Orthopedic Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441708 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Orthopedic Shoes Market Size

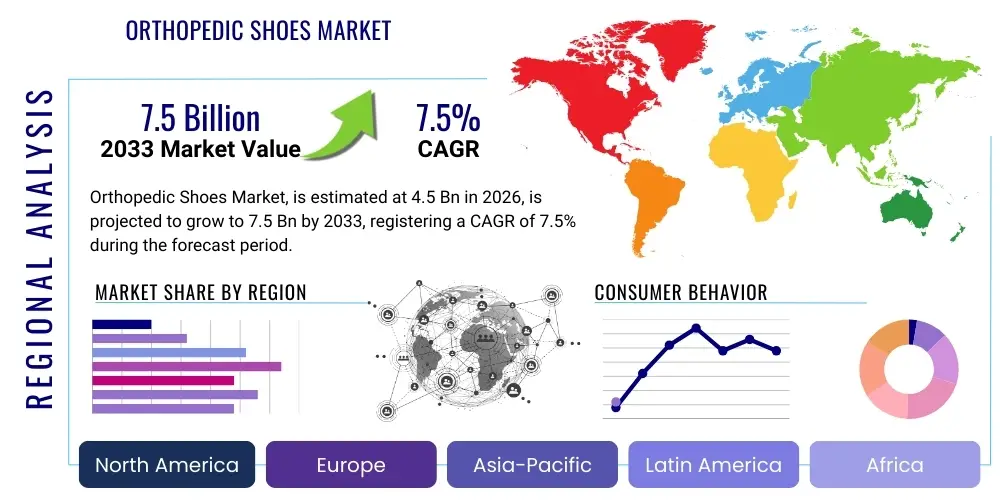

The Orthopedic Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Orthopedic Shoes Market introduction

The Orthopedic Shoes Market encompasses footwear designed with specialized features to provide therapeutic benefits, correct anatomical misalignments, and accommodate foot conditions such as diabetes, arthritis, bunions, and plantar fasciitis. These shoes prioritize comfort, support, and stability over purely aesthetic appeal, utilizing features like deep toe boxes, specialized insoles (orthotics), rigid shanks, and padded collars. The product category includes a wide variety of styles, ranging from athletic sneakers and casual wear to formal shoes and specialized post-operative boots, catering to diverse consumer needs.

Major applications of orthopedic shoes are concentrated in managing chronic conditions and preventing further musculoskeletal deterioration. They are crucial for diabetic patients requiring pressure-reducing footwear to prevent ulcers and subsequent amputations (diabetic foot care). Additionally, individuals suffering from rheumatoid arthritis or osteoarthritis benefit significantly from the cushioning and customized support offered by these shoes, which helps reduce joint pain and improve mobility. The increasing prevalence of obesity, which places undue stress on the feet and lower limbs, further contributes to the growing demand for supportive orthopedic footwear globally.

Key benefits driving market adoption include enhanced patient quality of life, pain reduction, improved posture, and injury prevention. Market growth is primarily driven by the rapidly aging global population, which is inherently more susceptible to foot ailments and degenerative joint diseases. Furthermore, increased healthcare awareness regarding the long-term benefits of preventative foot care, coupled with advancements in custom footwear technology and materials science, significantly propels market expansion across developed and developing economies.

Orthopedic Shoes Market Executive Summary

The global Orthopedic Shoes Market is characterized by robust expansion driven by demographic shifts, specifically the aging population, and the rising incidence of lifestyle diseases such as diabetes and obesity. Business trends emphasize personalization and technological integration, moving beyond traditionally clinical designs towards stylish, comfortable, and therapeutic footwear. Key market players are heavily investing in 3D scanning technology and computer-aided design (CAD) to offer highly customized solutions, appealing to a broader consumer base that seeks both medical necessity and fashion compatibility. Strategic collaborations between footwear manufacturers, orthopedic specialists, and material science companies are defining the competitive landscape, aiming to develop lightweight, durable, and highly functional orthopedic products.

Regionally, North America and Europe maintain dominance due to high healthcare expenditure, established reimbursement policies, and strong awareness regarding foot health. However, the Asia Pacific region is poised for the highest growth rate, fueled by improving economic conditions, increasing penetration of western lifestyles, and a massive diabetic population base, particularly in countries like China and India. Governments in these regions are also starting to implement programs focused on preventative care, which includes subsidized or recommended therapeutic footwear, further accelerating market penetration in previously untapped areas.

Segment trends reveal that the diabetic application segment commands the largest market share, driven by stringent clinical guidelines recommending specialized footwear for neuropathy management. In terms of product type, orthopedic sneakers and athletic shoes are witnessing the fastest growth, reflecting the growing consumer preference for comfortable, supportive footwear suitable for active lifestyles. The distribution channel is rapidly shifting, with specialized orthopedic retail stores and online platforms gaining prominence over traditional pharmacies, offering greater variety, expert fitting services, and direct-to-consumer convenience, optimizing overall customer experience and accessibility.

AI Impact Analysis on Orthopedic Shoes Market

Common user questions regarding AI's impact typically center on how technology can improve fit accuracy, reduce manufacturing costs for customization, and personalize the therapeutic experience. Users are concerned about whether AI can truly replace the expertise of a podiatrist in diagnosing complex foot issues but are highly optimistic about AI-powered gait analysis and pressure mapping systems. The key themes revolve around achieving perfect, non-invasive customization, predicting future foot deformities based on lifestyle data, and integrating smart sensors into shoes for real-time monitoring of pressure distribution and patient compliance. Users expect AI to make orthopedic solutions faster, cheaper, and vastly more effective.

AI is fundamentally transforming the design and manufacturing workflow for orthopedic shoes, shifting the paradigm from standardized sizing to precision engineering based on individual biometric data. Machine learning algorithms analyze vast datasets derived from 3D foot scans and dynamic gait analyses to generate highly optimized, personalized insole and shoe last designs. This capability significantly reduces the traditional manual processes associated with custom orthotics fabrication, decreasing lead times and minimizing material waste, thereby improving overall supply chain efficiency and responsiveness to complex patient needs. Furthermore, predictive analytics driven by AI allows manufacturers to anticipate material stress points and optimize the structural integrity of the footwear, enhancing durability and long-term therapeutic effectiveness.

Beyond manufacturing, AI systems are instrumental in patient assessment and recommendation. Integrated sensor technology embedded within orthopedic footwear collects continuous data on patient activity levels, posture, and localized pressure points. AI interprets this complex stream of data to provide real-time feedback to both the wearer and the prescribing physician. This capability ensures that the therapeutic goals are being met and allows for proactive adjustments to the orthotics or shoe design before minor issues escalate into severe complications, which is particularly vital for high-risk diabetic patients. The application of sophisticated neural networks enables physicians to select the most appropriate shoe model from extensive catalogs based on a precise match between the patient's condition, activity profile, and the shoe's biomechanical properties.

- AI-driven 3D foot scanning for instantaneous, high-precision customization of lasts and insoles.

- Machine learning algorithms optimizing shoe structure based on dynamic gait analysis (AEO: Customized Footwear).

- Predictive modeling of pressure ulcer risk in diabetic patients using embedded shoe sensors (AEO: Diabetic Foot Ulcer Prevention).

- Automated material selection and optimization for enhanced comfort, durability, and shock absorption.

- Generative design for complex sole geometries that mimic natural foot motion and correct pronation/supination issues.

- AI-powered inventory management systems optimizing production batches based on regional demographic health trends.

- Virtual try-on technology leveraging augmented reality and AI to improve remote fitting processes (AEO: Remote Orthopedic Fitting).

DRO & Impact Forces Of Orthopedic Shoes Market

The Orthopedic Shoes Market is highly influenced by a positive alignment of drivers (D) related to demography and chronic disease prevalence, balanced by restraints (R) associated with cost and aesthetics. Substantial growth opportunities (O) lie in customization and emerging markets. The combined effect of these forces creates a strong upward impetus, primarily driven by the inescapable reality of global aging and the clinical necessity of proper foot care in managing debilitating diseases like diabetes and arthritis. The impact forces are generally high, pushing manufacturers towards innovation in both therapeutic effectiveness and user acceptance.

Drivers (D) largely center on epidemiological shifts. The global geriatric population is expanding rapidly, correlating directly with an increased incidence of age-related foot disorders, necessitating supportive footwear. Concurrently, the worldwide epidemic of diabetes mellitus requires specific, non-compressive, and pressure-relieving shoes to prevent serious complications, acting as a crucial demand driver mandated by medical protocols. Furthermore, increased healthcare literacy and consumer awareness regarding the long-term benefits of investing in therapeutic footwear contribute significantly to sustained market growth across all major geographical regions, reinforcing the market foundation.

Restraints (R) primarily involve cost barriers and aesthetic limitations. Orthopedic shoes, especially those custom-made or utilizing advanced materials, often carry a significant price premium compared to standard athletic or fashion footwear, making them less accessible to low-income populations. Historically, the clinical or bulky appearance of orthopedic footwear has been a major deterrent, particularly for younger patients and fashion-conscious consumers, although significant efforts are being made to address this. Additionally, inconsistent reimbursement policies across different national healthcare systems create financial bottlenecks for widespread consumer adoption, especially in regions lacking comprehensive public health coverage for specialized medical devices.

Opportunities (O) are abundant in technological integration and market penetration. Advances in 3D printing and scanning open lucrative avenues for scalable, mass-customization services, bridging the gap between personalized medical devices and retail accessibility. The emergence of specialized athletic orthopedic footwear (performance orthopedic) caters to active individuals seeking injury prevention and recovery, expanding the market beyond strictly chronic patient groups. Furthermore, significant untapped potential exists in developing economies where healthcare infrastructure is improving and the disposable income of the middle-class segment is rising, indicating strong future demand for supportive footwear solutions.

- Drivers: Rising geriatric population; Increasing prevalence of diabetes and obesity; Growing sports injury rates requiring supportive footwear; Greater physician recommendations for preventative foot care.

- Restraints: High manufacturing costs and associated consumer prices; Perceived lack of aesthetic appeal compared to fashion footwear; Limited or inconsistent healthcare reimbursement policies; Lack of standardization in global orthopedic fitting and prescribing practices.

- Opportunity: Integration of smart technology (sensors, gait analysis); Expansion into customized 3D-printed orthotics; Growth in performance-oriented orthopedic athletic footwear; Penetration of large, underserved markets in Asia Pacific and Latin America.

- Impact Forces: High regulatory scrutiny ensuring product efficacy (positive force); Strong consumer demand for comfort and customization (positive force); Price sensitivity in non-reimbursed markets (negative force).

Segmentation Analysis

The Orthopedic Shoes Market is extensively segmented based on criteria essential for diagnosis, treatment, and distribution efficiency. Analysis across these segments provides a nuanced understanding of consumer needs, identifies high-growth therapeutic areas, and highlights profitable distribution channels. Key segmentation criteria include the product's design (to address specific biomechanical needs), the medical application (targeting primary foot conditions), the gender of the end-user, and the method through which the product is purchased. Understanding these subdivisions is vital for market players to tailor product development, marketing strategies, and channel partnerships effectively.

The segmentation by application remains the most critical dimension, as it directly correlates with the severity and specific design requirements of the condition. For instance, shoes designed for severe diabetic neuropathy must adhere to much stricter depth, width, and seamless interior specifications than those addressing mild pronation issues. This clinical differentiation drives product innovation and regulatory compliance within each therapeutic niche. Similarly, the distribution channel segment reflects evolving consumer behavior, with a noticeable shift towards convenient online platforms offering virtual fitting and detailed product specifications, although specialized retail stores remain essential for complex custom fittings and expert advice.

Geographically, market segmentation reveals disparities in maturity and growth potential. Mature markets like North America and Europe emphasize premium, technologically advanced products, focusing on convenience and style integration. Conversely, high-growth emerging markets prioritize basic accessibility, affordability, and meeting the fundamental need for preventative diabetic foot care, presenting substantial opportunities for manufacturers capable of scaling cost-effective production models. This granular segmentation informs strategic resource allocation for market penetration and expansion efforts globally.

- By Product Type:

- Slippers and House Shoes

- Sandals and Open-Toe Footwear

- Athletic and Sports Shoes

- Boots and Formal Footwear

- Post-Operative and Specialized Shoes

- By Application:

- Diabetic Foot

- Arthritis and Gout

- Plantar Fasciitis and Heel Spurs

- Bunions and Hammertoes

- General Posture and Biomechanical Correction

- By Distribution Channel:

- Retail Stores (Pharmacies, Drug Stores)

- Specialized Orthopedic Clinics/Stores

- Online Retail and E-commerce Platforms

- By End-User:

- Men

- Women

- Children (Pediatric Orthopedics)

Value Chain Analysis For Orthopedic Shoes Market

The value chain for orthopedic shoes begins with the upstream segment, which involves the sourcing and meticulous processing of specialized raw materials. This includes high-grade, breathable textiles, non-allergenic liners, specialized shock-absorbing foams (like EVA and PU), and high-durability synthetic or natural rubber for outsoles. Given the therapeutic function of the product, raw material selection is governed by strict criteria focusing on comfort, pressure mitigation, and longevity. Research and development activities, often involving partnerships with material scientists, are paramount at this stage to innovate new lightweight and supportive composite materials that enhance product performance while maintaining patient safety standards.

The midstream phase focuses on manufacturing and assembly, which is increasingly sophisticated due to customization demands. This stage integrates advanced technologies such as 3D scanning for precise foot measurement, Computer-Aided Design (CAD) for last and orthotic creation, and often, 3D printing for rapid prototyping and limited-run customized component production. Quality control is exceptionally rigorous here, ensuring compliance with medical device regulations (e.g., ISO standards and FDA clearance), especially for diabetic footwear. Efficient manufacturing processes are crucial for managing the cost structure, which is inherently higher than standard footwear due to the complexity of multi-layered sole construction and custom fitting requirements.

The downstream segment encompasses distribution and final consumption. Distribution channels are bifurcated into direct sales, typically through specialized orthopedic clinics that handle measurement and fitting, and indirect sales via retail and e-commerce platforms. Specialized stores offer the critical service of professional fitting by certified pedorthists or podiatrists, a crucial value-add that ensures therapeutic efficacy. E-commerce, while expanding, generally caters more effectively to recurring purchases or conditions that require less stringent personalized fitting. Effective marketing focuses on health professionals (physicians, endocrinologists) who act as key influencers and prescribers, alongside direct-to-consumer health education campaigns emphasizing comfort and prevention.

Orthopedic Shoes Market Potential Customers

The primary customer base for orthopedic shoes consists of individuals whose mobility and quality of life are significantly impacted by chronic foot and lower limb conditions, or those seeking preventative care due to high risk factors. This segment is dominated by the geriatric population, typically aged 60 and above, who frequently experience degenerative conditions such as osteoarthritis, bunions, heel pain, and circulatory issues. The rising global life expectancy directly contributes to the expansion of this core demographic, making them consistent buyers motivated by pain relief and the desire to maintain independence and activity levels in their later years.

A second crucial segment comprises patients diagnosed with specific systemic diseases, most notably Type 1 and Type 2 diabetes. These individuals are clinically mandated to wear protective footwear to manage neuropathy and prevent potentially catastrophic foot ulcers, making the purchase of orthopedic shoes a medical necessity, often subsidized or reimbursed. Endocrinologists and general practitioners serve as gatekeepers for this segment, and manufacturers must focus their outreach efforts on clinical validation and prescription adherence. This customer group requires shoes that prioritize seamless interiors, extra depth, and specialized material construction for maximum protection.

Finally, a rapidly growing customer base includes younger, health-conscious consumers and athletes seeking injury rehabilitation or superior support for high-impact activities. This non-traditional segment is driven by a focus on preventative biomechanical health, often purchasing orthopedic or supportive athletic shoes to correct minor gait imbalances (like over-pronation) or to aid recovery from sports-related injuries. These consumers prioritize design aesthetics, lightweight construction, and integration of performance technology, demanding products that blend seamlessly with mainstream activewear brands, broadening the market appeal beyond strictly therapeutic applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dr. Comfort (DJO Global), Aetrex Worldwide, New Balance (Therapeutic Lines), Apex Foot Health, Orthofeet, Vionic Group, Hoka One One, Clarks (Orthopedic Range), Propet, Rockport (Therapeutic), Drew Shoe, Finn Comfort, Mephisto, Altra, Xelero, Hush Puppies, Birkenstock (Specialty), P.W. Minor, Samuel Hubbard, SAS Shoes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Orthopedic Shoes Market Key Technology Landscape

The Orthopedic Shoes Market is undergoing significant technological transformation, moving beyond conventional foam and leather manufacturing towards sophisticated digital solutions. Central to this evolution is the adoption of 3D scanning and imaging technology, which allows for extremely precise, non-contact measurement of the foot geometry and volume, capturing details essential for crafting custom-fit orthotics and shoe lasts. This precision minimizes fitting errors, substantially improving patient comfort and therapeutic effectiveness, particularly for complex deformities. Furthermore, the integration of Computer-Aided Manufacturing (CAM) with these digital models facilitates automated, high-fidelity production, ensuring consistency and scalability in personalized footwear creation.

A second major technological advancement involves the rapid proliferation of advanced materials and smart textiles. Manufacturers are utilizing proprietary cushioning materials such as viscoelastic polymers and high-rebound foams that offer superior shock absorption and energy return compared to older rubber compounds. These materials enhance overall biomechanical performance and reduce stress on joints. Moreover, the emergence of smart orthopedic footwear incorporates embedded sensor technology—often pressure mapping and accelerometer sensors—to monitor gait cycle, weight distribution, and activity levels in real-time. This data connectivity provides objective feedback to clinicians, allowing for data-driven adjustments to the prescription and verifying patient compliance with wearing instructions, thereby enhancing the overall efficacy of the treatment plan.

The application of Additive Manufacturing (3D Printing) is revolutionizing the production segment by enabling cost-effective, complex geometric structures that were previously impossible with traditional molding techniques. 3D printing allows for the rapid creation of custom insoles with variable density zones, tailored precisely to the pressure distribution needs of the individual foot. This customization capability is crucial for treating high-risk conditions like diabetic foot where mitigating pressure in localized areas is vital for ulcer prevention. These technological shifts are not only improving product quality but are also streamlining the supply chain, facilitating mass-customization, and lowering the barrier to entry for innovative material experimentation.

Regional Highlights

The global Orthopedic Shoes Market demonstrates varied maturity levels and growth trajectories across different regions, influenced by healthcare expenditure, disease prevalence, and regulatory frameworks.

- North America: This region holds a leading market share, characterized by high consumer awareness, robust health insurance coverage (especially for medically necessary devices), and a strong presence of key market players specializing in high-end customized solutions. The high prevalence of obesity and the large geriatric population base, combined with advanced technology adoption (3D printing, AI analysis), solidify North America's dominance.

- Europe: Europe represents a mature and technologically sophisticated market, driven by stringent foot health regulations and well-established public healthcare systems that often facilitate reimbursement for therapeutic footwear. Germany, the UK, and France are critical markets, focusing heavily on quality control, certified pedorthists, and the integration of orthopedic principles into mainstream comfortable footwear design.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is underpinned by the massive and rapidly expanding diabetic population, particularly in China and India, coupled with increasing disposable incomes and improving access to modern healthcare services. Market focus here is on affordability and scaling production to meet high volume demands for diabetic and basic supportive footwear.

- Latin America (LATAM): The LATAM market is in a nascent but growing phase. Economic stability and increasing healthcare investment in key economies like Brazil and Mexico are driving demand. Challenges include lower awareness and less developed reimbursement structures, pushing the market toward essential, cost-effective orthopedic solutions.

- Middle East and Africa (MEA): Growth in MEA is highly localized. The prevalence of diabetes is notably high in the Gulf Cooperation Council (GCC) countries, driving demand for specialized diabetic footwear. Investment in medical tourism and modern healthcare facilities is boosting market penetration, although political instability and varied regulatory environments pose unique regional challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Orthopedic Shoes Market.- Dr. Comfort (DJO Global)

- Aetrex Worldwide, Inc.

- New Balance Athletics, Inc. (Therapeutic and Customized Lines)

- Apex Foot Health Industries, LLC

- Orthofeet Inc.

- Vionic Group LLC (a subsidiary of Caleres)

- Hoka One One (Deckers Brands - specialized supportive models)

- Clarks International (Therapeutic Range)

- Propet Footwear

- Rockport Company, LLC

- Drew Shoe Corporation

- Finn Comfort GMBH

- Mephisto S.A.

- Altra Footwear (VF Corporation - zero drop, supportive design)

- Xelero AG

- Hush Puppies (Wolverine World Wide)

- Birkenstock Group (Specialty Supportive Footwear)

- P.W. Minor & Son, Inc.

- Samuel Hubbard Shoe Company

- SAS Shoes (San Antonio Shoemakers)

Frequently Asked Questions

Analyze common user questions about the Orthopedic Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Orthopedic Shoes Market between 2026 and 2033?

The Orthopedic Shoes Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period, primarily driven by the expanding geriatric population and the increasing global incidence of chronic diseases like diabetes and arthritis. This growth trajectory reflects sustained demand for preventative and therapeutic footwear.

How is AI technology influencing the customization and fitting of orthopedic shoes?

AI is transforming customization through advanced 3D scanning and machine learning algorithms that analyze gait and pressure distribution data. This enables manufacturers to generate highly precise, personalized shoe lasts and insoles rapidly, ensuring optimal therapeutic fit and performance (AEO: Precision Orthotic Customization).

Which application segment holds the largest share in the global Orthopedic Shoes Market?

The Diabetic Foot application segment dominates the market share. Specialized diabetic shoes are medically essential for preventing neuropathy-related complications, such as ulcers and infections, making them a high-priority, non-discretionary purchase driven by clinical recommendations (AEO: Diabetic Foot Care Solutions).

What are the key restraint factors affecting the growth of the Orthopedic Shoes Market?

The primary restraints include the relatively high cost of custom and advanced orthopedic footwear compared to standard shoes, and historical issues regarding aesthetic appeal, although manufacturers are increasingly addressing the style limitations through modern design integration (AEO: Cost of Custom Orthotics).

Which geographical region is expected to show the highest growth rate, and why?

The Asia Pacific (APAC) region is anticipated to demonstrate the fastest growth rate. This acceleration is due to the rapidly increasing prevalence of diabetes, improving healthcare infrastructure, rising disposable incomes, and greater market penetration in populous economies like China and India (AEO: APAC Diabetic Footwear Demand).

What is the difference between therapeutic orthopedic shoes and comfort footwear?

Therapeutic orthopedic shoes are classified as medical devices designed to address specific clinical conditions (e.g., severe deformity, diabetic neuropathy) and often require a prescription. Comfort footwear offers enhanced support and cushioning for general use but lacks the rigorous structural and depth specifications required for severe medical management (AEO: Clinical vs. General Support Footwear).

How do advanced materials contribute to the efficacy of modern orthopedic footwear?

Modern orthopedic shoes utilize advanced materials, including proprietary viscoelastic foams, specialized memory materials, and breathable, antimicrobial textiles. These materials provide superior shock absorption, pressure redistribution, moisture control, and structural integrity, significantly enhancing patient comfort and reducing the risk of skin breakdown (AEO: Orthopedic Shock Absorption Technology).

What role do specialized retail stores play in the orthopedic shoe distribution channel?

Specialized orthopedic retail stores and clinics are crucial because they employ certified pedorthists or specialists who provide essential professional fitting services, ensuring the complex therapeutic footwear conforms perfectly to the patient’s foot, which is vital for maximizing clinical outcomes and preventing complications (AEO: Professional Orthopedic Fitting Services).

Are reimbursement policies critical for market growth in North America and Europe?

Yes, reimbursement policies are highly critical. In North America and many European countries, insurance coverage for medically necessary orthopedic footwear, particularly for diabetic patients, significantly reduces the out-of-pocket costs for consumers, thereby boosting adoption rates and market stability in these regions (AEO: Healthcare Reimbursement for Therapeutic Shoes).

What specific challenges does the children's orthopedic footwear segment face?

The pediatric orthopedic segment faces challenges related to rapid foot growth, requiring frequent replacement of expensive custom shoes, and ensuring compliance, as children often resist wearing bulky or aesthetically unappealing therapeutic footwear. Innovation focuses on flexible, adjustable designs and more child-friendly aesthetics (AEO: Pediatric Orthopedic Footwear Challenges).

How does the increasing prevalence of obesity drive demand for orthopedic shoes?

Obesity increases strain on the feet, ankles, and knees, leading to conditions like plantar fasciitis, flat feet, and joint pain. Orthopedic shoes provide the necessary wide fit, superior support, and deep cushioning to manage the increased weight load and associated biomechanical stress, acting as a crucial preventative measure (AEO: Obesity and Foot Biomechanics).

What is the significance of the shift towards athletic orthopedic shoe designs?

The shift towards athletic orthopedic designs signifies market expansion beyond chronic patients to include active consumers seeking preventative or rehabilitative support. These designs blend therapeutic functionality (stability, arch support) with performance features (lightweight, durability), appealing to a broader demographic interested in maintaining an active lifestyle safely (AEO: Performance Orthopedic Footwear).

How are orthopedic shoe manufacturers addressing the historical aesthetic challenge?

Manufacturers are heavily investing in design research, utilizing modern color palettes, sleek profiles, and high-quality materials that minimize the clinical appearance. Collaborations with fashion designers and the use of flexible, fashionable textiles are key strategies to integrate therapeutic function with contemporary style (AEO: Aesthetic Integration in Therapeutic Footwear).

What defines the upstream segment of the orthopedic shoe value chain?

The upstream segment involves sourcing specialized raw materials such as proprietary, durable rubbers, specialized viscoelastic foams for cushioning, and antimicrobial, non-irritating textiles. This phase is characterized by stringent material selection based on clinical performance requirements and regulatory compliance (AEO: Orthopedic Material Sourcing).

Does the market favor direct or indirect distribution channels more significantly?

While the market is increasingly favoring indirect channels like e-commerce for convenience, the direct distribution channel (specialized clinics) remains critically important. Direct channels are necessary for custom fittings and initial medical prescriptions, ensuring proper sizing and complex adjustments crucial for therapeutic efficacy (AEO: Distribution Channel Efficacy).

What is generative design, and how is it used in orthopedic shoe manufacturing?

Generative design is an AI-driven process where algorithms explore thousands of design possibilities based on performance criteria (e.g., maximizing shock absorption while minimizing weight). In orthopedic shoe manufacturing, it is used to create highly complex and optimized sole and midsole geometries tailored to individual pressure maps, improving both function and material efficiency (AEO: AI-Based Generative Footwear Design).

How do regulatory standards affect market entry for new orthopedic shoe companies?

Regulatory standards, such as those set by the FDA (US) and CE marking (Europe), mandate rigorous testing and clinical validation for therapeutic orthopedic footwear, especially diabetic shoes. These requirements create significant entry barriers, necessitating high investment in R&D and quality control, thereby favoring established companies (AEO: Regulatory Compliance in Medical Footwear).

What role does the increased focus on preventative foot health play in market growth?

The increased focus on preventative care encourages individuals without severe conditions to adopt supportive orthopedic or semi-orthopedic footwear to mitigate the risk of future joint pain, arch collapse, and other common ailments. This broadens the total addressable market beyond strictly symptomatic patients (AEO: Preventative Footwear Adoption).

How is the market addressing the need for durable yet lightweight orthopedic products?

The market addresses this need through the continuous innovation of lightweight composite materials and refined manufacturing techniques. Utilizing advanced EVA formulations, carbon fiber shanks, and 3D-printed lattice structures allows shoes to retain high support and durability while significantly reducing the overall weight, enhancing comfort for long-term wear (AEO: Lightweight Orthopedic Material Innovation).

What specific challenges does Latin America face in adopting orthopedic shoes?

Latin America primarily faces challenges related to lower public awareness regarding specialized foot health needs, inconsistent disposable income levels, and less developed comprehensive health insurance and reimbursement systems compared to Western markets, requiring manufacturers to focus on accessible pricing strategies (AEO: LATAM Market Access Challenges).

How do smart sensors in orthopedic shoes benefit patient care?

Smart sensors embedded in orthopedic shoes continuously monitor key biomechanical data, such as gait parameters, pressure distribution, and step count. This data is transmitted to clinicians, allowing for remote monitoring, verifying consistent wear (compliance), and providing objective metrics for tracking the effectiveness of the prescribed therapy (AEO: Remote Patient Monitoring via Smart Footwear).

What are the key differences between orthotics and orthopedic shoes?

Orthotics are specialized insoles, often custom-made, inserted into footwear to correct specific foot mechanics. Orthopedic shoes are the complete footwear designed with intrinsic therapeutic features—such as deep toe boxes, rigid soles, and specialized lasts—to accommodate and work synergistically with orthotics, or to provide necessary support where orthotics alone are insufficient (AEO: Orthotics vs. Therapeutic Footwear).

How does plantar fasciitis contribute to the demand for orthopedic shoes?

Plantar fasciitis, a common cause of heel pain, requires footwear that offers superior arch support, cushioning in the heel region, and rigidity in the midfoot to prevent excessive stretching of the fascia. Orthopedic shoes designed for this condition provide targeted relief and mechanical correction necessary for healing and pain management (AEO: Footwear for Plantar Fasciitis Relief).

What impact does digital pathology and foot analysis have on the market?

Digital pathology, combined with foot analysis systems, provides podiatrists with detailed, quantifiable data on foot movement and pressure patterns. This data leads to more accurate diagnoses and highly customized prescriptions for orthopedic shoes and inserts, driving consumer confidence in the efficacy of personalized solutions (AEO: Digital Foot Analysis).

How do environmental and sustainability concerns affect orthopedic shoe manufacturing?

The market is increasingly responding to sustainability concerns by exploring eco-friendly materials, such as recycled plastics and bio-based polymers, without compromising performance. Manufacturers are also optimizing 3D printing processes to reduce material waste, aligning with global trends favoring environmentally conscious production practices (AEO: Sustainable Orthopedic Footwear Materials).

Why is the women’s segment showing faster growth than the men’s segment?

The women's segment often exhibits faster growth due to higher reported rates of specific foot conditions (such as bunions, often linked to wearing tight or high-heeled fashion shoes) and an increasing consumer willingness among women to invest in supportive footwear that integrates better aesthetic design (AEO: Women's Orthopedic Health Trends).

What is the key driver for demand in the Middle East and Africa (MEA) region?

The predominant driver in the MEA region is the exceptionally high incidence rate of diabetes, particularly in the GCC countries. This necessitates a strong focus on diabetic foot care solutions, making preventative and therapeutic orthopedic footwear an urgent medical priority in these markets (AEO: MEA Diabetic Foot Care).

How crucial are partnerships between manufacturers and medical professionals?

Partnerships between manufacturers and podiatrists, endocrinologists, and pedorthists are critically important. These collaborations ensure that product development is clinically validated, distribution channels align with prescription pathways, and marketing messages effectively convey the therapeutic benefits to the relevant patient populations (AEO: Clinical Validation and Partnerships).

What defines a 'post-operative' orthopedic shoe product type?

Post-operative shoes are specialized temporary footwear designed to protect the foot, stabilize the surgical site, and accommodate bulky dressings following foot or ankle surgery. They often feature squared toes, adjustable strapping, and rigid soles to minimize pressure and motion during the crucial recovery phase (AEO: Surgical Recovery Footwear).

How does the segmentation by end-user (Men, Women, Children) influence product design?

Segmentation influences design by addressing anatomical differences (e.g., the Q-angle in women), activity levels (men often require rugged designs), and developmental stages (children need flexible yet supportive structures). This ensures that the footwear biomechanically supports the specific needs of each demographic (AEO: Gender and Age-Specific Biomechanics).

What technological advancement is bridging the gap between clinical need and retail appeal?

The integration of digital measurement technologies (3D scanning) with mass customization capabilities is bridging this gap. This allows high-volume production of near-customized shoes that retain therapeutic integrity while enabling more stylish, less bulky designs previously associated only with mass-market retail (AEO: Mass Customization in Therapeutic Footwear).

Explain the concept of 'Impact Forces' in the context of the orthopedic shoe market.

Impact Forces refer to the cumulative effect of drivers and restraints on the market's trajectory. In this context, the strong positive forces (demographic shifts and technology) significantly outweigh the negative restraints (cost, aesthetics), resulting in a powerful and sustained upward pressure on market growth and innovation (AEO: Market Trajectory Determinants).

What are the implications of the shift from traditional materials to advanced composites?

The shift implies higher performance standards, including enhanced durability, superior shock absorption, reduced weight, and improved breathability. While initially increasing production costs, advanced composites offer better long-term therapeutic outcomes and patient compliance, justifying the premium price point (AEO: Performance Materials in Orthopedics).

Why is accuracy in foot measurement vital for orthopedic shoe efficacy?

Accuracy is vital because even minor discrepancies in fit can negate the therapeutic benefit, leading to rubbing, pressure points, and increased risk of ulcers, particularly for diabetic patients. Precise measurement ensures the shoe supports the arch, stabilizes the heel, and prevents harmful compression (AEO: Foot Measurement Precision for Efficacy).

How does e-commerce facilitate the growth of the orthopedic shoe market?

E-commerce platforms facilitate growth by providing greater accessibility, detailed product information, and competitive pricing transparency, reaching consumers in geographically remote areas. Modern platforms also integrate virtual fitting tools and sophisticated return policies to mitigate the risks associated with buying therapeutic footwear sight unseen (AEO: E-commerce Orthopedic Footwear Distribution).

What is the typical profile of a company categorized as a 'Key Player'?

Key Players are typically large, established brands with global distribution, extensive R&D capabilities, strong clinical validation for their products, and comprehensive product portfolios covering multiple orthopedic applications and end-user segments. They often hold significant intellectual property related to material science and design patents (AEO: Defining Orthopedic Market Leaders).

What is the key driver for demand in the Middle East and Africa (MEA) region?

The predominant driver in the MEA region is the exceptionally high incidence rate of diabetes, particularly in the GCC countries. This necessitates a strong focus on diabetic foot care solutions, making preventative and therapeutic orthopedic footwear an urgent medical priority in these markets (AEO: MEA Diabetic Foot Care).

How crucial are partnerships between manufacturers and medical professionals?

Partnerships between manufacturers and podiatrists, endocrinologists, and pedorthists are critically important. These collaborations ensure that product development is clinically validated, distribution channels align with prescription pathways, and marketing messages effectively convey the therapeutic benefits to the relevant patient populations (AEO: Clinical Validation and Partnerships).

What defines a 'post-operative' orthopedic shoe product type?

Post-operative shoes are specialized temporary footwear designed to protect the foot, stabilize the surgical site, and accommodate bulky dressings following foot or ankle surgery. They often feature squared toes, adjustable strapping, and rigid soles to minimize pressure and motion during the crucial recovery phase (AEO: Surgical Recovery Footwear).

How does the segmentation by end-user (Men, Women, Children) influence product design?

Segmentation influences design by addressing anatomical differences (e.g., the Q-angle in women), activity levels (men often require rugged designs), and developmental stages (children need flexible yet supportive structures). This ensures that the footwear biomechanically supports the specific needs of each demographic (AEO: Gender and Age-Specific Biomechanics).

What technological advancement is bridging the gap between clinical need and retail appeal?

The integration of digital measurement technologies (3D scanning) with mass customization capabilities is bridging this gap. This allows high-volume production of near-customized shoes that retain therapeutic integrity while enabling more stylish, less bulky designs previously associated only with mass-market retail (AEO: Mass Customization in Therapeutic Footwear).

Explain the concept of 'Impact Forces' in the context of the orthopedic shoe market.

Impact Forces refer to the cumulative effect of drivers and restraints on the market's trajectory. In this context, the strong positive forces (demographic shifts and technology) significantly outweigh the negative restraints (cost, aesthetics), resulting in a powerful and sustained upward pressure on market growth and innovation (AEO: Market Trajectory Determinants).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager