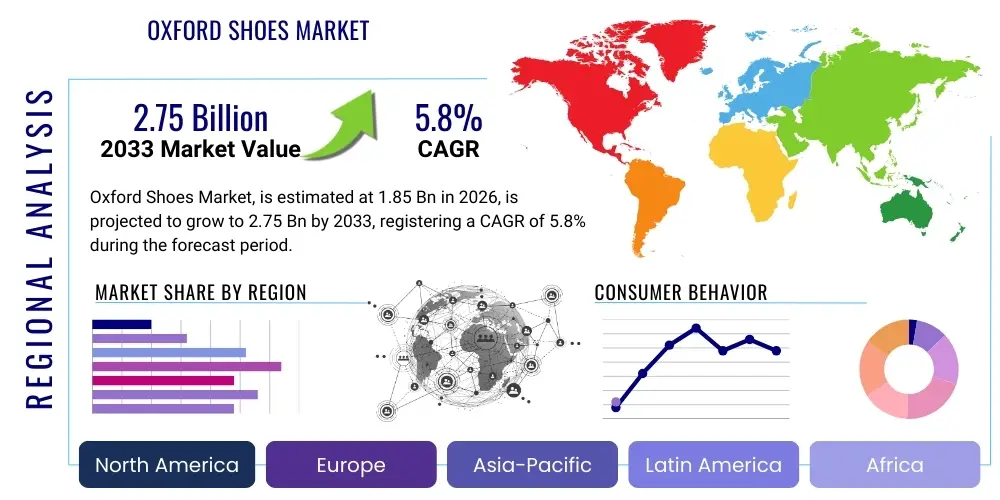

Oxford Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443526 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Oxford Shoes Market Size

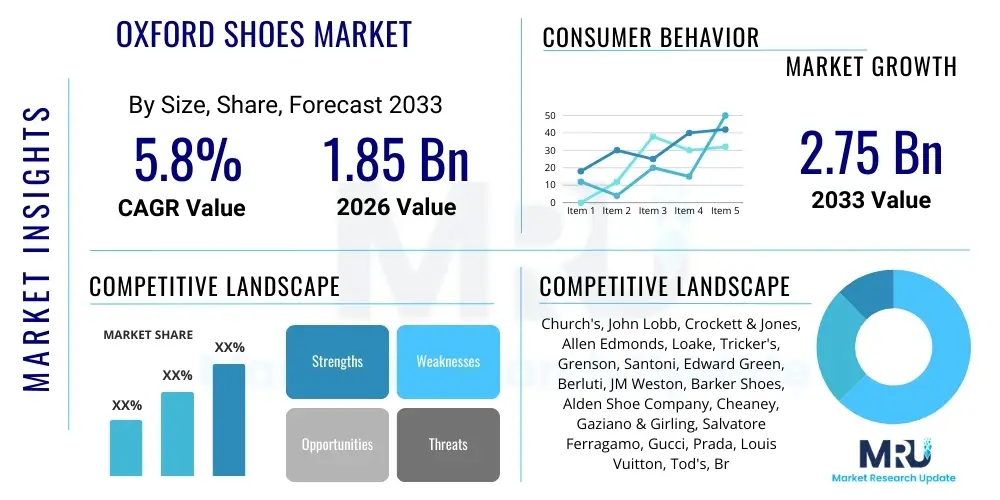

The Oxford Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.85$ Billion USD in 2026 and is projected to reach $2.75$ Billion USD by the end of the forecast period in 2033.

Oxford Shoes Market introduction

The Oxford Shoes Market encompasses the global trade of high-quality, structured footwear defined by its signature closed lacing system, distinguishing it as the cornerstone of formal and corporate professional attire. Key product categories include the Cap-toe, Wingtip, Plain-toe, and Wholecut variations, primarily crafted from premium materials such as calf leather, patent leather, and high-grade suede. These shoes serve major applications across corporate settings, high-level diplomatic events, formal ceremonies, and luxury social gatherings. The fundamental benefits driving persistent market demand are the shoe's superior durability, timeless elegance, and perceived status as an investment piece in a classic wardrobe. Market expansion is being driven by the globalization of business culture necessitating standardized formal wear, the increasing purchasing power of affluent demographics in emerging markets, and a renewed appreciation for artisanal craftsmanship and sustainable, long-lasting products, solidifying the Oxford’s position against fleeting casual footwear trends.

The Oxford shoe, originating as a functional boot in the early 19th century, has undergone centuries of refinement to become the quintessential formal shoe. Its construction, often utilizing complex methods such as Goodyear or Blake welting, ensures exceptional longevity and repairability, key benefits that resonate deeply with modern consumers prioritizing sustainability and value. This emphasis on quality has fostered a strong brand loyalty segment where consumers are willing to pay a significant premium for heritage labels that guarantee artisanal production standards. Major driving factors include the revitalization of formal occasions post-pandemic, reinforcing the social requirement for polished dressing, and technological advancements that enhance comfort, such as improved arch supports and flexible sole compounds, mitigating the historical critique that formal shoes lack ergonomic consideration. These improvements expand the Oxford’s suitability for daily professional use, ensuring its sustained relevance.

Further propelling the market are sophisticated digital marketing strategies employed by luxury brands, which effectively translate the value proposition of heritage and meticulous manufacturing processes to a globally distributed, digitally native audience. These campaigns often highlight the history, the skilled labor involved, and the traceable sourcing of materials, which appeal directly to the conscientious luxury buyer. Economic growth in regions such as the Asia Pacific continues to create new pools of consumers adopting Western business attire, seeing the Oxford shoe as a definitive symbol of professional success and sophistication. The market's stability is inherently tied to the luxury goods sector’s resilience during economic downturns, as core consumers view these purchases as necessary, long-term assets, ensuring consistent revenue streams and justifying the projected moderate Compound Annual Growth Rate throughout the forecast period.

Oxford Shoes Market Executive Summary

The Oxford Shoes Market is currently navigating a pivotal phase characterized by strategic digital integration and a sharpened focus on ethical sourcing, resulting in robust growth, particularly within the premium and luxury tiers. Current business trends indicate a significant push toward Direct-to-Consumer (DTC) sales models, where brands leverage proprietary e-commerce sites and flagship stores to control pricing, inventory, and the complete customer narrative, maximizing brand perception and profitability. Competition is intense, focusing less on price and more on differentiation through niche offerings such as eco-friendly leather alternatives and hyper-customization services (e.g., bespoke lasting). Furthermore, leading manufacturers are actively investing in enhancing operational efficiencies through semi-automation of routine tasks, addressing rising labor costs and skilled workforce shortages inherent in traditional, hand-finished production methods, while adhering to stringent sustainability goals demanded by modern governance and consumer expectations.

Regionally, the market presents a diverse landscape of maturity and growth acceleration. North America and Western Europe collectively constitute the primary revenue generators, driven by established corporate sectors and deeply entrenched luxury consumer bases, emphasizing consistency and traditional styles like the Cap-Toe Oxford. In contrast, the Asia Pacific (APAC) region is emerging as the undisputed engine of future growth, witnessing rapid market penetration spurred by economic liberalization and the expansion of the professional class in metropolitan areas such as Shanghai, Seoul, and Sydney. This region often favors models that integrate modern fashion trends with classic structures, requiring brands to maintain flexible production pipelines capable of responding rapidly to localized aesthetic shifts. Strategic market entry and expansion in APAC necessitate localized partnerships and distribution strategies to efficiently navigate complex retail environments and reach burgeoning Tier 2 city markets.

Segmentation analysis reveals key shifts in consumer preference and market structure. The End-User segmentation continues to be dominated by the Men's category, but the Women's professional Oxford segment is experiencing the highest proportional growth, driven by changes in corporate female attire seeking comfortable, formal alternatives to traditional high heels. By Material, classic Calf Leather maintains its prestige, but the sustainable, high-quality Synthetic/Vegan Leather segment is rapidly expanding its market share, appealing to younger, ethically conscious consumers who are unwilling to compromise on aesthetic quality. Within the Distribution Channel, the increasing sophistication of online retail platforms, including 3D visualization and enhanced sizing tools, is blurring the historical necessity of in-person fitting, making the online channel an increasingly viable and high-converting option even for ultra-premium footwear purchases, thereby reshaping traditional retail reliance.

AI Impact Analysis on Oxford Shoes Market

User queries regarding the influence of Artificial Intelligence on the Oxford Shoes Market primarily investigate its capacity to revolutionize the intricate processes of luxury manufacturing and personalize the high-touch purchasing experience. Key themes revolve around how AI can maintain the integrity of artisanal quality while boosting efficiency, particularly in pattern cutting, material selection, and forecasting high-cost inventory needs. Stakeholders are keen to understand the application of generative AI in design—not to replace human designers, but to accelerate the development of new, anatomically superior lasts and sole structures that integrate modern comfort without compromising the traditional, formal look of the Oxford silhouette. The prevailing sentiment is that AI serves as a precision amplifier, ensuring consistency in hand-finished goods and enabling mass customization at a scale previously impossible in traditional luxury craft settings, thereby safeguarding high margins.

The adoption of machine learning is proving transformative in two critical areas: quality assurance and demand sensing. AI-powered visual inspection systems now scan entire leather hides for imperfections that are invisible to the human eye, ensuring that only the highest grade, structurally sound sections are used for the main body of the Oxford shoe—a necessity given the visibility and cost of raw materials. This proactive quality control drastically reduces production waste and upholds the promise of flawlessness inherent in luxury pricing. Simultaneously, complex machine learning models analyze vast streams of sales data, social media sentiment, and macroeconomic indicators to predict nuanced shifts in style demand, such as the preference for a specific type of brogue pattern or toe shape, far more accurately than traditional forecasting methods. This data-driven approach allows manufacturers to optimize raw material procurement and production scheduling, mitigating the significant financial risk associated with producing season-specific, high-inventory items.

Furthermore, AI significantly enhances the end-customer journey, particularly in the challenging online sphere for fitted products. Advanced recommendation engines utilize predictive modeling based on customer-provided biometric data or historical purchase patterns to suggest the optimal size, width, and last shape, replicating the expertise traditionally provided by highly trained sales associates. This personalization is crucial for structured footwear like Oxfords, where a perfect fit is non-negotiable for comfort and longevity. Some luxury brands are exploring the use of AI in optimizing customer relationship management (CRM) by analyzing interaction history to offer proactive, highly relevant post-purchase services, such as personalized care instructions or timely reminders for resoling, thereby enhancing customer lifetime value and reinforcing the investment narrative associated with premium Oxford shoes. This integrated approach ensures that technological efficiency supports, rather than detracts from, the core value proposition of artisan-made quality.

- AI optimizes material yield by using machine vision for flawless leather cutting, minimizing waste.

- Predictive modeling forecasts precise sizing and style demands across regional markets to refine inventory management.

- Machine learning enhances online user experience via personalized sizing recommendations and virtual fit tools.

- Generative AI assists designers in prototyping new ergonomic last shapes for enhanced comfort.

- AI-driven quality control systems ensure product consistency and uphold luxury manufacturing standards.

- Automated service bots provide 24/7 expert advice on shoe maintenance and formal styling protocols.

DRO & Impact Forces Of Oxford Shoes Market

The Oxford Shoes Market is dynamically shaped by powerful drivers and countervailing restraints, punctuated by strategic opportunities that define future growth parameters. Key drivers include the ongoing professionalization of global economies and the sustained necessity for formal attire in executive, legal, and finance sectors. The increasing affluence in key Asian markets generates high demand for luxury status symbols, prominently featuring premium footwear. A significant restraint is the intrinsic complexity and cost associated with traditional construction techniques, such as genuine Goodyear welting, which requires a highly skilled, aging labor force, leading to production bottlenecks and elevated retail prices. Opportunities are concentrated in technological advancements allowing for mass customization and fit precision, expansion into the burgeoning Women’s professional footwear segment, and the strategic adoption of verifiable sustainable sourcing practices to capture the environmentally conscious luxury buyer, mitigating the impact of external forces like global trade volatility.

The enduring prestige and cultural significance of the Oxford shoe remain the primary market drivers. For centuries, the shoe has symbolized discipline, authority, and meticulous presentation, making it an irreplaceable item in highly structured social and professional environments. The focus on “investment dressing” among affluent consumers ensures that the high initial purchase cost is offset by perceived longevity and repairability, a concept aggressively marketed by heritage brands. Furthermore, global media and cultural trends, including period dramas and the consistent portrayal of high-status figures wearing traditional formal footwear, continually reinforce the desirability of the product across younger demographics seeking to emulate success. This strong, consistent cultural endorsement provides the market with a robust foundation largely immune to the volatility faced by trend-dependent fashion segments, ensuring demand stability irrespective of cyclical changes in casual wear preferences.

However, the market faces structural restraints directly linked to its commitment to quality. The required artisanal skill set is becoming scarce, particularly in Western manufacturing hubs, increasing dependency on training new artisans, a lengthy and expensive process. This labor constraint limits the scalability of high-end production. Simultaneously, external competition from the high-end casual shoe market is exerting pressure on the utilization frequency of Oxfords; many workplaces now permit high-quality leather sneakers or loafers as acceptable alternatives, particularly in technology and creative industries. Addressing these restraints requires manufacturers to strategically blend automated processes—such as laser cutting and component preparation—with core artisanal techniques (the actual welting and finishing), thereby improving efficiency while preserving the hand-crafted status and narrative essential for premium positioning. This delicate balance is vital for maintaining production capacity and controlling inflationary pressures on the final retail price.

Significant opportunities exist for market expansion and differentiation. The burgeoning demand for luxurious yet comfortable formal footwear in the professional Women’s segment is largely untapped, offering substantial growth potential for brands that can adapt traditional lasts to feminine sizing and aesthetic demands without losing formality. Technological opportunities, specifically the integration of 3D printing for rapid prototype last creation and customized inserts, allow brands to offer unparalleled personalization, moving beyond standard sizing toward a truly bespoke online experience. Moreover, the stringent demand for verifiable ethical sourcing and transparency—a global trend in luxury goods—presents an opportunity for leading Oxford brands to utilize blockchain technology to trace leather provenance from the farm through the tannery to the final product. Brands that lead in both ethical production and technological customization will secure market share by appealing to both the traditionalist and the modern, conscious consumer.

Segmentation Analysis

The structured analysis of the Oxford Shoes Market segmentation provides critical insights into manufacturing specialization and consumer purchasing behavior, optimizing product portfolio management and market targeting. The market is primarily divided by four critical attributes: Product Type, Material Composition, End-User Demographics, and the prevailing Distribution Channel. Product Type segmentation is crucial as it dictates formality; for instance, the Plain-Toe Oxford is often reserved for the most formal occasions, while the Wingtip caters to business-casual settings. The Material segment is directly correlated with price point and luxury positioning, with exotic and premium calf leather occupying the highest tiers. Successful market penetration strategies depend on accurately mapping these segments to regional purchasing power and cultural requirements, ensuring the right product variety is available in the correct distribution channels globally.

The End-User split between Men and Women reflects historical market dominance versus future growth potential. Historically, the male segment has been the traditional anchor, providing stable and consistent demand driven by established business protocols. However, demographic shifts and changes in professional wear have accelerated growth in the Women’s segment, where demand is focused on high-quality, comfortable, and professionally styled Oxfords that offer an alternative to traditional, less ergonomic female formal footwear. Analyzing this segment requires a deep understanding of evolving female professional fashion and the necessity for distinct sizing and fitting approaches, as women often prioritize comfort alongside elegance and durability, presenting a unique challenge and opportunity for last development and product design specialization.

Distribution Channel analysis highlights a transition toward greater control over the final sale. While Offline channels—especially specialized brand boutiques—remain essential for the high-touch customer experience necessary to validate luxury purchases and ensure precise fitting, Online channels are rapidly growing in importance. E-commerce platforms now utilize sophisticated visualization and sizing technologies, reducing the transactional risk associated with buying structured footwear remotely. Furthermore, the strategic segmentation by Material is vital for risk mitigation; brands must ensure that their sourcing of traditional materials meets escalating ethical standards, while simultaneously investing in R&D for certified sustainable alternatives to capture the high-growth, environmentally conscious sub-segment, balancing heritage with future-proof compliance and consumer values.

- By Product Type: Cap-Toe (most formal), Plain-Toe (highest formality), Wingtip (decorative), Wholecut (premium, seamless), Saddle Oxford, Kiltie Oxford.

- By Material: Calf Leather (premium core), Patent Leather (occasional formality), Suede (casual/seasonal), Exotic Leather (high luxury), Synthetic/Vegan Leather (sustainability-focused).

- By End-User: Men (largest volume segment), Women (fastest growing segment).

- By Distribution Channel: Offline (Specialty Stores, Brand Flagships, Department Stores - provides high-touch service), Online (E-commerce Platforms, Brand Websites - enables global reach and DTC margins).

Value Chain Analysis For Oxford Shoes Market

The Oxford Shoes Market value chain commences with upstream activities centered on the procurement and preparation of ultra-high-quality raw materials, primarily fine-grain calf leather. Upstream success hinges on forming exclusive, long-term partnerships with globally recognized tanneries that adhere to strict environmental and ethical standards, often involving chrome-free or vegetable tanning processes. The high cost of these materials necessitates sophisticated inventory management and strict quality control prior to manufacturing. Other vital upstream components include specialized natural rubber or leather outsoles, high-quality lining materials (e.g., specific calf or goat hides), and, crucially, the precise manufacturing of lasts, which determines the final fit and comfort. For luxury brands, transparency and traceability of these inputs via certification and tracking systems are becoming non-negotiable requirements that justify the premium market position.

The midstream phase—manufacturing—is characterized by the combination of meticulous, highly skilled labor and selective technological integration. This stage involves pattern drafting, rigorous leather selection and cutting (increasingly optimized by laser cutters for minimal waste), lasting the upper, and the complex stitching of the welt. The choice between traditional construction methods (e.g., Goodyear welting for durability and water resistance, or Blake stitching for sleekness) defines the shoe's characteristics and price point. Production facilities, often located in historically significant areas like Italy, Spain, or the UK, leverage generational expertise. Operational efficiency is a constant focus, utilizing ERP systems to manage the bespoke nature of production and ensure consistency across small-batch, high-value outputs, differentiating true luxury manufacturing from commodity footwear production.

Downstream activities involve distribution, marketing, and post-sale servicing. Distribution channels are strategic, favoring controlled environments: Direct channels (brand flagship stores and e-commerce platforms) offer the highest margin capture and allow brands to fully manage the luxury experience, offering bespoke consultations and personalization services. Indirect channels, such as high-end department stores (e.g., Harrods, Neiman Marcus), are used primarily for market entry and brand visibility, lending credibility. Marketing efforts focus heavily on visual storytelling, emphasizing the provenance, the craftsmanship legacy, and the notion of the shoe as a collectible or generational asset. Furthermore, robust post-sale services, including professional shoe care, resoling, and repair programs, are critical downstream activities that reinforce the concept of durability and long-term investment, cementing customer loyalty and extending the product lifecycle.

Oxford Shoes Market Potential Customers

The core potential customer base for Oxford shoes consists of high-earning professionals in global business, law, finance, and executive management, primarily located in major metropolitan and financial centers. These individuals prioritize a formal, structured appearance as an essential part of their professional credibility. They typically exhibit low price elasticity, focusing instead on brand heritage, material quality, and the demonstrable longevity of the product. This affluent demographic (predominantly men aged 35-60) views the purchase of premium Oxfords as an investment in personal brand image and professional necessity, often maintaining a diversified wardrobe of varying styles and formality levels (e.g., Cap-toe for meetings, Wholecut for galas). Effective engagement with this group requires personalized sales interactions and marketing that emphasizes history, craftsmanship, and the scarcity of bespoke services.

A rapidly expanding segment of potential customers includes aspirational young professionals (25-35) entering high-status corporate roles. While budget-conscious compared to the core segment, these buyers seek foundational, high-quality investment pieces that will last their careers. They are highly influenced by digital content, placing significant value on transparency regarding ethical sourcing and sustainability claims. Brands target this demographic by offering entry-level premium lines or collaborations that emphasize modern comfort features built into classic styles, easing the transition from casual footwear to structured professional shoes. The marketing challenge here is balancing the heritage narrative with modern relevance and digital accessibility, ensuring the brand remains aspirational but attainable for career starters.

Finally, the growing market for high-quality Women's Oxfords targets professional female executives, academics, and creative directors who require footwear that balances formality, enduring style, and all-day comfort. These customers reject the traditional discomfort often associated with female formal shoes and seek products engineered specifically for female anatomy but bearing the authoritative aesthetic of the Oxford. Furthermore, footwear enthusiasts and collectors represent a high-value niche, characterized by their demand for extremely rare materials (like bespoke Shell Cordovan), limited-edition collaborations, and deep technical knowledge of construction methods. Targeting this collector segment requires maintaining a constant stream of exclusive, highly publicized releases and highly detailed, expert-level communication regarding the production process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $2.75 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Church's, John Lobb, Crockett & Jones, Allen Edmonds, Loake, Tricker's, Grenson, Santoni, Edward Green, Berluti, JM Weston, Barker Shoes, Alden Shoe Company, Cheaney, Gaziano & Girling, Salvatore Ferragamo, Gucci, Prada, Louis Vuitton, Tod's, Bruno Magli. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oxford Shoes Market Key Technology Landscape

The technology landscape in the Oxford Shoes Market is characterized by the intelligent application of digital tools to enhance traditional processes without compromising the fundamental artisanal quality. Computer-Aided Design (CAD) software is standard practice for creating and refining shoe lasts (the forms that define the shoe's fit and shape), allowing for rapid virtual prototyping and testing of new designs with precise anatomical consideration before committing to physical production. Specialized 3D scanning equipment is critical in bespoke and made-to-order services, capturing highly accurate three-dimensional foot data to construct individualized lasts, effectively bridging the gap between historical craftsmanship and modern personalized fit demands. Furthermore, high-precision laser-guided cutting machines are utilized in the manufacturing phase to optimize the yield from expensive raw leather hides, minimizing waste and ensuring that only the most consistent, flawless sections are used for critical components of the upper.

Material science innovation plays a crucial role in improving both the durability and comfort of Oxford shoes. This includes advanced research into proprietary sole compounds—such as shock-absorbing rubbers or complex layered leather stacks—that increase flexibility and wearer comfort for extended periods without visually altering the shoe's formal aesthetic. Simultaneously, the focus on sustainability drives technological advancements in leather processing, including the development of certified, environmentally friendly tanning agents and processes that eliminate hazardous chemicals while maintaining superior leather quality and longevity. These technological material improvements allow brands to address modern consumer demands for ethics and comfort without diluting the traditional structure or design integrity of the formal Oxford shoe, enhancing its suitability for an active professional lifestyle.

On the distribution and customer engagement front, the deployment of Augmented Reality (AR) and virtual reality (VR) technologies is transforming the online sales experience. AR fitting apps enable customers to visualize the shoe in their own environment and accurately gauge fit and style from a distance, significantly lowering the hesitation associated with buying luxury footwear online. Supply chain resilience is bolstered by the use of advanced Enterprise Resource Planning (ERP) systems integrated with IoT tracking devices, providing end-to-end transparency and real-time inventory visibility across global warehouses and retail points. This digital infrastructure is essential for managing the complexity of diverse sizing, material variations, and regional stock requirements, ensuring efficient capital deployment and robust authentication capabilities, crucial for combating counterfeiting in the high-value luxury market.

Regional Highlights

- Europe: The foundational and largest revenue market, driven by established heritage brands and deeply ingrained formal culture in the UK and Italy. Demand is characterized by a preference for Goodyear-welted construction and classical designs. Italy focuses on sleeker, fashion-forward leather processing, while the UK specializes in traditional, robust, and repairable styles, maintaining premium pricing due to acclaimed artisanal expertise.

- North America: A high-volume market characterized by strong corporate demand, particularly in financial and legal hubs. Consumers balance quality with comfort, leading to strong sales of American heritage brands focusing on durable yet slightly more ergonomic designs. The market is mature but highly responsive to digital marketing emphasizing long-term value and convenient online customization services.

- Asia Pacific (APAC): The fastest-growing region globally, fueled by rapid urbanization and the rising adoption of Western formal wear as a marker of professional success in countries like China and South Korea. This market exhibits strong aspirational buying behavior, prioritizing internationally recognized luxury brands and often showing a preference for highly finished, aesthetically impeccable styles and exotic leathers.

- Latin America (LATAM): Growth is steady but concentrated, focused within major economic hubs like São Paulo and Mexico City. The market tends to prioritize genuine leather quality and robust construction due to regional climate conditions. Luxury international brands dominate the high-end sector, relying on targeted marketing to HNI consumers.

- Middle East and Africa (MEA): High expenditure on luxury goods, particularly in the GCC countries, drives demand for elite, high-status Oxford shoes often required for religious holidays and significant formal gatherings. The market demands authenticity and brand prestige, making brand-owned boutiques and exclusive distributor relationships crucial for market access and control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oxford Shoes Market.- Church's

- John Lobb

- Crockett & Jones

- Allen Edmonds

- Loake

- Tricker's

- Grenson

- Santoni

- Edward Green

- Berluti

- JM Weston

- Barker Shoes

- Alden Shoe Company

- Cheaney

- Gaziano & Girling

- Salvatore Ferragamo

- Gucci

- Prada

- Louis Vuitton

- Tod's

- Bruno Magli

Frequently Asked Questions

Analyze common user questions about the Oxford Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Oxford shoes and Derby shoes?

The Oxford shoe is fundamentally distinguished by its closed lacing system, where the eyelet tabs are sewn beneath the vamp, creating a sleek, formal aesthetic. The Derby shoe, conversely, features an open lacing system, with the eyelet tabs sewn on top of the vamp, lending it a slightly less formal and more versatile character.

Which material is most commonly used for high-end Oxford shoe manufacturing?

Calf Leather is the most prevalent material for premium Oxford shoes due to its fine grain, exceptional durability, and ability to develop a rich patina over time. High-end brands also utilize specialized leathers like Shell Cordovan for specific investment-grade models.

What is the projected Compound Annual Growth Rate (CAGR) for the Oxford Shoes Market?

The Oxford Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by sustained demand for formal professional attire and expansion in the Asia Pacific luxury segment.

How is AI impacting the customization and fit of Oxford shoes in online retail?

AI is critically impacting customization by enabling precise 3D foot scanning and machine learning algorithms that provide hyper-accurate sizing recommendations and virtual try-ons. This technology significantly enhances the customer experience and reduces return rates for structured luxury footwear purchased online.

Which geographical region exhibits the fastest growth rate in the Oxford Shoes Market?

The Asia Pacific (APAC) region, particularly driven by economies like China and South Korea, is anticipated to exhibit the fastest growth rate, fueled by rising disposable incomes and the increasing integration of Western professional dress standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager