Packaging Vacuum Coater Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443280 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Packaging Vacuum Coater Market Size

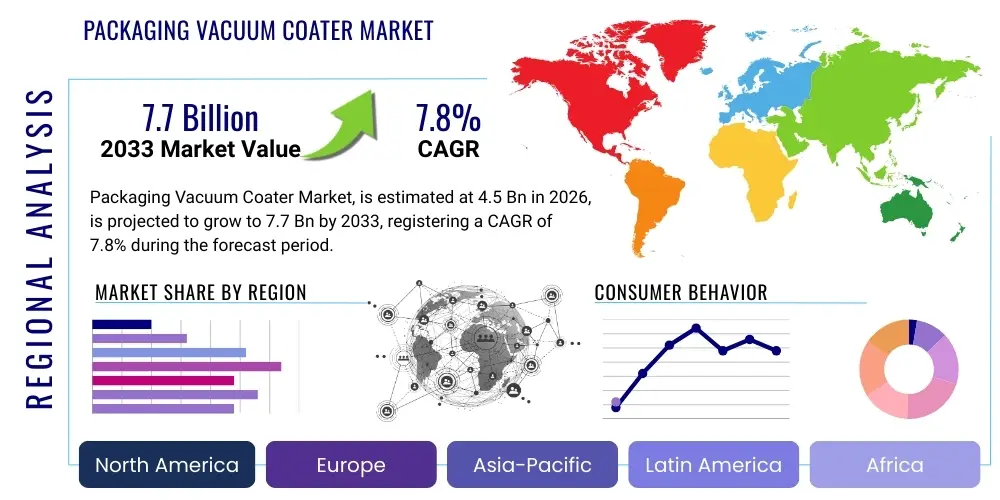

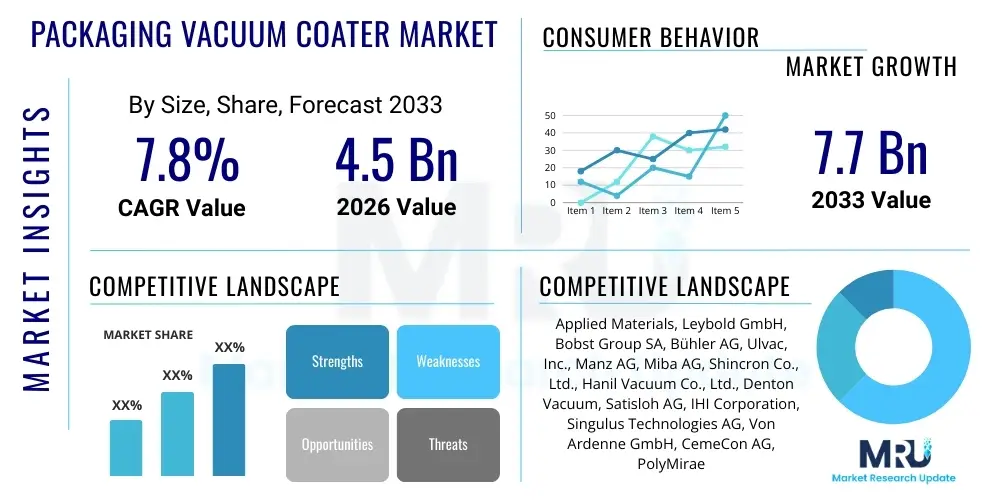

The Packaging Vacuum Coater Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Packaging Vacuum Coater Market introduction

The Packaging Vacuum Coater Market encompasses the specialized industrial machinery and systems designed for the precision deposition of thin films onto flexible and rigid packaging substrates within a high-vacuum environment. These sophisticated systems utilize technologies predominantly centered around Physical Vapor Deposition (PVD), including thermal evaporation and sputtering, to apply materials such as aluminum, silicon oxide (SiOx), and aluminum oxide (AlOx). The fundamental purpose of this process is to dramatically improve the barrier properties of packaging materials against critical permeants like oxygen and moisture, which is essential for preserving the freshness, flavor, and pharmaceutical efficacy of packaged goods. The market's growth trajectory is strongly linked to the increasing global demand for extended shelf life and reduced food waste, coupled with the industry's pervasive shift towards sustainable, recyclable monomaterial structures where high-performance barrier coatings are indispensable. Vacuum coaters are pivotal in enabling high-volume production of metallized films and transparent barrier films used across various sectors.

Product description highlights the primary categories of equipment, including Batch Vacuum Coaters, utilized for smaller volumes or specialized applications, and the high-throughput, capital-intensive Roll-to-Roll (R2R) Vacuum Coaters, which dominate the flexible packaging segment. R2R systems are complex integration platforms involving advanced web handling systems, powerful vacuum pumps, and highly precise material deposition sources (e.g., electron beam sources or magnetron sputtering cathodes). Major applications span the entirety of consumer packaging, including food and beverage flexible pouches, high-barrier lidding films, pharmaceutical blister packs, and aesthetically superior decorative packaging for cosmetics. The ability of these coaters to ensure uniform, defect-free deposition across wide substrates at high speeds is a key performance metric that determines market competitiveness and technological advancement within the sector.

The core benefits driving the adoption of Packaging Vacuum Coaters include superior barrier performance, the ability to achieve thinner material profiles, and significant contributions to material circularity goals, particularly through the use of transparent oxide barriers that do not impede recycling processes. Key driving factors propelling market expansion are the escalating consumer demand for packaged and processed foods in developing economies, stringent global regulations concerning food safety and preservation, and the sustained innovation in coating materials that offer enhanced environmental resistance and improved adhesion. Furthermore, the persistent growth of the e-commerce sector necessitates robust packaging that maintains product integrity through complex distribution channels, thereby fueling the demand for vacuum-coated protective films and containers.

Packaging Vacuum Coater Market Executive Summary

The Packaging Vacuum Coater Market is characterized by intense technological competition focused on increasing deposition speed, improving coating uniformity, and enhancing the sustainability profile of the resulting films. Current business trends indicate a strong market shift toward advanced Roll-to-Roll (R2R) systems capable of handling ultra-wide webs and integrating multiple process steps, such as plasma pretreatment and dual-sided coating, to maximize efficiency and barrier performance. There is significant business investment in developing hybrid PVD/PECVD (Plasma Enhanced Chemical Vapor Deposition) systems to produce multi-layered barrier stacks, catering specifically to demanding applications like medical device packaging and sensitive electronics packaging. Key manufacturers are prioritizing modular designs that allow end-users flexibility in adapting to evolving coating material specifications, minimizing downtime, and optimizing operational expenditure (OPEX) through energy-efficient vacuum pump technologies and automated process control systems. Mergers and acquisitions focusing on integrating specialized component manufacturers (e.g., vacuum pump suppliers, plasma source providers) into larger coater manufacturing portfolios are shaping the competitive landscape.

Regionally, the Asia Pacific (APAC) stands as the undisputed engine of market growth, driven by massive manufacturing capacity expansion, particularly in China, India, and Southeast Asian nations, reflecting explosive growth in the processed food and consumer goods sectors and a burgeoning middle class demanding higher quality packaged products. North America and Europe, while being mature markets, exhibit high value-growth due to strict regulatory requirements and a pronounced market preference for transparent high-barrier oxide coatings (AlOx and SiOx) over traditional metallization, driven by circular economy mandates and retailer sustainability commitments. European trends are heavily influenced by the EU’s Green Deal objectives, pushing investments into sustainable barrier solutions that are fully recyclable. Latin America and the Middle East and Africa (MEA) represent emerging opportunity zones, showing increasing demand for intermediate-level vacuum coating systems as local manufacturing capabilities expand and reliance on imported packaging solutions diminishes.

Segment trends underscore the rising prominence of the transparent barrier film segment, specifically applications utilizing AlOx and SiOx coatings, positioning them as critical enablers of sustainable flexible packaging solutions. Although metallized films (aluminum) remain the highest volume application due to cost-effectiveness, the fastest CAGR is observed in oxide coatings, which are essential for applications where product visibility is required or where packaging needs to be microwaveable. By end-user, the Food & Beverage segment is the largest consumer of vacuum-coated films, reflecting the global focus on shelf-life extension and waste reduction. Furthermore, there is a distinct trend towards highly customized vacuum coating solutions for the pharmaceutical sector, demanding ultra-reliable, validation-ready equipment capable of depositing sophisticated multilayered protective barriers for sensitive drug formulations and sterile medical devices, prioritizing regulatory compliance and process repeatability above initial capital investment costs.

AI Impact Analysis on Packaging Vacuum Coater Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Packaging Vacuum Coater Market frequently center on three critical themes: achieving ultra-high precision coating quality under high-speed conditions, predictive maintenance and optimization of complex vacuum systems, and enhancing the overall yield through real-time defect detection. Users are concerned about how AI can mitigate inherent process variabilities, such as uneven web tension, fluctuating plasma conditions, or target erosion rates, which directly impact coating thickness and uniformity—key performance indicators for barrier films. Expectations are high for AI-driven systems to move beyond simple automation to genuine prescriptive analytics, allowing coaters to adjust parameters autonomously to maintain optimal deposition profiles, thereby maximizing throughput while minimizing material waste and energy consumption.

AI's initial integration is primarily focused on enhancing in-line metrology and control systems. Machine learning algorithms are being deployed to process massive datasets generated by sensors monitoring deposition rates, film structure, and web speed. These algorithms can identify subtle, non-linear relationships between input variables (e.g., power supply fluctuations, gas flow mixture ratios) and resulting film properties (e.g., Oxygen Transmission Rate (OTR) or Water Vapor Transmission Rate (WVTR)). This capability allows manufacturers to achieve closed-loop control, where the system preemptively adjusts coating sources or web speed to correct drift or potential defects before they escalate, significantly boosting manufacturing consistency and reducing the need for costly offline quality assurance processes.

Furthermore, AI is transformative in optimizing the operational expenditure of highly complex vacuum coating machines. AI models analyze operational patterns, including pump cycles, vacuum integrity fluctuations, and component wear, to establish highly accurate predictive maintenance schedules. This shift from time-based or reactive maintenance to prescriptive maintenance minimizes unexpected machine failures, maximizes equipment uptime—a critical factor given the high capital cost of R2R coaters—and intelligently manages the consumption of expensive consumables like targets and process gases. AI-powered recipe management also enables rapid and accurate transitions between different coating specifications (e.g., switching from AlOx to metallization), drastically reducing changeover times and supporting the high-mix, low-volume production increasingly demanded by packaging converters.

- AI-driven Real-Time Defect Detection: Utilizing computer vision and deep learning for instantaneous identification and classification of pinholes, scratches, or non-uniformities during high-speed web processing.

- Predictive Maintenance: Analyzing operational data (vibration, temperature, vacuum level) to forecast component failure (e.g., vacuum pumps, power supplies) and schedule maintenance proactively.

- Closed-Loop Process Optimization: Implementing machine learning algorithms to autonomously adjust deposition parameters (power, gas pressure, web speed) to maintain target barrier properties (OTR/WVTR).

- Yield Maximization: Using AI to analyze historical production data to optimize startup sequences and transition procedures, reducing scrap material significantly.

- Energy Efficiency Management: Applying prescriptive analytics to optimize vacuum cycling and plasma generation schedules, minimizing energy consumption per square meter of coated material.

DRO & Impact Forces Of Packaging Vacuum Coater Market

The Packaging Vacuum Coater Market is shaped by a confluence of powerful dynamics that simultaneously propel growth (Drivers), restrict widespread adoption (Restraints), and create new avenues for expansion (Opportunities), resulting in measurable Impact Forces across the value chain. Key drivers include the overwhelming global imperative to minimize food spoilage and waste, which necessitates superior barrier packaging solutions that only vacuum coating can reliably provide at industrial scale. The massive expansion of organized retail and the e-commerce sector globally further intensifies the need for durable, shelf-stable, and protected packaging. Moreover, the accelerating regulatory and consumer push toward sustainable, easily recyclable monomaterial packaging formats creates a powerful opportunity for oxide-based barrier coatings (AlOx, SiOx) as alternatives to complex, multi-layer laminates, directly driving investment in R2R oxide deposition systems.

However, significant restraints temper this growth. The most prominent barrier is the extraordinarily high initial capital investment required for high-throughput vacuum coating systems. These machines, especially R2R coaters, require substantial financial outlay, specialized cleanroom environments, and highly skilled technical personnel for operation and maintenance, limiting market penetration primarily to large-scale packaging converters and specialized film producers. Furthermore, the inherent complexity of the vacuum coating process, which involves managing high vacuum, precise gas flows, and volatile coating materials, poses operational challenges that can affect yield and consistency, particularly for new entrants. Restraints also arise from competition with lower-cost, albeit lower-performing, barrier alternatives such as specialized co-extruded polymers and conventional lamination techniques, which may suffice for less demanding packaging applications.

Opportunities for market growth are vast and centered on material science and technological hybridization. The development of novel, ultra-high barrier transparent coatings (e.g., multilayer stacks, hybrid organic-inorganic coatings) capable of replacing aluminum foil in flexible packaging represents a major market expansion avenue. Another significant opportunity lies in the rapid adoption of vacuum coating technologies in non-traditional packaging formats, such as rigid plastic bottles (e.g., plasma coating for PET/PP) and recyclable paper-based packaging materials, enabling high-performance barriers on substrates previously deemed unsuitable. Impact forces are strongly felt in standardization efforts, where industry leaders are pushing for standardized testing protocols for OTR/WVTR of vacuum-coated films, and in supply chain security, necessitating reliable, localized manufacturing hubs for coater systems and their critical components to mitigate geopolitical risks and shipping complexities associated with large equipment.

- Drivers: Demand for extended shelf life, growth of e-commerce, shift towards sustainable monomaterials (oxide coatings), and expansion of packaged food consumption in emerging markets.

- Restraints: High capital expenditure for equipment, complexity of vacuum processes, and requirement for specialized operational expertise.

- Opportunities: Development of novel ultra-high barrier materials (hybrid coatings), integration into rigid packaging and paper-based substrates, and technological advancements in energy efficiency.

- Impact Forces: Technological parity among leading manufacturers, stringent quality control demands from pharmaceutical end-users, and pressure to reduce the environmental footprint of coating materials and processes.

Segmentation Analysis

The Packaging Vacuum Coater Market is comprehensively segmented based on technology type, the material deposited, the specific application of the resulting film, and the primary end-user industry, providing a granular view of market dynamics and investment pockets. Segmentation by type differentiates between high-volume Roll-to-Roll (R2R) systems, crucial for flexible packaging films, and Batch systems, typically used for smaller-scale metallization or coating of three-dimensional parts. The most crucial segmentation for value is by coating material, distinguishing the mature, cost-effective aluminum metallization segment from the rapidly growing, high-performance transparent barrier oxide segments (AlOx and SiOx), which command higher price points due to the complexity of the deposition process and the superior functionality they provide for sustainability-focused applications. These segments reflect diverse technological needs and varying levels of required barrier performance.

Segmentation by application clarifies the varied market requirements, contrasting high-throughput flexible barrier films used for food preservation against rigid packaging coating for products like PET bottles or specialty containers, each requiring highly specialized coating systems (e.g., rotary systems for bottles vs. planar systems for films). Finally, the end-user segmentation reveals the largest consumers of vacuum-coated products, dominated by the highly sensitive Food & Beverage and Pharmaceuticals sectors. Understanding these segments is vital for equipment manufacturers to tailor machine specifications, such as web width, deposition sources, and compliance features, directly addressing specific industry demands for purity, throughput, and regulatory adherence.

- By Type:

- Batch Vacuum Coaters

- Roll-to-Roll (R2R) Vacuum Coaters

- By Coating Material:

- Aluminum (Metallization)

- Silicon Oxide (SiOx)

- Aluminum Oxide (AlOx)

- Other Oxides and Hybrid Materials (e.g., multi-layer structures, plasma polymers)

- By Application:

- Flexible Barrier Films (Food, Medical)

- Decorative and Aesthetic Films

- Rigid Packaging (e.g., PET bottle barrier enhancement)

- Specialty Films (e.g., security, insulation)

- By End-User Industry:

- Food & Beverage

- Pharmaceuticals and Healthcare

- Cosmetics and Personal Care

- Electronics and Industrial

Value Chain Analysis For Packaging Vacuum Coater Market

The value chain for the Packaging Vacuum Coater Market begins with upstream analysis, which involves the specialized suppliers of core components and raw materials essential for machine manufacturing and operation. This includes high-purity metal targets (e.g., aluminum, silicon, copper), specialized process gases (e.g., argon, oxygen, nitrogen), and highly engineered components like ultra-high vacuum pumps, sophisticated web handling systems (tension control, precision rollers), and proprietary deposition sources (e.g., magnetron sputtering cathodes, thermal evaporation boats/crucibles, electron beam sources). The performance and reliability of the final coater machine are heavily dependent on the quality and longevity of these upstream supplied technologies, necessitating strong integration and collaborative R&D between coater manufacturers and component suppliers, particularly for vacuum technology specialists.

The core segment involves the Original Equipment Manufacturers (OEMs) of the vacuum coating systems. These companies are responsible for the complex design, integration, assembly, testing, and installation of the coaters, often providing comprehensive service contracts, calibration, and training. Following manufacturing, the distribution channel is primarily direct, given the high value, customization, and logistical complexity of the equipment. Direct sales teams work closely with large packaging converters and specialized film manufacturers, offering tailored solutions and long-term technical support. Indirect distribution, involving agents or regional representatives, plays a smaller role, mainly for market intelligence gathering and localized parts support in geographically dispersed regions like Southeast Asia and Latin America.

The downstream analysis focuses on the end-users and the applications of the coated product. The immediate downstream entities are the packaging converters (film producers, flexible packaging integrators) who purchase the coater equipment and use it to produce metallized or barrier films. These films are then sold to the final packaging users, such as multinational Food & Beverage corporations, pharmaceutical companies, and major cosmetic brands. The market’s health is directly tied to the demand from these downstream consumer product manufacturers, who increasingly demand films that offer verifiable barrier performance and meet specific recyclability or compostability mandates. Feedback from these end-users regarding film performance, defect rates, and material handling capabilities influences future coater design iterations and technological focus areas for the OEMs.

Packaging Vacuum Coater Market Potential Customers

The potential customers and end-users of Packaging Vacuum Coater systems are diverse but heavily concentrated in sectors requiring uncompromising product protection and extended preservation capabilities. The largest and most consistent buyers are large-scale packaging converters and specialized film manufacturers (e.g., BOPP film producers, PET film manufacturers) who invest in high-volume Roll-to-Roll coaters to produce metallized films, high-barrier laminates, and transparent oxide barrier films as their core business offering. These converters serve as the primary link between the coater OEMs and the ultimate brand owners. Their buying decisions are driven by throughput requirements, coating uniformity guarantees, energy efficiency, and the ability of the machine to handle thin-gauge and heat-sensitive substrates at high speeds.

In the end-user sphere, the Food & Beverage industry represents the single largest consumer segment of vacuum-coated films. Companies producing snacks, coffee, dairy, processed meats, and beverages rely on these films to prevent oxidation, moisture ingress, and flavor loss, thereby safeguarding their supply chain and maximizing shelf presence. The Pharmaceutical and Healthcare sector is another critical customer base, demanding coaters capable of producing ultra-reliable, contamination-free barrier layers for blister packs, medical pouches, and drug delivery systems, where regulatory compliance and absolute material integrity are non-negotiable. Cosmetic and Personal Care companies utilize vacuum coating for both functional barrier protection (especially for sensitive ingredients) and for aesthetic, high-gloss metallization used in premium packaging and labeling.

A smaller, but high-value segment of potential customers includes research institutions, specialized material development labs, and in-house packaging divisions of major multinational corporations (MNCs) who invest in smaller, highly flexible batch or pilot R2R systems. These customers typically use the coaters for developing proprietary barrier structures, prototyping new packaging formats, and conducting material research, often prioritizing versatility and precise control over raw throughput. The shift toward sustainable packaging has also opened up new customers among producers of paperboard and molded fiber packaging seeking innovative ways to apply thin, functional barrier layers without relying on traditional plastic liners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Leybold GmbH, Bobst Group SA, Bühler AG, Ulvac, Inc., Manz AG, Miba AG, Shincron Co., Ltd., Hanil Vacuum Co., Ltd., Denton Vacuum, Satisloh AG, IHI Corporation, Singulus Technologies AG, Von Ardenne GmbH, CemeCon AG, PolyMirae Co., Ltd., Mitsubishi Heavy Industries, Optorun Co., Ltd., VTD Vacuum Technologies Dresden GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packaging Vacuum Coater Market Key Technology Landscape

The technology landscape of the Packaging Vacuum Coater Market is defined by the evolution and hybridization of deposition techniques, primarily revolving around Physical Vapor Deposition (PVD) and the integration of plasma treatment. PVD methods, such as thermal evaporation (resistive or electron beam) and magnetron sputtering, form the backbone of modern packaging coaters. Thermal evaporation is predominantly used for high-speed, cost-effective aluminum metallization, offering excellent visual appeal and acceptable barrier levels for many food applications. However, magnetron sputtering and specialized plasma-enhanced chemical vapor deposition (PECVD) techniques are increasingly crucial for depositing high-performance oxide layers (AlOx, SiOx). These oxide processes require much finer control over plasma chemistry and substrate temperature compared to simple metallization, driving technological sophistication in power supply control, gas handling, and plasma source design.

The core technological innovation centers on Roll-to-Roll (R2R) web handling precision. High-speed R2R systems must maintain extremely tight tension control and high process stability across wide film webs (often exceeding 2 meters in width) to ensure uniform coating thickness and adhesion, which are directly proportional to barrier effectiveness. Recent technological advancements include the integration of in-line diagnostics, such as optical emission spectroscopy and quartz crystal microbalances, which allow for real-time monitoring and adjustment of the deposition process. Furthermore, the push for enhanced barrier performance has led to the development of multi-chamber systems, enabling sequential deposition of different material layers (e.g., polymer primer, oxide barrier, protective topcoat) within a single integrated vacuum system, achieving sophisticated multilayer barrier stacks at high throughputs previously unattainable.

A burgeoning area of technological focus is Atomic Layer Deposition (ALD), though currently high-cost, it offers the potential for near-perfect conformity and ultra-low pinhole density on complex substrates, which is highly appealing for pharmaceutical or electronic packaging where absolute barrier reliability is mandatory. Simultaneously, manufacturers are focusing heavily on vacuum pump technology, moving toward dry pumps and advanced turbo-molecular pumps to minimize environmental impact and contamination risks while improving pumping speeds. Plasma pretreatment stations, strategically placed before the coating zone, utilize specialized plasma etching or activation techniques to optimize the surface energy of the substrate, dramatically improving the adhesion and barrier uniformity of the subsequent metal or oxide layer, ensuring the final packaged product achieves maximum protection throughout its lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Packaging Vacuum Coater Market both in terms of volume and new installation growth, driven primarily by robust economic expansion, rising consumer spending on packaged goods, and massive population bases in countries like China and India. The region serves as the global manufacturing hub for flexible packaging, necessitating continuous investment in high-throughput R2R metallization and oxide coating systems to meet local and export demands. Government initiatives supporting infrastructure development and the pharmaceutical sector further catalyze market expansion in this region.

- North America: Characterized by high technological maturity and an early adoption curve for sustainable innovations. North America is a key market for high-value applications, particularly transparent SiOx/AlOx barriers required for premium, recyclable packaging and stringent medical device standards. Market growth here is driven less by volume expansion and more by the replacement of older metallization systems with advanced oxide coaters that support circular economy goals and meet sophisticated brand owner specifications.

- Europe: This region exhibits a strong focus on sustainability, dictated by aggressive EU directives such as the Green Deal, which prioritize material efficiency and recyclability. The European market leads in the adoption of complex, high-reliability barrier structures and specialized coatings for sensitive applications (e.g., organic food, high-end cosmetics). Investment is concentrated on optimizing existing installed bases for energy efficiency and adapting equipment to handle bio-based or compostable substrates, often necessitating highly flexible coating parameter controls.

- Latin America (LATAM): LATAM represents an accelerating market, fueled by urbanization and the expansion of modern retail chains. While cost sensitivity remains a factor, increasing local manufacturing capacity in countries like Brazil and Mexico is boosting demand for cost-effective R2R metallization systems. The market is gradually transitioning towards incorporating basic barrier oxides to compete with global standards for perishable goods.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by investments in the pharmaceutical and food processing sectors in the GCC (Gulf Cooperation Council) countries and parts of South Africa. The challenging climatic conditions (high temperature and humidity) necessitate very high-performance barrier packaging, creating specific, albeit smaller, pockets of demand for reliable vacuum coating solutions to ensure product integrity across long supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packaging Vacuum Coater Market.- Applied Materials

- Leybold GmbH

- Bobst Group SA

- Bühler AG

- Ulvac, Inc.

- Manz AG

- Miba AG

- Shincron Co., Ltd.

- Hanil Vacuum Co., Ltd.

- Denton Vacuum

- Satisloh AG

- IHI Corporation

- Singulus Technologies AG

- Von Ardenne GmbH

- CemeCon AG

- PolyMirae Co., Ltd.

- Mitsubishi Heavy Industries

- Optorun Co., Ltd.

- VTD Vacuum Technologies Dresden GmbH

Frequently Asked Questions

Analyze common user questions about the Packaging Vacuum Coater market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for adopting Roll-to-Roll (R2R) vacuum coaters in packaging?

The primary driver is the necessity for mass-producing high-performance barrier films (metallized or oxide-coated) at high speeds and low cost, essential for extending the shelf life of food and pharmaceutical products globally.

How do transparent barrier coatings (AlOx/SiOx) benefit packaging sustainability?

AlOx and SiOx coatings enable the creation of high-barrier monomaterial films (e.g., 100% PET or 100% PP), replacing multi-layer laminates that are difficult to recycle, thus supporting circular economy objectives.

What are the major technological challenges facing the Packaging Vacuum Coater Market?

Key challenges include reducing the high capital cost of advanced systems, ensuring coating uniformity across ultra-wide webs at high speeds, and developing reliable, high-speed defect detection systems for quality control.

Which end-user segment utilizes the largest volume of vacuum-coated flexible packaging?

The Food & Beverage segment is the largest end-user, relying extensively on vacuum-coated films for pouches, bags, and lidding applications requiring robust protection against oxygen and moisture ingress to prevent spoilage.

Is the market moving away from traditional aluminum metallization?

While aluminum metallization remains dominant in terms of volume due to cost, the fastest growth is observed in transparent oxide coatings (AlOx/SiOx), driven by regulatory pressure for recyclability and consumer preference for product visibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager