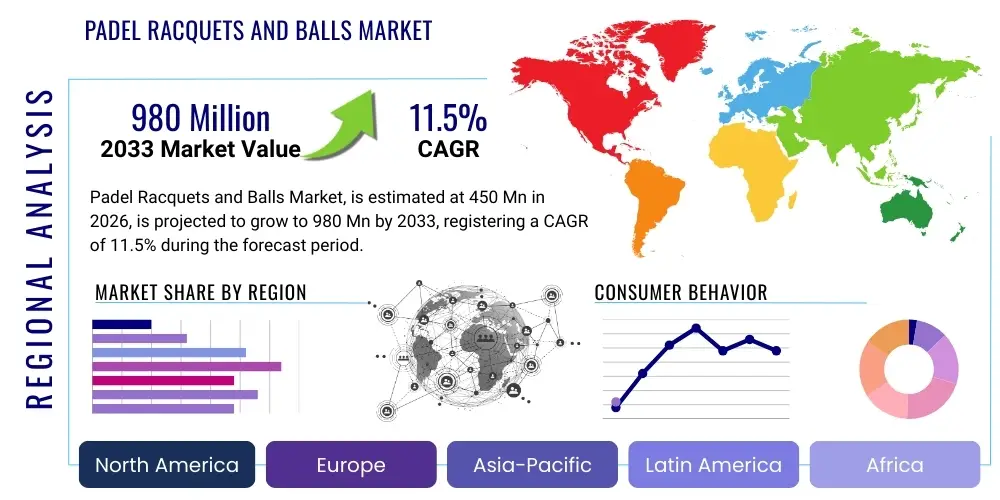

Padel Racquets and Balls Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441934 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Padel Racquets and Balls Market Size

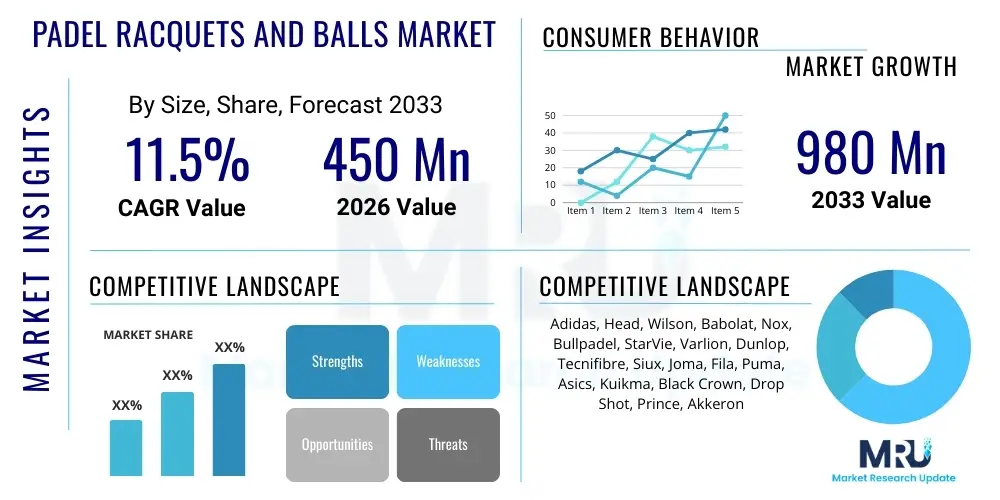

The Padel Racquets and Balls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated globalization of Padel as a professional and recreational sport, coupled with significant investment in court infrastructure across non-traditional Padel regions, particularly North America and Asia Pacific. The rising consumer disposable income in emerging economies further enables the adoption of specialized sports equipment, solidifying the market's trajectory towards robust financial growth over the next seven years.

Padel Racquets and Balls Market introduction

The Padel Racquets and Balls Market encompasses the manufacturing, distribution, and sale of specialized equipment required for Padel, a racket sport recognized globally for its accessibility and social nature. Padel racquets, often referred to as 'palas,' differ significantly from conventional tennis rackets, featuring a solid, stringless striking surface typically constructed from carbon fiber, fiberglass, or a blend of composite materials, surrounding an EVA (Ethylene-Vinyl Acetate) foam core. These racquets are engineered with strategic drilling patterns to optimize aerodynamics and enhance ball control, catering to players ranging from novice enthusiasts to elite professional athletes competing in circuits such as the World Padel Tour (WPT).

Padel balls, while visually similar to tennis balls, are designed specifically for the unique environment of the Padel court—a smaller, glass-enclosed playing area. They are manufactured to maintain lower internal pressure than standard tennis balls, resulting in a slightly reduced bounce and speed, which is essential for ensuring rallies remain engaging within the confined court dimensions. Major applications for these products span professional tournament play, where stringent equipment quality standards are mandated by governing bodies, organized amateur leagues, and widespread recreational usage in fitness centers, dedicated Padel clubs, and private residential courts.

The principal driving factors for market expansion include the sport's inherently low learning curve and high social appeal, making it attractive to a wide demographic spectrum, including younger players and older adults seeking low-impact exercise. The benefits derived from participation, such as improved cardiovascular health, enhanced coordination, and significant social interaction opportunities, translate directly into sustained demand for high-quality, durable equipment. Furthermore, intensive marketing campaigns by major sports brands and strategic corporate sponsorships of professional Padel events contribute substantially to brand visibility and consumer purchasing inclination toward premium product lines.

Padel Racquets and Balls Market Executive Summary

The Padel Racquets and Balls Market is undergoing a rapid transformation characterized by dynamic business trends, marked regional shifts, and evolving consumer segment preferences. Key business trends indicate a strong move toward vertical integration among leading equipment manufacturers, who are increasingly acquiring or forming strategic partnerships with court construction companies and Padel club operators to control the end-to-end consumer experience. Innovation in materials science, particularly the utilization of advanced carbon composite weaves and customized EVA foam densities, drives premiumization, ensuring that high-margin products contribute disproportionately to overall revenue growth. Sustainability is emerging as a critical competitive factor, with companies investing in recyclable materials for both racquets and ball production to appeal to environmentally conscious consumers, thereby mitigating future regulatory risks and enhancing brand equity.

Regional trends clearly demarcate mature markets, such as Spain and Argentina, which maintain high per-capita participation rates but offer limited growth potential, from high-growth potential regions. Europe, specifically Italy, Sweden, and France, is experiencing explosive adoption rates, necessitating rapid investment in localized manufacturing and distribution infrastructure. Crucially, North America, spearheaded by the United States, is positioned as the next major growth engine, supported by celebrity endorsements and significant real estate development dedicated to Padel facilities. Meanwhile, the Asia Pacific region, particularly countries like Japan and the UAE, are showcasing burgeoning interest, underpinned by luxury sports complex developments and government initiatives promoting physical wellness, signaling substantial long-term market opportunities.

Segmentation trends reveal a persistent consumer preference for specialized products catering to specific playing styles, such as control-focused round palas versus power-oriented diamond-shaped palas. The online retail segment is expanding aggressively, offering consumers broader product selections, competitive pricing, and detailed product reviews, challenging traditional brick-and-mortar sports retailers. Within the raw materials segment, the demand for high-modulus carbon fiber is escalating as manufacturers seek to reduce weight while enhancing the stiffness and responsiveness of professional-grade racquets. This stratification allows companies to effectively target distinct user groups, from the entry-level recreational player concerned primarily with cost and durability, to the professional player prioritizing technological superiority and performance optimization.

AI Impact Analysis on Padel Racquets and Balls Market

User queries regarding the impact of Artificial Intelligence (AI) on the Padel market predominantly center on improving player performance, enhancing equipment manufacturing precision, and optimizing club management efficiencies. Users frequently inquire about AI-driven coaching platforms capable of providing real-time feedback on shot mechanics, positioning, and strategy, analogous to systems utilized in established sports like golf and tennis. There is significant interest in how AI algorithms can analyze complex data sets derived from material stress tests and player movement patterns to inform the next generation of racquet designs, optimizing factors like weight distribution, vibration dampening, and sweet spot location, thereby moving beyond conventional trial-and-error design methodologies. Concerns also revolve around the potential ethical implications of data privacy related to player tracking technologies and the potential for AI-driven manufacturing processes to displace skilled labor, necessitating a proactive approach to workforce retraining and process integration.

The application of machine learning in production is transforming quality control, allowing manufacturers to detect microscopic structural defects in composite materials during layup and curing phases, significantly reducing the failure rate of high-end racquets and guaranteeing product consistency. Furthermore, AI systems are being deployed to predict inventory needs and optimize supply chain logistics based on seasonal demand fluctuations and regional growth rates, minimizing warehousing costs and improving order fulfillment speeds. This predictive capability ensures that popular products are readily available in rapidly expanding geographical regions, mitigating potential stock-outs that could hinder market penetration and consumer satisfaction.

In the consumer-facing environment, AI is set to revolutionize the retail experience. Personalized equipment recommendation engines analyze a player's skill level, physical attributes, and existing equipment history to suggest the optimal racquet, leading to higher customer satisfaction and reduced return rates. For Padel facility management, AI scheduling and dynamic pricing models maximize court utilization during peak hours and stimulate off-peak usage through targeted promotional offerings. Ultimately, the adoption of AI is viewed not just as a marginal improvement, but as a foundational element for sophisticated product development, optimized operational efficiency, and a highly personalized user experience across the entire Padel ecosystem.

- AI-Powered Coaching Systems: Provides real-time feedback on technique, strategy, and court positioning using computer vision and sensor data.

- Optimized Equipment Design: Machine learning models simulate material performance (carbon, EVA) to design racquets with optimal balance, power, and shock absorption.

- Predictive Supply Chain Management: AI algorithms forecast regional demand shifts to optimize inventory, reducing lead times and minimizing logistics expenditures.

- Injury Prevention Analytics: Analyzing player biomechanics to identify risk factors and recommend personalized training regimens.

- Automated Quality Control (QC): Utilizing vision systems and deep learning to detect minute manufacturing defects in composite materials.

DRO & Impact Forces Of Padel Racquets and Balls Market

The dynamics of the Padel Racquets and Balls Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive environment and future growth potential. Primary market drivers include the phenomenal global proliferation of Padel court construction, supported by substantial private and public sector investment seeking to capitalize on the sport's popularity. The low barrier to entry for new players, combined with Padel’s strong social component, significantly enhances player retention and encourages recurrent spending on replacement equipment and upgrades. Furthermore, the relentless technological advancements in composite materials, such as the integration of aerospace-grade fibers and enhanced polymer cores, continually drive the premium segment, convincing consumers to replace existing equipment for performance gains.

However, the market expansion faces notable restraints. The initial capital expenditure required for building high-quality, covered Padel courts remains substantial, particularly in densely populated urban areas, which restricts rapid infrastructure scaling. Secondly, the market, especially in Europe, exhibits high brand loyalty, making it challenging for smaller or nascent manufacturers to penetrate and capture meaningful market share without aggressive pricing strategies or groundbreaking technological differentiation. The environmental impact associated with non-recyclable composite materials and rubber further presents a long-term regulatory and consumer perception challenge that manufacturers must actively address through sustainable innovation and transparent sourcing practices.

Opportunities for growth are concentrated in untapped geographical markets, particularly in Asia Pacific and North America, where Padel is shifting from a niche activity to a mainstream sport, offering significant greenfield potential for equipment sales and club partnerships. The integration of digital technologies, including performance tracking wearables and subscription-based digital coaching platforms, provides new revenue streams and enhances user engagement, creating an ecosystem around the core product. The rising focus on health and wellness post-pandemic globally also strengthens the Padel value proposition as a highly accessible and engaging form of physical activity, fueling latent consumer demand. The combined impact forces suggest that while capital intensive court development acts as a short-term constraint, the widespread consumer adoption and ongoing product innovation will ensure substantial long-term market resilience and financial viability.

Segmentation Analysis

The Padel Racquets and Balls Market is meticulously segmented across various dimensions to cater to diverse consumer needs, technological preferences, and spending capabilities. Effective segmentation allows manufacturers to precisely target marketing efforts and optimize product portfolios, ranging from mass-market durable goods to highly specialized professional equipment. The primary segmentation criteria include product type (Racquets vs. Balls), material composition (Carbon Fiber, Fiberglass, Hybrid Composites), end-user demographics (Amateur/Recreational vs. Professional/Tournament), and distribution channels (Online Retail, Specialty Sports Stores, Hypermarkets, and Direct-to-Consumer models). This complex segmentation structure reflects the market's maturity and the increasing sophistication of the Padel consumer base, who demand tailored products optimized for their specific skill level and preferred playing style.

Segmentation by product type reveals that racquets consistently generate the highest revenue share due to their high unit cost and the perceived performance benefits associated with material upgrades. Within the racquet segment, further differentiation occurs based on shape—round (control), teardrop (balance), and diamond (power)—each targeting distinct tactical requirements. Conversely, the ball segment, characterized by high volume and lower margins, is driven primarily by replacement rates and consistency standards mandated for tournament play. The interplay between these segments is critical; advancements in racquet technology often necessitate corresponding changes in ball design to maintain optimal playability and court speed, ensuring market dynamics are interdependent.

Analysis of the end-user segment indicates that the amateur and recreational market segment dominates in terms of volume, driven by social Padel players and casual club members who prioritize durability and comfort. The professional segment, although smaller in volume, holds significant strategic importance as it drives technological innovation and acts as a crucial marketing platform through player endorsements and tournament visibility, influencing the purchasing decisions of the broader consumer base. Understanding these segmented dynamics is crucial for market participants looking to maximize profitability by balancing high-volume, cost-effective production for the recreational segment with high-performance, premium product development for the elite athlete segment, thereby ensuring holistic market coverage and sustained revenue generation across all consumer tiers.

- By Product Type:

- Padel Racquets (Palas)

- Padel Balls

- Accessories (Grips, Protectors, Bags)

- By Material Composition:

- Carbon Fiber (3K, 12K, 18K)

- Fiberglass

- Hybrid/Composite Materials (Kevlar, Graphene Infusion)

- Core Material (Soft EVA, Medium EVA, Hard EVA/Polyethylene)

- By Shape (Racquets):

- Round Shape (Control Focus)

- Teardrop/Hybrid Shape (Balance Focus)

- Diamond Shape (Power Focus)

- By End-User:

- Professional Players

- Amateur/Recreational Players

- Padel Clubs and Academies

- By Distribution Channel:

- Online Retail (E-commerce platforms, Brand Websites)

- Offline Retail (Specialty Sports Stores, Hypermarkets, Department Stores)

- Direct Sales (Club Pro Shops)

Value Chain Analysis For Padel Racquets and Balls Market

The value chain for the Padel Racquets and Balls Market commences with upstream activities centered on the procurement and processing of specialized raw materials. For racquets, this involves sourcing high-grade composite fibers (carbon, fiberglass, Kevlar), specialized resins, and varying densities of EVA or FOAM cores. Ball production relies heavily on high-quality natural and synthetic rubber, felt, and chemical compounds necessary for maintaining optimal internal pressure and external durability. Key challenges at this stage involve ensuring consistent material quality, managing volatility in commodity prices, and navigating complex global supply chains, particularly those originating from specialized textile and chemical processing hubs in Asia. Manufacturers often enter long-term contracts with material suppliers to stabilize input costs and guarantee uninterrupted production flow, which is crucial for meeting escalating demand.

Midstream activities encompass the manufacturing, assembly, and quality control processes. Racquet production is technically intensive, involving specialized processes such as mold creation, composite layup (often requiring manual skill for high-end models), curing in autoclaves, precise drilling, and finishing. Balls are manufactured through automated vulcanization and pressure-filling processes to achieve the required internal pressure specifications set by regulatory bodies. Efficiency and precision in these stages are critical determinants of product performance and manufacturer profitability. Leading companies utilize sophisticated Computer Numerical Control (CNC) machining and rigorous quality assurance protocols to minimize material waste and ensure product specifications align perfectly with brand quality standards, enhancing overall competitive differentiation through superior build quality.

Downstream activities involve distribution and sales, leveraging a combination of direct and indirect channels. Indirect distribution relies heavily on major e-commerce platforms and specialty sports retailers who provide wide geographical reach and professional customer service. Direct channels, such as brand-owned websites and pro shops located within Padel clubs, offer greater control over pricing and customer engagement, facilitating a crucial feedback loop for product development. The growth of the market increasingly favors omni-channel strategies, enabling consumers to research products online and purchase them through trusted local outlets. Effective logistics management is paramount in the downstream segment to ensure rapid fulfillment, especially in high-growth regions where immediate access to new equipment is a significant driver of consumer satisfaction and market share capture.

Padel Racquets and Balls Market Potential Customers

The primary customer base for the Padel Racquets and Balls Market is highly segmented, primarily comprising three core groups: dedicated recreational athletes, professional and semi-professional players, and institutional buyers like Padel clubs and sports academies. Dedicated recreational athletes constitute the largest volume segment; these are often high-frequency players (2-3 times per week) aged 30 to 65, motivated by fitness and social interaction. They represent repeat buyers who prioritize durability, comfort, and technological advancements that enhance control and minimize injury risk. Their purchasing decisions are often influenced by club recommendations, social media trends, and value propositions that blend quality with longevity, frequently leading them to mid-to-high range equipment that offers a balance between performance and price point.

Professional and semi-professional players represent the crucial, though smaller, high-margin segment. These end-users demand the latest, most technically advanced equipment, characterized by high-modulus carbon fiber construction, specific weight tolerances, and highly responsive EVA cores. Their buying behavior is driven by marginal performance gains, brand sponsorships, and the need to comply with stringent tournament specifications. This group not only purchases premium equipment but also acts as key influencers, setting trends that cascade down to the recreational player segment, making brand visibility in professional circuits vital for overall market success. Equipment customization, including specific grip weights and personalized aesthetics, is often a prerequisite for this elite consumer group, driving manufacturers towards tailored production capabilities.

Institutional buyers, encompassing Padel clubs, municipal sports centers, schools, and professional academies, act as bulk purchasers of both racquets (primarily for rentals and starter kits) and balls (required in massive volumes for training and continuous play). These buyers prioritize cost-effectiveness, bulk purchasing discounts, and product longevity, necessitating commercial-grade equipment built to withstand rigorous, continuous use across multiple users. Furthermore, these institutions are often the first adopters of innovative court materials and accessories, serving as critical distribution points for balls and entry-level racquets, providing the initial touchpoint for new participants entering the sport and solidifying their status as vital components of the Padel market's foundational structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adidas, Head, Wilson, Babolat, Nox, Bullpadel, StarVie, Varlion, Dunlop, Tecnifibre, Siux, Joma, Fila, Puma, Asics, Kuikma, Black Crown, Drop Shot, Prince, Akkeron |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Padel Racquets and Balls Market Key Technology Landscape

The technological landscape of the Padel Racquets and Balls Market is characterized by intense research and development focused primarily on enhancing material performance, improving ergonomic design, and integrating digital tracking capabilities. In racquet manufacturing, the shift towards higher grades of carbon fiber (e.g., 12K and 18K weaves) and advanced material reinforcements, such as Graphene and Aramid fibers, is crucial. These innovations aim to achieve the optimal trifecta of lightweight design, extreme rigidity for power, and improved vibration dampening to minimize player fatigue and injury risk. Furthermore, the core material technology is evolving, with manufacturers experimenting with multi-layer EVA foams of varying densities (soft outer layer for touch, hard inner layer for power) to create more customized hitting surfaces and expand the racquet's 'sweet spot,' catering to a wider range of playing styles.

Ergonomic innovation focuses on refining the racquet handle and wrist strap designs to maximize comfort and reduce the likelihood of common Padel-related injuries like epicondylitis (tennis elbow). This involves advanced Computational Fluid Dynamics (CFD) analysis to optimize the frame's aerodynamics, ensuring minimal air resistance during fast swings. For Padel balls, technological advancements focus on achieving superior durability and maintaining consistent bounce pressure under varied climatic conditions, often through proprietary rubber formulations and reinforced felt coatings. Manufacturing processes are increasingly relying on precision CNC machining for mold creation and robotic automation for composite layup, guaranteeing repeatable quality that is paramount for high-performance equipment.

The digital integration segment represents a rapidly growing technological frontier. Manufacturers are embedding micro-sensors, often in collaboration with third-party tech firms, into racquet handles or grips. These sensors track critical performance metrics such as swing speed, ball impact location, spin rate, and calories burned. This data is transmitted wirelessly to smartphone applications, providing players with immediate, quantifiable feedback that enhances training effectiveness and facilitates personalized coaching. Furthermore, 3D printing (additive manufacturing) is beginning to gain traction, predominantly used for prototyping new racquet designs and customizing non-structural components like handle caps and specialized inserts, promising shorter product development cycles and highly personalized gear for professional athletes.

Regional Highlights

Europe currently dominates the Padel Racquets and Balls Market, largely due to the sport's historical establishment and overwhelming popularity in the Iberian Peninsula, particularly Spain, which serves as the global epicenter for the sport's professional circuit and manufacturing base. However, the dynamics are shifting as Padel experiences unprecedented growth rates across Northern and Central Europe, with countries like Sweden, Italy, and France registering triple-digit annual growth in court installations and player participation. This rapid expansion necessitates substantial logistical investment to ensure adequate supply of equipment. European manufacturers are leveraging their expertise in composite materials and design to maintain a competitive edge, though they face increasing competitive pressure from large American and Asian sporting goods conglomerates entering the market via acquisitions and aggressive sponsorship deals.

North America, particularly the United States, represents the most significant emerging market opportunity. While historically focused on tennis and pickleball, Padel is rapidly gaining traction, driven by favorable demographics (high disposable income), celebrity endorsement, and strategic investment by international Padel companies in developing large-scale, dedicated club facilities in key metropolitan areas. The market here is characterized by high demand for premium, technologically advanced equipment, and consumers are less price-sensitive than in mature markets. This region requires localized marketing efforts emphasizing Padel’s social and low-impact nature to differentiate it from established racket sports and accelerate market penetration, promising exponential revenue growth over the forecast period as infrastructure catches up with latent demand.

The Asia Pacific (APAC) and Middle East and Africa (MEA) regions, while starting from a lower base, are exhibiting accelerating market momentum, fueled primarily by luxury sports complexes and government initiatives promoting physical activity. In the Middle East, high-net-worth individuals and rapid urban development are fostering elite Padel facilities, creating high demand for ultra-premium racquets. In APAC, countries like Japan, Australia, and certain Southeast Asian nations are recognizing Padel as an ideal use of limited urban space due to its smaller court footprint. Challenges in these regions include cultural assimilation of the sport and establishing local manufacturing capabilities, leading to reliance on imports. Nonetheless, the high population density and increasing middle-class spending power project these regions as vital long-term growth platforms, diversifying the global market beyond its traditional European concentration.

- Europe: Market Maturity in Spain; Explosive Growth in Italy, Sweden, and France; Dominance in advanced racquet manufacturing and tournament hosting.

- North America (U.S. & Canada): Highest growth potential region; Driven by new court construction investment; Focus on premium equipment and celebrity-backed promotions.

- Asia Pacific (APAC): Emerging market; Significant government support in specific nations (Japan, UAE); High demand for imported high-end products.

- Latin America: Traditional Padel stronghold (Argentina, Brazil); Consistent, steady demand; Focus shifting from recreational to professional development.

- Middle East & Africa (MEA): Growth centered around luxury clubs and hospitality sector investments; Key market for ultra-premium equipment sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Padel Racquets and Balls Market.- Adidas

- Head

- Wilson

- Babolat

- Nox

- Bullpadel

- StarVie

- Varlion

- Dunlop

- Tecnifibre

- Siux

- Joma

- Fila

- Puma

- Asics

- Kuikma (Decathlon)

- Black Crown

- Drop Shot

- Prince

- Akkeron

Frequently Asked Questions

Analyze common user questions about the Padel Racquets and Balls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Padel Racquets and Balls Market through 2033?

The Padel Racquets and Balls Market is anticipated to exhibit a robust Compound Annual Growth Rate (CAGR) of 11.5% from 2026 to 2033, driven primarily by the rapid global expansion of Padel infrastructure and increasing player adoption in North America and Asia Pacific.

How does carbon fiber material impact Padel racquet performance and cost?

Carbon fiber significantly enhances racquet rigidity, power, and responsiveness while minimizing weight compared to fiberglass. Higher carbon weave counts (e.g., 18K) increase material cost but deliver superior performance preferred by professional and advanced amateur players, justifying the premium price point.

Which geographical region currently leads the global Padel equipment market?

Europe leads the global Padel equipment market in terms of current market size and established infrastructure, with Spain remaining the dominant country. However, North America and Northern Europe are registering the fastest acceleration in adoption and investment.

What are the key technological advancements shaping modern Padel racquet design?

Key technological advancements include the integration of multi-density EVA cores for optimized shock absorption and power, advanced carbon and Graphene composite materials, and embedded sensors for performance tracking and biomechanical analysis.

What is the significance of the shift toward online distribution channels for Padel equipment?

Online distribution is crucial for market growth as it provides extensive product variety, competitive pricing, direct customer feedback loops, and essential global reach, enabling brands to efficiently serve rapidly emerging markets that lack established physical specialty stores.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager