Paper Trays Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443506 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Paper Trays Market Size

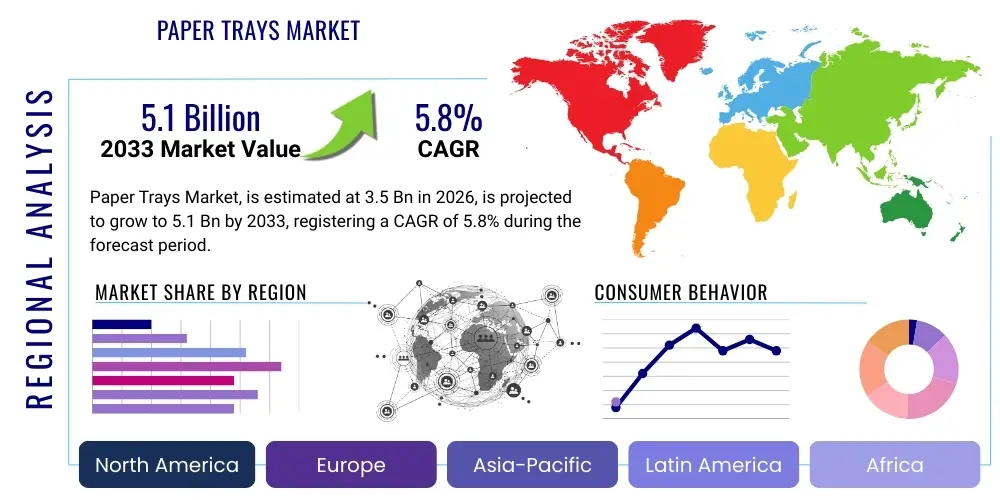

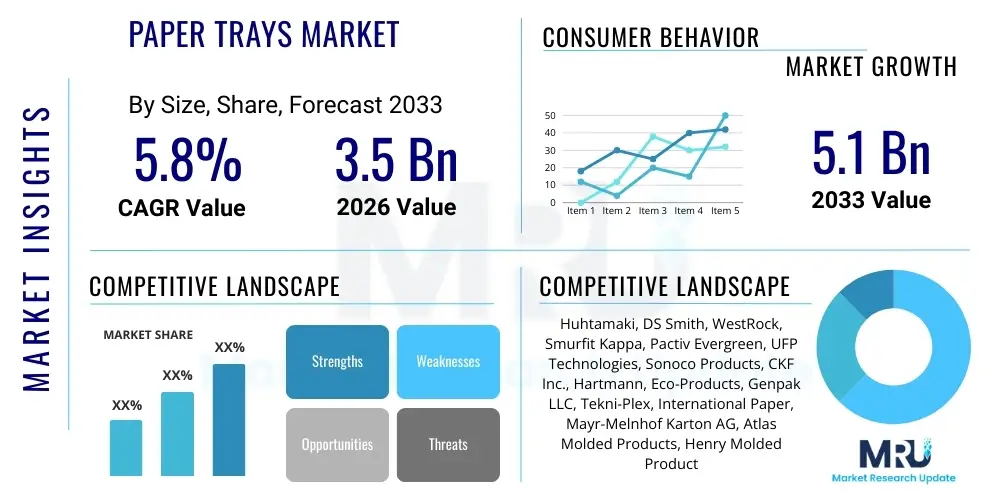

The Paper Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.1 Billion by the end of the forecast period in 2033.

Paper Trays Market introduction

The Paper Trays Market encompasses the production and distribution of packaging solutions primarily manufactured from virgin pulp, recycled paper, or molded fiber materials. These trays serve as essential components in protecting, transporting, and presenting various goods across multiple sectors. The fundamental product, the paper tray, is valued for its versatility, lightweight nature, and, most importantly, its inherent biodegradability and recyclability, addressing escalating consumer and regulatory demands for sustainable packaging alternatives globally. Molded pulp trays, a significant sub-segment, are formed by pressing wet fiber pulp into specific shapes and are extensively utilized in sensitive applications such as egg packaging, fruit transportation, and medical device containment, offering superior cushioning and impact resistance compared to traditional plastic inserts.

Major applications of paper trays span the entire consumer packaged goods (CPG) ecosystem, ranging from holding ready-to-eat meals in the food service industry to providing structured support for complex electronic components and intricate machinery parts in industrial manufacturing. The increasing adoption within the burgeoning e-commerce sector for secondary and tertiary packaging further amplifies market growth, as online retailers seek eco-friendly cushioning solutions that maintain product integrity during transit. Benefits derived from using paper trays include reduced environmental footprint, enhanced brand image associated with sustainability, and compliance with stringent international packaging standards that increasingly restrict non-biodegradable materials. These structural advantages position paper trays as a crucial element in the future of responsible packaging logistics.

The market is primarily driven by the global imperative to phase out single-use plastics, catalyzed by widespread governmental bans and heightened consumer awareness regarding ocean pollution. Additionally, technological advancements in pulping and molding processes are enabling the production of trays with higher moisture resistance and improved structural strength, expanding their applicability into previously dominated plastic markets. The efficiency of manufacturing, coupled with the relatively stable supply chain for raw cellulosic materials, supports the competitive pricing of paper trays, making them an economically viable and environmentally responsible choice for large-scale packaging operations worldwide. This synergy of regulatory pressure, consumer preference, and technological capability underscores the positive trajectory of the Paper Trays Market.

Paper Trays Market Executive Summary

The Paper Trays Market is undergoing rapid transformation, propelled primarily by global sustainability initiatives which mandate the transition away from fossil fuel-derived packaging materials. Current business trends indicate a strong shift towards advanced molded pulp technology, focusing on developing trays that offer superior barrier properties and customizable designs suitable for demanding applications like chilled and frozen food packaging. Strategic partnerships between pulp manufacturers and CPG companies are increasing, aiming to close the loop on circular economy models by enhancing recycling infrastructure and utilizing a higher percentage of post-consumer recycled fiber in tray production. Furthermore, the expansion of food delivery services and direct-to-consumer (D2C) channels in retail is creating sustained demand for ready-meal and protective produce trays, accelerating production capacity expansions across key manufacturing hubs globally.

Regional trends reveal significant growth disparities, with Asia Pacific exhibiting the highest growth trajectory, fueled by rapid urbanization, substantial growth in the organized food retail sector, and increasing environmental legislation adoption in countries like India and China. North America and Europe, already established markets, are witnessing mature but stable growth driven largely by stringent EU directives (e.g., the Single-Use Plastics Directive) and strong corporate social responsibility commitments from multinational corporations. Latin America and the Middle East & Africa are emerging markets showing nascent adoption, primarily focusing on basic egg and agricultural packaging, but poised for expansion as sustainability awareness penetrates local supply chains and industrial infrastructure improves.

Segmentation trends highlight the dominance of the food and beverage application segment, particularly for egg cartons and fruit packaging, which utilizes molded pulp technology extensively due to its cushioning efficiency. However, the electronics and healthcare segments are demonstrating above-average growth rates, demanding trays engineered for electrostatic discharge (ESD) protection and stringent hygiene requirements, respectively, thereby driving innovation in material treatments and surface finishing. By product type, molded pulp trays remain the largest segment, but corrugated trays are seeing increased adoption in heavy-duty industrial applications requiring high stack strength. This complex interplay of end-user needs and regional regulatory frameworks defines the competitive landscape and investment priorities within the Paper Trays Market.

AI Impact Analysis on Paper Trays Market

User queries regarding AI's influence on the Paper Trays Market often center on how Artificial Intelligence can optimize complex manufacturing processes, enhance predictive maintenance schedules, and improve quality control, particularly in high-volume molded pulp production facilities. Key themes emerging from these searches include the feasibility of using computer vision for defect detection in irregularly shaped trays, the application of machine learning algorithms to optimize pulp mixture ratios for maximum strength and minimal material use, and how supply chain AI can manage the volatile sourcing and pricing of raw materials like recycled paper and virgin pulp. Users also frequently inquire about AI-driven demand forecasting, which is critical for packaging manufacturers serving highly seasonal markets such as agriculture and food service, seeking precision to minimize inventory waste and maximize production efficiency. The overarching expectation is that AI integration will lead to significant cost reductions, higher output consistency, and enable highly customized production runs, thereby improving the market's competitiveness against plastic alternatives.

- AI-Powered Process Optimization: Machine learning models optimize drying times and temperature profiles in molded fiber production, reducing energy consumption and throughput time.

- Predictive Maintenance: AI algorithms analyze sensor data from forming and pressing machinery to predict equipment failure, minimizing costly unplanned downtime.

- Automated Quality Control: Computer vision systems rapidly scan finished trays for structural defects, material inconsistency, and geometric deviations, ensuring high batch quality compliance.

- Supply Chain Resilience: AI-driven logistics platforms provide real-time tracking and predictive pricing models for pulp commodities, mitigating supply chain risks associated with volatile raw material markets.

- Customization and Design Optimization: Generative AI assists in designing complex tray geometries that maximize cushioning properties while minimizing material weight (lightweighting).

DRO & Impact Forces Of Paper Trays Market

The Paper Trays Market is strongly influenced by a robust set of driving forces centered around global sustainability mandates and shifting consumer preferences, pushing for bio-based packaging solutions. Governments worldwide are actively implementing bans on various single-use plastics, creating an immediate and substantial vacuum that paper trays are optimally positioned to fill across sectors like food service, agricultural packaging, and retail. Furthermore, corporate commitments to environmental, social, and governance (ESG) standards necessitate a visible shift in packaging choices, often favoring certified recyclable and compostable materials like molded pulp. These drivers collectively establish a strong, non-cyclical foundation for market growth, ensuring continuous investment in manufacturing capacity and material science innovation within the industry.

However, the market faces significant restraints, primarily related to the intrinsic characteristics of paper-based products and supply chain complexities. High volatility in the prices of raw materials, specifically recycled fiber and wood pulp, presents a continuous challenge to profit margins and pricing stability for manufacturers. Paper trays also inherently possess lower barrier properties compared to plastic, particularly sensitivity to moisture and oxygen, which restricts their applicability in specific long-shelf-life or high-humidity environments without advanced (and sometimes costly) coatings. The need for specialized machinery for complex molded pulp production, requiring substantial capital investment, also acts as a barrier to entry for smaller manufacturers and slows rapid capacity expansion in emerging economies.

Opportunities within the sector are abundant, centered on technological breakthroughs and geographical expansion. Innovation in barrier coatings—such as mineral-based or bio-polymer coatings—is actively being pursued to enhance water resistance, expanding paper trays' use in refrigerated and frozen food markets without compromising recyclability or compostability. Furthermore, the untapped potential in developing nations, coupled with the increasing sophistication of e-commerce packaging demands worldwide, presents avenues for specialized, customized, and lightweight tray designs. The cumulative impact force of sustainability, driven by regulatory urgency and consumer demand, consistently outweighs the inherent material limitations and supply chain volatility, securing a positive long-term market outlook.

Segmentation Analysis

The Paper Trays Market segmentation provides a granular view of diverse product applications and material compositions shaping industry dynamics. Segmentation by product type highlights the distinction between simple fiber trays, robust corrugated inserts, and high-precision molded pulp trays, each addressing specific structural and protective requirements across end-user industries. Molded pulp trays dominate due to their excellent cushioning ability and eco-friendly profile, extensively used in delicate food packaging. Segmentation by application underscores the high dependency on the food and beverage sector (especially egg, fruit, and ready-meal packaging), though industrial and electronics segments are increasingly contributing to revenue streams by demanding tailored solutions for component protection. Geographic segmentation confirms that market growth is disproportionately concentrated in regions actively enforcing plastic bans and possessing mature recycling infrastructures.

- By Product Type:

- Molded Pulp Trays

- Fiber Trays (Pressed Board/Folding Carton)

- Corrugated Trays (Heavy-duty inserts)

- By Application:

- Food & Beverage Packaging (Egg Trays, Fruit Trays, Meat & Poultry Trays, Ready-Meal Trays)

- Electronics & Appliances Packaging (Component Inserts, Protective Cradles)

- Industrial Packaging (Automotive Parts, Machinery Components)

- Healthcare and Pharmaceuticals (Vial Holders, Medical Device Trays)

- By End-User Industry:

- Food Service and Catering

- Retail and E-commerce

- Agriculture

- Manufacturing and Industrial

- Healthcare

- By Material Source:

- Recycled Paper

- Virgin Pulp (Wood Fiber)

- Non-wood Plant Fibers (e.g., Bagasse)

Value Chain Analysis For Paper Trays Market

The Paper Trays market value chain begins with the upstream sourcing of raw materials, primarily encompassing recycled paper and various grades of virgin wood pulp. This phase is crucial as the cost and sustainability profile of the final product are heavily influenced by the accessibility, quality, and volatility of fiber prices. Key upstream players include specialized recycling facilities, forest management operations, and pulp mills. Efficiency at this stage relies heavily on fiber preparation processes such as sorting, pulping, and bleaching, which determine the strength, color, and texture of the resulting paper slurry used for tray molding. Given the global push for circularity, manufacturers increasingly prioritize post-consumer recycled (PCR) fiber, necessitating strong partnerships with waste management companies to ensure a consistent, clean supply of raw input.

The midstream phase involves the core manufacturing process, where paper trays are produced using techniques like thermoforming, dry pressing, or transfer molding. This stage includes sophisticated machinery investment for high-speed, precision molding, followed by drying and optional surface treatments (e.g., barrier coatings or printing). Manufacturers of paper trays must constantly optimize these processes to reduce energy consumption, minimize water use, and ensure product conformity, especially for high-cushioning and sensitive applications. Direct distribution involves large-volume sales to anchor clients, such as multinational food processors, electronics assembly plants, and agricultural cooperatives, often under long-term supply contracts tailored to specific logistical requirements and high-frequency delivery schedules.

The downstream segment focuses on the distribution channels, reaching the final end-users. Distribution is often segmented into direct sales, managed by the manufacturer's internal logistics team for major corporate accounts, and indirect sales, leveraging third-party packaging distributors, wholesalers, and retail supply intermediaries for smaller clients and localized markets. The final consumption occurs across industrial facilities, retail environments, and food service outlets where the trays are used for primary or secondary packaging. Effective downstream operations require precise inventory management and close collaboration with logistics partners to ensure timely delivery of bulky, yet lightweight, packaging materials. The high demand from the rapidly expanding e-commerce sector further necessitates robust, wide-reaching distribution networks capable of handling regional fulfillment.

Paper Trays Market Potential Customers

The primary customer base for the Paper Trays Market spans several large-scale industries that require protective, sustainable, and high-volume packaging solutions. Food producers, particularly those involved in egg production, fresh fruit and vegetable harvesting, and pre-packaged meal preparation, represent the largest and most consistent buyers, demanding trays optimized for product separation, ventilation, and moisture management during cold chain logistics. Retailers, especially major supermarket chains and bulk discount stores, are crucial customers, integrating paper trays not only for shelf display (e.g., produce trays) but also to align their corporate image with environmental responsibility, directly impacting consumer purchasing decisions at the point of sale. Furthermore, the massive and growing e-commerce sector relies heavily on paper trays as internal cushioning components, providing lightweight, sustainable void fill and component stabilization for shipping fragile or irregularly shaped items, securing products ranging from small electronics to high-end ceramics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki, DS Smith, WestRock, Smurfit Kappa, Pactiv Evergreen, UFP Technologies, Sonoco Products, CKF Inc., Hartmann, Eco-Products, Genpak LLC, Tekni-Plex, International Paper, Mayr-Melnhof Karton AG, Atlas Molded Products, Henry Molded Products, Fibrocell, Brodrene Hartmann A/S, Novipax, Primapack |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper Trays Market Key Technology Landscape

The technological landscape of the Paper Trays Market is characterized by continuous refinement aimed at improving efficiency, material properties, and design complexity. The core technology, molded fiber packaging, has evolved significantly from traditional wet-press operations to advanced dry-press and thermoforming techniques. Thermoforming, in particular, allows for the production of smoother, denser, and more dimensionally accurate trays, crucial for applications requiring high aesthetic quality or precise fit, such as electronics inserts or high-end cosmetic packaging. Innovations in tooling materials and machinery speed have dramatically reduced the cycle time for high-volume production, making paper trays a more cost-effective and faster alternative to traditional plastic forming processes. This focus on precision manufacturing ensures that paper trays can meet stringent performance specifications traditionally reserved for plastic counterparts.

A second pivotal area of technological advancement involves material science, specifically the development of sustainable barrier technologies. Since natural fiber trays are susceptible to moisture and grease penetration, manufacturers are investing heavily in innovative coatings that enhance functionality without compromising compostability or recyclability. These include proprietary bio-based polymers, starch-based formulations, and mineral coatings that are applied post-molding. These advancements are critical for expanding the application scope of paper trays into demanding environments, such as refrigerated food packaging, enabling them to safely contain products with high liquid or fat content for extended periods. Furthermore, research into utilizing non-wood fibers, such as bagasse (sugarcane residue) and bamboo, is diversifying the raw material base, improving fiber availability, and often enhancing the mechanical properties of the final molded product.

Finally, digitalization and automation are transforming the production floor. The integration of advanced sensor technology, coupled with Industrial Internet of Things (IIoT) frameworks, allows for real-time monitoring of pulp consistency, mold pressure, and drying efficiency. This data-driven approach facilitates proactive quality control and predictive maintenance, minimizing resource wastage and maximizing equipment uptime. Furthermore, 3D printing and advanced CAD software are being utilized in the prototyping phase, significantly shortening the development cycle for customized tray designs. These technological developments collectively aim to increase the functional parity between paper trays and plastic packaging while maintaining the superior environmental performance demanded by contemporary markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive consumption growth in emerging economies like China and India, coupled with rapid industrialization and the expansion of organized retail chains. The region is seeing increased government focus on waste management and single-use plastic restrictions, particularly in Southeast Asia, creating immense opportunities for paper tray manufacturers to cater to the immense population base and developing food processing sectors. Local manufacturers are scaling up rapidly to meet both domestic demand and serve as export hubs.

- North America: A mature market characterized by high adoption rates in the food service and agriculture sectors. Growth is sustained by robust e-commerce activity and strong corporate commitments to sustainable sourcing. High labor and operational costs necessitate significant investment in automation and high-efficiency molded pulp machinery to maintain competitiveness and production quality standards. Key drivers include state-level plastic bans and established recycling infrastructure.

- Europe: The market is highly regulated, primarily governed by the EU's comprehensive environmental policies, including the Single-Use Plastics Directive, which strongly favors fiber-based solutions. Innovation is high, focusing on certified compostable and home-compostable barrier trays for ready-meals and fresh produce. Germany, the UK, and France are leading consumers, demanding premium, visually appealing, and highly functional sustainable packaging solutions.

- Latin America (LATAM): Currently experiencing moderate growth, primarily focused on essential applications such as egg packaging and basic industrial protective inserts. Market expansion is dependent on improving waste collection and recycling infrastructure, along with increasing awareness and implementation of national environmental packaging laws in countries like Brazil and Mexico. Investment focus is on establishing efficient, localized production facilities.

- Middle East and Africa (MEA): This region is in the nascent stage of adoption, with growth concentrated in high-income Gulf Cooperation Council (GCC) countries driven by tourism and sophisticated retail sectors. Challenges include logistical complexities and lower overall recycling rates, though emerging regulations promoting sustainability are expected to accelerate demand over the forecast period, particularly in the food and catering sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper Trays Market.- Huhtamaki

- DS Smith

- WestRock

- Smurfit Kappa

- Pactiv Evergreen

- UFP Technologies

- Sonoco Products

- CKF Inc.

- Hartmann

- Eco-Products

- Genpak LLC

- Tekni-Plex

- International Paper

- Mayr-Melnhof Karton AG

- Atlas Molded Products

- Henry Molded Products

- Fibrocell

- Brodrene Hartmann A/S

- Novipax

- Primapack

Frequently Asked Questions

Analyze common user questions about the Paper Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Paper Trays Market?

The primary driver is the accelerating global shift towards sustainable packaging, fueled by widespread governmental bans and stringent regulations on single-use plastics, forcing industries to adopt highly recyclable and biodegradable paper-based alternatives like molded pulp trays.

Are paper trays suitable for frozen food applications?

Standard paper trays are moisture-sensitive, but technological advancements in barrier coatings (bio-polymers, mineral-based) now enable specialized, functional paper trays to be used effectively for frozen and refrigerated food products without compromising their compostability or recyclability.

Which paper tray segment holds the largest market share by product type?

Molded Pulp Trays currently hold the largest market share due to their superior cushioning properties, cost-effectiveness, and high usage in essential applications such as egg packaging, fruit transportation, and protective inserts across major food and industrial segments globally.

How does the volatility of pulp prices impact the market?

Raw material price volatility, particularly for recycled fiber and virgin pulp, is a significant restraint. It directly affects the profit margins of manufacturers and can lead to unpredictable pricing for end-users, requiring enhanced supply chain management and forward contracting strategies.

Which region is expected to show the fastest growth rate for paper tray adoption?

Asia Pacific (APAC) is projected to exhibit the fastest growth, driven by rapid economic development, urbanization, expanding retail and e-commerce sectors, and the recent introduction of strong national and regional environmental policies enforcing sustainable packaging mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager