Outbound Tourism Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443372 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Outbound Tourism Market Size

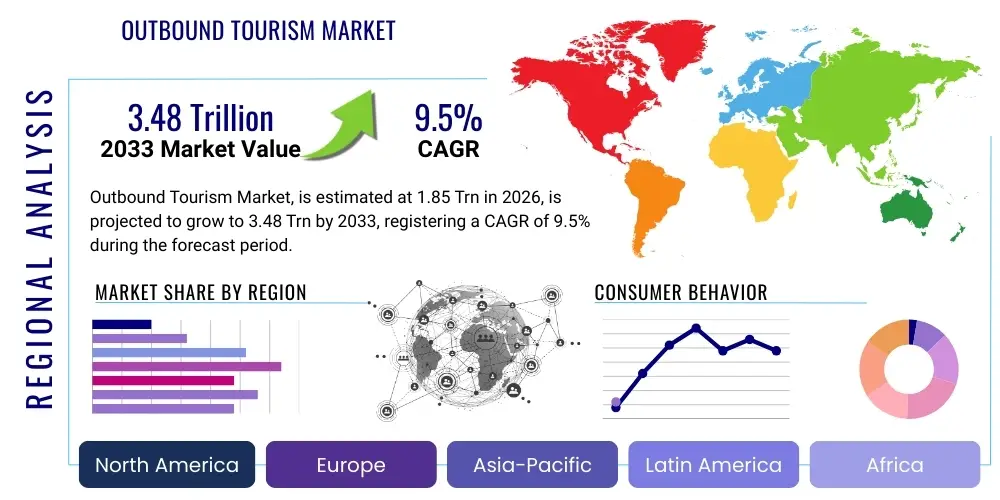

The Outbound Tourism Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Trillion in 2026 and is projected to reach USD 3.48 Trillion by the end of the forecast period in 2033.

Outbound Tourism Market introduction

The Outbound Tourism Market encompasses all travel activities undertaken by residents of one country to destinations outside their national borders, primarily for purposes such as leisure, recreation, business, education, or visiting friends and relatives (VFR). This market is characterized by complex logistical chains involving international air and ground transportation, cross-border accommodation services, and diverse travel experiences. Globalization, coupled with increasing disposable incomes in emerging economies, particularly in the Asia-Pacific region, serves as a fundamental catalyst driving robust market expansion. The digital transformation of the travel ecosystem, led by Online Travel Agencies (OTAs) and direct booking platforms, has significantly lowered barriers to international travel planning and execution.

The core product offerings within this market include customized travel packages, individual flight and accommodation bookings, specialized tours (e.g., adventure, cultural, eco-tourism), and comprehensive travel insurance services. Major applications span leisure travelers seeking relaxation and exploration, business travelers engaged in conferences or corporate meetings, and educational tourists pursuing international academic opportunities. The primary benefits derived from outbound tourism include economic diversification for host nations, fostering cultural exchange and understanding, and providing personal enrichment and relaxation for travelers. The driving factors sustaining this growth momentum include heightened global connectivity, the proliferation of low-cost carriers (LCCs) making international travel more accessible, and strong governmental support for international cooperation in travel and visa facilitation.

Outbound Tourism Market Executive Summary

The Outbound Tourism Market is currently experiencing a strong post-pandemic resurgence, marked by fundamental shifts toward sustainable and experiential travel models. Business trends emphasize hyper-personalization, driven by AI and data analytics, enabling travel providers to offer highly tailored itineraries and dynamic pricing structures. Furthermore, consolidation among major airline groups and large hotel chains continues to reshape the competitive landscape, pushing smaller, localized operators to focus on niche offerings. The adoption of contactless technologies, from mobile check-ins to biometric verification at airports, is improving efficiency and traveler throughput, while sustainability commitments are becoming mandatory criteria for consumer choice, leading to increased demand for carbon-offsetting options and eco-certified accommodations.

Regionally, the Asia Pacific (APAC) market is poised to become the most dominant force in outbound tourism, driven by the burgeoning middle classes in China, India, and Southeast Asian nations exhibiting substantial pent-up demand for international experiences. North America and Europe remain mature markets, focusing on premiumization, short-haul, and weekend trips, and demonstrating high adoption rates of digital booking technologies. Segment trends reveal a strong preference for independent travel (FIT) over traditional group tours, particularly among Millennials and Generation Z, who prioritize authenticity and flexibility. The business travel segment is also evolving, integrating ‘bleisure’ (business plus leisure) components, lengthening average trip durations, and necessitating integrated booking solutions that handle complex corporate policies seamlessly.

AI Impact Analysis on Outbound Tourism Market

Common user questions regarding AI’s impact on outbound tourism frequently revolve around how AI can enhance the personalization of itineraries, ensure real-time price accuracy, and handle immediate customer service needs during travel. Users are also concerned about the trade-off between convenience and data privacy, questioning how their personal travel data is utilized to generate predictive recommendations. A significant theme is the expected disruption to traditional travel agency roles, with many users asking if AI-powered chatbots and virtual assistants will completely replace human travel planners. Key expectations center on seamless, end-to-end digital experiences, from automated visa application guidance to on-the-ground support and dynamic trip rescheduling capabilities based on real-time external factors like weather or geopolitical events.

The synthesis of user concerns and industry developments indicates that AI is fundamentally transforming operational efficiency and the consumer experience in outbound tourism. Predictive analytics models, leveraging vast datasets of booking histories, search patterns, and social media sentiment, are enabling providers to forecast demand for specific routes and destinations with unprecedented accuracy. This capability optimizes inventory management for airlines and hotels, reducing waste and maximizing yield. Furthermore, natural language processing (NLP) and machine learning (ML) are powering sophisticated customer relationship management (CRM) systems, providing instant, multilingual support that drastically cuts response times and resolves common traveler issues proactively, significantly elevating overall customer satisfaction scores.

In the competitive landscape, the strategic deployment of AI tools dictates which market participants can capture and retain high-value travelers. Dynamic pricing algorithms allow OTAs and direct providers to adjust fares and package costs instantaneously based on real-time competitor pricing, demand fluctuations, and consumer behavior profiles, ensuring optimal revenue capture. Beyond commercial applications, AI is critical in enhancing traveler safety and security by analyzing large volumes of global risk data, providing personalized alerts regarding health hazards, political instability, or severe weather conditions at the traveler’s destination, thus fulfilling the modern traveler's requirement for informed, secure journeys. The integration of virtual reality (VR) and augmented reality (AR) powered by AI further enriches the pre-booking experience, allowing users to "test" destinations and accommodations virtually.

- AI-driven personalized itinerary generation and recommendation engines.

- Implementation of intelligent chatbots and virtual assistants for 24/7 multilingual customer support.

- Dynamic pricing optimization for flights, hotels, and travel packages based on real-time demand.

- Predictive modeling for forecasting travel demand and optimizing inventory management.

- Enhanced security and fraud detection through pattern recognition in booking data.

- Automated visa and documentation processing using machine learning algorithms.

- Real-time sentiment analysis of traveler feedback to facilitate immediate service recovery.

DRO & Impact Forces Of Outbound Tourism Market

The Outbound Tourism Market is propelled by powerful drivers (D) such as the rapid expansion of the global middle class, particularly across Asian economies, leading to substantial increases in discretionary spending allocated to international travel. Enhanced global aviation connectivity, driven by the emergence of new direct routes and the sustained growth of budget airlines, makes destinations more accessible and affordable. Conversely, the market faces significant restraints (R), including persistent geopolitical instability and rising protectionism in certain regions, which can suddenly halt travel flows and deter long-term planning. Additionally, growing concerns over the environmental footprint of air travel and increasing regulatory pressure for sustainable practices pose challenges to the high-volume model prevalent in the sector. These forces interact dynamically, shaping investment strategies and consumer behavior.

Opportunities (O) abound in the sphere of niche tourism, catering to specialized interests such as eco-tourism, medical tourism, experiential travel, and gastronomic exploration. The increasing demand for highly customized, unique travel experiences, enabled by sophisticated digital platforms, offers avenues for market differentiation and premium pricing strategies. Furthermore, technological advancements, especially in mobile integration and blockchain for secure ticketing and identity management, provide operational efficiencies and enhanced trust among consumers. The market is also heavily influenced by impact forces (I), which include disruptive events like pandemics or major economic recessions that trigger immediate, profound changes in travel patterns, and structural forces such as demographic shifts—specifically the aging populations in developed nations demanding accessible and high-quality travel products, contrasting with the adventure-seeking younger demographic.

The balance between these forces determines the overall market trajectory. While economic growth and digital penetration act as constant upward drivers, the inherent volatility associated with global health crises and political tensions mandates adaptive business models focusing on flexibility and rapid response. Achieving resilience in the face of these restraints necessitates significant investment in travel insurance products and flexible cancellation policies. The long-term growth hinges on capitalizing on the opportunity for sustainable development, transforming the perception of travel from a purely consumptive activity to one that incorporates positive local impact, thereby satisfying the ethical demands of modern global travelers. This complex interplay of macroeconomic trends, technological progress, and social responsibility defines the current operational environment for outbound tourism stakeholders worldwide.

Segmentation Analysis

The Outbound Tourism Market is highly fragmented and analyzed across several critical dimensions, enabling stakeholders to target specific consumer groups effectively with tailored products. The primary segmentation categories include the Purpose of Travel, the Mode of Transport utilized, the Traveler Type (demographics and group composition), and the specific Destination Region. Analyzing the market through these lenses provides a detailed understanding of consumer preferences, spending patterns, and required service levels. For instance, business travel necessitates high flexibility, premium services, and efficient logistics, contrasting sharply with leisure travel, which prioritizes experiences, affordability, and duration. Demographic segmentation, particularly by age, highlights distinct differences: younger travelers often seek adventure and budget-friendly options, while older travelers tend to opt for comfort, comprehensive packages, and longer durations.

Segmentation by Mode of Transport reveals that air travel dominates long-haul outbound tourism due to speed and necessity, yet the market is seeing increasing usage of high-speed rail and customized road trips for intra-continental travel, particularly within regions like Europe and North America. The Purpose of Travel is crucial, categorizing demand into leisure (holiday and recreational), business (corporate and MICE - Meetings, Incentives, Conferences, and Exhibitions), VFR (Visiting Friends and Relatives), and specialized trips (medical, educational, religious). The fastest-growing segment often revolves around experiential leisure travel, moving away from standardized sightseeing towards immersive cultural and adventure activities. Understanding these segment dynamics is essential for designing effective promotional campaigns, optimizing distribution channels, and predicting future infrastructure needs, such as capacity expansion in airports or investment in specialized accommodation facilities catering to niche groups like eco-tourists.

- By Purpose of Travel:

- Leisure and Holidays

- Business Travel (including MICE)

- Visiting Friends and Relatives (VFR)

- Educational and Academic

- Medical Tourism

- By Traveler Type:

- Solo Travelers

- Family Travelers

- Group Travelers

- Senior Travelers

- By Mode of Transport:

- Air Travel

- Road Transport (Car rentals, Buses)

- Rail Transport (High-speed, Long-distance)

- Sea Transport (Cruises, Ferries)

- By Booking Channel:

- Online Travel Agencies (OTAs)

- Direct Supplier Websites (Airlines, Hotels)

- Traditional Travel Agencies/Tour Operators

- By Age Group:

- 18-24 Years (Gen Z)

- 25-44 Years (Millennials)

- 45-64 Years (Gen X)

- 65+ Years (Baby Boomers)

Value Chain Analysis For Outbound Tourism Market

The Outbound Tourism value chain is an intricate network starting with upstream suppliers and extending to downstream end-consumers. Upstream analysis focuses on primary providers of core travel assets, including global and regional airlines, cruise lines, hotel operators, and specialized asset owners like theme parks or adventure activity providers. These entities are responsible for setting the base costs and capacity limits for the entire ecosystem. Key dynamics upstream involve fuel price volatility for airlines and asset management strategies for accommodation providers, alongside technological investment in fleet optimization and property digitization. The efficiency and pricing structures established upstream heavily dictate the final price sensitivity and flexibility available to the end consumer.

Midstream activities involve critical intermediaries that facilitate the transaction and packaging of services. This includes major Global Distribution Systems (GDS) like Amadeus and Sabre, Online Travel Agencies (OTAs) such as Expedia and Booking.com, and traditional brick-and-mortar travel agencies and tour operators. Distribution channels are bifurcated into direct and indirect methods. Direct channels involve consumers booking services straight through the supplier's website (e.g., airline or hotel direct booking portals), which allows suppliers to maintain higher margins and direct customer relationships. Indirect channels, primarily dominated by OTAs, offer convenience, price aggregation, and often package multiple services, albeit taking a commission, resulting in a complex channel management strategy for suppliers aiming for optimal reach without overly sacrificing profitability.

Downstream analysis focuses on the end-user interaction and the destination service providers. This includes in-destination transportation (taxis, local rail), food and beverage services, local tour guides, and souvenir retailers. The success of the outbound journey often relies on the quality and coordination of these highly localized, downstream services. The trend toward customized travel has placed increased importance on niche local operators and personalized guiding services, which OTAs and tour operators now integrate into their package offerings. The effective functioning of the entire value chain hinges on seamless data exchange, robust financial transaction systems, and collaborative relationships between geographically dispersed entities to deliver a unified and satisfactory traveler experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Trillion |

| Market Forecast in 2033 | USD 3.48 Trillion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Booking Holdings, Expedia Group, Trip.com Group, TUI Group, Intrepid Travel, Abercrombie & Kent, Lindblad Expeditions, Carnival Corporation & plc, Royal Caribbean Group, Airbnb, Flight Centre Travel Group, MakeMyTrip, Thomas Cook (India) Ltd., Cox & Kings, Qatar Airways, Emirates Group, Lufthansa Group, Marriott International, Hilton Worldwide, Accor Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outbound Tourism Market Potential Customers

The primary end-users and buyers in the Outbound Tourism Market are highly segmented, generally categorized by income level, generation, and travel motivation. High-net-worth individuals (HNWIs) represent a crucial segment, prioritizing bespoke luxury experiences, privacy, and exclusive access, often relying on specialized high-end tour operators or concierge services for complex itineraries. The rapidly expanding middle-class populations in emerging economies, particularly across APAC and LATAM, form the largest volume base, demonstrating price sensitivity and a preference for package tours or budget-friendly flights and standardized accommodation, often seeking their first international experiences.

Corporations constitute a vital buyer segment, particularly for the business travel and MICE components, requiring streamlined booking processes, corporate discounts, and robust expense management integration. These buyers prioritize reliability, flight schedule convenience, and premium accommodation near business hubs. Furthermore, the burgeoning demographic of "digital nomads" and remote workers represent a novel customer segment, demanding long-stay accommodation, reliable high-speed internet access globally, and flexible booking terms that accommodate extended, purpose-blended trips. Targeting potential customers requires nuanced understanding of their specific digital platform usage and sensitivity to value-added services over sheer cost reduction.

Generational segmentation is paramount: Millennials and Gen Z increasingly utilize social media for destination discovery and booking, favoring sustainable brands and authentic, personalized cultural immersion. Baby Boomers, conversely, often seek comfortable, well-organized long-duration trips, prioritizing safety, accessibility, and high levels of customer support during travel. Therefore, effective market penetration necessitates diversified service delivery, spanning highly digital, self-service platforms for younger travelers and dedicated, human-assisted consultative services for older or specialized groups, ensuring maximum customer lifetime value across the diverse customer spectrum.

Outbound Tourism Market Key Technology Landscape

The Outbound Tourism Market is undergoing rapid technological transformation, primarily centered on enhancing efficiency, personalization, and security across the customer journey. One key technological pillar is the robust deployment of Artificial Intelligence (AI) and Machine Learning (ML), as detailed previously, which powers recommendation engines, predictive analytics for demand forecasting, and conversational interfaces (chatbots). Furthermore, the shift to mobile-first platforms is ubiquitous, with travelers demanding seamless booking, check-in, and in-destination guidance through dedicated travel apps. These applications often leverage geo-location services and push notifications to offer real-time, context-aware information, ranging from flight gate changes to local restaurant recommendations, fundamentally integrating technology into the physical act of travel.

Another significant area of technological investment is in Distributed Ledger Technology (DLT), commonly known as Blockchain. While still nascent, blockchain applications are being explored extensively to revolutionize ticketing, loyalty programs, and identity management. For ticketing, DLT offers enhanced security against fraud and allows for transparent, verifiable transfers, reducing dependence on centralized clearing systems. In identity management, it promises a secure, single digital identity credential that can be used across borders for airport security, hotel check-ins, and even visa application streamlining, significantly improving the friction points associated with international travel. This technology holds the potential to build unprecedented levels of trust and transparency across the complex array of travel suppliers and intermediaries.

Moreover, the Internet of Things (IoT) is increasingly integrated into the hospitality and airport ecosystem, contributing substantially to operational streamlining and personalized experiences. Smart hotel rooms, equipped with sensors and connected devices, allow guests to control temperature, lighting, and services via voice commands or mobile apps. Similarly, smart airports utilize IoT sensors for real-time monitoring of luggage, crowd flow, and infrastructure maintenance, optimizing resource allocation and reducing delays. The convergence of 5G networks further accelerates the effectiveness of these technologies, enabling faster data processing and real-time communication, which are vital for delivering the seamless, hyper-connected travel experience that modern outbound tourists expect from their service providers.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate in the outbound tourism market globally. This exponential growth is primarily driven by the expansion of the middle class in emerging economies like China, India, and Indonesia, coupled with increasing accessibility of international flights and simplified visa regimes in key destination markets. Chinese outbound tourists represent the largest volume and spending segment globally, though recent trends show diversification to nearby Asian destinations and increasingly complex, independent travel to Europe and North America. India is poised to be the next major growth engine, characterized by a younger demographic prioritizing adventure and experiential tourism.

- Europe: Europe remains a mature market characterized by high outbound travel frequency, driven by short-haul trips within the Schengen area and a strong tradition of long-haul holidays. The market here focuses heavily on sustainability and quality of experience. Key outbound markets include Germany, the UK, and France. European travelers are highly digitally engaged, demanding sophisticated mobile booking solutions and ethical, eco-friendly travel options. The segment is also marked by substantial senior travel activity, prioritizing cruises and comprehensive packaged tours.

- North America (NA): The U.S. and Canada constitute a highly valuable market, dominated by long-haul travel, primarily to Europe, Latin America, and increasingly Asia. North American outbound tourism is characterized by high average spending per trip and a strong reliance on loyalty programs (e.g., airline miles, hotel points). Business travel remains a significant component, necessitating reliable, premium services. A key trend is the rise of 'revenge travel' post-pandemic, focusing on bucket-list destinations and high-end luxury experiences, driving growth in the premium segment.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, demonstrates substantial long-term growth potential, though it is often subject to local economic volatility and currency fluctuations. Outbound travel is largely concentrated towards North America and Europe, driven by VFR segments and leisure travel. Market development is heavily reliant on improvements in local economic stability and increased access to reliable international air routes. Digital adoption is high, with mobile devices being the preferred booking channel for travel services.

- Middle East and Africa (MEA): The Middle East market is dominated by high-income travelers from the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), characterized by high expenditures on luxury travel, medical tourism, and educational trips. Destinations such as the UK, Switzerland, and the U.S. are highly favored. The African market, while smaller, is growing, particularly from South Africa and Nigeria, often driven by VFR and business travel, necessitating specialized regional airline connectivity and robust visa processing support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outbound Tourism Market.- Booking Holdings (Booking.com, Agoda, Priceline)

- Expedia Group (Expedia, Hotels.com, Vrbo)

- Trip.com Group (Ctrip, Qunar, Skyscanner)

- TUI Group

- Intrepid Travel

- Abercrombie & Kent

- Lindblad Expeditions

- Carnival Corporation & plc

- Royal Caribbean Group

- Airbnb

- Flight Centre Travel Group

- MakeMyTrip

- Thomas Cook (India) Ltd.

- Cox & Kings

- Qatar Airways

- Emirates Group

- Lufthansa Group

- Marriott International

- Hilton Worldwide

- Accor Group

Frequently Asked Questions

Analyze common user questions about the Outbound Tourism market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Outbound Tourism Market?

The primary driver is the rapid expansion of the global middle class, particularly in emerging economies of Asia Pacific, resulting in increased disposable incomes and greater propensity for international leisure travel and cultural exchange.

How is AI specifically influencing booking processes in outbound tourism?

AI utilizes predictive analytics to personalize travel recommendations, optimize pricing dynamically in real-time, and manage instant customer inquiries through sophisticated chatbots, leading to faster, more customized, and efficient booking experiences for international travelers.

Which geographical region holds the highest growth potential for outbound tourism?

The Asia Pacific (APAC) region, driven predominantly by China and India, is anticipated to register the highest Compound Annual Growth Rate (CAGR) due to low current penetration rates and significant demographic shifts increasing travel affordability.

What are the major restraints affecting the growth of the Outbound Tourism Market?

Key restraints include geopolitical instability, which introduces travel uncertainty, increasing environmental concerns related to air travel's carbon footprint, and economic volatility affecting consumer confidence and discretionary travel spending globally.

What are the prevalent segmentation categories used to analyze the market?

The market is predominantly segmented by Purpose of Travel (Leisure, Business, VFR), Traveler Type (Solo, Family, Group), Mode of Transport (Air, Rail, Road), and Booking Channel (OTA, Direct Supplier, Traditional Agency).

The Outbound Tourism Market remains robustly dynamic, continuously evolving under the influence of technological disruption and shifting consumer priorities towards sustainability and unique experiences. The integration of advanced AI tools is moving beyond simple recommendation systems to fundamentally reconstruct the travel planning and execution phases, offering unparalleled personalization and operational efficiencies. Regulatory bodies and industry players are increasingly focusing on multilateral agreements to facilitate easier cross-border movement, enhancing infrastructure, and mitigating environmental impact, ensuring long-term viable growth. Geographically, while established markets in North America and Europe retain high expenditure levels, the future dominance of the market hinges on the capacity and willingness of suppliers to effectively cater to the immense and diverse demands emanating from the burgeoning middle-class populations across the APAC region. The success of travel service providers will be intrinsically linked to their adaptability in incorporating flexible, technologically superior, and ethically responsible offerings into their core business models to attract and retain the modern global traveler.

Digital transformation, particularly the move towards mobile-centric ecosystems and the utilization of cloud-based platforms for integrated service delivery, is central to managing the complexity inherent in international travel logistics. Stakeholders across the value chain, from upstream airlines to downstream local operators, must prioritize investment in seamless cross-platform communication and secure data handling to minimize friction points for travelers. Furthermore, the shift in market preference towards niche and experiential travel segments necessitates innovation in product development, moving away from mass tourism packages. This includes developing specialized products for wellness tourism, adventure expeditions, and educational sabbaticals, which command higher average spending and cater to the specific demands of discerning travelers seeking deeper, authentic cultural engagement. The long-term forecast suggests sustained growth, contingent upon the industry's collective ability to navigate economic uncertainties and prioritize environmental stewardship in their global operations.

The strategic imperative for market leaders involves fostering resilience against external shocks, such as health crises or geopolitical conflicts, by diversifying destination portfolios and offering comprehensive insurance and cancellation flexibilities. Competitive advantage is increasingly gained through proprietary data utilization and superior customer relationship management (CRM) capabilities powered by sophisticated analytics. As the competitive landscape intensifies, characterized by major OTA mergers and airline code-share expansions, smaller, specialized operators are finding success by focusing sharply on unique value propositions and exceptional, human-centric service delivery, contrasting with the automated efficiency of large digital platforms. The convergence of travel technology (TravelTech) and financial technology (FinTech) is also noteworthy, facilitating micro-lending for travel, secure cross-currency transactions, and integrated expense reporting for business travelers, thereby reducing barriers to international travel and sustaining the positive momentum forecast for the outbound tourism sector through 2033.

The imperative for sustainability is no longer a peripheral concern but a core strategic pillar for outbound tourism stakeholders. Consumers, especially in developed markets, are exhibiting a higher willingness to pay a premium for certified carbon-neutral flights and accommodations, placing pressure on airlines to invest in Sustainable Aviation Fuels (SAF) and on hotels to adhere to strict green building standards. This push for responsible tourism is creating a new segment of environmentally conscious travelers who specifically choose tour operators transparent about their supply chain ethics and local community engagement. Furthermore, governmental policies supporting international tourism—through visa waiver programs, open skies agreements, and investment in cross-border infrastructure—play a pivotal role in unlocking new market potential and facilitating smoother, high-volume international movement, underpinning the robust CAGR projected for the forecast period.

The development of customized marketing strategies, moving beyond broad demographics to precise psychographic segmentation, is essential for capturing niche markets. For instance, focusing marketing efforts on the specific interests of culinary tourists, heritage seekers, or sports enthusiasts allows providers to optimize their promotional spend and achieve higher conversion rates. The role of destination marketing organizations (DMOs) in this ecosystem is evolving, shifting from simple promotion to co-creation of safe and sustainable destination experiences in partnership with international tour operators. This collaboration ensures that local communities benefit directly from the inbound spend generated by outbound travelers, addressing social equity concerns often associated with large-scale tourism. The future of outbound tourism is defined by sophisticated digital integration, personalized service delivery, and a non-negotiable commitment to sustainable global practices.

The long-term outlook for the outbound tourism sector suggests continued emphasis on health and safety protocols as non-negotiable components of the travel package. This includes enhanced transparency regarding destination-specific health advisories, comprehensive pre-departure testing options (where required), and partnerships with high-standard medical facilities abroad for immediate traveler support. The adoption of robust digital health passports and verifiable credential systems is gaining traction, promising to simplify cross-border health checks and reduce administrative delays at airports. Furthermore, the growing demand for flexibility means that travel products must inherently feature modularity, allowing travelers to easily modify dates, routes, and services without incurring punitive cancellation fees, which fundamentally alters the risk management strategies employed by travel insurance providers and major service suppliers.

Investment in technological training for human agents is crucial, as the increased sophistication of AI tools means human interaction is reserved for complex, high-value, and emotional aspects of trip planning or problem resolution. This hybrid service model—leveraging AI for speed and humans for complexity—is proving most effective in maintaining customer loyalty in a competitive environment. The exploration of new modalities of travel, such as space tourism and ultra-high-speed ground transport connecting continents, while currently niche, points toward a future where the concept of "outbound" travel may involve even greater geographical scope and technological reliance. Stakeholders must therefore maintain agile organizational structures capable of integrating disruptive innovations quickly, ensuring sustained relevance in an industry characterized by high volatility and rapid technological change.

Finally, macroeconomic factors, including global interest rate movements and the stability of major reserve currencies, exert considerable influence on the affordability of international travel. For highly currency-sensitive outbound markets, exchange rate volatility can instantly impact purchasing power, necessitating dynamic hedging strategies for tour operators and transparent pricing models for consumers. Government investment in bilateral tourism agreements that reduce visa restrictions and taxes between trading partners remains a powerful catalyst for encouraging travel volume. Therefore, comprehensive market reports must track not only consumer trends and technological adoption but also the fluid geopolitical and macroeconomic climate that defines the operational boundaries and growth forecasts for the USD 3.48 Trillion Outbound Tourism Market by 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager