Organic Infant Formula Milk Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441013 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Organic Infant Formula Milk Powder Market Size

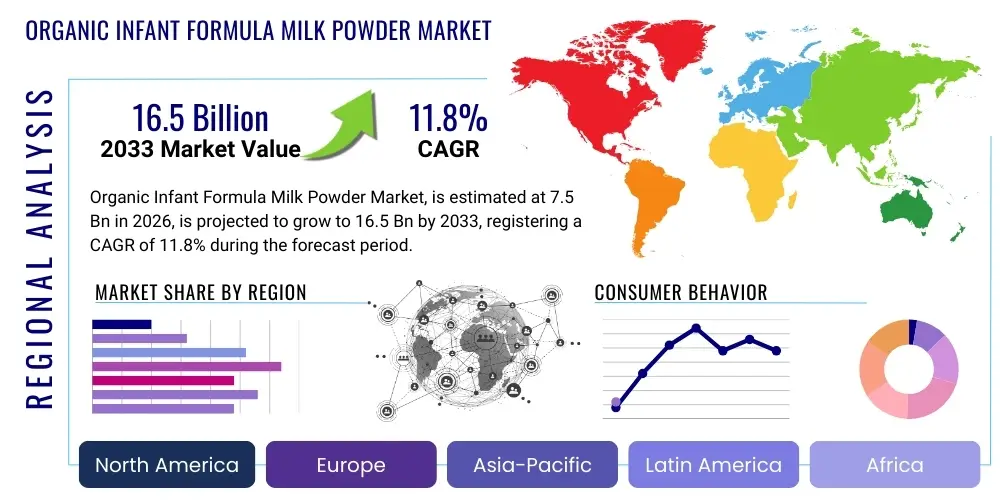

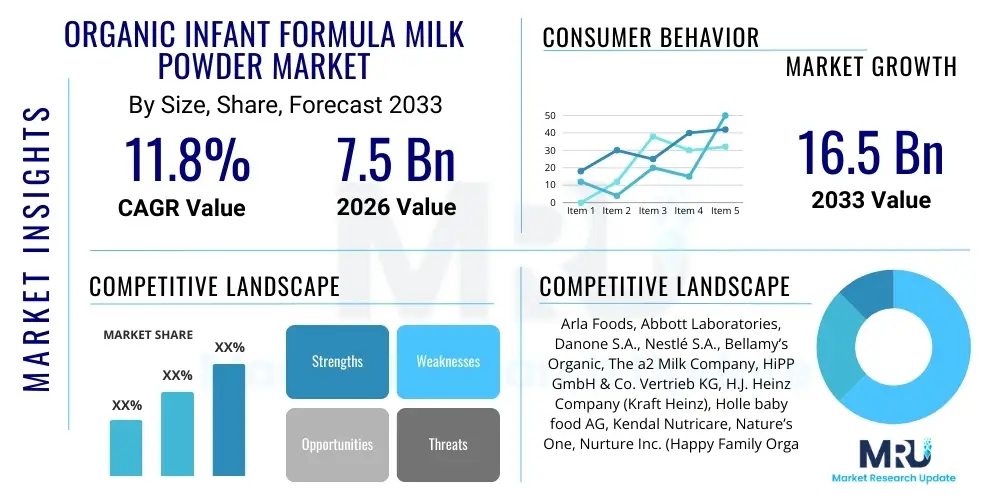

The Organic Infant Formula Milk Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $16.5 Billion by the end of the forecast period in 2033.

Organic Infant Formula Milk Powder Market introduction

The Organic Infant Formula Milk Powder Market encompasses specialized nutritional products designed for infants up to 36 months, manufactured using ingredients sourced from certified organic farms that strictly adhere to agricultural standards, ensuring the complete absence of synthetic pesticides, herbicides, growth hormones, and genetically modified organisms (GMOs). This segment is primarily driven by rapidly increasing parental awareness regarding the long-term health benefits associated with clean-label nutrition and the growing global concern over chemical residues potentially present in conventional food processing. The core product description emphasizes the utilization of organic dairy sources, often grass-fed, and the meticulous formulation to meet or exceed international nutritional standards while excluding artificial preservatives, flavors, and colors, providing a safer, premium alternative to conventional formula options.

Major applications for organic infant formula include serving as a complete nutritional source for infants whose mothers cannot or choose not to breastfeed, and as a reliable supplementary feeding solution during weaning or mixed feeding schedules. Key benefits that drive consumer preference include a reduced exposure risk to potentially harmful chemical residues, improved digestive tolerance often attributed to carefully selected organic prebiotics and specific protein structures (like A2 organic milk), and the perceived superior quality assurance derived from rigorous organic certification processes. This assurance builds critical consumer trust, especially in markets where confidence in domestic conventional food safety has been historically challenged, driving robust demand for international organic standards.

Driving factors propelling this market expansion include significant demographic shifts, particularly the rising global population of affluent, urban parents who possess high disposable income and prioritize ethical and health-focused consumer goods. Further momentum is provided by aggressive marketing campaigns that strategically emphasize the purity, traceability, and sustainability aspects of organic inputs, coupled with continually stricter governmental regulations regarding organic farming and certification globally. The ongoing scientific documentation supporting the critical role of the early life microbiome further reinforces market demand for organic formulas enriched with natural prebiotics and probiotics, expanding both the market size and product sophistication across established and emerging international markets.

Organic Infant Formula Milk Powder Market Executive Summary

The global Organic Infant Formula Milk Powder market is defined by aggressive business trends focused on vertical integration and technological innovation aimed at securing ingredient provenance and superior formulation complexity. Leading global players are heavily investing in establishing dedicated organic supply chains, often contracting directly with certified organic dairy farms to ensure stringent quality control from the source to the final package, mitigating risks associated with contamination or fraudulent labeling. A notable business trend involves the rapid commercialization of highly specialized organic ingredients, such as Organic Human Milk Oligosaccharides (HMOs) and advanced organic protein blends, positioning these products at the high-premium end of the market and creating substantial differentiation from standard organic offerings. Strategic mergers, acquisitions, and partnerships are commonplace, enabling larger entities to quickly gain access to niche organic brands that command strong local loyalty and specialized sourcing networks, consolidating market control.

From a regional perspective, the market shows distinct maturity in Europe and North America, regions characterized by deep consumer acceptance, well-established retail infrastructures, and highly sophisticated regulatory frameworks that support organic certification. While these regions offer stable growth, the highest growth rates are unequivocally situated in the Asia Pacific (APAC) region. The immense consumer base in China, coupled with surging disposable incomes in Southeast Asian economies, fuels explosive demand, often favoring imported organic formulas due to perceived quality superiority. This regional dynamism necessitates complex cross-border logistics and localized certification expertise for manufacturers aiming to capitalize on the region’s high growth potential, driving significant international trade flows.

Segmentation trends reveal a sustained market reliance on Stage 1 (Starter) formulas for newborns, representing the highest value segment due to the critical nature of early-stage nutrition. However, the most rapid growth is observed in the specialized organic formula categories, including formulations tailored for sensitive digestion, lactose intolerance, or specific allergies, leveraging cutting-edge organic protein processing technologies. Geographically, the distribution segment is evolving, showing a marked increase in the influence of online retail channels, which bypass traditional supply hurdles and efficiently deliver premium, often imported, organic brands directly to digitally-savvy parents. Overall, the market remains highly competitive, demanding continuous investment in product safety, clinical validation, and transparent sourcing narratives to sustain premium pricing and brand loyalty.

AI Impact Analysis on Organic Infant Formula Milk Powder Market

Common user and industry inquiries regarding the influence of Artificial Intelligence (AI) on the Organic Infant Formula Milk Powder market predominantly revolve around ensuring authenticity, optimizing highly sensitive supply chain operations, and facilitating personalized nutritional guidance. Users frequently pose questions concerning AI's capability to provide immutable traceability verification across international borders, ensuring that the 'organic' claim withstands intense scrutiny and combats counterfeiting, a persistent concern in premium imported markets. There is significant consumer expectation for AI tools to analyze complex infant biometric and health data (e.g., gut health indicators, growth charts) to offer precise, evidence-based recommendations for the most suitable organic formula variant, moving beyond generic categorization. Furthermore, industry stakeholders are keenly interested in how AI can be deployed in manufacturing for predictive maintenance, hyper-accurate quality assurance checks, and real-time detection of minute contaminants to uphold the impeccable safety record required for premium organic infant nutrition.

- AI-driven blockchain solutions significantly enhance the traceability and transparency of organic ingredient sourcing, validating organic certification in real-time.

- Machine learning algorithms optimize demand forecasting and inventory management for short-shelf-life ingredients, minimizing operational waste and spoilage in the organic supply chain.

- Predictive analytics monitors manufacturing equipment parameters to prevent downtime and identify potential microbial contamination risks before they compromise product safety.

- AI-powered image recognition and spectroscopic analysis are used during quality control to detect foreign materials or inconsistencies in the milk powder composition at high speeds.

- Automated customer service bots leverage natural language processing (NLP) to address specific parental inquiries about organic formula ingredients and usage, enhancing consumer education and support.

DRO & Impact Forces Of Organic Infant Formula Milk Powder Market

The primary drivers of the Organic Infant Formula Milk Powder market are deeply rooted in pervasive consumer shifts towards wellness and the increasing distrust of chemically processed foods. A foundational driver is the rising global awareness of the long-term health risks associated with pesticide exposure in early life, compelling discerning parents to prioritize certified organic products as a precautionary health measure. Concurrently, the proliferation and standardization of global organic certifications (such as USDA Organic and stringent EU organic standards) provide crucial verification and build consumer trust in the premium claims of these products. Socioeconomic factors, including rapidly rising disposable incomes among the global urban middle class, enable wider access to premium-priced organic formulas, transitioning them from niche products to mainstream staple options in developed economies.

However, significant restraints temper the market’s explosive potential, primarily revolving around the economics of organic production. The substantially higher operational costs associated with maintaining organic farms—including specialized feed, lower crop yields, and meticulous regulatory compliance—result in retail prices that are often 30% to 50% higher than conventional formula, creating a substantial barrier to entry for lower and middle-income demographics globally. A persistent supply-side restraint is the inherent volatility and limited capacity of the certified organic dairy supply chain, particularly for meeting highly specific global quality standards necessary for infant nutrition. Additionally, aggressive public health campaigns mandated by international organizations, consistently promoting breastfeeding as the superior infant feeding method, impose a fundamental regulatory ceiling on overall market growth for all formula types.

Opportunities for profound growth lie primarily in technological innovation and geographic diversification. The market benefits significantly from the opportunity to develop highly specialized organic formulas, such as those targeting common infant digestive issues or incorporating complex, bio-active organic compounds like Human Milk Oligosaccharides (HMOs) or organic synbiotics, thereby capturing niche medical segments. Geographically, aggressive expansion into high-potential, underserved markets within the Asia Pacific (APAC) region, Eastern Europe, and select Latin American countries represents critical revenue opportunities, provided manufacturers successfully navigate complex import tariffs and localized certification requirements. The overall impact forces acting on this market are substantial, with regulatory stringency and consumer perception of product safety exerting the highest gravitational pull, making quality assurance and transparent communication non-negotiable competitive factors.

Segmentation Analysis

The Organic Infant Formula Milk Powder Market is systematically segmented across various parameters to accurately reflect the complex tapestry of consumer demand and manufacturer offerings. Segmentation by product stage acknowledges the developmental nutritional needs of infants, dictating differential fortification requirements for newborns versus older toddlers. Source type segmentation highlights consumer preference for specific organic dairy bases (cow, goat) or the rapidly expanding market for organic plant-based alternatives, addressing allergies or lifestyle choices. Analyzing distribution channels is vital for understanding market penetration, balancing the high volume sales achievable through traditional mass retail with the consultative expertise provided by pharmacies, and the efficiency and reach offered by rapidly maturing online retail platforms which often cater to specialized imported organic brands.

- By Product Stage:

- Starter Formula (0–6 months) – Focus on high nutritional complexity and digestibility for newborns.

- Follow-on Formula (6–12 months) – Increased caloric and iron content supporting active growth phases.

- Toddler Formula (12–36 months) – Used as a nutritional supplement alongside solid food introduction.

- By Source Type:

- Organic Cow Milk Based – The dominant segment, utilizing organic certified cow’s milk.

- Organic Goat Milk Based – Gaining traction due to perceived easier digestibility and specific protein structures.

- Organic Plant-Based (e.g., Soy, Rice, Avena) – Niche market addressing allergies or vegan/vegetarian consumer preferences.

- By Distribution Channel:

- Supermarkets/Hypermarkets – High-volume sales, accessibility, and visibility.

- Pharmacies/Drug Stores – Channels where professional consultation and trust are paramount.

- Online Retail Channels – High growth segment facilitating access to specialized and international brands.

- Specialty Stores – Focused on natural and organic products, often serving specific demographic clusters.

- By Form:

- Powder – Dominant segment due to extended shelf stability, cost-effectiveness, and ease of transport.

- Ready-to-Feed (RTF) Liquid – Premium convenience segment, growing primarily in high-income, time-sensitive markets.

Value Chain Analysis For Organic Infant Formula Milk Powder Market

The value chain for Organic Infant Formula Milk Powder initiates with extremely rigorous upstream activities centered on certified organic farming and raw material sourcing, which establishes the foundation for the product's premium cost structure. Upstream procurement requires dedicated contracts with certified organic dairy farms that must adhere to strict regulatory compliance regarding feed purity, non-GMO status, and environmental stewardship, often extending beyond baseline conventional requirements. Milk collection, segregation, and initial processing—including specialized pasteurization—must be meticulously managed in dedicated facilities to ensure there is absolutely no cross-contamination from non-organic inputs. This initial phase involves intense quality checks and mandatory documentation to maintain traceability and organic integrity, which adds significant complexity and expense compared to conventional formula production.

Midstream activities encompass sophisticated manufacturing, formulation, and blending processes. Formula manufacturers must execute precision blending of the organic dairy base with essential micronutrients, vitamins, and complex organic functional ingredients, such as organic oils, prebiotics, and minerals, often utilizing advanced spray drying technology to achieve a stable, homogenous powder. Packaging is a high-cost component, demanding specialized, high-barrier materials to protect the sensitive organic ingredients from oxidation and moisture without relying on artificial preservatives. Downstream strategy is focused on robust quality assurance and complex regulatory compliance, especially for global brands where product labeling and composition must satisfy dozens of different national standards (e.g., EU, FDA, CFDA) concurrently, necessitating highly adaptable production batches and extensive compliance testing protocols.

The distribution segment of the value chain employs both highly controlled direct channels and broad, high-volume indirect channels. Direct distribution includes manufacturer-operated e-commerce platforms and branded specialty stores, allowing for optimized inventory control, rapid delivery, and direct engagement with the consumer base, particularly for high-end, niche products. Indirect distribution heavily relies on established networks of supermarkets, hypermarkets, and pharmaceutical chains, providing volume and visibility. Given the product's sensitive nature and premium status, maintaining high standards for temperature control (if applicable) and preventing product counterfeiting, particularly through international e-commerce routes, are critical challenges managed through technological solutions like enhanced serialization and blockchain-based authentication mechanisms integrated throughout the distribution lifecycle.

Organic Infant Formula Milk Powder Market Potential Customers

The core customer demographic for Organic Infant Formula Milk Powder consists of educated, affluent, and hyper-health-conscious parents, predominantly within the Millennial and upper-income Gen Z brackets, who reside in metropolitan and surrounding suburban areas across North America, Western Europe, and high-growth Asian cities. These consumers possess a high willingness to pay a substantial premium, viewing organic certification as a non-negotiable indicator of safety, ethical sourcing, and superior quality. They are highly engaged digital researchers, often prioritizing brand transparency, verifiable sourcing stories, and sustainability commitments over price in their purchasing decisions, seeing the formula as a critical early-life preventative health investment rather than a mere necessity.

A secondary, yet rapidly expanding, segment includes parents of infants experiencing mild to moderate digestive issues or allergies who seek organic alternatives perceived to be gentler, such as organic goat milk formulas or formulas containing easily digestible A2 organic proteins. This segment is highly motivated by pediatric or dietary recommendations and relies heavily on specialty retailers and pharmacy channels for validated product endorsements. Furthermore, parents situated in developing economies, particularly China, who have witnessed food safety crises in their domestic markets, form a substantial loyal customer base for high-quality, traceable, and certified organic imported brands, often driving cross-border e-commerce consumption patterns.

The consumer base is also significantly influenced by cultural and regulatory environments. In regions with strict organic standards and robust consumer trust (like Germany or Australia), the customer base is broader. Conversely, in regions with nascent organic awareness, customers are primarily the early adopters who follow global health trends closely. Institutional buyers, including premium daycare centers, pediatric clinics focusing on holistic wellness, and high-end hospitals, represent a growing third segment, purchasing organic formula in bulk to align with the wellness expectations of their clientele and staff, solidifying the market for specialized bulk organic formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $16.5 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arla Foods, Abbott Laboratories, Danone S.A., Nestlé S.A., Bellamy’s Organic, The a2 Milk Company, HiPP GmbH & Co. Vertrieb KG, H.J. Heinz Company (Kraft Heinz), Holle baby food AG, Kendal Nutricare, Nature’s One, Nurture Inc. (Happy Family Organics), Biostime, Little Oak, Verla Organic, Else Nutrition Holdings Inc., Babynat (Vitagermine), Plum Organics (Campbell Soup Company), Healthy Times Inc., Jiahe Dairy (China). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Infant Formula Milk Powder Market Key Technology Landscape

The technological evolution in the Organic Infant Formula Milk Powder market is strategically centered on safeguarding the purity of organic components while maximizing nutritional bioavailability and ensuring absolute manufacturing safety. A cornerstone technology is advanced low-temperature spray drying, which is essential for transforming the liquid organic milk blend into a shelf-stable powder while preserving the delicate structure of heat-sensitive organic vitamins, enzymes, and functional proteins. Furthermore, manufacturers employ sophisticated membrane filtration techniques, such as microfiltration and ultrafiltration, to precisely isolate and purify specific organic protein fractions (elike A2 beta-casein) and remove potential contaminants without relying on aggressive chemical agents, fully aligning with the market's clean-label ethos and regulatory mandates for infant consumption safety.

Innovation is also highly concentrated in the sphere of functional ingredient production and stabilization. This includes the development of proprietary organic fermentation processes necessary for the scalable and cost-effective production of bio-active components like Organic Human Milk Oligosaccharides (HMOs), which are crucial for immune and gut health support, and must be certified organic despite their complex biochemical nature. Encapsulation technology plays a vital role in protecting and delivering highly sensitive ingredients, such as organic sourced essential fatty acids (DHA/ARA) derived from algae, ensuring they remain protected from oxidation, stable throughout the product's extended shelf life, and maintain full bioefficacy upon consumption, supporting neonatal cognitive development.

Beyond formulation, the most transformative technology is the integration of end-to-end digital traceability systems. Leading manufacturers are implementing blockchain technology coupled with advanced sensor data logging across their entire organic supply chain, from the certified farm fields to the final retail shelf. This technology provides an immutable, transparent, and auditable record of every processing step, batch composition, and certification status. This radical transparency is paramount in the organic segment, serving not only to meet increasingly stringent regulatory requirements for infant food safety but also acting as a powerful defense against global counterfeiting rings, thereby reinforcing the brand's premium positioning and sustaining consumer confidence in the authenticity of the organic origin claim. Furthermore, continuous process optimization utilizing digital twins and simulation software is becoming standard practice to enhance yield efficiency and maintain precise nutritional consistency.

Regional Highlights

The global distribution and growth profile of the Organic Infant Formula Milk Powder market reveal marked regional variations dictated by regulatory maturity, economic affluence, and distinctive consumer trust paradigms. Europe remains a foundational pillar of the market, primarily because its strict and globally respected organic standards, exemplified by the EU Organic Regulation, foster high consumer confidence and market stability. Core markets such as Germany and France showcase deeply embedded organic consumption habits, driven by long-standing domestic brands like HiPP and Holle which have successfully positioned themselves as historical symbols of quality and purity, demanding continuous innovation in areas like biodynamic farming and sustainable packaging practices.

North America, particularly the United States, represents a highly dynamic and high-value market, characterized by strong consumer purchasing power and a significant preference for USDA Organic certified products. The North American segment is driven by health trends originating from affluent coastal metropolitan areas, resulting in rapid adoption of specialized organic formulas, including those based on organic A2 milk or goat milk. Although facing regulatory challenges related to importing European standard formulas, the strong growth in local production and the dominant role of highly efficient e-commerce platforms ensure swift market penetration and distribution of niche and premium organic offerings across the continent.

The Asia Pacific (APAC) region stands out as the primary engine for future market expansion, exhibiting the highest Compound Annual Growth Rate globally. This growth is predominantly fueled by the massive market demand originating from China, where rapid urbanization, increasing wealth, and a critical lack of consumer trust in historical domestic conventional food safety protocols drive an overwhelming preference for imported, certified organic formulas from Europe, Australia, and New Zealand. This phenomenon necessitates significant investment in complex cross-border logistics, multilingual labeling compliance, and robust anti-counterfeiting technologies to secure market share among highly discerning urban Chinese consumers.

In contrast, Latin America (LATAM) is categorized as an emerging market where growth is accelerating but remains uneven, highly concentrated in economic centers like Brazil and Mexico. Expansion in LATAM is heavily contingent upon improving economic stability, rising per capita disposable income among the middle class, and successful regulatory efforts to harmonize organic certification standards regionally. Price sensitivity remains a substantial barrier for mass adoption; therefore, market entry strategies often focus on smaller pack sizes and targeted high-end pharmacy distribution to manage affordability and consumer access in key metropolitan areas.

The Middle East and Africa (MEA) region shows measured and targeted growth, primarily restricted to the affluent Gulf Cooperation Council (GCC) countries (such as UAE and Saudi Arabia) where high incomes facilitate the sustained import of premium international organic brands. Consumption is heavily influenced by expatriate populations and high-end retail chains specializing in imported goods. Market penetration is restricted by complex import regulations, lower general organic awareness in non-GCC countries, and logistical challenges, although increasing governmental focus on infant healthcare infrastructure presents long-term potential for specialized organic medical nutrition formulas.

- Europe: Market leader, strong regulatory framework, mature consumer base, focus on sustainability and deep ethical sourcing.

- North America: High-value market, strong demand for certified USDA Organic products, high e-commerce penetration, and growth in organic specialty formulas.

- Asia Pacific (APAC): Fastest-growing region, driven by explosive demand in China and rising wealth in Southeast Asia; critical dependence on trusted international imports.

- Latin America (LATAM): Emerging market, growth concentrated in urban areas; faces challenges related to price sensitivity and regulatory harmonization.

- Middle East and Africa (MEA): Growth driven by high-income GCC states; reliant on specialized imported premium formulas; potential for specialized medical nutrition expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Infant Formula Milk Powder Market.- Arla Foods amba (Arla Baby & Me)

- Abbott Laboratories (Similac Organic)

- Danone S.A. (Nutricia, Aptamil Organic)

- Nestlé S.A. (Gerber Organic)

- Bellamy’s Organic (The Bellamy’s Australia Ltd.)

- The a2 Milk Company Limited

- HiPP GmbH & Co. Vertrieb KG

- H.J. Heinz Company (Kraft Heinz)

- Holle baby food AG

- Kendal Nutricare Ltd.

- Nature’s One, LLC

- Nurture Inc. (Happy Family Organics)

- Biostime (H&H Group)

- Little Oak (Goat Milk Formula)

- Verla Organic

- Else Nutrition Holdings Inc.

- Babynat (Vitagermine)

- Plum Organics (Campbell Soup Company)

- Healthy Times Inc.

- Jiahe Dairy (China)

- Perrigo Company plc (through specific brand acquisitions)

- Good Goat Milk Company

- AptarGroup (Packaging solutions provider impacting the value chain)

- BASF SE (Specialty ingredients for organic formulations)

- Sonneveld Group BV (Dairy ingredients supplier)

Frequently Asked Questions

Analyze common user questions about the Organic Infant Formula Milk Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes certified Organic Infant Formula Milk Powder from conventional alternatives?

Certified Organic Infant Formula Milk Powder is fundamentally distinguished by the stringent sourcing requirements for its primary ingredients, particularly the milk source. Organic standards, such as those mandated by the USDA or EU, strictly prohibit the use of synthetic pesticides, herbicides, chemical fertilizers, growth hormones (rBST/rBGH), and genetically modified organisms (GMOs) in the production of milk and other agricultural inputs used in the formula. This commitment results in a product profile designed to minimize infant exposure to chemical residues, which is a major concern for modern parents seeking cleaner nutrition. Furthermore, organic certification often mandates higher animal welfare standards for the organic dairy sources, requiring specific outdoor grazing periods and ethical treatment, which provides an additional layer of appeal to values-driven consumers. The entire manufacturing process must also utilize dedicated, contamination-free processing lines, enhancing transparency and consumer trust in the product's purity and nutritional consistency for neonatal development.

How does the high cost of organic formula impact market accessibility and purchasing decisions?

The high production costs associated with stringent organic certification, specialized farming practices (e.g., lower milk yield, dedicated organic feed supply chains), and complex regulatory compliance translate directly into a premium retail price for organic infant formula, significantly impacting market accessibility. This elevated pricing structure inherently restricts the market, making the product primarily accessible to high-income families in developed nations and affluent urban centers globally. For the majority of consumers, particularly in emerging markets, the substantial price differential compared to conventional options acts as a major restraint, limiting mass adoption. However, for affluent consumers, purchasing decisions are influenced less by the absolute price and more by the perceived long-term health value, verifiable safety assurances, and strong brand reputation. Manufacturers often attempt to mitigate the accessibility challenge through differential pricing strategies based on regional income levels and offering smaller, entry-level package formats, yet the intrinsic cost of achieving organic integrity remains the chief barrier to broader socioeconomic market penetration.

What are the key functional ingredients driving innovation in premium Organic Infant Formula formulations?

Innovation in premium Organic Infant Formula is heavily concentrated on incorporating functional ingredients designed to closely emulate the complex biological benefits of human breast milk, while strictly adhering to organic sourcing and processing requirements. The most significant technological driver is the commercialization of Organic Human Milk Oligosaccharides (HMOs), increasingly produced through organic fermentation processes, which are crucial for supporting the infant immune system maturation and fostering a robust gut microbiome development. Additionally, the mandated inclusion of essential fatty acids, specifically certified organic Omega-3 components like DHA (docosahexaenoic acid) and ARA (arachidonic acid), typically sourced from highly controlled organic algae cultivation, is critical for neonatal brain and visual development. Another rapidly growing trend involves the incorporation of specific organic protein types, such as organic A2 milk protein, which epidemiological evidence suggests may offer superior digestibility compared to conventional A1 protein, successfully capturing market share among parents concerned about infant sensitivity.

Which geographical region exhibits the highest growth potential for Organic Infant Formula Milk Powder?

The Asia Pacific (APAC) region consistently demonstrates the highest projected growth potential for the Organic Infant Formula Milk Powder market, primarily propelled by unparalleled demographic and socioeconomic forces. China dominates this regional growth due to its immense market size, rapidly increasing urbanization, and high consumer expenditure on infant nutrition, exacerbated by a deep-seated cultural preference for imported, highly certified organic formulas following past domestic dairy safety incidents. This robust demand for external certifications drives significant cross-border e-commerce activity, favoring premium European, Australian, and New Zealand organic brands. Secondary growth contributors include rapidly expanding economies like India, Indonesia, and Vietnam, where the burgeoning middle class is increasingly adopting global health and wellness trends. Successful market strategies in APAC require localized regulatory expertise, significant investment in trusted brand narratives, and robust infrastructure to counteract counterfeiting across diverse distribution channels.

How do regulatory bodies ensure the nutritional adequacy and safety of organic infant formulas?

Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Chinese Administration of Market Regulation (SAMR) impose a rigorous, multi-layered regulatory framework to guarantee the safety and nutritional completeness of organic infant formula. Firstly, they establish precise nutritional specifications, defining strict minimum and maximum concentration levels for all essential macro- and micronutrients, ensuring the formula provides complete sustenance for infant development. Secondly, the product must adhere fully to national organic certification standards, which verify ingredient purity, ethical sourcing, and the absolute exclusion of synthetic contaminants. Compliance mandates comprehensive, mandatory batch testing for contaminants, rigorous record-keeping establishing farm-to-shelf traceability, and periodic, unannounced facility audits by both food safety and organic certification bodies. This overlapping regulatory oversight ensures both the integrity of the organic claim and the guaranteed nutritional adequacy essential for a product serving as a primary food source for vulnerable infants, thereby reinforcing consumer confidence globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager