Organic Vanilla Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443421 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Organic Vanilla Market Size

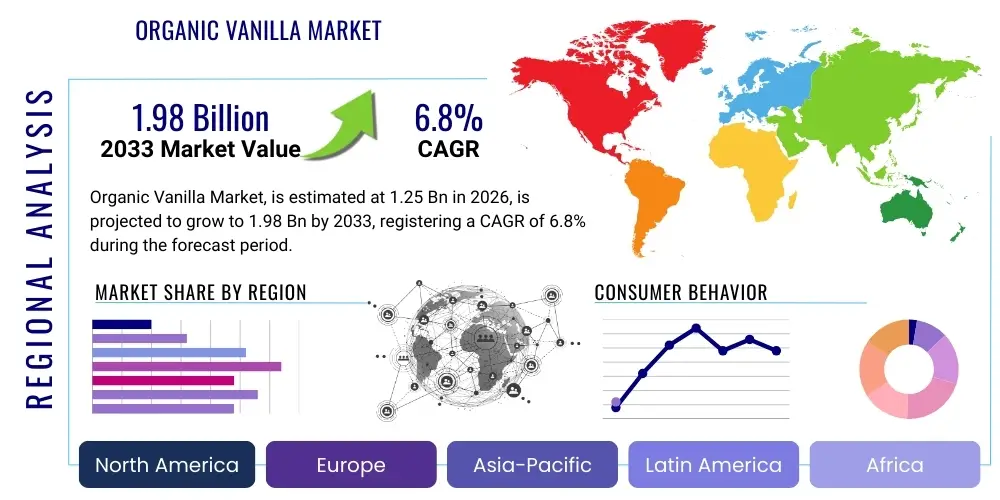

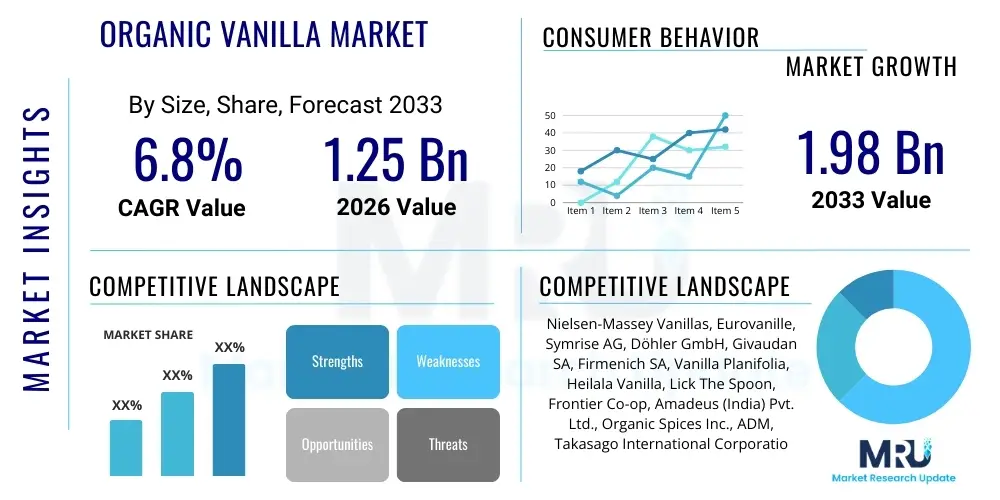

The Organic Vanilla Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033.

Organic Vanilla Market introduction

The Organic Vanilla Market encompasses the trade and consumption of vanilla products derived from certified organic sources, primarily the cured pods of the Vanilla planifolia orchid, cultivated without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). This segment represents a premium niche within the broader flavor and fragrance industry, driven significantly by global consumer trends prioritizing clean labels, natural ingredients, and sustainable agricultural practices. Organic vanilla is distinguished by stringent third-party certification processes (such as USDA Organic or EU Organic) that ensure ecological health and biodiversity preservation throughout the cultivation and processing stages. Its superior flavor profile, often described as more complex and nuanced compared to synthetic alternatives, solidifies its indispensable role in high-end food, beverage, cosmetic, and pharmaceutical formulations. The core value proposition of organic vanilla rests on its purity, ethical sourcing assurances, and alignment with modern health-conscious consumer behavior.

Major applications of organic vanilla span across the industrial food and beverage sector, where it is a foundational ingredient in premium ice creams, dairy products, baked goods, confectionery, and functional beverages. Furthermore, the cosmetic industry utilizes organic vanilla extracts and essential oils for their aromatic and antioxidant properties in skincare, haircare, and fine fragrance production, catering to the burgeoning demand for natural personal care products. The pharmaceutical and nutraceutical sectors also incorporate organic vanilla due to its recognized health benefits and efficacy as a flavoring agent in supplements and medicinal preparations. The complexity of its production, involving labor-intensive hand pollination and a curing process that can last several months, contributes to its high market valuation and emphasizes the intricate supply chain dynamics governing this commodity.

Key factors driving the expansion of this market include increasing consumer awareness regarding the potential adverse effects of artificial additives and flavors, leading to a strong shift towards natural and organic alternatives. Regulatory support favoring organic farming methods in key consuming regions like North America and Europe further stimulates market growth. Additionally, the proliferation of specialized health food stores, rapid globalization of premium bakery and confectionery chains, and robust marketing efforts highlighting the sustainability and traceability of organic ingredients are creating sustained demand. However, the market remains highly susceptible to climatic variability in primary producing regions, which often causes price volatility and supply constraints, necessitating continuous investment in diversified sourcing strategies and resilient supply chain management practices by major industry players.

Organic Vanilla Market Executive Summary

The Organic Vanilla Market is characterized by robust growth underpinned by strong consumer preference for natural, traceable ingredients, positioning it favorably within the global premium food and personal care markets. Current business trends indicate a critical focus on vertically integrated supply chains, allowing major players to ensure quality control, stability in pricing, and ethical sourcing compliance, thereby mitigating risks associated with high price volatility and intermittent supply shortages inherent to traditional vanilla production. Innovation in product formats, such as organic vanilla pastes and powders, is expanding application flexibility for industrial end-users, while sustainability initiatives, including regenerative farming techniques and fair trade certifications, are becoming non-negotiable competitive differentiators, especially among European and North American brand owners aiming for enhanced corporate social responsibility (CSR) metrics.

Regionally, North America and Europe dominate consumption due to high disposable income, established organic retail infrastructure, and stringent clean label regulations driving ingredient substitution away from synthetics. The Asia Pacific region, particularly emerging economies like India and China, is projected to register the fastest growth, propelled by the rapid Westernization of dietary preferences, expansion of organized retail, and rising middle-class interest in imported premium food ingredients. Producers in Madagascar, Indonesia, and Uganda are enhancing organic certification rates and improving curing technology to meet this escalating global demand, though infrastructure challenges in these areas necessitate targeted development investments and collaborative partnerships to optimize output quality and consistency.

Segmentation analysis highlights the dominance of the Food & Beverage sector, particularly the dairy and bakery segments, as the largest consumer of organic vanilla extract and beans. However, the fastest-growing segment is anticipated to be the Cosmetics and Personal Care industry, driven by the clean beauty movement which mandates the use of naturally derived and certified organic fragrances and functional ingredients. Market dynamics show a progressive shift towards certified organic vanilla beans and extracts over less processed forms, emphasizing the industrial requirement for standardized strength and flavor profiles, which necessitates sophisticated extraction and quality assurance technologies throughout the value chain.

AI Impact Analysis on Organic Vanilla Market

User queries regarding the impact of Artificial Intelligence (AI) on the Organic Vanilla Market primarily revolve around optimizing agricultural yields, enhancing traceability and preventing fraud, and forecasting the volatile commodity prices. Consumers and industry stakeholders are keen to understand how AI-driven predictive analytics can mitigate climate risks affecting vanilla harvests and stabilize global supply chains, which are notoriously susceptible to disruption. Furthermore, there is significant interest in utilizing machine learning for image recognition to verify the authenticity and grade of organic vanilla beans, thereby strengthening consumer trust in certified products. Key themes emerging from this analysis include the potential for AI to revolutionize farm management practices, improve supply chain efficiency, and introduce higher levels of transparency regarding ethical sourcing and environmental compliance, ultimately creating a more resilient and verifiable organic vanilla market ecosystem.

- AI-driven Precision Agriculture: Deployment of sensors and drones combined with machine learning algorithms to monitor soil health, predict pest outbreaks, and optimize irrigation schedules in organic vanilla farms, leading to enhanced yields and resource efficiency.

- Supply Chain Traceability: Use of AI integrated with blockchain technology to provide end-to-end transparency, verifying organic certification status, tracking the origin of beans from the farm gate to the consumer, and minimizing adulteration or mislabeling.

- Predictive Price Modeling: Application of advanced analytical models to forecast commodity price fluctuations based on climate data, political stability in sourcing regions, and global demand trends, aiding procurement managers in strategic purchasing decisions.

- Quality Control Automation: Implementation of computer vision and deep learning techniques to automatically assess the quality, curing stage, and grade of vanilla beans, ensuring consistent industrial quality standards and reducing manual inspection errors.

- Consumer Demand Forecasting: Analyzing vast consumer data sets (social media, retail sales, search trends) using AI to accurately predict shifts in flavor preferences and demand for organic vanilla in various application sectors.

DRO & Impact Forces Of Organic Vanilla Market

The dynamics of the Organic Vanilla Market are significantly shaped by a compelling combination of drivers, inherent restraints, and emerging opportunities, all mediated by critical impact forces that dictate market entry and profitability. A major driver is the persistent global shift toward health-conscious consumption, where certified organic ingredients are perceived as inherently superior and safer, aligning with clean label movements advocated globally by retailers and regulatory bodies. Coupled with this is the substantial growth in the premium food and artisanal beverage sector, which relies heavily on authentic, high-quality flavoring agents like organic vanilla to justify premium pricing and maintain brand credibility. These drivers exert a strong positive impact, compelling major food manufacturers to reformulate products and secure long-term organic vanilla contracts.

However, the market faces significant restraints, primarily stemming from the extreme vulnerability of the vanilla supply chain. The high cost of organic certification and the labor-intensive nature of cultivation contribute to notoriously high raw material prices and price volatility, making organic vanilla prohibitively expensive for mass-market applications compared to synthetic vanillin. Moreover, production is geographically concentrated (e.g., Madagascar), making it highly susceptible to catastrophic weather events and climate change impacts, leading to recurrent supply shocks. These restraints necessitate substantial risk management strategies, often leading companies to invest in diverse sourcing regions or sustainable, vertically integrated operations.

Opportunities for market expansion include the rapid development of sustainable sourcing models, such as agroforestry and regenerative agriculture, which not only enhance environmental resilience but also attract ethically-minded consumers and investors. Furthermore, innovation in processing technology is creating value-added products, such as organic vanilla concentrates and specialty extracts tailored for new applications in the expanding nutraceutical and functional food segments. The core impact forces include regulatory compliance pressures (mandating organic standards), the influence of major retailers (driving clean label adoption), and evolving consumer ethics (demanding traceability and fair trade), collectively pushing the industry toward more transparent and sustainable operational frameworks globally.

Segmentation Analysis

The Organic Vanilla Market is comprehensively segmented based on its Source Form, Application, and geographic distribution, allowing for a granular understanding of purchasing patterns and growth trajectories across various end-use industries. The segmentation reflects the diverse needs of industrial buyers, ranging from those requiring the raw, whole bean for premium extraction processes to those utilizing standardized powder and paste formats for large-scale manufacturing efficiency. Analyzing these segments is crucial as industrial requirements for flavor strength, consistency, and shelf stability directly influence the preferred product form. The market structure emphasizes the value addition at different stages of processing, with high-quality organic extracts commanding significant premiums due to their standardized vanilla content and ease of integration into liquid formulations. The analysis across these dimensions provides clear strategic insights into where market value creation is highest and where innovation in product delivery is most concentrated.

- Source Form:

- Organic Vanilla Bean (Whole Bean)

- Organic Vanilla Extract

- Organic Vanilla Powder

- Organic Vanilla Paste/Flavoring

- Organic Vanilla Essential Oil

- Application:

- Food & Beverage Industry

- Confectionery & Bakery

- Dairy Products (Ice Cream, Yogurt)

- Beverages

- Desserts & Sweet Preparations

- Cosmetics & Personal Care

- Pharmaceuticals & Nutraceuticals

- Aromatherapy

- Food & Beverage Industry

- End-User:

- Commercial/Industrial

- Household

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Organic Vanilla Market

The Organic Vanilla value chain is complex and lengthy, beginning with the highly specialized cultivation of vanilla orchids in tropical climates. Upstream analysis involves smallholder organic farmers who must adhere to stringent certification standards, including mandatory natural pollination and lengthy, climate-dependent curing processes that are essential for developing the characteristic flavor profile. This stage is capital and labor-intensive, often involving cooperatives and specialized curing houses to ensure compliance and consistent quality. Key challenges upstream include yield optimization, securing organic certification renewal, and managing the inherent risks posed by phytosanitary issues and climate variability, necessitating strong governmental and NGO support for local farming communities.

The midstream component focuses on primary processing, extraction, and refinement. This stage typically involves larger industrial players or specialized extractors who purchase cured organic beans and process them into various formats—extracts, pastes, and powders—using sophisticated and often proprietary methods to standardize vanillin content and flavor strength. Distribution channels for organic vanilla are highly diversified; direct channels involve large industrial manufacturers sourcing directly from cooperatives through vertical integration agreements, ensuring traceability and supply stability. Indirect channels involve complex global trading houses and specialty ingredient distributors who manage logistics, warehousing, and quality assurance, serving a broad base of smaller and medium-sized enterprise (SME) clients globally.

Downstream analysis centers on the end-use applications, primarily large multinational food, beverage, and cosmetic corporations that integrate the organic vanilla products into their consumer offerings. The direct path sees major F&B companies negotiating long-term contracts with producers/processors, while the indirect path involves specialized ingredient suppliers who customize blends and formulations for specific applications (e.g., dairy stabilizers, flavor compounds). Retail distribution is crucial for the household segment, relying on health food stores, online organic platforms, and mainstream supermarkets that stock certified organic vanilla beans and extracts, where brand reputation, ethical labeling (e.g., fair trade), and sustainability certifications play a pivotal role in consumer purchasing decisions.

Organic Vanilla Market Potential Customers

Potential customers for the Organic Vanilla Market are predominantly industrial entities operating in sectors where flavor authenticity, clean labeling, and ingredient quality are paramount competitive factors. The largest consumer base resides within the high-end Food & Beverage industry, specifically premium ice cream manufacturers, artisanal bakeries, and organic confectionery producers who utilize organic vanilla to justify high price points and appeal to affluent, health-conscious demographics. These commercial customers require large, consistent volumes of certified organic extract or paste that maintains standardized flavor strength across production batches globally.

Beyond traditional food manufacturing, the rapidly expanding Cosmetics and Personal Care sector represents a high-growth potential customer base. Driven by the "clean beauty" trend, these companies seek organic vanilla for its natural fragrance, antioxidant properties, and perceived therapeutic benefits in high-value products such as organic lotions, hair treatments, and natural perfumes. These buyers prioritize ethical sourcing and certification consistency, often demanding detailed documentation regarding sustainability practices and supply chain transparency to support their own ethical marketing claims.

Furthermore, the Nutraceuticals and Functional Foods sector is increasingly adopting organic vanilla. It is utilized both as a natural flavoring agent to improve the palatability of nutritional supplements (protein powders, vitamins) and occasionally for its functional properties. These customers are highly sensitive to regulatory compliance and require guarantees that the organic vanilla used meets stringent food safety and pharmaceutical-grade quality controls. The Household segment, though smaller in volume, consists of individual consumers who purchase certified organic vanilla beans or extracts primarily through specialized retail channels, demonstrating a strong willingness to pay a premium for guaranteed organic purity for home cooking and baking applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nielsen-Massey Vanillas, Eurovanille, Symrise AG, Döhler GmbH, Givaudan SA, Firmenich SA, Vanilla Planifolia, Heilala Vanilla, Lick The Spoon, Frontier Co-op, Amadeus (India) Pvt. Ltd., Organic Spices Inc., ADM, Takasago International Corporation, VKL Seasoning, Mane Kancor, Prova, Vanilla Extract Co., Cook Flavoring Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Vanilla Market Key Technology Landscape

The technology landscape within the Organic Vanilla Market focuses intensely on enhancing sustainability, improving processing efficiency, and ensuring authenticity across the supply chain. In cultivation, advanced agricultural technologies, particularly sensor-based monitoring systems and localized climate control mechanisms, are being piloted to mitigate the risks associated with adverse weather conditions and optimize soil nutrient delivery without relying on synthetic inputs, a crucial requirement for organic certification. Furthermore, genomics research is exploring new, resilient varieties of Vanilla planifolia that maintain high vanillin content but exhibit increased resistance to common fungal diseases, reducing crop loss and stabilizing raw material availability, a persistent technological challenge in tropical farming.

In processing, supercritical fluid extraction (SFE) and other advanced, solvent-free extraction technologies represent a significant area of focus. These methods allow for the extraction of high-pquality, clean label organic vanilla concentrates and oleoresins with minimal chemical residue, aligning perfectly with the demand for purity in premium end products. These modern extraction techniques offer superior efficiency and yield compared to traditional alcohol-based methods, allowing processors to maximize the value derived from costly organic beans. Maintaining the organic integrity throughout the extraction process often requires specialized, contaminant-free machinery and adherence to strict operational protocols which are subject to rigorous third-party audits.

Crucially, digital technologies are transforming supply chain integrity. The adoption of blockchain technology integrated with IoT devices is becoming essential for creating an immutable, transparent record of organic certification, curing process details, and transfer of ownership from the farm gate. This not only bolsters consumer trust by proving the authenticity and ethical sourcing of the organic vanilla but also provides valuable data for optimizing logistics and predicting quality deterioration. Furthermore, spectroscopic analysis and chemical fingerprinting techniques are widely employed by industrial buyers to rapidly verify the organic purity and prevent economic adulteration with synthetic vanillin or non-organic substitutes, securing the high investment made in premium organic raw materials.

Regional Highlights

- North America: North America, particularly the United States, represents the largest consumer market for certified organic vanilla. This dominance is driven by high per capita spending on specialty foods, robust clean label legislation, and a well-established retail infrastructure dedicated to organic products. The region shows strong demand for organic vanilla extracts in premium dairy, artisanal bakery, and functional beverage segments. Strategic focus for market players involves securing reliable supply chains to meet consistent industrial demand, despite the high import costs.

- Europe: Europe stands as a highly mature and influential market, marked by stringent EU organic regulations and a powerful consumer preference for ethically sourced and Fair Trade certified ingredients. Countries like Germany, France, and the UK are primary hubs for innovation in organic confectionery and cosmetic formulations. European companies often lead the adoption of sustainable sourcing practices, including investment in agroforestry projects in producing countries to ensure long-term supply resilience and meet complex CSR mandates.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market globally, fueled by expanding middle-class populations, increasing urbanization, and the consequent adoption of Western dietary habits, particularly in premium bakery and dessert consumption. While local production remains limited, rapid growth in industrial food processing and rising awareness of organic certifications in countries such as China, India, and Japan are translating into substantial import volumes of high-quality organic vanilla products.

- Latin America (LATAM): LATAM is vital primarily as a sourcing region, with countries like Mexico and certain parts of South America contributing unique varietals and small-scale organic production. As a consumer market, growth is moderate but steady, centered around locally manufactured organic food items. The regional highlight focuses on strengthening local organic certification bodies and investing in sustainable cultivation techniques to enhance export potential to North American and European markets.

- Middle East & Africa (MEA): MEA presents mixed dynamics. While certain African nations (e.g., Uganda, Tanzania) are crucial organic vanilla producers, the consumer market growth within the MEA region itself is driven mainly by the Gulf Cooperation Council (GCC) countries. High-net-worth consumers in the GCC drive demand for imported luxury organic food products, including those flavored with premium organic vanilla, making the region an important, though specialized, consumption point.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Vanilla Market.- Nielsen-Massey Vanillas

- Eurovanille

- Symrise AG

- Döhler GmbH

- Givaudan SA

- Firmenich SA

- Vanilla Planifolia

- Heilala Vanilla

- Lick The Spoon

- Frontier Co-op

- Amadeus (India) Pvt. Ltd.

- Organic Spices Inc.

- ADM (Archer Daniels Midland Company)

- Takasago International Corporation

- VKL Seasoning Pvt. Ltd.

- Mane Kancor Ingredients Private Limited

- Prova Gourmet Flavors

- Vanilla Extract Co.

- Cook Flavoring Company

- Lafayette Spices

Frequently Asked Questions

Analyze common user questions about the Organic Vanilla market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for certified organic vanilla?

The primary driver is the accelerating consumer shift towards clean label ingredients, transparency, and natural flavors, fueled by concerns over synthetic additives and a preference for products supporting sustainable and ethical agricultural practices verified by organic certification bodies.

How does the price volatility of organic vanilla impact the market?

Extreme price volatility, often caused by concentrated production in climate-sensitive regions (e.g., Madagascar), significantly impacts market profitability, forcing industrial buyers to diversify sourcing strategies, enter into long-term contracts, and sometimes explore high-quality natural substitutes to manage procurement risks.

Which geographical region dominates the consumption of organic vanilla products?

North America and Europe currently dominate the consumption landscape due to high disposable incomes, stringent clean label regulations, and mature organic retail distribution networks that facilitate widespread access to certified organic food and cosmetic products.

What is the role of technology in enhancing organic vanilla supply chain integrity?

Technology, particularly the integration of blockchain with IoT tracking, is crucial for improving supply chain integrity by providing verifiable, immutable records of the organic certification status, ethical sourcing compliance, and farm-to-shelf traceability, minimizing fraud and bolstering consumer trust.

In which application sector is the Organic Vanilla Market projected to see the highest growth?

While Food & Beverage remains the largest segment, the Cosmetics and Personal Care industry is projected to exhibit the fastest growth, driven by the clean beauty movement which mandates the use of naturally derived and certified organic ingredients in fragrances, skincare, and hair products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager