Panel Saw Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441599 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Panel Saw Machines Market Size

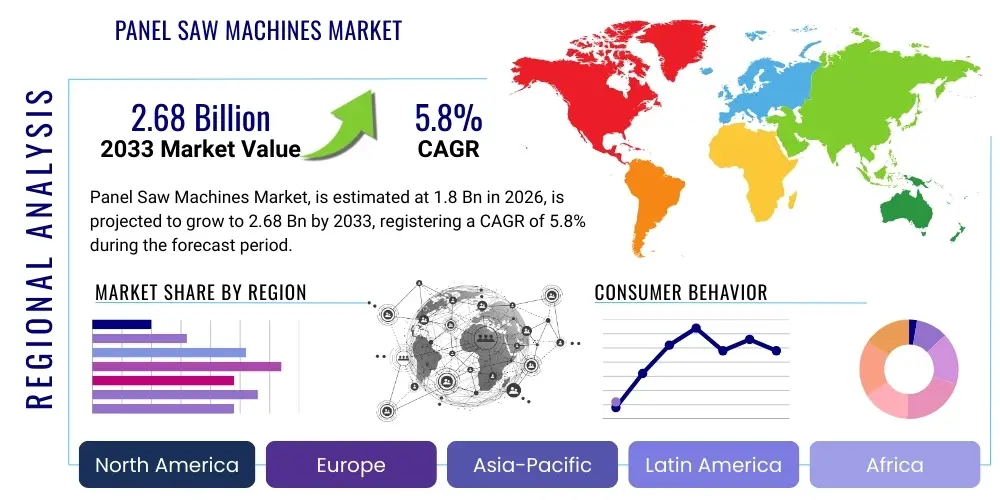

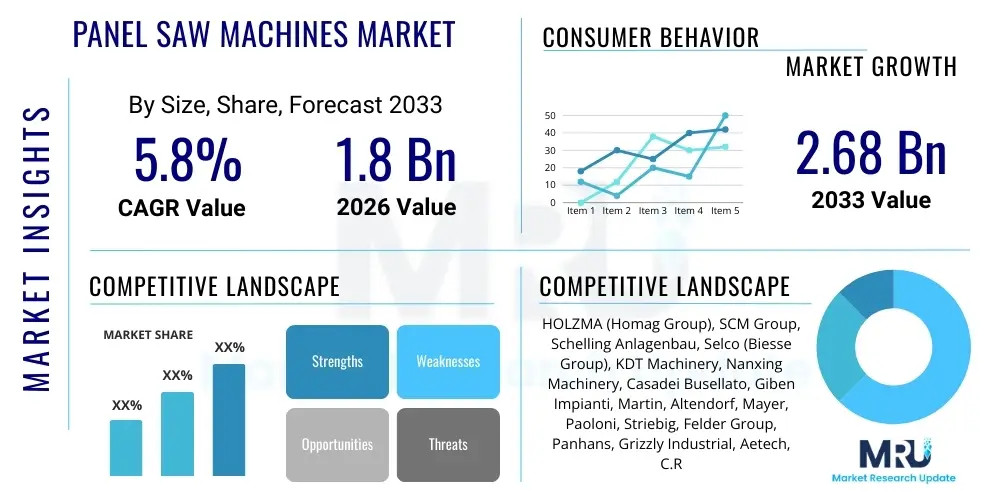

The Panel Saw Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.68 Billion by the end of the forecast period in 2033.

Panel Saw Machines Market introduction

The Panel Saw Machines Market encompasses specialized woodworking machinery designed for precision cutting of large panel materials such as Medium-Density Fiberboard (MDF), particleboard, plywood, and high-pressure laminates. These robust industrial tools are indispensable in manufacturing environments where high-volume, accurate dimensional cutting is required, primarily serving the global furniture, cabinet, and architectural millwork industries. Modern panel saws, particularly those incorporating advanced automation, are engineered to handle panel sizes far exceeding the capabilities of standard table saws, delivering straight, chip-free edges essential for automated assembly and finished product quality. The sophistication spectrum ranges from manually operated sliding table saws, favored by small-to-medium enterprises (SMEs), to massive, computer numerical control (CNC) controlled beam saws used in large, high-throughput factory settings, reflecting the varied scale of global woodworking production.

Panel saw machines offer numerous compelling advantages over traditional or manual cutting methodologies, fundamentally improving operational metrics such as material yield, throughput speed, and labor utilization. The integration of advanced features, including automatic panel loading systems, dust collection mechanisms, and variable cutting speeds, ensures a cleaner, safer, and more efficient working environment. Major applications span the production of kitchen and bath cabinets, high-end office systems, retail display fixtures, and components for pre-fabricated housing and construction. The market expansion is significantly underpinned by the accelerating global demand for readily available, stylish, and durable interior furnishings, particularly the ready-to-assemble (RTA) furniture segment which relies entirely on accurate, high-volume panel processing.

Furthermore, the market is currently undergoing a pivotal transformation driven by Industry 4.0 principles, emphasizing connectivity and data exchange. Contemporary panel saws are often equipped with Internet of Things (IoT) sensors, enabling real-time performance monitoring, remote diagnostics, and seamless communication with enterprise resource planning (ERP) systems and other machinery on the factory floor. This level of integration supports trends such as mass customization and just-in-time (JIT) manufacturing, requiring the flexibility, speed, and absolute accuracy that only advanced computerized panel saw systems can reliably deliver. The continuous development of specialized software for cutting optimization and machine management further solidifies the panel saw’s role as a mission-critical asset in modern wood panel processing.

Panel Saw Machines Market Executive Summary

The global Panel Saw Machines Market trajectory is characterized by a strong secular trend toward automation and digital integration, primarily fueled by rising global labor costs and the imperative to maximize material efficiency. Current business trends heavily favor the adoption of high-performance CNC beam saws, which minimize material handling risks and maximize precision, driving value growth across developed economies. Manufacturers are increasingly focused on developing comprehensive software suites bundled with the machinery, providing advanced features like simulation, predictive maintenance insights, and sophisticated nesting optimization tools, which are now key differentiators in competitive tender processes. Furthermore, the emphasis on sustainability is shaping purchasing decisions, pushing manufacturers to innovate in areas like reduced power consumption and efficient waste management systems, aligning with global environmental governance.

Regionally, the Asia Pacific (APAC) region dominates in terms of consumption volume, primarily driven by massive production capabilities in China, which serves both domestic and international markets with furniture and cabinet components. However, North America and Europe represent the vanguard of technological adoption, showing the highest uptake of premium, fully automated, and flexible saw solutions designed to handle customized, smaller batch sizes efficiently. These mature markets are largely driven by replacement cycles and the need for higher integration capabilities into existing factory automation systems. The market in Latin America and the Middle East & Africa (MEA) is poised for substantial growth, reflecting increasing industrialization and local capacity building, though demand in these regions is currently centered on entry-level and semi-automatic machines due to capital constraints.

Analysis of market segments reveals that the Automatic (CNC) Operation Mode segment holds the highest revenue share, reflecting the industrial shift towards minimized manual intervention and maximized throughput consistency. By Product Type, Beam Saws command the leading market valuation due to their application in large-scale facilities, while Vertical Panel Saws are gaining traction in small workshops due to their inherent space-saving design and high cutting accuracy for single sheets. The Furniture Manufacturing End-User segment remains the largest revenue contributor, intrinsically linking market success to the housing and commercial construction cycles. Strategic market positioning now requires equipment vendors to offer scalable solutions, robust training programs, and extended digital support to capture market share across the diverse needs of industrial behemoths and specialized custom fabricators globally.

AI Impact Analysis on Panel Saw Machines Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance cutting efficiency, predict maintenance failures, and automate design-to-cut workflows in panel processing. Common user questions revolve around quantifiable benefits in material savings, reduction of machine downtime, and enhanced operational autonomy. Significant concern persists regarding the cost-benefit ratio of retrofitting AI systems onto older machinery and ensuring robust cybersecurity protocols protect the sensitive proprietary data related to design files and production metrics. The overarching expectation is that AI will move panel saw operations beyond simple optimization algorithms into truly predictive and autonomous manufacturing environments, optimizing processes far beyond the scope of traditional parametric optimization software, particularly in managing dynamic production schedules and maximizing profitability.

The application of deep learning algorithms in predictive maintenance is a transformative use case, allowing panel saw operators to move from reactive or time-based maintenance to condition-based servicing. By analyzing vast datasets generated by machine sensors—including vibrations during cutting, motor current fluctuations, and temperature profiles—AI models can accurately predict the remaining useful life (RUL) of critical components like saw blades, bearings, and linear guides. This predictive capability ensures components are replaced just before failure, eliminating costly unplanned shutdowns and extending the machine’s effective operational lifespan, which is a significant factor in calculating total cost of ownership (TCO) and maintaining high factory efficiency.

Furthermore, AI significantly impacts material management and quality control. Machine learning models can analyze visual data from integrated cameras, identifying subtle defects (e.g., surface scratches, core voids, or warping) in panels faster and more consistently than human operators. By detecting these flaws pre-cut, the AI can instantaneously modify the nesting pattern to avoid defective areas, thereby salvaging material that would otherwise be wasted and ensuring only high-quality parts move down the production line. This real-time, data-driven optimization drastically reduces waste, a critical advantage in an industry characterized by high material costs, while also improving the consistency and reliability of the output for downstream processes like edge banding and assembly.

- AI-driven optimization software enhances nesting accuracy, reducing material waste by up to 10% compared to traditional algorithms by analyzing complex geometric part interactions and material grain.

- Predictive maintenance schedules utilizing machine learning (ML) minimize unplanned downtime by accurately analyzing multivariate sensor data from vibration, temperature, and current consumption patterns.

- AI vision systems automate quality control by detecting subtle surface defects or structural inconsistencies in raw panels, enabling real-time adjustment of cutting plans to maximize yield.

- Autonomous scheduling and dynamic routing capabilities integrate panel saw operations seamlessly with wider ERP systems, managing complex sequencing for mass customization orders (batch-of-one production).

- Natural Language Processing (NLP) interfaces simplify machine programming, allowing operators to input instructions more intuitively, accelerating setup for small, diverse batches and reducing training requirements.

- Reinforcement learning models are being trialed to autonomously optimize cutting speeds and feed rates based on material density and blade wear, maximizing throughput while maintaining cut quality and tool life.

DRO & Impact Forces Of Panel Saw Machines Market

The core momentum driving the Panel Saw Machines Market stems from the convergence of several macroeconomic factors, notably the global surge in middle-class populations in emerging economies and the corresponding demand for affordable yet quality furnishings, which are heavily reliant on panel components. This demand necessitates manufacturers to scale production rapidly, making the investment in high-speed, multi-shift capable beam saws unavoidable. Additionally, environmental regulations favoring reduced material waste and the necessity to comply with increasing safety standards compel legacy manufacturers to upgrade their machinery to modern, enclosed, and optimized systems. The trend towards customized, small-batch manufacturing requires machinery that can switch between cutting programs rapidly, further propelling the adoption of flexible CNC solutions over static manual saws.

However, the market faces significant structural headwinds. The most immediate restraint is the cyclical nature of the construction and furniture industries; global economic downturns or prolonged periods of high interest rates can severely curb capital expenditure on new machinery, leading to deferred purchases and extended replacement cycles. Furthermore, while automation reduces operational labor, the maintenance and programming of sophisticated CNC equipment require highly specialized technicians, a workforce that is often scarce and expensive globally. Manufacturers must invest heavily in proprietary training and support infrastructure to mitigate this skill gap restraint, adding to the overall cost of machine ownership. This operational complexity often deter smaller workshops from adopting high-end automation.

Opportunities for market players are primarily found in developing innovative financial models, such as leasing or Machine as a Service (MaaS) arrangements, which lower the prohibitive entry barrier posed by high capital costs for SMEs. Geographically, expanding localized service and support networks in high-growth regions like Southeast Asia and Latin America will be crucial for capturing market share. The primary impact force influencing market evolution is the continuous compression of production timelines; customers require saws that deliver not just accuracy, but integrated solutions that handle material from storage to cutting and sorting in an unbroken, optimized chain. This pressure necessitates deep integration between machinery providers and software developers, fundamentally transforming the competitive landscape from hardware sales to comprehensive system provisioning.

Segmentation Analysis

The granular analysis of the Panel Saw Machines Market through segmentation across Product Type, Operation Mode, and End-User provides a critical framework for understanding market dynamics and competitive positioning. Segmentation by Product Type is essential, as Beam Saws are categorized as the premium, high-production segment, tailored for tier-one manufacturers requiring maximum throughput and stack cutting capacity. Conversely, Vertical Panel Saws address the crucial need for space optimization, appealing particularly to custom fabricators and small workshops in densely populated urban areas, while Sliding Table Saws maintain their utility as the versatile workhorse for flexible, precision single-panel cuts.

The Operation Mode segmentation highlights the ongoing industrial transition, with the shift from Manual to Semi-Automatic, and ultimately to fully Automatic (CNC Controlled) systems being the most defining market trend. The growth in the Automatic segment is directly correlated with advancements in software control and automation features, providing repeatable accuracy and reduced reliance on operator skill. This trend is especially pronounced in North America and Europe where labor cost mitigation is a key driver. Conversely, the persistence of the Manual and Semi-Automatic segments, largely prevalent in APAC and LATAM, indicates the diverse capital investment strategies and labor cost structures globally.

End-User segmentation reveals that the destiny of the Panel Saw Market is inextricably linked to the housing and commercial build cycles, with Furniture Manufacturing holding the overwhelming majority share. This sector demands specialized software integration for handling diverse material types and thickness variations common in modern kitchen, closet, and office systems. The growing segments of Construction and Architectural Millwork, driven by customized interior projects and offsite panelized construction, necessitate machines capable of extreme precision over large formats, indicating potential growth pockets for specific product types like advanced Beam Saws with specialized clamping systems.

- By Product Type:

- Beam Saws: Characterized by automated feed, high speed, and capability for cutting stacked panels; subdivided into Front Load for smaller factories and Rear Load for automated, integrated lines.

- Sliding Table Saws (Horizontal Panel Saws): Versatile machines providing high angular accuracy, primarily utilized by custom shops and educational facilities due to their flexibility and relatively lower capital cost.

- Vertical Panel Saws: Space-saving solution offering precise vertical and horizontal cutting of large panels in confined spaces; popular for retail, signage, and low-volume millwork applications.

- By Operation Mode:

- Manual: Requires operator involvement for material feeding, clamping, and cutting path execution; lowest cost but highest labor requirement.

- Semi-Automatic: Features powered movements (e.g., scoring blade setup, fence positioning) but still requires manual material handling and setup adjustments.

- Automatic (CNC Controlled): Full automation of material handling, clamping, cutting, and sorting based on pre-programmed digital data; essential for high-throughput factories seeking minimal human intervention.

- By End-User Industry:

- Furniture Manufacturing (Residential, Commercial)

- Cabinet Making and Architectural Millwork

- Construction and Building Materials

- Packaging and Crating

- Others (Exhibits, Signage, Composites)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, Italy, France, UK, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Panel Saw Machines Market

The foundational strength of the panel saw machine value chain originates in robust upstream supply management, primarily focused on securing high-grade, specialized components. This involves procuring precision-engineered steel alloys for machine beds and structural elements to ensure vibration dampening and long-term geometric stability, crucial for maintaining cutting accuracy. Key upstream suppliers also provide proprietary electronic components, notably high-speed servo motors, Programmable Logic Controllers (PLCs), and advanced Human-Machine Interface (HMI) touchscreens. Critical attention is paid to the saw blade technology, with suppliers constantly innovating in carbide tip formulations and specialized coatings to enhance longevity and cut quality across diverse materials like melamine and compact laminates. Strategic partnerships with these component suppliers are vital for machine manufacturers to control costs and integrate the latest technological advancements effectively.

The midstream segment, dominated by major original equipment manufacturers (OEMs) like Homag, Biesse, and SCM, involves the highly specialized manufacturing and assembly of the panel saw systems. This phase requires sophisticated internal processes, focusing on heavy fabrication, precision machining of guides and carriage systems, and the rigorous testing of integrated software and electronic controls. Quality assurance and adherence to international safety certifications (e.g., CE marking for European markets) are paramount to ensure global market acceptance. Manufacturers distinguish themselves here by incorporating unique technological features, such as patented clamping mechanisms, optimized dust extraction technologies, and intuitive CNC operating systems that minimize training requirements for end-users, differentiating their products based on efficiency and compliance.

Distribution and downstream activities constitute the crucial link between production and end-user satisfaction. For large industrial beam saws, the distribution typically follows a direct sales model, involving dedicated sales engineers who handle complex technical specifications, installation, calibration, and extensive operator training programs. This direct engagement ensures precise system integration within the customer's existing factory layout. Conversely, standard sliding table saws and vertical saws are often sold through an indirect network of authorized regional dealers and distributors. These partners provide localized technical support, spare parts inventory, and faster response times, which are critical for SMEs. The downstream service segment—covering preventative maintenance contracts, emergency repairs, and software upgrades—is increasingly becoming a significant, high-margin revenue stream, reinforcing customer retention through maximized machine uptime and operational continuity.

Panel Saw Machines Market Potential Customers

The core customer base for high-performance panel saw machines is the industrial furniture manufacturing complex, which encompasses both residential and commercial sectors globally. These end-users, typically operating large-scale production facilities, require the highest level of automation, speed, and precision afforded by sophisticated CNC beam saws. Their purchasing decisions are primarily driven by throughput metrics (panels per shift), material recovery rates (enabled by optimization software), and the ability of the machine to seamlessly integrate into automated storage and retrieval systems (AS/RS) and edge banding lines. Key target accounts include global RTA furniture giants, large-scale cabinet component suppliers, and contract manufacturers catering to international brands that demand standardized, high-quality output.

A second, equally vital, segment comprises smaller custom millwork shops, interior design contractors, and specialized cabinet makers. These customers value flexibility, minimal footprint, and ease of operation more than absolute speed. They are the primary buyers of high-quality sliding table saws and technologically advanced vertical panel saws. For this segment, the availability of financing options, localized technical training, and the machine's capability to handle diverse, non-standard materials and geometries for unique projects are the decisive purchasing factors. Manufacturers are increasingly catering to this market with mid-range automated solutions that offer a strong balance between investment cost and productivity gains, often incorporating modular design for future scalability.

Furthermore, the emerging customer segment in the construction industry, particularly focused on modular and prefabricated housing (panelized construction), represents a significant growth area. These buyers require panel saws capable of cutting large structural components, such as Structural Insulated Panels (SIPs) or cross-laminated timber (CLT) panels, with construction-grade accuracy. Their needs often overlap with those of industrial manufacturers but include requirements for ruggedness and the ability to handle non-wood composite materials. Catering to this customer base involves adapting saw technologies to manage thicker, denser, and sometimes abrasive materials while integrating cutting programs directly with architectural BIM (Building Information Modeling) software to streamline the design-to-production workflow.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HOLZMA (Homag Group), SCM Group, Schelling Anlagenbau, Selco (Biesse Group), KDT Machinery, Nanxing Machinery, Casadei Busellato, Giben Impianti, Martin, Altendorf, Mayer, Paoloni, Striebig, Felder Group, Panhans, Grizzly Industrial, Aetech, C.R. Onsrud, SAWTEK, Putsch Meniconi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Panel Saw Machines Market Key Technology Landscape

The competitive edge in the Panel Saw Machines Market is increasingly derived from advancements in non-mechanical components, specifically in sensor technology and digital processing power. Modern beam saws are now equipped with sophisticated vision systems utilizing high-resolution cameras and advanced algorithms to perform real-time measurements of panel dimensions and detect minor defects (e.g., edge chipping, bowing, or surface contamination) before the cut begins. This technological layer provides an unparalleled level of quality assurance and further drives optimization algorithms by ensuring that cutting decisions are made based on the actual, instantaneous quality of the input material, not just theoretical specifications. The precision of the movement is assured through magnetic linear drive systems in high-end models, offering wear-free operation and exceptional acceleration, surpassing traditional rack-and-pinion or ball-screw mechanisms in speed and accuracy maintenance.

Connectivity standards are paramount, with the adoption of standardized communication protocols allowing panel saws to integrate seamlessly into broader factory networks, facilitating data exchange with ERP, MES (Manufacturing Execution Systems), and upstream design software. The implementation of cloud-based diagnostics allows manufacturers to offer proactive maintenance services, analyzing performance telemetry across thousands of deployed machines globally to identify potential anomalies predictive of failure. Security protocols around this network connectivity are also a rapidly developing technology area, crucial for protecting the customer's proprietary production data and ensuring the operational integrity of the CNC systems against external threats. These integrated digital features significantly enhance the resale value and operational lifespan of modern machinery by maximizing uptime and data security.

Innovation also permeates the interface and user experience (UX). Manufacturers are deploying augmented reality (AR) applications to assist operators with setup, maintenance, and complex blade changes, projecting instructional overlays directly onto the machine components. Furthermore, the development of quieter, more efficient dust extraction and noise reduction technologies addresses occupational health and safety concerns, making the working environment significantly better. Blade technology itself continues to advance, with specialized diamond-tipped tools designed for cutting modern, highly abrasive composite panels and engineered stones, broadening the scope of materials that a single panel saw can efficiently process. The convergence of these hardware and software enhancements defines the leadership trajectory in the global panel processing machinery market.

Regional Highlights

The geographical distribution of demand for panel saw machines reflects global manufacturing shifts and regional economic maturity. Asia Pacific (APAC), particularly fueled by the expansive manufacturing base in China, maintains its position as the largest and most dynamic market. This region is characterized by massive governmental investment in infrastructure and industrial capacity, leading to sustained high demand for large, robust CNC beam saws capable of 24/7 operation to feed the global supply chains of furniture and construction components. While cost sensitivity remains relevant, the competitive nature of manufacturing in APAC increasingly compels local producers to invest in automated, efficient German and Italian machinery, driving replacement cycles and expansion demand simultaneously.

Europe represents the technological epicenter of the market, driven by stringent quality standards, high labor costs, and a market preference for customized, sustainable production. European consumers demand panel saws that are not only precise and energy-efficient but also seamlessly integrate with sophisticated manufacturing ecosystems (Industry 4.0). Countries like Germany and Italy host the leading global manufacturers and exhibit high internal consumption of premium, specialized equipment designed for niche applications like high-end architectural millwork and batch-of-one furniture production. The emphasis in Europe is less on volume and more on precision, flexibility, and minimizing material waste, setting global benchmarks for technological complexity and environmental compliance.

North America’s market growth is stable, primarily driven by replacement demand and the crucial necessity to offset soaring labor costs through maximum automation. The US market, in particular, shows a strong preference for integrated solutions—panel saws linked directly to robotic stacking, labeling, and conveying systems. The demand here is highly focused on machines that offer high reliability and extensive digital diagnostics, minimizing downtime across decentralized manufacturing facilities. Latin America and the Middle East & Africa (MEA), conversely, are rapidly maturing markets. Growth is driven by local industrialization efforts, requiring reliable, mid-tier semi-automatic solutions. As these regions expand their urban infrastructure and develop local furniture industries, the gradual transition towards fully automatic CNC technology will accelerate, positioning them as high-potential growth territories in the latter half of the forecast period.

- Asia Pacific (APAC): Market leader by volume; growth is exponential due to massive furniture production and urban development in China, India, and Vietnam. Dominant demand for high-speed, stacked panel cutting (Rear-Load Beam Saws).

- Europe: Leading technology adopter; high market saturation compensated by demand for specialized, premium, automated machinery focused on precision, material flexibility, and energy efficiency compliant with strict EU regulations.

- North America: Stable market driven by investment in high-level automation to mitigate labor costs; strong focus on software integration (ERP connectivity) and reliable after-sales support for complex machinery.

- Latin America (LATAM): Emerging market undergoing rapid industrialization; initial demand is concentrated in the Semi-Automatic and Sliding Table Saw segments, with Brazil and Mexico acting as regional hubs for local manufacturing growth.

- Middle East and Africa (MEA): Growth tied directly to major real estate and construction projects; increasing focus on establishing local wood processing capabilities to reduce import dependence; market sensitive to global commodity price stability and access to technical skills.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Panel Saw Machines Market.- HOLZMA (Homag Group)

- SCM Group

- Schelling Anlagenbau

- Selco (Biesse Group)

- KDT Machinery

- Nanxing Machinery

- Casadei Busellato

- Giben Impianti

- Martin

- Altendorf

- Mayer

- Paoloni

- Striebig

- Felder Group

- Panhans

- Grizzly Industrial

- Aetech

- C.R. Onsrud

- SAWTEK

- Putsch Meniconi

- Masterwood S.p.A.

- ZMM Stomana

- V-Hold Machinery

- Anderson Industrial Corp.

- SCM Tecnostar

Frequently Asked Questions

Analyze common user questions about the Panel Saw Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Beam Saws and Sliding Table Saws?

Beam saws are fully automated, high-throughput industrial machines designed for continuous, high-volume processing of panel stacks, delivering superior speed and minimal waste via CNC nesting. Sliding table saws are semi-manual or semi-automatic, offering greater flexibility and versatility for custom jobs and smaller batches, appreciated by SMEs for their lower initial investment and ease of material handling for non-standard cuts.

How does CNC technology improve panel saw machine performance?

CNC (Computer Numerical Control) technology dramatically enhances precision and speed by automating blade positioning, clamping, and cutting sequences based on digital programming. This integration minimizes setup time, eliminates manual measurement errors, ensures repeatable accuracy, and maximizes material yield through advanced nesting algorithms, which is essential for profitability in modern manufacturing.

Which end-user industry is driving the highest demand for panel saw machines?

The Furniture Manufacturing sector, encompassing residential and commercial cabinetry and fixtures, remains the largest revenue driver. This demand is sustained by the accelerating global trend towards modular and ready-to-assemble furniture, which requires exceptionally high volumes of accurately cut panel components to meet mass market needs.

What is the role of optimization software in modern panel saw operations?

Optimization software is critical for operational efficiency and sustainability, utilizing complex algorithms to calculate the optimal cutting layout (nesting) to maximize the number of usable parts extracted from a standard panel. This capability significantly reduces material wastage, minimizes cutting time, and ultimately lowers the total manufacturing cost per part, enhancing the machine's return on investment (ROI).

What regional market shows the fastest growth potential for panel saw machine adoption?

The Asia Pacific (APAC) region exhibits the fastest growth potential, driven by accelerating urbanization, massive infrastructure projects, and the region's centralized position as the global hub for export-oriented furniture and panel goods manufacturing, necessitating continuous investment in advanced, high-throughput machinery for global supply chain resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager