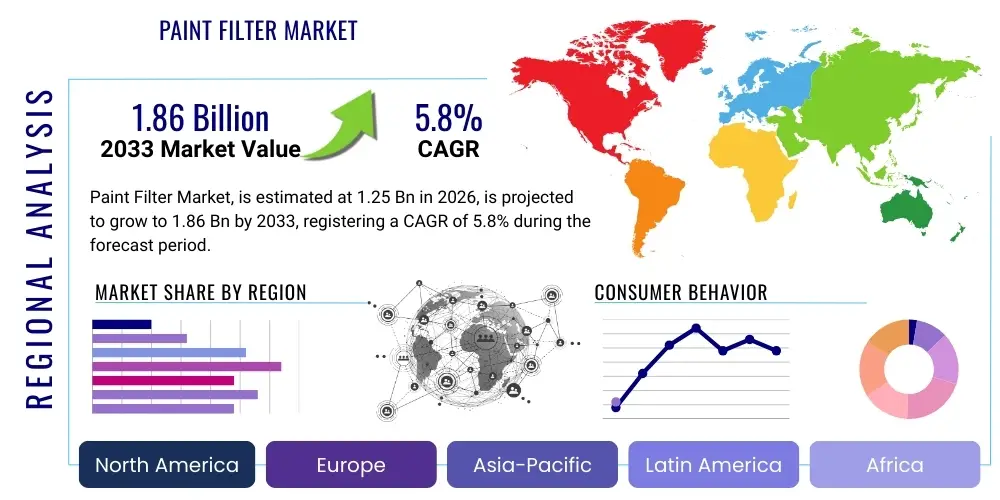

Paint Filter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442790 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Paint Filter Market Size

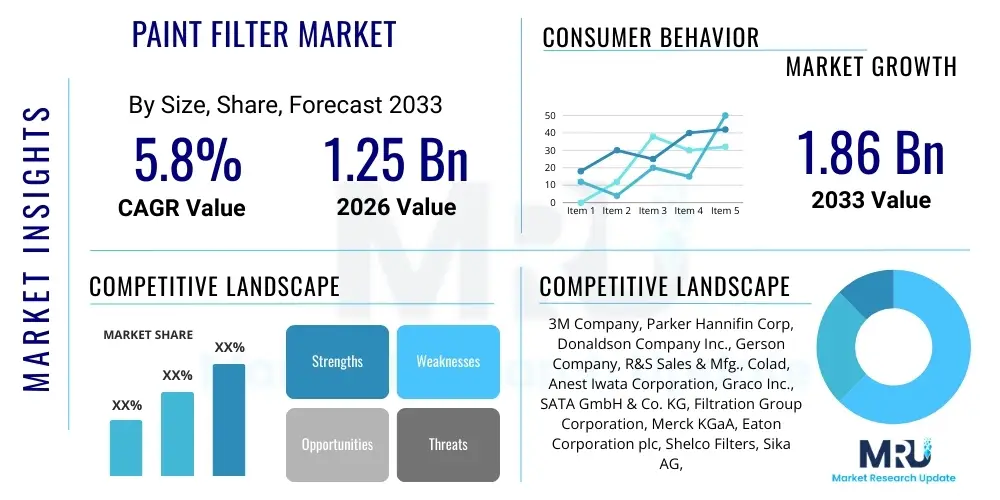

The Paint Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.86 Billion by the end of the forecast period in 2033. This consistent growth trajectory is driven by rigorous quality control standards in end-use industries, particularly automotive and aerospace, where flawless paint finishes are paramount, coupled with increasing global manufacturing output requiring high-efficiency filtration solutions.

Paint Filter Market introduction

The Paint Filter Market encompasses a range of specialized filtration products designed to remove contaminants, impurities, and particulates from liquid paint, lacquers, varnishes, and other coating materials before or during application. These filters are essential tools in industrial, commercial, and artistic painting processes, ensuring the highest possible quality finish, preventing defects such as fisheyes or craters, and extending the lifespan of expensive spraying and pumping equipment. The core function of these filters is to maintain the purity and consistency of the coating material, critical for meeting stringent aesthetic and performance specifications across diverse sectors.

Product descriptions within this market vary widely, including mesh strainers, cone filters, bag filters, and cartridge filters, differentiated by their pore size, material composition (such as nylon, polyester, stainless steel, or specialized polypropylene), and flow rate capacity. Major applications span the automotive manufacturing sector, where filtration is crucial for body coating lines; the aerospace industry, requiring precise contamination control for specialized coatings; general industrial coating facilities; marine applications; and architectural finishes. The technological evolution focuses on enhanced chemical resistance and the ability to handle high-solids paints and two-component systems effectively.

The primary benefits of utilizing effective paint filters include significantly improved surface quality, reduction in rework and waste materials, protection of application equipment (especially nozzles and pumps), and compliance with increasing quality assurance regulations. Key driving factors include the rapid industrialization in developing economies, the continued expansion of the automotive sector globally, and the rising demand for high-performance and specialty coatings that necessitate ultra-clean application environments. Furthermore, stringent environmental and safety regulations regarding volatile organic compounds (VOCs) and particulate control are indirectly boosting demand for superior filtration systems capable of handling complex, modern paint formulations.

Paint Filter Market Executive Summary

The Paint Filter Market is characterized by robust business trends emphasizing efficiency and sustainability, moving away from disposable paper filters toward more durable, reusable, and self-cleaning cartridge systems. Key players are heavily investing in filter media innovation, focusing on materials that offer superior chemical compatibility and micron retention rates, which is crucial for advanced waterborne and high-solids paint formulations. Strategic mergers and acquisitions are shaping the competitive landscape, as established filtration giants seek to integrate specialized coating filtration technologies, thereby consolidating market share and achieving economies of scale in manufacturing and distribution.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, driven by massive expansions in automotive manufacturing, electronics production, and infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit high value consumption, characterized by a demand for premium, high-efficiency filters necessary to comply with the region’s strict quality and environmental standards, particularly within the aerospace and luxury goods sectors. Emerging markets in Latin America and the Middle East & Africa (MEA) are showing promising growth, buoyed by new industrial facility investments and increased local assembly operations, creating sustained demand for reliable coating preparation equipment.

Segment trends highlight the sustained dominance of cartridge filters due to their efficiency, ease of replacement, and capacity for high flow rates, although bag filters remain popular for high-volume, lower-micron applications. In terms of end-users, the Automotive OEM and Refinish segments account for the largest market share, dictating innovation in filter media capable of handling complex clear coats and base coats. The future trajectory suggests increased penetration of automated filtration systems that integrate sensor technology and predictive maintenance capabilities, moving the market toward highly efficient, less manually intensive filtration processes, thereby ensuring consistent quality control in large-scale operations.

AI Impact Analysis on Paint Filter Market

User inquiries regarding AI's influence in the Paint Filter Market overwhelmingly center on two key themes: predictive maintenance for optimal filter replacement schedules and enhancing quality control automation. Users are highly interested in how machine learning algorithms can analyze real-time paint contamination data (e.g., pressure differential, flow rate deviations) gathered by IoT-enabled sensors to determine the precise moment a filter should be changed, maximizing filter lifespan while preventing costly quality defects. Furthermore, there is significant curiosity regarding AI's role in correlating filter performance with final product quality, allowing manufacturers to dynamically adjust filtration parameters based on the specific paint batch or environmental conditions, thereby ensuring consistent, zero-defect coating application. The primary expectation is that AI integration will transform filter management from a reactive or time-based process into a highly accurate, predictive, and optimized system, minimizing downtime and optimizing consumable usage.

The integration of artificial intelligence primarily occurs at the industrial process management layer, impacting how filtration systems are monitored and maintained rather than changing the fundamental mechanical properties of the filter itself. AI models analyze complex datasets encompassing paint viscosity, temperature, line speed, particle counts, and differential pressure across the filter media. By processing these variables concurrently, AI provides highly accurate forecasts of filter choking or performance degradation long before a manual inspection would reveal the issue. This shift towards smart filtration reduces unplanned stops in highly automated production lines, such as those found in major automotive plants, directly translating into significant operational expenditure savings and superior finish quality.

This technological evolution necessitates a higher degree of sensorization and connectivity in filtration units. Advanced filtration systems are now equipped with integrated IoT sensors that feed continuous data streams to cloud-based AI platforms. These platforms not only predict maintenance requirements but also optimize inventory management for replacement filters based on anticipated usage patterns across various manufacturing facilities. While the initial investment in smart filtration infrastructure is higher, the long-term benefits derived from reduced material waste, extended equipment life, and guaranteed paint finish consistency make AI integration a crucial component of future high-precision paint application environments.

- AI enables predictive maintenance scheduling for filtration units, maximizing efficiency and minimizing unexpected downtime.

- Machine learning algorithms analyze differential pressure and flow rate data to accurately forecast filter saturation and degradation.

- AI facilitates automated quality control by correlating real-time filtration parameters with required coating purity standards.

- Optimization of supply chain and inventory management for replacement filter cartridges based on predicted consumption rates across plants.

- Enhanced process stability through dynamic adjustment of filtration processes based on real-time environmental and paint chemistry variables.

DRO & Impact Forces Of Paint Filter Market

The Paint Filter Market is fundamentally shaped by stringent quality demands in high-value industries (Drivers), coupled with challenges related to waste disposal and raw material cost volatility (Restraints). Opportunities lie in developing advanced filtration media and automated self-cleaning systems, while the market’s trajectory is heavily influenced by the globalization of manufacturing and the persistent need for flawless aesthetic finishes (Impact Forces). These forces collectively push manufacturers toward high-performance, sustainable, and technologically integrated filtration solutions.

Key drivers propelling the market include the stringent quality standards implemented in automotive original equipment manufacturing (OEM), aerospace, and protective coatings, where even minute impurities can compromise the integrity and aesthetic appeal of the final product. The global expansion of industrial and manufacturing activities, particularly in emerging economies, significantly increases the volume of coatings applied, necessitating robust filtration processes. Furthermore, the shift from solvent-based to environmentally friendly waterborne and high-solids paints, which are inherently more challenging to filter due to their rheology and particle composition, necessitates continuous innovation in filter media design, thereby driving market value upwards. Regulatory bodies imposing tighter controls on product quality and environmental emissions also indirectly mandate superior filtration practices.

Conversely, the market faces significant restraints, including the high operational cost associated with the frequent disposal of used filter media, which often contain hazardous paint residues and require specialized waste management protocols, particularly in regions with strict environmental regulations. Price volatility of essential raw materials used in filter manufacturing, such as specialized polymers (polypropylene, nylon) and stainless steel mesh, can impact profit margins. Another restraint is the prevalent existence of low-cost, less-efficient conventional filtration methods, which may still be utilized by smaller application shops, slowing the adoption rate of premium, high-efficiency cartridge and bag filters, particularly in price-sensitive markets.

Significant opportunities exist in the development and commercialization of advanced filtration technologies, such as nanofiltration and membrane filtration techniques, which offer ultra-high retention rates suitable for highly specialized coatings. The transition toward automated and self-cleaning filter systems represents a major growth avenue, reducing manual intervention, lowering labor costs, and improving consistency. Furthermore, the push for sustainability creates opportunities for reusable filter elements and filtration media manufactured from recyclable or bio-based polymers. The primary impact forces shaping the competitive dynamics include globalization, which increases supply chain complexity but also opens up new manufacturing bases, and continuous R&D investment by leading players aimed at achieving higher chemical resistance and thermal stability in filter materials to cope with increasingly complex industrial coatings.

Segmentation Analysis

The Paint Filter Market is systematically segmented based on Product Type, Filter Material, Application Method, and End-User Industry, allowing for a detailed analysis of demand dynamics across various operational requirements. The segmentation by Product Type, encompassing cone filters, bag filters, cartridge filters, and specialized membrane filters, determines the filter’s capacity, flow rate suitability, and particulate retention accuracy. Material segmentation, which includes nylon, polyester, stainless steel, and polypropylene, reflects chemical compatibility and cost constraints faced by end-users. Analysis across these segments helps identify high-growth niches, particularly the sustained demand for advanced cartridge systems in high-precision, automated industrial settings.

Segmentation by Application Method, focusing on gravity feed, suction feed, and pressure feed systems, dictates the pressure rating and structural integrity required of the filter unit. The market size and growth rates are heavily influenced by the End-User Industry classification, where Automotive OEM and Refinish represent the most demanding and financially significant segments, closely followed by the General Industrial segment, encompassing machinery, furniture, and infrastructure coatings. Analyzing these segments is crucial for manufacturers to tailor product specifications, focusing R&D on specific micron ratings and chemical resistances necessary for specialized industry requirements, such as high-temperature aerospace coatings or highly corrosive marine paints.

- Product Type:

- Cone Filters (Paper & Nylon Mesh)

- Bag Filters (Felt & Mesh)

- Cartridge Filters (Pleated & Melt Blown)

- Specialized Filters (Membrane & Depth Filtration Units)

- Filter Material:

- Nylon

- Polyester

- Polypropylene (PP)

- Stainless Steel Mesh

- Others (PTFE, Fiberglass)

- Application Method:

- Spray Gun Filtration (Gravity Feed & Suction Feed)

- Pump/Line Filtration (Pressure Feed)

- Bulk Filtration/Mixing Tank Filtration

- End-User Industry:

- Automotive (OEM & Refinish)

- Aerospace and Defense

- Marine Coatings

- General Industrial Coatings

- Architectural and Decorative

Value Chain Analysis For Paint Filter Market

The value chain for the Paint Filter Market begins with the Upstream Analysis, which involves the sourcing of critical raw materials, primarily specialized synthetic fibers (polypropylene, nylon, polyester), stainless steel, and various resins for housing and bonding agents. Suppliers of these materials operate in a competitive environment, and their pricing significantly impacts the filter manufacturer's cost structure. Efficiency in material procurement, especially specialized polymers offering high chemical resistance, is paramount for maintaining competitive pricing and ensuring filter compatibility with complex, modern paint formulations, such as two-component polyurethanes and advanced epoxies. The quality and purity of these raw inputs directly determine the filtration media's efficiency and lifespan.

The Midstream phase involves core manufacturing and processing, where raw materials are converted into finished filtration products through processes like melt blowing, pleating, mesh weaving, and assembly. This stage demands sophisticated machinery, stringent quality control for micron rating accuracy, and adherence to ISO standards. Manufacturers strategically optimize production to handle diverse product types—from low-cost paper cone filters to high-precision, industrial-grade cartridge units. Distribution Channel Analysis reveals a reliance on both Direct and Indirect methods. Direct distribution involves sales teams servicing large OEM clients (e.g., automotive plants) who require customized bulk orders and technical support. Indirect distribution utilizes specialized industrial distributors, paint and coatings suppliers, and large retail outlets that serve smaller refinish shops, general contractors, and DIY consumers. The effectiveness of the distribution network is crucial for market penetration and timely delivery of replacement parts.

Downstream Analysis focuses on the end-users and the service life of the product. The performance of the filter, measured in terms of flow rate, pressure drop, and retention efficiency, directly impacts the quality control standards of the customer. Technical support and maintenance services, particularly for automated or high-volume industrial systems, add significant value downstream. The disposal and environmental compliance aspect also sits at the end of the chain, where manufacturers who offer environmentally conscious solutions or recycling programs gain a competitive advantage, especially in highly regulated European markets. Optimizing the flow through this value chain is centered on reducing manufacturing lead times while maintaining extremely accurate micron tolerances required by modern high-performance coatings.

Paint Filter Market Potential Customers

The primary customers in the Paint Filter Market are entities requiring consistent, high-quality surface finishes on manufactured goods, ranging from large multinational corporations to independent small and medium-sized enterprises (SMEs). The largest and most demanding segment consists of Automotive Original Equipment Manufacturers (OEMs), who utilize vast quantities of high-efficiency cartridge filters in their automated paint shops to ensure flawless clear coat and base coat applications, demanding filters that can handle high flow rates and aggressive chemicals. This segment's purchasing decisions are driven by process reliability, adherence to strict quality protocols, and long-term supply agreements with proven filter providers.

Another significant customer base includes the Automotive Refinish sector (body shops), utilizing smaller, more portable filtration products such as cone filters and small cartridge systems for localized repair and repainting work. These buyers prioritize convenience, ease of use, and competitive pricing, often sourcing products through local paint distributors. Furthermore, the General Industrial Coatings sector, which covers heavy machinery, infrastructure, appliances, and furniture manufacturing, represents a diverse set of customers seeking filters compatible with a wide array of coatings, including powder coat pre-treatment filtration and liquid industrial enamels. Customers in the Aerospace and Defense industries represent a high-value segment, requiring specialized, certified filters for coatings that provide corrosion resistance and stealth capabilities, prioritizing ultra-high purity over cost considerations.

Finally, smaller, specialized customers include marine maintenance facilities, utilizing filters to protect against fouling and corrosion on vessels, and architectural paint contractors, who use simple mesh filters to ensure smooth application of decorative paints. The purchasing cycle varies widely: large industrial users employ sophisticated procurement strategies focused on minimizing total cost of ownership (TCO) through long-life filters and bulk supply contracts, while smaller customers often engage in transactional purchasing driven by immediate needs and accessible distribution channels. Understanding the specific micron rating requirements and chemical exposure risks unique to each customer type is essential for market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.86 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Parker Hannifin Corp, Donaldson Company Inc., Gerson Company, R&S Sales & Mfg., Colad, Anest Iwata Corporation, Graco Inc., SATA GmbH & Co. KG, Filtration Group Corporation, Merck KGaA, Eaton Corporation plc, Shelco Filters, Sika AG, Nordson Corporation, FSI Filtration Systems, Saint-Gobain, DuPont, Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paint Filter Market Key Technology Landscape

The technological landscape of the Paint Filter Market is rapidly evolving, driven primarily by the need for enhanced particle retention efficiency, chemical inertness, and increased filter service life. A major area of advancement is the refinement of depth filtration technology, specifically using high-purity melt-blown polypropylene and proprietary resin-bonded fibers. These materials create a matrix with graded pore structures, allowing larger particles to be trapped on the outer layer while finer particles are captured deeper within the media, significantly increasing the dirt-holding capacity and extending the time between filter changes, which is critical for continuous industrial operations. Furthermore, the development of specialized membrane filters, utilizing materials like PTFE (Polytetrafluoroethylene), is expanding to meet the requirements of ultra-fine filtration (sub-micron levels) necessary for sophisticated aerospace and electronics coatings.

Another crucial technological trend is the proliferation of automated and self-cleaning filtration systems, which represent a paradigm shift from traditional disposable media. These systems, often incorporating back-flush mechanisms or scraper technology, reduce manual labor and the environmental impact associated with disposing of contaminated filters. Integration of Internet of Things (IoT) sensors within these automated systems allows for real-time monitoring of differential pressure and flow dynamics. This data feeds into control systems, often utilizing rudimentary AI/ML algorithms, to trigger the cleaning cycle precisely when filtration performance begins to degrade, ensuring maximum consistency and minimizing paint waste during changeovers. This integration aligns filtration with Industry 4.0 standards, making the entire coating process more responsive and data-driven.

Material science innovation also plays a vital role, particularly in developing filter housing and sealing mechanisms that can withstand the increasingly aggressive solvent blends found in modern industrial paints and cleaning fluids. Manufacturers are focusing on enhancing the thermal stability and chemical compatibility of components, preventing filter breakdown or leaching of materials that could contaminate the paint. The trend towards sustainable filtration involves the development of high-efficiency filters with a lower mass and smaller environmental footprint, alongside research into materials that facilitate easier separation of paint solids from the filter media during waste processing. These technological advancements collectively reduce operational costs for end-users while simultaneously raising the performance bar for paint purity and application quality across all relevant industries.

Regional Highlights

Regional dynamics dictate significant variations in market size, growth rates, and technological adoption within the Paint Filter Market, influenced primarily by regional manufacturing intensity, regulatory environments, and the maturity of industrial sectors. The Asia Pacific (APAC) region stands out as the highest-growth market globally, driven predominantly by expansive automotive production hubs in China, India, and Southeast Asia, coupled with substantial government investment in infrastructure and general manufacturing. This region primarily sees demand for cost-effective, high-volume filtration solutions, though rapid urbanization is also fueling a need for high-quality architectural and decorative coating filters. The APAC market benefits from comparatively lower operating costs, attracting global manufacturers to establish local production facilities.

North America (NA) represents a mature, high-value market characterized by strict regulatory compliance, especially concerning air quality and worker safety, which compels industries like aerospace and high-end automotive manufacturing to adopt premium, high-efficiency, and fully compliant filtration systems. Innovation adoption, including self-cleaning and smart filtration units, is rapid in this region, driven by the high cost of labor and the push toward automated, Industry 4.0-compliant production lines. Europe mirrors North America in its focus on high quality, but places an even stronger emphasis on environmental sustainability, driving demand for reusable filters and products with documented, favorable environmental footprints, influenced heavily by EU directives and circular economy goals.

The Latin America and Middle East & Africa (MEA) regions are emerging markets showcasing significant potential, fueled by increasing foreign direct investment in manufacturing and localized assembly operations, particularly in automotive and construction sectors. While adoption rates for advanced filtration systems are currently lower, the rapid industrialization in countries like Brazil, Mexico, Saudi Arabia, and the UAE promises accelerated growth in the forecast period. Demand in MEA is often tied directly to large-scale infrastructure projects and protective coating requirements for oil and gas infrastructure, necessitating highly durable and chemically resistant filtration media.

- Asia Pacific (APAC): Highest CAGR, driven by automotive OEM expansion, general industrial growth, and infrastructure investment, particularly in China and India.

- North America: Mature market focusing on high-value, premium filtration solutions, rapid adoption of automation (IoT/AI integration), and strict compliance with environmental and quality standards (e.g., aerospace coatings).

- Europe: Strong demand for sustainable and environmentally compliant filtration materials; high adoption in specialized industries like luxury automotive and high-precision machinery.

- Latin America & MEA: Emerging markets with accelerating demand fueled by industrialization, infrastructure projects, and local assembly expansion, creating new opportunities for basic and intermediate filtration products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paint Filter Market.- 3M Company

- Parker Hannifin Corporation

- Donaldson Company Inc.

- Gerson Company

- R&S Sales & Mfg.

- Colad

- Anest Iwata Corporation

- Graco Inc.

- SATA GmbH & Co. KG

- Filtration Group Corporation

- Merck KGaA

- Eaton Corporation plc

- Shelco Filters

- Sika AG

- Nordson Corporation

- FSI Filtration Systems

- Saint-Gobain

- DuPont

- Honeywell International Inc.

- Wix Filters (Mann+Hummel Group)

Frequently Asked Questions

Analyze common user questions about the Paint Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-efficiency paint filters?

The increasing stringent quality control standards in end-user industries, particularly automotive OEM and aerospace, necessitating flawless surface finishes and the elimination of microscopic contamination, are the primary market drivers.

How do waterborne paints affect paint filter technology requirements?

Waterborne and high-solids paints often require filters with specific chemical compatibility and higher dirt-holding capacity, as their unique rheology and particle structure can accelerate filter clogging compared to traditional solvent-based formulations, driving demand for specialized polypropylene cartridge filters.

Which filter type dominates the industrial segment based on efficiency and capacity?

Cartridge filters, particularly those utilizing pleated or melt-blown media, dominate the industrial segment due to their superior filtration efficiency, high flow rate capability, and ease of automated integration in high-volume industrial lines.

What role does Artificial Intelligence (AI) play in the future of paint filtration?

AI is crucial for enabling predictive maintenance systems by analyzing real-time sensor data (pressure, flow) to forecast filter saturation accurately, minimizing production downtime and optimizing the filter replacement cycle for cost efficiency.

Which geographical region is expected to show the fastest growth rate in the Paint Filter Market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expansive growth in automotive production and massive infrastructure development across key emerging economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager