Outrigger Skiies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443389 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Outrigger Skiies Market Size

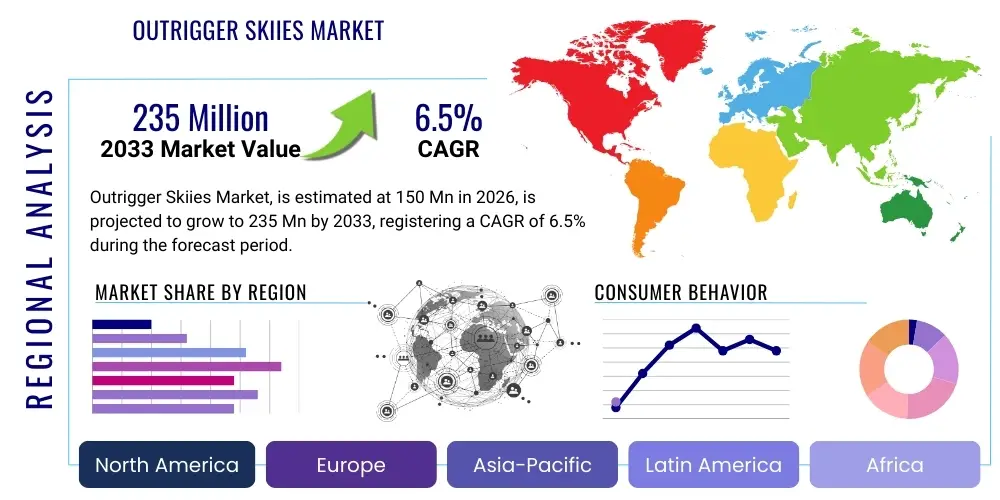

The Outrigger Skiies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This growth trajectory reflects increasing participation in adaptive winter sports and the rising demand for stability-enhancing equipment among recreational and specialized skiers. The market is estimated at $150 Million in 2026 and is projected to reach $235 Million by the end of the forecast period in 2033. Factors contributing to this expansion include technological advancements in lightweight materials and ergonomic design, making outrigger ski systems more accessible and efficient for a wider user base, especially in developed ski regions across North America and Europe.

Outrigger Skiies Market introduction

The Outrigger Skiies Market centers on specialized snow sports equipment designed primarily to enhance stability, balance, and control, particularly crucial for adaptive athletes, rehabilitation patients, and skiers seeking additional support on challenging terrains. An outrigger ski system typically involves lightweight poles equipped with small ski-like attachments at the base, functioning as stabilizing elements parallel to the main skis. These systems are instrumental in providing mobility and independence in snow sports, fundamentally expanding participation opportunities. The product's core benefits include improved confidence, reduced risk of falls, and the ability to navigate diverse snow conditions, from groomed slopes to powder. The market is propelled by increasing government and non-profit support for adaptive sports programs, technological innovation in composite materials that reduce equipment weight without compromising strength, and a growing general interest in inclusive recreational activities. Major applications span competitive adaptive skiing, therapeutic rehabilitation, and recreational use by novice or stability-concerned skiers.

Outrigger Skiies Market Executive Summary

The global Outrigger Skiies Market is characterized by steady growth driven predominantly by advancements in material science and a significant push toward inclusivity in winter sports. Current business trends indicate a shift towards modular and customizable outrigger systems, utilizing premium materials like carbon fiber to maximize durability while minimizing weight, addressing the professional adaptive racing segment's needs. Segment trends highlight the dominance of the Carbon Fiber material segment due to its performance advantages, although the Aluminum segment maintains market share due to cost-effectiveness and durability in rental applications. Regionally, North America and Europe remain the primary revenue generators, driven by established adaptive sports infrastructure and high disposable incomes allocated to specialized sports equipment. The Asia Pacific region, particularly countries like Japan and South Korea, is emerging as a critical growth engine, supported by recent investments in winter sports facilities and increasing awareness of adaptive recreation.

AI Impact Analysis on Outrigger Skiies Market

User queries regarding AI's influence on the Outrigger Skiies Market commonly revolve around personalized equipment design, performance optimization, and manufacturing efficiency. Users are keenly interested in whether AI-driven analytics can tailor outrigger length, stiffness, and placement precisely to an individual's biomechanics, disability level, and specific skiing goals, moving beyond generic sizing standards. Another central theme concerns the integration of machine learning for real-time performance feedback and safety monitoring, potentially leading to 'smart' outrigger systems. The key expectation is that AI will democratize high-performance adaptive equipment by optimizing complex material usage and reducing production waste, thus potentially lowering the barrier to entry for expensive, customized gear. Manufacturers are exploring AI simulations to predict stress points and fatigue in composite materials, accelerating R&D cycles and ensuring equipment safety under extreme conditions encountered in competitive adaptive skiing.

The application of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly reshaping the product lifecycle of outrigger ski equipment, spanning design, manufacturing, and personalized user experience. In the design phase, AI algorithms are being employed to analyze vast datasets of user biomechanics, performance metrics, and injury patterns to generate optimal structural designs. This leads to outrigger models perfectly tuned for specific balance requirements and snow conditions, drastically improving user safety and efficiency. Furthermore, ML is enhancing predictive maintenance strategies; by embedding micro-sensors into high-stress areas of the outrigger system, AI can monitor material fatigue in real-time and alert users or technicians to potential structural failures long before they occur, which is a critical safety factor in adaptive sports.

- AI-driven Biomechanical Optimization: Customized outrigger geometry (length, angle, stiffness) based on individual user physical data and performance needs.

- Predictive Material Science: ML models predicting the performance and longevity of new composite structures under various temperature and stress loads, speeding up material innovation.

- Smart Outrigger Systems: Integration of sensors and AI for real-time feedback on balance, pressure distribution, and technique correction during skiing.

- Optimized Manufacturing Processes: Use of AI in robotics and additive manufacturing (3D printing) to reduce material waste and achieve complex, lightweight component geometries.

- Personalized Coaching & Rehabilitation: ML algorithms analyze performance data gathered via embedded sensors to create individualized training plans for adaptive athletes.

DRO & Impact Forces Of Outrigger Skiies Market

The Outrigger Skiies Market is influenced by a dynamic interplay of factors primarily stemming from increasing inclusivity efforts in global sports and continuous material innovation. Key drivers include the global expansion of adaptive sports programs, better awareness and accessibility to assistive technologies, and rising government funding supporting winter Paralympic athletes and adaptive recreational centers. However, market growth faces restraints, notably the high initial cost of advanced outrigger systems, particularly those featuring aerospace-grade carbon fiber components, making them prohibitive for some non-profit organizations or individual users. Furthermore, the niche nature of the market results in a limited distribution network and specialized servicing requirements. Opportunities abound in the development of cost-effective, modular systems targeting the robust rental market and integrating IoT capabilities for enhanced safety and performance tracking. The market impact forces indicate that external factors such as global health crises or geopolitical instability could temporarily restrict international travel and participation in winter sports, impacting equipment sales, while favorable regulatory frameworks supporting adaptive equipment standards act as powerful positive accelerators.

Drivers are strongly rooted in socio-economic shifts favoring accessible recreation. The increasing elderly population in developed nations, often seeking low-impact, supportive recreational activities, presents a nascent but growing user base for stability-focused equipment like outrigger skis. Technological breakthroughs, specifically in bonding agents and composite layups, allow manufacturers to achieve superior stiffness-to-weight ratios, directly appealing to high-performance athletes who require precision and minimal equipment burden. Furthermore, the established success and visibility of events like the Winter Paralympics inspire more individuals with physical disabilities to engage in snow sports, fueling demand for both entry-level and professional-grade outrigger solutions.

Restraints largely revolve around market visibility and economic barriers. The specialized nature of outrigger skis means they require dedicated fitting and coaching, often unavailable outside major ski resorts or specialized adaptive centers, limiting broader adoption. Counterfeit or substandard materials entering the market pose a restraint as failure in such safety-critical equipment can lead to severe injury, damaging consumer trust in lower-cost options. Opportunities, conversely, focus on strategic partnerships between manufacturers and adaptive ski schools to develop standardized rental fleets and integrated training programs. Expansion into emerging markets, where ski culture is developing, offers long-term growth potential provided local adaptive infrastructure can be established. The primary impact force remains the velocity of innovation in composite material technology, directly influencing product weight, performance, and manufacturing cost.

Segmentation Analysis

The Outrigger Skiies Market segmentation provides a granular view of user needs, material preferences, and channel optimization, allowing manufacturers to strategically position their product lines. Segmentation by material is crucial, distinguishing between high-performance carbon fiber systems favored by competitive athletes for maximum lightness and responsiveness, and more durable, cost-effective aluminum or composite fiber systems suitable for recreational use and institutional rental programs. The application segment dictates design complexity, ranging from basic stability-focused models for beginners and rehabilitation to highly articulated, adjustable systems required for elite adaptive racing. Understanding these segments is key to addressing the diverse requirements of the market, ensuring product offerings align with specific price points and functionality expectations.

Further segmentation by distribution channel emphasizes the importance of specialty retailers and direct-to-consumer (DTC) online sales, particularly for customized or high-end models where expert consultation is often necessary. The distinction between single outrigger and dual outrigger setups (Type segment) addresses different levels of support required—single poles often used by individuals with unilateral impairments or advanced skiers seeking minor assistance, while dual setups cater to those requiring full bilateral stability support. The convergence of these segmentations informs pricing strategies, inventory management, and marketing campaigns, focusing efforts on high-value segments such as specialized adaptive sports centers which often purchase equipment in bulk for their programs.

- By Type: Single Outrigger Ski Systems, Dual Outrigger Ski Systems

- By Material: Carbon Fiber, Aluminum Alloy, High-Grade Composite Materials

- By Application: Recreational Skiing (Stability/Beginner Use), Adaptive Sports (Competitive Racing), Therapeutic/Rehabilitation Use

- By Distribution Channel: Specialty Retail Stores, Online Sales Channels, Adaptive Sports Centers (Direct Institutional Sales), Rental Services

Value Chain Analysis For Outrigger Skiies Market

The value chain for the Outrigger Skiies Market begins with upstream material procurement, heavily focused on specialized raw inputs such as high-modulus carbon fiber prepregs, lightweight aluminum alloys (e.g., aerospace-grade 7000 series), and precision plastics for component linkages and handles. Key considerations in the upstream stage are quality control, material certification, and negotiating stable supply agreements, especially for composite materials whose cost volatility can significantly impact final product pricing. Manufacturing involves highly technical processes, including mandrel wrapping for carbon poles, precise CNC machining for aluminum components, and rigorous assembly and testing. Due to the safety-critical nature of the equipment, rigorous quality assurance is integrated at every stage, adding complexity and cost compared to standard ski equipment manufacturing.

The downstream component of the value chain is characterized by a reliance on specialized distribution channels. Direct sales to major adaptive sports organizations and rehabilitation centers form a significant portion of institutional revenue, requiring specialized sales teams knowledgeable in adaptive equipment fitting and standards. Indirect distribution primarily moves through specialty winter sports retailers who often have trained staff capable of advising on adaptive gear, and through dedicated online platforms that can offer customization tools. Standard mass-market distribution channels are generally less effective due to the niche and specialized nature of the product, necessitating a tailored approach to inventory and retail partner selection.

The distribution channel landscape is critical; direct channels often yield higher margins and direct customer feedback, which is vital for continuous product refinement tailored to adaptive needs. Indirect channels, through specialized retailers and rental fleets, offer greater market penetration and visibility. Optimizing the logistics involves managing delicate, often oversized equipment while ensuring global standards of certification (e.g., ISO for adaptive aids) are maintained across all sales regions. Efficiency gains in this chain primarily come from streamlining the custom fitting process, potentially utilizing digital scanning technologies to reduce lead times between order and delivery, enhancing the overall customer experience for highly specialized users.

Outrigger Skiies Market Potential Customers

The primary customer base for the Outrigger Skiies Market is highly defined, focusing on individuals requiring enhanced stability and balance mechanisms to participate in snow sports. Adaptive athletes form the most prominent segment, ranging from those participating recreationally to elite competitors in events like the Paralympics, who demand the lightest, most responsive, and technologically advanced systems available. This group often requires highly customized solutions tailored to specific physical impairments, driving demand for premium, custom-fit carbon fiber outriggers. Furthermore, rehabilitation clinics and physical therapy centers frequently purchase outrigger systems for use in therapeutic settings, utilizing skiing as a means to improve balance, core strength, and mobility for patients recovering from injuries or managing chronic conditions.

A secondary, yet rapidly expanding, customer segment includes the general population of beginner skiers or those returning to the sport later in life who feel apprehensive about stability, particularly on challenging slopes or in crowded environments. These users seek user-friendly, robust systems—often aluminum or composite—that offer an added sense of security, allowing them to enjoy the activity with greater confidence. Rental shops located at major ski resorts constitute a significant institutional buyer, purchasing durable, adjustable outriggers to meet the fluctuating demands of tourists and temporary visitors seeking adaptive equipment or beginner stability aids.

The identification of these specific end-user groups dictates sales strategies, emphasizing relationships with adaptive sports organizations and therapeutic providers over general sports retail. Understanding the purchasing cycles—often dictated by grant funding or insurance reimbursement schedules for adaptive users—is crucial for manufacturers. Customer loyalty is high in this segment, driven by the specialized fit and critical safety function of the equipment; therefore, exceptional post-sale support and servicing are critical for maintaining market share and reputation among this core user group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million |

| Market Forecast in 2033 | $235 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rossignol, Salomon, Head, Atomic, Fischer, Volkl, Kastle, Elan, Blizzard, Nordica, DPS Skis, Black Crows, Armada, Meier Skis, Moment Skis, Unity Skis, Fat-ypus, Icelantic, Liberty Skis, Dynastar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outrigger Skiies Market Key Technology Landscape

The technological landscape of the Outrigger Skiies Market is heavily dependent on material science and precision engineering, focusing primarily on achieving optimal strength-to-weight ratios and ergonomic function. The most significant technological driver is the use of advanced composite materials, particularly high-modulus carbon fiber (e.g., T700, M40J), which allows manufacturers to produce incredibly light yet stiff poles and foot attachments. This is crucial for adaptive athletes, where minimizing energy expenditure and maximizing control are paramount. Manufacturing processes utilize techniques like automated fiber placement and resin transfer molding (RTM) to ensure consistent quality and defect-free composite structures, critical for equipment reliability under competition stress.

Furthermore, innovations in joint mechanisms and articulation points are enhancing product versatility. Modern outrigger systems feature quick-release mechanisms, highly adjustable cuffs, and customizable pole lengths that can be modified on the fly to suit changing terrain, snow conditions, or user fatigue levels. These advancements improve usability for the adaptive user who may have limited dexterity. The trend toward modular design, where components can be easily replaced or upgraded, contributes to the longevity and sustainability of the equipment, reducing the overall lifecycle cost for specialized centers.

A growing area of technological integration involves the application of smart technologies. Though nascent, sensor integration (e.g., gyroscopes, accelerometers, pressure sensors) embedded within the outrigger attachments is being piloted to capture real-time data on user balance, lean angle, and ground contact force. This data is invaluable for coaches and therapists, enabling precise feedback for technique refinement and measuring rehabilitation progress. The convergence of these material, mechanical, and digital innovations is defining the next generation of high-performance and therapeutic outrigger ski equipment, solidifying the market's trajectory toward highly specialized, data-informed product offerings.

Regional Highlights

The Outrigger Skiies Market exhibits distinct growth patterns influenced by regional winter sports culture, adaptive program funding, and economic development. North America, encompassing the United States and Canada, represents the largest and most mature market segment. This dominance is attributable to extensive governmental and non-profit support for adaptive sports, well-established infrastructure (such as specialized ski schools and accessible resorts), and a high concentration of leading manufacturers and adaptive technology developers. The high visibility of Paralympic sports and strong consumer purchasing power also drives the continuous demand for premium, custom-fitted equipment in this region.

Europe holds the second-largest market share, led by countries in the Alps region (e.g., Austria, Switzerland, France, Germany). Growth in Europe is stimulated by a deeply entrenched ski culture, comprehensive social welfare systems that often subsidize therapeutic and adaptive sports equipment, and rigorous standardization requirements (CE markings) that ensure product safety and quality. Eastern European countries are showing potential, driven by infrastructure investment in winter tourism, though the adaptive sports infrastructure remains less developed than in Western Europe.

Asia Pacific (APAC) is identified as the region with the highest potential CAGR during the forecast period. This rapid growth is fueled by major investments in winter sports infrastructure, particularly following recent Winter Olympic and Paralympic Games hosting (e.g., in China and South Korea). Increasing disposable incomes and greater awareness of adaptive recreation opportunities among large populations in countries like Japan and Australia are accelerating market uptake. While currently a smaller overall market than North America or Europe, the pace of infrastructure development and consumer awareness suggests APAC will be crucial for global expansion.

- North America: Market leader due to robust adaptive sports funding, large network of accessible resorts, and high adoption of premium, carbon fiber systems.

- Europe: Strong market driven by traditional ski culture, government subsidies for adaptive equipment, and established therapeutic use of snow sports.

- Asia Pacific (APAC): Fastest-growing region, driven by recent investments in winter sports facilities and increasing awareness of adaptive recreation, particularly in urbanized, affluent areas.

- Latin America & MEA: Emerging markets characterized by lower penetration; growth potential tied to isolated projects focused on specialized tourism and localized adaptive programs in niche skiing destinations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outrigger Skiies Market.- Rossignol

- Salomon

- Head

- Atomic

- Fischer

- Volkl

- Kastle

- Elan

- Blizzard

- Nordica

- DPS Skis

- Black Crows

- Armada

- Meier Skis

- Moment Skis

- Unity Ski Solutions (Specialized Adaptive Gear)

- Adaptive Ski Products (Focus on Outriggers)

- Sit Ski Systems Inc.

- Dynastar

- Liberty Skis

Frequently Asked Questions

Analyze common user questions about the Outrigger Skiies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and who benefits most from Outrigger Skiies?

Outrigger Skiies are specialized poles with miniature skis attached, designed primarily to enhance stability, balance, and lateral control for skiers. They significantly benefit adaptive athletes, individuals with mobility impairments, and novice skiers requiring additional support to navigate slopes safely and independently, promoting inclusivity in winter sports.

How is the adoption of carbon fiber affecting the Outrigger Skiies market?

Carbon fiber is a major growth driver, offering superior stiffness and minimal weight compared to aluminum. This material is crucial for high-performance and competitive adaptive racing segments, as it reduces skier fatigue and improves precision control, justifying the higher premium for these specialized systems.

What are the key technological trends influencing outrigger design?

Key trends include the implementation of modular, adjustable joint systems for customizable ergonomics, and the experimental integration of micro-sensors (IoT) for real-time data collection on balance and performance metrics, moving towards 'smart' adaptive equipment for enhanced training and safety.

Which geographical regions dominate the sales of Outrigger Skiies?

North America and Europe currently dominate the market due to well-established adaptive sports programs, extensive ski resort infrastructure, and high consumer spending on specialized equipment. The Asia Pacific region is forecast to experience the fastest growth due to increasing infrastructure investment.

What are the main barriers to entry for new manufacturers in this specialized market?

Main barriers include the necessity for highly specialized technical expertise in adaptive equipment design, meeting stringent safety certifications required for therapeutic and sports aids, and navigating the niche distribution network that relies heavily on adaptive sports centers and specialty retailers rather than mass market channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager