Outdoor Gear Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443343 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Outdoor Gear Equipment Market Size

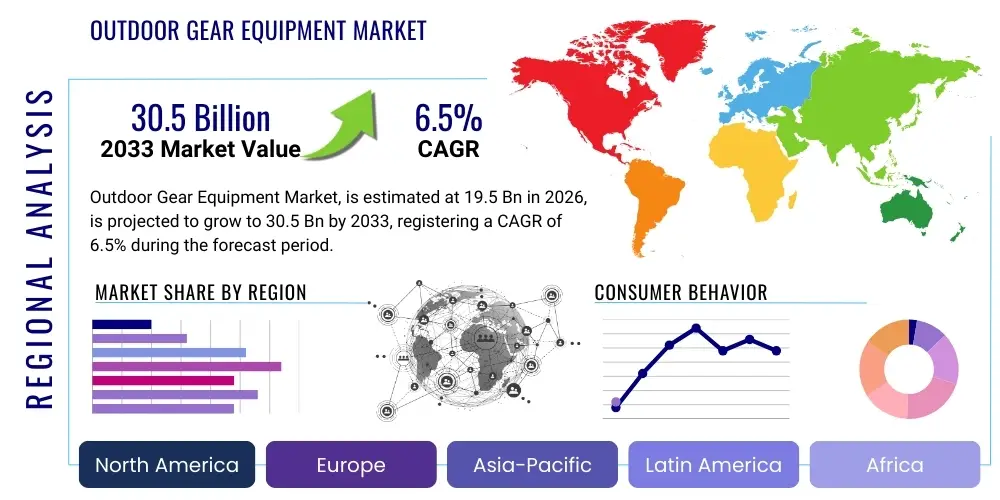

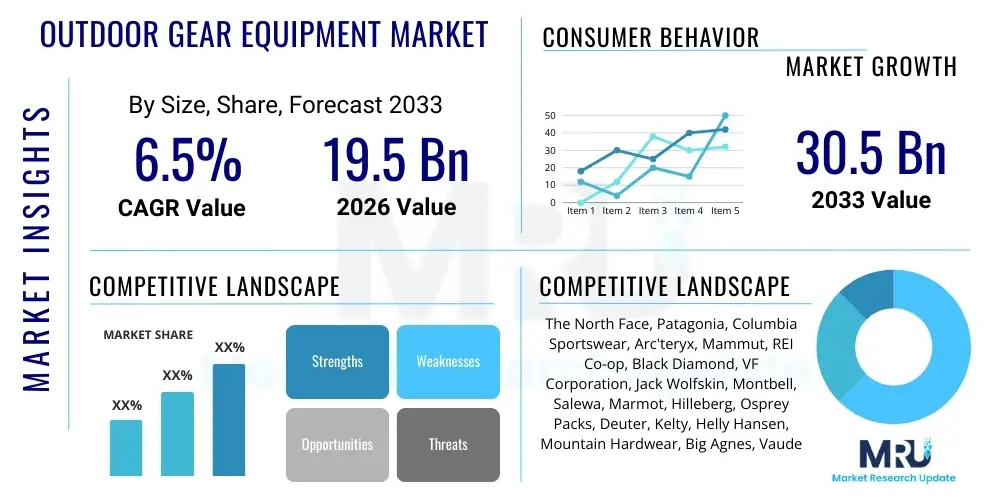

The Outdoor Gear Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing participation in adventure tourism, a renewed focus on health and wellness activities following global health events, and significant advancements in material science leading to lighter, more durable, and performance-oriented equipment. The valuation reflects the high consumer willingness to invest in specialized gear for activities such as hiking, camping, climbing, and water sports, signifying a long-term trend toward experiential consumption over material goods.

The market size calculation incorporates revenues derived from sales across various product categories, including apparel, footwear, camping gear, backpacks, and safety equipment. Geographical diversity plays a crucial role, with developed regions like North America and Europe maintaining high average spending per participant, while emerging economies in Asia Pacific are witnessing the fastest growth due to rising disposable incomes and infrastructure development supporting outdoor recreation. Crucially, the move towards sustainable and eco-friendly manufacturing processes is increasingly influencing purchasing decisions, prompting major market players to innovate and introduce premium-priced, environmentally conscious product lines, thus bolstering overall market value projections.

Outdoor Gear Equipment Market introduction

The Outdoor Gear Equipment Market encompasses a wide range of specialized products designed to facilitate and enhance activities undertaken in non-urban, natural environments, spanning everything from high-altitude mountaineering to leisurely park trekking. Products typically include functional apparel engineered for weather resistance, durability, and breathability, specialized footwear optimized for rugged terrain, essential camping supplies like tents, sleeping bags, and cooking systems, as well as crucial safety equipment such as ropes, harnesses, and navigation tools. These products are fundamentally defined by their reliability, ergonomic design, and ability to perform under challenging conditions, moving far beyond basic consumer goods to become critical tools for safety and enjoyment.

Major applications of outdoor gear span recreational activities such as hiking and backpacking, where lightweight, durable, and weather-protective essentials are paramount; adventure sports including rock climbing and kayaking, requiring high-strength safety and technical gear; and camping, demanding comfortable and robust shelter solutions. The primary benefits derived from using quality outdoor equipment include enhanced safety through reliable protection from elements and risks, improved performance owing to specialized materials and ergonomic designs, and significantly greater comfort, which encourages longer and more frequent participation. This market serves a diverse user base, ranging from survivalists and professional athletes to casual weekend adventurers, all seeking to maximize their engagement with nature.

Key driving factors accelerating the market’s growth include the global expansion of ecotourism and adventure travel, increasing consumer awareness regarding the health benefits of outdoor activities, and technological advancements, particularly in smart gear and sustainable materials. Furthermore, social media platforms have played a pivotal role in popularizing outdoor lifestyles, transforming niche hobbies into mainstream aspirations. These forces collectively contribute to sustained demand, pushing manufacturers to continuously innovate and diversify their product offerings to cater to increasingly segmented and demanding consumer preferences globally.

Outdoor Gear Equipment Market Executive Summary

The Outdoor Gear Equipment Market is experiencing dynamic growth, characterized by strong consumer spending driven by health and experiential trends, coupled with rapid technological integration across product lines. Business trends indicate a significant shift towards Direct-to-Consumer (DTC) models, allowing brands greater control over pricing and customer experience, and a pronounced focus on mergers and acquisitions among smaller, niche sustainable brands by large conglomerates seeking to expand their ethical portfolios. Sustainability and circular economy initiatives are no longer optional but critical components of corporate strategy, influencing supply chain restructuring and product lifecycle design, while investment in advanced materials like recycled plastics and bio-based fibers is escalating across the industry.

Regionally, North America maintains its dominance, primarily due to established outdoor recreation infrastructure and high consumer spending power, with camping and hiking remaining the foundational activities, yet Europe is rapidly catching up, distinguished by strong demand for specialized winter sports gear and stricter adherence to sustainability standards. The Asia Pacific region is the fastest-growing market, propelled by demographic factors such as a large, increasingly affluent youth population in countries like China and India discovering trekking and climbing, alongside government investments in developing national parks and adventure tourism sites. Latin America and MEA, while smaller, are showing significant potential, particularly in eco-tourism destinations where specialized professional equipment is required.

Segment trends highlight the exceptional performance of the apparel segment, driven by crossover utility where outdoor clothing is increasingly adopted for daily wear, blending functionality with fashion (Athleisure). The camping equipment sub-segment is seeing accelerated growth, particularly in lightweight, portable, and multi-functional gear suitable for car camping and glamping, catering to family groups and less experienced users. In terms of distribution, e-commerce platforms continue to capture market share due to unparalleled accessibility and the ability to offer detailed product comparisons and reviews, forcing traditional brick-and-mortar stores to adapt by offering highly curated experiences and expert consultation services.

AI Impact Analysis on Outdoor Gear Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Outdoor Gear Equipment Market predominantly center on how technology can enhance safety, personalize the customer journey, and improve product longevity. Key user themes include curiosity about 'smart' apparel that adapts to temperature changes, fear regarding data privacy when using GPS-enabled or biometric-tracking equipment, and expectation for AI-driven manufacturing processes that minimize waste and optimize material use. There is a high level of interest in AI's role in predictive maintenance for specialized equipment, such as analyzing historical usage data from climbing harnesses or diving regulators to recommend precise replacement schedules, thereby enhancing user safety and trust. Users expect AI to move beyond simple automation to provide personalized recommendations for optimal gear based on specific physiological metrics, intended activity duration, and environmental conditions, transforming the shopping experience from generic selection to highly specialized consultation.

The integration of AI is fundamentally reshaping both the demand and supply sides of the outdoor gear industry. On the demand side, sophisticated machine learning algorithms analyze purchasing history, demographic data, and even social media engagement to deliver hyper-personalized marketing campaigns and product recommendations, significantly increasing conversion rates and reducing customer churn. AI chatbots and virtual assistants are becoming common on retailer websites, providing instant, knowledgeable advice on complex gear requirements—a service traditionally exclusive to highly trained retail staff. This focus on digital personalization lowers the barrier to entry for novice outdoor enthusiasts who might otherwise be overwhelmed by the complexity of specialized equipment choices, simultaneously catering to expert users by swiftly locating highly technical niche items.

Operationally, AI is being deployed across the entire value chain to drive efficiency and sustainability. Predictive analytics optimize inventory management, forecasting seasonal spikes in demand for specific regional activities (e.g., ski gear in the Rockies, tropical hiking gear in Southeast Asia), minimizing overstocking and reducing waste. Furthermore, AI-driven computational design allows engineers to simulate performance and durability under extreme conditions using digital twins, speeding up R&D cycles and enabling the creation of lighter, stronger materials tailored specifically for functional requirements. This technological infusion promises not only better products but also a more streamlined, responsive, and environmentally accountable manufacturing ecosystem, addressing critical user concerns about product quality and ethical sourcing.

- AI-driven personalized gear recommendations based on user biometrics and activity profiles.

- Optimization of supply chain and logistics through predictive demand forecasting and automated inventory management.

- Integration of machine learning models for materials science research, accelerating the development of lighter, stronger, and sustainable fabrics.

- Enhanced product safety features through embedded sensors and AI analysis for real-time condition monitoring (e.g., fatigue detection in structural components).

- AI-powered virtual fitting rooms and augmented reality tools improving online purchase accuracy and reducing returns.

- Automation of quality control processes using computer vision to ensure manufacturing defect detection with high precision.

DRO & Impact Forces Of Outdoor Gear Equipment Market

The Outdoor Gear Equipment Market is powerfully influenced by key drivers, significant restraints, and expansive opportunities, all converging to create a dynamic competitive landscape. The primary drivers include the pervasive global trend toward health and wellness, where outdoor physical activity is recognized as essential for mental and physical well-being, coupled with the burgeoning growth of experiential travel and adventure tourism, which inherently requires specialized, reliable equipment. Restraints largely revolve around the high initial cost of specialized, performance-grade gear, which can deter casual participants, and mounting pressure regarding the environmental footprint of manufacturing complex, material-intensive products. Opportunities are concentrated in leveraging smart technology (IoT integration), expanding into underserved emerging markets, and capitalizing on the premium segment through certified sustainable and circular economy business models, focusing on durability and repairability.

A major driving force is the shifting demographic landscape, particularly in developed nations, where there is an increasing number of retired individuals engaging in active outdoor pursuits, demanding ergonomic and comfort-focused gear. Simultaneously, the younger generation exhibits strong ethical consumerism, compelling brands to adhere to stringent transparency and sustainability standards, making ethical sourcing a competitive differentiator rather than merely a compliance issue. Furthermore, government initiatives promoting national park usage and outdoor education programs inadvertently stimulate baseline demand for essential, entry-level equipment, creating a broad foundational market that continuously feeds into the higher-end specialized segments as consumers gain experience and demand better performance.

However, the industry faces substantial impact forces from economic volatility and supply chain disruptions, especially concerning raw material costs, as many performance textiles rely on petroleum derivatives or globally sourced specialty fibers, making pricing sensitive to geopolitical events. The seasonal nature of certain outdoor activities, such as skiing or mountaineering, creates intense demand cycles, necessitating highly flexible production planning, posing a restraint for smaller manufacturers. Opportunities lie in establishing robust secondary markets for used gear, which not only addresses the cost barrier for new entrants but also reinforces the sustainability credentials of the overall market. Moreover, the integration of digital services alongside physical products—such as guided adventure apps, virtual reality training simulations, or digital gear maintenance logs—presents a high-potential avenue for recurring revenue generation and deeper customer loyalty, transforming product sales into an integrated service offering.

Segmentation Analysis

The Outdoor Gear Equipment Market is structurally segmented across various dimensions, primarily categorized by Product Type, Application, and Distribution Channel, each exhibiting unique growth trajectories and competitive intensities. Product segmentation provides granular detail on manufacturing focus, separating the market into technical apparel, specialized footwear, indispensable camping equipment, crucial climbing gear, and other accessories. The application segment reveals demand patterns driven by specific activities, differentiating needs between hiking and trekking, water sports, winter sports, and professional use. Analysis by Distribution Channel highlights the consumer purchasing journey, contrasting the dynamics of retail stores versus the explosive growth and global reach of e-commerce platforms, providing crucial insight for market entry and operational strategy.

Within Product Type, the Apparel segment dominates in terms of revenue, driven by the frequency of replacement purchases and the successful incorporation of outdoor functionality into everyday fashion (Athleisure). High-performance technical clothing, utilizing advanced membranes like Gore-Tex or proprietary thermal insulation, commands premium pricing and higher margins. Conversely, the Camping Equipment segment, encompassing tents, sleeping bags, and camp furniture, sees steady growth, accelerated by the appeal of accessible outdoor recreation post-pandemic, characterized by innovation focusing on lightweight, modular, and easy-to-pitch designs suitable for families and novices alike. The equipment designed for specialized activities like mountaineering or rescue operations, while smaller in volume, holds significant strategic importance due to its high barrier to entry and requirement for rigorous safety certification.

The Distribution Channel analysis confirms the increasing hegemony of the Online Retail channel, which offers consumers unparalleled selection, competitive pricing, and comprehensive user reviews, critical for complex purchasing decisions. However, specialized brick-and-mortar stores, particularly those operated directly by brands or highly reputable third-party vendors, retain importance for high-value technical gear (e.g., backpacks, climbing hardware) where physical fitting, expert consultation, and hands-on testing are necessary prerequisites for purchase. This hybrid model—combining the reach of digital platforms with the expertise of physical retail—is crucial for maintaining customer trust and providing necessary education regarding gear safety and usage.

- By Product Type:

- Outdoor Apparel (Jackets, Pants, Base Layers)

- Footwear (Hiking Boots, Trail Running Shoes, Water Shoes)

- Camping Equipment (Tents, Sleeping Bags, Camp Kitchen)

- Climbing and Mountaineering Gear (Ropes, Harnesses, Helmets)

- Backpacks and Luggage (Daypacks, Multi-day Packs)

- Water Sports Equipment (Kayaks, Paddleboards, Accessories)

- By Application:

- Hiking and Trekking

- Camping and Backpacking

- Climbing and Mountaineering

- Water Sports (Kayaking, Canoeing, Fishing)

- Winter Sports (Skiing, Snowboarding)

- Running and Biking (Outdoor focused)

- By Distribution Channel:

- Specialty Stores (Outdoor Retailers)

- Department Stores and Hypermarkets

- Online Retail/E-commerce

- Direct-to-Consumer (Brand Stores)

Value Chain Analysis For Outdoor Gear Equipment Market

The value chain of the Outdoor Gear Equipment Market is extensive and complex, starting with the sourcing of specialized raw materials and culminating in distribution to diverse consumer segments globally. Upstream analysis highlights the critical reliance on suppliers providing high-performance technical textiles (e.g., durable nylons, recycled polyester, hydrophobic coatings), specialty metal alloys for hardware, and advanced insulation materials. Innovation at this stage, particularly in sustainable and bio-based alternatives, directly dictates the final product's performance and environmental profile. Manufacturing involves high levels of expertise in precision cutting, bonding (to replace traditional stitching for weatherproofing), and quality control, often demanding specialized machinery and skilled labor, leading many firms to rely on strategic partnerships with specialized contract manufacturers in Asia.

Midstream activities involve core operations such as design, prototyping, and branding, where market research insights on trends, aesthetics, and user feedback are transformed into marketable products. This stage is crucial for establishing brand identity and perceived value. Logistics and inventory management form the bridge to downstream distribution, requiring efficient global shipping networks to manage seasonal peaks in demand. Downstream analysis focuses intensely on the distribution channels. The proliferation of direct-to-consumer (DTC) channels, both online and through branded flagship stores, allows manufacturers to capture higher margins and build deeper customer relationships, providing invaluable feedback loops for future product development. Simultaneously, indirect distribution through established specialty retailers remains vital for market penetration, leveraging their expert sales staff and local market knowledge, especially for complex technical purchases.

The distribution channel dynamics are characterized by a dual approach: high-volume, low-consultation products utilize broad e-commerce platforms and mass retailers, benefiting from scale and convenience. Conversely, high-consultation, high-safety products like climbing ropes or technical tents rely heavily on specialty retailers or authorized dealers who can provide mandatory safety guidance and fitting services. Direct sales channels, including official brand websites and dedicated physical stores, serve as critical platforms for storytelling, reinforcing brand ethos, and providing authentic product experiences, ultimately solidifying customer loyalty and driving premium sales. The strategic management of both direct and indirect channels is essential for maximizing market reach while maintaining brand integrity and technical authority.

Outdoor Gear Equipment Market Potential Customers

The potential customers for the Outdoor Gear Equipment Market are highly segmented, extending beyond the traditionally defined outdoor enthusiast to include several emerging buyer categories driven by lifestyle, professional necessity, and increasing focus on preparedness. The primary end-users are recreational adventurers—individuals who regularly participate in hiking, camping, climbing, and kayaking, seeking performance, durability, and specialized functionality. These buyers are typically brand-loyal, informed about technical specifications, and willing to invest significantly in high-quality, long-lasting gear. Their purchase decisions are heavily influenced by independent reviews, expert endorsements, and proven field performance, making brand reputation and product reliability paramount.

A rapidly expanding segment consists of the "casual enthusiasts" or "lifestyle buyers," who primarily engage in weekend trips, car camping, and urban commuting that requires outdoor-grade functionality (e.g., waterproof backpacks, insulated jackets). This group prioritizes aesthetic appeal, versatility for urban crossover use, and relative affordability. While they may not require the extreme performance characteristics of professional gear, they are highly sensitive to branding and sustainable practices, using outdoor gear as a component of their overall lifestyle identity. Marketing efforts targeted at this segment often focus on comfort, style integration, and ease of use rather than just technical specifications.

Finally, institutional and professional buyers represent a consistent, high-volume customer segment. This includes military and tactical operations requiring rugged, specialized equipment; emergency rescue services (fire, search and rescue); educational institutions hosting outdoor programs; and large-scale adventure tourism operators. These customers demand adherence to specific safety standards (e.g., EN, UIAA certifications), bulk purchasing capabilities, and long-term warranties. Sales to this segment are often based on rigorous tender processes and established contracts, prioritizing certified safety, operational reliability, and proven longevity under extreme duress, making them fundamentally different from retail consumer purchasing dynamics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Patagonia, Columbia Sportswear, Arc'teryx, Mammut, REI Co-op, Black Diamond, VF Corporation, Jack Wolfskin, Montbell, Salewa, Marmot, Hilleberg, Osprey Packs, Deuter, Kelty, Helly Hansen, Mountain Hardwear, Big Agnes, Vaude |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor Gear Equipment Market Key Technology Landscape

The Outdoor Gear Equipment Market is defined by a continuous push toward technological superiority, focusing heavily on advanced material science and the integration of smart electronics. Key technology involves the evolution of performance textiles, moving beyond simple waterproofing to membranes that offer superior breathability and dynamic climate control, utilizing materials like recycled content and bio-based polymers to align with sustainability goals. The development of proprietary insulation technologies, such as synthetic fills that retain warmth when wet and mimic the structure of natural down, allows for lighter, more versatile apparel. Furthermore, specialized hardware requires breakthroughs in lightweight, high-tensile alloys (e.g., aerospace-grade aluminum and carbon fiber composites) to ensure safety and portability in climbing and camping equipment without compromising structural integrity.

The integration of the Internet of Things (IoT) is a rapidly maturing trend, transforming static equipment into smart devices capable of data collection and real-time interaction. Examples include smart compasses and GPS devices with enhanced battery life and ruggedized housing, apparel embedded with biometric sensors to monitor vital signs during extreme exertion, and smart tents equipped with integrated power sources and climate monitoring capabilities. These technologies cater directly to safety-conscious consumers and those seeking performance optimization through quantifiable data. Miniaturization of power sources and efficient energy harvesting techniques are central to expanding the applicability of smart gear in remote, off-grid environments where recharging is impractical, pushing the boundaries of autonomous performance.

Manufacturing technologies are also undergoing transformation, leveraging automation and digital precision to enhance product quality and consistency. Laser cutting and ultrasonic welding are increasingly replacing traditional sewing methods, particularly for high-stress seams in waterproof and high-performance outerwear, resulting in enhanced durability and reduced material waste. Furthermore, 3D printing (Additive Manufacturing) is gaining traction, particularly in prototyping and the production of customized parts like complex boot components, equipment fasteners, and highly specialized climbing hardware, enabling rapid design iterations and catering to niche demands with unprecedented precision. These manufacturing advancements contribute directly to improved product reliability, a critical purchasing criterion for consumers relying on gear for safety.

Regional Highlights

- North America (U.S. and Canada) remains the largest and most mature market for outdoor gear equipment, driven by a deeply ingrained culture of hiking, camping, and national park utilization, supported by extensive outdoor infrastructure and high consumer disposable income. The region is characterized by high average spending per user, leading demand for premium, high-tech, and specialized equipment, particularly in categories like technical apparel and advanced camping systems. Strong competition exists among major domestic and international brands, often centered on rapid innovation, digital engagement, and strong sustainability narratives. The U.S. government's emphasis on conservation and recreation also provides a stable backdrop for continued market demand, especially for national park usage passes and related gear requirements.

- Europe demonstrates robust growth, marked by distinct regional preferences—high demand for skiing and mountaineering gear in Central Europe (e.g., Alps regions) and strong marine and sailing gear consumption in Scandinavian and Mediterranean countries. European consumers are particularly sensitive to environmental and ethical certifications, often favoring European brands that comply with strict chemical regulations (like REACH) and demonstrate verifiable commitments to fair labor practices and material circularity. Germany, the UK, and France are key contributors to market revenue, where highly specialized retail chains and cooperatives play a dominant role in consulting and sales, focusing on durability and multi-season functionality.

- Asia Pacific (APAC) is projected to be the fastest-growing market globally, propelled by rising middle-class disposable incomes, increased leisure time, and a growing interest in adventure tourism, particularly in densely populated countries like China, India, and South Korea. While the market historically focused on manufacturing for Western brands, domestic consumption is surging, demanding localized product adaptations (e.g., smaller sizing, specific color preferences, lighter gear suitable for humid climates). Government investment in developing adventure tourism infrastructure and the cultural adoption of wellness activities are crucial catalysts. The expansion of e-commerce channels across the region makes high-quality gear more accessible to urban populations engaging in accessible outdoor activities.

- Latin America is an emerging market with significant potential, particularly tied to ecotourism destinations such as Patagonia, the Amazon, and the Andes regions, demanding high-quality professional and guiding equipment. Economic volatility and varying retail infrastructure pose challenges, resulting in a higher dependence on international imports and regional specialty distributors. Demand is strongest in Chile, Brazil, and Argentina, driven by both professional necessity and growing domestic adventure travel segments. The focus here is often on robust, durable, and repairable gear due to limited access to replacement parts.

- The Middle East and Africa (MEA) market is dominated by specific applications, including desert expedition gear, specialized fishing equipment, and high-performance cooling apparel necessary for extreme heat environments. Growth is accelerating in tourism hubs like the UAE and South Africa, which actively promote nature reserves and adventure sports. Demand remains highly segmented, with professional and luxury adventure tourism segments driving high-value purchases, focusing on brand prestige and highly customized performance features tailored for regional climatic extremes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor Gear Equipment Market.- The North Face (VF Corporation)

- Patagonia, Inc.

- Columbia Sportswear Company

- Arc'teryx (Amer Sports)

- Mammut Sports Group AG

- REI Co-op

- Black Diamond Equipment

- VF Corporation (including Timberland and Vans outdoor lines)

- Jack Wolfskin GmbH & Co. KGaA

- Montbell Co., Ltd.

- Salewa (Oberalp Group)

- Marmot Mountain LLC

- Hilleberg The Tentmaker

- Osprey Packs, Inc.

- Deuter Sport GmbH

- Kelty (Exxel Outdoors)

- Helly Hansen (Canadian Tire Corporation)

- Mountain Hardwear (Columbia Sportswear)

- Big Agnes, Inc.

- Vaude Sport GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Outdoor Gear Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Outdoor Gear Equipment Market?

The primary growth drivers are the global proliferation of health and wellness initiatives, which boost participation in outdoor activities, coupled with the rapid expansion of adventure tourism and experiential travel. Additionally, consumer demand for sustainable and technically advanced gear that offers superior performance and durability contributes significantly to market value acceleration and premium segment growth worldwide.

How is sustainability impacting the purchasing decisions for outdoor gear?

Sustainability is now a critical factor influencing purchasing decisions, with consumers increasingly favoring brands that utilize recycled materials, minimize environmental impact in manufacturing, and offer repair programs to extend product lifecycles (circular economy models). This trend drives innovation toward bio-based materials and transparent supply chains, often justifying a higher price point for eco-friendly products.

Which product segment holds the largest share of the Outdoor Gear Equipment Market revenue?

The Outdoor Apparel segment consistently holds the largest revenue share. This dominance is attributed to high-frequency replacement cycles, the rapid integration of outdoor functionality into everyday fashion (Athleisure), and continued advancements in technical textiles that command premium pricing for features like advanced waterproofing, superior breathability, and sophisticated thermal regulation technologies.

What role does Artificial Intelligence (AI) play in the future development of outdoor equipment?

AI is strategically employed to enhance personalization, allowing brands to recommend optimal gear based on user biometrics and specific activity needs, thereby improving customer satisfaction. Furthermore, AI streamlines manufacturing processes through predictive demand forecasting and is crucial in materials science research for developing lighter, stronger, and more sustainable technical fabrics, ensuring future gear is safer and more efficient.

How do distribution channels influence the sales of highly specialized technical gear?

While general outdoor gear sales increasingly favor high-volume online retail, highly specialized technical equipment (e.g., climbing harnesses, mountaineering boots) still heavily relies on specialty stores and direct-to-consumer outlets. These channels provide essential expert consultation, professional fitting services, and safety guidance, which are critical for high-value purchases where user safety depends directly on proper product selection and fit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager