescription). Effective logistics, managing temperature-sensitive products, and ensuring product traceability are critical to maintaining product integrity until it reaches the end-user. Robust marketing and professional medical education campaigns are also integral downstream elements, emphasizing the compliance benefits and convenience of the ODF format to prescribers and consumers.

Oral Dissolving Film Market Potential Customers

The primary potential customers and end-users of Oral Dissolving Films are diverse, spanning multiple healthcare segments but concentrating heavily on specific patient demographics facing administration challenges. The geriatric population constitutes a major customer segment globally, driven by the high prevalence of dysphagia—the difficulty or discomfort in swallowing—which affects a significant percentage of individuals over 65, particularly those requiring polypharmacy for chronic conditions like cardiovascular disease, diabetes, or neurological disorders. ODFs provide a non-invasive, convenient alternative to solid dosage forms, significantly enhancing adherence to complex medication schedules. Targeting this segment requires products with minimal residue, neutral or pleasant taste profiles, and clear, easy-to-read packaging instructions, emphasizing ease of use.

Another critical customer group is the pediatric population. Children often refuse to take medication due to taste aversion or difficulty swallowing tablets, leading to dosing inaccuracies and treatment failure. ODFs formulated with strong taste-masking technologies and child-friendly flavors are highly sought after by pediatricians and parents for conditions ranging from pain relief to treatment of infectious diseases or ADHD. Furthermore, patients suffering from conditions such as nausea, vomiting, or acute migraines benefit immensely from ODFs, as oral administration of liquids or solids can be challenging or counterproductive during episodes. The rapid onset of action offered by ODFs, achieved through pre-gastric absorption, provides immediate relief, making this segment a high-value customer base for acute care applications.

Beyond traditional patient care, the market extends to consumers seeking dietary supplements and wellness products. Athletes, busy professionals, and general consumers utilize ODFs for vitamins, energy boosters, and oral hygiene products, valuing the discreetness, portability, and perceived faster absorption rates compared to conventional tablets. Lastly, institutional buyers, including hospitals, long-term care facilities, and military logistics units, represent significant purchasing power. They procure ODFs not only for patient compliance benefits but also for logistical advantages—the thin film format reduces storage space and weight compared to bottles of tablets or liquid formulations, simplifying inventory management and emergency kit packing. Thus, the customer base is segmented by need: compliance (geriatric/pediatric), acute care (migraine/nausea), and convenience (consumer/institutional).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck KGaA, Novartis AG, Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Flimpact GmbH, IntelGenx Technologies Corp., Aquestive Therapeutics Inc., Zydus Cadila, LTS Lohmann Therapie-Systeme AG, MonoSol Rx LLC, Sun Pharmaceutical Industries Ltd., Mylan N.V., BioDelivery Sciences International (BDSI), Indivior PLC, Solvay S.A., Catalent, Inc., Adare Pharma Solutions, CIMA Labs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Dissolving Film Market Key Technology Landscape

The technological landscape of the Oral Dissolving Film market is primarily defined by advanced polymer chemistry and sophisticated manufacturing processes designed to produce ultra-thin, rapidly dissolving matrices loaded with APIs. The two dominant manufacturing techniques are Solvent Casting and Hot-Melt Extrusion (HME). Solvent casting involves dissolving the drug and film-forming polymers in a volatile solvent, casting the mixture onto a carrier substrate, and subsequently drying it to remove the solvent. This method is widely established and offers high flexibility in material selection, formulation fine-tuning, and achieving excellent uniformity, making it the preferred method for many existing commercial ODF products. Continuous research focuses on optimizing drying cycles and minimizing residual solvent levels to meet stringent regulatory safety requirements and enhance film stability during storage.

Hot-Melt Extrusion (HME) represents a more modern, solvent-free approach gaining significant traction due to its scalability and environmental benefits. HME involves blending the drug, polymers, and plasticizers above their glass transition temperature and extruding the molten mixture onto a release liner. This process is particularly advantageous for APIs that are sensitive to moisture or high temperatures, as the process involves minimal water. HME also allows for the creation of solid dispersions, which can enhance the bioavailability of poorly soluble drugs—a critical pharmaceutical challenge. Technological advancements in HME are focused on refining extruder design to handle a wider range of high-viscosity polymers and developing novel cooling systems that ensure the final film maintains mechanical integrity and rapid dissolution characteristics, thereby offering a highly efficient route for high-volume manufacturing.

Beyond these primary methods, other crucial technologies contribute to market growth, including sophisticated taste-masking and drug stabilization techniques. Taste-masking, essential for improving patient compliance, often involves microencapsulation, complexation with cyclodextrins, or incorporating high-intensity sweeteners and flavor modifiers into the polymer matrix. Furthermore, the development of mucoadhesive films represents a key innovation, designed to adhere to the mucosal surface for prolonged drug release and enhanced local effect. Ongoing R&D efforts are intensely focused on integrating Continuous Manufacturing (CM) principles into both solvent casting and HME lines. CM offers significant advantages in terms of quality consistency, reduced batch variability, and cost-efficiency compared to traditional batch processing, promising to revolutionize the economic viability and scale of ODF production globally. These integrated technological advancements are defining the next generation of oral delivery solutions.

Regional Highlights

North America: North America, encompassing the United States and Canada, holds the dominant share in the global Oral Dissolving Film market. This leadership position is underpinned by several factors, including exceptionally high healthcare expenditure per capita, a strong presence of major pharmaceutical and biotechnology companies actively investing in advanced drug delivery systems, and a mature, well-defined regulatory framework (e.g., FDA) that facilitates the approval of innovative drug products. The significant prevalence of chronic diseases, coupled with a high awareness among both consumers and healthcare providers regarding the benefits of convenient dosage forms, drives robust demand. Furthermore, the region is a hub for contract research and manufacturing organizations specializing in ODF technology, contributing to a rich ecosystem for continuous product innovation and commercialization. The high adoption rate of expensive, specialized medicines also contributes significantly to the overall market valuation in this region.

Europe: Europe represents the second-largest market, characterized by stringent quality standards enforced by the European Medicines Agency (EMA) and strong governmental focus on improving drug safety and patient adherence, particularly in geriatric care. Countries such as Germany, the UK, and France are key contributors, driven by established pharmaceutical industries and proactive healthcare policies promoting innovative delivery methods like ODFs. The market here is witnessing increasing utilization of ODFs for pain management and psychiatric disorders, aiming to improve patient outcomes and compliance. A key trend in the European market is the emphasis on developing tamper-resistant and abuse-deterrent ODF formulations for controlled substances, responding to public health concerns and regulatory pressure, thereby ensuring sustainable long-term market growth.

Asia Pacific (APAC): The Asia Pacific region is forecast to exhibit the highest CAGR during the projected period, positioning it as the most dynamic market globally. This exponential growth is primarily fueled by rapid economic development, significant expansion of healthcare infrastructure, and a massive, underserved patient population in countries like China, India, and Japan. Increasing disposable incomes and growing public awareness of advanced medical treatments are driving the shift from conventional tablets to modern dosage forms. Moreover, domestic pharmaceutical companies in APAC are rapidly adopting ODF technology for generic drug development and for entering the lucrative dietary supplement market. Regulatory reforms aimed at streamlining drug approval processes in emerging economies further accelerate market access, making APAC a critical strategic focus area for global ODF manufacturers.

Latin America (LATAM): The LATAM market is experiencing steady growth, albeit slower than APAC, driven by improving access to patented medicines and rising investment in public and private healthcare facilities. Brazil and Mexico are the principal contributors, characterized by large patient pools and increasing efforts to modernize pharmaceutical manufacturing capabilities. Market penetration is often focused on the convenience factor of ODFs for high-volume OTC products and pain relief medications. Challenges remain regarding economic instability and variable regulatory landscapes across different nations, but the fundamental demand for advanced, patient-friendly drug delivery remains a strong driver for sustained, moderate growth in the region.

Middle East and Africa (MEA): The MEA market for Oral Dissolving Films is currently in an early growth stage but holds significant potential, largely concentrated in the GCC countries (Saudi Arabia, UAE) and South Africa, which possess advanced healthcare systems and strong purchasing power. Investment in pharmaceutical manufacturing infrastructure is increasing, often driven by government initiatives aiming for pharmaceutical self-sufficiency. The adoption of ODFs is influenced by the demand for premium, convenient dosage forms, particularly within the affluent consumer segment and for specialized hospital care. While market size remains relatively smaller compared to North America or Europe, rapid urbanization, growing health consciousness, and strategic partnerships with global manufacturers are expected to stimulate considerable future market development, particularly in OTC supplements and certain specialty medications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Dissolving Film Market.- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Merck KGaA

- Novartis AG

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- Flimpact GmbH

- IntelGenx Technologies Corp.

- Aquestive Therapeutics Inc.

- Zydus Cadila

- LTS Lohmann Therapie-Systeme AG

- MonoSol Rx LLC

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V. (now Viatris)

- BioDelivery Sciences International (BDSI)

- Indivior PLC

- Solvay S.A.

- Catalent, Inc.

- Adare Pharma Solutions

- CIMA Labs

Frequently Asked Questions

Analyze common user questions about the Oral Dissolving Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Oral Dissolving Film (ODF) Market?

The primary growth applications for ODFs are Central Nervous System (CNS) disorders, pain management, and acute conditions like nausea/vomiting, where rapid drug absorption and enhanced patient compliance, particularly among pediatric and geriatric populations, are crucial therapeutic benefits.

What technological factors limit the potential drug dosage in Oral Dissolving Films?

Drug loading in ODFs is constrained by the physical capacity of the ultra-thin polymer film; high doses often require a film size that is too large or thick to dissolve rapidly or be comfortably retained in the mouth, necessitating complex formulation strategies.

Which geographical region exhibits the fastest growth potential for ODF adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by improving healthcare access, large patient populations, rising disposable incomes, and increasing investments in localized pharmaceutical manufacturing capabilities across countries like China and India.

How does the solvent casting method compare to hot-melt extrusion in ODF manufacturing?

Solvent casting is the established method offering flexibility in formulation but involves solvent removal, while hot-melt extrusion (HME) is a solvent-free process that is highly scalable and environmentally cleaner, offering advantages for APIs sensitive to moisture and enhancing bioavailability of poorly soluble drugs.

What role do nutraceuticals and dietary supplements play in the Oral Dissolving Film market?

Nutraceuticals constitute a high-growth segment, leveraging ODF technology for vitamins, supplements, and wellness products due to perceived superior absorption rates, consumer convenience, and portability, significantly contributing to the overall OTC market revenue.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager