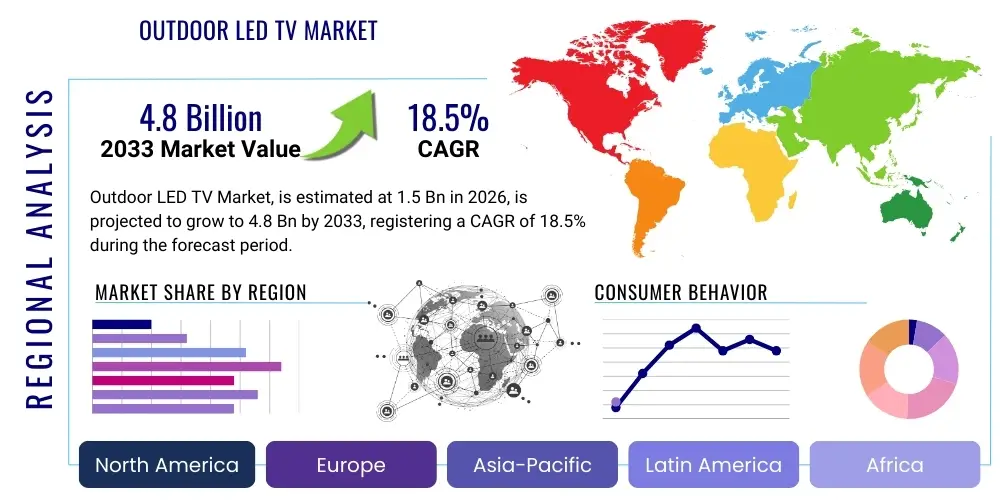

Outdoor LED TV Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442282 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Outdoor LED TV Market Size

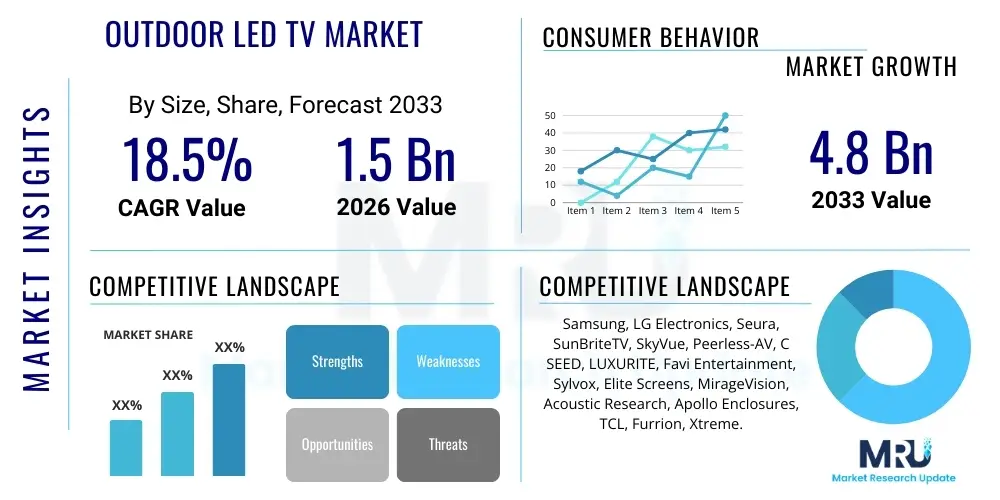

The Outdoor LED TV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing consumer demand for luxury outdoor entertainment spaces, the rapid expansion of the hospitality and commercial sectors requiring high-brightness digital signage, and continuous technological advancements improving screen durability and visibility under direct sunlight.

Outdoor LED TV Market introduction

The Outdoor LED TV Market encompasses specialized display solutions designed to withstand environmental factors such as moisture, extreme temperatures, UV exposure, and dust, while providing optimal brightness and clarity for viewing in external environments. Unlike standard indoor televisions, these units incorporate ruggedized casings, advanced thermal management systems, and specialized anti-glare screens, making them suitable for permanent installation in patios, decks, outdoor kitchens, and public areas. The core product category includes high-definition LED and QLED displays, often integrated with smart connectivity features, that maintain performance integrity even when exposed to harsh weather conditions. These devices cater to a growing lifestyle trend that integrates home comfort and advanced technology with outdoor living, transforming traditional backyard spaces into fully functional entertainment zones.

Major applications for Outdoor LED TVs span both the residential and commercial sectors. In residential settings, they are increasingly popular in luxury homes and specialized leisure spaces, providing seamless viewing experiences for sports, movies, and gaming outdoors. Commercially, they serve vital functions in enhancing customer engagement and communication across sectors such as hospitality (resorts, hotels, poolside bars), retail (outdoor advertisements, storefront displays), and sports venues (scoreboards, viewing areas). The critical benefit these displays offer is the ability to maintain high luminance—often exceeding 2,000 nits—necessary to counteract ambient daylight, ensuring content remains vibrant and readable. Furthermore, their superior IP ratings (Ingress Protection) guarantee protection against water and dust intrusion, providing longevity and reliable performance.

Driving factors for this market include the global rise in discretionary income allocated to home improvement and outdoor leisure activities, especially following trends emphasizing the utilization of external residential spaces. Technological improvements in display backlighting and heat dissipation are constantly lowering the total cost of ownership while enhancing product lifespan and energy efficiency. Additionally, the proliferation of large-scale commercial projects, coupled with the increasing adoption of digital out-of-home (DOOH) advertising, significantly boosts demand for durable, high-impact outdoor display solutions. These combined forces are positioning the Outdoor LED TV market for sustained expansion across all major geographic regions, establishing these units as standard components of modern, interconnected outdoor environments.

Outdoor LED TV Market Executive Summary

The Outdoor LED TV market is characterized by robust growth, driven by key business trends emphasizing product differentiation through enhanced ruggedization, superior brightness, and smart integration capabilities. Manufacturers are increasingly focusing on developing ultra-large screen formats and integrating features like advanced weather sealing (high IP ratings), anti-corrosion coatings, and ambient light sensors that automatically adjust display parameters for optimal viewing. A significant business trend involves the collaboration between display manufacturers and smart home technology providers to offer integrated outdoor entertainment ecosystems, controlling audio, lighting, and video centrally. Furthermore, the commercial sector’s shift toward highly engaging visual communications is accelerating the adoption of professional-grade outdoor displays, creating opportunities for specialized B2B offerings tailored to harsh public environments.

Regionally, North America currently holds the largest market share, fueled by high consumer spending on luxury outdoor renovations, robust climate diversity necessitating high-durability products, and the prevalence of professional sports and entertainment venues. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by rapid urbanization, increasing infrastructural development, and the burgeoning hospitality and tourism industries, particularly in countries like China, India, and Southeast Asian nations. Europe maintains a steady market presence, with demand concentrated in Western European countries emphasizing aesthetically pleasing, energy-efficient outdoor installations that comply with stringent environmental regulations. The Middle East and Africa (MEA) are emerging as high-potential markets, particularly due to large-scale construction projects in hospitality and retail, requiring weatherproof digital signage solutions.

Segment trends highlight the growing dominance of the 4K resolution segment, which is rapidly becoming the standard across both residential and commercial applications, although 8K displays are beginning to gain traction in high-end luxury installations. By application, the commercial segment is experiencing swifter adoption rates than the residential segment, primarily due to the quantifiable return on investment offered by outdoor digital advertising and informational displays. Furthermore, the large screen size category (above 65 inches) is witnessing the highest unit shipment growth, reflecting the desire for immersive viewing experiences in expansive outdoor settings. This segment shift underscores a market moving towards higher performance specifications, greater connectivity, and increasingly tailored solutions for specific climatic and usage demands.

AI Impact Analysis on Outdoor LED TV Market

User queries regarding AI's influence on the Outdoor LED TV market frequently center on three main themes: enhanced visual optimization, personalized content delivery in public spaces, and predictive maintenance capabilities. Users are keen to understand how AI can dynamically adjust screen brightness and color temperature in real-time based on fluctuating weather conditions and ambient lighting, thus ensuring superior picture quality without manual intervention. There is also considerable interest in AI-driven behavioral analysis in commercial settings, enabling outdoor screens to display contextually relevant advertisements or information tailored to detected demographic profiles or traffic patterns. Finally, the expectation for AI-powered diagnostics that can anticipate component failure, especially related to overheating or moisture infiltration—critical issues for outdoor electronics—is high, signifying a demand for increased operational efficiency and reduced downtime in these exposed systems.

AI integration is poised to significantly transform the functionality and operational lifespan of outdoor displays. By leveraging machine learning algorithms, Outdoor LED TVs can move beyond simple ambient light sensors to incorporate predictive models that account for location, time of day, seasonal variations, and specific weather forecasts. This level of dynamic optimization not only improves the user experience but also enhances energy efficiency by precisely controlling backlight intensity. Furthermore, in the commercial sphere, AI facilitates highly effective programmatic advertising by integrating with sensor data, ensuring that the displayed content achieves maximum relevance and engagement, thereby justifying the substantial initial investment required for outdoor digital infrastructure.

- AI-Powered Ambient Optimization: Dynamic adjustment of brightness, contrast, and color temperature using real-time sensor data and predictive weather analytics for optimal daytime viewing.

- Predictive Maintenance: Utilization of machine learning to monitor internal temperature, component stress, and power fluctuations, flagging potential hardware failures (e.g., thermal management system faults) before they occur, minimizing expensive field service calls.

- Intelligent Content Personalization: Commercial displays using computer vision and AI analytics to detect audience demographics and behavior, serving highly targeted digital signage content.

- Voice and Gesture Control Enhancement: Improved accuracy and responsiveness of hands-free operation in outdoor environments where noise and varied lighting conditions can affect standard input mechanisms.

- Enhanced Security Monitoring: Integrating AI cameras within the TV enclosure for security surveillance and anti-theft monitoring in exposed public installations.

DRO & Impact Forces Of Outdoor LED TV Market

The dynamics of the Outdoor LED TV market are shaped by a complex interplay of drivers, restraints, and opportunities, culminating in significant impact forces. Key drivers include the strong global trend toward creating sophisticated outdoor living spaces, increased consumer willingness to invest in high-end entertainment electronics, and the rising demand for robust digital signage solutions across various commercial verticals like Quick Service Restaurants (QSRs), retail, and transportation hubs. These factors collectively push manufacturers toward innovation, focusing particularly on display brightness, durability, and smart connectivity. The opportunity landscape is broad, encompassing the development of modular and flexible outdoor display systems, the integration of cutting-edge technologies like MicroLED for superior resilience, and expansion into emerging markets in the APAC and MEA regions where infrastructural development is accelerating.

However, market growth is significantly restrained by the high initial cost of Outdoor LED TVs compared to standard indoor models, which often acts as a deterrent for budget-conscious consumers and smaller businesses. Technical restraints include the persistent challenge of effective thermal management, as displays must dissipate significant heat generated both internally and externally from direct sunlight exposure, requiring expensive cooling systems. Furthermore, market entry is challenging due to the stringent requirements for durability and weatherproofing (IP ratings), necessitating substantial R&D investment and adherence to complex environmental testing standards. These restraints mean that the market remains relatively niche and premium-priced.

The resultant impact forces are driving consolidation and specialization within the market. High investment barriers favor established players with strong R&D capabilities in ruggedized electronics and thermal engineering. The primary market impact is the intensifying focus on Total Cost of Ownership (TCO) for commercial buyers, pressuring manufacturers to extend product life cycles and enhance energy efficiency. The secondary impact force is the segmentation of the market based on climatic requirements; for instance, specialized products are being developed for extreme heat (desert environments) versus extreme cold (northern latitudes), reflecting a move away from one-size-fits-all solutions toward highly tailored, application-specific displays that address diverse operational demands globally.

Segmentation Analysis

The Outdoor LED TV Market is comprehensively segmented based on fundamental product characteristics, performance metrics, and end-user applications. Key segmentation criteria include the physical dimensions of the display (Display Size), the clarity and detail of the image (Resolution), and the intended usage environment (Application). Analyzing these segments provides crucial insights into consumer preferences and commercial adoption patterns, guiding product development toward areas of highest demand, such as large-format 4K displays utilized primarily in the growing commercial hospitality sector. The interplay between resolution and size is particularly critical, as viewing distance in outdoor settings necessitates higher pixel density for large screens to maintain picture integrity.

- By Display Size:

- Small (Up to 40 Inches)

- Medium (41-55 Inches)

- Large (56-75 Inches)

- Very Large (Above 75 Inches)

- By Resolution:

- HD (1366x768 and below)

- Full HD (1920x1080)

- 4K UHD (3840x2160)

- 8K UHD (7680x4320)

- By Application:

- Residential (Backyards, Patios, Outdoor Kitchens)

- Commercial

- Hospitality (Hotels, Resorts, Cruise Ships)

- Retail & QSR (Digital Menu Boards, Storefront Signage)

- Sports & Entertainment Venues

- Public Spaces & Transportation

Value Chain Analysis For Outdoor LED TV Market

The value chain for the Outdoor LED TV market begins with upstream activities focused on securing high-quality, specialized components crucial for ruggedization and high performance. This includes sourcing high-brightness LED panels (often requiring custom backlighting solutions), robust, heat-resistant electronic components, advanced cooling systems (fans, heat sinks, fluid cooling), and specialized protective casings and anti-glare coatings. Key suppliers include panel manufacturers (Samsung Display, LG Display) and component providers specializing in industrial-grade circuitry and thermal management solutions. The critical differentiating factor in the upstream stage is the ability to integrate components that guarantee a high Ingress Protection (IP) rating and superior durability against temperature extremes and UV degradation, which adds complexity and cost compared to indoor TV manufacturing.

Midstream activities involve the core manufacturing and assembly processes. This stage requires specialized facilities capable of precision sealing, application of conformal coatings to circuit boards, and rigorous environmental stress testing (thermal chambers, water jet testing) to validate IP ratings and operational reliability. Manufacturers often employ stringent quality control protocols specific to outdoor use, focusing on heat dissipation effectiveness and long-term corrosion resistance. Downstream activities encompass the distribution and installation phases. Products are moved through established distribution channels, including specialized electronics distributors, professional AV installers, and direct sales channels targeting large commercial clients (e.g., hotel chains, stadium operators). Unlike standard consumer electronics, installation often requires specialized technical knowledge related to mounting structures, concealed wiring, and integration with existing outdoor media systems, necessitating robust partnerships with certified installation professionals.

The distribution channel is generally bifurcated into direct sales for high-volume commercial projects and indirect sales via retail and e-commerce for residential consumers. Direct channels allow manufacturers to offer tailored solutions and maintenance contracts, capitalizing on higher margins and deeper customer relationships. Indirect channels rely heavily on clear product differentiation, detailed weatherproofing specifications, and high-quality marketing content to educate consumers about the necessity of choosing specialized outdoor displays over adapting indoor units. Furthermore, aftermarket services, including maintenance and extended warranty provision, form a vital part of the downstream value proposition, as ensuring longevity in harsh environments is critical to customer satisfaction and repeat business.

Outdoor LED TV Market Potential Customers

The primary customer base for the Outdoor LED TV market is segmented into high-net-worth individuals and families investing in sophisticated outdoor living spaces, and diverse commercial entities seeking durable, high-visibility digital displays. For the residential segment, end-users are typically seeking to extend the functionality and luxury of their indoor entertainment systems to poolsides, covered patios, and dedicated outdoor viewing areas. These buyers prioritize aesthetics, connectivity (smart features, streaming capability), and reliability in all weather conditions, viewing the purchase as a long-term investment in lifestyle enhancement and property value. The key determinant for residential buyers is the balance between size, brightness, and aesthetic design integration with the home environment.

In the commercial sector, the potential customers are significantly more varied and motivated by operational efficiency and revenue generation. Hospitality customers, including luxury hotels, resorts, and cruise lines, use these displays for guest entertainment, poolside movie nights, and dynamic informational signage, demanding units with high operational hours and robust warranty support. Retail and Quick Service Restaurant (QSR) operators utilize Outdoor LED TVs for dynamic digital menu boards and promotional signage to capture pedestrian attention, prioritizing extreme brightness and content management system compatibility. Furthermore, public spaces, such as parks, transit stations, and sports arenas, represent a significant segment, requiring ruggedized displays for public safety announcements, wayfinding, and live event viewing.

Specific end-users include construction project managers specifying AV equipment for new commercial builds, facility managers overseeing maintenance of existing infrastructure, and advertising agencies managing programmatic digital out-of-home (DOOH) campaigns. These B2B customers prioritize technical specifications like maximum brightness (measured in nits), verifiable IP ratings (e.g., IP65 or IP66), integration ease with enterprise content networks, and long-term durability metrics (MTBF - Mean Time Between Failure). The shift towards digitalization in public environments is consistently expanding the commercial customer base, driving volume demand for robust and highly visible display technology capable of continuous operation in varied outdoor environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, LG Electronics, Seura, SunBriteTV, SkyVue, Peerless-AV, C SEED, LUXURITE, Favi Entertainment, Sylvox, Elite Screens, MirageVision, Acoustic Research, Apollo Enclosures, TCL, Furrion, Xtreme. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outdoor LED TV Market Key Technology Landscape

The technological landscape of the Outdoor LED TV market is defined by innovations centered on achieving extreme brightness, superior weather resilience, and efficient thermal regulation. A critical technology is High Brightness LED Backlighting, where panels are engineered to achieve luminance levels significantly exceeding standard indoor displays, typically ranging from 1,500 to 5,000 nits, essential for maintaining contrast and color fidelity in direct sunlight. This requirement necessitates the use of specialized LED array designs and highly efficient optical films. Furthermore, advancements in specialized coatings, such as Anti-Reflective (AR) and Anti-Glare (AG) treatments, are crucial for minimizing reflections and improving outdoor visibility, preventing the wash-out effect common with standard screens. Manufacturers are continuously refining these surface technologies to strike an optimal balance between glare reduction and image clarity.

Another pivotal area is Ruggedized Enclosure Design and Thermal Management Systems. Given the susceptibility of electronic components to heat and moisture, Outdoor LED TVs utilize heavy-duty, corrosion-resistant materials (like powder-coated aluminum) and employ sophisticated IP-rated sealing techniques to protect internal circuitry from ingress of dust (D) and water (P), often achieving IP65 or IP66 certification. Thermal management is handled through advanced cooling solutions, including internal active cooling systems (high-flow fans, heat pumps) and passive systems (oversized heat sinks, specialized venting). The efficiency of these cooling systems directly impacts the display's lifespan and reliability, preventing isotropic blackening—a phenomenon where direct solar radiation permanently damages the liquid crystal layer due to excessive heat exposure.

Emerging technologies, particularly MicroLED and QLED, are poised to reshape the market by offering superior display attributes. MicroLED technology promises exceptional brightness, perfect blacks, and improved energy efficiency, all within a more resilient module structure that inherently handles thermal stress better than conventional LED/LCD panels. QLED (Quantum Dot LED) technology enhances color volume and brightness, making displays more vivid and resilient in brightly lit environments. Additionally, the incorporation of advanced sensor suites—including ambient light sensors, temperature and humidity sensors, and even gyroscopic sensors for precise installation leveling—is becoming standard, enabling sophisticated dynamic control and integration with sophisticated automation protocols for seamless outdoor media management.

Regional Highlights

- North America: This region is the dominant market leader, characterized by high disposable incomes, a strong culture of outdoor entertaining, and the presence of major key players (e.g., SunBriteTV, Seura). Demand is robust in both the luxury residential sector and high-volume commercial applications like stadium advertising, sports bars, and large public digital signage networks. Strict weather conditions across parts of the US and Canada mandate the highest IP and temperature ratings, driving innovation in durability.

- Europe: The European market shows steady growth, prioritizing aesthetic integration, energy efficiency, and compliance with stringent environmental regulations (e.g., WEEE, RoHS). Key demand centers are the UK, Germany, and France, with a focus on high-quality, discreet installations in hospitality (outdoor cafes, hotel terraces) and luxury residential settings. The market places a premium on design quality and energy conservation features.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rapid urbanization, significant government investment in smart city infrastructure, and explosive growth in the tourism and retail sectors, particularly in China, Japan, and India. The APAC region is transitioning from standard indoor signage to robust, high-brightness outdoor displays to accommodate densely populated commercial areas and diverse climatic zones.

- Latin America (LATAM): Growth is accelerating due to rising middle-class disposable income and increased investment in retail infrastructure and public sporting venues. The market is highly price-sensitive but shows strong potential in key urban centers like Brazil and Mexico, where outdoor advertising and entertainment are becoming increasingly popular.

- Middle East and Africa (MEA): This region is witnessing substantial market expansion, driven by mega-projects in the hospitality (Dubai, Saudi Arabia) and entertainment sectors. The extreme heat and dusty conditions necessitate highly specialized thermal management and superior IP ratings, positioning MEA as a key market for ultra-durable, premium-priced commercial displays.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outdoor LED TV Market.- Samsung

- LG Electronics

- Seura

- SunBriteTV

- SkyVue

- Peerless-AV

- C SEED

- LUXURITE

- Favi Entertainment

- Sylvox

- Elite Screens

- MirageVision

- Acoustic Research

- Apollo Enclosures

- TCL

- Furrion

- Xtreme

Frequently Asked Questions

Analyze common user questions about the Outdoor LED TV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key technical differences between an Outdoor LED TV and a standard indoor television?

The primary differences lie in durability and visibility. Outdoor LED TVs feature enhanced protection, including high IP (Ingress Protection) ratings (IP65 or above) for protection against dust and water, specialized anti-glare screens, corrosion-resistant casings, and advanced internal thermal management systems necessary to operate safely in temperatures ranging from below freezing to extreme heat. Furthermore, outdoor units typically offer significantly higher brightness (1,500 to 5,000 nits) to counteract direct sunlight.

What is the typical lifespan and required maintenance for a weatherproof outdoor display?

The typical lifespan of a high-quality Outdoor LED TV ranges from 5 to 7 years, though professional-grade commercial units may exceed this. Maintenance primarily involves routine cleaning of the screen surface and verifying that the cooling vents remain unobstructed. Modern systems are designed for minimal intervention, relying on automated thermal controls and sealed components. Predictive AI diagnostics are increasingly reducing the need for reactive maintenance.

Is 4K resolution necessary for outdoor viewing, and how does screen brightness affect performance?

While Full HD can be adequate for smaller screens, 4K resolution is increasingly preferred, especially for large outdoor displays (65 inches and above), as it maintains picture clarity over typical outdoor viewing distances. Screen brightness (measured in nits) is critical; a brightness level of 1,000 nits is the minimum acceptable for shaded areas, while 2,000 to 4,000 nits is essential for reliable viewing in direct, mid-day sunlight, ensuring the image is not washed out by ambient light.

Which application segment (residential vs. commercial) is driving the highest growth in the market?

The commercial segment is currently driving the highest growth, particularly in sectors such as hospitality, retail, and digital out-of-home (DOOH) advertising. Commercial buyers purchase high volumes of high-durability units for revenue-generating purposes, leading to faster market adoption. However, the residential sector, driven by increasing consumer investment in luxury outdoor leisure and smart home integration, provides substantial foundational demand.

What is the significance of the IP rating for an Outdoor LED TV purchase?

The IP (Ingress Protection) rating is the most significant indicator of a unit’s resistance to environmental factors. A rating like IP65 signifies complete protection against dust (the '6') and protection against low-pressure water jets from any direction (the '5'). Buyers should look for high IP ratings (IP65 or IP66) to ensure the internal electronics are sealed against rain, humidity, and fine dust, guaranteeing long-term operational reliability in exposed settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager