Outdoor Camp Kitchen Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442229 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Outdoor Camp Kitchen Market Size

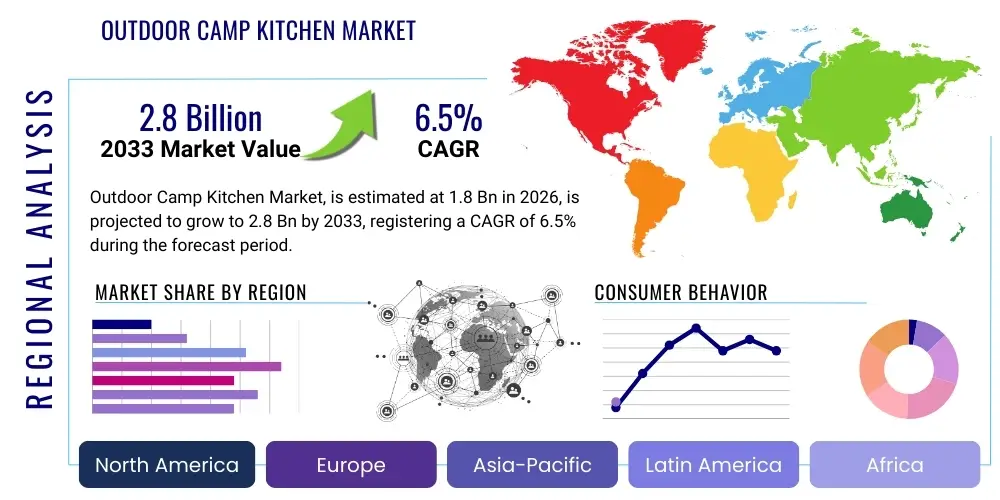

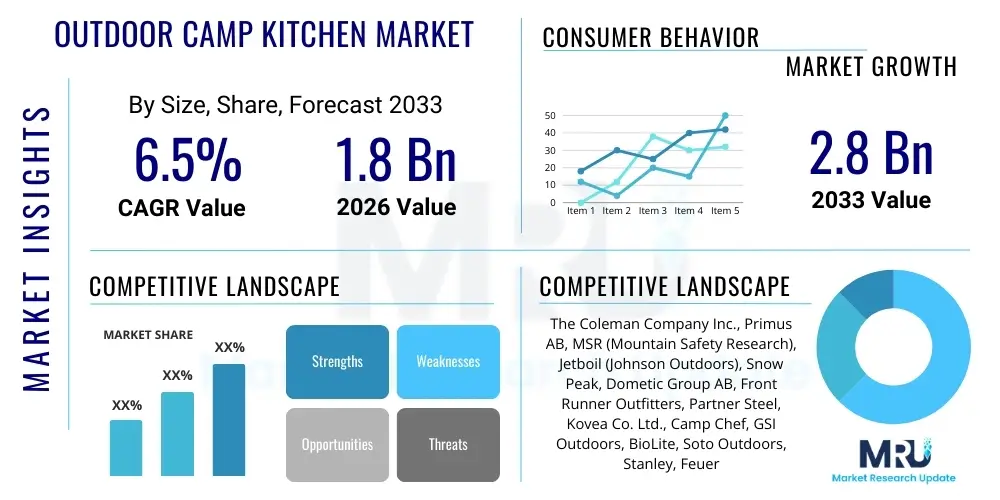

The Outdoor Camp Kitchen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Outdoor Camp Kitchen Market introduction

The Outdoor Camp Kitchen Market encompasses a diverse range of portable, functional, and durable equipment designed to facilitate cooking and food preparation in non-traditional settings, primarily during camping, backpacking, overlanding, and remote excursions. These systems include modular components such as compact stoves, collapsible sinks, portable storage units, food preparation surfaces, and specialized cookware tailored for outdoor use. The fundamental objective of these products is to replicate the efficiency and convenience of a home kitchen in rugged environments, enhancing the overall quality and enjoyment of outdoor dining experiences while adhering to principles of mobility and weight optimization.

Major applications of outdoor camp kitchens extend beyond traditional recreational camping to include specialized uses in off-grid living, emergency preparedness, and remote scientific expeditions. The market has seen significant evolution driven by consumer demand for increased efficiency, reduced weight, and integration of smart features, such as advanced fuel efficiency in stoves and highly durable, food-grade materials that withstand extreme temperatures and environmental stresses. The primary benefits derived from these integrated systems include improved food safety, greater variety in meal preparation capabilities, and streamlined organization, which collectively minimize the environmental impact often associated with dispersed cooking practices.

The market growth is substantially driven by the global resurgence in outdoor recreational activities, particularly among younger demographics who prioritize experiential travel and self-sufficiency in remote areas. Furthermore, advancements in materials science, leading to lighter yet sturdier products (such as titanium and specialized alloys), alongside growing disposable incomes in developed and rapidly developing economies, significantly fuel product adoption. The shift towards sustainable and eco-friendly camping gear also presents a crucial opportunity, pushing manufacturers to innovate systems that minimize waste and maximize energy conservation, thereby ensuring sustained market expansion throughout the forecast period.

Outdoor Camp Kitchen Market Executive Summary

The global Outdoor Camp Kitchen Market is undergoing robust expansion, characterized by significant shifts towards modularity, lightweight design, and premiumization driven by enthusiastic overlanding and specialized remote adventure segments. Business trends indicate a pronounced focus on direct-to-consumer (DTC) sales models, alongside intensified product differentiation through sustainability credentials and multi-functional designs that cater to various user skill levels and trip durations. Key players are heavily investing in product development to meet stringent demands for durability and ease of setup, recognizing that convenience is a paramount factor influencing purchasing decisions among modern campers, distinguishing robust expedition systems from simpler backpacking setups.

Regionally, North America maintains market dominance, propelled by a deep-rooted camping culture, high discretionary spending, and the popularity of extensive road trips and recreational vehicle (RV) usage, necessitating comprehensive kitchen setups. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by rising interest in domestic tourism, increasing middle-class disposable income, and government initiatives promoting outdoor leisure activities in countries like China, Japan, and Australia. European markets demonstrate a strong preference for high-quality, sustainably sourced, and aesthetically pleasing products, aligning with their established standards for environmental compliance and product longevity.

Segmentation trends highlight the increasing significance of the integrated systems segment, which offers comprehensive, box-style kitchens that bundle stoves, prep areas, and storage into one portable unit, appealing particularly to family campers and overlanders who prioritize organization and minimizing setup time. Conversely, the demand for ultra-lightweight, high-performance cooking gear remains strong within the specialty backpacking segment, driving innovation in advanced materials like specialized aluminum alloys and carbon fiber components. The aftermarket for accessories, including specialized induction cooktops compatible with portable power stations, is also witnessing accelerated growth, reflecting the broader market trend towards electrification and maximizing self-sufficiency off-grid.

AI Impact Analysis on Outdoor Camp Kitchen Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Outdoor Camp Kitchen Market reveals primary themes revolving around enhanced planning, personalized cooking experiences, and integrated safety mechanisms. Users frequently inquire about the feasibility of AI-driven meal planning apps that automatically calculate caloric and nutritional needs based on trip duration, weather conditions, and physical exertion levels. There is significant interest in 'smart' camp stoves capable of maintaining precise temperature control through embedded sensors and algorithms, ensuring perfect cooking results even under varying altitude and wind conditions. Furthermore, concerns often center on how AI can optimize resource management, specifically monitoring fuel levels, food freshness (via smart storage integration), and suggesting efficient replenishment strategies during long expeditions.

The key expectations are centered on AI transforming the camp kitchen experience from purely functional to highly personalized and seamless. This includes AI algorithms optimizing packing lists based on recipe suggestions and available storage space, minimizing weight and redundancy. Manufacturers are exploring incorporating machine learning into portable power solutions, allowing battery management systems to learn usage patterns and predict remaining cook time accurately, integrating seamlessly with induction cooktops and portable refrigeration units. While direct AI application in hardware (like a self-cleaning sink) is still nascent, the power of AI lies predominantly in enhancing the software ecosystem surrounding the physical kitchen components.

Adoption of AI-enhanced features will likely start with high-end, premium systems targeting professional users, extreme outdoor enthusiasts, and specialized commercial operators who demand reliability and precision. The integration of voice commands for operating smart stoves or referencing digital recipes hands-free is a foreseen trend, improving user safety and convenience in challenging environments. The ethical considerations around data privacy and security related to detailed nutritional and location tracking also form a part of user discourse, requiring transparent data handling policies from market innovators seeking to capitalize on these smart technologies.

- Enhanced Meal Planning: AI algorithms suggest recipes based on ingredients, environment, and caloric requirements.

- Optimized Resource Management: Predictive analytics for fuel consumption, water purification needs, and food spoilage monitoring.

- Smart Temperature Control: Sensor-driven stoves adjust heat automatically based on altitude and wind for consistent cooking.

- Personalized Cooking Guides: Real-time digital assistance for new recipes via integrated screen interfaces.

- Inventory Tracking: Automated tracking of supplies within smart storage units to prompt restocking alerts.

DRO & Impact Forces Of Outdoor Camp Kitchen Market

The dynamics of the Outdoor Camp Kitchen Market are strongly influenced by the accelerating global participation in outdoor recreation, particularly camping and overlanding, serving as the primary driver. This trend is amplified by advancements in product design that prioritize compact, multi-functional solutions, making outdoor cooking accessible and convenient for novice and experienced users alike. However, the market faces significant restraints, chiefly the high initial cost of premium, integrated kitchen systems, which can deter budget-conscious consumers. Furthermore, the reliance on specialized fuels or portable power sources introduces logistical complexities and limitations in extremely remote locations, slightly dampening universal adoption rates across all segments of outdoor enthusiasts.

Opportunities for market growth are abundant, notably in the development and proliferation of lightweight, efficient, and sustainable power solutions, such as high-capacity solar panels and portable lithium-ion battery packs, which directly enable the use of modern appliances like induction cooktops and electric coolers. A crucial opportunity also lies in penetrating emerging markets, particularly in Asia, where a burgeoning middle class is seeking leisure activities and domestic travel options. Furthermore, manufacturers can capitalize on the increasing consumer preference for highly customizable and modular kitchen systems that can be tailored precisely to the specific requirements of various types of expeditions, from simple car camping to months-long off-grid exploration.

The key impact forces shaping this market include intense competition leading to rapid innovation in material science and thermal efficiency, alongside stringent regulatory pressures related to environmental safety and fire hazard prevention, which dictate product design standards, particularly for stoves and fuel containers. Furthermore, socioeconomic factors such as fluctuating fuel prices and global tourism trends significantly influence consumer travel budgets and, consequently, their spending on high-end outdoor equipment. The synergistic effect of social media and digital content creation, where users showcase elaborate outdoor meals, also acts as a powerful promotional force, driving demand for aesthetically pleasing and high-performance cooking gear that supports such content creation.

Segmentation Analysis

The Outdoor Camp Kitchen Market is segmented across several crucial dimensions, allowing manufacturers and retailers to target specific user groups with tailored product offerings. The key segmentation criteria include Product Type, Distribution Channel, and End-User. Analyzing these segments reveals shifting consumer preferences, particularly the movement towards comprehensive, bundled solutions that offer convenience and robustness over individual, piecemeal components. The market structure emphasizes the importance of differentiation based on intended use, recognizing that the needs of a long-distance backpacker differ significantly from those of a family utilizing a car camping setup, thus requiring highly specific design philosophies in terms of weight, volume, and functionality.

The Product Type segment is dominated by portable stoves and burners, which are fundamental to any outdoor cooking setup, but the fastest growth is observed within the integrated and modular kitchen systems segment. These systems, often built into boxes or drawers, provide a complete cooking, preparation, and storage unit, appealing heavily to the overlanding and RV market where space efficiency and quick deployment are essential. Concurrently, the Distribution Channel analysis shows a strong reliance on specialized outdoor retail stores and growing traction through e-commerce platforms, driven by detailed product reviews and the ability for manufacturers to bypass traditional intermediaries.

Understanding these segmentations is critical for strategic market positioning. Companies focusing on the high-margin, specialized segment may invest heavily in advanced materials (like titanium) and smart features, targeting professional guides and ultra-lightweight enthusiasts. Conversely, manufacturers targeting the mass market emphasize affordability, durability, and multi-use components distributed widely through large chain retailers. The diversity across these segments ensures sustained innovation across the value chain, constantly balancing the trade-offs between portability, performance, and price point to meet the heterogeneous demands of the global outdoor enthusiast community.

- Product Type

- Portable Stoves and Burners (Gas, Liquid Fuel, Wood)

- Cookware and Utensils (Pots, Pans, Cutlery Sets)

- Integrated Kitchen Systems (Box Kitchens, Slide-out Systems)

- Food Preparation Tools (Cutting Boards, Prep Stations)

- Storage and Organization Units (Containers, Shelving)

- Distribution Channel

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Outdoor Stores, Department Stores)

- End-User

- Recreational Campers (Family and Casual Users)

- Backpackers and Mountaineers (Ultra-lightweight Focus)

- Overlanders and RV Users (Integrated and Durable Systems)

- Emergency and Military Applications

Value Chain Analysis For Outdoor Camp Kitchen Market

The value chain for the Outdoor Camp Kitchen Market begins with the upstream segment, encompassing the sourcing and processing of essential raw materials. This includes high-grade stainless steel, specialized aluminum alloys (often required for lightweight and heat-efficient cookware), titanium for premium products, durable plastics, and composite materials used in storage boxes and frames. Key upstream activities involve smelting, rolling, and specialized material treatments that ensure the components can withstand high temperatures, corrosion, and physical impact typical of outdoor use. Successful manufacturers maintain strong, reliable relationships with specialized metal and polymer suppliers who can guarantee consistent quality and adherence to strict safety standards required for food-contact items.

The midstream phase focuses on manufacturing and assembly, where design innovation plays a critical role. This involves precision engineering for components like folding mechanisms, pressurized fuel delivery systems (stoves), and integration of advanced thermal insulation (coolers). Production is often consolidated in regions with specialized manufacturing capabilities, emphasizing scalable processes and quality control to ensure products meet international standards for durability and safety, such as CSA or CE certifications. Logistical efficiency in manufacturing is paramount, especially for modular systems that require complex component integration while maintaining a portable form factor, leading to increased automation in the assembly process to reduce labor costs and improve precision.

The downstream component involves distribution and sales. The market utilizes both direct and indirect distribution channels. Direct channels include manufacturer-owned e-commerce platforms, which allow for better margin control and direct customer feedback gathering, particularly effective for high-value items or customized systems. Indirect channels, which remain crucial, involve wholesale distributors, large sporting goods chains, and specialized outdoor retailers who provide necessary product expertise and localized customer service. Specialized retailers are vital because consumers often seek hands-on demonstrations and expert advice regarding the compatibility and functionality of integrated camp kitchen components before committing to a purchase. Effective marketing strategies in the downstream segment leverage digital content and influencer partnerships to showcase product resilience and functionality in real-world outdoor settings.

Outdoor Camp Kitchen Market Potential Customers

The primary segment of potential customers for the Outdoor Camp Kitchen Market comprises recreational campers, ranging from weekend family car campers to casual users seeking occasional outdoor dining convenience. These buyers prioritize ease of use, durability, and sufficient capacity to prepare meals for small groups. Their purchasing decisions are often influenced by value proposition, focusing on mid-range integrated systems and durable, standardized cookware sets that offer a balance between affordability and functionality. They frequently utilize large sporting goods retailers and general e-commerce platforms to source their equipment, often seeking comprehensive starter kits that minimize the complexity of selecting individual components.

A highly lucrative and rapidly expanding customer segment is Overlanders and specialized expedition users. These buyers engage in extended, often remote, journeys using specialized vehicles (4x4s or RVs), requiring the highest level of reliability, robustness, and integration. Their demands drive the premium segment, focusing on heavy-duty slide-out kitchen modules, high-efficiency induction systems compatible with vehicle power setups, and advanced portable refrigeration. For this group, weight and space efficiency are secondary to sheer durability and mission-critical reliability, leading to investment in expensive, high-performance materials like marine-grade steel and custom fabrication solutions, often sourced directly from specialty gear manufacturers or custom vehicle outfitters.

The third significant segment includes Backpackers and Ultra-lightweight enthusiasts, whose core requirement is minimal weight and maximum portability, even if it means sacrificing some cooking complexity or volume. This segment targets specialized products such as titanium stoves, minimalist cook sets, and highly compressed fuel canisters. They are sophisticated consumers, driven by technical specifications, fuel efficiency metrics, and material science, often relying on specialty outdoor retailers and direct-to-consumer websites that provide deep technical documentation. Additionally, institutional buyers, such as disaster relief organizations, military units, and educational outdoor programs, represent consistent, albeit specialized, customers who purchase durable, high-volume cooking and preparation equipment designed for rapid deployment and harsh operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Coleman Company Inc., Primus AB, MSR (Mountain Safety Research), Jetboil (Johnson Outdoors), Snow Peak, Dometic Group AB, Front Runner Outfitters, Partner Steel, Kovea Co. Ltd., Camp Chef, GSI Outdoors, BioLite, Soto Outdoors, Stanley, Feuerhand, Petromax, Zoleo Inc., Goal Zero, Tembo Tusk, Ozark Trail. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Camp Kitchen Market Key Technology Landscape

The technological landscape of the Outdoor Camp Kitchen Market is defined by relentless pursuit of lighter weight, higher thermal efficiency, and increased integration of smart functionality. A core area of innovation is materials science, specifically the use of advanced metals such as high-grade titanium and hard-anodized aluminum. Titanium, despite its cost, is increasingly utilized in backpacking gear due to its exceptional strength-to-weight ratio and corrosion resistance. Hard-anodization processes enhance the durability and non-stick properties of aluminum cookware, improving cooking performance and simplifying cleaning processes in remote settings. Furthermore, composite materials and specialized polymers are being developed for robust, weather-proof storage systems and cutting-edge water purification components that are crucial for off-grid operations.

Energy and heating technology represent another vital area of innovation. Traditional liquid fuel and canister stoves are being continuously refined for better cold-weather performance and fuel efficiency, with multi-fuel capabilities becoming standard in high-end models. Crucially, the market is seeing a growing adoption of electric cooking solutions, primarily portable induction cooktops, enabled by advancements in lightweight, high-capacity lithium-ion battery banks (e.g., portable power stations). This electrification trend reduces dependence on fossil fuels in base camp environments, aligns with sustainability goals, and allows for precise temperature control, mimicking residential cooking standards.

Modular design and connectivity integration are shaping the future of camp kitchen setups. Modular systems allow users to mix and match components—such as stove tops, prep sinks, and storage drawers—to create customized layouts for specific trip requirements, significantly improving versatility. Connectivity, while nascent, involves the integration of Bluetooth or Wi-Fi into appliances like smart coolers and power banks, allowing users to monitor temperature, battery life, and resource levels via mobile applications. This move towards 'connected camping' enhances user convenience, optimizes resource utilization, and paves the way for future AI-driven optimization, ensuring the technology landscape remains dynamic and responsive to evolving consumer expectations for high-tech outdoor gear.

Regional Highlights

North America is anticipated to retain its leading position in the Outdoor Camp Kitchen Market throughout the forecast period. This dominance is attributable to the region's robust outdoor culture, substantial forested areas and national parks, and high levels of consumer disposable income dedicated to recreational activities. The U.S. and Canada have an established market for both traditional camping gear and the booming niche of Overlanding, which drives demand for premium, integrated kitchen slide-out systems and high-capacity portable power solutions. Furthermore, a highly active retail and e-commerce infrastructure specialized in outdoor goods facilitates widespread product availability and consumer engagement, reinforcing the region's strong market share and driving continuous product innovation focused on extreme durability and high performance.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), making it the most dynamic market globally. This exponential growth is underpinned by rapid urbanization, increasing middle-class income levels, and the corresponding desire for leisure activities and domestic tourism, especially among millennials and Gen Z. Countries like China, India, and Australia are witnessing a surge in camping and adventure tourism. Australian consumers, in particular, lead in adopting sophisticated overlanding and 4x4-based camping gear. Manufacturers are keenly focused on adapting product design to cater to the diverse climates and varied cooking styles prevalent across APAC, often requiring more compact, multi-functional units suitable for smaller groups and dense travel itineraries.

Europe represents a mature yet significant market characterized by a strong emphasis on sustainability, quality craftsmanship, and efficient design. European consumers show a preference for locally sourced, environmentally conscious products, driving demand for biomass stoves and highly fuel-efficient gas burners. Germany, France, and the Nordic countries are major contributors, with consumers favoring gear that adheres to strict environmental regulations and offers long operational lifetimes. The fragmented nature of European camping environments, ranging from mountain expeditions to regulated campsites, ensures a steady demand across all segments, from ultra-lightweight backpacking equipment to durable car camping setups that prioritize minimal environmental footprint and aesthetic appeal.

- North America: Market leader due to pervasive outdoor culture, high consumer spending, and strong demand from the Overlanding community.

- Asia Pacific (APAC): Fastest-growing region driven by rising disposable incomes, domestic tourism boom, and increasing interest in structured outdoor activities.

- Europe: Mature market focused on sustainable materials, fuel efficiency, and high-quality, long-lasting products, particularly in Germany and Scandinavia.

- Latin America: Emerging market with growth potential linked to eco-tourism and adventure travel, focusing on durable, mid-range affordability.

- Middle East and Africa (MEA): Growth concentrated in specialized expedition gear and luxury desert camping setups, often requiring robust, sand-resistant equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Camp Kitchen Market.- The Coleman Company Inc.

- Primus AB

- MSR (Mountain Safety Research)

- Jetboil (Johnson Outdoors)

- Snow Peak

- Dometic Group AB

- Front Runner Outfitters

- Partner Steel

- Kovea Co. Ltd.

- Camp Chef

- GSI Outdoors

- BioLite

- Soto Outdoors

- Stanley

- Feuerhand

- Petromax

- Zoleo Inc. (Focus on connectivity integration)

- Goal Zero (Focus on Portable Power that enables electric kitchens)

- Tembo Tusk

- Ozark Trail

Frequently Asked Questions

Analyze common user questions about the Outdoor Camp Kitchen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for integrated camp kitchen systems?

The primary driver is the growth of Overlanding and car camping, where consumers prioritize convenience, organization, and rapid deployment. Integrated systems, often housed in durable boxes or vehicle slide-outs, minimize setup time and maximize storage efficiency compared to separate components, appealing to users on multi-day vehicle-supported trips.

How do advancements in portable power influence camp kitchen technology?

Advancements in portable lithium-ion power stations are facilitating a major shift towards electric cooking, specifically enabling the use of induction cooktops and electric coolers. This allows campers to cook cleaner, faster, and with more precise temperature control, reducing reliance on traditional gas or liquid fuels, particularly in established base camps.

Which material is preferred for ultra-lightweight backpacking cook systems?

Titanium is highly preferred for ultra-lightweight backpacking cook systems due to its superior strength-to-weight ratio and exceptional resistance to corrosion. While more expensive than aluminum, titanium reduces pack weight significantly, which is critical for long-distance hikers and mountaineers focused on maximizing efficiency and portability.

What are the key differences between two-burner propane stoves and liquid fuel stoves?

Two-burner propane stoves (canister-based) offer superior convenience, easier setup, and stable performance at moderate temperatures, making them ideal for casual family camping. Liquid fuel stoves (like white gas) offer better performance and reliability in extreme cold or high altitudes and are often multi-fuel capable, favored by expedition campers for their robustness and efficiency in harsh environments.

Where is the Outdoor Camp Kitchen Market experiencing the fastest regional growth?

The Asia Pacific (APAC) region, particularly countries experiencing rapid economic development and increasing middle-class leisure spending such as China and India, is registering the fastest market growth. This is fueled by rising interest in domestic tourism, organized camping events, and government support for outdoor recreational infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager