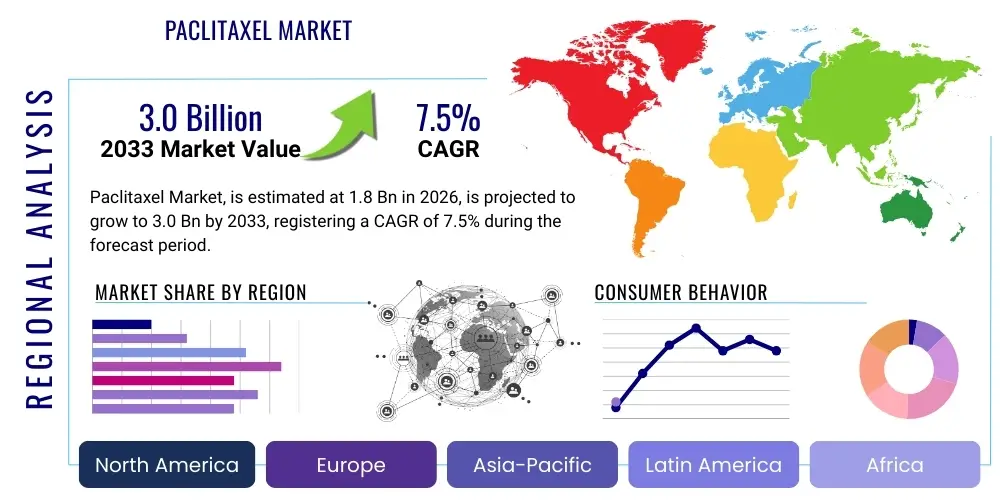

Paclitaxel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441215 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Paclitaxel Market Size

The Paclitaxel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global prevalence of various cancers, including ovarian, breast, lung, and advanced stomach cancers, coupled with the established efficacy of Paclitaxel as a foundational chemotherapy agent.

Paclitaxel Market introduction

The Paclitaxel market encompasses the global trade and utilization of Paclitaxel, a highly effective chemotherapeutic agent belonging to the taxane class. Originally derived from the bark of the Pacific yew tree (Taxus brevifolia), modern Paclitaxel production primarily relies on semi-synthetic processes due to sustainability and scale constraints. Paclitaxel functions by stabilizing microtubules, thereby disrupting cell division and triggering apoptosis, making it a critical treatment for various solid tumors. Its mechanism of action offers distinct advantages in treating rapidly proliferating cancer cells, positioning it as a cornerstone in oncology protocols worldwide.

Major applications of Paclitaxel span multiple high-incidence cancer types. It is routinely used as first-line therapy, often in combination with platinum-based compounds or monoclonal antibodies, for ovarian cancer, non-small cell lung cancer (NSCLC), and various stages of breast cancer, including adjuvant, neoadjuvant, and metastatic settings. Furthermore, specific formulations, such as albumin-bound Paclitaxel (nab-Paclitaxel), have expanded its therapeutic window, particularly in pancreatic cancer and metastatic breast cancer, by reducing hypersensitivity reactions and potentially improving drug delivery to the tumor site. The proven clinical efficacy and versatility of this molecule cement its indispensable position in the current oncology treatment landscape.

The market expansion is significantly driven by continuous advancements in drug delivery systems designed to enhance patient compliance and reduce severe side effects associated with conventional formulations, which often require solvents like Cremophor EL. Innovations such as liposomal and nanoparticle formulations aim to improve pharmacokinetics, increase bioavailability, and enable targeted drug release. These technological enhancements, combined with a rising elderly population globally—a demographic highly susceptible to cancer—and increasing healthcare expenditure in developing regions, are the principal factors propelling market growth and sustaining demand for Paclitaxel and its advanced derivatives.

Paclitaxel Market Executive Summary

The Paclitaxel market is experiencing dynamic shifts characterized by robust competition among generic manufacturers and innovation focused on drug delivery systems. Business trends indicate a strategic focus among major pharmaceutical firms on securing regulatory approvals for advanced formulations, such as those utilizing nanotechnology, to capture premium segments, while generic manufacturers compete aggressively on price in established markets. Key business activity revolves around strategic partnerships for clinical trials involving Paclitaxel in novel combination therapies, particularly with immune checkpoint inhibitors, aiming to overcome resistance mechanisms and improve patient outcomes across refractory cancers. The overarching business objective remains leveraging the molecule’s proven efficacy while mitigating historical delivery challenges and toxicities.

Regionally, North America and Europe currently dominate the market due to established cancer care infrastructure, high rates of adoption of advanced chemotherapy protocols, and substantial research and development investment. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rising cancer incidence, improving access to sophisticated healthcare, and expanding government initiatives aimed at enhancing oncology services. Increasing generic manufacturing capabilities and expanding patient populations in countries like China and India are major contributors to APAC's rapid market expansion, leading to increased focus on supply chain efficiency and regional manufacturing partnerships.

In terms of segmentation, the nanoparticle-based formulation segment, led primarily by nab-Paclitaxel, is expected to grow faster than the conventional formulation segment, driven by superior safety profiles and ease of administration. Application-wise, the breast cancer and non-small cell lung cancer (NSCLC) segments remain the largest revenue generators, reflecting the high global prevalence of these diseases. Furthermore, the increasing use of Paclitaxel in combination regimens, moving beyond traditional monotherapy, dictates segmental growth, emphasizing the rising significance of outpatient oncology clinics and specialized cancer centers as key end-users for drug procurement and administration.

AI Impact Analysis on Paclitaxel Market

Common user questions regarding AI's impact on the Paclitaxel market center on how AI can enhance the drug's efficacy, reduce side effects, and streamline its discovery and manufacturing processes. Users frequently inquire about AI's role in predicting patient response to Paclitaxel-based regimens (personalized medicine), optimizing complex dosing schedules, and accelerating the identification of novel Paclitaxel analogs or synergistic combination partners. Based on this, key themes indicate high expectation for AI to fundamentally improve precision oncology by moving beyond 'one-size-fits-all' treatments toward data-driven, individualized chemotherapy protocols, while also addressing high production costs and supply chain vulnerabilities associated with this complex molecule.

- AI accelerates the identification of molecular markers that predict responsiveness or resistance to Paclitaxel, enabling highly personalized treatment plans.

- Machine learning algorithms optimize clinical trial designs, speeding up recruitment of suitable candidates and analyzing complex multi-omic data generated during Paclitaxel studies.

- AI aids in high-throughput screening of Paclitaxel analogs and combination drugs, potentially uncovering formulations with improved toxicity profiles or enhanced efficacy against resistant tumors.

- Predictive modeling enhances quality control and yield optimization in the complex semi-synthetic manufacturing process of Paclitaxel, ensuring supply chain stability.

- AI systems analyze real-world evidence (RWE) to continuously refine dosing parameters and manage potential adverse drug reactions (ADRs) associated with Paclitaxel administration in clinical settings.

DRO & Impact Forces Of Paclitaxel Market

The dynamics of the Paclitaxel market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction. The primary Driver is the rising global incidence of cancers such as breast, ovarian, and lung cancer, ensuring sustained and increasing demand for established, effective chemotherapy agents like Paclitaxel. Simultaneously, the refinement of delivery technologies, notably the shift towards nanoparticle formulations, improves the therapeutic index and patient tolerability, further boosting adoption. These drivers exert a significant upward pressure on market valuation, supported by increasing cancer screening programs and improved diagnostic capabilities globally, leading to earlier and more frequent initiation of chemotherapy treatment.

Conversely, the market faces significant Restraints. The most critical constraint involves the severe side effects associated with conventional Paclitaxel formulations, including peripheral neuropathy, myelosuppression, and hypersensitivity reactions, which limit dosing and necessitate complex patient management. Furthermore, the widespread availability of low-cost generic versions, following the expiration of major patents, creates downward pressure on pricing, affecting the profitability margins of branded drug developers. This generic erosion necessitates continuous investment in novel, patentable formulations to maintain market relevance and premium pricing structures. Another restraint is the development of resistance mechanisms in tumor cells, requiring continuous research into combination therapies to maintain drug effectiveness over long periods.

Opportunities for growth are concentrated in the development of targeted and localized drug delivery systems, such as antibody-drug conjugates (ADCs) utilizing Paclitaxel derivatives, and the strategic integration of Paclitaxel into immunotherapy combinations to potentiate immune responses against cancer. Significant opportunity lies in expanding usage in emerging economies where oncology infrastructure is rapidly developing and patient populations are vast. Impact Forces include intense regulatory scrutiny over manufacturing standards and clinical safety, particularly concerning generic bioequivalence, and the considerable influence of health technology assessment (HTA) bodies in developed nations determining reimbursement levels based on cost-effectiveness relative to newer targeted therapies. These forces compel manufacturers to demonstrate clear clinical and economic value.

- Drivers: High global cancer prevalence; established efficacy in multiple tumor types; increasing adoption of advanced nanoparticle formulations; growing healthcare expenditure in emerging markets.

- Restraints: Severe side effects (peripheral neuropathy, myelosuppression); intense competition from generic manufacturers and pricing pressure; development of tumor resistance; manufacturing complexities.

- Opportunities: Research into novel drug delivery (e.g., liposomes, micelles); combination therapies with checkpoint inhibitors; expansion into overlooked cancers; strategic partnerships for localized manufacturing in APAC.

- Impact Forces: Strict regulatory requirements for formulation stability and bioequivalence; reimbursement policies influencing uptake; competitive pressure from next-generation targeted therapies; R&D intensity focused on reducing toxicity.

Segmentation Analysis

The Paclitaxel market is systematically segmented based on formulation type, therapeutic application, and end-user, providing a granular view of market dynamics and growth potential across various dimensions. Understanding these segments is crucial for stakeholders to tailor their product development, marketing, and distribution strategies effectively. The formulation segmentation highlights the ongoing transition from traditional, solvent-based drugs to modern, less toxic, and more efficient delivery platforms. The application segments reveal which cancer types generate the highest demand and where future clinical research is likely to concentrate, guided by unmet clinical needs and prevalence trends.

Segmentation by formulation distinguishes between conventional Paclitaxel, which often requires significant premedication due to its excipients (like Cremophor EL), and innovative, alternative formulations, predominantly albumin-bound Paclitaxel (nab-Paclitaxel) and liposomal Paclitaxel. Nanoparticle formulations, in particular, offer superior pharmacokinetic profiles, reduced systemic toxicity, and are increasingly favored in specific treatment protocols, leading to faster market penetration and premium pricing compared to generic conventional versions. The end-user segment distribution between hospitals and specialized cancer centers reflects the evolving trend towards outpatient chemotherapy administration, emphasizing the growing importance of specialized oncology practices as key decision-makers and purchasers.

The detailed market segmentation provides specific insights into regional variances in therapeutic preferences and access. For instance, while high-income regions show rapid adoption of nab-Paclitaxel due to better reimbursement, conventional generic Paclitaxel retains significant market share in developing economies due to cost advantages. Analyzing these segments helps pharmaceutical companies prioritize investment in areas promising the highest return, whether through pipeline expansion for new indications or optimizing supply chain efficiency for existing high-volume products within the breast and lung cancer segments.

- By Product Type (Formulation):

- Conventional Paclitaxel (Solvent-based)

- Albumin-Bound Paclitaxel (nab-Paclitaxel)

- Other Novel Formulations (Liposomal, Polymeric Micelles)

- By Application:

- Breast Cancer

- Ovarian Cancer

- Non-Small Cell Lung Cancer (NSCLC)

- Pancreatic Cancer

- Kaposi's Sarcoma

- Others (e.g., Stomach Cancer, Head and Neck Cancer)

- By End User:

- Hospitals

- Oncology Clinics and Cancer Centers

- Ambulatory Surgical Centers

Value Chain Analysis For Paclitaxel Market

The Paclitaxel value chain is intricate, commencing with highly specialized upstream activities related to raw material sourcing and initial synthesis, progressing through complex intermediate manufacturing, and concluding with highly regulated downstream distribution and patient administration. Upstream analysis reveals reliance on two main methods: extraction from plant biomass (Taxus species) or, more predominantly, semi-synthesis utilizing precursors like 10-deacetylbaccatin III, which are more readily sourced from cultivated yew trees or plant cell culture. This initial stage is characterized by high capital investment, specialized chemical engineering, and stringent purification requirements to achieve pharmaceutical-grade active pharmaceutical ingredient (API).

Midstream activities involve the formulation and final product manufacturing, where the API is combined with excipients to create conventional or advanced formulations (e.g., nanoparticle suspension). This stage is critical for adding value, as advancements in formulation technology (nab-Paclitaxel) dramatically improve efficacy and reduce toxicity, thus justifying premium pricing and establishing competitive differentiation. Manufacturing plants must comply with global Good Manufacturing Practices (GMP) and handle potent cytotoxic substances, adding to operational complexity and cost. Intellectual property related to specific formulation methods remains a key factor influencing competitive dynamics at this stage.

Downstream analysis focuses on distribution channels and patient access. The distribution network is complex, requiring specialized logistics for cold chain management and handling of cytotoxic drugs. Direct channels involve manufacturers selling high-volume tenders directly to large hospital systems or governmental procurement agencies. Indirect channels rely heavily on specialized pharmaceutical wholesalers, distributors, and group purchasing organizations (GPOs) to reach smaller oncology clinics and pharmacies. Effective channel management, including managing inventory and preventing counterfeiting, is vital for ensuring secure and timely drug delivery to the end-users—hospitals and specialized cancer centers—where skilled personnel administer the drug under rigorous medical supervision.

Paclitaxel Market Potential Customers

The primary customers and end-users of Paclitaxel are highly specialized institutions within the healthcare sector focused on oncology treatment and cancer management. These entities include large, multi-specialty hospitals with dedicated oncology departments, specialized government and private cancer centers, and smaller, rapidly growing community oncology clinics that handle a substantial volume of outpatient chemotherapy administration. These customers purchase Paclitaxel in bulk, either directly from the manufacturer or through established distribution channels like Group Purchasing Organizations (GPOs), for utilization in chemotherapy protocols.

Secondary but crucial customers include governmental health procurement agencies and national health systems (such as the NHS in the UK or regional health authorities in Europe) that negotiate large-scale contracts for generic and branded oncology drugs to ensure universal access and manage healthcare budgets. Furthermore, academic research institutions and contract research organizations (CROs) serve as important, albeit smaller, customers, procuring Paclitaxel for preclinical and clinical research focused on combination therapies, mechanism studies, and formulation improvements. Their purchasing decisions are driven by research needs and regulatory compliance rather than immediate patient volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol-Myers Squibb (BMS), Abraxis BioScience (Acquired by Celgene/BMS), Pfizer Inc., Fresenius Kabi AG, Hospira (Acquired by Pfizer), Sandoz International GmbH, Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Actavis (Allergan), Luye Pharma Group, Intas Pharmaceuticals Ltd., Cipla Ltd., Beijing Union Pharmaceutical Factory, Samyang Biopharmaceuticals, Ascent Pharmaceuticals Inc., Sorrento Therapeutics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paclitaxel Market Key Technology Landscape

The technological landscape surrounding the Paclitaxel market is predominantly defined by advancements in semi-synthetic production methods and sophisticated drug delivery systems designed to overcome the intrinsic limitations of the molecule. Initially, Paclitaxel was scarce due to reliance on extraction from the slow-growing Pacific yew tree. Current technology leverages semi-synthesis, primarily starting with renewable precursors such as 10-deacetylbaccatin III derived from cultivated Taxus species needles or through fermentation and plant cell culture technologies. This process involves complex, multi-step chemical reactions to achieve the final Paclitaxel structure, requiring highly controlled environments and advanced analytical chemistry techniques to ensure purity and compliance with pharmacopeial standards. Efficiency and yield optimization in this semi-synthetic route remain a critical competitive advantage, driving continuous process improvement investments by major API manufacturers.

Perhaps the most transformative technological area is drug delivery. Conventional Paclitaxel requires high concentrations of solvents, leading to dose-limiting toxicities. This restraint spurred the development of advanced systems like albumin-bound nanoparticle technology (nab-Paclitaxel, e.g., Abraxane), which encapsulates Paclitaxel within albumin particles to enhance solubility, improve tumor targeting via the gp60 receptor pathway, and eliminate the need for toxic surfactants. This technology significantly improves the safety profile, allowing for higher, less frequent dosing and expanded therapeutic applications. Further research involves developing liposomal formulations, where Paclitaxel is enclosed in lipid bilayers, and polymeric micelles, both aimed at prolonged systemic circulation and passive targeting of solid tumors through enhanced permeability and retention (EPR) effect.

Beyond formulation and synthesis, computational chemistry and high-throughput screening technologies are playing an increasing role in the Paclitaxel ecosystem. These tools are utilized to rapidly identify and synthesize novel Paclitaxel analogs (taxoids) with modified structures aimed at reducing neuropathy or overcoming multidrug resistance mechanisms observed in refractory cancers. Furthermore, personalized medicine technologies, integrating genomic and proteomic data, guide the therapeutic use of Paclitaxel. Diagnostics that predict the activity of specific metabolic enzymes (e.g., CYP2C8) are used to adjust Paclitaxel dosage, representing the technological integration necessary to maximize efficacy while minimizing personalized toxicities, reinforcing Paclitaxel’s relevance amidst the rise of targeted therapy.

Regional Highlights

- North America: This region dominates the Paclitaxel market, driven by high cancer incidence rates, well-established healthcare infrastructure, high reimbursement rates for advanced formulations (like nab-Paclitaxel), and robust R&D activities leading to early adoption of new combination therapies and clinical protocols. The presence of major pharmaceutical innovators and a large patient pool undergoing aggressive chemotherapy treatment sustains high market valuation.

- Europe: Characterized by sophisticated national health systems and stringent regulatory frameworks (EMA), Europe represents a mature market with high generic penetration. Growth is stimulated by standardized treatment guidelines emphasizing Paclitaxel's role and increasing government investment in cancer screening and early diagnosis, particularly in Western European nations.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapidly increasing cancer prevalence due to aging populations and lifestyle changes, improving access to specialized oncology care, and expanding healthcare expenditure. Large patient bases in China and India, coupled with the establishment of significant local generic manufacturing capabilities, make this region a crucial strategic focus for market expansion.

- Latin America (LATAM): Market growth in LATAM is moderate but steady, largely driven by expanding access to essential medicines and gradual improvements in healthcare infrastructure, particularly in countries like Brazil and Mexico. Economic volatility and varying regulatory speeds across nations present challenges, but the demand for cost-effective generic Paclitaxel remains strong.

- Middle East and Africa (MEA): This region is characterized by fragmented market development, with growth concentrated in high-income Gulf Cooperation Council (GCC) countries benefiting from high healthcare spending and medical tourism. Paclitaxel market penetration in Sub-Saharan Africa is restricted by infrastructure limitations and affordability issues, though humanitarian aid and public health programs are slowly increasing access to essential oncology drugs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paclitaxel Market.- Bristol-Myers Squibb (BMS)

- Pfizer Inc.

- Fresenius Kabi AG

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Sandoz International GmbH (Novartis)

- Luye Pharma Group

- Intas Pharmaceuticals Ltd.

- Cipla Ltd.

- Beijing Union Pharmaceutical Factory

- Samyang Biopharmaceuticals

- Ascent Pharmaceuticals Inc.

- Sorrento Therapeutics

- Merck KGaA

- Mylan N.V. (now Viatris)

- Sun Pharmaceutical Industries Ltd.

- Zydus Cadila

- Gland Pharma Limited

Frequently Asked Questions

Analyze common user questions about the Paclitaxel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Paclitaxel in cancer treatment?

Paclitaxel acts as a mitotic inhibitor by stabilizing tubulin polymers and preventing the depolymerization of microtubules within the cancer cell. This stabilization effectively arrests the cell in the G2/M phase of the cell cycle, leading to subsequent apoptosis or cell death, particularly in rapidly dividing cells associated with solid tumors.

How do novel Paclitaxel formulations, such as nab-Paclitaxel, differ from conventional formulations?

Novel formulations, primarily albumin-bound Paclitaxel (nab-Paclitaxel), utilize nanotechnology to encapsulate the drug, eliminating the need for conventional toxic solvents like Cremophor EL. This results in reduced risk of severe hypersensitivity reactions, improved pharmacokinetic profiles, and better tumor tissue penetration, often allowing for higher tolerated doses.

Which cancer types are primarily treated using Paclitaxel?

Paclitaxel is a cornerstone treatment used extensively for a range of solid tumors, including breast cancer (metastatic and adjuvant settings), ovarian cancer, non-small cell lung cancer (NSCLC), and pancreatic cancer. It is often employed in combination with platinum-based drugs or newer biological agents.

What are the main growth drivers for the Paclitaxel market?

Key growth drivers include the rising global incidence and prevalence of high-volume cancers, the established clinical effectiveness of Paclitaxel in first and second-line regimens, and continuous technological innovation in drug delivery systems aimed at reducing toxicity and improving patient convenience and compliance.

What are the major challenges facing Paclitaxel manufacturers and researchers?

Major challenges include managing intense competition from generic versions, addressing the complex logistical and manufacturing requirements for the API and specialized formulations, and overcoming the limiting factors of dose-dependent toxicities, such as peripheral neuropathy, which necessitates ongoing research into improved analogs and delivery methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Paclitaxel Injection Market Size Report By Type (Drug Strength, Raw meterial Paclitaxel API source), By Application (Ovarian cancer, Breast cancer, Cervical cancer, Pancreatic cancer, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Paclitaxel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Semi-synthetic Paclitaxel, Natural Paclitaxel), By Application (Breast Cancer, Cervical Cancer, Ovarian Cancer, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager