Over-the-Counter (OTC) and Diet Supplement Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442338 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Over-the-Counter (OTC) and Diet Supplement Market Size

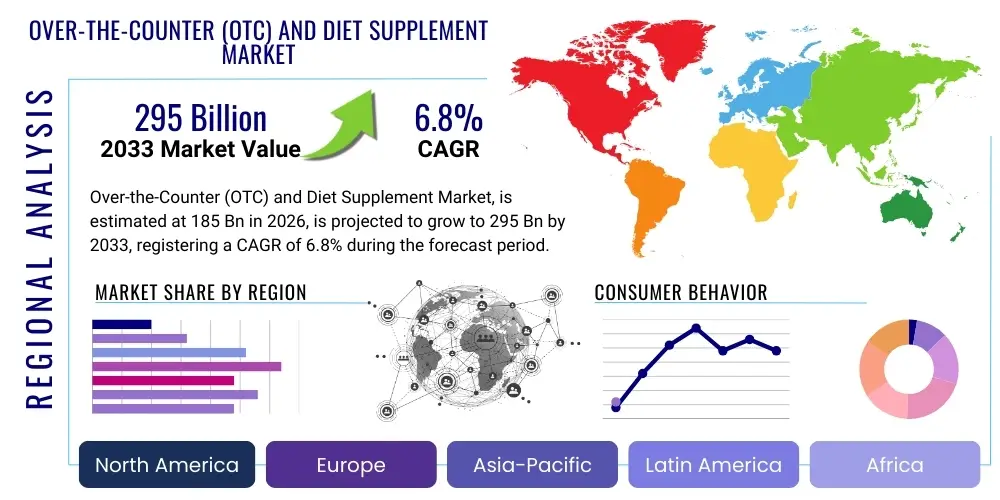

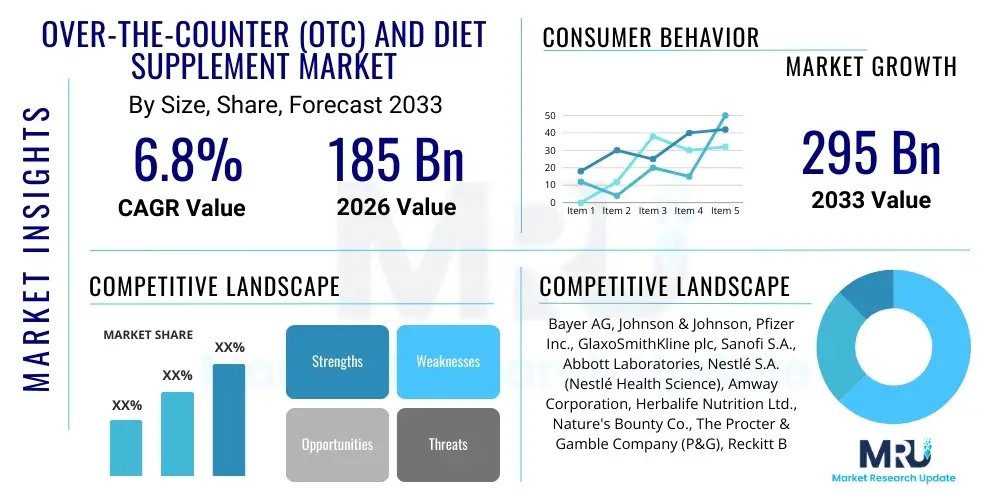

The Over-the-Counter (OTC) and Diet Supplement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185 Billion in 2026 and is projected to reach USD 295 Billion by the end of the forecast period in 2033.

Over-the-Counter (OTC) and Diet Supplement Market introduction

The Over-the-Counter (OTC) and Diet Supplement Market encompasses a vast array of health and wellness products purchased directly by consumers without a prescription. This segment includes categories such as vitamins, minerals, herbal supplements (botanicals), sports nutrition products, weight management aids, and non-prescription medications for common ailments like pain relief, cold, and flu. The primary product description centers on accessibility, self-care, and preventative health maintenance. Products are formulated to address nutritional deficiencies, enhance physical performance, support specific biological functions (e.g., digestive or immune health), or manage minor acute health conditions, reflecting a fundamental shift towards proactive consumer health management and personalized nutrition strategies globally.

Major applications of OTC drugs involve symptom management for common illnesses, including allergies, dermatological issues, and gastrointestinal discomfort, facilitating faster return to daily activities and reducing dependence on professional medical services for minor conditions. Diet supplements are primarily applied in addressing lifestyle gaps, such as supporting bone health (Vitamin D, Calcium), energy levels (B vitamins), and muscle repair (Protein, BCAAs). The dual focus on therapeutic efficacy (OTC) and lifestyle enhancement (Supplements) drives market dynamism. Key benefits include convenience, cost-effectiveness compared to prescription alternatives, and empowering consumers with greater control over their immediate health needs. This emphasis on immediate accessibility and perceived low risk fosters high consumer loyalty in established brands.

The market is predominantly driven by powerful demographic and social trends, particularly the aging global population seeking solutions for age-related ailments and maintaining vitality, coupled with rising health consciousness among millennials and Gen Z. Increased urbanization, leading to higher stress levels and nutritional compromises, fuels demand for convenient supplemental solutions. Furthermore, aggressive digital marketing and the proliferation of e-commerce platforms have broadened geographical reach and reduced barriers to entry for specialized supplement brands, transforming purchasing patterns. Regulatory evolution, particularly the classification and approval processes for novel dietary ingredients, also significantly influences innovation and market expansion trajectories within established regulatory frameworks across North America, Europe, and increasingly, Asia Pacific.

Over-the-Counter (OTC) and Diet Supplement Market Executive Summary

The Over-the-Counter (OTC) and Diet Supplement Market is experiencing robust acceleration, fueled by consumer prioritization of proactive health maintenance and the expanding availability of personalized nutritional solutions. Current business trends indicate a strong move towards clean-label products, transparency in ingredient sourcing, and scientific validation of efficacy, compelling major players to invest heavily in research and development to differentiate premium offerings. Strategic mergers, acquisitions, and partnerships are highly prevalent as established pharmaceutical companies look to integrate fast-growing, agile supplement brands, particularly those specializing in niche areas like probiotics, personalized vitamin packs, and cognitive enhancers (nootropics). The integration of digital health tools, such as symptom checkers and personalized recommendation engines, is revolutionizing product discovery and consumer engagement, cementing e-commerce as the dominant distribution channel globally.

Regionally, North America maintains its dominance due to high disposable incomes, mature regulatory frameworks supporting extensive product innovation, and deep-rooted consumer habits regarding self-medication and supplementation. However, the Asia Pacific region, led by China and India, is registering the highest growth rate. This rapid expansion is attributed to increasing awareness of preventative healthcare, improving economic conditions, and the adaptation of traditional herbal remedies into modern, standardized supplement formats. European markets show stable, sustained growth, driven primarily by demand for functional ingredients and high-quality, traceable natural products, often supported by stringent European Union standards regarding health claims and safety. Latin America and MEA represent emerging opportunities, characterized by foundational growth in basic vitamins and minerals, soon to be followed by more specialized segments as consumer education increases.

Segmentation trends highlight the exceptional growth of the dietary supplements category, specifically functional ingredients such as protein powders, omega-3 fatty acids, and specialized botanical extracts tailored for stress, sleep, and immunity support. Within the OTC segment, digital health solutions and advanced formulations for digestive health (prebiotics, postbiotics) are witnessing significant uptake. The shift from synthetic ingredients to natural or naturally derived ingredients is paramount across all segments, dictating formulation strategies. Furthermore, customized nutrition, facilitated by direct-to-consumer (DTC) models leveraging genetic and lifestyle data for personalized supplement regimens, is transitioning from a niche offering to a mainstream expectation, reshaping traditional mass-market approaches and emphasizing highly tailored consumer experiences.

AI Impact Analysis on Over-the-Counter (OTC) and Diet Supplement Market

User queries regarding the impact of Artificial Intelligence (AI) on the OTC and Diet Supplement Market primarily revolve around three key themes: personalization at scale, regulatory compliance and safety monitoring, and supply chain optimization. Consumers frequently ask how AI can create truly individualized supplement stacks based on genomics, microbiome data, and wearable technology inputs, moving beyond generic recommendations. Manufacturers are keenly focused on leveraging AI for accelerated product development, particularly for identifying novel bioactive compounds and predicting formulation stability and efficacy, streamlining the often-lengthy R&D process. A third major area of concern is the use of AI in fraud detection, combating counterfeit products, and enhancing pharmacovigilance for OTC drugs, ensuring consumer trust and maintaining high safety standards across geographically fragmented markets. The consensus expectation is that AI will be the primary catalyst for the next generation of consumer-centric, evidence-based wellness products.

- Personalized Formulation: AI algorithms analyze genetic data, lifestyle metrics from wearables, and dietary habits to recommend precision supplement formulations tailored to individual physiological needs, driving the growth of the customized nutrition segment.

- Supply Chain Optimization: Predictive analytics enhance inventory management, forecast demand fluctuation, and optimize cold chain logistics, reducing waste and improving product freshness and availability across complex global distribution networks.

- Accelerated R&D: Machine learning identifies potential synergistic ingredient combinations, predicts the bioavailability and toxicology of novel compounds, and significantly reduces the time required for identifying effective nutraceuticals.

- Enhanced Customer Experience (CX): AI-powered chatbots and virtual assistants provide immediate, 24/7 self-care advice, personalized dosage instructions, and rapid answers to common OTC drug inquiries, improving adherence and satisfaction.

- Quality Control and Fraud Detection: AI monitors manufacturing processes in real-time for deviations, analyzes spectral data to verify ingredient authenticity, and scans e-commerce platforms to identify and flag counterfeit supplement listings, ensuring product integrity.

- Regulatory Compliance: Automated systems track evolving regulatory requirements across different jurisdictions, helping manufacturers ensure that labeling, claims, and documentation meet the specific legal standards of target markets instantaneously.

DRO & Impact Forces Of Over-the-Counter (OTC) and Diet Supplement Market

The OTC and Diet Supplement Market is shaped by a confluence of powerful drivers, structural restraints, strategic opportunities, and immediate impact forces. Primary drivers include the increasing consumer preference for self-care and preventative medicine, the escalating cost of prescription healthcare compelling consumers towards accessible OTC alternatives, and the massive influence of digital health trends facilitating unprecedented market reach and consumer education. These factors create strong tailwinds, promoting continuous product innovation and segmentation into highly specialized categories like gut health, cognitive support, and targeted anti-aging solutions. The shift towards natural, plant-based ingredients further accelerates market momentum, responding to a global desire for less synthetic consumption.

Conversely, significant restraints temper growth potential. Regulatory complexity remains a major challenge; unlike pharmaceuticals, supplements often face a patchwork of different regulations globally, leading to high compliance costs, especially for international brands, and creating hurdles for substantiating health claims without robust clinical data. The risk of product misuse or over-consumption, coupled with consumer skepticism regarding the efficacy of certain supplements due to past instances of contamination or misleading labeling, acts as a structural restraint on consumer trust. Economic volatility, particularly in emerging markets, can restrict consumer spending on non-essential health expenditures like premium supplements, favoring basic OTC remedies instead, impacting overall revenue stability and pricing power.

Strategic opportunities lie predominantly in leveraging technology for hyper-personalization, integrating diagnostic tools (e.g., at-home testing kits for vitamin levels) directly into the supplement purchasing journey. The expansion into untapped therapeutic areas, such as mental wellness, sleep disorders, and women’s specific health concerns (e.g., menopause support), represents substantial new market niches. Furthermore, partnerships between supplement manufacturers and major pharmacy chains or healthcare providers to offer integrated wellness programs legitimize the role of supplements in mainstream health. Impact forces currently revolving around global supply chain fragility and inflationary pressures are forcing companies to rethink sourcing and manufacturing location strategies, emphasizing resilience and regionalization to maintain competitive pricing and stable inventory levels for essential health products.

Segmentation Analysis

The Over-the-Counter (OTC) and Diet Supplement Market is extensively segmented by product type, formulation, distribution channel, and target application, reflecting the heterogeneous nature of consumer needs and market structures. The comprehensive segmentation strategy allows manufacturers to precisely target specific demographic groups or health conditions, maximizing product relevance and market penetration. Product segmentation distinguishes between therapeutic OTC medications (e.g., analgesics, cold remedies) and nutritional supplements (e.g., vitamins, proteins), each governed by different regulatory standards and consumer perception profiles. Formulation segmentation, highlighting tablets, capsules, liquids, and novel formats like gummies and effervescents, directly addresses consumer preference for ease of use and palatability, while distribution segmentation reflects the critical shift towards digital commerce and pharmacy retail dominance.

Detailed analysis of the market segments reveals distinct growth drivers within each category. For instance, the demand for natural and clean-label supplements is fueling the sub-segment of plant-based proteins and organic ingredients, often commanding premium pricing. Application-based segmentation underscores the shift toward specialized health targets, with immune health and digestive health supplements consistently outpacing general wellness products, especially post-pandemic. The differentiation between adult and pediatric formulations is critical in OTC drugs, requiring specialized regulatory oversight and rigorous safety testing. Understanding these segment dynamics is essential for market participants seeking competitive advantage through targeted product development and optimized channel strategies, focusing investments where consumer demand signals the clearest path to growth and sustained profitability.

- By Product Type (OTC):

- Cold, Cough, and Flu Products

- Analgesics (Pain Relief)

- Dermatological Products

- Digestive Health Products (Antacids, Laxatives)

- Sleep Aids and Sedatives

- Eye and Ear Care

- First Aid Kits and Wound Care

- By Product Type (Dietary Supplement):

- Vitamins (Multivitamins, Vitamin C, D, B Complex)

- Minerals (Calcium, Magnesium, Iron)

- Herbal/Botanical Supplements (Ginseng, Turmeric, Echinacea)

- Protein and Amino Acid Supplements (Whey, Casein, BCAAs)

- Fatty Acids (Omega-3, EPA, DHA)

- Probiotics, Prebiotics, and Synbiotics

- Specialty Supplements (e.g., Glucosamine, Nootropics, Meal Replacements)

- By Formulation:

- Tablets and Capsules

- Powders

- Liquids and Gels

- Gummies and Chewables (High Growth Segment)

- Softgels

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- E-commerce and Online Retail (Fastest Growing Segment)

- Direct Selling

- By Target Application/End Use:

- General Wellness

- Immune Health

- Bone and Joint Health

- Energy and Weight Management

- Digestive Health

- Cardiovascular Health

- Sports Nutrition

Value Chain Analysis For Over-the-Counter (OTC) and Diet Supplement Market

The value chain for the OTC and Diet Supplement Market begins with robust upstream activities focused on the sourcing, extraction, and purification of raw materials, which are highly diverse, ranging from synthesized chemicals for OTC drugs to botanical extracts and specialized nutritional components for supplements. Upstream analysis highlights the critical importance of supply chain transparency and quality control, especially given the global sourcing of ingredients like fish oils, herbal extracts, and amino acids. Certification of suppliers (e.g., GMP, organic certification) is non-negotiable, ensuring the safety and efficacy of the final product. Key challenges in this stage include managing price volatility of agricultural commodities and maintaining sustainable sourcing practices, which directly impact the final cost and ethical positioning of the brand. Advanced technology, such as vertical farming for botanicals and synthetic biology for specialized ingredients, is starting to reshape this upstream component.

Midstream activities involve sophisticated manufacturing and formulation processes. This stage is characterized by significant capital investment in Good Manufacturing Practice (GMP) compliant facilities for blending, encapsulation, tableting, and packaging. The distinction between OTC pharmaceuticals and dietary supplements impacts required quality assurance levels and batch testing protocols; OTC products must adhere to stricter pharmaceutical standards. Optimization of formulation to enhance bioavailability and stability is a key competitive differentiator. Downstream analysis focuses heavily on market access, branding, and distribution. Effective marketing, leveraging digital platforms and influencer networks, is crucial for consumer education and brand building, especially in the crowded supplement space where direct-to-consumer (DTC) models bypass traditional retail gatekeepers.

The distribution channel landscape is highly bifurcated between direct and indirect methods. Indirect distribution, dominated by retail pharmacies, drug stores, and supermarkets, offers broad accessibility and often benefits from consumer trust in professional retail environments. Direct distribution, primarily through e-commerce and proprietary brand websites, provides higher margins, allows for greater personalization (e.g., subscription services), and offers direct access to consumer data, facilitating rapid product iteration and personalized marketing. The emergence of omnichannel strategies, seamlessly integrating online ordering with in-store pickup, is now standard practice. Logistics and warehousing must manage diverse product requirements, including specific temperature controls for probiotics and certain liquids, necessitating specialized logistics partners who can ensure product integrity until the point of sale, thereby maximizing consumer safety and extending shelf life.

Over-the-Counter (OTC) and Diet Supplement Market Potential Customers

The potential customer base for the OTC and Diet Supplement Market is extremely broad, encompassing virtually all demographics seeking health maintenance, preventative care, or symptomatic relief. End-users fall into several core segments. The largest and fastest-growing segment consists of Health-Conscious Millennials and Gen Z individuals. These younger buyers are proactive, utilize digital channels extensively for health information, and prioritize supplements related to stress management, cognitive performance (nootropics), and sustainable energy, viewing supplements as integral to achieving peak performance and longevity. They demand transparency, ethical sourcing, and evidence-based efficacy, driving the trend toward clean-label and scientifically validated products.

Another major segment includes the Aging Population (Baby Boomers and Silent Generation). These consumers are high-volume purchasers of OTC analgesics, joint support supplements (glucosamine, chondroitin), and basic vitamins (D, Calcium) necessary for managing age-related conditions. Their purchasing decisions are often influenced by medical professionals and rely heavily on traditional retail channels like pharmacies. Brand loyalty is high within this segment, provided products deliver consistent results and perceived value, often favoring established, trusted pharmaceutical names for OTC solutions and specialized brands recommended by geriatric experts for supplements.

The third significant group comprises Athletes and Fitness Enthusiasts, spanning both professional and amateur levels. This segment focuses heavily on sports nutrition, including protein powders, creatine, BCAAs, and pre-workout supplements, seeking products that enhance physical performance, muscle recovery, and stamina. Purchasing decisions are driven by performance metrics, certification (e.g., NSF Certified for Sport), and ingredient quality. Beyond these core groups, impulse buyers seek quick relief from acute symptoms (colds, headaches) utilizing classic OTC drugs, while individuals with chronic dietary restrictions (vegans, those with allergies) form a critical niche demanding specialized, contaminant-free nutritional replacements, demonstrating the market's expansive scope across varied consumer health needs and priorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Billion |

| Market Forecast in 2033 | USD 295 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Johnson & Johnson, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Abbott Laboratories, Nestlé S.A. (Nestlé Health Science), Amway Corporation, Herbalife Nutrition Ltd., Nature's Bounty Co., The Procter & Gamble Company (P&G), Reckitt Benckiser Group plc, Takeda Pharmaceutical Company Limited, Church & Dwight Co., Inc., Perrigo Company plc, Blackmores Limited, DSM, GNC Holdings, Inc., Kenvue (J&J Consumer Health Spinoff), DuPont Nutrition & Biosciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Over-the-Counter (OTC) and Diet Supplement Market Key Technology Landscape

The technological landscape of the OTC and Diet Supplement Market is rapidly evolving, driven by the need for enhanced product efficacy, improved bioavailability, and sophisticated consumer interaction. A primary focus is on advanced drug delivery systems for OTC products, such as microencapsulation and sustained-release formulations, which enhance therapeutic effect duration and patient compliance by requiring less frequent dosing. For supplements, nanotechnology is being utilized to improve the absorption rates of poorly soluble nutrients, such as curcumin and certain vitamins, allowing for higher efficacy at lower concentrations. Furthermore, the integration of blockchain technology is gaining traction, particularly for tracking ingredients from source to consumer, providing unparalleled transparency and verifying the authenticity of high-value or highly regulated supplements, mitigating risks associated with counterfeiting and ensuring compliance with 'clean label' requirements.

Biotechnology and synthetic biology play a critical role in the development of next-generation ingredients, particularly in the probiotic and protein segments. Precision fermentation allows for the sustainable production of highly pure, novel compounds, such as specific fatty acids, rare cannabinoids, and non-animal proteins, bypassing traditional agricultural limitations and ensuring consistent quality independent of environmental factors. This technological advancement is essential for meeting the growing ethical and sustainability demands of modern consumers. Digitalization underpins the entire market strategy; AI and machine learning tools are not only used for personalization but also for predicting the optimal flavor profiles, ingredient combinations, and shelf-life stability during the formulation stage, drastically reducing time-to-market for innovative products and optimizing manufacturing yields.

Beyond product creation, manufacturing processes are increasingly leveraging advanced automation and robotics to ensure sterility and precision in high-volume production, crucial for maintaining GMP compliance across both OTC and supplement lines. Quality assurance is revolutionized by spectroscopic methods (e.g., Near-Infrared Spectroscopy, Mass Spectrometry) that provide instantaneous, non-destructive analysis of raw materials and finished goods, moving quality control from batch testing to continuous, real-time monitoring. These technologies collectively enable manufacturers to offer highly innovative, safer, and more personalized products while simultaneously streamlining operational costs and enhancing global regulatory adherence, creating a highly competitive environment focused on scientific rigor and technological superiority.

Regional Highlights

- North America (United States, Canada, Mexico): North America dominates the global OTC and Diet Supplement market in terms of revenue share, characterized by high consumer awareness, significant disposable income allocated to health and wellness, and a well-established regulatory environment (FDA/Health Canada). The U.S. market is the primary driver, showing massive demand for specialized supplements, particularly sports nutrition, personalized vitamins, and nootropics, heavily supported by aggressive digital marketing and a thriving DTC ecosystem. Innovation in delivery formats (e.g., functional gummies, personalized subscription services) is most prominent here, setting global trends for consumer engagement.

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe): Europe is characterized by stringent quality control and high demand for natural, botanical, and sustainably sourced ingredients, particularly in Germany and the UK. The market growth is stable, driven by an aging population increasing the demand for bone health and cardiovascular OTC solutions. The regulatory landscape (EFSA regulations on health claims) ensures product trustworthiness but often restricts the speed of innovation compared to the U.S. E-commerce penetration is rising rapidly, challenging traditional pharmacy dominance, especially for wellness supplements.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Australia, Rest of APAC): APAC is the fastest-growing region, driven by massive population size, rising middle-class disposable income, and increasing Western influence on healthcare practices combined with strong consumer acceptance of Traditional Chinese Medicine (TCM) and Ayurvedic principles. China and India are the primary growth engines, seeing explosive demand for general vitamins, immune boosters, and basic OTC analgesics. Regulatory harmonization efforts across ASEAN countries are gradually easing market entry, fostering high investment in local manufacturing capabilities and ingredient sourcing.

- Latin America (Brazil, Argentina, Rest of Latin America): Latin America represents an emerging market with significant growth potential, although market penetration is uneven. Growth is primarily centered in major urban areas, fueled by increasing health consciousness and better access to international products via retail and online channels. Economic instability and fluctuating currency values remain key barriers to consistent growth, often forcing consumers to prioritize essential OTC medications over premium supplements. Brazil leads the region due to its substantial domestic supplement industry and high consumer expenditure on fitness-related products.

- Middle East and Africa (MEA): The MEA market is heavily influenced by rapid urbanization and the establishment of sophisticated retail infrastructure, particularly in the GCC countries. The demand for supplements is driven by rising lifestyle diseases and a focus on specialized nutrition linked to religious practices (e.g., Halal certification). The market remains reliant on imported finished goods, though local manufacturing initiatives are being supported by government programs aimed at fostering pharmaceutical self-sufficiency, indicating future growth opportunities in local production of basic vitamins and minerals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Over-the-Counter (OTC) and Diet Supplement Market.- Bayer AG

- Johnson & Johnson (J&J)

- Pfizer Inc.

- GlaxoSmithKline plc (Haleon)

- Sanofi S.A.

- Abbott Laboratories

- Nestlé S.A. (Nestlé Health Science)

- Amway Corporation

- Herbalife Nutrition Ltd.

- The Procter & Gamble Company (P&G)

- Reckitt Benckiser Group plc

- Takeda Pharmaceutical Company Limited

- Church & Dwight Co., Inc.

- Perrigo Company plc

- Blackmores Limited

- Koninklijke DSM N.V. (DSM)

- GNC Holdings, Inc.

- Kenvue (J&J Consumer Health Spinoff)

- DuPont Nutrition & Biosciences

- Cargill, Incorporated

Frequently Asked Questions

Analyze common user questions about the Over-the-Counter (OTC) and Diet Supplement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the global OTC and Diet Supplement Market?

The market growth is fundamentally driven by rising consumer focus on preventative healthcare, the global aging population seeking vitality solutions, and the significant shift toward self-medication due to escalating prescription healthcare costs. Furthermore, the immense convenience and product diversity offered through specialized e-commerce platforms significantly accelerate market accessibility and consumption rates worldwide.

Which distribution channel is witnessing the fastest growth rate for diet supplements?

E-commerce and Online Retail is the fastest-growing distribution channel. This rapid expansion is facilitated by the direct-to-consumer (DTC) model, which allows niche brands to scale quickly, offers personalized subscription services, and provides consumers with comprehensive digital information regarding product efficacy and ingredient sourcing, often bypassing traditional pharmacy retail limitations.

How is Artificial Intelligence (AI) being utilized to enhance personalized nutrition in this industry?

AI is crucial for creating hyper-personalized supplement regimens by analyzing individual biological data, including genomics, blood markers, and lifestyle metrics derived from wearable technology. This allows manufacturers to formulate precision nutrition products that address specific deficiencies or health goals more effectively than mass-market options, driving the next phase of innovation.

What are the major challenges facing manufacturers in the Over-the-Counter segment?

Major challenges include navigating complex and fragmented global regulatory environments, particularly concerning health claims substantiation and ingredient standardization. Additionally, intense competition requires continuous investment in clinically proven efficacy and differentiated delivery mechanisms (e.g., sustained release) to maintain consumer trust and market share against established brands and private labels.

Which geographical region holds the largest market share for OTC drugs and supplements?

North America currently holds the largest market share, predominantly driven by the robust U.S. market. This dominance is due to high consumer acceptance of supplements, mature retail and regulatory infrastructure, and significant expenditure on lifestyle and wellness products, particularly in specialized areas like sports nutrition and cognitive enhancers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager