Panoramic X-Ray System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441862 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Panoramic X-Ray System Market Size

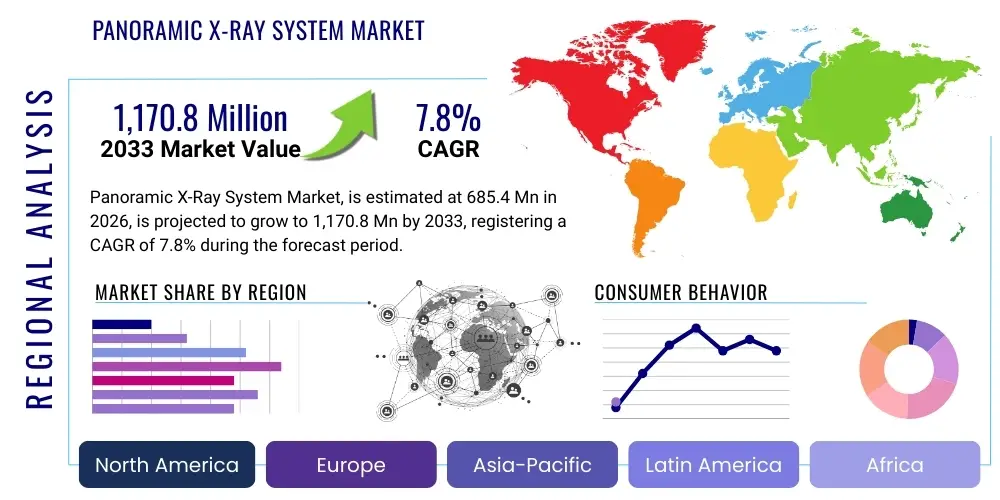

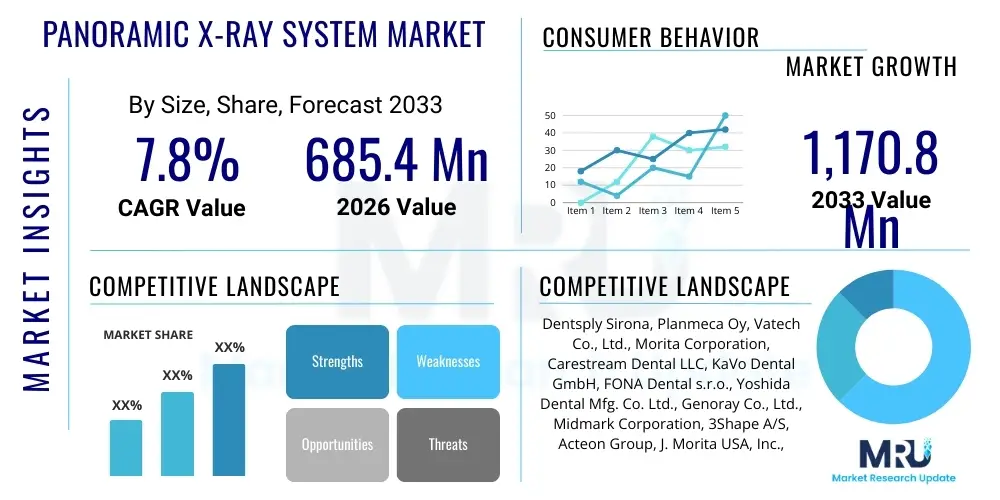

The Panoramic X-Ray System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 685.4 million in 2026 and is projected to reach USD 1,170.8 million by the end of the forecast period in 2033.

Panoramic X-Ray System Market introduction

Panoramic X-ray systems, formally known as Orthopantomography (OPG) or Panorex machines, are highly specialized medical imaging devices crucial for diagnosing and planning treatment across various dental and maxillofacial specialties. These systems capture a single, comprehensive two-dimensional image of the entire mouth, including the teeth, jaws, and surrounding structures, offering essential diagnostic information that traditional intraoral radiographs often cannot provide. The primary diagnostic utility lies in detecting impacted teeth, identifying cysts and tumors, assessing temporomandibular joint (TMJ) disorders, and evaluating alveolar bone structure before complex procedures like implantology or orthodontics. The inherent benefit of panoramic radiography is the minimal radiation exposure compared to full-mouth series, coupled with the ability to visualize a wide anatomical area efficiently, making it a cornerstone technology in modern dental practice.

The core product description revolves around highly sophisticated mechanical and digital components. Modern systems utilize advanced digital sensors (CMOS or CCD) to instantly capture images, eliminating the need for chemical processing and drastically improving image resolution and workflow efficiency. The mechanical arm and tube head rotate synchronously around the patient's head, projecting a thin focal layer onto the sensor, which generates the curved, panoramic view. Key innovations, such as pulsed X-ray generation and dose modulation, are continuously integrated to enhance patient safety and image quality. These systems are essential for general dentists, oral surgeons, and orthodontists who require expansive diagnostic views for comprehensive patient care planning, driving their adoption across developed and emerging healthcare infrastructures.

Major applications for Panoramic X-Ray systems span general dental diagnostics, oral surgery, forensic dentistry, and specialized orthodontic treatment planning. Driving factors for market growth include the escalating global prevalence of dental diseases, particularly periodontal issues and malocclusion, which necessitates advanced imaging for accurate diagnosis. Furthermore, the rising awareness regarding preventative dental care, coupled with increasing disposable incomes in Asia Pacific and Latin America, allows for greater patient access to advanced dental services. Technological advancements, particularly the shift from 2D panoramic systems to integrated 3D cone-beam computed tomography (CBCT) capabilities within the same unit, are significantly pushing market expansion by offering enhanced diagnostic precision and versatility to dental professionals.

Panoramic X-Ray System Market Executive Summary

The Panoramic X-Ray System Market is characterized by robust technological integration and shifting consumer focus towards preventative and aesthetic dental procedures. Business trends indicate a strong move away from analog systems entirely, with digital systems dominating new installations due to superior image quality, immediate accessibility, and seamless integration with Electronic Health Records (EHRs). Key market players are investing heavily in hybrid systems that combine 2D panoramic functionality with 3D CBCT capabilities, providing dental practitioners with a full diagnostic suite in a single footprint. Furthermore, subscription-based models for software upgrades and service contracts are becoming increasingly popular, ensuring consistent revenue streams for manufacturers and maintaining high operational standards for end-users. Consolidation within the dental device manufacturing sector, driven by mergers and acquisitions aimed at expanding geographic reach and technology portfolios, is redefining competitive landscapes.

Regional trends reveal that North America and Europe currently hold the largest market shares, primarily due to established healthcare infrastructure, high healthcare spending, and rapid adoption of advanced digital imaging technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to the massive expansion of the dental tourism industry, increasing governmental investment in public dental care programs, and a rapidly expanding middle-class population that demands high-quality dental services. Countries like China and India are seeing a proliferation of private dental clinics, driving substantial demand for reliable and efficient imaging equipment. Latin America and the Middle East & Africa (MEA) are emerging as critical markets, driven by improving economic conditions and increased focus on chronic disease management, where dental health plays an interconnected role.

Segment trends highlight the dominance of the digital systems segment over film-based technologies, reinforcing the industry’s commitment to efficiency. Within application segments, the highest growth is expected in implantology and orthodontics, specialized fields that rely heavily on precise measurements and anatomical assessment provided by high-resolution panoramic imaging. Furthermore, the end-user segment analysis shows that large dental hospitals and multispecialty clinics are major purchasers, although the rising number of independent, smaller dental practices adopting compact, cost-effective digital panoramic units is significantly contributing to market volume. The integration of artificial intelligence (AI) for automated landmark identification and pathology detection is the defining technological trend influencing segmental demand, promising greater diagnostic consistency and speed.

AI Impact Analysis on Panoramic X-Ray System Market

Common user questions regarding AI's impact on Panoramic X-Ray Systems frequently revolve around how AI can enhance diagnostic accuracy, reduce the need for specialized human interpretation, and integrate seamlessly into existing dental practice workflows. Users are keen to understand if AI-powered systems can automatically detect subtle signs of early-stage periodontal disease, identify complex root canal configurations, or accurately localize mandibular nerve canals, thereby minimizing clinical errors during surgical planning. Concerns often focus on data privacy, the regulatory approval process for AI diagnostic aids, and the potential for deskilling dental professionals who may become overly reliant on automated interpretation. There is significant expectation that AI will standardize radiographic readings across different practitioners and dramatically shorten the time required for comprehensive treatment planning.

The implementation of artificial intelligence (AI) is transforming the utility and efficiency of Panoramic X-Ray systems, fundamentally shifting them from mere image capture devices to sophisticated diagnostic platforms. AI algorithms are being trained on vast datasets of panoramic radiographs to automatically perform complex tasks such as identifying dental caries, classifying periodontal bone loss severity, and mapping anatomical structures (e.g., mandibular canal, mental foramen). This automation significantly reduces the reliance on manual measurement and subjective visual inspection, leading to higher levels of diagnostic standardization and consistency across different clinicians. By flagging potential pathologies or abnormalities that might be missed during routine examinations, AI acts as a crucial second opinion, improving patient outcomes and streamlining the diagnostic process, which is especially beneficial in high-volume clinic environments.

Furthermore, AI integration extends into operational and workflow efficiency. Systems powered by machine learning can automatically optimize image exposure parameters based on patient size and density, ensuring optimal image quality while minimizing radiation dose, a key patient safety concern. For treatment planning, particularly in orthodontics and implantology, AI can accelerate tasks like tracing cephalometric landmarks and calculating specific angles and proportions necessary for surgical guides. This enhancement in speed and precision is translating directly into improved practice profitability and patient satisfaction. However, widespread adoption is currently mitigated by the initial investment costs associated with AI-integrated software licenses and the need for clinical validation studies to build trust in these automated diagnostic capabilities.

- AI-driven pathology detection: Automated identification of cysts, tumors, and specific inflammatory processes.

- Dose optimization algorithms: Real-time adjustments of radiation parameters based on anatomical feedback.

- Automated cephalometric analysis: Rapid and accurate landmark tracing for orthodontic planning.

- Enhanced image processing: Noise reduction and artifact suppression using machine learning models.

- Standardization of diagnoses: Reducing inter-observer variability in radiographic interpretation.

- Predictive modeling: Identifying high-risk patients for bone loss progression or TMJ disorders.

- Workflow integration: Seamless connection with practice management software and patient records for instantaneous AI insights.

DRO & Impact Forces Of Panoramic X-Ray System Market

The dynamics of the Panoramic X-Ray System market are governed by a robust interplay of driving forces, inherent restraints, and lucrative opportunities. The primary driver is the global increase in dental health expenditure coupled with the rising incidence of chronic dental and maxillofacial diseases that necessitate detailed imaging for accurate diagnosis and complex treatment planning. Technological advancements, particularly the fusion of 2D panoramic capabilities with 3D CBCT, significantly boost market appeal by offering multipurpose functionality. However, these systems face restraint due to their substantial initial capital cost, which can be prohibitive for small and independent dental practices, especially in developing economies. Moreover, the stringent regulatory environment governing medical devices and radiation safety adds complexity and time to market entry for new products. Opportunities abound in emerging markets where dental infrastructure is rapidly expanding, and in the continued refinement of AI tools to enhance diagnostic accuracy, thereby demonstrating clear clinical and economic value.

Impact forces on the market are high, driven predominantly by technology penetration and shifting demographics. The increasing global elderly population, which requires extensive prosthetic and restorative dental work, acts as a continuous demand multiplier. Simultaneously, regulatory requirements, such as those imposed by the FDA or CE standards, force manufacturers to invest heavily in robust quality control and clinical testing, impacting product development cycles and costs. Furthermore, the competitive rivalry among established market leaders (e.g., Vatech, Planmeca, Dentsply Sirona) ensures continuous price pressure and innovation velocity. The threat of substitutes, while moderated by the unique diagnostic view panoramic systems provide, comes from handheld intraoral systems and high-end specialized CBCT units, forcing manufacturers to continuously integrate superior features and connectivity options to maintain market relevance.

Specific opportunities focus on developing portable or lightweight panoramic units that can be deployed in mobile dental clinics or remote healthcare settings, expanding access to essential diagnostics. Another crucial avenue is the evolution towards 'smart imaging'—systems that integrate cloud connectivity for remote diagnostics, automated calibration, and continuous software updates. Addressing the restraining factor of cost through flexible financing, leasing arrangements, or offering refurbished equipment options can unlock significant demand from budget-constrained clinics. The long-term trajectory of the market is heavily influenced by how effectively manufacturers can leverage AI to demonstrate improved diagnostic efficiency, leading to faster insurance approvals and reduced chair time, thereby maximizing the return on investment for end-users.

Segmentation Analysis

The Panoramic X-Ray System market is comprehensively segmented based on technology type, product type, application, and end-user, providing a granular view of market dynamics and adoption patterns across various clinical settings. Technology segmentation primarily distinguishes between digital and film-based systems, with digital technology (CCD/CMOS sensors) maintaining overwhelming dominance due to its workflow advantages and superior image quality. Product type often separates the market into standard 2D panoramic units and advanced hybrid systems that incorporate 3D CBCT features, reflecting the increasing demand for integrated, versatile imaging solutions. This segmentation is critical for manufacturers tailoring their offerings to specific clinical demands, such as orthodontic specialists requiring precise cephalometric capabilities versus general dentists focused on basic diagnostics.

Application analysis highlights key clinical areas driving purchasing decisions. Major applications include implantology, where highly accurate preoperative bone assessment is mandatory; orthodontics, requiring comprehensive visualization of jaw structure and eruption patterns; and general dentistry, used for routine screenings and detection of latent pathologies. The relative growth rate across these applications demonstrates the increasing complexity of dental treatments globally. Furthermore, the End-User segment differentiates demand between specialized environments like dental hospitals and research institutes, which require high-throughput and premium features, and independent dental clinics and dental laboratories, which prioritize cost-effectiveness, compact size, and user-friendly interfaces suitable for private practice settings.

This structured segmentation allows market participants to refine their strategic focus, identify high-growth niches, and allocate R&D resources effectively. For instance, the escalating demand from specialized periodontal clinics indicates a growing need for panoramic systems offering high-resolution detail in bone structure visualization. Understanding the geographical distribution of these segments is equally important; for example, hybrid CBCT-Pan systems see higher adoption rates in high-income regions, while basic digital 2D units remain the primary choice for expanding clinics in emerging economies focusing on foundational care and affordability.

- By Technology:

- Digital Panoramic X-Ray Systems (CMOS, CCD)

- Film-based Panoramic X-Ray Systems

- By Product Type:

- Standard 2D Panoramic Systems

- Hybrid Panoramic/CBCT Systems (Cone Beam CT Integration)

- Portable Panoramic Systems

- By Application:

- Implantology

- Orthodontics

- Periodontics

- Oral and Maxillofacial Surgery

- General Dentistry

- By End User:

- Dental Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Dental Laboratories

- Academic and Research Institutes

- By Price Range:

- Premium Systems (High-end features and CBCT integration)

- Mid-Range Systems

- Economical/Basic Systems

Value Chain Analysis For Panoramic X-Ray System Market

The value chain for the Panoramic X-Ray System Market begins with the upstream activities centered around raw material procurement and component manufacturing. This stage involves sourcing high-precision components, including specialized X-ray tubes, advanced digital sensors (CMOS/CCD), rotating mechanical arms, and sophisticated control electronics. Suppliers of these core components operate under rigorous quality standards and often maintain long-term, strategic partnerships with the major Original Equipment Manufacturers (OEMs). The quality and reliability of these upstream inputs—particularly the X-ray source and sensor technology—directly dictate the final image resolution and system longevity, representing a significant portion of the total manufacturing cost and requiring extensive R&D investment for continuous performance improvement.

The midstream activities encompass the core manufacturing, assembly, software integration, and stringent quality assurance processes. OEMs focus on designing user-friendly interfaces, optimizing mechanical movements for patient comfort and stability, and integrating advanced image processing algorithms, increasingly featuring AI capabilities. After manufacture, distribution forms a crucial part of the downstream segment. Most panoramic X-ray systems are distributed through a mixed channel approach: large, established OEMs often utilize a blend of direct sales teams for key accounts (e.g., major hospital networks or governmental tenders) and an expansive network of authorized, specialized distributors. These distributors handle localized sales, installation, staff training, and critical post-sale service and maintenance, acting as the primary point of contact for independent dental practitioners.

Direct distribution offers manufacturers greater control over pricing and customer relationships, particularly for premium, technologically complex hybrid systems. Conversely, indirect distribution through third-party dealers allows rapid market penetration in geographically diverse regions, especially in countries with complex import regulations or fragmented dental clinic landscapes. After-market services, including maintenance contracts, calibration, sensor replacement, and software updates, constitute a significant and high-margin revenue stream in the value chain, ensuring system longevity and maximizing the lifetime value of the customer relationship. The efficiency and quality of this entire chain, from high-precision sensor procurement to reliable local technical support, significantly influence the ultimate market penetration and brand perception of the panoramic system.

Panoramic X-Ray System Market Potential Customers

The primary end-users and potential buyers of Panoramic X-Ray Systems are diverse, ranging from large institutional settings to individual private practitioners, all united by the need for comprehensive maxillofacial imaging capabilities. Dental Hospitals and large multi-specialty clinics represent the highest volume purchasers. These institutions require robust, high-throughput systems, often demanding hybrid models that combine 2D panoramic and 3D CBCT imaging to cater to a broad spectrum of patient cases, including complex trauma, surgical procedures, and orthodontic referrals. Their purchasing decisions are often driven by institutional budgets, tender processes, and the desire for seamless integration with existing hospital information systems and Picture Archiving and Communication Systems (PACS).

Independent dental clinics and specialized practices, particularly those focused on implantology, orthodontics, and cosmetic dentistry, form another critical customer base. For independent practitioners, the purchasing drivers often shift towards Return on Investment (ROI), compact size (due to space constraints), and ease of operation. The demand from specialized clinics is rapidly growing, as panoramic imaging is increasingly becoming a non-negotiable standard of care for pre-surgical planning. These customers value systems that offer high-resolution images necessary for precise measurements and detailed anatomical assessment, often favoring mid-range or premium digital 2D systems with advanced software features for treatment simulation.

Furthermore, academic and research institutes, alongside government-sponsored public health programs, represent significant potential customers. Academic institutions purchase these systems for teaching purposes, clinical trials, and advanced research in dental materials and diagnostics, demanding cutting-edge technology and customizable parameters. Government buyers, particularly in emerging economies focused on expanding primary healthcare access, prioritize durable, cost-effective, and easy-to-maintain 2D digital panoramic systems suitable for screening large populations. Dental laboratories are also becoming essential buyers, utilizing specialized panoramic or CBCT data provided by partner clinics to fabricate custom appliances, surgical guides, and prosthetics, driving demand for excellent software interoperability and data exchange capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.4 Million |

| Market Forecast in 2033 | USD 1,170.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Planmeca Oy, Vatech Co., Ltd., Morita Corporation, Carestream Dental LLC, KaVo Dental GmbH, FONA Dental s.r.o., Yoshida Dental Mfg. Co. Ltd., Genoray Co., Ltd., Midmark Corporation, 3Shape A/S, Acteon Group, J. Morita USA, Inc., The Instrumentarium Dental (part of Danaher), Belmont Dental (Takara Belmont). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Panoramic X-Ray System Market Key Technology Landscape

The technological landscape of the Panoramic X-Ray System market is defined by a rapid evolution towards enhanced digital clarity, minimized radiation dose, and integrated multi-modality capabilities. The fundamental shift from outdated film-based systems to advanced digital technology utilizing high-sensitivity CMOS (Complementary Metal-Oxide-Semiconductor) and CCD (Charge-Coupled Device) sensors has been completed in most developed markets, setting the standard for instantaneous image acquisition and superior contrast resolution. Current technological innovation focuses heavily on reducing artifacts caused by patient movement or metal restorations, employing software-based filtering algorithms and advanced exposure control techniques. Furthermore, pulsed X-ray generation is a critical technology employed to deliver the necessary radiation dose in ultra-short bursts, significantly improving image sharpness while adhering to ALARA (As Low As Reasonably Achievable) principles for radiation safety.

The most impactful technological trend is the proliferation of hybrid imaging systems, specifically combining 2D panoramic radiography with 3D Cone Beam Computed Tomography (CBCT) capabilities within a single machine. This integration provides unparalleled diagnostic flexibility; practitioners can capture a low-dose 2D screening image and, if necessary, immediately transition to a high-resolution 3D volume scan for complex surgical planning (e.g., bone density analysis for implants) without repositioning the patient. This technological convergence is highly valued for its space efficiency and clinical versatility, justifying the higher purchase price for specialized clinics. Key technological advancements in CBCT integration include focused field-of-view (FOV) options, allowing clinicians to target specific areas, further reducing unnecessary radiation exposure.

Software and networking capabilities are equally crucial components of the modern Panoramic X-Ray System landscape. Advanced proprietary software manages image stitching, artifact removal, and integration with specialized treatment planning software (e.g., CAD/CAM systems). The adoption of AI and machine learning for automated image analysis is transitioning from a niche feature to a market expectation. This includes algorithms for automatic tracing of anatomical landmarks, identification of subtle bone changes, and quality control checks to minimize retakes. Connectivity standards, such as DICOM (Digital Imaging and Communications in Medicine) compliance, ensure seamless interoperability with practice management systems, making the data instantly accessible and secure across the entire clinical network, thereby reinforcing efficiency and diagnostic speed in modern dental practice environments.

Regional Highlights

Geographical market analysis reveals distinct consumption patterns, growth drivers, and competitive strategies across major global regions, reflecting differences in healthcare infrastructure, regulatory environments, and disposable income levels.

- North America: This region maintains the largest market share, driven by high per capita healthcare expenditure, the presence of major dental device manufacturers, and rapid adoption of cutting-edge technology, particularly hybrid CBCT/Panoramic systems. High awareness of preventative dental care and strong reimbursement structures for advanced imaging procedures further fuel market growth. The US market dominates the region, showcasing continuous demand for AI-integrated, high-definition digital systems.

- Europe: Europe represents a mature market, characterized by stringent regulatory standards (CE marking) and a strong emphasis on reducing radiation dosage. Germany, France, and the UK are key contributors, driven by aging populations requiring complex dental reconstructions and a preference for highly reliable, advanced European and Japanese manufactured systems. Adoption of digital solutions is nearly universal, focusing on workflow optimization and connectivity.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, projected to exhibit the highest CAGR. This growth is underpinned by expanding dental tourism sectors in countries like Thailand and South Korea, coupled with significant governmental investment in upgrading public dental health facilities in China and India. The rising number of private dental clinics catering to an expanding middle class drives high demand, often favoring cost-effective, durable digital 2D systems initially, with hybrid models rapidly gaining traction in metropolitan areas.

- Latin America (LATAM): Growth in LATAM is moderate but steady, largely influenced by improving economic stability in major economies like Brazil and Mexico. The market is primarily driven by the increasing availability of affordable, imported digital systems and growing patient willingness to pay for specialized treatments, particularly implantology and orthodontics, which necessitate panoramic imaging.

- Middle East and Africa (MEA): This region is characterized by fragmented but high-potential markets. Growth is concentrated in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) due to high government spending on healthcare infrastructure and medical technology imports. In Africa, adoption remains nascent, but increasing foreign investment and the establishment of new private health facilities signal future growth potential, often focusing on robust, easily maintainable equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Panoramic X-Ray System Market.- Dentsply Sirona

- Planmeca Oy

- Vatech Co., Ltd.

- Morita Corporation

- Carestream Dental LLC

- KaVo Dental GmbH

- FONA Dental s.r.o.

- Yoshida Dental Mfg. Co. Ltd.

- Genoray Co., Ltd.

- Midmark Corporation

- 3Shape A/S

- Acteon Group

- J. Morita USA, Inc.

- The Instrumentarium Dental (part of Danaher Corporation)

- Belmont Dental (Takara Belmont)

- Asahi Roentgen Ind. Co., Ltd.

- Air Techniques, Inc.

- Trex Medical Corporation

- Runyes Medical Instrument Co., Ltd.

- Villa Sistemi Medicali SpA

Frequently Asked Questions

Analyze common user questions about the Panoramic X-Ray System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a 2D Panoramic system and a Hybrid CBCT system?

A 2D Panoramic system captures a single, comprehensive flat image of the entire dentition and jaw structures, primarily used for screening and general diagnosis. A Hybrid CBCT system integrates 3D Cone Beam Computed Tomography capability, allowing the capture of detailed, volumetric (3D) cross-sectional images for complex surgical planning, such as implant placement and nerve tracing, offering superior diagnostic depth in a single unit.

Which geographical region exhibits the highest growth rate for Panoramic X-Ray Systems?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily driven by the substantial expansion of dental healthcare infrastructure, increasing rates of dental tourism, and rising disposable incomes leading to higher investment in private dental clinics across countries like China and India.

How does Artificial Intelligence (AI) enhance the functionality of modern Panoramic X-Ray Systems?

AI significantly enhances functionality by automating key diagnostic tasks, including the identification of anatomical landmarks, detection of subtle pathologies (e.g., early-stage bone loss), and optimization of image parameters to minimize radiation exposure. This integration improves diagnostic accuracy, standardizes radiographic interpretation across practitioners, and streamlines treatment planning workflows.

What are the main financial constraints affecting the adoption of Panoramic X-Ray Systems?

The primary financial constraint is the substantial initial capital expenditure required for purchasing and installing advanced digital or hybrid panoramic systems. This cost barrier particularly affects small, independent dental practices and clinics in developing economies, prompting a demand for flexible financing options, leasing models, and reliable mid-range systems to maximize the return on investment (ROI).

What are the major applications driving the demand for advanced Panoramic X-Ray imaging?

The primary applications driving demand are Implantology, which requires precise 3D bone volume assessment and surgical guidance; and Orthodontics, which necessitates detailed visualization of jaw relationships and developing teeth for comprehensive treatment planning. General dentistry screening for impacted teeth and latent cysts also remains a foundational driver.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager