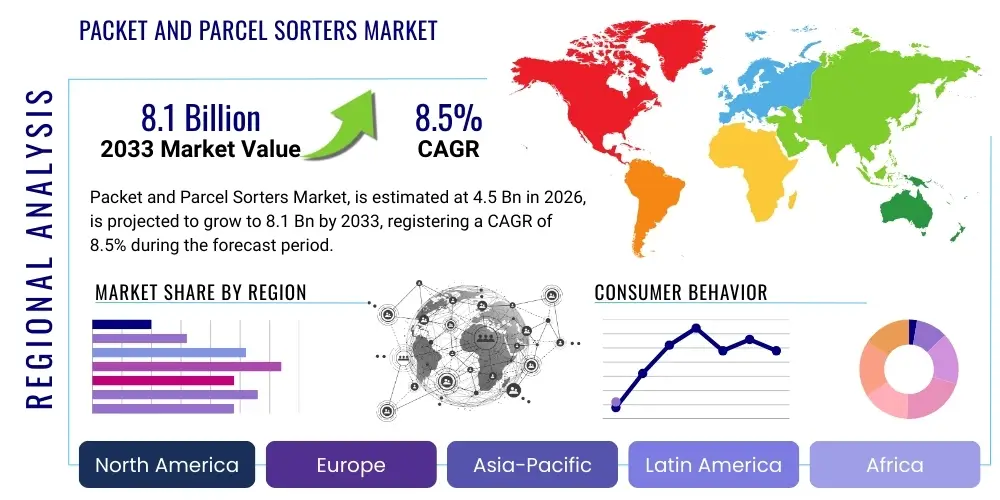

Packet and Parcel Sorters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442614 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Packet and Parcel Sorters Market Size

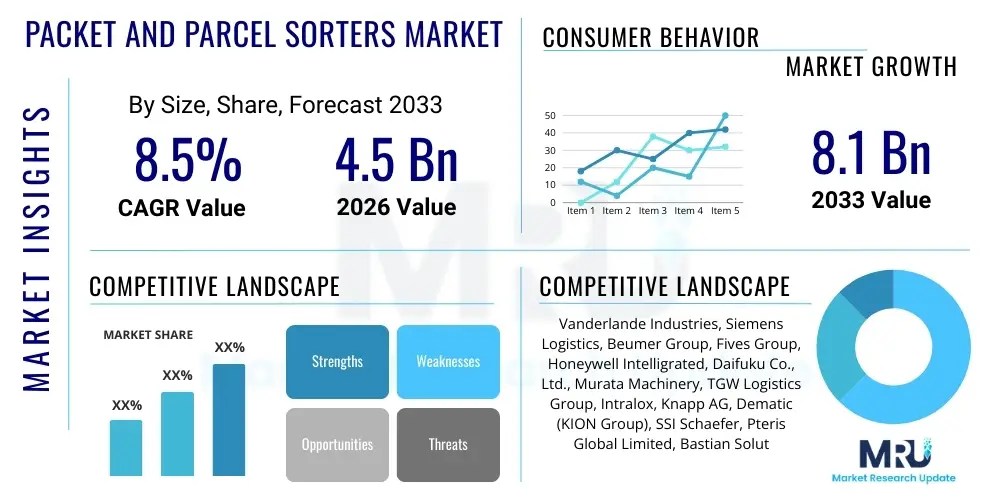

The Packet and Parcel Sorters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033.

Packet and Parcel Sorters Market introduction

The Packet and Parcel Sorters Market encompasses the technological solutions and automated machinery specifically designed for the high-speed categorization and routing of small packets and medium to large parcels within logistics, postal, and e-commerce fulfillment operations. This essential infrastructure component is characterized by sophisticated mechanical systems—such as cross-belt, tilt-tray, and sliding shoe sorters—integrated with advanced controls, machine vision, and software optimization tools. The fundamental purpose of these systems is to dramatically increase throughput rates, minimize manual handling errors, and reduce operational costs associated with the overwhelming volume of items processed daily, especially driven by the global surge in direct-to-consumer e-commerce shipments.

Packet and parcel sorters are deployed across a broad spectrum of applications, including large regional distribution centers, last-mile fulfillment hubs, and dedicated postal sorting facilities. Key benefits derived from the adoption of these automated systems include accelerated delivery times, enhanced accuracy in destination routing, optimized use of warehouse space, and improved labor efficiency, mitigating the pervasive challenges of workforce shortages in industrialized nations. The machinery is engineered to handle heterogeneous items, adapting swiftly to varying shapes, weights, and packaging materials—a critical capability required by diversified e-commerce platforms handling everything from small poly-bags to oversized boxes. The continuous development of faster, more flexible, and modular sorting solutions is positioning this market as pivotal to the modernization of global supply chains.

Major driving factors fueling the expansion of this market include the relentless growth of the business-to-consumer (B2C) and consumer-to-consumer (C2C) e-commerce sectors, which necessitate massive scaling of sorting capacity. Furthermore, the rising consumer expectation for rapid, often same-day or next-day delivery, pressures logistics providers to invest heavily in high-speed automation. Regulatory shifts and increasing concerns over workplace safety also contribute to the push toward automated sorting solutions, which provide repeatable, controlled handling environments. Technological advancements, particularly in integrating robotics and artificial intelligence (AI) with traditional sorters, are making these systems more versatile and cost-effective, thus broadening their adoption base beyond only the largest national carriers to regional third-party logistics (3PL) providers.

Packet and Parcel Sorters Market Executive Summary

The Packet and Parcel Sorters Market is experiencing robust expansion, primarily fueled by transformative shifts in global consumption patterns, particularly the exponential rise of e-commerce. Business trends indicate a clear preference for high-speed, modular, and scalable sorter technologies that can rapidly adapt to fluctuating demand and seasonal peaks. Manufacturers are increasingly focusing on solutions that offer higher energy efficiency and require smaller physical footprints, addressing real estate constraints in urban logistics hubs. Key market players are consolidating through strategic mergers and acquisitions to offer comprehensive, end-to-end automation portfolios, integrating sorting capabilities seamlessly with automated storage and retrieval systems (AS/RS) and conveyance infrastructure. The shift toward software-defined logistics is also prominent, with sophisticated warehouse execution systems (WES) driving optimization of sorter utilization.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, driven by massive domestic e-commerce markets in China and India, coupled with significant government investment in postal infrastructure modernization. North America and Europe, while mature markets, continue to show strong growth due to the pressing need to replace aging infrastructure and combat escalating labor costs through comprehensive automation. European growth is characterized by stringent efficiency standards and a focus on specialized sorting for highly diverse package dimensions. Furthermore, emerging economies in Latin America and the Middle East are beginning to make significant, albeit selective, investments in localized sorting hubs to improve intra-regional trade flow and manage localized e-commerce activity, signaling future growth centers.

Segment trends highlight the dominance of the Cross-Belt Sorter segment due to its high throughput capacity and reliability in handling a wide range of item sizes and weights. However, the Sliding Shoe Sorter segment maintains significant market share, particularly in established large-scale postal applications requiring precise, gentle handling. From an application perspective, the E-commerce segment remains the largest revenue generator and the primary driver of technological innovation, demanding the highest speeds and maximum flexibility. The growing need for micro-fulfillment centers and urban logistics solutions is driving demand for compact, localized sorting technologies, potentially increasing the adoption of robotic and automated guided vehicle (AGV)-based sorting systems in the near future, disrupting traditional fixed-infrastructure sorter dominance.

AI Impact Analysis on Packet and Parcel Sorters Market

Common user questions regarding the integration of Artificial Intelligence (AI) in the Packet and Parcel Sorters Market typically center on how AI can enhance existing mechanical efficiency, justify the increased complexity of implementation, and ensure data security. Users frequently ask about the practical application of machine learning for optimizing sortation logic, predicting maintenance failures before they occur, and improving the accuracy of optical character recognition (OCR) and computer vision systems used for label reading. There is a strong interest in AI’s role in transforming operational workflow from reactive to predictive, ensuring maximum uptime, especially during peak seasons. Expectations are high regarding AI’s ability to handle unprecedented volumes and heterogeneity in package characteristics without human intervention, thus making sorting facilities truly "smart" and fully autonomous.

AI's primary influence is moving the market beyond purely mechanical solutions to data-driven, adaptive systems. Machine learning algorithms are crucial for dynamic capacity planning, allowing the system to reallocate sorting resources in real-time based on incoming package flow, anticipated bottlenecks, and destination priority. This capability significantly enhances utilization rates, transforming a fixed-asset investment into a dynamic, performance-optimized asset. Furthermore, AI-powered predictive maintenance models analyze sensor data from motors, belts, and actuators to identify subtle deviations indicative of imminent failure, scheduling preventative interventions and drastically reducing unplanned downtime—a critical factor given the high cost of sorter inactivity.

The integration of AI also fundamentally improves the accuracy and speed of package identification and tracking. Advanced computer vision systems, trained using deep learning models, can read damaged, poorly printed, or obscured labels with higher reliability than traditional fixed scanners. This enhancement minimizes "no-reads" or mis-sorts, which otherwise require manual intervention, thereby accelerating throughput and decreasing operational exceptions. Ultimately, AI transforms sorter systems from deterministic machines into intelligent, self-optimizing ecosystems capable of learning from past performance and adapting to novel operational challenges, ensuring the Packet and Parcel Sorters Market remains responsive to the complexities of modern logistics.

- AI-driven Predictive Maintenance: Minimizes unplanned downtime by analyzing operational telemetry data.

- Optimized Sortation Logic: Machine learning algorithms dynamically adjust routing tables for maximum throughput efficiency.

- Enhanced Vision Systems: Deep learning improves accuracy of reading damaged or obscured parcel labels (OCR/DWS).

- Robotic Integration Control: AI enables seamless coordination between fixed sorters and autonomous mobile robots (AMRs) for induction and discharge tasks.

- Dynamic Resource Allocation: Real-time decision-making based on traffic flow to prevent congestion and bottlenecks.

- Energy Consumption Optimization: Algorithms modulate motor speeds based on load factors, reducing overall energy usage.

- Anomaly Detection: Identifies unusual package behaviors or system malfunctions instantly for rapid resolution.

DRO & Impact Forces Of Packet and Parcel Sorters Market

The Packet and Parcel Sorters Market is powerfully shaped by a confluence of driving factors, restrictive complexities, and evolving technological opportunities, creating significant impact forces across the logistics sector. The primary driver is the unparalleled acceleration of e-commerce, demanding infrastructural investment that can manage exponentially increasing volumes and handle the complex challenge of peak season surges, necessitating sorters with high speed and flexibility. Restraints primarily involve the substantial initial capital expenditure required for installing these large, complex systems, coupled with the difficulty and expense of integrating new systems into legacy IT and operational environments. Opportunities lie in the development of modular, scalable, and smaller footprint sorters, and the application of IoT and AI to create adaptive, maintenance-friendly systems. The combined impact forces are pushing the industry towards consolidation, standardization of interfaces, and a greater emphasis on solutions that offer rapid return on investment (ROI) through labor savings and efficiency gains.

Key drivers include the global push for operational efficiency to offset rising labor costs, especially in developed economies, making automated sorting a critical component of cost mitigation strategies. Additionally, the proliferation of specialized delivery services (e.g., cold chain, hazardous materials) requires sorters capable of specialized, gentle, or prioritized handling, broadening the functional requirements of new equipment. However, the market faces significant restraints. The long depreciation cycles for traditional, fixed sorting infrastructure often delay upgrades, as companies are hesitant to replace perfectly functional, though less efficient, older systems. Furthermore, the specialized skillset required to maintain and operate these sophisticated systems poses a constraint, increasing reliance on vendor support and specialized training programs. The complexity of integrating various automation components—such as conveyors, scanners, and sorters from different vendors—adds to project costs and timelines, deterring smaller logistics players.

Opportunities for market growth are abundant through technological innovation. The shift toward incorporating robotics, particularly robotics that can assist with induction and discharge from primary sorters, offers a path to lower CAPEX and greater scalability, especially for 3PLs managing diverse client needs. The development of advanced sensing technologies and predictive analytics (as driven by AI/IoT) promises to transform system maintenance and uptime, making the cost of ownership more predictable and attractive. Moreover, the increasing demand for returns processing, particularly critical for fashion e-commerce, presents a unique niche opportunity for bi-directional and multi-functional sorters optimized for reverse logistics. Ultimately, the impact forces compel manufacturers to prioritize flexibility, modularity, and seamless software integration to address the dynamic and unpredictable nature of modern parcel flow.

Segmentation Analysis

The Packet and Parcel Sorters Market is segmented primarily based on the core mechanical technology utilized, the speed or capacity of the system, and the primary application sector served. Segmentation by type—encompassing Cross-Belt, Tilt-Tray, Sliding Shoe, and Pop-Up Sorters—allows for differentiation based on throughput capacity, cost, handling characteristics (gentleness), and footprint requirements. Cross-belt sorters, recognized for their high reliability and speed, dominate installations where throughput is paramount, such as major e-commerce fulfillment hubs. Segmentation by speed categorizes systems into low, medium, and high-speed tiers, directly correlating with the sorting capacity measured in packages per hour (PPH), which is essential for matching system capability to the user's operational requirements, whether it be a small depot or a massive sorting center.

Further granularity is achieved through segmentation based on end-use application, which includes E-commerce and Retail, Postal and Courier Services, Food and Beverage, and General Logistics/3PL. The E-commerce and Postal sectors are the most significant drivers, necessitating specialized sorters capable of handling highly variable items and managing extremely high peak volumes. The 3PL segment is rapidly growing, focusing on flexible, multi-client sorting solutions that can be reconfigured easily. Geographic segmentation divides the market based on regional deployment maturity and growth rates, highlighting the contrasting needs between established markets in North America and Europe, which demand upgrades and replacement, and fast-growing markets like APAC, which require new, large-scale infrastructure deployment.

This detailed segmentation provides stakeholders with targeted insights necessary for product development and market penetration strategies. For instance, companies targeting last-mile fulfillment often focus on compact, medium-speed Pop-Up or Bombay-style sorters suitable for urban depots, minimizing spatial constraints. Conversely, those focused on national distribution hubs emphasize the throughput efficiency and redundancy provided by large Cross-Belt or high-capacity Tilt-Tray systems. Understanding these nuances is critical for designing solutions that address specific client challenges, whether it relates to handling delicate items, maximizing density within a limited footprint, or achieving the lowest possible cost per sort.

- By Type:

- Cross-Belt Sorters

- Tilt-Tray Sorters

- Sliding Shoe Sorters

- Pop-Up Sorters (or Activated Roller Belts)

- Bomb Bay Sorters

- By Speed:

- High-Speed (>15,000 PPH)

- Medium-Speed (5,000 - 15,000 PPH)

- Low-Speed ( <5,000 PPH)

- By Application/End-User:

- E-commerce and Retail Fulfillment

- Postal and Courier Services (P&C)

- Third-Party Logistics (3PL)

- Food and Beverage Distribution

- General Manufacturing and Distribution

- By Component:

- Hardware (Mechanical Systems, Conveyors)

- Software and Controls (WES/WMS Integration, PLC, Vision Systems)

- Services (Maintenance, Integration, Consultation)

Value Chain Analysis For Packet and Parcel Sorters Market

The value chain for the Packet and Parcel Sorters Market is complex, involving multiple specialized tiers, beginning with the upstream supply of core components and culminating in the downstream installation and after-sales support provided to end-users. Upstream activities involve the procurement of specialized raw materials, including high-grade steels, aluminum alloys for lightweight frames, advanced polymeric materials for belts and trays, and sophisticated electronic components like motors, controllers, proximity sensors, and industrial computers necessary for system operation. These suppliers often deal with high customization requirements, as sorter system designs demand specific mechanical tolerances and durability standards far exceeding standard industrial equipment. The cost and quality of these upstream inputs directly influence the final cost, throughput capacity, and lifespan of the sorting machinery.

Midstream, the value chain is dominated by specialized sorter manufacturers and system integrators. Manufacturers are responsible for the detailed mechanical and electrical engineering, assembly, factory acceptance testing (FAT), and production of the complex sorting modules. System integrators play a crucial role by taking these modules and designing a complete, customized warehouse solution, which includes integrating the sorter with inbound/outbound conveyor systems, scanning tunnels, weighing systems (DWS), and the overarching warehouse management and execution systems (WMS/WES). The trend toward turnkey solutions means integrators often hold the highest value-added position, managing project risks and ensuring seamless operational deployment within the client's existing physical and digital infrastructure.

Downstream activities focus on distribution, installation, commissioning, and long-term service provision. Distribution channels are predominantly direct, particularly for large, bespoke installations, involving direct sales forces and engineering teams engaging with major logistics, postal, or e-commerce clients. Indirect distribution sometimes occurs through regional partners or authorized re-sellers for smaller, standardized systems or modular additions. The profitability in the downstream is increasingly shifting towards services—specifically long-term maintenance contracts, predictive maintenance subscriptions (often leveraging IoT and AI), and software updates. End-users rely heavily on robust service support to maintain high uptime, making the aftermarket service segment a substantial component of the overall market value chain.

Packet and Parcel Sorters Market Potential Customers

Potential customers for high-throughput packet and parcel sorters are organizations facing overwhelming volume mandates, stringent delivery windows, and high costs associated with manual labor in their supply chain operations. The primary customer segment is undeniably the E-commerce and Retail fulfillment industry, driven by global behemoths and regional online retailers requiring massive, often dedicated, sorting capacity to manage millions of SKUs and daily shipments. These clients prioritize speed, flexibility to handle varied package types, and scalability to manage explosive growth, often leading them to invest in top-tier Cross-Belt and Tilt-Tray sorters. A second critical segment is the global Postal and Courier Services, including national postal organizations (e.g., USPS, Royal Mail) and international express carriers (e.g., FedEx, UPS, DHL). These entities require robust, reliable systems capable of sorting diverse mail classes and large parcels across vast distribution networks, often operating systems for decades.

The Third-Party Logistics (3PL) providers represent a rapidly expanding customer base. 3PLs require sorting solutions that offer maximum flexibility and modularity, as they must handle the inventory and shipping needs of multiple clients simultaneously, each with unique volume profiles and service level agreements (SLAs). Their investment decisions are heavily influenced by the ability of the system to be reconfigured or scaled quickly based on new contract acquisition or seasonal demands. Furthermore, emerging customer groups include large distribution centers for Food & Beverage, particularly ambient grocery delivery services, and major wholesalers who are increasingly transitioning to e-commerce models. These groups seek sorting technologies that can handle high case volumes alongside smaller e-commerce packets, balancing traditional pallet/case movement with individual parcel handling within the same facility.

Beyond the core logistics players, potential customers also include specialized logistics providers focusing on reverse logistics (returns processing), pharmaceutical distribution (requiring controlled environments), and large internal corporate mailrooms or campus services that handle significant internal parcel movements. Investment justification across all customer types fundamentally revolves around labor displacement, error reduction (mis-sorts), and the ability to guarantee specific, rapid throughput rates necessary to meet customer expectations. The adoption of new sorter technology is typically seen not just as a cost replacement but as a strategic asset enabling competitive advantages in speed and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vanderlande Industries, Siemens Logistics, Beumer Group, Fives Group, Honeywell Intelligrated, Daifuku Co., Ltd., Murata Machinery, TGW Logistics Group, Intralox, Knapp AG, Dematic (KION Group), SSI Schaefer, Pteris Global Limited, Bastian Solutions, Inc., MHS Global, Inc., Interroll Group, Okura Yusoki Co., Ltd., EuroSort Systems, Savoye, Locus Robotics (indirect sorting solutions). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Packet and Parcel Sorters Market Key Technology Landscape

The technological landscape of the Packet and Parcel Sorters Market is characterized by a concerted move toward smarter, faster, and more integrated solutions, driven largely by the need to manage greater variability in package size and flow. Traditional mechanical engineering excellence remains foundational, focusing on developing lighter, high-durability materials for sorter components (belts, carriers, shoes) to increase operating speed and reduce wear and energy consumption. Critical advancements are being made in the drive systems, moving towards decentralized, energy-efficient motor technologies that allow for greater precision in sorting operations and simpler maintenance routines. The shift from pneumatic actuators to electric servo drives offers increased control, reduced noise, and improved longevity, particularly in high-cycle Pop-Up and Divert systems, ensuring smoother and more accurate handling of delicate or irregularly shaped parcels.

Optical and digital technologies form the second crucial pillar of the modern sorter landscape. The proliferation of advanced dimensioning, weighing, and scanning (DWS) systems, utilizing high-resolution cameras, Lidar, and advanced vision tunnels, ensures rapid and highly accurate package identification and classification—a prerequisite for effective sorting logic. The integration of high-speed industrial scanners capable of reading 1D, 2D, and damaged barcodes, alongside sophisticated machine vision for volumetric calculation, minimizes manual data entry and correction. Furthermore, these systems are increasingly networked, feeding real-time dimensional data into Warehouse Execution Systems (WES) to optimize sorter loading and dynamic routing, maximizing the utilization of available chutes and destinations.

The most significant technological trend is the convergence of material handling equipment with industrial IT and data science. The deployment of the Internet of Things (IoT) sensors across all critical mechanical components allows for granular collection of operational telemetry data, which is essential for predictive maintenance models powered by Artificial Intelligence (AI). This digital overlay transforms the sorter from a standalone machine into a networked asset that communicates its health status and optimizes its performance autonomously. Furthermore, the development of sophisticated Warehouse Execution Systems (WES) is central, acting as the intelligent bridge between the overall Warehouse Management System (WMS) and the physical control of the sorters, enabling highly complex sort plans, real-time rerouting based on upstream delays, and seamless integration with robotic induction and robotic item picking solutions.

Regional Highlights

- North America (NA): Characterized by highly mature logistics infrastructure and extremely high labor costs, making automation essential for competitive survival. NA market growth is dominated by investment from large e-commerce giants and major logistics providers focused on optimizing last-mile delivery and consolidating distribution networks. The demand here centers on ultra-high-speed sorters (Cross-Belt and Tilt-Tray) and solutions designed to maximize throughput efficiency in massive regional hubs. Replacement and upgrade cycles for existing automated facilities also drive significant market activity, specifically focusing on integrating robotics for automated induction and secondary sorting processes.

- Europe: The European market displays diversity, influenced by varying country-specific regulatory standards, parcel size constraints, and a highly complex postal infrastructure spanning multiple borders. Growth is steady, driven by modernization projects in national postal services and the expansion of pan-European e-commerce logistics. Manufacturers often focus on modularity and flexibility to cater to urban sorting centers with limited space. German, UK, and Benelux markets are technological leaders, emphasizing advanced controls, energy efficiency, and adherence to high safety standards in their sorter deployments.

- Asia Pacific (APAC): APAC is the epicenter of market growth, fueled by the explosive expansion of domestic e-commerce in densely populated markets like China, India, and Southeast Asia. The region is marked by rapid infrastructure development, often skipping generations of technology and implementing the latest high-speed, large-scale sorters in newly built mega-hubs. Demand is highly volume-driven, requiring robust, reliable systems capable of handling peak volumes that dwarf those in Western markets. Government initiatives in countries like Japan and South Korea to upgrade postal infrastructure also contribute substantially to regional investment, particularly for advanced systems utilizing machine vision and IoT.

- Latin America (LATAM): The LATAM market is emerging, demonstrating high growth potential from a lower base. Investment is concentrated in key urban centers and major trade hubs (e.g., Brazil, Mexico). Market penetration is accelerating as international and local e-commerce platforms invest in centralized distribution infrastructure to combat regional logistical challenges, such as fragmented delivery networks and high freight costs. The region often seeks cost-effective, durable, and highly scalable solutions.

- Middle East and Africa (MEA): Growth in MEA is highly localized around the GCC states (UAE, Saudi Arabia) and certain economic hubs in South Africa. Investment is spurred by ambitious national logistics visions (e.g., UAE's push for a global logistics hub status) and rising consumerism. The projects tend to be large-scale, greenfield investments focused on establishing world-class sorting capabilities, primarily utilizing high-end sorter technologies imported from North American and European manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Packet and Parcel Sorters Market.- Vanderlande Industries (A KION Group Company)

- Siemens Logistics

- Beumer Group

- Fives Group

- Honeywell Intelligrated

- Daifuku Co., Ltd.

- Murata Machinery, Ltd.

- TGW Logistics Group

- Knapp AG

- Dematic (A KION Group Company)

- SSI Schaefer

- Pteris Global Limited

- Bastian Solutions, Inc. (A Toyota Industries Company)

- MHS Global, Inc.

- Interroll Group

- Okura Yusoki Co., Ltd.

- EuroSort Systems

- Savoye

- Shanxiao Technology

- Zhejiang Damon Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Packet and Parcel Sorters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fastest type of parcel sorter available?

The fastest sorters are typically high-speed Cross-Belt Sorters and Tilt-Tray Sorters, capable of handling throughput rates exceeding 30,000 packages per hour (PPH). Cross-Belt technology is generally favored for its reliability and speed in high-volume e-commerce and postal applications, offering maximum sort destinations.

How does AI improve the efficiency and reliability of packet sorting systems?

AI enhances efficiency through dynamic sortation logic optimization, real-time traffic flow management, and improved label reading accuracy via deep learning vision systems. Reliability is boosted significantly by AI-powered predictive maintenance, which preempts component failures and maximizes system uptime during critical operational periods.

What is the primary factor driving new investment in the Packet and Parcel Sorters Market?

The primary driver is the necessity to manage the exponential and highly volatile growth of e-commerce volumes. Logistics providers and retailers must invest in automated sorters to maintain competitive delivery speeds and offset the prohibitive cost and scarcity of manual labor required for high-volume handling.

What are the typical capital expenditure (CAPEX) considerations for installing a high-speed sorter?

CAPEX for a high-speed sorter is substantial, encompassing the cost of the mechanical sorter itself, complementary conveyance systems, advanced scanning and vision tunnels (DWS), proprietary control software (WES), and significant installation and commissioning fees. Total project costs are highly dependent on facility size and desired throughput capacity.

Which geographical region exhibits the highest growth rate for parcel sorter adoption?

The Asia Pacific (APAC) region currently exhibits the highest growth rate in the adoption of packet and parcel sorters. This rapid expansion is driven by the massive scale of domestic e-commerce markets in countries like China and India, coupled with widespread investment in modernizing national logistics and postal infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager