Pad Printing Supplies Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442390 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Pad Printing Supplies Sales Market Size

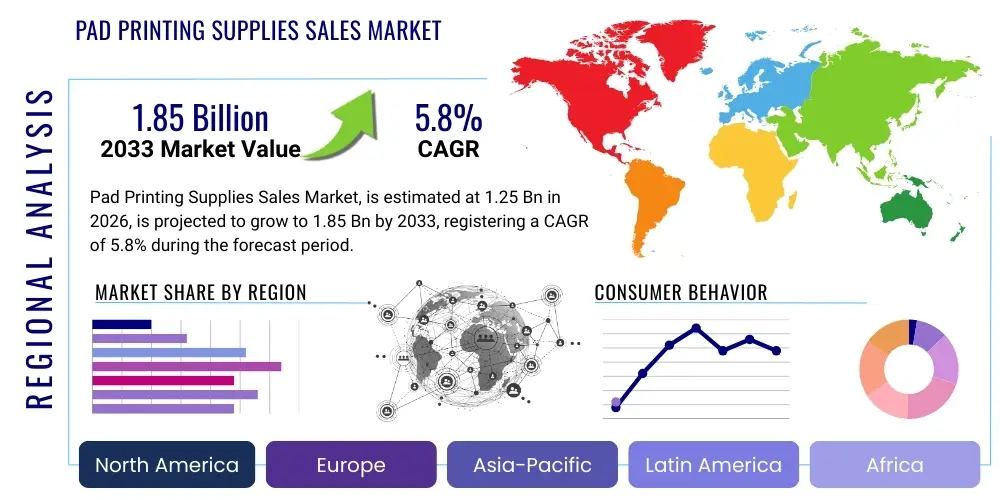

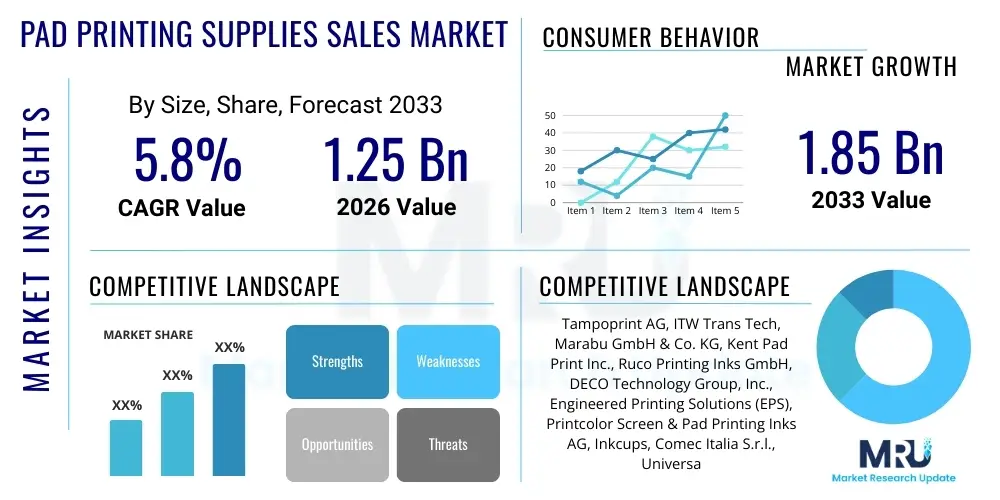

The Pad Printing Supplies Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Pad Printing Supplies Sales Market introduction

The Pad Printing Supplies Sales Market encompasses all consumables essential for the process of pad printing (tampo printing), which is an offset gravure printing technique renowned for its ability to transfer a 2-D image onto a 3-D object. This market primarily includes printing pads (made of silicone polymers), specialized inks (solvent-based, UV-curable, and epoxy), printing plates (clichés), solvents, and auxiliary cleaning agents. Pad printing is widely utilized across industries requiring high-precision, fine-detail marking on irregularly shaped or delicate substrates, such as medical devices, automotive components, electronics, and promotional products. The inherent flexibility and adaptability of silicone pads allow for pristine image transfer onto convex, concave, cylindrical, and textured surfaces, driving its sustained demand compared to alternative marking methods like screen printing or laser etching.

Product description in this sector focuses heavily on the material science behind the consumables. Silicone pads vary significantly in hardness (durometer), shape, and size, tailored specifically to the geometry of the part being decorated and the required print quality. The ink formulations are critical, needing specific adhesion properties, chemical resistance, and opacity, depending on the substrate, whether it be plastic, metal, glass, or ceramic. Continuous innovation focuses on developing environmentally friendly, VOC-compliant ink systems and long-lasting, high-resolution printing plates, which are pivotal in maintaining print consistency and reducing downtime in high-volume production lines. The synergy between high-performance inks and optimized pad geometries dictates the overall efficiency and quality achieved in the final printed product.

Major applications include marking essential data such as batch codes and regulatory symbols on syringes and catheters in the medical sector; branding interior components like dashboard buttons and gear shifts in the automotive industry; and applying intricate logos and functional graphics on consumer electronics. The market growth is primarily driven by the increasing complexity of product designs, the stringent regulatory requirements for permanent traceability marking in regulated industries, and the global expansion of consumer goods manufacturing, which necessitates robust decoration capabilities. The unique benefit of pad printing lies in its non-contact nature during the crucial image transfer phase and its ability to deposit extremely thin, uniform layers of ink, making it indispensable for micro-printing applications where precision is paramount.

Pad Printing Supplies Sales Market Executive Summary

The Pad Printing Supplies Sales Market is characterized by steady growth, driven primarily by the stringent quality control standards in the medical and automotive sectors, coupled with the rising global production of electronic devices. Business trends indicate a strong shift towards automation and integration of printing processes into existing assembly lines, necessitating high-durability, quick-curing supplies, especially UV-curable inks that minimize cycle times. Key manufacturers are focusing on backward integration to control the quality of raw materials, particularly the specialized silicones required for high-performance pads and advanced photo-polymer clichés. This strategy aims to enhance supply chain resilience and offer customized solutions tailored to specific client application requirements, thereby increasing switching costs for end-users.

Regional trends reveal that Asia Pacific (APAC) dominates the market, largely due to its status as the global hub for electronics manufacturing and high-volume consumer goods production. However, North America and Europe maintain significant value share, propelled by high demand from the medical device manufacturing sector, which requires premium, biocompatible inks and validated supply chains. There is a growing focus in these developed regions on sustainability, leading to increased investment in biodegradable solvents and low-VOC (Volatile Organic Compound) ink formulations. The competitive landscape is moderately fragmented, with specialized suppliers competing fiercely on quality, consistency, and technical support rather than solely on price.

Segment trends highlight the dominance of specialty inks in terms of revenue, specifically those designed for difficult-to-adhere substrates like polypropylene and specialized engineered plastics used in automotive interiors. Within the segmentation by product type, printing pads represent a stable, recurring revenue stream, as they are wear components requiring frequent replacement. Furthermore, the consumables required for digital pad printing—a nascent but growing technology combining the benefits of pad printing with the flexibility of digital image processing—are expected to witness the highest growth rate during the forecast period. The increasing awareness among manufacturers regarding the total cost of ownership (TCO) is pushing demand for longer-lasting plates and pads, optimizing consumable usage and reducing operational expenses.

AI Impact Analysis on Pad Printing Supplies Sales Market

User queries regarding AI's influence on the pad printing supplies market often center on whether AI-driven automation will render current supplies obsolete, how AI can optimize printing parameters, and the role of machine learning in quality control and consumable forecasting. Key concerns revolve around the integration cost of sophisticated sensors and software, the reliability of AI systems in maintaining color consistency, and the potential displacement of skilled labor involved in manual setup and adjustment of pad printing machines. Users expect AI to reduce material waste, predict equipment failure, and provide real-time adjustments to ink viscosity and pad pressure, thereby dramatically improving process stability and reducing dependence on operator expertise. The underlying theme is leveraging AI to transform the inherently mechanical and operator-dependent process of pad printing into a data-driven, highly automated manufacturing step.

AI's primary impact is anticipated in enhancing operational efficiencies rather than replacing the fundamental mechanical process. Machine vision systems, powered by deep learning algorithms, are increasingly being deployed for 100% inline quality inspection, immediately identifying defects such as incomplete prints, smearing, or misregistration far faster and more accurately than human operators. This minimizes scrap rates, directly impacting the demand pattern for supplies by ensuring optimal use of expensive specialty inks and preventing unnecessary production restarts. Furthermore, predictive maintenance models utilize AI to analyze vibration, temperature, and usage patterns of pad printing machinery, forecasting the optimal replacement time for wear parts like pads and clichés, leading to reduced unplanned downtime and optimizing inventory management for supply vendors.

The secondary, yet crucial, impact of AI lies in formulation optimization and supply chain management. AI tools analyze vast datasets regarding ink performance under various environmental conditions (humidity, temperature) and substrate types, enabling manufacturers to fine-tune ink formulations for superior adhesion and longevity. In terms of supply sales, AI-driven demand forecasting leverages historical sales data, seasonal trends, and client production schedules to predict precise consumable requirements (e.g., specific durometer pads or specialized ink batches) for distribution partners and large customers. This shift from reactive to proactive inventory management improves customer satisfaction and reduces obsolescence risks for both suppliers and end-users, stabilizing the overall market distribution chain.

- AI-powered machine vision systems enhance 100% inline print quality inspection, drastically reducing defect rates and material wastage.

- Predictive maintenance algorithms optimize the lifespan and replacement cycles of printing pads and clichés, minimizing unscheduled machine downtime.

- Machine learning facilitates real-time adjustment of printing parameters (pressure, speed, viscosity) to maintain strict color and registration consistency across long production runs.

- AI assists in optimizing ink formulation chemistry by analyzing performance data across diverse substrates and environmental variables.

- Advanced analytics improve supply chain resilience and inventory forecasting, ensuring timely delivery of specialized consumables based on predicted client demand.

DRO & Impact Forces Of Pad Printing Supplies Sales Market

The Pad Printing Supplies Sales Market is shaped by a confluence of influential factors, encompassing strong demand drivers rooted in industrial growth, significant technological restraints related to process complexity, and emerging opportunities in specialized applications. The primary drivers include the mandatory requirement for permanent marking and traceability in high-value, regulated industries such as aerospace and medical devices, where indelible marking is non-negotiable. Opportunities are particularly pronounced in the development of functional inks, such as conductive inks for electronics or bio-compatible inks for implantable devices. However, the market faces restraints, chiefly the environmental regulations restricting the use of certain volatile organic compounds (VOCs) in traditional solvent-based inks, necessitating costly shifts to UV-curable or water-based alternatives, which require significant capital investment in curing equipment.

Impact forces within this ecosystem include the increasing pressure from alternative marking technologies, specifically laser etching and direct-to-object inkjet printing, which offer lower consumable costs and higher automation potential for certain applications. While pad printing retains superiority for 3D curved surfaces and delicate materials, competitive technologies constantly erode market share in flatter, less complex applications. The global economic stability and manufacturing output remain powerful external impact forces; fluctuations in automotive or consumer electronics production directly translate into volatility in demand for high-volume pad printing supplies. Geopolitical factors affecting cross-border trade of chemical components necessary for ink manufacturing also exert significant pricing pressure and supply chain instability.

A crucial factor driving growth is the miniaturization trend across electronics and medical devices. As components shrink, the need for microscopic, high-resolution marking increases, a domain where pad printing excels due to its ability to transfer incredibly thin layers of ink with extreme precision. The continuous innovation in silicone pad polymers, offering enhanced abrasion resistance and superior ink release characteristics, helps maintain the competitiveness of this technology. Conversely, a major restraint is the technical expertise required for effective setup and operation—pad printing is an art and a science, demanding skilled technicians to manage parameters like plate depth, ink dilution, and pad compression, which complicates widespread adoption in regions lacking specialized labor resources. This reliance on technical skill acts as a natural barrier to entry and a constraint on operational scalability for many end-users.

- Drivers:

- Growing demand for precise, durable marking on irregularly shaped products in automotive and electronics sectors.

- Stringent regulatory requirements in medical and pharmaceutical industries necessitating permanent, non-toxic marking.

- Miniaturization of electronic components demanding high-resolution, micro-scale printing capabilities.

- Restraints:

- Increasing environmental regulations concerning VOC emissions from solvent-based inks.

- Competition from advanced alternative marking technologies like industrial inkjet and laser etching.

- The high degree of technical expertise and complex setup procedures required for optimal pad printing operations.

- Opportunities:

- Development and adoption of functional inks (e.g., conductive, thermal, biometric) for specialized electronics applications.

- Expansion into new materials and substrates, including flexible materials and bio-plastics.

- Growth of sustainable supplies, including water-based and bio-degradable solvents and ink systems.

- Impact Forces:

- Global macroeconomic conditions influencing manufacturing output, particularly in Asia Pacific.

- Fluctuations in raw material prices (silicones, specialized pigments, chemical solvents).

- Rapid advancements in machine vision and automation impacting process efficiency and supply usage patterns.

Segmentation Analysis

The Pad Printing Supplies Sales Market is systematically segmented primarily based on Product Type, Ink Type, and Application (End-Use Industry). This multi-dimensional segmentation provides critical insights into the consumption patterns and technological demands specific to various operational environments. The segmentation by Product Type, which includes Pads (Tampo), Inks, Plates (Clichés), and Solvents/Additives, helps suppliers allocate resources efficiently to the high-volume replacement items (pads and solvents) versus the high-value specialized items (inks and custom plates). Understanding these segments allows market players to tailor their manufacturing processes and distribution channels to meet the diverse needs of small job shops and large-scale industrial manufacturers alike.

The segmentation based on Ink Type is arguably the most dynamic and technologically sensitive area of the market. Inks are categorized into Solvent-based, UV-curable, Water-based, and Epoxy-based formulations, each offering distinct advantages regarding adhesion, cure time, chemical resistance, and environmental compliance. UV-curable inks are gaining significant traction due to their rapid curing properties and lower environmental impact compared to traditional solvent systems, aligning with global sustainability goals. Conversely, epoxy inks remain crucial for applications requiring extreme chemical and physical durability, particularly in harsh industrial environments or when printing on difficult substrates like glass or thermoset plastics. This diversification in ink technology reflects the highly specialized nature of the pad printing process.

Application segmentation reveals the core consumption centers, spanning Automotive, Medical Devices, Consumer Electronics, Promotional Products, and Industrial Goods. The medical and automotive sectors command premium pricing and demand stringent quality assurance due to high regulatory hurdles, driving demand for specialized, certified consumables. In contrast, the promotional products sector focuses more on aesthetic qualities and cost-effectiveness, leading to higher consumption of standard, general-purpose inks and pads. Analyzing these end-use applications helps suppliers understand volume requirements, necessary certifications, and regional purchasing behaviors, facilitating targeted marketing and sales strategies across the heterogeneous customer base.

- By Product Type:

- Printing Pads (Tampo)

- Printing Plates (Clichés)

- Printing Inks

- Solvents and Auxiliary Materials

- By Ink Type:

- Solvent-Based Inks

- UV-Curable Inks

- Epoxy-Based Inks

- Water-Based Inks

- Specialty Functional Inks (e.g., Conductive, Biocompatible)

- By Application (End-Use Industry):

- Medical Devices and Pharmaceutical Packaging

- Automotive Components (Interior and Exterior)

- Consumer Electronics and Appliances

- Promotional Products and Toys

- Industrial Goods and Aerospace Components

Value Chain Analysis For Pad Printing Supplies Sales Market

The value chain for the Pad Printing Supplies Sales Market begins upstream with the procurement of highly specialized raw materials, primarily silicone polymers (for pads), photo-sensitive metals or polymers (for plates), and chemical pigments, resins, and solvents (for inks). Upstream suppliers are typically large chemical companies or specialized material manufacturers who must meet strict quality controls and chemical compliance standards, especially for medical and food-contact applications. The quality and purity of these raw inputs directly determine the performance characteristics of the final consumables, such as pad resilience, ink adhesion, and plate resolution. Establishing long-term, secure relationships with reliable raw material providers is paramount for manufacturers of pad printing supplies to ensure consistent production quality and mitigate supply chain risks related to volatile chemical markets.

The midstream involves the manufacturing and formulation of the supplies. Ink manufacturers require specialized mixing and dispersion equipment to formulate complex chemical mixtures, ensuring consistent viscosity and color match. Pad manufacturers utilize precision molding and casting techniques for silicone to achieve specific durometer and geometry requirements, a critical step demanding high technical expertise. Plate manufacturers involve processes like photochemical etching or laser engraving to create high-resolution clichés. This stage often includes significant research and development investments aimed at enhancing product durability, optimizing cure times, and improving environmental profiles (e.g., developing cleaner solvent alternatives or specialized adhesion promoters). Manufacturers often serve both direct B2B customers (large manufacturers) and indirect channels (distributors and authorized resellers).

Downstream activities focus on distribution, sales, and technical support. Direct distribution is common for large industrial accounts, allowing for direct consultation and customized supply solutions. However, a vast network of indirect distributors and local agents is crucial for reaching small-to-medium enterprises (SMEs) and job shops worldwide. These distributors often maintain local stock and provide immediate technical service and troubleshooting, which is essential given the technical nature of pad printing setup. The final end-users consume the supplies in their manufacturing processes, ranging from high-speed, fully automated lines in electronics plants to manual or semi-automated operations in customized product environments. The provision of exceptional post-sales technical training and maintenance support represents a significant value-add in the downstream segment, reinforcing customer loyalty and maximizing the lifespan of printing equipment.

Pad Printing Supplies Sales Market Potential Customers

The primary potential customers for the Pad Printing Supplies Sales Market are large-scale industrial manufacturers and specialized contract decorators across several high-volume and high-precision sectors. End-users in the medical device manufacturing sector, including producers of syringes, catheters, surgical tools, and diagnostic test kits, represent a high-value customer segment due to the necessity for non-toxic, sterilized, and permanently marked surfaces. These customers require highly specialized inks that resist sterilization processes (e.g., autoclaving, ETO gas) and have certifications for biocompatibility. The automotive sector, encompassing manufacturers of vehicle interiors, dashboards, controls, and exterior components, is another major buyer, requiring durable inks that withstand abrasion, temperature fluctuations, and UV exposure, focusing heavily on aesthetic consistency and longevity.

Furthermore, the consumer electronics industry, covering smartphones, laptops, peripheral devices, and household appliances, generates immense recurring demand for pads and inks used to mark keypads, logos, regulatory information, and function indicators on complex plastic or metal casings. The trend toward sophisticated design and unique textures in electronics necessitates customized pad geometries and high-opacity inks. The buyers in this segment prioritize efficiency and speed, favoring supplies compatible with automated, high-throughput production lines. This customer base is highly price-sensitive but values technical partnership and just-in-time delivery capabilities to prevent production bottlenecks.

Lastly, the industrial and promotional goods sectors form a substantial base of potential customers. Industrial manufacturers require marking on tools, heavy equipment components, and electrical connectors, often demanding inks with extreme chemical resistance. The promotional products segment, while less focused on durability compared to medical or automotive, drives massive volume demand for a wide variety of colors and effects for branding items like pens, golf balls, and customized novelty goods. These customers rely heavily on distribution channels for rapid replenishment of standard supplies. The diversity of substrate materials across these end-use sectors dictates that potential customers require a broad, specialized portfolio of inks and pads tailored to their specific adhesion and performance needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tampoprint AG, ITW Trans Tech, Marabu GmbH & Co. KG, Kent Pad Print Inc., Ruco Printing Inks GmbH, DECO Technology Group, Inc., Engineered Printing Solutions (EPS), Printcolor Screen & Pad Printing Inks AG, Inkcups, Comec Italia S.r.l., Universal Stamping & Manufacturing, Inc., AutoTran Inc., Norcote International, Sefar AG, Luen Cheong Printing Equipment Group, Teca-Print USA, Zenith Pad Print, Prismatic LLC, Gremak, Mascoprint Developmants Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pad Printing Supplies Sales Market Key Technology Landscape

The technological landscape of the Pad Printing Supplies market is undergoing steady evolution, primarily driven by demands for higher resolution, faster cycle times, and enhanced durability. A key area of innovation lies in the material science of printing pads. Manufacturers are developing advanced silicone compounds with optimized surface energy and elasticity, allowing for superior ink pick-up and release, especially on highly textured or hydrophobic substrates. Novel pad designs are focusing on multi-angle printing capabilities and minimizing distortion on extreme 3D contours. Furthermore, specialized coatings applied to the silicone surface are extending pad life and resisting ink buildup, reducing the frequency of replacement and contributing to operational cost savings. The introduction of materials that offer greater resistance to aggressive solvents and UV exposure is critical for maintaining consistency in demanding industrial environments.

Another pivotal technological advancement involves the development of high-performance printing inks, particularly in the UV-curable and specialty functional categories. UV-curable inks have revolutionized the market by offering instantaneous curing upon exposure to UV light, eliminating the need for lengthy solvent evaporation and significantly accelerating production speeds. Continuous R&D is focused on enhancing the adhesion profile of these UV inks across difficult substrates, ensuring they meet the stringent scratch and chemical resistance requirements of automotive and medical applications. Furthermore, the burgeoning demand for conductive pad printing—using inks containing silver or carbon particles to create electrical circuits or sensors on flexible materials—is opening new high-value segments, particularly in flexible electronics and smart packaging. This requires extremely precise control over ink viscosity and particle dispersion.

The evolution of printing plates (clichés) also plays a vital role. While steel plates offer the greatest durability for ultra-high volume runs, there is a substantial trend towards high-definition photo-polymer plates and ceramic plates. Photo-polymer plates offer flexibility, cost-effectiveness, and rapid prototyping capabilities, which are essential for short-run, customized jobs. Technological improvements in laser etching systems allow for far greater precision in engraving ceramic plates, achieving finer lines and sharper images than traditional etching methods. This precision is directly linked to the quality of the final print and is paramount in meeting the micro-printing demands of miniaturized electronics. Ultimately, the integration of precise digital imaging technologies with the plate making process ensures accurate, repeatable results, supporting the overall move towards higher quality control standards across the industry.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Pad Printing Supplies, primarily fueled by the region’s dominant role in global manufacturing, especially consumer electronics, automotive parts, and high-volume toys/promotional items. Countries like China, South Korea, and Japan house massive production facilities requiring continuous replenishment of inks, pads, and plates to sustain high-throughput operations. The intense competition in the electronics sector drives demand for quick-curing, high-resolution supplies. Furthermore, the expanding local medical device manufacturing sector in India and Southeast Asia is rapidly increasing demand for biocompatible and certified inks, requiring local suppliers to scale up their technical support and compliance infrastructure. Price sensitivity is higher in the mass production segments, leading to a strong focus on cost-efficient and high-mileage consumables.

- North America: This region maintains a high-value market share, characterized by its focus on premium, specialized applications, particularly within the medical, aerospace, and high-end automotive sectors. North American buyers prioritize compliance, quality consistency, and supply chain validation above initial cost, driving demand for premium UV-curable and epoxy ink systems that meet FDA and OEM standards. The stringent environmental regulations in the US and Canada have accelerated the adoption of low-VOC and environmentally sustainable supplies. Technological early adoption, especially in automated printing systems utilizing AI for quality control, is a key characteristic, resulting in consistent demand for technologically advanced and highly durable printing pads and plates designed for extended service life in automated environments.

- Europe: The European market is mature and innovation-driven, defined by strict quality control standards, particularly in Germany and Italy, which have strong automotive and industrial machinery manufacturing bases. The region is a leader in adopting sustainable manufacturing practices, leading to aggressive regulatory push and high market penetration of water-based and compliant solvent systems. There is robust demand for supplies that facilitate micro-printing for luxury goods and complex industrial components, demanding exceptionally fine-detail clichés and precise dispensing equipment. European suppliers often differentiate themselves through superior technical service, customization, and adherence to specialized safety and environmental certifications like REACH, driving premium pricing for validated supply chains.

- Latin America (LATAM): The LATAM market, while smaller in scale, is experiencing steady growth driven by expanding local manufacturing capabilities, particularly in Brazil and Mexico, which serve as regional hubs for automotive assembly and consumer goods production. The demand is currently centered around general-purpose solvent-based inks and standard pads due to cost considerations and less pervasive regulatory oversight compared to North America or Europe. However, as foreign investment increases and local quality standards rise, there is a gradual shift towards higher-quality, certified supplies, particularly for export-oriented manufacturing. Infrastructure development in distribution and technical training remains a critical factor for market expansion in this region.

- Middle East and Africa (MEA): This region represents the nascent stage of the market, with demand concentrated in key industrial hubs like the UAE and Saudi Arabia, driven by infrastructure projects, packaging, and small-scale electronics assembly. Growth is highly dependent on capital investment in new manufacturing plants. The primary demand is for durable supplies suitable for high-temperature environments. Logistical challenges and reliance on imports necessitate robust distribution partnerships to ensure timely supply of perishable items like solvents and high-use consumables. Future growth prospects are tied closely to economic diversification efforts away from traditional oil economies into manufacturing and logistics sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pad Printing Supplies Sales Market.- Tampoprint AG

- ITW Trans Tech

- Marabu GmbH & Co. KG

- Kent Pad Print Inc.

- Ruco Printing Inks GmbH

- DECO Technology Group, Inc.

- Engineered Printing Solutions (EPS)

- Printcolor Screen & Pad Printing Inks AG

- Inkcups

- Comec Italia S.r.l.

- Universal Stamping & Manufacturing, Inc.

- AutoTran Inc.

- Norcote International

- Sefar AG

- Luen Cheong Printing Equipment Group

- Teca-Print USA

- Zenith Pad Print

- Prismatic LLC

- Gremak

- Mascoprint Developmants Limited

Frequently Asked Questions

Analyze common user questions about the Pad Printing Supplies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between UV-curable inks and traditional solvent-based inks in pad printing applications?

UV-curable inks represent a significant technological advancement over traditional solvent-based inks, primarily concerning environmental impact, cure time, and durability. Traditional solvent-based inks require solvents to evaporate for curing, a process that releases volatile organic compounds (VOCs) and demands considerable time, often requiring heat or forced air circulation. This results in slower production cycles and increased environmental compliance issues. In contrast, UV-curable inks contain photoinitiators and cure almost instantaneously when exposed to ultraviolet light, eliminating VOC emissions, drastically reducing cycle times, and enabling higher throughput rates. Furthermore, cured UV inks typically offer superior scratch resistance, chemical resistance, and adhesion properties, making them preferred for high-performance applications in the automotive and medical sectors. While UV systems require initial investment in specialized curing equipment and high-quality pads designed to resist UV degradation, their operational efficiencies and enhanced durability often result in a lower total cost of ownership (TCO) over the long term, especially in high-volume, automated manufacturing environments where speed and environmental compliance are critical factors. The shift towards UV technology is a major driver of change in the consumables market, necessitating specialized pads that maintain integrity under constant UV exposure and specialized cleaning agents compatible with the cured polymers.

How does the durometer (hardness) of the silicone pad affect the quality and application range of the print?

The durometer, or hardness, of the silicone printing pad is a critical variable that directly impacts the pad printing process, particularly the quality of the image transfer and the range of surfaces the machine can successfully print upon. Durometer is typically measured on the Shore A scale, ranging from very soft (low durometer, typically 20 Shore A) to very hard (high durometer, 60 Shore A or higher). Softer pads (low durometer) are highly flexible, conforming easily to extremely irregular, complex, or heavily textured three-dimensional surfaces, ensuring complete ink contact across the entire image area. These pads are essential for highly concave or convex parts but may wear out faster and can sometimes distort fine line details due to excessive compression. Conversely, harder pads (high durometer) are more rigid and offer superior stability, which is necessary for maintaining the integrity of extremely fine details, high-resolution text, and precise line work on relatively flat or mildly curved surfaces. Harder pads also generally exhibit longer service life and are less prone to edge curl but require highly precise machine setup to ensure sufficient contact pressure. Selecting the correct durometer is a critical operational decision; manufacturers must balance the required image detail against the complexity of the substrate geometry to optimize both print quality and pad durability, often relying on specialized technical guidance from the supplies vendor.

What role do printing plates (clichés) play, and what are the cost implications of metal versus polymer plates?

Printing plates, or clichés, serve as the foundational element in the pad printing process, functioning as the stencil that holds the ink image to be transferred. The cliché contains the etched or engraved image well (intaglio) from which the silicone pad picks up the ink. The choice between plate materials—primarily photo-polymer and steel (thin or thick)—significantly influences operational costs, quality, and lifespan. Photo-polymer plates are typically more economical upfront and allow for rapid in-house production using UV exposure and washing techniques. They are ideal for short-to-medium production runs, prototype testing, or applications where frequent design changes are necessary, as their low cost per plate minimizes obsolescence risk. However, polymer plates have a limited lifespan, typically lasting only tens of thousands to a few hundred thousand impressions before the image well degrades.

In contrast, steel plates (often referred to as thin steel or thick steel plates) are significantly more expensive to produce, requiring precision laser etching or chemical milling processes. Their primary advantage lies in their extreme durability, often lasting millions of impressions. Thick steel plates are the material of choice for ultra-high-volume, long-term production runs, particularly in demanding industrial and automotive environments where uninterrupted service life is paramount. While the initial investment in steel plates is higher, the cost per print becomes minimal over the plate’s extended operational life, making them economically advantageous for mass production. The selection criteria depend entirely on the total volume requirements, frequency of design updates, and the necessary level of print resolution, as high-precision etching is easier to maintain consistently over time on durable steel surfaces.

How is the Pad Printing Supplies Market addressing the growing demands for environmental sustainability and VOC reduction?

The Pad Printing Supplies Market is responding robustly to environmental pressures, focusing intently on reducing Volatile Organic Compounds (VOCs) and developing more sustainable consumable solutions, driven by stricter global regulations (like REACH in Europe) and corporate sustainability goals. The most significant shift is the increased adoption of UV-curable inks, which are 100% solids, curing instantly via photopolymerization without releasing VOCs into the atmosphere. This transition not only aids compliance but also improves workplace safety and reduces the need for expensive ventilation systems. While solvent-based inks remain necessary for certain difficult substrates, manufacturers are aggressively reformulating these products to use 'green solvents'—less aggressive, bio-based, or non-toxic alternatives with significantly lower vapor pressure and less environmental impact.

Furthermore, innovation extends beyond inks to auxiliary supplies. Suppliers are introducing water-based cleaning solvents and biodegradable diluents to replace highly aggressive chemicals traditionally used for machine and pad cleaning. For the printing pads themselves, R&D is focused on producing silicones that offer enhanced resistance to a broader range of solvents, thereby extending pad life and reducing consumable waste. By emphasizing closed-cup ink systems over older open-tray systems, manufacturers also minimize solvent evaporation and ink waste, providing a more contained and resource-efficient process. This comprehensive approach ensures that the market remains competitive while meeting the increasing global imperative for environmentally responsible manufacturing practices.

What are the primary challenges related to ink adhesion when printing on difficult substrates like polypropylene and specialized engineered plastics?

Achieving reliable and durable ink adhesion on substrates known for low surface energy, such as untreated polypropylene (PP), polyethylene (PE), or certain specialized engineered plastics used in automotive interiors, is one of the most persistent technical challenges in the pad printing supplies market. Low surface energy materials naturally resist bonding, causing inks to bead up or peel off easily. To overcome this, specialized ink formulations and pre-treatment methods are essential. Ink manufacturers develop high-performance epoxy or specialized one- and two-component solvent-based inks specifically engineered to 'bite' into these difficult surfaces, often containing powerful adhesion promoters.

However, successful printing often necessitates substrate pre-treatment to artificially increase the surface energy. Common methods include flame treatment, corona discharge treatment, or plasma treatment, which chemically modify the top molecular layer of the plastic to make it more receptive to bonding. The supplies market addresses this by offering primer systems—thin layers of clear liquid applied just before printing—which act as a bridge between the plastic surface and the ink layer. The efficacy of the supply chain relies on providing precise information regarding ink compatibility with various plastic grades and recommending the appropriate pre-treatment methodology, as a mismatch between ink, substrate, and pre-treatment can lead to costly adhesion failures and high scrap rates in high-volume production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager