Pallet Stretch Wrapper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442544 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Pallet Stretch Wrapper Market Size

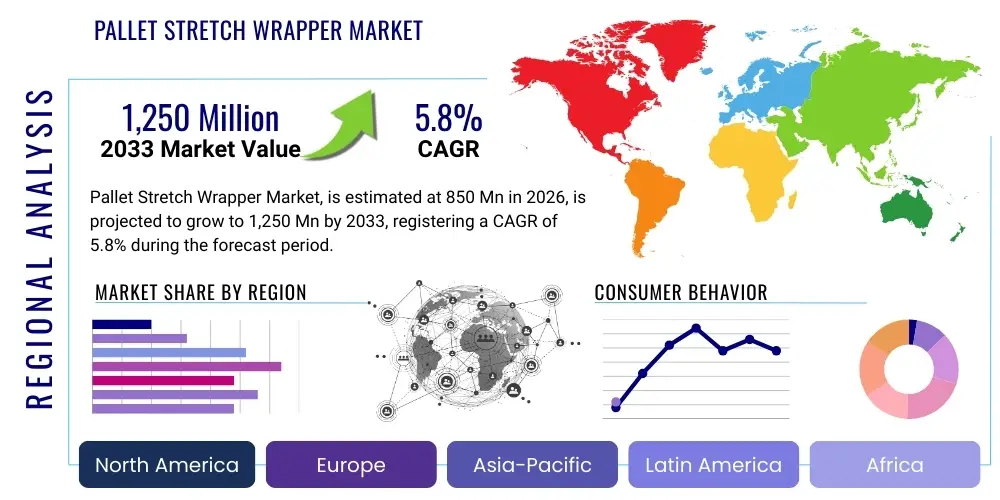

The Pallet Stretch Wrapper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for automated packaging solutions across diverse industrial sectors, particularly logistics, e-commerce, and manufacturing. The imperative to secure palletized loads for safe transit, minimizing product damage, and improving warehouse operational efficiency are critical factors propelling market valuation expansion over the next decade.

Pallet Stretch Wrapper Market introduction

The Pallet Stretch Wrapper Market encompasses the machinery designed to apply stretch film around palletized loads. This process ensures load stability, protects goods from dust and moisture, and significantly reduces damage during handling, warehousing, and transportation. The wrapper machines, ranging from manual and semi-automatic to fully automated systems, utilize specialized polymer films to bind products securely to the pallet base. These systems are indispensable components in modern supply chains, fulfilling the crucial requirement of unitizing bulk shipments efficiently before distribution.

Major applications for pallet stretch wrappers span a vast array of industries, including food and beverage processing, pharmaceuticals, chemicals, construction materials, and the burgeoning e-commerce fulfillment sector. The technological evolution of these machines focuses on enhancing film efficiency—often referred to as pre-stretch capabilities—which allows less film material to be used while maintaining superior load retention force. This emphasis on material savings not only reduces operational costs for end-users but also aligns with global sustainability initiatives seeking to minimize plastic waste in packaging operations, thereby enhancing the overall value proposition of automated wrapping solutions.

The primary driving factors for market proliferation include the continuous global expansion of manufacturing output, the increasing adoption of automated material handling systems in logistics hubs, and stringent regulatory requirements pertaining to load stability and worker safety. Benefits derived from deploying advanced pallet stretch wrapping equipment encompass maximized throughput speed, significant labor cost reduction, consistent and repeatable wrapping quality compared to manual processes, and optimized utilization of stretch film material. Furthermore, the rising integration of IoT and diagnostic capabilities into newer wrapper models provides predictive maintenance alerts and operational data analysis, further solidifying their role as vital assets in optimized warehousing environments.

Pallet Stretch Wrapper Market Executive Summary

The Pallet Stretch Wrapper Market is poised for robust expansion, predominantly fueled by global shifts toward supply chain automation and efficiency improvements in large-scale logistics operations. Key business trends indicate a strong preference for fully automatic, high-speed rotary arm wrappers, particularly among enterprises dealing with high volumes or unstable loads, as these models drastically enhance throughput and minimize downtime. Furthermore, product innovation is concentrated on sustainability, introducing machines optimized for thinner gauge films and incorporating features that reduce film usage per pallet, responding directly to consumer and corporate mandates for environmentally responsible packaging practices.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, driven by rapid industrialization, massive investments in infrastructure development, and the expansion of the manufacturing base, especially in China and India. North America and Europe, while mature markets, continue to invest heavily in machine upgrades and retrofits to integrate smart factory concepts (Industry 4.0), focusing on connectivity, data analytics, and increased safety features. The growing complexity of cross-border trade and the need for standardized, secure packaging are reinforcing demand across all major geographical regions, making load containment a global priority for shippers and receivers alike.

Segment trends demonstrate substantial growth in the automatic machine category over semi-automatic and manual variants, underscoring the shift toward fully autonomous end-of-line packaging. The end-user analysis confirms the logistics and warehousing sector, including third-party logistics (3PL) providers, as the dominant consumer segment due to the inherent requirement for securing diverse, high-volume shipments. Stretch film type preference is evolving towards high-performance linear low-density polyethylene (LLDPE) films that maximize pre-stretch ratios, ensuring effective load containment with minimal material input, thereby contributing to lower operational expenditures for widespread industrial users.

AI Impact Analysis on Pallet Stretch Wrapper Market

Common user questions regarding AI's impact on the Pallet Stretch Wrapper Market primarily revolve around operational efficiency gains, predictive maintenance capabilities, and the potential for real-time load stabilization optimization. Users are highly interested in how machine learning algorithms can analyze pallet characteristics—such as weight distribution, dimensions, and product fragility—to automatically adjust wrapping parameters (e.g., tension, overlap, number of wraps) dynamically, minimizing both film consumption and load failure rates. Key concerns also include the cybersecurity risks associated with connecting end-of-line packaging equipment to industrial IoT networks and the required investment in retrofitting existing machinery with AI-enabled sensor arrays and control systems. Expectations center on achieving unprecedented levels of film efficiency, reducing product damage claims, and moving toward truly autonomous decision-making in packaging processes.

AI and machine learning are transforming the functionality of high-end pallet stretch wrappers by enabling intelligent load sensing and adaptive control. Traditional semi-automatic machines rely on pre-set parameters, which may be inefficient for heterogeneous loads. AI integration allows the machine vision systems to profile each incoming pallet in real-time, instantaneously calculating the optimal wrapping pattern required for maximum containment while strictly adhering to minimum material usage standards. This level of optimization significantly reduces operational waste and ensures a standardized level of security, regardless of minor variations in the palletized goods.

Beyond adaptive wrapping, AI applications fundamentally enhance the maintenance and reliability profile of the equipment. Machine learning models analyze vibration data, motor temperatures, and operational cycle statistics to predict component failure well before it occurs. This transition from reactive or scheduled maintenance to predictive maintenance drastically minimizes unexpected production halts, a critical factor for high-throughput logistics centers where downtime is prohibitively expensive. This predictive capability ensures higher overall equipment effectiveness (OEE) and extends the useful lifespan of sophisticated wrapping machinery, offering substantial long-term cost savings to facility managers.

- Enhanced Predictive Maintenance: AI algorithms analyze machine operational data to forecast component failure, minimizing unexpected downtime and optimizing maintenance schedules.

- Adaptive Load Profiling: Integration of AI-powered vision systems allows wrappers to automatically adjust film tension, wrap counts, and overlap based on real-time analysis of load dimensions, stability, and weight distribution.

- Optimized Film Consumption: Machine learning minimizes stretch film usage by calculating the optimal tension and pre-stretch ratio needed for secure load containment, aligning with sustainability goals.

- Autonomous Fault Detection: AI systems instantly identify and diagnose operational anomalies, improving troubleshooting efficiency and reducing reliance on manual operator intervention.

- Integration with Warehouse Management Systems (WMS): AI facilitates seamless communication, allowing the wrapper to receive instructions and report status back to the central WMS, ensuring end-to-end supply chain visibility.

DRO & Impact Forces Of Pallet Stretch Wrapper Market

The Pallet Stretch Wrapper Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively dictate its growth trajectory and competitive landscape. The principal driver remains the continuous expansion of global trade and the pervasive shift towards automated logistics solutions to meet the demands of rapid e-commerce growth. Conversely, high initial capital investment costs for fully automatic systems and the fluctuating prices of LLDPE film material act as significant restraints, especially for small and medium-sized enterprises (SMEs). Opportunities are primarily concentrated in the development of smarter, IoT-enabled machinery that offers advanced diagnostic capabilities and in emerging markets where industrial automation penetration is still relatively low but rapidly accelerating, promising substantial future adoption.

Key drivers include the global imperative for improved supply chain efficiency and product protection. As goods travel longer distances and through complex intermodal networks, secure load containment is paramount to prevent product damage, which translates directly into cost savings and enhanced customer satisfaction. Furthermore, regulatory pressures related to workplace safety mandate the replacement of manual, potentially dangerous wrapping methods with automated solutions. The automation trend extends beyond wrapping speed; it includes features like automatic film attach/cut systems, integrated top sheet dispensers for dust protection, and seamless integration with existing conveyor systems, making the automated wrapper an essential link in high-speed production lines.

Restraints, such as the initial high expense of acquiring and installing sophisticated machinery, particularly for businesses transitioning from semi-automatic equipment, can slow adoption rates. Additionally, the operational expenses associated with stretch film, derived primarily from petrochemicals, are vulnerable to crude oil price volatility, affecting total cost of ownership (TCO) calculation for end-users. Opportunities arise from technological advancements, such as the maturation of robotic stretch wrapping and mobile autonomous wrappers, which offer flexibility in challenging layouts. Furthermore, the push for sustainable packaging drives opportunities for manufacturers developing equipment optimized for biodegradable films or ultra-thin, high-strength stretch films, catering to the growing environmental consciousness across the consumer and industrial base.

Segmentation Analysis

The Pallet Stretch Wrapper Market is comprehensively segmented based on product type, automation level, end-user industry, and stretch film type, allowing for targeted analysis of market dynamics within specific operational contexts. Segmentation by product type primarily includes turntable, rotary arm, and orbital wrappers, each designed for different load characteristics and operational speeds. Automation level is a critical differentiator, dividing the market into manual, semi-automatic, and fully automatic systems, reflecting the varying investment capacities and throughput requirements of end-users. The diversity of applications across end-user industries, such as Food & Beverage, 3PL/Logistics, and Pharmaceuticals, dictates the feature set and robustness required from the wrapping equipment. Analyzing these segments provides strategic insights into consumer preferences and areas exhibiting the highest growth potential for machinery manufacturers and film suppliers.

- By Product Type:

- Turntable Stretch Wrappers

- Rotary Arm Stretch Wrappers

- Orbital Stretch Wrappers

- Robotic/Mobile Stretch Wrappers

- By Automation Level:

- Manual

- Semi-Automatic

- Fully Automatic

- By End-User Industry:

- Food & Beverage

- Pharmaceuticals & Healthcare

- Chemicals & Fertilizers

- Consumer Goods

- Logistics & Warehousing (3PL)

- Building & Construction

- E-commerce Fulfillment Centers

- By Film Type Compatibility:

- Standard LLDPE Film

- Pre-Stretch Film

- High-Performance Film (e.g., Nano-layered)

- Specialty Films (VCI, UV Resistant)

Value Chain Analysis For Pallet Stretch Wrapper Market

The value chain for the Pallet Stretch Wrapper Market begins with upstream activities involving the sourcing of raw materials, primarily steel, specialized components (motors, sensors, PLCs), and the petroleum derivatives used to manufacture stretch film. Key upstream players include raw steel providers, specialized component manufacturers, and chemical companies supplying polymer resins (LLDPE). Efficiency in this segment is crucial, as cost fluctuations in materials directly impact the final machine and film pricing. Robust supplier relationships, quality assurance in component manufacturing, and securing stable supply routes for high-grade steel and electronic parts are foundational to maintaining competitive advantage in the manufacturing phase.

The core value addition occurs in the manufacturing and assembly phase, where machine builders design, engineer, and integrate complex mechanical and electronic systems. This segment involves research and development (R&D) focused on improving pre-stretch capabilities, increasing operational speed, enhancing safety features, and developing smart, IoT-enabled control systems. Downstream activities involve distribution, sales, installation, and essential after-sales support, including maintenance contracts and spare parts provisioning. Machine manufacturers often rely on specialized third-party distributors or utilize direct sales channels to reach diverse industrial end-users globally, requiring a highly efficient logistics network for machine delivery and installation.

Distribution channels are categorized into direct and indirect methods. Direct channels involve machine manufacturers selling directly to large-scale enterprises or integrating the wrappers into complete end-of-line systems for major customers, allowing for better customization and control over the sales process. Indirect channels rely on a network of dealers, distributors, and integrators who possess regional expertise and often package the wrapper with other material handling equipment, such as conveyors and shrink-wrapping machines. The effectiveness of the after-sales service, including remote diagnostics and rapid response times for technical issues, significantly contributes to brand loyalty and overall customer value realization, making the service segment a critical component of the overall value chain.

Pallet Stretch Wrapper Market Potential Customers

Potential customers for pallet stretch wrapper equipment are predominantly large-scale industrial operators, manufacturers, and logistics service providers who handle high volumes of unitized goods requiring secure containment for transit and storage. The essential requirement for these end-users is mitigating product damage, maximizing throughput speed, and optimizing labor utilization in their warehousing and distribution centers. Key buyer personas include Warehouse Operations Managers, Logistics Directors, Packaging Engineers, and Plant Managers, all of whom prioritize reliability, integration capabilities with existing conveyor systems, and low total cost of ownership (TCO) derived from efficient film usage and minimized maintenance requirements.

The fastest growing buyer segment originates from the Third-Party Logistics (3PL) sector and large e-commerce fulfillment centers. 3PL providers manage highly diverse loads from multiple clients, necessitating flexible, highly reliable wrapping systems that can adapt rapidly to different pallet sizes and load profiles. E-commerce operations, facing surging order volumes and rapid shipping timelines, mandate fully automated, high-speed rotary arm wrappers that can handle continuous throughput rates without compromising load stability, making efficiency and automation paramount decision factors for procurement. Furthermore, the global proliferation of cold chain logistics, particularly for pharmaceuticals and frozen food, creates specialized demand for wrappers capable of operating reliably in low-temperature environments.

Within the manufacturing sector, the Food & Beverage industry represents a substantial segment due to high production volumes, strict hygiene standards, and the need for consistent wrapping to prevent contamination and damage. Chemical and Construction materials producers require robust machines capable of handling heavy, potentially unstable, or corrosive loads. The purchasing decision across these diverse sectors is increasingly influenced by the machine's ability to demonstrate film savings and its compliance with international shipping and safety standards, such as those related to unit load containment requirements, thereby positioning advanced features and quantifiable ROI as major selling points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lantech, Wulftec International, Orion Packaging Systems, M.J. Maillis Group, Stretch Wrapping Machine Co., ITW Muller, Signode Industrial Group, Robopac, Premier Packaging, Cousins Packaging, Handle It Inc., Aetnagroup SpA, K.L. Hauer, Phoenix Wrappers, SCM Group, Fromm Packaging, Highlight Industries, Atlantic Packaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pallet Stretch Wrapper Market Key Technology Landscape

The technology landscape of the Pallet Stretch Wrapper Market is rapidly evolving, moving beyond simple mechanical application towards precision automation and digital integration. A pivotal technology is the development of advanced pre-stretch carriages, which are critical for controlling film yield. Modern carriages are capable of pre-stretching the film up to 300% or more, meaning one foot of film can cover four feet of the load perimeter, significantly reducing material consumption and cost. This high-efficiency stretching requires sophisticated motor control and electronic tensioning systems to maintain consistent force-to-load throughout the entire wrapping cycle, ensuring optimal containment without crushing fragile products.

Another dominant technological trend is the pervasive adoption of Industry 4.0 standards, characterized by the integration of IoT sensors, programmable logic controllers (PLCs), and human-machine interfaces (HMIs). Modern stretch wrappers feature connectivity options that allow seamless integration with existing Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) software. This connectivity enables real-time monitoring of operational metrics such as wraps per hour, film usage per pallet, and machine health status, facilitating data-driven decision-making regarding throughput optimization and preventative maintenance scheduling. Remote diagnostics capabilities, accessed via secure cloud platforms, are now standard for troubleshooting and software updates.

Furthermore, innovations in machine configuration, such as the rise of Mobile Robotic Stretch Wrappers, represent a significant technological shift. These autonomous guided vehicles (AGVs) equipped with wrapping capabilities are highly flexible, navigating warehouse floors to wrap pallets wherever they are staged, eliminating the need to convey pallets to a centralized wrapping station. This is particularly valuable in facilities with complex or changing layouts. Safety technology has also advanced, utilizing light curtains, integrated sensors, and sophisticated programming to meet stringent international safety standards (e.g., European CE certification), ensuring operator protection while maintaining high operational speeds.

Regional Highlights

The global Pallet Stretch Wrapper Market exhibits diverse growth patterns influenced by regional industrial maturity, investment in logistics infrastructure, and labor costs. North America, encompassing the United States and Canada, remains a dominant market, characterized by a high installed base of automated systems and a continuous demand for machine upgrades centered around speed, connectivity, and film efficiency. The region's vast logistics network, coupled with the rapid expansion of fulfillment centers responding to e-commerce demands, ensures sustained investment in high-throughput, fully automatic rotary arm wrappers to manage immense volumes.

Europe constitutes a mature but highly innovative market. Driven by strict safety regulations (CE standards) and a strong emphasis on sustainability, European manufacturers lead in the development of wrappers optimized for minimal film consumption and capable of handling high pre-stretch ratios. Central and Western Europe exhibit high automation rates, whereas Eastern European nations are experiencing accelerated adoption as manufacturing relocates and modernizes. The focus here is not only on efficiency but also on reducing the packaging carbon footprint, driving demand for machines compatible with thinner, eco-friendly films.

Asia Pacific (APAC) stands out as the primary growth engine for the forecast period. Countries like China, India, and Southeast Asian nations are undergoing massive industrialization and infrastructure overhauls. The combination of burgeoning manufacturing output, expanding export activity, and the exponential growth of local e-commerce platforms is driving unprecedented demand for both semi-automatic wrappers (for smaller operations) and high-speed automatic systems. The lower initial adoption rate compared to Western markets means APAC offers substantial untapped potential for new installations and market penetration.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets characterized by significant investments in logistics infrastructure and diversified manufacturing sectors (e.g., food processing, construction). While penetration of fully automatic systems is generally lower, the demand for semi-automatic turntable wrappers is robust, driven by the need to standardize packaging and improve load security for both internal logistics and export purposes. Growth in these regions is heavily contingent on stable economic conditions and foreign direct investment into local production capabilities.

- North America: High adoption of fully automatic systems, driven by e-commerce and high labor costs, focusing on high speed and WMS integration.

- Europe: Strong emphasis on safety compliance and sustainability; leading innovations in film efficiency and eco-friendly packaging compatibility.

- Asia Pacific (APAC): Fastest growing region due to rapid industrialization, burgeoning manufacturing output, and significant investment in logistics hubs in China and India.

- Latin America: Growing utilization of semi-automatic wrappers to improve load stability and minimize manual labor, driven by increasing export activities.

- Middle East and Africa (MEA): Emerging market demand focused on core industrial sectors like construction and chemicals, with increasing investment in specialized, robust equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pallet Stretch Wrapper Market.- Lantech

- Wulftec International

- Orion Packaging Systems

- M.J. Maillis Group (part of Signode Industrial Group)

- Stretch Wrapping Machine Co.

- ITW Muller

- Signode Industrial Group

- Robopac (Aetnagroup SpA)

- Premier Packaging

- Cousins Packaging

- Handle It Inc.

- Aetnagroup SpA

- K.L. Hauer

- Phoenix Wrappers

- SCM Group

- Fromm Packaging

- Highlight Industries

- Atlantic Packaging

- Thimon S.A.

- Goodwrapper

Frequently Asked Questions

Analyze common user questions about the Pallet Stretch Wrapper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Turntable and Rotary Arm stretch wrappers?

Turntable wrappers rotate the palletized load on a platform, suitable for stable, lighter loads and medium-throughput operations. Rotary Arm wrappers keep the pallet stationary while the wrapping arm rotates around it, making them ideal for high-speed applications, extremely heavy, or inherently unstable loads that cannot withstand rotation, significantly enhancing throughput efficiency.

How does pre-stretch technology impact the overall cost of ownership for pallet wrappers?

Pre-stretch technology dramatically increases the yield of the stretch film (up to 300% or more), meaning less material is required per pallet. This reduction in film usage is the single largest factor in lowering the total operational expenditure and contributes significantly to minimizing packaging material waste, thus offering a high return on investment.

Which end-user industry is driving the highest demand for fully automatic stretch wrapping systems?

The Third-Party Logistics (3PL) sector and large-scale E-commerce fulfillment centers are driving the highest demand. These operations require maximum speed, continuous wrapping capability, and seamless integration with complex conveyor and sorting systems to manage extremely high, diverse volumes efficiently without manual intervention.

What is the role of Industry 4.0 and IoT connectivity in modern pallet stretch wrappers?

Industry 4.0 integration enables real-time performance monitoring, remote diagnostics, and predictive maintenance scheduling through IoT sensors and connectivity. This technology minimizes unplanned downtime, optimizes machine performance metrics (OEE), and allows wrappers to communicate seamlessly with centralized Warehouse Management Systems (WMS).

What are the main factors influencing the decision between purchasing a semi-automatic versus a fully automatic wrapper?

The primary influencing factors are the required throughput volume and labor costs. Semi-automatic wrappers are cost-effective for lower volumes (10-30 pallets/hour) and require an operator to attach and cut the film. Fully automatic systems are necessary for high volumes (60+ pallets/hour) and justify the higher initial investment by eliminating direct labor needs and maximizing production line speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager