Outdoor Footwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440909 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Outdoor Footwear Market Size

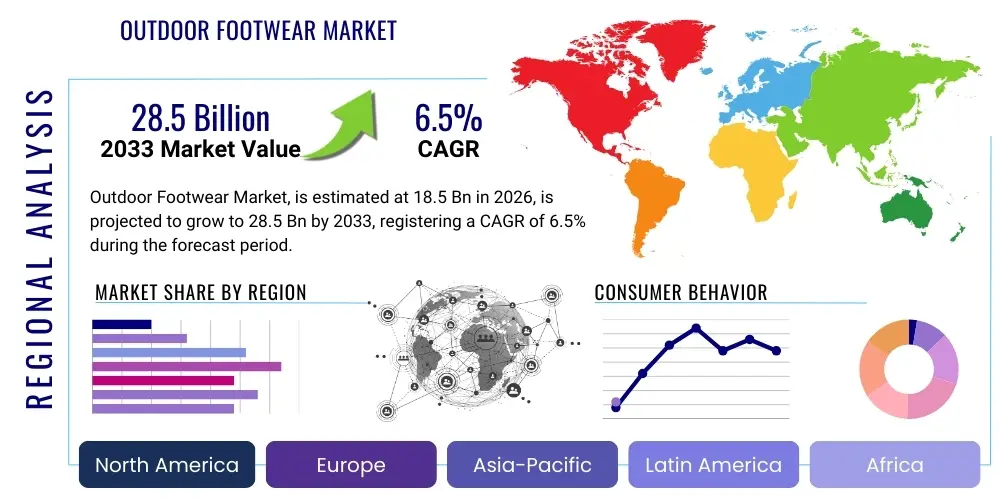

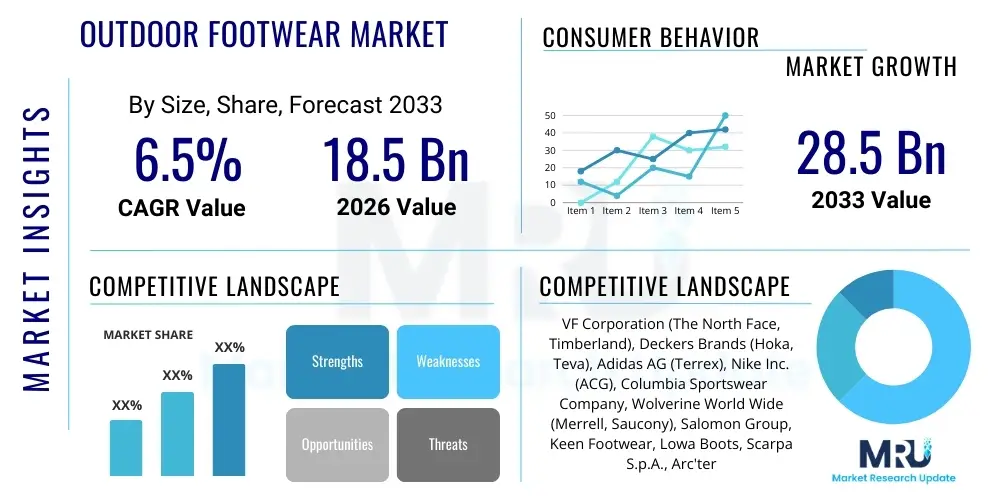

The Outdoor Footwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global participation in outdoor recreational activities, coupled with significant advancements in material science that enhance product durability, comfort, and performance across diverse terrains and climatic conditions. The premiumization trend, where consumers are willing to invest more in specialized, high-performance footwear for specific activities like trail running or mountaineering, further accelerates revenue expansion within this specialized global industry.

Outdoor Footwear Market introduction

The Outdoor Footwear Market encompasses specialized footwear designed for protection, comfort, and performance in natural, often challenging environments, distinct from everyday athletic or casual shoes. Products range widely, including technical hiking boots, light trail running shoes, waterproof walking shoes, mountaineering specific equipment, and robust water sports sandals. These products are engineered using advanced technologies focusing on features such as superior traction (outsoles), stability (midsoles), waterproof breathability (membranes like GORE-TEX), and impact absorption. The primary applications span across general outdoor recreational use, serious hiking and trekking expeditions, extreme mountaineering, backpacking, and highly dynamic activities like fast packing or trail running, serving diverse consumer segments globally.

Major driving factors include the substantial rise in health and wellness awareness globally, prompting greater engagement in nature-based activities, especially among younger demographics. Furthermore, post-pandemic trends emphasizing experiences over material goods have fueled sustained interest in domestic and international travel focused on exploring natural landscapes, directly translating into higher demand for reliable outdoor gear. Technological innovation in sustainable manufacturing practices, such as the use of recycled materials and solvent-free bonding agents, also plays a crucial role in attracting environmentally conscious consumers who prioritize ecological responsibility alongside functional performance.

The core benefits offered by high-quality outdoor footwear center on injury prevention and maximized user comfort during prolonged exposure to rugged conditions. Features like ankle support in high-cut boots minimize sprains on uneven terrain, while waterproof yet breathable membranes ensure feet remain dry, preventing blisters and frostbite. This specialized functional design, which merges ergonomic engineering with material science excellence, makes outdoor footwear indispensable for safe and enjoyable participation in activities ranging from simple day hikes to multi-day alpine treks, positioning it as a fundamental component of the adventure tourism economy and recreational sector.

Outdoor Footwear Market Executive Summary

The Outdoor Footwear Market is characterized by robust growth driven primarily by shifting consumer lifestyle preferences favoring experiential consumption and health-focused activities. Business trends indicate a strong move toward digitalization of distribution channels, with e-commerce platforms and Direct-to-Consumer (DTC) models gaining significant traction, allowing specialized brands to bypass traditional retail bottlenecks and foster direct customer relationships. Crucially, market leaders are increasingly focusing their Research and Development (RD) efforts on sustainability, integrating bio-based and recycled materials into product lines, which not only meets regulatory requirements but also serves as a critical differentiator in a crowded, competitive landscape. Mergers and acquisitions remain a relevant strategy for established companies seeking to acquire specialized niche brands, particularly those focused on performance segments like trail running, thus diversifying their portfolio and geographical reach.

Regionally, North America and Europe maintain dominance, driven by well-established outdoor recreation infrastructures, high disposable income levels, and a deeply entrenched culture of hiking and trekking. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, underpinned by rapidly expanding middle-class populations in China and India, coupled with increasing government investment in national parks and eco-tourism initiatives. This swift urbanization in APAC is paradoxically fueling a counter-movement toward nature exploration, creating immense unmet demand for reliable and affordable outdoor gear. Latin America and MEA, while smaller, present promising future growth avenues, especially within adventure tourism hotspots like Patagonia and emerging eco-tourist destinations in South Africa, necessitating localized product adaptations for unique climatic requirements.

In terms of segmentation, the Trail Running Shoes category is experiencing explosive growth, outpacing traditional heavy hiking boots, driven by the popularity of high-intensity, low-weight footwear suitable for varied terrains and fitness activities. Distribution remains primarily split between specialized retail stores, which offer expertise and fitting services, and the burgeoning online segment, which offers convenience and broader inventory access. The Men's segment currently holds the largest market share in terms of volume, but the Women's segment is projected to show a higher CAGR due to increasing female participation rates in adventure sports and a corresponding growth in product offerings specifically tailored to female biomechanics and aesthetic preferences, leading to greater average selling prices and stronger market penetration.

AI Impact Analysis on Outdoor Footwear Market

User queries regarding AI's influence in the Outdoor Footwear Market frequently center on its potential to revolutionize product personalization, supply chain efficiency, and customer interaction. Common concerns revolve around how AI can enhance the fit and performance attributes of footwear using predictive modeling, the role of generative design in creating lighter, stronger materials, and whether AI-driven inventory management can mitigate the significant seasonal volatility inherent in outdoor retail. Users are keenly interested in direct-to-consumer applications, such as virtual try-ons and personalized size recommendations based on detailed 3D foot scans processed by AI algorithms, ensuring optimal comfort and reducing return rates, which is a major logistical and financial burden for e-commerce operators in this sector.

The primary expectation is that AI will move beyond simple data analytics to truly transformative applications. For instance, manufacturers are exploring how AI can optimize the placement and density of cushioning materials in midsoles based on personalized gait analysis data, leading to truly bespoke performance footwear that adapts to individual user needs and specific terrain types. Furthermore, the integration of smart sensors into outdoor footwear, analyzed by on-board AI, promises real-time feedback on environmental conditions, foot fatigue, and biomechanical stress, offering a new dimension of safety and performance tracking for hikers and mountaineers, thereby converting the product from a static item into a connected device.

Finally, the operational impact of AI is highly anticipated in improving speed-to-market. By leveraging machine learning models to analyze global weather patterns, consumer sentiment shifts (via social media and search data), and geopolitical impacts on raw material sourcing, companies can forecast demand with much greater accuracy. This superior forecasting capability directly leads to leaner manufacturing processes, minimized waste, optimized logistics routes, and the ability to pivot design strategies mid-season in response to emerging trends or unexpected climatic events, enhancing overall operational resilience and profitability in this highly cyclical industry.

- Enhanced Predictive Fit Modeling: AI algorithms utilizing 3D scanning data to offer hyper-accurate sizing and volume recommendations, significantly reducing returns.

- Generative Design for Materials: Using AI to simulate thousands of material structures to optimize weight, durability, and specific thermal properties for specialized usage scenarios.

- Optimized Supply Chain Logistics: Machine learning forecasting demand volatility, enabling just-in-time manufacturing and dynamic inventory allocation across global distribution networks.

- Personalized Product Customization: AI analyzing gait and usage history to tailor midsole cushioning, arch support, and lug pattern for individual user profiles.

- Smart Footwear Integration: Implementation of embedded sensors and AI analytics for real-time performance tracking, health monitoring, and environmental hazard warnings.

DRO & Impact Forces Of Outdoor Footwear Market

The dynamics of the Outdoor Footwear Market are shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A dominant driver is the pervasive consumer shift towards health-focused lifestyles and the subsequent boom in recreational outdoor participation, fueled further by rising adventure tourism and the expansion of organized outdoor events like marathons and trail races. Concurrently, technological innovation acts as a potent driving force, particularly the development of high-performance, lightweight, and sustainable materials (e.g., bio-based polymers and advanced rubber compounds), which continually elevate consumer expectations regarding product functionality and environmental credentials. The ability of manufacturers to rapidly integrate these performance technologies, such as advanced waterproofing membranes and energy-returning midsole foams, determines market leadership and consumer loyalty in this highly competitive arena.

Despite strong market momentum, several restraints challenge sustained high growth. The primary restraint is the significant initial cost and inherent complexity associated with manufacturing high-quality, technical outdoor footwear, leading to premium pricing that can deter price-sensitive consumer segments in emerging economies. Furthermore, the market faces intense competition from general athletic footwear brands that are increasingly launching 'outdoor-adjacent' product lines, blurring traditional segment boundaries and placing downward pressure on mid-range pricing. External factors, such as volatile raw material costs, particularly leather and specialized synthetic compounds derived from petrochemicals, alongside increasing global logistics costs, introduce operational risk and margin compression for market participants, complicating long-term investment planning and stable pricing strategies across international markets.

Opportunities for expansion are abundant, centered largely on geographical penetration into untapped high-growth regions like Southeast Asia and parts of Africa, where disposable income is rising and infrastructure for eco-tourism is being developed. Product diversification presents another crucial avenue, specifically targeting specialized niche markets such as high-altitude trekking, tactical and military applications, and safety-focused industrial outdoor wear. Impact forces, particularly stringent governmental environmental regulations concerning material sourcing, waste reduction, and manufacturing emissions, necessitate fundamental shifts in production processes. Moreover, climate change impacts, leading to more extreme weather events, directly influence consumer purchasing behavior, increasing the demand for highly specialized, all-weather protection footwear capable of performing reliably under unpredictable, harsh environmental conditions, thereby demanding constant adaptation and resilience from market leaders.

Segmentation Analysis

The Outdoor Footwear Market is highly diversified, segmented based on Product Type, Application (End-User), Material, and Distribution Channel, reflecting the varied requirements of outdoor enthusiasts worldwide. Segmentation ensures that manufacturers can accurately target specific consumer needs, ranging from the robustness required for mountaineering expeditions to the lightweight agility demanded by trail runners. Analyzing these segments is critical for identifying key growth pockets, understanding consumer willingness to pay for specialized features, and tailoring marketing strategies to different demographic groups across diverse geographic regions. The continued evolution of product types, especially the blurring line between technical athletic shoes and light hiking gear, necessitates frequent re-evaluation of market definitions and segment performance dynamics to maintain competitive relevance.

The primary classification by Product Type—Hiking Boots, Trail Running Shoes, Mountaineering Boots, and Outdoor Sandals—reveals distinct market trajectories. While traditional Hiking Boots remain the volume backbone, the rapid consumer adoption of Trail Running Shoes indicates a strong shift towards faster, lighter, and more versatile outdoor experiences. Segmentation by Material (Leather vs. Synthetic) highlights consumer trade-offs between classic durability and waterproof performance versus modern, lightweight, and often more sustainable synthetic options. The complex segmentation by Distribution Channel—Offline (Specialty Stores, Hypermarkets) versus Online (E-commerce)—reflects the industry's digital transformation, where consumers increasingly leverage online platforms for price comparison and product research before purchase, often utilizing specialized online retailers that offer curated selections and detailed product reviews.

Geographical segmentation emphasizes regional consumer preferences and infrastructural differences. For instance, European markets prioritize sustainability and classic leather craftsmanship, while North American markets often focus on maximum technical features and aggressive marketing around brand heritage and extreme sports endorsements. Understanding these granular segmentation details allows brands to optimize supply chains and inventory mix, ensuring that appropriate products, whether high-end mountaineering boots for the Alps or lightweight sandals for Southeast Asian trails, are available at competitive price points through the preferred local distribution mechanism, thereby maximizing revenue capture and minimizing inventory carrying costs across the global footprint.

- Product Type:

- Hiking Boots (Heavy Duty, Mid-Cut, Low-Cut)

- Trail Running Shoes (Minimalist, Cushioned, Technical)

- Mountaineering Boots (Single Boot, Double Boot)

- Trekking & Multi-Sport Shoes

- Outdoor Sandals and Water Shoes

- Material:

- Leather (Full-grain, Nubuck, Suede)

- Synthetic Materials (Nylon Mesh, Polyester, PU, TPU)

- Hybrid Materials

- End-User (Application):

- Men

- Women

- Children

- Distribution Channel:

- Offline Channels:

- Specialty Sports and Outdoor Stores

- Department Stores and Hypermarkets

- Brand-Owned Outlets

- Online Channels:

- E-commerce Platforms (Amazon, Alibaba)

- Brand Websites (Direct-to-Consumer - DTC)

- Online Specialty Retailers

Value Chain Analysis For Outdoor Footwear Market

The Value Chain for the Outdoor Footwear Market begins with the upstream activities centered on raw material sourcing and primary manufacturing processes, which are critical determinants of final product quality and cost structure. Upstream analysis involves the procurement of specialized materials, including high-performance rubbers for outsoles, advanced polymer foams (like EVA and PU) for midsoles, technical fabrics (e.g., GORE-TEX or proprietary waterproof membranes), and increasingly, sustainable bio-based alternatives. Manufacturers must establish highly reliable and often exclusive partnerships with suppliers capable of providing materials that meet stringent requirements for abrasion resistance, water resistance, and breathability. Innovation at this stage, particularly in material lightweighting and sustainability certification, yields significant competitive advantage, requiring substantial investment in research and quality control to ensure component durability and ethical sourcing compliant with global standards.

Midstream processes focus on the design, manufacturing, and assembly of the footwear. This stage involves complex technical processes such as injection molding, specialized lasting techniques, and complex stitching to attach membranes and protective overlays. Due to the high degree of technical expertise and specialized machinery required, manufacturing often concentrates in regions offering skilled labor and cost efficiencies, primarily Asia (Vietnam, China, Indonesia) and parts of Europe (Italy, Romania). Brands must carefully manage production capacity, lead times, and quality assurance protocols to maintain product consistency and responsiveness to seasonal demand fluctuations. Efficient production planning and the integration of automated processes are essential for optimizing cost of goods sold (COGS) and maintaining competitive pricing in global markets where margin pressure is constantly increasing.

Downstream activities encompass warehousing, logistics, marketing, and distribution channels, leading to the end consumer. Distribution can be classified into Direct and Indirect channels. Indirect distribution, historically dominant, relies heavily on large wholesale agreements with specialized outdoor retailers and department stores, where the product benefits from expert sales advice and in-store fitting services. Direct distribution (DTC) via brand-owned physical stores and sophisticated e-commerce platforms is rapidly expanding, offering brands higher margins, direct access to consumer data, and greater control over brand messaging and pricing strategies. Effective downstream management requires optimizing global logistics networks to handle high-volume, seasonal shipments and deploying highly targeted digital marketing campaigns optimized for Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) to capture consumer attention during key purchasing cycles, especially leading into peak hiking and winter seasons.

Outdoor Footwear Market Potential Customers

Potential customers for the Outdoor Footwear Market are broadly categorized based on their primary usage intensity and demographic profile, spanning from casual recreational users to professional guides and extreme athletes. The largest segment, representing significant volume, comprises general outdoor enthusiasts who engage in activities such as day hiking, weekend camping, and walking on maintained trails. This segment prioritizes comfort, versatility, and accessible pricing, driving demand for multi-sport and light hiking shoes. This demographic often includes families, older adults seeking low-impact exercise, and young consumers adopting outdoor activities as a lifestyle choice, making them susceptible to broad-based digital marketing campaigns focused on lifestyle benefits and ease of use.

A second crucial segment consists of serious enthusiasts and professional users, including experienced trekkers, mountaineers, trail running competitors, and outdoor professionals (e.g., park rangers, geologists). This group demands specialized, high-performance footwear, often characterized by maximum durability, specialized technical features (e.g., crampon compatibility, advanced waterproof ratings, or specific ankle support systems), and willingness to pay a significant premium for specialized construction and materials. Purchases in this segment are typically high-involvement, relying heavily on peer reviews, technical specifications, and reputation, making specialized specialty stores and technical review sites critical points of influence in the purchasing journey for these knowledgeable consumers who demand product failure resilience.

Emerging consumer groups also represent substantial future market potential, including urban consumers seeking 'outdoor-ready' lifestyle wear that blends technical performance with urban aesthetics (the 'gorpcore' trend) and corporate entities purchasing durable outdoor footwear for industrial safety, field work, or tactical applications. Furthermore, the burgeoning adventure tourism sector generates a constant influx of first-time buyers needing reliable basic equipment, often influenced by rental services and package tour providers. Targeting these diverse potential customers requires a layered marketing approach, balancing broad-appeal messaging for mass segments with highly specific technical communication and channel partnerships geared toward expert and professional user bases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VF Corporation (The North Face, Timberland), Deckers Brands (Hoka, Teva), Adidas AG (Terrex), Nike Inc. (ACG), Columbia Sportswear Company, Wolverine World Wide (Merrell, Saucony), Salomon Group, Keen Footwear, Lowa Boots, Scarpa S.p.A., Arc'teryx, Mammut Sports Group AG, La Sportiva, ECCO Sko A/S, Sorel, Hi-Tec, Vasque, Garmont International, Zamberlan, ASICS Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Footwear Market Key Technology Landscape

The technological landscape of the Outdoor Footwear Market is fiercely competitive, driven by a continuous quest for lighter weight, superior durability, and enhanced environmental performance. A central focus remains on outsole technology, where proprietary rubber compounds are engineered for specific grip requirements across varied terrains—from wet rock to snow and mud. Brands leverage sophisticated geometric designs, often employing technologies like Vibram Megagrip or proprietary brand-specific systems, to maximize multi-directional traction and provide stability under load. Furthermore, the integration of advanced midsole materials, such as high-rebound EVA (Ethylene-Vinyl Acetate) or specialized Polyurethane (PU) foams, is critical for delivering sustained cushioning, energy return, and long-term structural resilience against compression set, directly impacting user comfort and reducing fatigue over multi-day use.

Another pivotal technological area is protection and climate control, primarily achieved through membrane technologies. While GORE-TEX remains a benchmark for waterproof breathability, competitors continue to innovate with proprietary membrane systems (e.g., Futurelight by The North Face or Omni-Tech by Columbia) focusing on balancing high moisture vapor transmission rates with robust hydrostatic resistance. Seamless construction methods, utilizing thermal welding and advanced bonding agents instead of traditional stitching, minimize potential failure points and enhance the overall waterproof integrity and longevity of the shoe, while reducing the manufacturing reliance on labor-intensive assembly processes, offering operational benefits.

Furthermore, digital technologies are fundamentally reshaping both the design and fit processes. Additive manufacturing (3D printing) is being explored for creating customized components, such as specialized insoles or lattice structures for midsoles, allowing for greater design complexity and personalized performance tuning. Sensor technology, coupled with Bluetooth connectivity, is enabling the development of 'smart' outdoor footwear capable of tracking metrics like altitude, distance, impact forces, and even soil temperature, providing valuable data to both the user and the manufacturer for iterative product improvement. These technological integrations move the product beyond simple protection into the realm of high-tech gear capable of augmenting the user's overall outdoor experience and safety profile.

Regional Highlights

- North America:

- Europe:

- Asia Pacific (APAC):

- Latin America:

- Middle East and Africa (MEA):

North America, comprising the United States and Canada, represents a mature and technologically sophisticated market, maintaining a substantial share of global revenue driven by high consumer spending power and a deeply ingrained culture of outdoor recreation, particularly hiking, backpacking, and trail running. The U.S. market is characterized by robust demand for premium, specialized footwear, with strong growth in the trail running and light hiking segments, reflecting a younger consumer base seeking versatility and performance. Brands leverage extensive national park systems and well-established retail infrastructure, focusing on digital engagement and sustainability certifications to capture market share. Competition is intense, with both domestic titans and European technical brands vying for dominance, necessitating continuous investment in branding and technical innovation to justify premium pricing in this highly discretionary sector.

The region’s demand dynamics are heavily influenced by seasonal variations and diverse geographical conditions, requiring brands to maintain expansive product lines suitable for everything from the arid deserts of the Southwest to the wet, temperate forests of the Pacific Northwest and the rugged peaks of the Rockies. Key trends include the surging popularity of Direct-to-Consumer sales channels, which allow brands to directly communicate performance narratives and manage inventory effectively. Furthermore, the adoption of sustainable manufacturing practices, driven by conscious consumerism, is a critical purchasing determinant, compelling companies to focus on circular economy initiatives and traceable supply chains to satisfy environmentally stringent regional customer expectations.

Investment in localized customization and rapid prototyping, often leveraging regional manufacturing centers, aims to reduce turnaround times and cater to specific regional activities, such as hunting boots in rural areas or specialized snow boots for the Canadian market. Retail strategies are heavily weighted towards large specialty retailers like REI Co-op, alongside strong DTC e-commerce platforms. The North American market acts as a global benchmark for performance and trend adoption, often setting the standard for material innovation and marketing execution that subsequently influences global consumer preferences and product development cycles.

Europe is a critical market, dominated by the strong heritage of alpine activities and hiking in the Alps, Dolomites, and Pyrenees. This region is distinguished by a high demand for classic, durable, and repairable footwear, with a strong preference for high-quality leather and traditionally manufactured products, particularly in Central and Southern Europe. While traditionalism persists, there is also rapid assimilation of modern technologies, particularly lightweight construction and advanced waterproofing systems from global leaders. Germany, France, and the UK are primary revenue generators, each exhibiting slightly different consumer preferences, requiring manufacturers to tailor product ranges to local tastes and climate conditions effectively.

Sustainability and ethical sourcing are arguably more crucial drivers in Europe than in any other region, heavily influencing purchasing decisions and demanding stringent compliance with EU regulations regarding chemical usage (REACH). European consumers often seek products with long lifecycles and transparent manufacturing provenance, favoring brands that offer repair services or utilize certified recycled materials. This focus supports the dominance of established European technical brands (e.g., Lowa, Scarpa, La Sportiva) who market their deep technical expertise and regional manufacturing legacy as a key differentiator against mass-market global competitors, allowing them to command high average selling prices.

Distribution in Europe is highly fragmented, encompassing traditional family-owned specialty stores that provide expert fitting services, large sports retailers, and rapidly growing cross-border e-commerce operations. The development of advanced logistic networks within the Schengen Area facilitates efficient inventory movement and distribution velocity. The popularity of Via Ferratas, trekking routes, and specialized mountain sports ensures a continuous baseline demand for highly technical, specialized boots, positioning Europe not just as a consumer market but also as a vital hub for innovation in mountaineering and high-altitude performance footwear design and rigorous testing methodologies.

The APAC region is the fastest-growing market globally, driven by demographic expansion, rapid urbanization, and a subsequent cultural shift toward experiencing nature and engaging in outdoor wellness activities, especially among the burgeoning middle classes of China, India, and Southeast Asia. While traditional hiking footwear is gaining traction, the demand often leans towards lighter, multi-functional trail shoes suitable for day trips and urban-to-trail transition. Market growth is heavily dependent on the development of local outdoor infrastructure, government promotion of domestic tourism, and increased accessibility to international quality brands through expanding retail networks.

China represents the dominant opportunity within APAC, characterized by a highly digitalized purchasing landscape where e-commerce giants and social commerce influence consumer choices heavily. Consumers here often prioritize brand reputation, technological features, and the perceived status associated with international labels. However, localized product adaptation is vital; footwear needs to be suitable for the extreme humidity of Southeast Asia or the variable conditions of the Himalayan foothills, demanding specific material specifications and waterproofing resilience that differ significantly from temperate European requirements, driving specialized product RD efforts in the region.

Price sensitivity remains a key factor across many APAC nations; thus, manufacturers often adopt multi-tiered product strategies, offering high-end technical lines alongside more cost-effective, durable general-purpose footwear tailored for local accessibility. Distribution frequently utilizes large, modern shopping malls in metropolitan areas as primary retail points, complemented by explosive growth in online platforms like Tmall and JD.com. The establishment of local manufacturing hubs in countries like Vietnam and Indonesia further strengthens the regional supply chain, reducing logistics costs and time-to-market, making APAC a strategically crucial area for both consumption and production over the forecast period.

The Latin American outdoor footwear market is highly promising, albeit still emerging compared to North America and Europe. Growth is concentrated in countries with significant natural attractions and established adventure tourism sectors, such as Chile (Patagonia), Argentina, Brazil, and Peru. The market is primarily fueled by international tourists seeking high-quality gear and a small but growing segment of affluent domestic consumers participating in hiking, trekking, and eco-tourism activities that require durable protection. However, economic volatility and high import duties often constrain market growth and increase the final consumer price, limiting widespread adoption outside of major economic centers.

Consumer preferences in Latin America are often characterized by a demand for versatility, as buyers seek footwear that can serve multiple purposes due to budget constraints. Durable, robust footwear suitable for variable tropical climates and rugged, uneven terrain is essential. Distribution channels are less sophisticated than in developed markets, relying heavily on specialized sports shops in major cities and direct importation by large regional distributors. E-commerce penetration is rising rapidly, particularly in Brazil and Mexico, offering opportunities for international brands to circumvent complex physical retail limitations, providing greater choice to consumers who are increasingly connected digitally.

Opportunities are largely tied to infrastructural improvements in national parks and the continuous growth of adventure travel, which drives demand for specialized equipment. Local brands often compete effectively in the mid-range segment by offering price-competitive, regionally adapted products. International players must navigate complex regulatory and import structures while focusing marketing efforts on key outdoor hubs and utilizing localized content strategies to build trust and educate consumers on the necessity of investing in technical, high-performance protective gear for activities inherent to the rich, diverse geography of the continent.

The MEA region presents a diverse and challenging market landscape. In the Middle East, demand is primarily driven by specific regional activities, such as desert trekking, safari tourism, and a small segment of high-net-worth individuals engaging in international adventure travel. Consumption tends to focus on premium, lightweight materials that cope well with extreme heat and arid conditions, alongside high-performance tactical and safety footwear needed for infrastructure projects and defense sectors. Distribution is concentrated through luxury malls and specialized suppliers catering to niche markets in the UAE and Saudi Arabia, with less emphasis on mass-market recreation.

The African market is highly fragmented, with strong growth potential concentrated in countries like South Africa, which possess a mature domestic outdoor culture and robust tourism industry (e.g., safaris and mountaineering on Kilimanjaro). Demand in this segment focuses heavily on durability and reliability, often preferring traditional, robust hiking boots capable of withstanding rough conditions and long use periods. Significant challenges include widespread price sensitivity, leading to a strong prevalence of counterfeit goods, and underdeveloped formal retail infrastructure across many sub-regions, which complicates standardized distribution and quality control for international brands.

Future market expansion in MEA will be closely linked to urbanization rates, economic diversification away from oil dependence, and government investment in promoting domestic recreational tourism and sustainable development projects. International brands entering this market must prioritize robust partnerships with local distributors, ensure products are specifically optimized for regional climates (e.g., heat dissipation and sand resistance), and develop distribution strategies that effectively reach both the premium consumer segment in the Gulf Cooperation Council (GCC) countries and the price-sensitive, durability-focused consumers in key African economies, requiring a highly customized approach to product line management and regional pricing architecture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Footwear Market.- VF Corporation (The North Face, Timberland)

- Deckers Brands (Hoka One One, Teva)

- Adidas AG (Terrex)

- Nike Inc. (ACG)

- Columbia Sportswear Company

- Wolverine World Wide Inc. (Merrell, Saucony)

- Salomon Group

- Keen Footwear

- Lowa Boots

- Scarpa S.p.A.

- Arc'teryx (Amer Sports)

- Mammut Sports Group AG

- La Sportiva

- ECCO Sko A/S

- Sorel (Columbia Sportswear)

- Hi-Tec Sports

- Vasque (Red Wing Shoe Company)

- Garmont International

- Zamberlan

- ASICS Corporation

Frequently Asked Questions

Analyze common user questions about the Outdoor Footwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected market growth rate for outdoor footwear between 2026 and 2033?

The Outdoor Footwear Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by increasing participation in global adventure and recreational activities and significant technological advancements in material science focusing on lightweight durability.

Which product segment is currently demonstrating the fastest growth in the market?

The Trail Running Shoes segment is exhibiting the fastest growth due to the consumer preference shift towards high-intensity, versatile, and lightweight outdoor activities. This category benefits heavily from cross-over appeal with general athletic footwear and continuous innovation in cushioning and traction technologies.

How is sustainability impacting consumer purchasing decisions in this market?

Sustainability is a critical determinant, particularly in North America and Europe. Consumers actively seek products made with recycled or bio-based materials, demanding transparent supply chains, and prioritizing brands that offer product longevity and repairability services, compelling manufacturers to invest heavily in ethical and sustainable production methods.

What role does Artificial Intelligence (AI) play in the manufacturing of outdoor footwear?

AI is increasingly used for advanced applications such as predictive fit modeling based on 3D foot scans to minimize returns, optimizing complex supply chain logistics for seasonal demand, and leveraging generative design to engineer lighter, more functional component materials (e.g., midsoles and outsoles) that enhance performance and durability.

Which geographical region is anticipated to be the key growth engine for the market?

The Asia Pacific (APAC) region, specifically driven by major economies such as China and India, is forecast to be the primary engine of market growth. This expansion is attributed to rapidly rising disposable incomes, expanding middle-class populations, and governmental support for eco-tourism and outdoor recreational infrastructure development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager