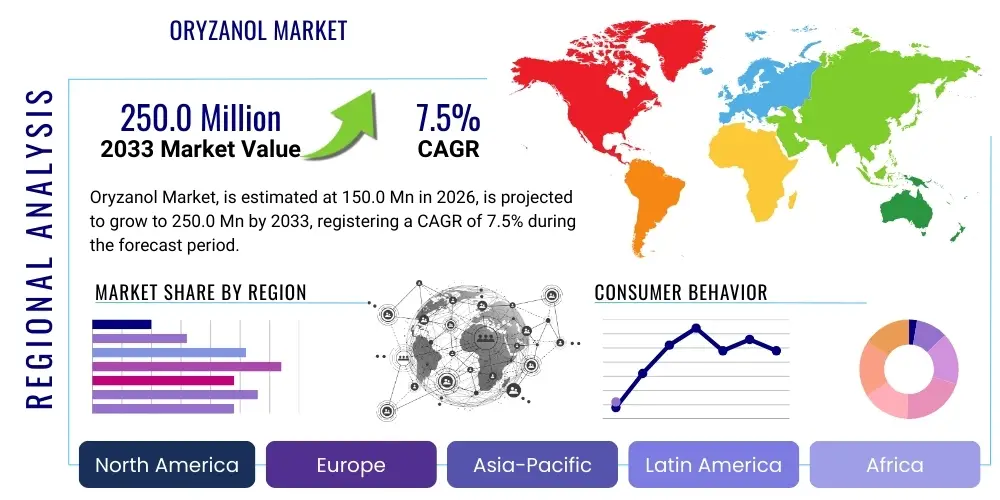

Oryzanol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441822 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Oryzanol Market Size

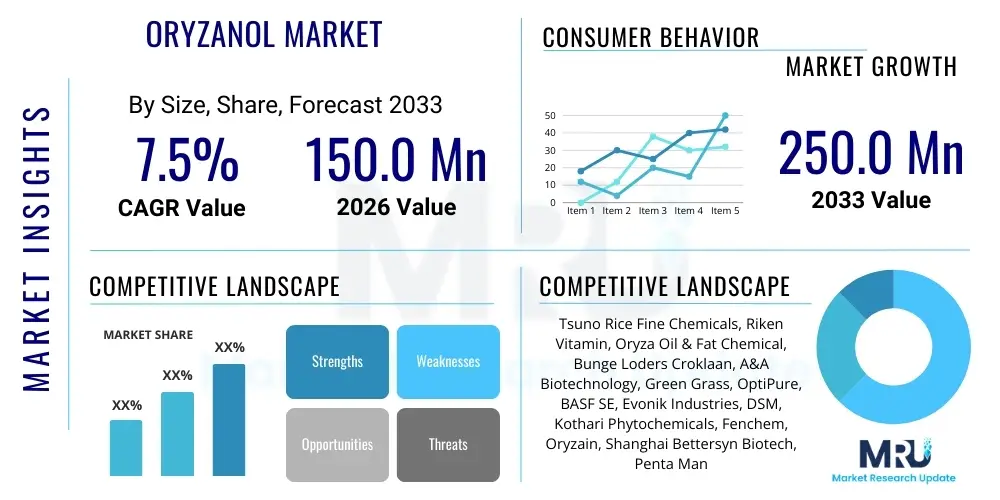

The Oryzanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 150.0 Million in 2026 and is projected to reach USD 250.0 Million by the end of the forecast period in 2033.

Oryzanol Market introduction

Gamma-Oryzanol, often referred to simply as Oryzanol, is a mixture of ferulic acid esters of triterpene alcohols and phytosterols, naturally found in rice bran oil. This compound is highly valued across various industries due to its potent antioxidant and anti-inflammatory properties, making it a critical ingredient in health supplements, pharmaceuticals, and high-end cosmetic formulations. Its primary source material, rice bran, is an abundant agricultural byproduct, ensuring a sustainable supply chain, although extraction and purification processes remain technically complex, influencing overall cost and market entry barriers.

The product’s versatility is a core driver of market penetration. In the nutraceutical sector, Oryzanol is widely utilized for its proven ability to help manage cholesterol levels, particularly reducing Low-Density Lipoprotein (LDL) cholesterol, thereby supporting cardiovascular health. Furthermore, its efficacy as a natural performance enhancer and muscle builder has seen its adoption grow significantly within the sports nutrition segment. In dermatology and cosmetic applications, it serves as a robust ultraviolet (UV) radiation absorber and skin conditioning agent, protecting the skin barrier against environmental stressors and oxidative damage.

Major applications span pharmaceutical development, where its anti-inflammatory characteristics are being researched for potential therapeutic uses; functional foods, where it fortifies health-oriented products; and the animal feed industry, where it is used to enhance growth and feed efficiency. The driving factors behind the market’s positive trajectory include increasing consumer awareness regarding natural ingredients, rising prevalence of lifestyle diseases necessitating dietary management, and continuous innovation in extraction technologies that improve yield and purity, thus lowering the cost of high-grade Oryzanol for mass market applications.

Oryzanol Market Executive Summary

The Oryzanol market is characterized by robust growth, driven primarily by the escalating demand for natural, functional ingredients in the health and wellness sector, particularly in developed economies across North America and Europe, and rapidly expanding economies in the Asia Pacific region. Business trends show a strong emphasis on supply chain integration and optimization, with key manufacturers investing heavily in advanced solvent-free or supercritical fluid extraction (SFE) technologies to meet stringent purity and quality standards demanded by pharmaceutical and cosmeceutical grade applications. Furthermore, strategic partnerships between Oryzanol producers and large functional food and beverage corporations are becoming commonplace, aimed at broadening product incorporation into mainstream consumer packaged goods.

Regionally, the Asia Pacific (APAC) region remains the dominant market segment and the primary source of raw material (rice bran), owing to massive rice production volumes, particularly in China and India. However, North America and Europe exhibit the highest consumption growth rates, attributed to mature regulatory environments supporting nutraceutical claims and high consumer spending on preventive healthcare. Regulatory harmonization and easing of restrictions on health claims in key markets are acting as accelerators, although the necessity for certified Non-GMO and organic sourcing remains a persistent challenge that suppliers must navigate to maintain market access.

Segment-wise, the Dietary Supplements and Nutraceuticals category holds the largest market share, directly benefiting from global demographic shifts toward aging populations and increasing focus on preventative cardiology. Within product type segmentation, high-purity crystalline Oryzanol is witnessing the fastest growth due to its preferred status in pharmaceutical formulations requiring precise dosage and stability. The market structure remains moderately consolidated, dominated by specialized producers headquartered primarily in Japan and China, yet new entrants leveraging novel enzymatic or environmentally friendly extraction methods pose competitive pressure, necessitating continuous innovation in product development and application diversification to sustain market leadership.

AI Impact Analysis on Oryzanol Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Oryzanol market typically revolve around optimizing complex extraction processes, accelerating R&D for novel Oryzanol derivatives, and ensuring supply chain resilience and purity tracing. Common concerns center on whether AI can enhance the yield and quality consistency of high-purity Oryzanol, which is notoriously difficult to isolate efficiently from crude rice bran oil. Users also frequently inquire about AI's role in drug discovery, specifically utilizing machine learning to predict the efficacy of Oryzanol analogues in treating specific cardiovascular or metabolic disorders, thereby speeding up pre-clinical trials and potentially creating entirely new high-value applications for the compound. The overarching expectation is that AI will minimize waste, reduce human error in manufacturing, and provide sophisticated tools for fraud detection concerning product adulteration, ensuring consumer safety and trust.

AI's primary influence is expected to materialize through enhanced operational efficiencies in processing and quality control. Machine learning algorithms can analyze multivariate data from extraction parameters—such as temperature, pressure, solvent ratio, and reaction time—to predict the optimal settings necessary to maximize Oryzanol yield and minimize impurities in real-time. This predictive modeling moves extraction from a batch-oriented, empirical process to a continuous, data-driven system, resulting in substantial cost savings and higher product consistency. Furthermore, integrating AI into chromatography and spectroscopic analysis allows for instantaneous quality checks, ensuring that every produced batch adheres precisely to the required pharmaceutical or cosmetic specifications, a crucial factor in this high-value ingredient market.

Beyond manufacturing, AI is revolutionizing market analysis and customer targeting. By processing vast datasets of consumer purchase behavior, social media sentiment, and epidemiological data, AI helps producers identify emerging regional demands for Oryzanol-based products (e.g., specialized sports nutrition in North America vs. anti-aging cosmetics in East Asia). This capability allows for precise inventory management and targeted product formulation, ensuring that R&D investments are channeled into the most profitable application areas. Overall, AI is viewed not just as an optimization tool, but as a mechanism for de-risking the supply chain, enhancing product integrity, and unlocking untapped therapeutic potential through advanced molecular modeling.

- AI-driven optimization of supercritical fluid extraction (SFE) parameters for increased Oryzanol purity and yield.

- Machine learning applied to predictive quality control and real-time contaminant detection in raw materials (rice bran oil).

- Implementation of AI in molecular modeling to accelerate the discovery and synthesis of novel, bioactive Oryzanol derivatives.

- Predictive supply chain analytics to forecast raw material fluctuations and ensure resilient sourcing, particularly for seasonal rice harvests.

- Enhanced inventory and logistics management using AI algorithms to reduce spoilage and optimize distribution networks across global markets.

- Natural Language Processing (NLP) tools used to analyze scientific literature and regulatory documents, accelerating compliance and application development.

DRO & Impact Forces Of Oryzanol Market

The Oryzanol Market is powerfully shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively dictate the long-term growth trajectory and short-term operational challenges. The primary driving force is the global paradigm shift towards preventive healthcare and the documented clinical benefits of Oryzanol in managing hyperlipidemia and cardiovascular risk, strongly supported by increasing scientific validation and consumer acceptance of natural alternatives to synthetic drugs. This driver is counterbalanced by significant restraints, primarily revolving around the high cost of production associated with achieving pharmaceutical-grade purity, complex regulatory hurdles regarding health claims in disparate geographical markets, and the inherent vulnerability of the raw material supply chain, which is linked to volatile agricultural output and seasonal variation in rice harvesting.

Opportunities for market expansion are abundant, centered predominantly on diversifying the application spectrum beyond traditional nutraceuticals. Novel avenues include the incorporation of Oryzanol into specialized dermatological therapeutics for skin barrier repair and advanced cosmeceuticals targeting photoaging. Furthermore, the development of sophisticated, environmentally conscious extraction technologies, such as enzymatic or microbial processes, offers the potential to overcome the cost constraints of conventional solvent-based methods, opening the door for larger volume production and wider applicability. Successful navigation of these forces requires strategic investment in R&D to improve cost-efficiency and proactive engagement with regulatory bodies to standardize purity metrics and substantiate health benefits globally.

The impact forces influencing the market dynamics are multifaceted. Economic impact forces include the fluctuations in global rice commodity prices, which directly affect the cost of rice bran oil, the primary source material, and the subsequent profitability margins for refiners and Oryzanol extractors. Technological forces are driving significant disruption, as continuous innovation in chromatographic separation and microencapsulation techniques allows for improved bioavailability and stability of Oryzanol in final product formulations. Sociological forces, such as the rising affluence in emerging economies combined with increasing awareness of natural dietary supplements, are widening the consumer base significantly. Lastly, regulatory impact forces dictate market access; stringent approval processes for novel food ingredients or drug precursors often result in protracted development timelines, requiring substantial financial commitment and adherence to Good Manufacturing Practices (GMP) and detailed clinical dossier submissions.

Segmentation Analysis

The Oryzanol market segmentation provides a critical framework for understanding demand patterns and strategic focus areas for key market participants. The market is typically segmented based on the form of Oryzanol (e.g., Powder, Oil Extract), the application (Nutraceuticals, Cosmetics, Pharmaceuticals), and the geographical distribution. Analyzing these segments helps stakeholders identify lucrative niches, such as the demand for high-concentration, tasteless Oryzanol powder in functional beverage fortification or the premium pricing commanded by certified organic Oryzanol used in high-end personal care products. The efficacy of segmentation analysis lies in detailing how varying purity levels cater to distinctly different end-user requirements, for instance, technical grade Oryzanol for animal feed versus 98% purity required for clinical trials, thereby establishing clear pricing tiers and specialized production pathways across the value chain.

The segmentation by application is the most influential, as it dictates the required investment in R&D, regulatory compliance, and marketing strategy. The largest and fastest-growing segment, Nutraceuticals, demands ingredients that are easily dispersible, stable, and substantiated by robust clinical data for general health claims. Conversely, the smaller but high-value Pharmaceuticals segment requires stringent quality assurance, complex documentation, and long-term commitment to drug development timelines. Furthermore, regional segmentation is crucial, recognizing that while the Asia Pacific leads in supply capacity, the demand for value-added, highly processed Oryzanol products (like encapsulated forms) is overwhelmingly concentrated in Western markets, necessitating geographically tailored distribution and sales strategies. This granular approach to segmentation ensures that market players can align their product offering with specific unmet needs within the global consumer landscape.

- By Type:

- Low Purity Oryzanol (30% to 50%)

- Medium Purity Oryzanol (50% to 90%)

- High Purity Oryzanol (90% and above, including Crystalline Grade)

- By Application:

- Nutraceuticals and Dietary Supplements

- Cosmetics and Personal Care

- Pharmaceuticals

- Functional Foods and Beverages

- Animal Feed

- By Form:

- Powder

- Oil Extract/Liquid

- Capsules/Tablets (Finished Products)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Oryzanol Market

The value chain for Oryzanol is intricate and commences with the upstream analysis, focusing heavily on the agricultural sector. The initial critical step is the cultivation and harvesting of rice, particularly the quality of the rice bran, which determines the potential Oryzanol content. Following harvesting, the extraction of crude rice bran oil occurs, often managed by large integrated milling operations. The efficiency and speed of processing the bran after milling are paramount, as enzyme activity can quickly degrade the Oryzanol content. This upstream phase is highly fragmented and vulnerable to commodity price volatility, requiring specialized logistics to manage the rapid degradation of the raw material.

Midstream activities involve the specialized refining and purification of Oryzanol from the crude oil. This step utilizes sophisticated techniques, predominantly solvent extraction followed by advanced chromatography or crystallization to achieve the high purities demanded by end-users. This refining stage represents the highest value addition point, requiring significant capital investment in plant infrastructure and technical expertise. Key manufacturers often maintain proprietary processes to maximize yield and purity, differentiating themselves primarily through quality and adherence to GMP standards. The refined Oryzanol is then processed into various forms—powder, oil, or encapsulated material—ready for distribution.

Downstream analysis involves the distribution channels and the final end-user markets. The distribution channel is often bifurcated: direct sales to large pharmaceutical or nutraceutical manufacturers, and indirect sales through specialized ingredient distributors and agents to smaller cosmetic and functional food producers. Direct sales facilitate deep customization and quality assurance, while indirect channels provide broader market reach. The ultimate consumption is driven by the end-user/buyer, including contract manufacturers (who produce supplements for private labels), major cosmetic brands, and R&D facilities. Supply chain integrity, traceable sourcing, and timely delivery are critical considerations in the downstream market to maintain the high standards required by health and personal care industries.

Oryzanol Market Potential Customers

Potential customers for Oryzanol are concentrated within industries focused on health optimization, personal appearance, and preventative medicine. The largest cohort of buyers comprises contract manufacturing organizations (CMOs) and in-house manufacturing divisions of major nutraceutical companies, such as producers of cardiovascular health supplements, joint support formulations, and sports nutrition products. These buyers typically require large volumes of high-purity (70% to 98%) Oryzanol powder with excellent flow characteristics and solubility for capsule filling and tablet compression. Their procurement strategy is heavily influenced by quality certifications, batch consistency, and reliable supply contracts that minimize stock-out risks.

Another significant customer base exists within the cosmetics and personal care sector, ranging from multinational giants to niche organic skincare brands. These end-users utilize Oryzanol primarily for its UV protective properties, skin conditioning, and anti-aging benefits in creams, lotions, and sunscreens. For these applications, buyers prioritize Oryzanol grades that are stable in emulsion systems, non-irritating, and often require sourcing that meets specific standards like ECOCERT or COSMOS approval. The demand here is driven by consumer desire for natural, scientifically backed ingredients that replace synthetic UV filters or aggressive chemical anti-oxidants.

Finally, the pharmaceutical and specialty functional food sectors represent high-value, albeit lower-volume, customers. Pharmaceutical companies purchase the highest purity, crystalline grade Oryzanol for use in clinical trials or as an active pharmaceutical ingredient (API) precursor for metabolic disorder treatments. Functional food and beverage companies integrate Oryzanol oil or highly dispersible powder into fortified cereals, dairy alternatives, and energy bars, catering to health-conscious consumers. These buyers demand stringent technical specifications, extensive stability data, and full regulatory dossiers, making them premium customers for specialized Oryzanol producers capable of meeting exacting pharmaceutical and food safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.0 Million |

| Market Forecast in 2033 | USD 250.0 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tsuno Rice Fine Chemicals, Riken Vitamin, Oryza Oil & Fat Chemical, Bunge Loders Croklaan, A&A Biotechnology, Green Grass, OptiPure, BASF SE, Evonik Industries, DSM, Kothari Phytochemicals, Fenchem, Oryzain, Shanghai Bettersyn Biotech, Penta Manufacturing, Solgar Inc., NOW Foods, Nature's Bounty, Jarrow Formulas, GNC Holdings, Health Leads. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oryzanol Market Key Technology Landscape

The technological landscape of the Oryzanol market is primarily defined by advanced extraction and purification methodologies, designed to maximize yield from rice bran oil while achieving high levels of purity required for sensitive applications. The traditional method involves alkaline saponification and solvent extraction (e.g., ethanol or hexane), which is cost-effective but often results in lower purity and potential solvent residue concerns, restricting its use in pharmaceutical and premium cosmetic grades. A major shift is occurring toward cleaner, more efficient technologies that address both environmental concerns and quality mandates.

A leading technology currently gaining significant traction is Supercritical Fluid Extraction (SFE), utilizing carbon dioxide (CO2) as a solvent. SFE offers distinct advantages: it is non-toxic, non-flammable, and allows for precise control over extraction parameters (temperature and pressure), resulting in an Oryzanol extract that is highly concentrated and virtually solvent-free. Although the initial capital outlay for SFE equipment is high, the resulting high-purity product commands a premium price, making it economically viable for specialized producers targeting the high-end nutraceutical and pharmaceutical markets where quality is non-negotiable.

Furthermore, chromatographic separation techniques, such as High-Performance Liquid Chromatography (HPLC) and column chromatography, are crucial in the final purification stage, particularly for isolating specific Oryzanol isomers or achieving the 98%+ crystalline grade. Emerging technologies include enzymatic extraction, which utilizes specific enzymes to release Oryzanol from the rice bran matrix under mild conditions, offering an environmentally sustainable and energy-efficient alternative. Continuous innovation in microencapsulation and liposomal delivery systems is also pivotal, focusing on improving the bioavailability and stability of Oryzanol once incorporated into final products, thereby enhancing therapeutic efficacy and prolonging shelf life.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market both in terms of production capacity and consumption volume, driven by high domestic rice production (especially in China, India, and Japan). Japan, in particular, has historically pioneered Oryzanol research and application in functional foods and drugs. Rapid urbanization, coupled with rising middle-class disposable incomes and the increasing adoption of Western dietary supplement habits, fuels explosive demand in developing economies.

- North America: North America represents the fastest-growing consumption market for high-purity Oryzanol. Growth is underpinned by a robust regulatory framework supporting dietary supplements, high consumer expenditure on sports nutrition and cardiovascular health products, and strong endorsement of natural ingredients by healthcare professionals. The U.S. is the primary driver, characterized by a highly innovative nutraceutical formulation industry.

- Europe: The European market demonstrates steady growth, highly influenced by stringent regulatory requirements regarding ingredient safety and traceability (e.g., Novel Food Regulations). Demand is strong in Western European nations, driven by an aging population seeking natural cholesterol management solutions and a sophisticated cosmetics industry prioritizing high-performance natural antioxidants. Germany and the UK are key consumption hubs.

- Latin America (LATAM): LATAM is an emerging market, showing potential for growth due to increasing health consciousness and rising imports of finished nutritional supplements. Brazil and Mexico are primary consumers, with local agricultural activity offering nascent opportunities for domestic rice bran processing and extraction facilities, reducing reliance on expensive imports.

- Middle East and Africa (MEA): The MEA region remains a smaller but promising market, largely dependent on finished product imports. Market growth is stimulated by lifestyle changes leading to higher rates of metabolic disorders, alongside governmental health initiatives promoting better nutrition. Growth is concentrated in the GCC countries and South Africa, focusing primarily on high-end dietary supplements and functional beverages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oryzanol Market.- Tsuno Rice Fine Chemicals Co., Ltd.

- Riken Vitamin Co., Ltd.

- Oryza Oil & Fat Chemical Co., Ltd.

- Bunge Loders Croklaan (Part of Bunge Limited)

- A&A Biotechnology

- Green Grass Group

- OptiPure (A Division of Ingredients by Nature)

- BASF SE

- Evonik Industries AG

- Royal DSM N.V.

- Kothari Phytochemicals International

- Fenchem Biotek Ltd.

- Oryzain Industries

- Shanghai Bettersyn Biotech Co., Ltd.

- Penta Manufacturing Company

- Vee Kay International

- Xi’an Natural Field Bio-Technique Co., Ltd.

- Nutricare Products Pvt. Ltd.

- Gencor Nutrients

- Jiangsu Yongjian Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Oryzanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and key benefit of Gamma-Oryzanol in dietary supplements?

The primary function of Gamma-Oryzanol in supplements is its potent antioxidant and cholesterol-lowering capability. It effectively helps reduce levels of LDL (bad) cholesterol while potentially increasing HDL (good) cholesterol, thereby supporting overall cardiovascular health and reducing oxidative stress in the body.

Which geographical region dominates the global supply chain for Oryzanol?

The Asia Pacific (APAC) region dominates the global Oryzanol supply chain, primarily due to large-scale rice cultivation and subsequent high availability of rice bran, which is the raw material. Countries like China, India, and Japan house major processing and extraction facilities crucial for global supply.

How do cosmetic companies utilize Oryzanol in their formulations?

Cosmetic companies utilize Oryzanol as a natural UV protectant, an effective antioxidant, and a skin conditioning agent. It helps neutralize free radicals caused by sun exposure and pollution, assists in maintaining the skin barrier function, and is often used in anti-aging and moisturizing creams.

What technological advancements are critical for producing high-purity pharmaceutical-grade Oryzanol?

The critical technological advancements are centered on non-toxic extraction and high-precision purification. Supercritical Fluid Extraction (SFE) using CO2 and advanced chromatographic separation techniques are essential for achieving the crystalline, solvent-free, and high-purity (98% and above) Oryzanol grade mandated by the pharmaceutical sector.

What are the key differences between low-purity and high-purity Oryzanol market applications?

Low-purity Oryzanol (30%-50%) is typically directed towards high-volume, lower-cost applications such as animal feed additives or general-purpose crude oil derivatives. Conversely, high-purity Oryzanol (90%+ purity) is reserved for premium human consumption products, including high-end nutraceuticals, sensitive cosmetic products, and pharmaceutical development, commanding significantly higher market prices.

The extensive analysis of the Oryzanol market confirms its vital role at the intersection of natural ingredients, advanced nutrition, and preventative medicine. The momentum generated by consumer focus on cardiovascular and overall wellness is expected to sustain high growth rates across all major application segments, particularly nutraceuticals and specialized cosmetics. Key players are strategically focused on improving purification processes, specifically leveraging cleaner technologies like SFE, to meet the stringent quality requirements of Western markets. Furthermore, integration of digital technologies, including AI, is poised to refine manufacturing consistency and accelerate the discovery of new therapeutic applications for this naturally derived compound.

Future market success will heavily depend on overcoming the persistent challenge of raw material volatility stemming from agricultural dependence, which necessitates robust, diversified sourcing strategies and technological solutions that maximize yield from available rice bran oil resources. As regulatory bodies globally continue to validate the health claims associated with Oryzanol, market access will broaden, further cementing its status as a premium, functional ingredient essential for supporting modern health trends. The pharmaceutical pathway, while demanding in terms of compliance and investment, offers the highest potential for long-term value creation through new drug development centered on Oryzanol's unique metabolic and anti-inflammatory attributes.

Moreover, the competition within the Oryzanol market is increasingly shifting from cost leadership to quality leadership. Suppliers who can demonstrate end-to-end traceability, sustainability in sourcing, and consistent delivery of high-purity grades will capture market share from smaller, less technologically equipped competitors. Strategic mergers, acquisitions, and joint ventures aimed at securing access to proprietary extraction technology or establishing integrated rice milling and refining operations are becoming central to maintaining competitive advantage. The sustained growth trajectory is forecast to make the Oryzanol sector one of the fastest-growing segments within the broader specialty ingredients market over the coming decade.

The continuous research into novel delivery systems, such as nanoemulsions and liposomes, further promises to enhance the bioavailability of Oryzanol, overcoming its natural solubility limitations and making it more effective in low concentrations within functional foods and beverages. This innovation pipeline ensures that the product remains relevant and highly competitive against synthetic alternatives. Furthermore, the global push for plant-derived ingredients in animal feed, replacing antibiotics and chemical growth promoters, provides a substantial, yet often overlooked, growth avenue for technical-grade Oryzanol, bolstering overall market volume.

In conclusion, the Oryzanol Market is positioned for significant expansion, underpinned by foundational drivers related to public health concerns and technological refinement. The market structure, while presently focused on APAC production, is evolving towards decentralized, high-value manufacturing hubs in Europe and North America to serve local demand swiftly. Successful market participants must adopt a strategy that balances raw material cost management with continuous investment in purity-enhancing technologies and rigorous regulatory adherence, positioning Oryzanol as a premium, science-backed ingredient for the global health and wellness ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager