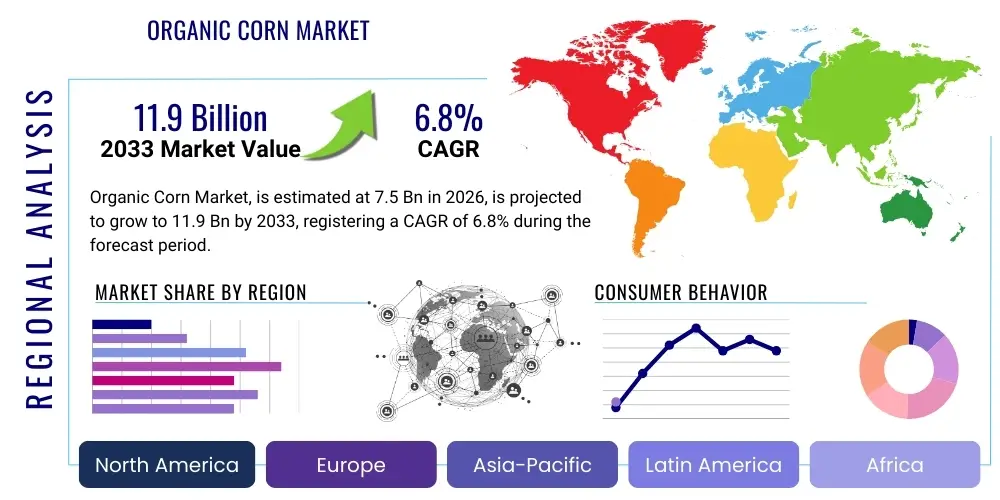

Organic Corn Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443585 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Organic Corn Market Size

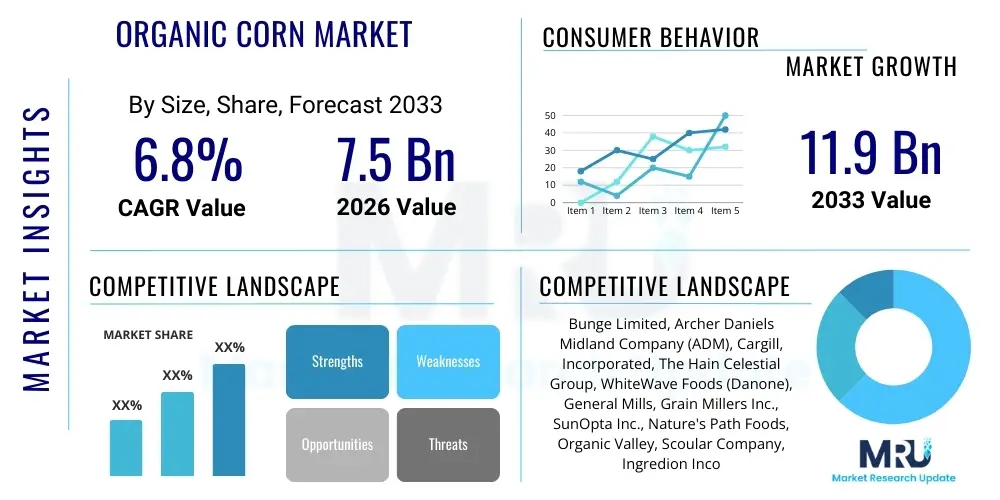

The Organic Corn Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.9 Billion by the end of the forecast period in 2033.

The consistent expansion of the organic food and beverage industry, coupled with heightened consumer awareness regarding health and environmental sustainability, serves as the primary catalyst for this robust growth trajectory. Demand is particularly strong in developed economies across North America and Europe, where regulatory frameworks support organic farming practices and consumers possess higher disposable incomes allocated toward premium, certified organic agricultural products. Furthermore, the necessity for non-GMO and residue-free animal feed contributes significantly to the demand side of the organic corn supply chain.

Market expansion is structurally supported by advancements in organic farming techniques that aim to increase yield without compromising certification standards. Investments in seed technology, soil management systems, and pest control methods compliant with organic regulations are becoming commonplace. Despite challenges related to higher production costs and land conversion times, the increasing penetration of organic ingredients into mainstream food processing and retail channels ensures a stable and escalating revenue flow for stakeholders throughout the forecast period, cementing the organic corn market’s position as a high-growth agricultural sector.

Organic Corn Market introduction

The Organic Corn Market encompasses the cultivation, processing, and trade of corn (Zea mays) produced strictly according to certified organic standards, prohibiting the use of synthetic fertilizers, pesticides, herbicides, and genetically modified organisms (GMOs). Organic corn serves as a foundational agricultural commodity critical for diverse applications, ranging from staple human foods and specialized animal feed to various industrial uses, including the production of organic sweeteners and bio-based materials. The core benefits driving its adoption include enhanced food safety due to the absence of chemical residues, improved ecological health through sustainable farming practices like crop rotation and natural pest control, and perceived nutritional advantages, catering directly to the global movement toward clean label ingredients and sustainable consumption patterns.

Major applications of organic corn span across three primary sectors. In the Food & Beverage industry, it is utilized for manufacturing organic corn flour, cornmeal, breakfast cereals, snack foods, and high-fructose corn syrup alternatives such as organic glucose. Crucially, its role in the Animal Feed segment is substantial, providing non-GMO and organically certified sustenance for livestock, particularly poultry and dairy cattle, required for organic meat and dairy production. Industrial applications, although smaller, include the use of organic corn starch for biodegradable plastics and textiles, aligning the commodity with broader sustainability initiatives across manufacturing sectors.

The growth dynamics of the organic corn sector are intrinsically linked to robust driving factors. These include mandatory organic certification requirements for feed components in organic livestock production, escalating consumer demand fueled by perceived health risks associated with pesticide exposure in conventional agriculture, and proactive governmental support, including subsidies and certification assistance, provided in key producing regions. The stability of premium pricing compared to conventional corn incentivizes farmers to undertake the rigorous transition process, further underpinning market expansion and attracting significant investment into organic agricultural infrastructure and supply chain development.

Organic Corn Market Executive Summary

The Organic Corn Market is characterized by favorable business trends driven by continuous consolidation across the supply chain and vertical integration efforts by major food processors and feed manufacturers aimed at securing stable, certified organic supply volumes. A pivotal trend involves technological adoption focusing on precision organic farming, utilizing advanced analytics and specialized machinery to manage weeds and pests organically, thereby addressing historical yield gaps compared to conventional farming. Furthermore, the shift towards regenerative organic certification, which emphasizes soil health and biodiversity beyond basic organic requirements, is emerging as a critical differentiator for premium product lines, influencing investment decisions and market positioning among leading stakeholders.

Regionally, North America maintains its dominance due to a highly developed organic consumer base, stringent certification bodies, and substantial government programs supporting organic acreage expansion, notably in the United States and Canada. Europe, particularly Germany, France, and the UK, represents another high-value market, driven by powerful consumer demands for locally sourced, sustainably produced food and robust EU regulations governing organic imports. Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily led by increasing affluence in China and India, translating into greater demand for organic baby food and animal protein derived from organic feed, necessitating increased domestic production and substantial import volumes.

Segment trends highlight the critical importance of the Animal Feed application segment, which typically consumes the largest volume of organic corn, providing a foundational demand base for commodity corn varieties. Within the Type segment, organic field corn, essential for feed and processing, dominates volume share, while specialty corns like organic sweet corn and organic popcorn command higher per-unit prices and drive value growth in the direct-to-consumer food sector. Distribution strategies are evolving, with traditional direct sales between farms and processors being supplemented by sophisticated e-commerce platforms and enhanced transparency systems leveraging blockchain technology to verify organic provenance from seed to shelf, optimizing supply chain efficiency and consumer trust.

AI Impact Analysis on Organic Corn Market

Common user questions regarding AI’s influence on the Organic Corn Market often center on its potential to reconcile the inherent challenges of organic farming—specifically, lower yields and higher labor costs—with the growing market demand for organic products. Users inquire about how AI can enhance non-chemical weed detection and removal, optimize nutrient management using organic inputs (manure, compost), and provide predictive analytics for pest and disease outbreaks without relying on synthetic interventions. The consensus expectation is that AI systems, utilizing machine learning and deep learning algorithms on image recognition and sensor data, will significantly boost operational efficiency and resource utilization, ensuring scalable, verifiable organic production while maintaining strict regulatory compliance and traceability across the complex supply chain.

The integration of Artificial Intelligence is poised to revolutionize several critical operational aspects within the organic corn value chain. In the upstream segment, AI-powered tools provide farmers with highly precise recommendations for planting density, optimal organic fertilization timings, and customized irrigation schedules based on real-time soil and microclimate data, maximizing yield potential under organic constraints. Midstream, AI significantly enhances quality control and sorting processes for harvested organic corn, rapidly identifying defects or contamination without human intervention. Furthermore, AI models are proving invaluable in predicting market price volatility and optimizing inventory management, thereby reducing post-harvest losses and ensuring timely delivery of certified organic commodities to processors and feed mills.

Crucially, AI applications also address critical regulatory and consumer trust requirements inherent in the organic sector. AI-driven tracking systems leverage satellite imagery and drone surveillance to automatically verify adherence to organic buffer zones and crop rotation requirements, providing irrefutable digital evidence for certification bodies. This enhanced transparency, utilizing tools like blockchain fed by AI-validated data, minimizes the risk of fraud and assures consumers and institutional buyers of the product's genuine organic provenance, thus solidifying the market's credibility and sustaining the premium price structure.

- AI-driven precision organic weeding using robotics and computer vision to replace chemical herbicides.

- Predictive modeling of soil health and organic nutrient cycles to optimize compost and manure application rates.

- Enhanced traceability and fraud detection in the organic supply chain through AI-validated digital records.

- Optimization of irrigation and water usage based on hyper-local weather and crop stress detection.

- Automated disease and pest management alerts specific to organic farming protocols.

- Yield forecasting and harvest timing optimization tailored for organic varieties.

- Machine learning algorithms for optimizing grain storage conditions and reducing spoilage.

DRO & Impact Forces Of Organic Corn Market

The Organic Corn Market is shaped by a confluence of accelerating drivers, structural restraints, and emergent opportunities, collectively defining its impact forces. Primary drivers include the escalating consumer preference for clean-label, non-GMO, and pesticide-free food, coupled with robust regulatory mandates in developed regions requiring organic inputs for certified organic livestock production. These foundational demands provide consistent market stability and justify the premium pricing associated with organic corn. Restraints predominantly involve the agricultural challenges inherent to organic production, notably the lower yield per acre compared to conventional methods, the high cost and labor intensity of manual or mechanical weed management, and the lengthy three-year land conversion period required for organic certification, which acts as a barrier to rapid entry for conventional farmers.

Opportunities for market growth are centered around innovation and market penetration. Significant opportunities exist in the expansion of organic poultry and dairy farming globally, creating sustained, high-volume demand for organic feed. Furthermore, the development and commercialization of new organic corn hybrids specifically bred for improved stress tolerance, pest resistance, and higher yields under organic growing conditions represent a crucial area for investment. The rising interest in regenerative agriculture, which builds upon organic standards by focusing intensely on carbon sequestration and soil biodiversity, presents an opportunity for stakeholders to command an even greater premium and appeal to environmentally conscious institutional buyers and ethical investors.

The key impact forces influencing the market trajectory are environmental sustainability pressures and shifting trade policies. Environmental consciousness drives demand, but simultaneously, the market is constrained by climate change effects such as extreme weather events that disproportionately impact organic yields due to the lack of chemical buffers. Trade agreements and varying international organic certification standards create complexity; harmonization efforts present an opportunity to streamline global supply chains, while protectionist policies in major consuming nations act as a restraint by increasing logistical barriers and certification compliance costs for global suppliers. The collective impact forces necessitate continuous technological adaptation, supply chain transparency, and strategic governmental partnerships to ensure stable growth.

Segmentation Analysis

The Organic Corn Market is meticulously segmented across Type, Application, and Distribution Channel, reflecting the diverse uses and specialized requirements of organic corn within the global agricultural economy. This detailed segmentation allows stakeholders to accurately gauge market penetration, identify high-growth niches, and tailor their product offerings and strategic investments. The Type segment differentiates products based on their genetic and end-use characteristics, ensuring specific requirements—such as high starch content for feed versus high sugar content for direct consumption—are met. The Application segmentation clearly defines the ultimate consumption category, highlighting the dominant role of the animal feed sector and the value addition provided by the food and beverage industry. Finally, the Distribution Channel segment maps the flow of commodities, from direct sales to sophisticated indirect retail networks.

Understanding these segmentations is critical for market players engaging in strategic planning. For instance, companies focusing on the Animal Feed segment prioritize efficiency and volume, requiring stable, high-tonnage supply contracts, whereas those targeting the Food & Beverage segment must focus on purity, specialized processing, and consumer-facing branding. Geographic segmentation is equally vital, determining regulatory compliance needs, logistical solutions, and price points, as the market premium for organic corn often varies significantly between well-established organic markets like North America and emerging markets in Asia, necessitating localized procurement and distribution strategies.

- Type:

- Organic Field Corn (Dent Corn)

- Organic Sweet Corn

- Organic Popcorn

- Other Specialty Corn (e.g., Organic Blue Corn, Flint Corn)

- Application:

- Animal Feed (Poultry, Dairy, Swine, Others)

- Food & Beverage Processing (Flour, Starch, Sweeteners, Snacks)

- Industrial Uses (Bio-plastics, Textiles, Chemicals)

- Distribution Channel:

- Direct Sales (Farm-to-Processor/Mill)

- Indirect Sales (Retail, Supermarkets, E-commerce, Distributors)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Organic Corn Market

The value chain of the Organic Corn Market is characterized by greater complexity and stricter control measures compared to conventional corn, driven by certification requirements that mandate traceability from seed to end-product. The upstream segment involves critical processes such as organic seed breeding and procurement, land preparation, and farm-level certification. Organic seed production requires specialized non-GMO verification and often includes partnerships with research institutions to develop varieties adapted for organic growing systems. Upstream efficiency is crucial, as the high input costs of organic agriculture, including certified composts and labor-intensive mechanical cultivation, determine the profitability margins for farmers before harvest.

The midstream segment focuses on post-harvest handling, storage, and initial processing. A key challenge here is preventing commingling and contamination with conventional corn, necessitating dedicated organic-only storage facilities and processing lines. Major players, including large commodity handlers and specialized organic mills, manage logistics and conduct primary processing (e.g., drying, grinding, milling) before the organic corn is channeled to end-use manufacturers. Distribution channels are bifurcated into direct sales, involving long-term contracts between large organic farms and major processors (such as feed manufacturers or industrial ingredient suppliers), and indirect sales, which utilize brokers, distributors, and retail chains to reach consumer-facing product manufacturers and specialized organic retail markets.

The downstream segment involves the ultimate utilization of organic corn by large Food & Beverage corporations, organic animal feed manufacturers, and niche industrial users. The profitability downstream is highly dependent on effective branding and certification marketing, with consumers willing to pay a substantial premium for traceable, organic finished products. Vertical integration strategies, where processors acquire or contract substantial organic acreage, are commonly employed to mitigate supply volatility and ensure the integrity of the distribution channel, directly controlling the flow from source to final consumer and bypassing multiple intermediary layers, thereby enhancing overall supply chain transparency and reducing transaction costs.

Organic Corn Market Potential Customers

The primary potential customers for the Organic Corn Market are heavily concentrated in institutional sectors that are mandated or strategically choose to utilize certified organic inputs. The largest customer base resides within the organic animal feed manufacturing industry, specifically those serving the growing organic poultry, dairy, and beef sectors globally. These manufacturers require high-volume, consistent supply of organic feed corn to maintain their clients’ organic certification status, making them the foundational purchasers of organic field corn commodities. The second significant institutional customer group is the major food and beverage corporations that require organic ingredients for their branded organic product lines, including breakfast cereals, organic snack foods, and specialized infant formula, where ingredient purity is paramount.

Beyond institutional purchasers, the market targets specialized industrial users and direct consumer channels. Industrial customers include manufacturers requiring non-GMO and organic starches or bio-polymers for niche applications, driven by corporate sustainability commitments to reduce reliance on conventional petroleum-based inputs. On the retail side, although smaller in volume, independent organic grocery stores, specialized health food chains, and e-commerce platforms serve as crucial distribution points for processed organic corn products such as organic cornmeal, organic tortillas, and frozen organic sweet corn, catering directly to the health-conscious consumer.

Furthermore, emerging markets represent crucial future potential customers, particularly in Asia Pacific, where rising middle-class disposable incomes are correlating with increased demand for organic and non-GMO food options. Government agencies and public sector procurement programs, particularly those focused on healthy school lunch initiatives or supporting local organic farms, also constitute a stable, albeit often geographically localized, customer segment. These diverse customer profiles underscore the market’s reliance on both large-scale industrial contracts and high-margin specialized product sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bunge Limited, Archer Daniels Midland Company (ADM), Cargill, Incorporated, The Hain Celestial Group, WhiteWave Foods (Danone), General Mills, Grain Millers Inc., SunOpta Inc., Nature's Path Foods, Organic Valley, Scoular Company, Ingredion Incorporated, Tate & Lyle PLC, Bay State Milling Company, ConAgra Brands, Perdue Farms, Kashi Company, J.R. Simplot Company, Kellogg Company, Seminis Vegetable Seeds |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Corn Market Key Technology Landscape

The technological landscape for the Organic Corn Market is distinctively focused on developing sustainable, non-chemical solutions to challenges typically addressed by synthetic inputs in conventional agriculture. Central to this landscape are advancements in organic seed technology, including classical breeding programs designed to enhance hybrid vigor, disease resistance, and yield stability specifically under organic farming conditions, without resorting to genetic modification (GMOs). Furthermore, soil health monitoring technologies, utilizing sophisticated sensors and satellite imaging, allow farmers to precisely track organic matter content, microbial activity, and nutrient availability in real-time, optimizing the effectiveness of natural inputs like cover crops and compost teas, which are essential for maintaining organic certification and maximizing yields sustainably.

A critical area of technological innovation lies in precision mechanical and robotic weeding systems. Since synthetic herbicides are prohibited, technology providers are developing advanced vision-guided implements, sometimes integrated with Artificial Intelligence, that can differentiate between corn plants and weeds with high accuracy and physically remove weeds using targeted mechanical tools. These solutions dramatically reduce the labor requirements and associated costs of organic farming, making large-scale organic corn production more economically viable and competitive. The adoption of these systems is crucial for overcoming the key constraint of weed management in certified organic fields.

Moreover, the organic supply chain relies heavily on technology for transparency and verification. Blockchain technology is increasingly being deployed to create immutable digital records tracing organic corn from the planting stage through harvesting, processing, and distribution. This technological layer ensures strict adherence to organic standards, provides instant auditability for certification bodies, and builds consumer trust by offering verifiable proof of non-GMO status and chemical-free cultivation. Integration of IoT sensors in storage and logistics also ensures optimal environmental conditions are maintained, reducing the risk of spoilage and maintaining the quality premium of the certified organic commodity.

Regional Highlights

Regional dynamics play a significant role in shaping the Organic Corn Market, reflecting variations in consumer demand, government support, and agricultural infrastructure. Market maturity and regulatory frameworks are key differentiators between regions.

- North America: Dominates the global market, driven by high consumer spending on organic products and extensive organic acreage, particularly in the US Midwest. The region benefits from established certification infrastructure and large-scale organic processors, with substantial demand emanating from the rapidly expanding organic dairy and poultry sectors. Policy support through farm bill initiatives further incentivizes organic conversion.

- Europe: Represents a mature and highly regulated market, with strong consumer preference for organic and locally sourced products. EU policies strictly govern organic farming and import standards, creating a high-value market. Demand is robust across Germany, France, and the UK, although production often lags consumption, making Europe a major net importer of organic corn, particularly for use in animal feed.

- Asia Pacific (APAC): Exhibits the fastest growth potential globally, fueled by rising disposable incomes and increasing awareness of food safety and quality, especially in China and India. While the organic sector is still developing, governmental initiatives to promote sustainable agriculture are supporting increased domestic production, and international trade agreements are facilitating greater influx of organic feed ingredients to support growing organic livestock operations.

- Latin America (LATAM): Key growth region, serving both local consumption and acting as a major global exporter, particularly utilizing vast agricultural land in countries like Argentina and Brazil. Organic corn production here often focuses on meeting international export standards for North American and European markets, capitalizing on favorable climates for high-yield, certified organic harvests.

- Middle East & Africa (MEA): Currently holds the smallest market share but is witnessing gradual growth driven by urbanization and rising health consciousness in affluent Gulf nations. Challenges include water scarcity and less developed organic certification infrastructure, necessitating a strong reliance on imports of processed organic corn products and feed inputs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Corn Market.- Bunge Limited

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- The Hain Celestial Group

- WhiteWave Foods (Danone)

- General Mills

- Grain Millers Inc.

- SunOpta Inc.

- Nature's Path Foods

- Organic Valley

- Scoular Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Bay State Milling Company

- ConAgra Brands

- Perdue Farms

- Kashi Company

- J.R. Simplot Company

- Kellogg Company

- Seminis Vegetable Seeds

Frequently Asked Questions

Analyze common user questions about the Organic Corn market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Organic Corn Market?

The primary driver is the accelerating consumer demand for non-GMO, pesticide-free food ingredients and the corresponding regulatory necessity for certified organic inputs in the expanding global organic animal feed sector, particularly for poultry and dairy production.

How do yields of organic corn compare to conventional corn?

Organic corn yields are typically 10% to 30% lower than conventional corn yields due to the restrictions on synthetic fertilizers and pesticides. However, advancements in organic breeding and precision farming techniques are continually working to minimize this yield gap sustainably.

Which application segment holds the largest share of the Organic Corn Market?

The Animal Feed segment holds the largest volume share of the Organic Corn Market. Organic corn is a staple commodity required by producers to meet the feed requirements for organically certified livestock and poultry globally.

What are the key technological solutions addressing organic corn farming challenges?

Key technological solutions include AI-driven precision mechanical weeding robotics, advanced soil health monitoring systems, and blockchain technology for supply chain traceability and robust organic verification, aimed at reducing costs and ensuring compliance.

Which geographical region is projected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is projected to experience the fastest growth, fueled by rapid economic development, increasing urbanization, rising disposable incomes, and a corresponding shift in consumer preference toward premium organic food and high-quality feed ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager